Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bluegreen Vacations Holding Corp | d591714d8k.htm |

Exhibit 99.1

Bluegreen Corporation

August 2013

|

|

Statements in this presentation may constitute forward-looking statements and are made pursuant to the Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. Forward looking statements are based largely on expectations and are subject to a number of risks and uncertainties including, but not limited to, the risks and uncertainties associated with economic, credit market, competitive and other factors affecting the Company and its operations, markets, products and services; risks relating to the merger with BFC Financial Corporation (“BFC”); the Company’s efforts to improve its liquidity through cash sales and larger down payments on financed sales may not be successful; the performance of the Company’s VOI notes receivable may deteriorate, and the FICO® score-based credit underwriting standards may not have the expected effects on the performance of the receivables; the Company may not be in a position to draw down on its existing credit lines or may be unable to renew, extend, or replace such lines of credit; the Company may require new credit lines to provide liquidity for its operations, including facilities to sell or finance its notes receivable; the Company may not be able to successfully securitize additional timeshare loans and/or obtain adequate receivable credit facilities in the future; risks relating to pending or future litigation, regulatory proceedings, claims and assessments; sales and marketing strategies may not be successful; marketing costs may increase and not result in increased sales; system-wide sales, including sales on behalf of third parties and sales to existing owners, may not continue at current levels or they may decrease; fee-based service initiatives may not be successful and may not grow or generate profits as anticipated; it may be necessary or desirable to increase capital expenditures, thereby decreasing free cash flow; risks related to other financial trends discussed in this presentation including that the Company may be required to further increase its allowance for loan losses in the future and record additional impairment charges as a result of any such increase; selling and marketing expenses as a percentage of system-wide sales of VOIs, net may not remain at current levels or they may increase; and the Company’s indebtedness may increase in the future; and the risks and other factors detailed in the Company’s previous SEC filings and BFC’s SEC filings, including those contained in the “Risk Factors” sections of such filings.

1

|

Table of Contents

| • | Company Profile |

| • | Highlights |

| • | Our Industry |

| • | Our Business |

| • | Liquidity |

Appendices

| • | A – Non-GAAP Reconciliations |

| • | B – Other Information |

NOTE: Bluegreen Corporation’s (“Bluegreen’s”) financial statements and all amounts derived from such included in this presentation are presented on Bluegreen’s historical basis accounting, materially consistent with the basis of accounting used in Bluegreen’s Annual Report on Form 10-K for the year ended December 31, 2012. Therefore, certain amounts included in this presentation will differ from the disclosure of Bluegreen’s financial statements in BFC Financial Corporation’s (“BFC’s”) filings with the Securities and Exchange Commission, due to the impact of certain “purchase accounting” adjustments recorded by BFC in connection with its November 2009 indirect acquisition of approximately 7.4 million additional shares of Bluegreen’s Common Stock, which resulted in BFC, indirectly, holding a controlling interest in Bluegreen.

2

|

Company Profile

3

|

Highlights

Operating model features improvements from historical, capital-intensive timeshare model:

| • | “Capital light” business model that is generating cash from multiple streams: |

| • | Traditional timeshare sales operations generate significant cash sales and currently have historically low capital requirements |

| • | Fee-based Services Business: |

| • | Fee-Based services sales & marketing commissions |

| • | Property management, title, mortgage servicing & other Fee-Based services |

| • | Finance business income |

| • | Growing sales while focusing on marketing efficiencies |

| • | Improving debt profile |

| • | Minimizing capital spending |

| • | Established FICO® score – based credit underwriting program in December 2008 |

| • | Completed sale of non-core real estate business (Bluegreen Communities) in May 2012 |

4

|

Highlights (cont.)

| • | Generated operating/investing cash flow of approximately $162 million in 2012(a). |

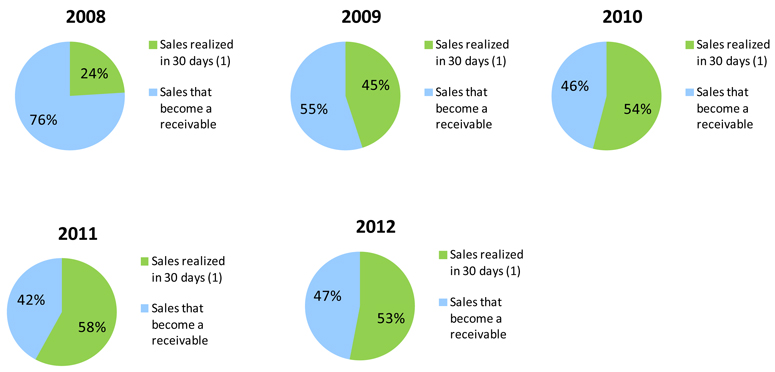

| • | Increased cash realized within 30 days of sale from 24% of sales in 2008, to 53% in 2012. |

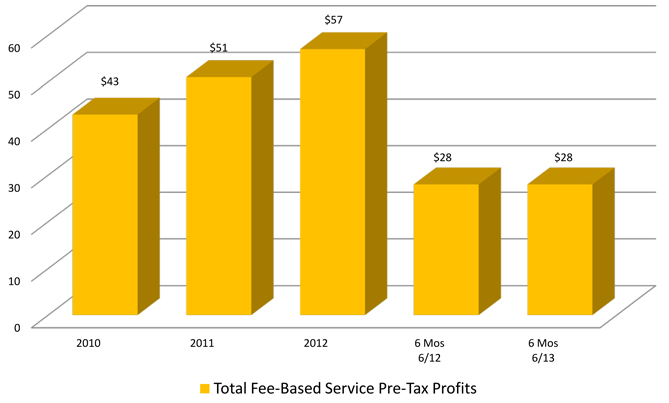

| • | The “capital-light” fee-based service business model generated $57 million in pre-tax profits in 2012. |

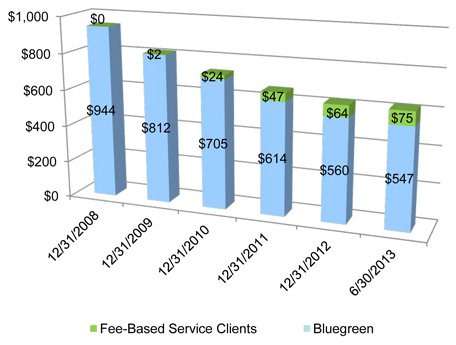

| • | Receivable-backed debt decreased 40% to $446 million at December 31, 2012 from $748 million at December 31, 2008. |

| • | Lines-of-credit and notes payable declined 90% to $22 million as of December 31, 2012 from $222.7 million as of December 31, 2008. Added $75 million in April 2013, in connection with the Merger. |

| • | Capital expenditures decreased from $188 million in 2008 to $18 million in 2012. |

| (a) | Excludes $27.8 million of gross proceeds from sale of Bluegreen Communities |

5

|

Highlights (cont.)

| • | Associate headcount went from 6,396 as of 9/30/08 to 4,387 as of 12/31/12. |

| • | Revolving receivable credit facilities of $190 million with availability of $81 million as of June 30, 2013(a). |

| • | Unrestricted cash and equivalents of $113.7 million as of June 30, 2013. |

| • | Improved delinquency and default performance in FICO® score-based credit underwritten portfolio. |

| • | Recent transactions in credit and securitization markets (including Merger financing of $75 million). |

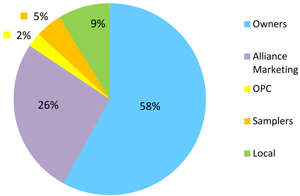

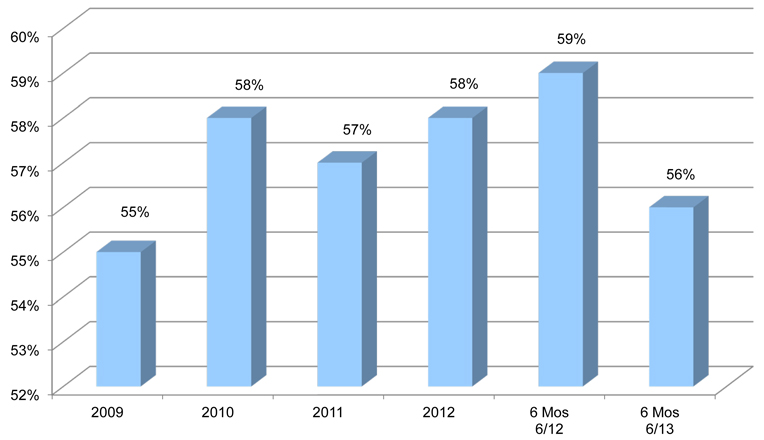

| • | Sales to Bluegreen Vacation Club owners represented 58% of total Resort sales in 2012, indicating a high level of customer satisfaction and providing a low cost marketing channel. |

| (a) | Including July 10, 2013 facility renewal. |

6

|

Results of Operations

| (a) | Excludes estimated uncollectible VOI notes receivable. Includes sales made on behalf of fee-based service clients. |

| (b) | Net of income taxes. |

7

|

| (a) | See Appendix A for reconciliation of Adjusted EBITDA to GAAP income/loss. |

| (b) | Excludes expenditures under “Just-in-Time” arrangements as part of the Fee-Based Services business. |

8

|

Timeshare Industry

| • | 2012 U.S. Timeshare sales of approximately $6.9 billion (up 6%). |

| • | Highest one-year sales growth since 2006. |

| • | Other participants include: Wyndham, Marriott, Starwood, Hilton, Hyatt, Disney, Diamond, Orange Lake and Silverleaf. |

| • | Increased activity in the industry in corporate transactions, consolidation and ongoing affiliation through Fee-Based Service arrangements. |

9

|

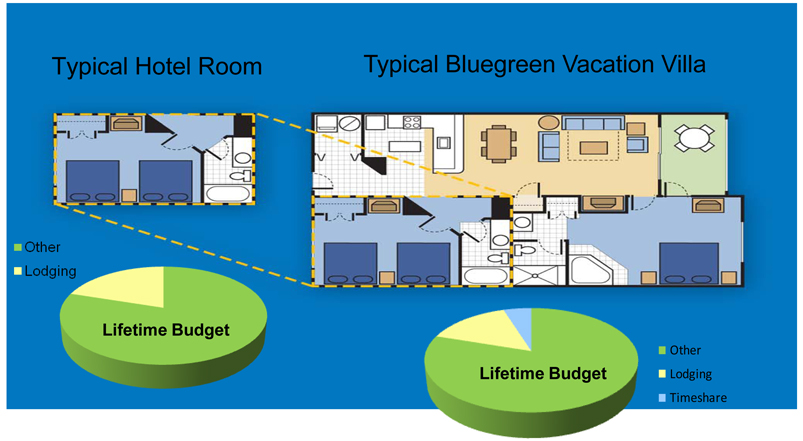

Why not just rent?

Hotel Room vs. Timeshare Vacation Home

10

|

Bluegreen Vacations

11

|

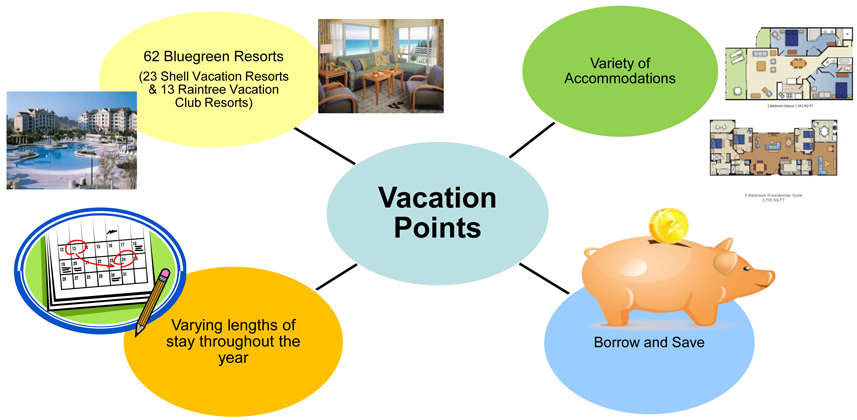

Bluegreen Vacation Club

Vacation Ownership with Flexibility, Quality and Value

Since 1994

Owners get the flexibility of a points-based reservation system, not an internal exchange.

Note: All subject to terms and conditions of the Bluegreen Vacation Club.

12

|

Bluegreen Vacation Club Resorts

13

|

Bluegreen Vacation Club Resorts

14

|

Bluegreen Vacation Club Resorts

15

|

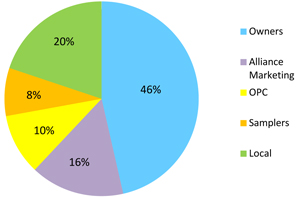

Typical Bluegreen Owner

| • | Average income: $75,000 - $80,000 |

| • | Age: 44-55 |

| • | Marital Status: Married |

| • | Number of persons per vacation ownership trip: 2.8 |

| • | Number of nights per stay: 4.3 |

16

|

Bluegreen Sales Centers

17

|

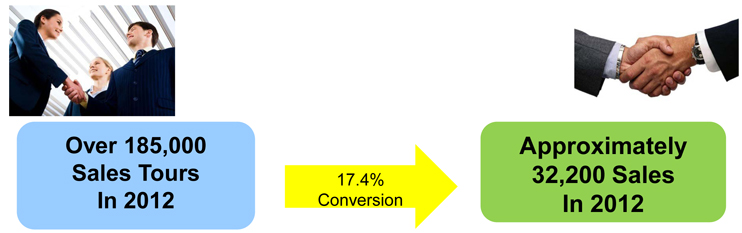

Experienced Direct Marketer

18

|

Selling and Marketing Expenses

19

|

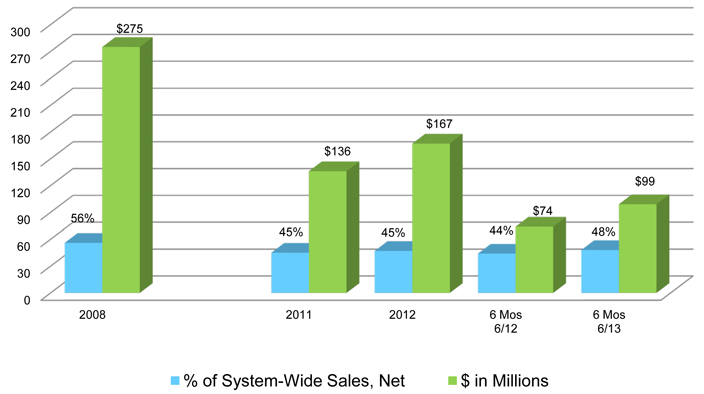

Fee-Based Services

| • | We provide various timeshare services and product offerings for third-party property owners/developers, lenders and investors. |

| • | Services are based on Bluegreen’s core competencies in: |

| • | Sales & Marketing |

| • | Property Management |

| • | Risk Management |

| • | Title & Escrow |

| • | Design & Development |

| • | Mortgage Servicing |

| • | Allows third-party property owners/developers to benefit from the Bluegreen Vacation Club product and sales distribution platform. |

| • | Two types of Sales & Marketing Arrangements: |

| • | Commission-Based |

| • | Just-in-Time |

| • | Cash business, which requires little, if any, capital expenditure/debt by Bluegreen. |

| • | Expands the offerings of the Bluegreen Vacation Club. |

20

|

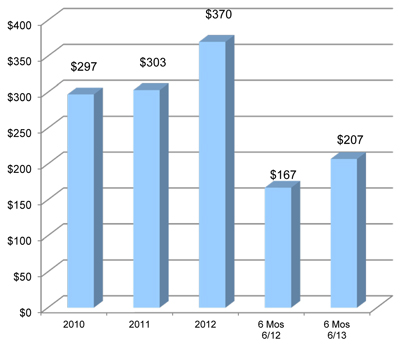

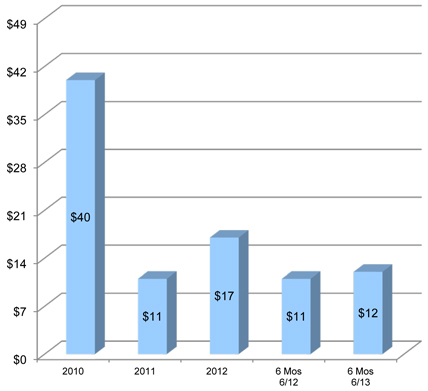

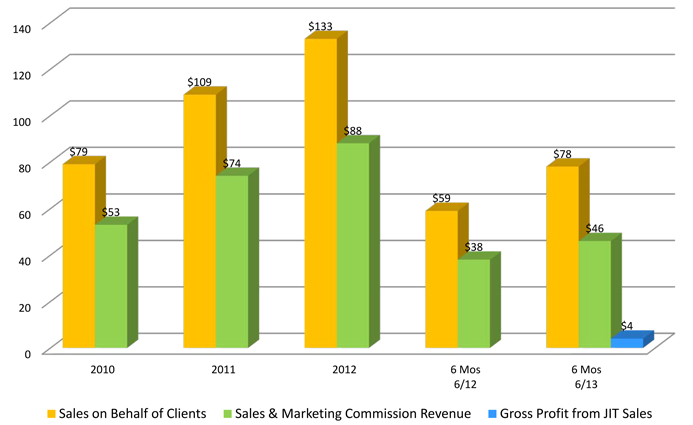

Fee-Based Services-Sales

($ in millions)

21

|

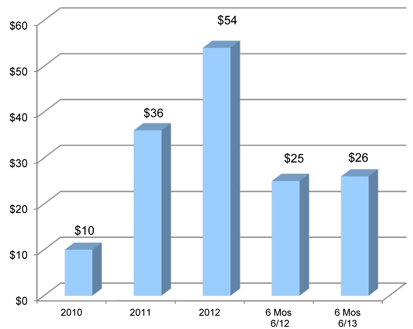

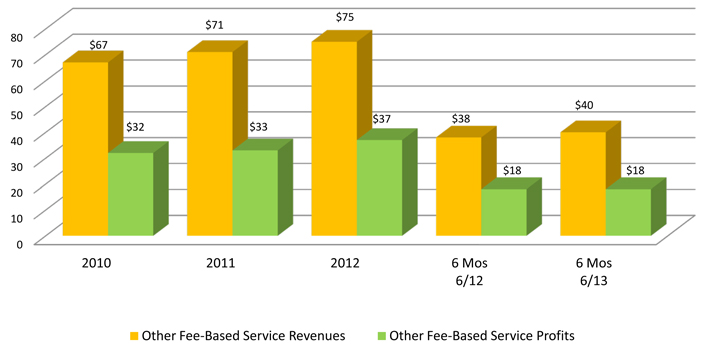

Other Fee-Based Services

($ in millions)

22

|

Fee-Based Services-Profits

($ in millions)

23

|

Finance Business

24

|

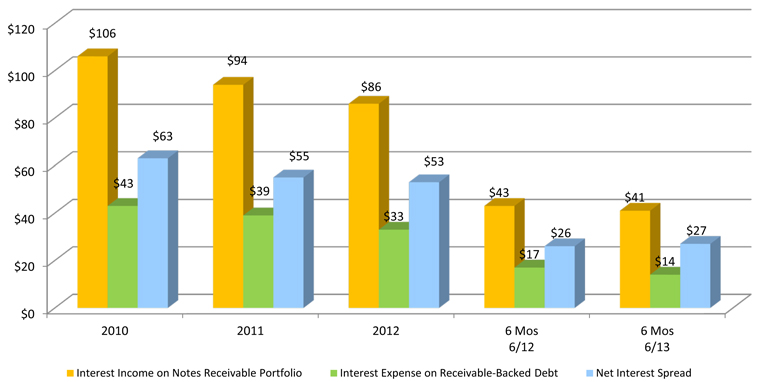

Finance Operations – Net Interest Spread

($ in millions)

25

|

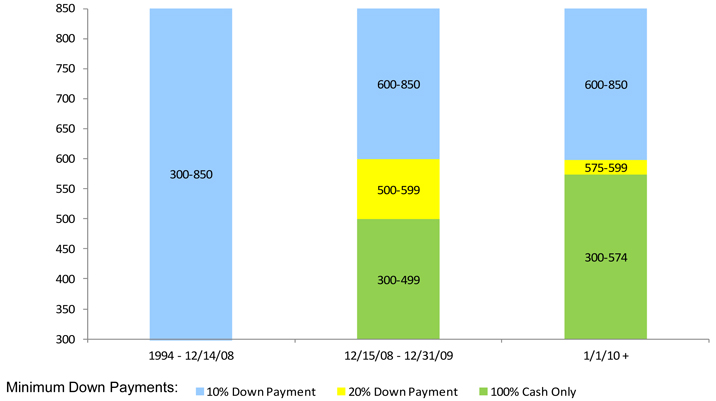

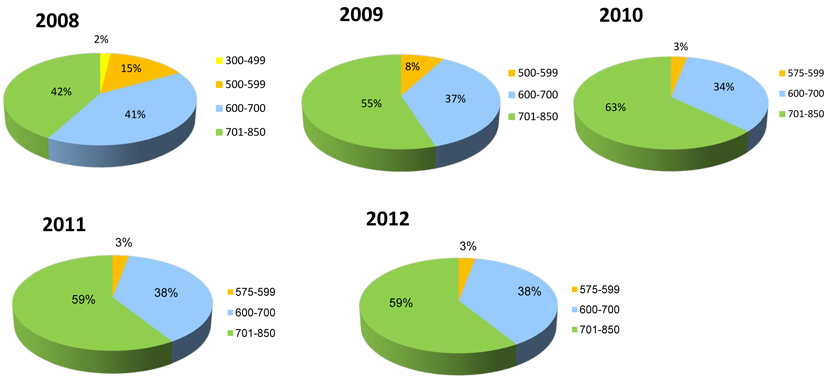

Bluegreen Resorts

Credit Underwriting Standards

(FICO® Scores at time of Origination)

26

|

Bluegreen Resorts

FICO® Profile (a)

| (a) | Percentage of portfolio outstanding at 12/31/10 originated in the 2008-2010 periods by FICO® strata (12/31/11 for 2011 originated loans and 12/31/12 for 2012 originated loans), excluding foreign obligors and other “No FICO®” loans in 2009 - 2012, which were less than 1.5% in 2009 and 2010, and 3% in 2011 and 2012. 2008 assumes strata for 10% of loans outstanding at 12/31/10, for which no FICO® score was obtained. Based on most recent FICO® score in Bluegreen’s files for each obligor. |

27

|

| * | In the event a borrower goes off of pre-authorized checking, the interest rate will increase by 1%. |

| (1) | Loans without a FICO® score are removed. FICO® is at the time of sale. Excluding loans paid in full within 6 months from origination. |

28

|

Typical Collection Process - VOI

| • | 10 Days – Telephone contact generally initiated on delinquent accounts when an account is as few as 10 days past due |

| • | 30 Days – Letter mailed advising the borrower (if a U.S. resident) that if the loan is not brought current, the delinquency will be reported to the credit reporting agencies (telephone contact continues) |

| • | 60 Days – “Lock-out” letter mailed, return receipt requested and regular mail, advising that the borrower cannot use any accommodations until the delinquency is cured (telephone contact continues) |

| • | 90 Days – “Notice of Intent to Cancel Membership” mailed, return receipt requested and regular mail, which informs the borrower that unless the delinquency is cured within 30 days, the borrower will forfeit ownership (telephone contact continues) |

| • | Approximately 120 Days – Termination letter mailed, return receipt requested and regular mail, advising the borrower that the owner’s beneficial rights in the Bluegreen Vacation Club have been terminated |

| • | The VOI is placed back into inventory for resale to a new purchaser |

29

|

VOI Portfolio Dynamics

| • | Unlike floating rate residential mortgage loans (many of which have “teaser” rates), the monthly payment for Bluegreen’s borrowers does not change over the life of the loan.* |

| • | The average monthly payment (approximately $200) for Bluegreen’s borrowers is much less than a typical mortgage payment. |

| • | Geographical diversity of obligors, few foreign obligors. |

| • | Bluegreen’s VOI collections team has an average of 15 years of collections experience. Our collectors are incentivized through a performance-based compensation program. |

| • | In addition, Bluegreen implemented FICO® score-based credit requirements on 12/15/08 and further raised such guidelines on 1/1/10. |

| * | In the event a borrower goes off of pre-authorized checking, the interest rate will increase by 1%. |

30

|

Bluegreen VOI Loan Payment Methods

As of December 2012

| PAC/ACH/Automated |

89.6 | % | ||

| Coupon Book |

10.4 | % | ||

|

|

|

|||

| Total |

100.0 | % | ||

|

|

|

| • | Each sale facility/securitization/hypothecation has a separate, dedicated lockbox. |

| • | There is a daily automated, repetitive wire to the paying agent/lender for each sale facility/securitization/hypothecation. |

| • | Banking Partners in current securitizations: |

Lock Box – Bank of America

Paying Agent & Indenture Trustee – U.S. Bank

31

|

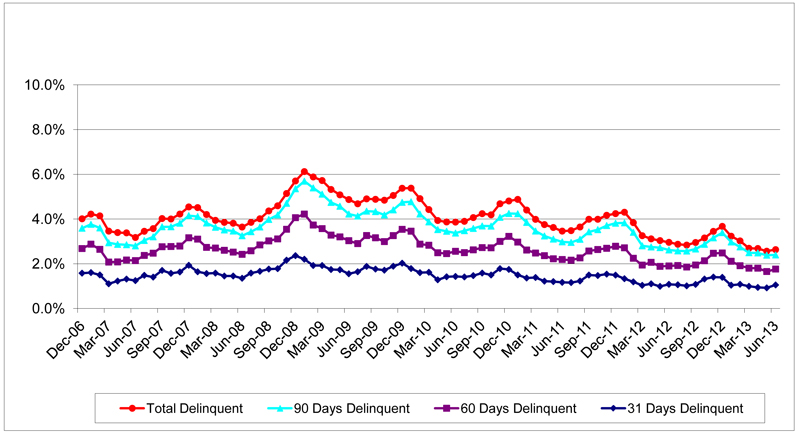

Bluegreen VOI Delinquency Performance(1)

| (1) | Excludes introductory products |

Note: Loans are generally defaulted, and therefore no longer included in delinquency, after 120 days.

32

|

Portfolio Performance(1)

VOI Delinquency Breakdown: As of June 30, 2013

| Percentage of | Percentage of outstanding | |||||||

| outstanding loans | principal balance over 30 days past due | |||||||

| Originations Pre-12/15/08 (loans not credit scored at origination) |

45.4 | % | 3.18 | % | ||||

|

|

|

|

|

|||||

| Originations 12/15/08 – 6/30/2013 (loans must meet minimum FICO® requirement of 500 from 12/15/2008 – 12/31/2009; 575 thereafter) |

54.6 | % | 2.16 | % | ||||

|

|

|

|

|

|||||

| Total |

100 | % | 2.62 | % | ||||

|

|

|

|

|

|||||

Non-Scored vs. Credit Scored VOI Defaults at 42 months

| Percentage defaulted | ||

| Loans originated 1/1/08 – 12/14/08 |

21.84% (as of 6/30/11) | |

| Loans originated 1/1/10 – 12/31/10 |

11.68% (as of 6/30/13) |

| (1) | Excludes introductory products |

33

|

Bluegreen’s Previous Receivables Purchase

Facilities and Term Securitizations

| Purchase Facility/Term Securitization |

Note Amount |

|||

| 1998 GE Purchase Facility |

$ | 100.0 MM | ||

| 2000 GE Purchase Facility |

$ | 90.0 MM | ||

| 2001-A ING Purchase Facility |

$ | 125.0 MM | ||

| 2002-A Term Securitization |

$ | 170.2 MM | ||

| 2004-A GE Purchase Facility |

$ | 38.6 MM | ||

| 2004-B Term Securitization |

$ | 156.6 MM | ||

| 2004-C BB&T Purchase Facility |

$ | 140.0 MM | ||

| 2005-A Term Securitization |

$ | 203.8 MM | ||

| 2006-A GE Purchase Facility |

$ | 125.0 MM | ||

| 2006-B Term Securitization |

$ | 139.2 MM | ||

| 2007-A Term Securitization |

$ | 177.0 MM | ||

| 2008-A Term Securitization |

$ | 60.0 MM | ||

| BXG Legacy 2010 Securitization |

$ | 27.0 MM | ||

| 2010-A Term Securitization |

$ | 107.6 MM | ||

| Quorum Federal Credit Union Purchase Facility |

$ | 30.0 MM | ||

| 2012-A Term Securitization |

$ | 100.0 MM | ||

| 2012 BB&T Purchase Facility |

$ | 40.0 MM | ||

|

|

|

|||

| Total |

$ | 1.8 Billion | ||

There has never been a principal or interest payment delinquency or default under any of these facilities.

34

|

Liquidity: Cash Flow Activities

($ in millions)

| 2010 | 2011 | 2012 | 6 Mos 6/2012 | 6 Mos 6/2013 | ||||||||||||||||

| Cash Flow provided by operating activities |

$ | 164 | $ | 167 | $ | 168 | $ | 64 | $ | 42 | ||||||||||

| Cash Flow provided by (used in) investing activities |

(6 | ) | (4 | ) | 22 | 25 | (5 | ) | ||||||||||||

| Cash Flow used in financing activities |

(156 | ) | (154 | ) | (117 | ) | (105 | ) | (77 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net increase (decrease) in cash and cash equivalents |

$ | 2 | $ | 9 | $ | 73 | $ | (15 | ) | $ | (40 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ending unrestricted cash balance |

$ | 72 | $ | 81 | $ | 154 | $ | 66 | $ | 114 | ||||||||||

35

|

Revolving Credit Facilities

($ in thousands)

June 30, 2013

| Revolving | ||||||||||||||||||||||

| Advance Period | Facility | Amount | Amount | |||||||||||||||||||

| Lender |

Type |

Expiration | Maturity | Amount | Outstanding | Available | ||||||||||||||||

| BB&T |

Receivables Purchase Facility | 12/17/2013 | 12/17/2016 | $ | 40,000 | $ | 25,314 | $ | 14,686 | (A) | ||||||||||||

| Quorum |

Receivables Purchase Facility | 3/31/2014 | 12/30/2030 | 30,000 | 19,624 | 10,376 | (A) | |||||||||||||||

| Liberty |

Receivable Hypothecation Facility |

3/1/2015 | 3/1/2018 | 50,000 | 25,471 | 24,529 | ||||||||||||||||

| CapitalSource |

Receivable Hypothecation Facility |

9/20/2016 | 9/20/2019 | 40,000 | 20,883 | 19,117 | (B) | |||||||||||||||

| NBA |

Receivable Hypothecation Facility |

10/10/2014 | 4/10/2020 | 30,000 | 17,673 | 12,327 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||

| $ | 190,000 | $ | 81,035 | |||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||

| A. | Non-recourse (except for representations and warranties) |

| B. | Reflects July 2013 Amendment. Amount outstanding includes June 30th $2.9 million from an associated inventory loan with same lender. |

36

|

Contractual Debt Maturities

As of June 30, 2013

($ in millions)

| Less Than | 1-3 | 4-5 | After 5 | Debt | ||||||||||||||||

| 1 Year | Years | Years | Years | Balance | ||||||||||||||||

| Receivable Backed Notes (Recourse) |

$ | — | $ | 5 | $ | 47 | $ | 20 | (A) | $ | 72 | |||||||||

| Lines of Credit & Notes Payable |

7 | 24 | 17 | 41 | 89 | |||||||||||||||

| Jr Subordinated Debentures |

— | — | — | 111 | 111 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Subtotal – Recourse Debt |

7 | 29 | 64 | 172 | 272 | |||||||||||||||

| Non- Recourse Receivable – Backed Notes |

— | 5 | 25 | 310 | 340 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 7 | $ | 34 | $ | 89 | $ | 482 | $ | 612 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (A) | Net of Legacy Discount |

37

|

Balance Sheet

($ in thousands)

| June 30, 2013 | December 31, 2012 | |||||||

| (unaudited) | ||||||||

| Assets |

||||||||

| Cash and cash equivalents, unrestricted |

$ | 113,698 | $ | 153,662 | ||||

| Cash and cash equivalents, restricted |

65,529 | 54,335 | ||||||

| Notes receivable, net |

467,871 | 480,865 | ||||||

| Inventory, net |

264,127 | 274,006 | ||||||

| Property and equipment, net |

70,201 | 68,975 | ||||||

| Prepaid Expenses and Other assets |

71,688 | 47,799 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,053,114 | $ | 1,079,642 | ||||

|

|

|

|

|

|||||

38

|

Balance Sheet (cont.)

($ in thousands)

| June 30, 2013 | December 31, 2012 | |||||||

| (unaudited) | ||||||||

| Liabilities and Shareholders‘ Equity |

||||||||

| Accounts payable & accrued liabilities |

$ | 88,759 | $ | 81,970 | ||||

| Deferred income |

30,229 | 27,679 | ||||||

| Deferred income taxes |

55,230 | 42,663 | ||||||

| Receivable—backed debt : |

||||||||

| Non-recourse |

340,454 | 356,015 | ||||||

| Recourse |

72,721 | 89,640 | ||||||

| Lines-of-credit and notes payable |

88,699 | 21,551 | ||||||

| Junior subordinated debentures |

110,827 | 110,827 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

786,919 | 730,345 | ||||||

| Non-controlling interest |

44,378 | 37,919 | ||||||

| Bluegreen shareholders’ equity (a) |

221,817 | 311,378 | ||||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

266,195 | 349,297 | ||||||

|

|

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | 1,053,114 | $ | 1,079,642 | ||||

|

|

|

|

|

|||||

| (a) | Reflects payments to public shareholders of $89.2 million in connection with the Merger and payment of $20 million of dividends. |

39

|

Income Statements

($ in millions)

| Six Months Ended(a) | Year Ended | |||||||||||||||

| 6/2013 | 6/2012 | 2012 | 2011 | |||||||||||||

| Sales of VOIs(b) |

$ | 119 | $ | 95 | $ | 208 | $ | 164 | ||||||||

| Fee-based sales commission revenue |

46 | 38 | 88 | 74 | ||||||||||||

| Other fee-based services revenue |

40 | 38 | 75 | 71 | ||||||||||||

| Interest income and other |

42 | 44 | 87 | 95 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 247 | 215 | 458 | 404 | |||||||||||||

| Cost of VOIs sold |

22 | 19 | 40 | 41 | ||||||||||||

| Cost of other resort fee-based services |

25 | 25 | 46 | 52 | ||||||||||||

| Selling, general and administrative expenses |

142 | 109 | 247 | 199 | ||||||||||||

| Interest expense |

20 | 22 | 42 | 54 | ||||||||||||

| Other expense, net |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 208 | 175 | 375 | 347 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pre-tax income from continuing operations |

38 | 39 | 83 | 57 | ||||||||||||

| Provision for income taxes |

13 | 14 | 29 | 21 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations |

$ | 26 | $ | 25 | $ | 54 | $ | 36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Unaudited |

| (b) | Sales of Bluegreen’s inventory only, net of estimated uncollectible VOI notes receivable. |

40

|

Appendix A:

Non- GAAP Reconciliations

41

|

Non-GAAP Measures

In addition to financial results determined in accordance with generally accepted accounting principles (“GAAP”), this presentation also contains financial information determined by methods other than in accordance with GAAP. The Company’s management uses these non-GAAP measures in their analysis of the Company’s performance. These non-GAAP measures are referred to in this presentation as “Adjusted EBITDA”, which the Company uses as a measure of financial performance, is defined as earnings before interest income (except interest income on notes receivable), interest expense (except interest expense on receivable-backed debt), provision for income taxes, depreciation, amortization, net income attributable to non-controlling interests, non-cash stock and other long-term compensation expense, loss on disposal of fixed assets, non-cash impairment charges, Bluegreen Communities’ Adjusted EBITDA and adjustments to loan loss allowance for pre-2009 originations (net of associated benefit to cost of sales).

The Company believes that these non-GAAP measures supplement its GAAP financial information and provide a useful measure of evaluating the Company’s operating results and any related trends that may be affecting the Company’s business. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

42

|

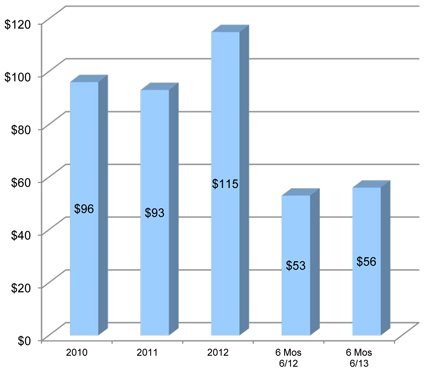

Adjusted EBITDA

($ in millions)

| 2010 | 2011 | 2012 | 6 Mos 6/2012 | 6 Mos 6/2013 | ||||||||||||||||

| Net Income(Loss) |

$ | (44.0 | ) | $ | (17.3 | ) | $ | 39.7 | $ | 18.9 | $ | 19.1 | ||||||||

| Minority Interest |

8.1 | 7.7 | 11.1 | 4.8 | 6.5 | |||||||||||||||

| Non-cash stock and other long-term compensation expense |

2.6 | 4.4 | 10.1 | 2.2 | 8.0 | |||||||||||||||

| Non-cash impairment charges |

54.6 | 0.5 | 0.0 | 0.0 | — | |||||||||||||||

| Loss on assets held for sale |

— | 62.0 | 1.2 | 0.2 | 0.1 | |||||||||||||||

| Plus: non-cash adjustment to pre-2009 loan loss provision |

69.7 | 13.0 | 7.3 | 3.4 | 0.1 | |||||||||||||||

| Less: benefit to cost of sales from loan loss adjustment |

(15.9 | ) | (3.2 | ) | (1.4 | ) | (0.7 | ) | — | |||||||||||

| Less: Other Interest income (a) |

(0.0 | ) | (0.1 | ) | (0.0 | ) | (0.2 | ) | (0.2 | ) | ||||||||||

| Interest Expense |

65.8 | 56.9 | 42.9 | 23.8 | 19.7 | |||||||||||||||

| Less: Interest expense on Receivable-Backed Debt |

(43.4 | ) | (39.0 | ) | (32.6 | ) | (16.8 | ) | (13.9 | ) | ||||||||||

| Taxes |

(22.2 | ) | (3.8 | ) | 27.6 | 12.1 | 12.7 | |||||||||||||

| Depreciation and amortization |

9.4 | 7.9 | 7.2 | 3.6 | 3.4 | |||||||||||||||

| Add Back: Bluegreen Communities’ negative EBITDA (b) |

12.0 | 4.3 | 1.8 | 1.9 | 0.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA* |

$ | 96.4 | $ | 93.3 | $ | 114.9 | $ | 53.1 | $ | 55.6 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Excludes Interest Income from the Notes Receivable portfolio. |

| (b) | For comparability, Communities EBITDA is adjusted for all years, including 2011 – 2012 when it was determined to be a discontinued operation. |

| * | May not balance due to rounding. |

43

|

Appendix B:

Other Information

44

|

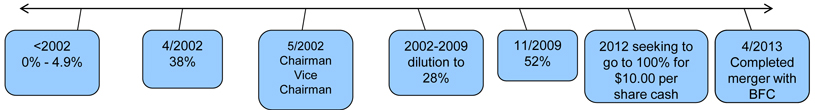

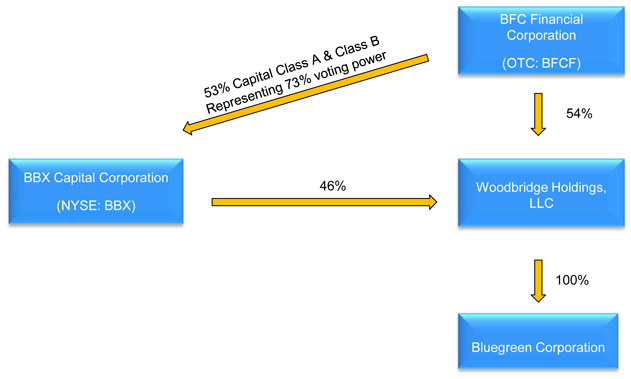

Completed Merger with BFC

| • | BFC’s Ownership History of Bluegreen |

| • | BFC is a diversified holding company |

45

|

Completed Merger with BFC

46

|

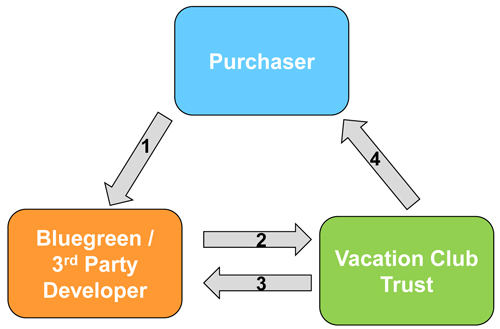

Unique Club Configuration

|

• Bluegreen Vacation Club- ‘Trust’ architecture allows for the retention of voting rights once inventory is sold, perpetual management control, and allows for recovery of the underlying collateral for non-performing consumer loans or assessments without necessity of judicial process. |

1. Promissory Note 2. Deed To VOI 3. Mortgage 4. Owner Beneficiary Rights |

47

|

Realized Cash vs Receivables at

Point of Sale

(as a percentage of sales)

| (1) | Includes both 100% cash sales and down payments. |

48

|

Sales to Existing Owner Base

(As a % of system-wide sales)

49

|

How Bluegreen VOI Buyers Finance Their Purchase

| Purchase Price of a Typical Vacation Ownership Interest: |

$ | 13,200 | 100% | |||||

| Cash Down Payment: |

($ | 1,320 | ) | (10%) | ||||

|

|

|

|

||||||

| Amount Financed: |

$ | 11,880 | 90% | |||||

| Terms of Typical Financing: |

||||||||

| Term / Amortization: |

10 years | |||||||

| Fixed Interest Rate: |

16.99 | % | ||||||

| Monthly Payment: |

$ | 206 | * | |||||

| Approx. Annual Maintenance Fee/ Club Dues: |

$ | 809 | ||||||

| Annual Cost During Financing Period: |

$ | 3,286 | * | (4.1% of Income**) | ||||

| Annual Cost After Financing Period: |

$ | 809 | (1.0% of Income**) | |||||

| * | Dollar amount rounded to the nearest whole dollar. |

| ** | Note: Based on average household income of $80,000 for timeshare buyers. |

50

|

2008 Strategic Initiatives

Transformative changes since 2008 to improve operating model…

| • | Substantially reduced timeshare sales operations to align with known receivable financing capacity, projected cash sales and marketing efficiencies. |

| • | Employing “capital light” business model that is generating excess cash from multiple streams: |

| • | Traditional timeshare sales operations generate significant cash sales and currently has historically low capital requirements |

| • | Fee-based Services Business: |

| • | Fee-Based services sales & marketing commissions |

| • | Property management, title, mortgage servicing & other Fee-Based services |

| • | Finance business income |

| • | Reduced overhead, improving debt profile, minimizing capital spending, increasing marketing efficiencies. |

| • | Established FICO® score – based credit underwriting program in December 2008. |

| • | Completed sale of non-core real estate business (Bluegreen Communities) in May 2012. |

51

|

Impact of 2008 Strategic Initiatives

Faced with the credit crisis in the fall of 2008, with reduced levels of timeshare receivable financing in general, and a freeze in the securitization markets in particular, Bluegreen quickly and efficiently navigated through the crisis by implementing numerous strategic initiatives in a 60 day period. Certain updated results of these original 2008 initiatives include:

| • | Generated operating/investing cash flow of approximately $162 million in 2012.(a) |

| • | Increased cash realized within 30 days of sale from 24% of sales in 2008 to 53% in 2012. |

| • | The “capital-light” fee-based service business model generated $57 million in pre-tax profits in 2012. |

| • | Lines-of-credit and notes payable declined 90% to $22 million as of December 31, 2012 from $222.7 million as of December 31, 2008. |

| • | Capital expenditures decreased from $188 million in 2008 to $18 million in 2012. |

| • | Successfully extended over $200 million in debt obligations in 2009 and 2010, with no defaults. |

| • | Associate headcount went from 6,396 as of 9/30/08 to 3,236 as of 1/31/09; as of 12/31/12 headcount was 4,387 (such increase was primarily due to fee-based service volume). |

| • | Revolving receivable credit facilities of $190 million with availability of $81 million as of June 30, 2013.(b) |

| • | Unrestricted cash and equivalents of $113.7 million as of June 30, 2013. |

| • | Improved delinquency and default performance in FICO® score-based credit underwritten portfolio. |

| • | Recent transactions in credit and securitization markets (including Merger financing of $75 million). |

| • | Sales to Bluegreen Vacation Club owners represented 58% of total Resort sales in 2012, indicating a high level of customer satisfaction and providing a low cost marketing channel. |

| (a) | Excludes $27.8 million of gross proceeds from sale of Bluegreen Communities |

| (b) | Including July 2013 facility renewal. |

52