Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED INSURANCE HOLDINGS CORP. | form8-k27aug13presentation.htm |

United Insurance Holdings Corp. NASDAQ: UIHC Investor Presentation August 2013

Safe Harbor – At a Glance 2 Statements in this presentation that are not historical facts are forward-looking statements that are subject to certain risks and uncertainties that could cause actual events and results to differ materially from those discussed herein. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “or “continue” or the other negative variations thereof or comparable terminology are intended to identify forward-looking statements. The forward-looking statements in this presentation include statements regarding the Company’s or management’s plans, objectives, goals, strategies, expectations, estimates, beliefs or projections, or any other statements concerning future performance or events. The risks and uncertainties that could cause our actual results to differ from those expressed or implied herein include, without limitation, the success of the Company’s marketing initiatives, inflation and other changes in economic conditions (including changes in interest rates and financial markets); the impact of new regulations adopted which affect the property and casualty insurance market; the costs of reinsurance and the collectability of reinsurance, assessments charged by various governmental agencies; pricing competition and other initiatives by competitors; or ability to obtain regulatory approval for requested rate changes, and the timing thereof; legislative and regulatory developments; the outcome of litigation pending against us, including the terms of any settlements; risks related to the nature of our business; dependence on investment income and the composition of our investment portfolio; the adequacy of our liability for loss and loss adjustment expense; insurance agents; claims experience; ratings by industry services; catastrophe losses; reliance on key personnel; weather conditions (including the severity and frequency of storms, hurricanes, tornadoes and hail); changes in loss trends; acts of war and terrorist activities; court decisions and trends in litigation, and health care; and other matters described from time to time by us in our filings with the SEC, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2012. In addition, investors should be aware that generally accepted accounting principles prescribe when a company may reserve for particular risks, including litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when a reserve is established for a major contingency. Reported results may therefore, appear to be volatile in certain accounting periods. The Company undertakes no obligations to update, change or revise any forward-looking statement, whether as a result of new information, additional or subsequent developments or otherwise. INTRODUCTION Industry Property/Casualty Insurance Business Homeowners Insurance in FL / SC / MA / RI / NC / NJ HQ St. Petersburg, FL Employees Approximately 80 Policies in Force 168,075 (at 6/30/13) Cash / Inv. $292.8M (at 6/30/13) Dividend $0.03 mrq (at 6/30/13)

Business Model 3 To produce superior risk-adjusted returns for investors by building a sustainable franchise that delivers quality homeowners insurance products in select markets. MISSION To be the premier provider of property insurance in catastrophe exposed areas. VISION To grow selectively in target markets by building a superior team of insurance professionals that (i) can build and maintain relationships with external partners; (ii) raise capital to support business growth; and (iii) provide agents and homeowners quality insurance products with world-class service and systems. STRATEGY

Corporate Structure 4 United Property & Casualty Insurance Company United Insurance Management UPC Re United Insurance Holdings Corp. (NASDAQ : UIHC) Insurance subsidiary that writes policies and bears risk of loss Managing general agency that provides personnel and management services for the combined entity Claims subsidiary that provides field inspection services for a portion of the company’s non- catastrophe claims Four wholly-owned subsidiaries Reinsurance subsidiary that provides fully collateralized risk transfer for a portion of the company’s reinsurance program United Property & Casualty Insurance Company United Insurance Management Skyway Claims Services UPC Re

5 Why UPC Insurance? • Profitable in 13 of 14 years since inception in 1999 • YTD 6/30/13 results: $191 million written & $8.9 million of net income • TTM ROAE of 14.7% despite nearly $4 million of catastrophe losses Strong Financial Performance • Continued de-concentration of risk by major national home underwriters • Only need small market share to generate significant premium growth • Top 10 in Florida & 48th nationally, but 3rd fastest growing in homeowners Compelling Market Opportunity • Public offering December 2012 • Raised roughly $28 million to support growth; achieved NASDAQ listing • Strong demand from reinsurance partners to help manage risk and volatility Proven Access to Capital • Stability and deep experience at the Board level • Augmenting strong foundation of tenured associates with new talent • Developing new incentive compensation plans to ensure proper alignment Exceptional Management Team • Focused on risk selection and spread of risk • Run sophisticated catastrophe modeling in house and supported by key partners • Highly automated and easy to use underwriting and agency systems Unique Insurance Capabilities

Exceptional Management Team 6 Gregory C. Branch Chairman • Chairman of United since inception in 1999 • Prior Member of Lloyd’s of London for over 20 years • Former Chairman of Summit Holding Southeast, Inc. (acquired by Liberty Mutual) John L. Forney, CFA President & CEO • 25+ year successful career in investment banking, insurance and risk management • Former Managing Director, Raymond James – Advised state government agencies in Florida (Citizens/FHCF/FIGA), California (CEA), Texas (TWIA), North Carolina (NCJUA) and Louisiana (Citizens) on insuring property catastrophe risks. • Advised major national industry consortium led by State Farm and Allstate on managing residential natural catastrophe risk B. Bradford Martz, CPA CFO • 19+ years of progressively responsible experience in the insurance, public accounting, homebuilding and technology sectors • Former CFO/CAO, Bankers Insurance Group / Former Managing Partner, Lake, Martz & Co, P.A. / Former CFO, Bonded Builders Home Warranty Andrew Swenson CIO • 25+ years of experience leading technology efforts at multiple large publicly traded international service organizations • Former CIO at Vology, Tribridge, Sykes Enterprises, ABR Information Services (a/k/a Ceridian) and ServiceMaster, LLP Deepak Menon, CPCU VP of Operations • 18+ years of underwriting, product and distribution strategy experience with a focus on well managed growth • Former VP of Marketing for American Strategic Insurance / Former Product Manager for ACE and One Beacon John Langowski, AIC, AIM VP of Claims • 22+ years of industry-related experience; 10+ years spent at Fortune 100 companies specializing in P&C insurance • Former VP and Chief Claims Officer, Cypress Insurance Group / Former Regional Director of Claims, Farmers Insurance Group in Texas Jay Williams, CIC, CRM, AAI, AIP, ACSR VP of Marketing • 33+ years of insurance experience; served in various new business development and marketing roles for insurance entities • Former Managing Director, Florida Association of Insurance Agents / Former Marketing VP at Bankers Insurance Group

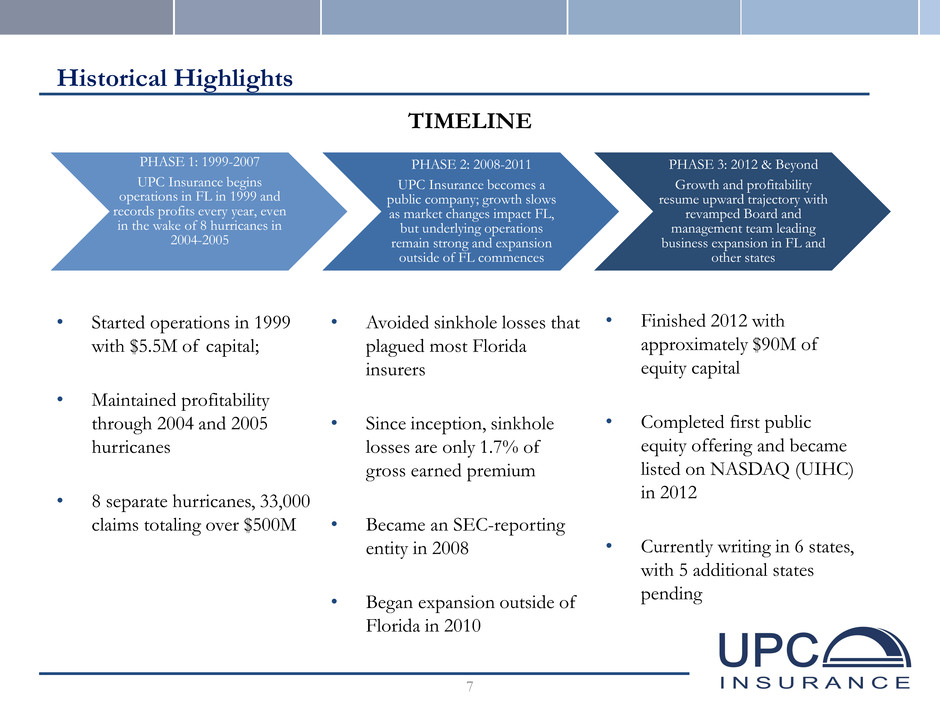

Historical Highlights 7 PHASE 1: 1999-2007 UPC Insurance begins operations in FL in 1999 and records profits every year, even in the wake of 8 hurricanes in 2004-2005 PHASE 2: 2008-2011 UPC Insurance becomes a public company; growth slows as market changes impact FL, but underlying operations remain strong and expansion outside of FL commences PHASE 3: 2012 & Beyond Growth and profitability resume upward trajectory with revamped Board and management team leading business expansion in FL and other states TIMELINE • Started operations in 1999 with $5.5M of capital; • Maintained profitability through 2004 and 2005 hurricanes • 8 separate hurricanes, 33,000 claims totaling over $500M • Avoided sinkhole losses that plagued most Florida insurers • Since inception, sinkhole losses are only 1.7% of gross earned premium • Became an SEC-reporting entity in 2008 • Began expansion outside of Florida in 2010 • Finished 2012 with approximately $90M of equity capital • Completed first public equity offering and became listed on NASDAQ (UIHC) in 2012 • Currently writing in 6 states, with 5 additional states pending

92% 4% 4% Homeowners Fire Flood 84% 4% 4% 4% 0% Florida Rhode Island South Carolina Massachusetts North Carolina (1) Premium in thousands. Data as of June 30, 2013. (2) Policy numbers exclude flood line of business. Data as of June 30, 2013 Total policies in-force: 168,075 (2) Total premium in-force: $301,744 (1) Current Portfolio Composition 8 Premium In-Force By Line of Business Policies In-Force

9 State Expansion Status Continued Growth in Existing States (FL, NC, SC, RI, MA) New Growth in Coastal States (TX, NJ, NH) Licensed App. Pending Future No Plans DC

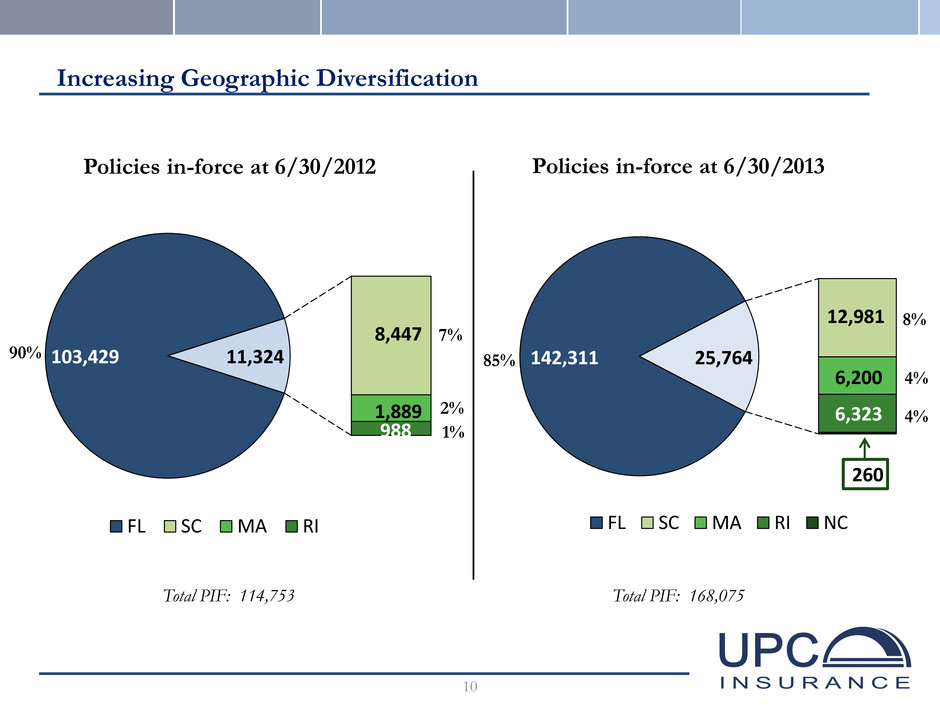

Increasing Geographic Diversification 10 103,429 8,447 1,889 988 11,324 FL SC MA RI 142,311 12,981 6,200 6,323 260 25,764 FL SC MA RI NC Policies in-force at 6/30/2013 Policies in-force at 6/30/2012 Total PIF: 114,753 Total PIF: 168,075 90% 7% 1% 2% 8% 4% 4% 85%

Huge Super Regional Opportunity Florida = 20% of DWP in UPC Insurance’s Target Markets Scale ($ Bil ) 0.00 to 0.25 0.25 to 0.50 0.50 to 1 1 to 2 2 to 3 3 to 4 4 to 5 FL 20% 5 to 6 NON-FL 80% 6 to 7 7+ Source: SNL Homeowners Direct Written Premium 2012 DC 11 Targeted Mix in 5 Years ~ 60% in Florida / 40% Other

Operational Excellence • Strong Marketing Presence • Growing independent agent distribution channels and aggregator relationships (Allstate, FAIA) • State marketing directors with strong agency relationships and extensive local market knowledge • Strategic partnerships with established carriers to bundle products • Rolling 12-month policy production average is 5,518 policies per month(1) • Risk Management • Conservative underwriting culture to select the right risks at the right rate • Utilize front end portfolio optimization tools to manage concentrations and spread of risk • Sophisticated in-house modeling with focus on data quality • Evolving enterprise risk management platform and policy profitability analysis • Experienced Claims Management • Handled over 33,000 claims with over $500 million of losses in 2004/2005 seasons • John Langowski, VP Claims – hired October 2012 (22+ years industry experience) • All adjusters are UPC Insurance employees averaging 10 years of experience • Dedicated CAT manager – 20 years experience in agency, claims, and CAT operations 12 (1) Data as of August 12, 2013.

Marketing Highlights 13 $0 $20 $40 $60 $80 $100 $ Mil lio n s 0 50 100 150 200 Tho u sa nd s PIF GPE Y/Y Growth = 37.6% Y/Y Growth = 46.5% Q2 GPE: $74.9M

Achieving Desired Balance 14 0 50 100 150 200 250 300 350 400 Polic y Co u n t NC RI MA SC FL New Business Writing by State 31% of new business in Q2 from outside FL Writing in 8 states by 2014

UPC Insurance Florida Average Earned Premium Trend 15

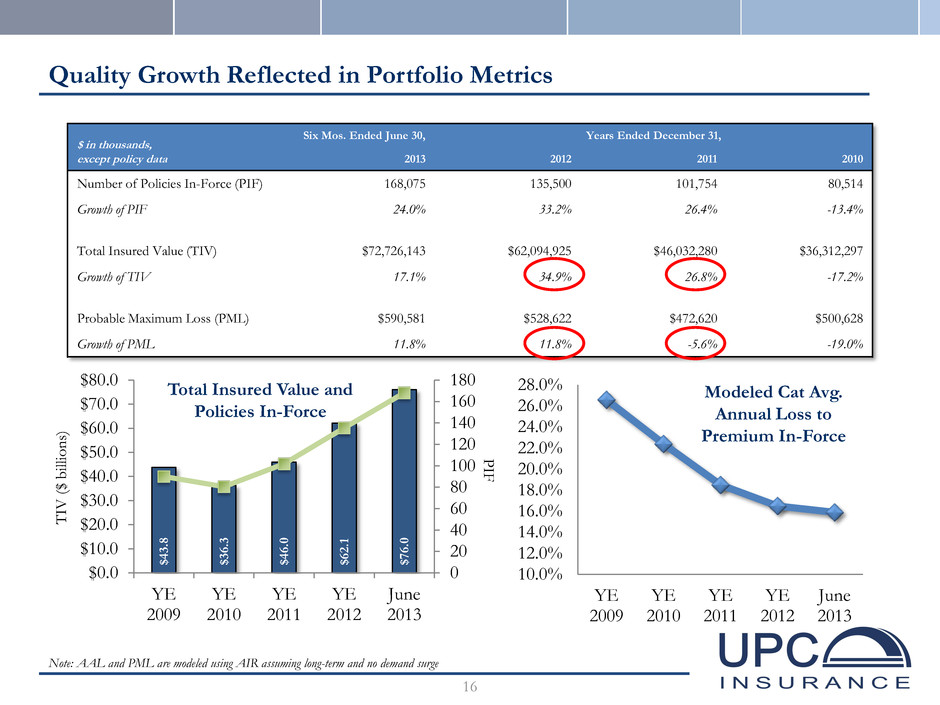

10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 22.0% 24.0% 26.0% 28.0% YE 2009 YE 2010 YE 2011 YE 2012 June 2013 Quality Growth Reflected in Portfolio Metrics Modeled Cat Avg. Annual Loss to Premium In-Force $ in thousands, except policy data Six Mos. Ended June 30, Years Ended December 31, 2013 2012 2011 2010 Number of Policies In-Force (PIF) 168,075 135,500 101,754 80,514 Growth of PIF 24.0% 33.2% 26.4% -13.4% Total Insured Value (TIV) $72,726,143 $62,094,925 $46,032,280 $36,312,297 Growth of TIV 17.1% 34.9% 26.8% -17.2% Probable Maximum Loss (PML) $590,581 $528,622 $472,620 $500,628 Growth of PML 11.8% 11.8% -5.6% -19.0% Note: AAL and PML are modeled using AIR assuming long-term and no demand surge 16 $43 .8 $36 .3 $46 .0 $62 .1 $76 .0 0 20 40 60 80 100 120 140 160 180 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 YE 2009 YE 2010 YE 2011 YE 2012 June 2013 Total Insured Value and Policies In-Force T IV ($ bil lion s) P IF

• UPC Insurance claims adjusters (all in- house) average 10+ years experience • UPC Insurance avoided sinkhole losses by non-renewing policies in sinkhole prone zones starting back in 2003 • Current Non-CAT loss ratio: 29.0% (only 1.1% attributable to sinkhole) Case Ultimate Accident Paid Loss &LAE IBNR Ultimate Ultimate Loss & LAE Year Loss & LAE Reserves Reserves Loss & LAE Loss Ratio per Exposure 2007 27,870,818$ 562,230$ 101,799$ 28,534,847$ 19.4% 430.31$ 2008 29,407,048$ 367,474$ 166,852$ 29,941,374$ 22.3% 421.54$ 2009 44,017,668$ 797,286$ 645,047$ 45,460,001$ 30.6% 497.91$ 2010 38,667,923$ 2,163,505$ 1,061,862$ 41,893,290$ 28.6% 478.80$ 2011 38,422,950$ 3,343,713$ 2,593,337$ 44,360,000$ 26.0% 465.33$ 2012 34,567,144$ 10,000,002$ 9,080,854$ 53,648,000$ 24.9% 460.57$ Q2 2013 21,886,113$ 10,522,332$ 7,871,555$ 40,280,000$ 29.0% 516.74$ Historical Non-CAT Loss Experience 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 2007 2008 2009 2010 2011 2012 Q2 2013 L o ss R a ti o Historical Non CAT Loss Ratio 6 Year Average 17

UPC Insurance’s Reinsurance Philosophy Here Today, Here Tomorrow We try to balance vertical coverage, horizontal coverage, and reinsurance spend 18 Consistent risk transfer is an integral part of our capital strategy View reinsurers as long-term partners, not short-term commodity relationships Oriented toward long-term solvency, even at the expense of some short-term profitability

2013-14 Catastrophe Reinsurance Program $20.0M LAYER 4 $150.0M xs $20.0M $677.8M LAYER 1 $30M xs $20.0M LAYER 2 $60.0M xs $20.0M $187.2M FHCF 90% of $490.6M xs $187.2M ($441.5M Limit) $14.0M RETENTION $110.0M $7M RETENTION 1st EVENT 2nd EVENT $50.0M LAYER 3 $100.0M xs $20.0M $415.0M $801.6M 30% QS 30% QS 2ND : 70% $10.0M xs $10.0M Remaining Limit after $202.8M Loss (Approx. 20 YR Event) LAYER 3 $21.3M xs $20.0M LAYER 4 $150.0M xs $20.0M FHCF 90% of $474.9M xs $187.2M ($427.4M Limit) $228.2M * Modeled hypothetical 1:100 year estimate shown using AIR v13 long-term excluding demand surge 1. Represents modeled losses on UPC Insurance’s current book from a repeat of Hurricane Charley in August 2004. Losses from Charley were $33.9M. 2. Represents modeled losses on UPC Insurance’s current book from a repeat of Hurricane Andrew in August 1992. UPC did not exist until 1999. Total Limit = $788M Cascading Limit = $340M Cascading Structure (Layers 1-4): • Attachment point of Layer 1 is net of a $20m retention • Subsequent layers are excess of loss over the immediately preceding layer • If the aggregate limit of the preceding layer is exhausted, the next layer drops down in its place Multiple Events: • Unused layer protection from first event drops down in multiple events, net of a $20m retention • Dedicated $10m x $10m (placed 70%) for second event to protect against surplus erosion • Third and subsequent event coverage of $10m x $10m (placed 100%), subject to aggregate limits 19 Andrew $65 M 2 Charley $221 M 1 1:100YR $611 M *

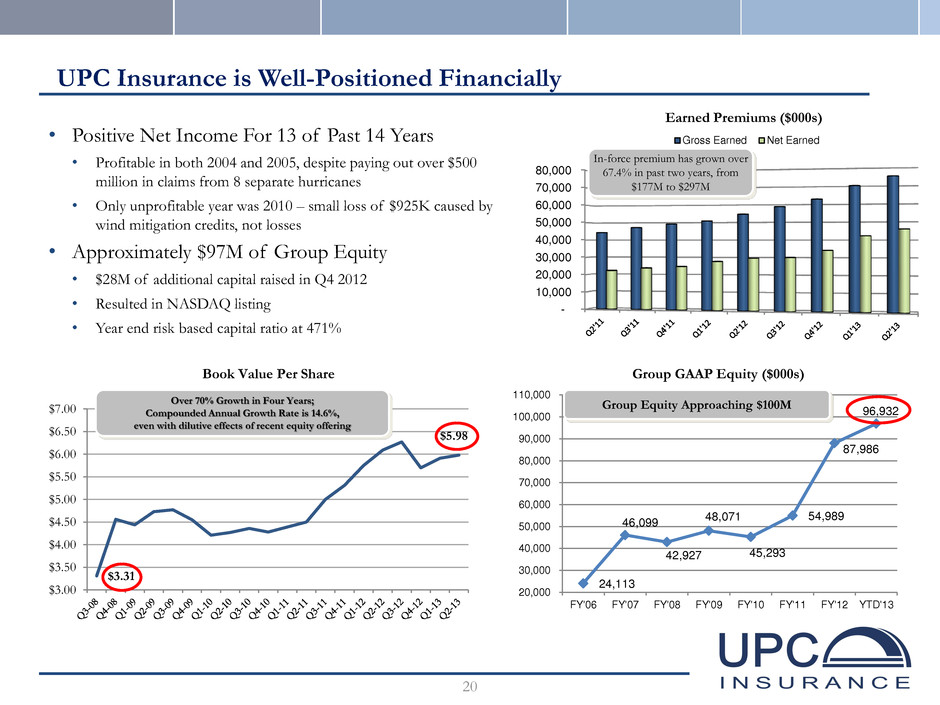

- 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Gross Earned Net Earned $3.31 $5.98 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 $7.00 24,113 46,099 42,927 48,071 45,293 54,989 87,986 96,932 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 FY'06 FY'07 FY'08 FY'09 FY'10 FY'11 FY'12 YTD'13 UPC Insurance is Well-Positioned Financially • Positive Net Income For 13 of Past 14 Years • Profitable in both 2004 and 2005, despite paying out over $500 million in claims from 8 separate hurricanes • Only unprofitable year was 2010 – small loss of $925K caused by wind mitigation credits, not losses • Approximately $97M of Group Equity • $28M of additional capital raised in Q4 2012 • Resulted in NASDAQ listing • Year end risk based capital ratio at 471% Group Equity Approaching $100M Group GAAP Equity ($000s) Over 70% Growth in Four Years; Compounded Annual Growth Rate is 14.6%, even with dilutive effects of recent equity offering Book Value Per Share Earned Premiums ($000s) In-force premium has grown over 67.4% in past two years, from $177M to $297M 20

June 2013 YTD Financial Highlights 21 P&L Balance Sheet Ratios CY PY CY PY CY PY Gross Loss Ratio 30.1% 21.4% Net Loss Ratio 49.3% 39.0% Gross Expense Ratio 24.0% 24.2% Net Expense Ratio 39.4% 44.2% EPS 0.55$ 0.75$ Book Value per Share 5.98$ 6.09$ Return on Average Equity 14.7% 26.6% Shareholders' Equity Gross Written Premiums Gross Earned Premiums Net Earned Premiums Cash and Equivalents Operating, G&A Expenses 191,049$ 144,776$ 88,268$ 22,451$ 25,627$ 96,932$ LAE to Incurred RatioNet Income Loss and LAE 43,554$ 34,938$ 35.9% 10.7%8,860$ Loss Reserves Total Liabilities Ceding Ratio Underlying Combined Ratio 467,139$ 135,924$ 105,125$ 57,512$ 50,815$ 241,963$ Investments Total Assets 42.5% 83.2% 84.2% 13.4%7,739$ 92,130$ 127,371$ 366,029$ 33,150$ 302,908$ 63,121$ 80.6% Net Combined Ratio 88.7%38,234$ 370,206$ Return on average equity is a trailing twelve month calculation

Components of Operating Return on Equity 1 22 ROAE 8.4% ROAE -2.0% ROAE 16.1% ROAE 16.1% ROAE 26.6% ROAE 14.7% -$10,000 -$5,000 $0 $5,000 $10,000 $15,000 $20,000 YE 2009 YE 2010 YE 2011 YE 2012 YTD 6/30/12 YTD 6/30/13 Underwriting G/L Inv Income CAT Losses PY Dev Fav/(Unfav) Core UW Results Improving

Investment Portfolio 1 • Designed to preserve capital, maximize after-tax investment income, maintain liquidity and minimize risk • As of June 30, 2013, 100% of the Company’s fixed maturity portfolio was rated investment grade – Average duration: 3.63 years – Composite rating: A+ – Average coupon: 2.40% U.S Government & Agency Securities 22.5% Cash & Cash Equivalents 17.4% Public Utilities and Corporate Securities 40.6% State, Municipalities & Political Subdivisions 15.9% Common Stocks 3.4% Preferred Stocks 0.1% Other Long- Term Investments 0.1% Securities Portfolio Value ($mm) % of total Cash and Investment U.S Government & agency securities $ 65.9 22.5% Cash & cash equivalents 50.8 17.4% Public utilities and corporate securities 119.0 40.6% State, municipalities & political subdivisions 46.6 15.9% Common stocks 9.9 3.4% Preferred stocks 0.3 0.1% Other long-term investments 0.3 0.1% Total cash and investments $292.8 100% Historical Return on Investments (1) 2009 2010 2011 2012 2013 1 Year 3.53% 7.43% 4.01% 6.56% 2.37% 3 Year 4.99% 6.00% 4.32% 5 Year 4.78% (1) Includes investment income and realized and unrealized gains. Data as of June 30, 2013 23

Company Highlights 1 Compelling Market Opportunity Strong Financial Performance Unique Insurance Capabilities Exceptional Management Team Proven Access to Capital Markets 24

Definitions of Non-GAAP Measures 25 We believe that investors’ understanding of UPC Insurance’s performance is enhanced by our disclosure of the following non-GAAP measures. Our methods for calculating these measures may differ from those used by other companies and therefore comparability may be limited. Combined ratio excluding the effects of current year catastrophe losses, prior year development from lines in run-off and prior year development (underlying combined ratio) is a non-GAAP ratio, which is computed as the difference between four GAAP operating ratios: the combined ratio, the effect of current year catastrophe losses on the combined ratio, the effect of development from lines in run-off and prior year development on the combined ratio. We believe that this ratio is useful to investors and it is used by management to reveal the trends in our business that may be obscured by current year catastrophe losses, losses from lines in run-off and prior year development. Current year catastrophe losses cause our loss trends to vary significantly between periods as a result of their incidence of occurrence and magnitude, and can have a significant impact on the combined ratio. Prior year development from lines in run-off is caused by unexpected development from our commercial auto product that is no longer offered by the Company. Prior year development is unexpected loss development on historical reserves. We believe it is useful for investors to evaluate these components separately and in the aggregate when reviewing our performance. The most direct comparable GAAP measure is the combined ratio. The underlying combined ratio should not be considered as a substitute for the combined ratio and does not reflect the overall profitability of our business.

26