Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DORAL FINANCIAL CORP | d585848d8k.htm |

Doral Financial Corporation

Q2 2013 Investor Presentation

August 16, 2013

Exhibit 99.1 |

Disclaimer

2

This presentation may include forward-looking statements as defined in the

Private Securities Litigation Reform Act of 1995 (the

“PSLRA”). These include comments with respect to our objectives and

strategies, and the results of our operations and our business.

Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts.

They

often

include

words

such

as

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“seeks,”

“estimates,”

or

words

of

similar

meaning,

or

future

or

conditional

verbs

such

as

“will,”

“would,”

“should,”

“could”

or

“may.”

We

intend

these

forward-looking

statements to be covered by the safe harbor provisions of the PSLRA.

Forward-looking statements provide our expectations or predictions of future

conditions, events or results. They are, by their nature, subject to risks

and uncertainties. They are not guarantees of future performance, and actual results may differ materially.

By their nature, these forward-looking statements involve numerous assumptions

and uncertainties, both general and specific, including those discussed in

Doral Financial Corporation’s 2012 Annual Report on Form 10-K and other filings we make with the

Securities and Exchange Commission. Risk factors and uncertainties that could cause

the Company's actual results to differ materially from those described in

forward-looking statements can be found in the Company's 2012 Annual Report on Form 10-K,

which

is

available

in

the

Company's

website

at

www.doralfinancial.com,

as

they

may

be

updated

from

time

to

time

in

the

Company’s periodic and other reports filed with the Securities and Exchange

Commission. The statements in this presentation speak only as of the date

they are made. We do not undertake to update forward-looking

statements

to

reflect

the

impact

of

circumstances

or

events

that

arise

after

the

date

the

forward-looking

statements

were

made,

other than as required by law, including requirements of applicable securities

laws. |

Q2

2013 Overview 3

Q2 results improved by $2MM versus Q1

US Business continues to fuel growth, grew loans to $2.5B

PR Mortgage franchise is a significant profit contributor

Maintaining Capital in excess of regulatory requirements

Doral Recovery strategy is producing benefits as NPAs fell $54MM during the quarter

|

Doral

Financial Corporation Profile 4

Company Overview

$8.5B Asset PR Mortgage & US Commercial Lender

Capital Ratios continue to exceed required levels:

o

Tier-1 Leverage Ratio:

9.0%

o

Total Risk-Based Capital Ratio: 12.5%

Book Value of $68.26 per share

o

Completed 1:20 reverse split on 6/28/2013

o

A valuation allowance against Doral’s remaining deferred

tax asset represents an additional $ 44.56 per share ($296.4MM)

Doral operates two segments:

1.

Doral Growth : Profitable Mortgage & Commercial bank

o

PR Growth: $2.6B Mortgage & Retail Bank

o

US: $2.6B Commercial & Retail Bank

2.

Doral Recovery:

$1.9B Special Servicing Portfolio

o

PR Residential Mortgage & OREO

o

PR Commercial Loans & OREO

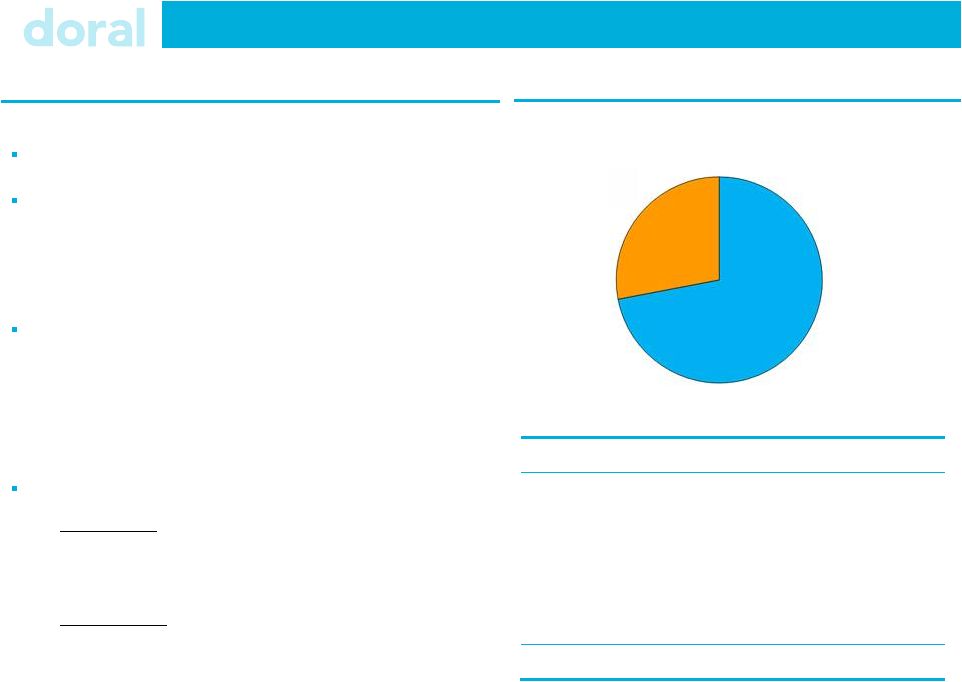

Loan Portfolio Composition ($6.7B)

Doral Growth

(73%)

Doral Recovery

(27%)

Loan Portfolio

$ MM

Loan Category

Growth

Recovery

Total

Residential

$2,310

$1,089

$3,399

CRE

691

490

1,181

C&I

1,537

118

1,655

Construction & Land

308

141

449

Consumer / Other

21

-

21

Total

$4,867

$1,838

$6,705 |

5

Doral Operating Segments

Two Operating Segments: High Margin Bank & Special Servicing Group

Puerto Rico Mortgage & Retail Banking

o

$2.6B Residential Mortgage Portfolio

o

#2 Mortgage Originator in Puerto Rico

o

A $11.1B Mortgage Servicer

o

$1.7B of deposits

US Commercial & Retail Banking

o

$2.6B High NIM Specialty Commercial Lender

o

8 branches with $1.2B of deposits

62% of Loans are Performing.

$1.1B of Puerto Rico Residential Mortgages

o

TDRs and Defaulted Loans (180 days past due)

o

65% of loans are Performing

$0.7B of Puerto Rico Commercial Loans

o

CRE, Small Business and Construction & Land

o

58% of loans are Performing

$0.1B of OREO & Other

1. Doral Growth: A $6.6B Mortgage & Commercial Bank

2. Doral Recovery: A $1.9B Special Servicing Group

Puerto Rico Loans

(35%)

US Loans

(38%)

OREO & Other

(7%)

Cash & Securities

(16%)

Commercial

(39%)

Residential Mortgage

(54%)

Taxes & Other

(11%) |

Q2

Results Net Loss ($MM)

2Q ’13

Net Interest Income

$50.5

Non Interest Income

16.8

Total Net Revenue

67.3

Non-Interest Expense

73.9

Pre-Tax, Pre-Provision Income

(6.6)

Credit Provision

5.5

Pre-Tax Income

(12.1)

Tax Expense (Benefit)

(1.8)

Reported Net Loss

$(10.4)

Ratios:

NIM (bps)

270

Average Assets

$8,418

Improved Net Loss by $2.0MM vs. Q1’13

NIM run-rate exceeds 300 bps

Non-Interest Income impacted by rate sensitive fair

value assets

Improved Q2 delinquency

Lower Q2 Provision on improved credit quality

6

Credit Provision Distribution by Reason

($MM)

Charge-off /

Valuation

Delinquency

Total

$5.7

$(0.2)

$5.5

1

includes correction of the loan modification process

o

~$5MM MSR and related hedge positions

o

~$3MM I/O

o

Doral Recovery: Significant improvement to non-performing

assets in both residential and commercial portfolios

o

PR Mortgage: Mature and stable $2.3B portfolio

o

US: Continued exceptional performance with less than

20 bps of delinquency

1 |

Doral

Growth 7

Segment Results

1

Overview

Doral

Growth

generated

$10MM

in

Pre-Tax

Income

NIM remained strong at 340bps

Non-Interest Income declined as Quarter end rate

increases negatively impacted rate sensitive fair

value assets

Non-Interest Expense includes $2MM related to a

PR Revenue Tax implemented in Q2

Continued strong US growth

($MM)

2Q 13

Net Interest Income

$48.4

Non Interest Income

18.9

Total Net Revenue

67.3

Non-Interest Expense

56.8

Pre-Tax, Pre-Provision Income

10.5

Credit Provision

0.5

Pre-Tax Income

$10.0

Ratios:

NIM (bps)

340

Efficiency Ratio

84%

Average Assets

$6,461

Pre-Tax ROAA

0.7%

1

Includes Allocation of Administrative Expenses ( Corporate and Treasury)

(for additional details see exhibit B)

Loan Portfolio

$ MM

Loan Category

PR

US

Total

Residential

$2,299

$11

$2,310

CRE

1

690

691

C&I

13

1,524

1,537

Construction & Land

-

308

308

Consumer / Other

21

-

21

Total

$2,334

$2,533

$4,867

o

Loans increased by $202MM to $2.5B

o

Retail

deposits

grew

by

$237MM

to

$1,195MM |

Doral

Recovery 8

Segment Results

($MM)

2Q 13

Net Interest Income

$2.0

Non Interest Income

(2.1)

Total Net Revenue

(0.1)

Non-Interest Expense

17.1

Pre-Tax, Pre-Provision Income

(17.2)

Credit Provision

5.0

Pre-Tax Income

$(22.2)

Ratios:

NIM (bps)

44

Average Assets

$1,957

Non-Performing Loans

$660

NPL %

38%

Overview

Net Loss improved by $5.2MM in the quarter

Lower provisions on stronger NPL performance

o

Q2 Provision driven by charge-off / valuation

adjustments

62% of Recovery Loans are Performing

o

65% of Mortgage loans are performing

o

58% of Commercial loans are performing

1

Includes Allocation of Administrative Expenses (Corporate and Treasury)

(for additional details see exhibit B)

Loan Portfolio

$ MM

Loan Category

Total

NPL

% NPL

Residential

$1,015

$360

35%

Commercial Real Estate

447

191

43%

Commercial

118

5

4%

Land & Construction

141

105

74%

Total

$1,721

$660

38%

2

NIM of 173 bps exclusive of correction of loan modification process

3

Excludes Loans HFS

1

2

3 |

Asset

Quality 9

1

Excludes Loans Held for Sale & FHA / VA Loans

2

UPB-

Partial Charge Offs

3

Reflects correction of the loan modification process

4

Adjusted Coverage ratio, (ALLL+Partial Charge Offs)/UPB

NPL: Adjusted Coverage Ratios

$ MM

UPB

Partial Charge-Offs,

Deferred Fees and

Discounts

Recorded

Investment

ALLL

ALLL + Partial

Charge-Offs

Adjusted

Coverage

Ratio

4

Residential

478.4

68.7

409.7

80.8

149.5

31.3%

Commercial &

Consumer

435.9

132.1

303.7

31.7

163.8

37.5%

Total

$914.3

$200.8

$713.4

$112.5

$313.3

34.3%

Increased NPL Coverage Ratios to 34%

NPL & NPA: Q1 vs. Q2

NPL

NPA

$ MM

Q1

Q2

Change

Q1

Q2

Change

Residential

436.7

409.7

(27.0)

545.1

527.1

(18.0)

Commercial

337.8

303.7

(34.1)

386.7

350.4

(36.3)

Total

$774.5

$713.4

$(61.1)

$931.8

$877.5

$(54.3)

1

2

3

1

Recovery efforts drove a $54MM reduction in NPAs |

10

Executive Summary

Doral Recovery efforts resulted in improved payment performance and lower NPAs

US operation provides attractive asset substitution opportunities

PR Mortgage franchise is a leader in fixed-rate, affordable mortgages

Opportunity to create additional value in PR Mortgage through simplification

Leverage ratio of 9% continues to be in excess of regulatory requirements

|

Investor Relations Contact and Conference Replay Details

11

Investor Relations:

Christopher Poulton

212 / 329-3794

christopher.poulton@doralfinancial.com

Media:

Lucienne Gigante –

SVP Public Relations

787 / 474-6298

lucienne.gigante@doralbank.com

Conference Call:

10.00 AM EDT August 16, 2013

(800) 288-8968 or (612) 332-0345

Conference Call Replay:

August 16, 2013 –

September 16, 2013

(800) 475-6701 or (320) 365-3844

Replay Code: 299763 |

Exhibits |

Exhibit A –

Financial Summary

13

($ MM)

30-June-13

31-Mar-13

31-Dec-12

30-Sep-12

30-Jun-12

Income Statement

Net Interest Income

50.5

60.7

56.8

56.2

54.8

Provision for Credit Losses

5.5

18.7

21.3

34.4

5.2

NII After Provisions

45.0

42.0

35.5

21.8

49.6

Non-Interest Income

16.8

24.4

29.1

19.7

20.1

Non-Interest Expense

73.9

74.9

86.5

73.5

70.5

Pre-Tax Income

(12.1)

(8.5)

(21.9)

(32.0)

(0.8)

Taxes

(1.8)

3.9

(50.2)

0.5

0.8

Net Income

(10.4)

(12.4)

28.3

(32.5)

(1.6)

Pre-Tax Pre-Provision Income

(6.6)

10.2

(0.6)

2.4

4.4

Balance Sheet

Total Gross Loans (incl. HFS)

$6,705

$6,614

$6,613

$6,611

$6,487

Loan Loss Reserves

112

125

135

146

153

Total Deposits

4,972

4,783

4,629

4,614

4,538

Total Assets

8,521

8,369

8,479

8,371

8,345

Profitability Metrics

Net Interest Margin

2.70%

3.31%

2.97%

2.95%

2.95%

Capital & Credit Ratios

NPL

/

Loans

11.6%

12.6%

12.2%

11.5%

11.4%

Leverage Ratio

8.98%

9.26%

9.39%

9.32%

9.92%

1

Excludes Loans Held for Sale and Residential loans guaranteed by FHA / VA

1 |

14

($ MM)

PR

US

Doral Growth

Recovery

Corporate

Treasury

Total

Income Statement

Net Interest Income

$25.7

$23.7

$49.4

$2.0

$(0.1)

$(0.9)

$50.5

Non-Interest Income

20.0

2.0

22.0

(2.1)

0.0

(3.1)

16.8

Total Net Revenue

45.7

25.7

71.4

(0.1)

(0.1)

(3.9)

67.3

Non-Interest Expense

36.8

12.4

49.2

14.7

8.7

1.3

73.9

Pre-Tax , Pre Provision Income

8.9

13.3

22.2

(14.8)

(8.8)

(5.3)

(6.6)

Credit Provision

(0.1)

0.6

0.5

5.0

0.0

0.0

5.5

Pre-Tax Income

$9.0

$12.7

$21.7

$(19.8)

$(8.8)

$(5.3)

$(12.1)

Allocation of Corporate & Treasury

Adjusted Revenue

(3.8)

0.0

0.1

3.9

0.0

Adjusted Non Interest Expense

7.6

2.4

(8.7)

(1.3)

0.0

Adjusted Pre-Tax Income

$10.0

$(22.2)

$0.0

$0.0

$(12.1)

Exhibit B –

Segment Reconciliation

1

Doral Growth is the sum of PR and US Segments

1 |