Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Aly Energy Services, Inc. | aly_8k.htm |

EXHIBIT 99.1

ALY ENERGY

SERVICES, INC.

SERVICES, INC.

1

DISCLAIMERS

• During this presentation, and in response to your questions, certain items may be

discussed which are not based entirely on historical facts. Any such items should be

considered forward-looking statements. Any forward-looking statements speak only

as of the date on which they are made, and we undertake no obligation to update

such statements to reflect events or circumstances arising after such date. All such

forward-looking statements are subject to risks and uncertainties, which could cause

actual results to differ from those anticipated. We have described the most significant

of these risks and uncertainties in our reports filed with the Securities and Exchange

Commission.

discussed which are not based entirely on historical facts. Any such items should be

considered forward-looking statements. Any forward-looking statements speak only

as of the date on which they are made, and we undertake no obligation to update

such statements to reflect events or circumstances arising after such date. All such

forward-looking statements are subject to risks and uncertainties, which could cause

actual results to differ from those anticipated. We have described the most significant

of these risks and uncertainties in our reports filed with the Securities and Exchange

Commission.

• This presentation may include certain non-GAAP financial information, which is not

intended to be considered in isolation or as a substitute for, or superior to, the

financial information prepared and presented in accordance with GAAP. The non-

GAAP financial measures may be calculated differently from, and therefore may not

be comparable to, similarly titled measures used by other companies.

intended to be considered in isolation or as a substitute for, or superior to, the

financial information prepared and presented in accordance with GAAP. The non-

GAAP financial measures may be calculated differently from, and therefore may not

be comparable to, similarly titled measures used by other companies.

• This presentation is presented solely for information purposes. This presentation is

not an offer to sell, or a solicitation of an offer to buy, any securities.

not an offer to sell, or a solicitation of an offer to buy, any securities.

2

ALY ENERGY

SERVICES, INC.

SERVICES, INC.

• ALYE is a high growth oilfield services company with equipment rentals and

services driven by the fast growth of the horizontal drilling revolution

focused in North American Shale Plays.

services driven by the fast growth of the horizontal drilling revolution

focused in North American Shale Plays.

• ALYE offers a differentiated mix of innovative mud-on-demand tanks,

supportive and ancillary equipment rentals surrounding the delivery of oil

based mud to the drilling rig for a growing number of Oil & Gas Operators

thru Master Service Agreements (MSAs).

supportive and ancillary equipment rentals surrounding the delivery of oil

based mud to the drilling rig for a growing number of Oil & Gas Operators

thru Master Service Agreements (MSAs).

• ALYE is focused on an internal growth objective of at least 20% growth in

our equipment fleet, new equipment categories, new oil company

customers, and geographic expansion.

our equipment fleet, new equipment categories, new oil company

customers, and geographic expansion.

• ALYE is looking for complementary acquisitions in high growth oil services

niche markets.

niche markets.

3

• Founded by Micki Hidayatallah and incorporated in Delaware in July

2012

2012

• Completed its platform acquisition of Austin Chalk Petroleum

Services Corp. (“ACPS”) in October 2012

Services Corp. (“ACPS”) in October 2012

• Shareholders executed a share exchange with the shareholders of a

public company in May 2013

public company in May 2013

• Aly Energy Services, Inc. trades on the OTCBB under the symbol

ALYE

ALYE

ALY ENERGY

SERVICES, INC.

SERVICES, INC.

4

MANAGEMENT TEAM

• CEO and Chairman - Micki Hidayatallah

– Former Founder, CEO and Chairman of the Board of Allis-Chalmers

Energy Inc. from 2001-2011, a NYSE company, and sold to

Seawell/Archer for $1.1billion

Energy Inc. from 2001-2011, a NYSE company, and sold to

Seawell/Archer for $1.1billion

• COO and President - Mark C. Patterson

– Over 33 years experience in the Oilfield Service Industry, joining Allis-

Chalmers in 2007, serving as EVP and President of Rental Segment

Chalmers in 2007, serving as EVP and President of Rental Segment

• President of ACPS - Kurt Chew

– Founder and former owner of ACPS; has manufactured and rented a

variety of OFS equipment and provided products and services

throughout multiple oil & gas markets for over 28 years.

variety of OFS equipment and provided products and services

throughout multiple oil & gas markets for over 28 years.

• CFO - Alya Hidayatallah

– Joined Team in January 2013 after serving as assistant CFO for Archer

LTD., a publicly traded company traded on the Oslo Exchange

LTD., a publicly traded company traded on the Oslo Exchange

5

CURRENT SERVICE MARKET

|

TX RRC District

|

Total Rigs

|

Horizontal Rigs

|

|

1

|

159

|

152

|

|

2

|

87

|

79

|

|

3

|

52

|

21

|

|

4

|

32

|

15

|

|

5

|

11

|

6

|

|

6

|

28

|

25

|

|

7C

|

84

|

43

|

|

8

|

265

|

84

|

|

Totals

|

713

|

425

|

*Rig Data as of June 25, 2013

6

400bbl MUD CIRCULATING

TANKS

TANKS

Differentiated and manufactured with

specifically designed jet lines for

maximum circulating capability.

specifically designed jet lines for

maximum circulating capability.

98 innovative space saving upright

tanks designed for use on smaller

drilling pads; unique in the markets

we serve.

tanks designed for use on smaller

drilling pads; unique in the markets

we serve.

7

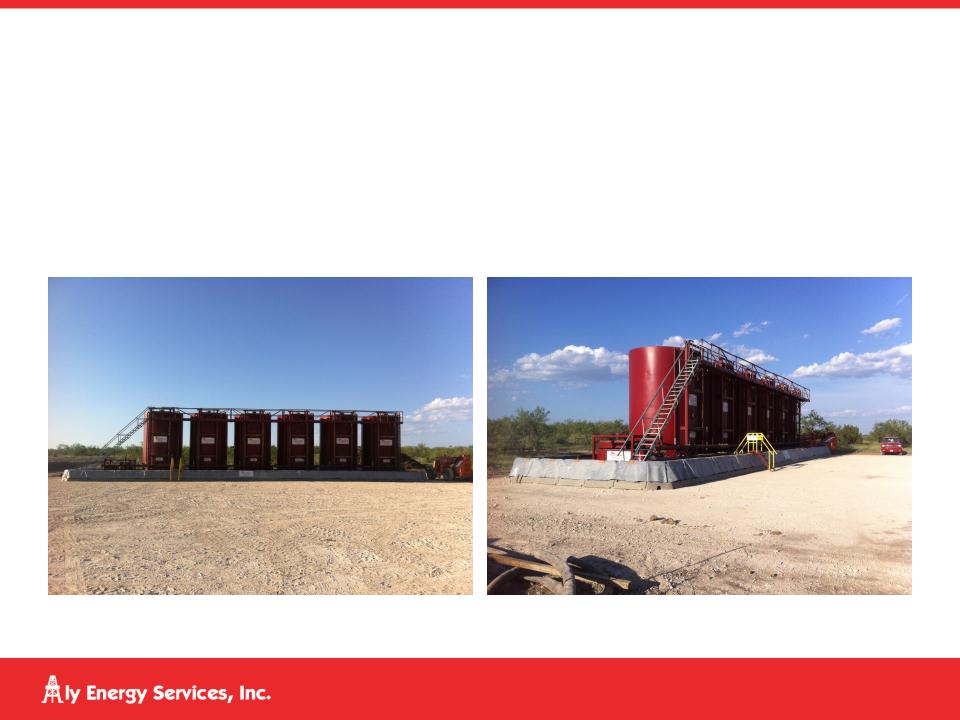

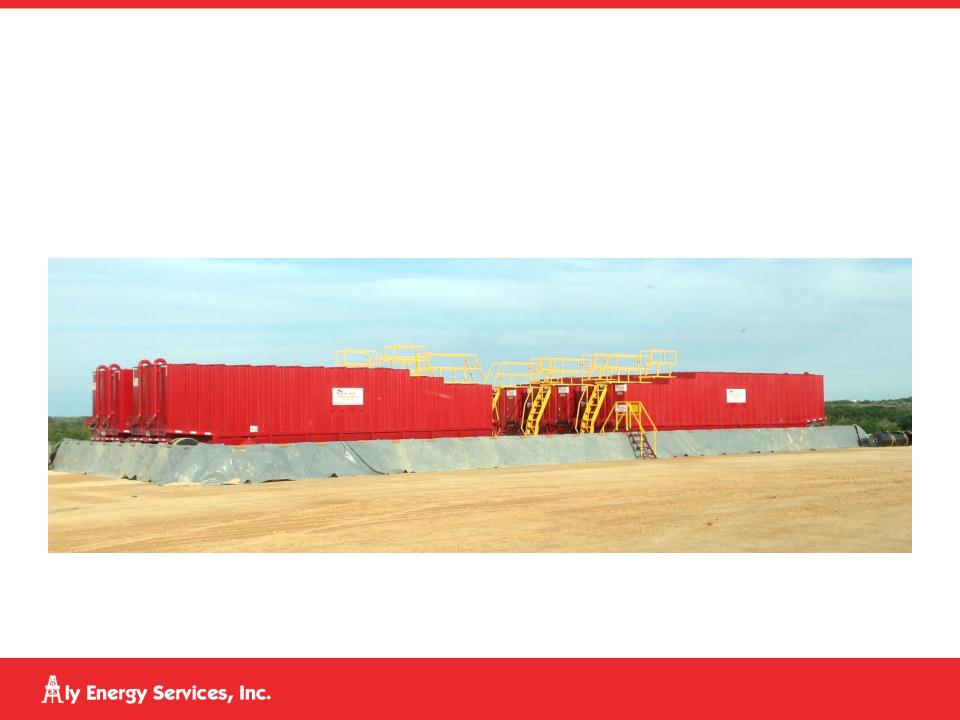

500bbl MUD CIRCULATING

TANKS

TANKS

117 new state of the art tanks on

wheels specifically designed for

maximum circulating capability

wheels specifically designed for

maximum circulating capability

8

SKIMMING SYSTEMS

CUSTOM DESIGN FOR

ENHANCED OIL

RECOVERY

ENHANCED OIL

RECOVERY

9

MUD GAS SEPARATORS

21 gas busters in inventory

used in both drilling and

flow-back applications to

safely separate and flair

surface gas and H2S from

return drilling and

completion fluid

used in both drilling and

flow-back applications to

safely separate and flair

surface gas and H2S from

return drilling and

completion fluid

10

CONTAINMENTS & BERMS

New Service Offering

11

CLEAN-OUT SERVICES

New Service Offering

12

STRENGTHS OF PRODUCTS

AND SERVICE

AND SERVICE

•Manufacturing capability

•In House and onsite retrofitting and repair

•Highly mobile product offerings

•Full service offerings with roustabouts and equipment

•Experienced personnel

13

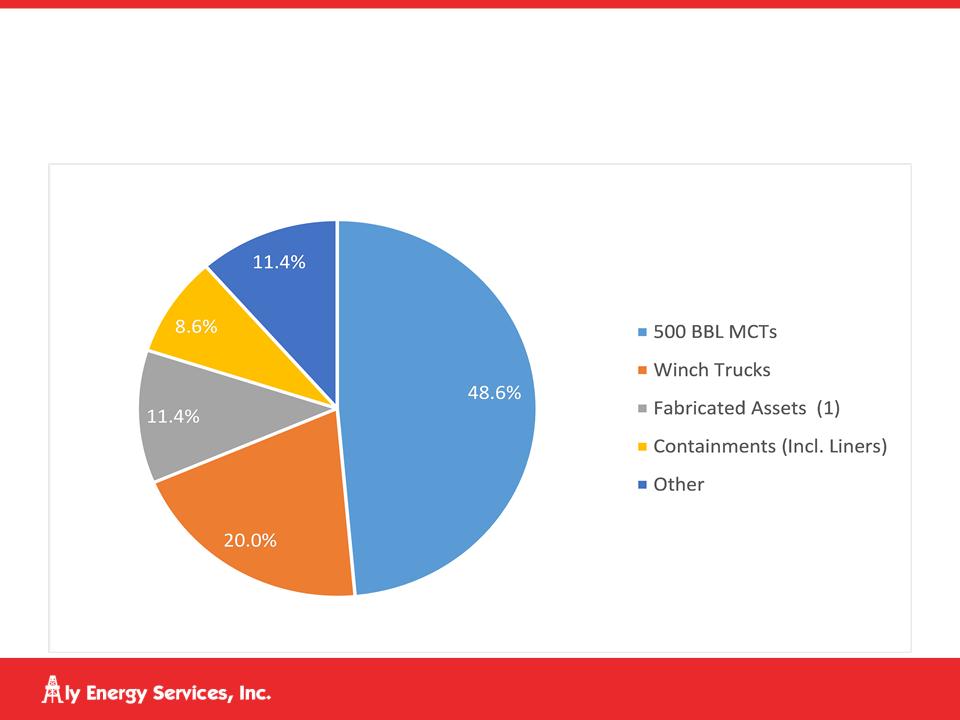

PRODUCT AND SERVICES

CONTRIBUTION

CONTRIBUTION

14

SAFETY AND

ENVIRONMENTAL

ENVIRONMENTAL

• Protect the health, safety and security of our people at all times thru

dedicated and specified training and supervision

dedicated and specified training and supervision

• Meet specified customer requirements and ensure continuous customer

satisfaction

satisfaction

• Minimize our impact on the environment through pollution prevention and

the reduction and recycling of waste

the reduction and recycling of waste

• Apply our technical skills to all HSE aspects in the design and engineering

of our products and services

of our products and services

15

STRATEGIC FOCUS,

OUTLOOK AND

OBJECTIVES

OUTLOOK AND

OBJECTIVES

• To provide our customers with the highest quality and most

advanced equipment with Best in Class service in a safe

environment at competitive prices

advanced equipment with Best in Class service in a safe

environment at competitive prices

• To grow both organically and through acquisitions with:

– Customer diversification

– Geographic expansion

– Asset inventory growth

– Adding new products and services

16

WHAT HAS CHANGED IN

YEAR 1?

YEAR 1?

|

2012

|

2013

|

|

126 Mud circulating Tanks w/ large sub-rental

associated costs |

Added 110 Mud Circulating Tanks for a total of

236, and associated ancillary equipment, with a large reduction of sub-rental costs |

|

Single service location serving the Eagle Ford

Shale and Woodbine formations from Giddings, Texas |

Added an additional service location in San

Angelo, Texas serving the Cline Shale, Wolfberry and Wolfcamp formations |

|

Over 25 different, but related, product and service

offerings |

Added 6 new product and service offerings

|

|

Small trucking service line

|

More than doubled our trucking capacity while

greatly reducing our costs related to trucking services |

|

31 Master Services Agreements

|

Added 9 MSAs with 12 more in process

|

17

2013 PROJECTED CAPITAL

EXPENDITURES

EXPENDITURES

(1) Includes 400 BBL MCTs, Skimming Systems, Driveovers, and Stairs

*Total 2013 Projected CapEx of approximately $8.8 million

18

19

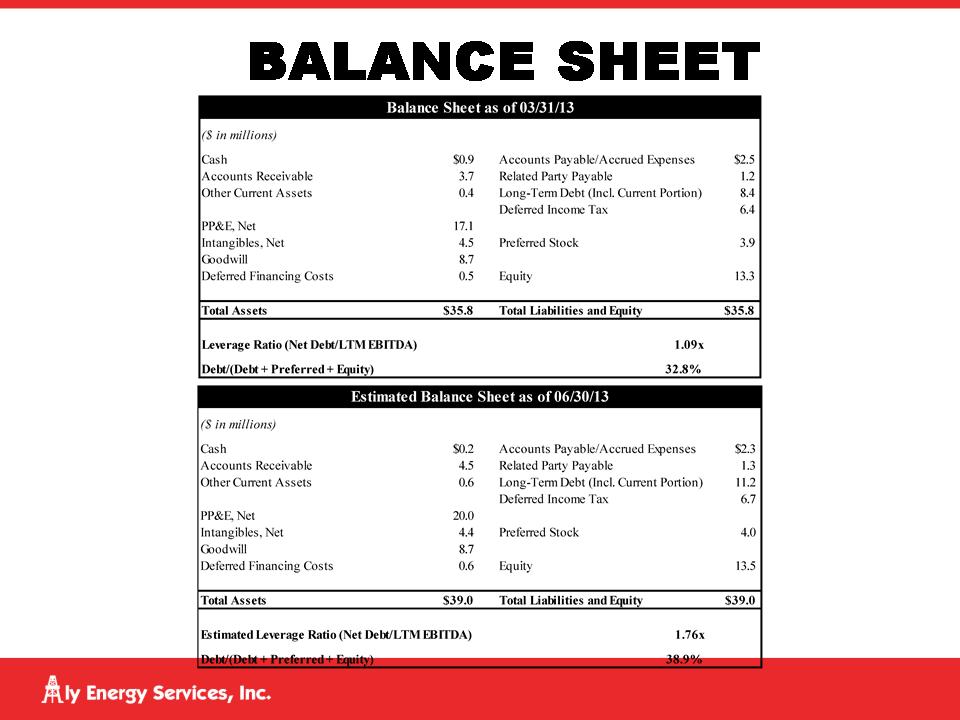

2013 FINANCIAL HIGHLIGHTS

(Thru June 30, 2013)

•YTD Capital Expenditures of approximately $7mm

•Total assets of $39mm

•Leverage Ratio of approximately 1.76x

• (Debt/LTM EBITDA)

•Debt (Debt + Equity) Ratio of approximately 39%

20

INVESTMENT HIGHLIGHTS

• Proven, Experienced Management Team

– Aly Energy Services is led by two oilfield service veterans, each with

over 20 years in the industry, that were critical in the expansion of

Allis-Chalmers from a $5mm revenue company in 2001 to over

$650mm in 2010

over 20 years in the industry, that were critical in the expansion of

Allis-Chalmers from a $5mm revenue company in 2001 to over

$650mm in 2010

• Differentiated Product Offering with High Quality Services

– a unique set of assets that have been specifically engineered to provide

customers with superior performance and is a recognized leader in

quality and services in its operating regions

customers with superior performance and is a recognized leader in

quality and services in its operating regions

21

INVESTMENT HIGHLIGHTS

• Geographically Located in High Growth Areas

– A continuous eye on opportunities to expand service markets

• Favorable Industry Dynamics

– We expect robust exploration and production spending for the

foreseeable future, as global exploration and production capital

expenditure is expected to increase from $261 billion to $420 billion

from 2011 to 2017

foreseeable future, as global exploration and production capital

expenditure is expected to increase from $261 billion to $420 billion

from 2011 to 2017

• High Quality Customer Base and Demand

– Additional equipment not currently in the fleet is continually requested

by key customers

by key customers

22