Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Silver Bay Realty Trust Corp. | sby8kq22012earningsrelease.htm |

| EX-99.1 - EX-99.2 - Silver Bay Realty Trust Corp. | a08_07x2013xsilverbayrealt.htm |

SILVER BAY REALTY TRUST CORP. SECOND QUARTER 2013 EARNINGS PRESENTATION

2 SAFE HARBOR STATEMENT FORWARD-LOOKING STATEMENTS This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Factors that could cause actual results to differ include: Silver Bay’s ability to execute share repurchases upon terms acceptable to the company; adverse economic or real estate developments in Silver Bay’s target markets; defaults on, early terminations of or non-renewal of leases by residents; difficulties in identifying properties to acquire and completing acquisitions; increased time and/or expense to gain possession and renovate properties; Silver Bay’s failure to successfully operate its properties; Silver Bay’s ability to obtain financing arrangements; Silver Bay’s failure to meet the conditions to draw under the credit facility; general volatility of the markets in which it participates; interest rates and the market value of Silver Bay’s target assets; the impact of changes in governmental regulations, tax law and rates, and similar matters. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Silver Bay does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Silver Bay’s most recent filings with the Securities and Exchange Commission. All subsequent written and oral forward looking statements concerning Silver Bay or matters attributable to Silver Bay or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

3 SECOND QUARTER 2013 HIGHLIGHTS Achieved record leasing pace; increased number of leased properties by ~1,200 homes or 50% quarter- over-quarter Total revenue increased 40% quarter-over-quarter to $10.7 million Net operating income, or NOI(1), increased 79%, outpacing quarterly revenue growth Improved occupancy for properties owned six months or longer by six percentage points to 87% Increased occupancy for aggregate portfolio by twelve percentage points to 65% Reported estimated net asset value, or NAV(1), of $18.95 per fully diluted share compared to book value per fully diluted share of $17.30 as of June 30, 2013(1) 5,571 PROPERTIES OWNED AS OF JUNE 30, 2013 (1) Estimated NOI and NAV are non-GAAP financial measures. Non-GAAP reconciliations of these measures are included on slides 14 and 15 in the appendix.

4 CURRENT HOUSING MARKET ENVIRONMENT Housing price recovery continues across Silver Bay markets, but prices remain well below peak pricing and replacement cost Shadow inventory decreased 18% over past year, but still considerable at ~2 million homes valued at estimated $314 billion National pricing up 12% year-over-year, representing highest annual growth rate since February 2006 − Pricing in all Silver Bay markets appreciated, experiencing increases of 6 to 10% over the three months ended May 2013 Investor focus on Fed’s potential to taper its bond buying program initiated a selloff of risk in rate sensitive sectors − Sharp move in thirty-year mortgages, increasing 100 basis points during the second quarter − Rising rates likely to impact sales volume, although housing affordability remains strong in a historical context − HPA pace could moderate in the near term; may have positive impact on the Company’s leasing operations as the relative cost of renting becomes more attractive (1) “MSA” means Metropolitan Statistical Areas, which is generally defined as one or more adjacent counties or county equivalents that have at least one urban core area of at least a 50,000-person population, plus adjacent territory that has a high degree of social and economic integration with the core as measured by commuting ties. (2) Peak refers to highest historical home prices in a particular market. Trough refers to lowest home prices in a particular market since the peak. (3) MSA used for Northern California is Fairfield-Vallejo, which most closely approximates the geographic area in which we purchase homes in Northern California. This MSA is comprised of Solano County and the most populous cities in the MSA are Vallejo, Fairfield, Vacaville, Suisun and Benicia. (4) MSA used for Southern California is Riverside-San Bernardino-Ontario. This MSA is comprised of Riverside and San Bernardino Counties and the most populous cities in the MSA are Riverside, San Bernardino, Fontana and Moreno. (5) MSA used for Southeast FL is Fort Lauderdale-Pompano Beach-Deerfield Beach, FL. MSA HOME PRICE APPRECIATION (“HPA”)(1) Source: Corelogic as of May 31, 2013 MARKET HPA (Peak to Trough)(2) HPA (Peak to Current) HPA (Prior 12 months) HPA (Prior 3 months) Phoenix, AZ -53% -36% 18% 6% Tucson, AZ -43% -34% 9% 6% Northern CA(3) -60% -50% 22% 7% Southern CA(4) -54% -43% 18% 8% Jacksonville, FL -41% -31% 8% 10% Orlando, FL -55% -43% 14% 7% Southeast FL(5) -54% -43% 13% 7% Tampa, FL -48% -39% 10% 7% Atlanta, GA -34% -18% 16% 10% Charlotte, NC -17% -5% 9% 9% Las Vegas, NV -60% -48% 25% 9% Columbus, OH -19% -12% 1% 6% Dallas, TX -14% 0% 10% 8% Houston, TX -13% 2% 10% 7% NATIONAL -33% -20% 12% 8%

5 STRATEGIC GROWTH IN ACQUISITIONS Continue to add high-quality single-family properties to the portfolio − Increased number of homes in the portfolio by 21% through acquisition of 985 properties − ~5,600 single-family properties in the portfolio as of July 31, 2013 With more than $710 million in properties, Silver Bay has the necessary scale to generate positive cash flow on a stabilized basis − Ability to leverage existing operating infrastructure and corporate expenses with incremental growth Top markets for acquisitions were Phoenix, Atlanta and Columbus, Ohio, comprising 53% of total acquisitions Continue to source through multiple acquisition channels − Broker transactions integral to strategy during second quarter, increased to 70% of total acquisitions Continue to acquire selectively with focus on expanding in markets with the most compelling opportunities QUARTERLY ACQUISITION PACE ($ IN MILLIONS)(1) (1) The above chart shows the pace of quarterly acquisitions by source of the Company’s Predecessor and the Company for 2012 and the first and second quarters of 2013 and does not reflect accepted purchase agreements that have not yet closed. Fourth quarter acquisition numbers exclude the acquisition of the 881 properties owned by the Provident Entities. "Broker" refers to a purchase of a single property directly from the owner, including REO, short sales and properties listed on a multiple listing service. "Auction" refers to properties purchased at trustee or judicial auctions. "Bulk" refers to purchases of more than one property in a single sale directly from the owner, often an investor group, bank, financial institution or governmental agency, and may include future acquisitions of entire legal entities holding single-family properties. $0 $20 $40 $60 $80 $100 $120 $140 $160 0 200 400 600 800 1,000 1,200 1,400 Q1 - 2012 Q2 - 2012 Q3 - 2012 Q4 - 2012 Q1 - 2013 Q2 - 2013 TOT AL PU RC HA SE PR IC E NU M BE R OF P ROP ER TI ES Broker Auction Bulk Purchase Price

6 0 200 400 600 800 1,000 1,200 Q1 - 2012 Q2 - 2012 Q3 - 2012 Q4 - 2012 Q1 - 2013 Q2 - 2013 Acquisitions Renovations Increase in Number of Leased Properties EXPANSION IN RENOVATION AND LEASING(1) (1) The above chart shows the pace of quarterly acquisitions, renovations and increase in number of leased homes of the Company’s Predecessor and the Company and does not reflect accepted purchase agreements that have not yet closed. Fourth quarter acquisition numbers exclude the acquisition of the 881 properties owned by the Provident Entities.

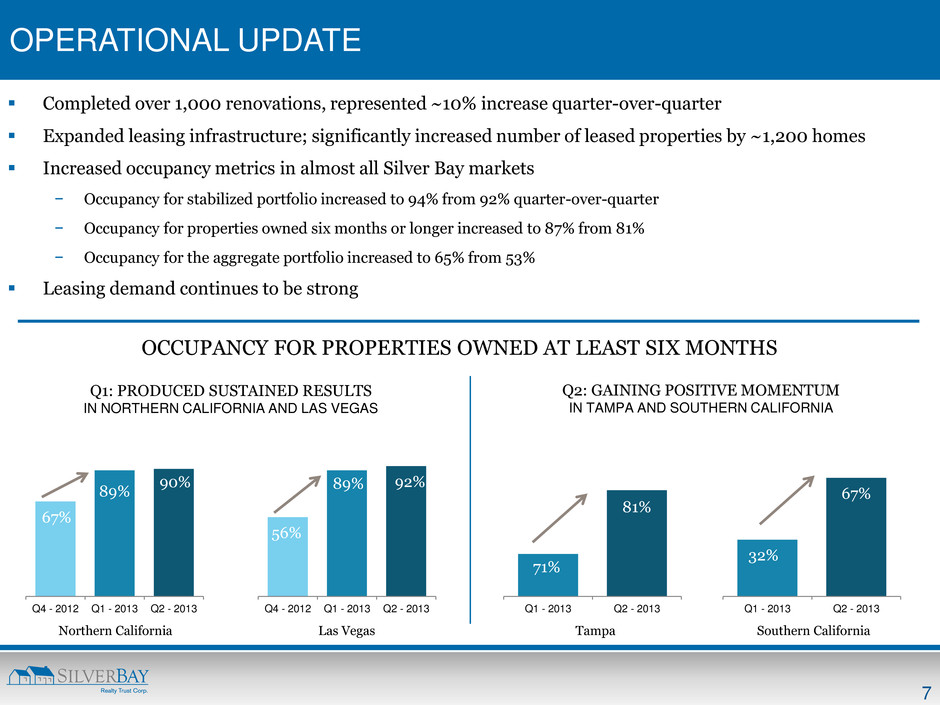

7 OPERATIONAL UPDATE 67% 89% 90% Q4 - 2012 Q1 - 2013 Q2 - 2013 Northern California 56% 89% 92% Q4 - 2012 Q1 - 2013 Q2 - 2013 Las Vegas 71% 81% Q1 - 2013 Q2 - 2013 Tampa 32% 67% Q1 - 2013 Q2 - 2013 Southern California Completed over 1,000 renovations, represented ~10% increase quarter-over-quarter Expanded leasing infrastructure; significantly increased number of leased properties by ~1,200 homes Increased occupancy metrics in almost all Silver Bay markets − Occupancy for stabilized portfolio increased to 94% from 92% quarter-over-quarter − Occupancy for properties owned six months or longer increased to 87% from 81% − Occupancy for the aggregate portfolio increased to 65% from 53% Leasing demand continues to be strong Q1: PRODUCED SUSTAINED RESULTS IN NORTHERN CALIFORNIA AND LAS VEGAS Q2: GAINING POSITIVE MOMENTUM IN TAMPA AND SOUTHERN CALIFORNIA OCCUPANCY FOR PROPERTIES OWNED AT LEAST SIX MONTHS

8 $7.7 $10.7 Q1 - 2013 Q2 - 2013 TOTAL REVENUE ($ IN MILLIONS) Q2 - 2013 FINANCIAL SUMMARY Total revenue increased 40% on a sequential quarter basis to $10.7 million NOI increased 79% on a sequential quarter basis to $3.1 million Property operating and maintenance expenses were $2.5 million, increase primarily attributed to growth in repairs and maintenance associated with a higher base of leased homes Property management expenses were $3.1 million, reflecting sequential quarter improvement as a percentage of revenue − Management anticipates continued infrastructure leverage as portfolio stabilizes Reported $1.9 million in G&A expenses; in line with expectations $1.7 $3.1 Q1 - 2013 Q2 - 2013 NET OPERATING INCOME ($ IN MILLIONS)

9 AVM OVERVIEW AND METHODOLOGY Reported estimated NAV of $18.95 per fully diluted share compared to book value per fully diluted share of $17.30 as of June 30, 2013(1) − Calculated by subtracting net investment in real estate from GAAP book value and adding AVM derived value of the Company’s properties with an adjustment for estimated renovation cost − Company believes AVM value and corresponding NAV calculation are useful metrics for investors Proprietary automated valuation model, or AVM, estimates value of a subject property using comparable sales analysis based on CoreLogic sales data − Comparable sales analysis is the same conceptual approach typically used by appraisers in valuing single-family properties − AVM has ability to evaluate hundreds of comparable properties as opposed to the three or six comparable properties used by a typical appraiser Multiple validation measures used to assess reasonableness of the AVM calculations − Independent third-party verified AVM working as designed − Completed testing against large sample of BPOs − Comparison of AVM’s predictive accuracy against thousands of transactions − June comparables calculation covered over 16,000 transactions; AVM derived value was 1.8% less than the actual sales price AVM has inherent limitations that may undervalue the value of Silver Bay’s portfolio − Ignores value of the aggregation of thousands of attractive assets selected largely on a one-by-one basis − Does not account for value of leases − May undervalue improvements to Silver Bay newly renovated properties AS OF JUNE 30TH, 2013 WE ESTIMATE NAV TO BE $18.95 PER SHARE (1) Estimated NAV is non-GAAP financial measures. Non-GAAP reconciliation of this measure is included on slide 14 in the appendix.

10 PORTFOLIO OVERVIEW As of June 30, 2013 AGGREGATE PORTFOLIO Total Number of Properties(1) 5,571 Properties Leased 3,610 Occupancy Rate 65% STABILIZED PROPERTIES Number of Stabilized Properties(2) 3,830 Properties Leased 3,610 Occupancy Rate 94% PROPERTIES OWNED AT LEAST SIX MONTHS Number of Properties Owned Six Months or Longer 3,371 Properties Leased 2,938 Occupancy Rate 87% PROPERTIES BY MARKET (1) Total properties exclude properties held for sale by the Company’s taxable REIT subsidiary and any properties acquired in previous periods in sales that have been subsequently rescinded or vacated. (2) The Company considers a property stabilized at the earlier of (a) its first authorized occupancy or (b) 90 days after the renovations for such property are complete. Properties acquired with in-place leases are considered stabilized even though such properties may require future renovation to meet our standards and may have existing residents who would not otherwise meet our resident screening requirements. Phoenix 26% Atlanta 17% Tampa 17% Northern CA 7% Las Vegas 5% Columbus 5% Tuscon 4% Dallas 4% Orlando 3% Southern CA 3% Southeast FL 3% Charlotte 2% Jacksonville 2% Houston 2%

APPENDIX

12 PORTFOLIO OF SINGLE-FAMILY PROPERTIES The following table provides a summary of Silver Bay’s portfolio of single-family properties as of June 30, 2013. (1) Total properties exclude properties held for sale by the Company’s taxable REIT subsidiary and any properties acquired in previous periods in sales that have been subsequently rescinded or vacated. (2) Aggregate cost includes all capitalized costs, determined in accordance with generally accepted accounting principles, incurred through June 30, 2013 for the acquisition, stabilization, and significant post-stabilization renovation of properties, including land, building, possession costs and renovation costs. Aggregate cost does not include accumulated depreciation. (3) As of June 30, 2013, approximately 19% of the properties in the combined portfolio were less than 10 years old, 26% were between 10 and 20 years old, 18% were between 20 and 30 years old, 17% were between 30 and 40 years old, 9% were between 40 and 50 years old, and 11% were more than 50 years old. (4) Total number of vacant properties includes properties in the process of stabilization as well as those available for lease. (5) Average monthly rent for leased properties was calculated as the average of the contracted monthly rent for all leased properties as of June 30, 2013 and reflects rent concessions amortized over the life of the related lease. (6) Northern California market currently consists of Contra Costa, Napa, Sacramento and Solano counties. (7) Southern California market currently consists of Riverside and San Bernardino counties. (8) Southeast Florida market currently consists of Miami Dade, Broward and Palm Beach counties. MARKET NUMBER OF PROPERTIES(1) AGGREGATE COST BASIS(2) (THOUSANDS) AVERAGE COST BASIS PER PROPERTY (THOUSANDS) AVERAGE AGE(3) (IN YEARS) AVERAGE SQUARE FOOTAGE NUMBER OF LEASED PROPERTIES NUMBER OF VACANT PROPERTIES(4) AVERAGE MONTHLY RENT FOR LEASED PROPERTIES(5) Phoenix 1,426 $ 192,860 $ 135 24.2 1,635 1,071 355 $ 1,045 Atlanta 973 113,951 117 16.9 2,019 629 344 1,178 Tampa 925 121,096 131 23.7 1,657 685 240 1,222 Northern CA(6) 413 73,104 177 45.1 1,381 323 90 1,451 Las Vegas 291 40,086 138 16.8 1,719 233 58 1,112 Columbus 273 22,422 82 35.8 1,415 66 207 889 Tucson 208 17,443 84 39.9 1,330 189 19 839 Dallas 204 23,053 113 20.4 1,642 72 132 1,240 Orlando 199 28,206 142 24.8 1,681 128 71 1,265 Southern CA(7) 158 22,847 145 43.1 1,347 105 53 1,115 Southeast FL(8) 156 26,907 172 33.0 1,734 11 145 1,757 Charlotte 129 16,563 128 11.8 1,982 65 64 1,193 Jacksonville 116 12,528 108 31.3 1,564 19 97 1,008 Houston 100 8,417 84 29.7 1,697 14 86 1,173 Totals 5,571 $ 719,483 $ 129 25.8 1,673 3,610 1,961 $ 1,148

13 STABILIZED PROPERTIES PROPERTIES OWNED AT LEAST SIX MONTHS MARKET NUMBER OF STABILIZED PROPERTIES(1) PROPERTIES LEASED PROPERTIES VACANT OCCUPANCY RATE AVERAGE MONTHLY RENT FOR LEASED STABILIZED PROPERTIES(2) PROPERTIES OWNED 6 MONTHS OR LONGER PROPERTIES LEASED PROPERTIES VACANT OCCUPANCY RATE AVERAGE MONTHLY RENT FOR PROPERTIES OWNED AT LEAST 6 MONTHS(3) Phoenix 1,158 1,071 87 93% $ 1,045 1,001 908 93 91% $ 1,056 Atlanta 700 629 71 90% 1,178 602 527 75 88% 1,190 Tampa 704 685 19 97% 1,222 810 652 158 81% 1,224 Northern CA 340 323 17 95% 1,451 255 229 26 90% 1,491 Las Vegas 238 233 5 98% 1,112 211 194 17 92% 1,177 Columbus(4) 66 66 - 100% 889 - - - - - Tucson 195 189 6 97% 839 187 179 8 96% 840 Dallas(4) 73 72 1 99% 1,240 26 23 3 89% 1,254 Orlando 129 128 1 99% 1,265 90 89 1 99% 1,308 Southern CA 108 105 3 97% 1,115 129 86 43 67% 1,141 Southeast FL(4) 14 11 3 79% 1,757 - - - - - Charlotte 70 65 5 93% 1,193 60 51 9 85% 1,191 Jacksonville(4) 21 19 2 91% 1,008 - - - - - Houston(4) 14 14 - 100% 1,173 - - - - - Totals 3,830 3,610 220 94% $ 1,148 3,371 2,938 433 87% $ 1,160 PORTFOLIO SUMMARY OF STABILIZED PROPERTIES AND THOSE OWNED SIX MONTHS OR LONGER The following table summarizes Silver Bay’s stabilized properties and those owned six months or longer as of June 30, 2013. (1) The Company considers a property stabilized at the earlier of (a) its first authorized occupancy or (b) 90 days after the renovations for such property are complete. Properties acquired with in-place leases are considered stabilized even though such properties may require future renovation to meet our standards and may have existing residents who would not otherwise meet our resident screening requirements. (2) Average monthly rent for leased stabilized properties was calculated as the average of the contracted monthly rent for all stabilized leased properties as of June 30, 2013 and reflects rent concessions amortized over the life of the related lease. (3) Average monthly rent for properties owned at least six months was calculated as the average of the contracted monthly rent for all properties owned at least six months as of June 30, 2013 and reflects rent concessions amortized over the life of the related lease. (4) As of June 30, 2013, there were no properties owned six months or longer in this market.

14 ESTIMATED PORTFOLIO AND ESTIMATED NET ASSET VALUE Estimated Portfolio Value and Estimated NAV are non-GAAP financial measures. Silver Bay provides the Estimated Portfolio Value and Estimated NAV as additional tools for investors seeking to value the Company. These metrics should be considered along with other available information in valuing and assessing Silver Bay, including the Company’s GAAP financial measures or other cash flow or yield metrics and should not be viewed as a substitute for book value, net investment in real estate, equity, net income or cash flows from operations prepared in accordance with GAAP, or as a measure of the Company’s profitability or liquidity. A description of the Company’s AVM along with certain assumptions and limitations related to its AVM and its calculations of Estimated Portfolio Value and Estimated NAV can be found on the Company’s website at www.silverbayrealtytrustcorp.com in the Investor Relations section under the non-GAAP Reconciliations link. The following is a reconciliation of the Company’s investment in real estate to Estimate Portfolio Value and book value to Estimated NAV: (1) Per share amounts are based upon common shares outstanding of 39,324,141 plus 27,459 of common units for a total of 39,351,600 fully diluted shares outstanding as of June 30, 2013. (2) Difference between AVM derived value of the Company’s portfolio of properties of $796,461, which assumes all properties are fully renovated, and net investment in real estate. (3) Estimated renovation reserve is calculated on properties in the portfolio that are not currently stabilized and for which the initial renovation has not been completed. (4) Book value as defined by U.S. generally accepted accounting principles, or GAAP, and represents total assets less total liabilities and less preferred stock in mezzanine or total equity. (AMOUNTS IN THOUSANDS OTHER THAN SHARE DATA) JUNE 30, 2013 AMOUNT PER SHARE(1) Investments in real estate, gross $ 719,483 $ 18.28 Accumulated depreciation (8,615) (0.22) Investments in real estate, net 710,868 18.06 Add: Increase in estimated fair market value of investment in real estate(2) 85,593 2.18 Less: Estimated Renovation Reserve(3) (20,811) (0.53) Estimated Portfolio Value $ 775,650 $ 19.71 Book value(4) $ 680,775 $ 17.30 Less: Investments in real estate, net (710,868) (18.06) Add: Estimated Portfolio Value 775,650 19.71 Estimated Net Asset Value $ 745,557 $ 18.95

15 NET OPERATING INCOME Net operating income, or NOI, is a non-GAAP measure and is defined by the Company as total revenue less property operating and maintenance, real estate taxes, homeowners’ association fees and property management expenses. NOI excludes depreciation and amortization, advisory management fee, general and administrative expenses, interest expense and other expenses. The Company considers NOI to be a meaningful financial measure, when considered with the financial statements determined in accordance with U.S. generally accepted accounting principles. The Company believes NOI is helpful to investors in understanding the core performance of the real estate operations of the Company. The following is a reconciliation of the Company’s NOI to net loss as determined in accordance with GAAP: (AMOUNTS IN THOUSANDS) THREE MONTHS ENDED JUNE 30, 2013 THREE MONTHS ENDED MARCH 31, 2013 Net loss $ (6,746) $ (6,382) Depreciation and amortization 4,961 3,417 Advisory management fees 2,578 2,852 General and administrative 1,949 1,528 Other 217 331 Interest expense 158 - Net Operating Income $ 3,117 $ 1,746

601 CARLSON PARKWAY | SUITE 250 | MINNETONKA | MN | 55305 P: 952.358.4400 | E: INVESTORS@SILVERBAYMGMT.COM