Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Manitex International, Inc. | d581168d8k.htm |

| EX-99.1 - EX-99.1 - Manitex International, Inc. | d581168dex991.htm |

“Focused

manufacturer of

engineered lifting

equipment”

Exhibit 99.2

Manitex International, Inc.

Conference Call

Second Quarter 2013

August 7th, 2013 |

2

Forward Looking Statements &

Non GAAP Measures

“Focused

manufacturer of

engineered lifting

equipment”

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of

1995: This presentation contains statements that are forward-looking in

nature which express the beliefs and expectations of management including

statements regarding the Company’s expected results of operations or liquidity;

statements concerning projections, predictions, expectations, estimates or forecasts

as to our business, financial and operational results and future economic

performance; and statements of management’s goals and objectives and

other similar expressions concerning matters that are not historical facts. In some

cases, you can identify forward-looking statements by terminology such as

“anticipate,” “estimate,”

“plan,”

“project,”

“continuing,”

“ongoing,”

“expect,”

“we believe,”

“we intend,”

“may,”

“will,”

“should,”

“could,”

and similar expressions. Such statements are based on current plans, estimates and

expectations and involve a number of known and unknown risks, uncertainties

and other factors that could cause the Company's future results, performance

or achievements to differ significantly from the results, performance or

achievements expressed or implied by such forward-looking statements. These factors and additional

information are discussed in the Company's filings with the Securities and Exchange

Commission and statements in this presentation should be evaluated in light of

these important factors. Although we believe that these statements are based

upon reasonable assumptions, we cannot guarantee future results.

Forward-looking statements speak only as of the date on which they are made, and

the Company undertakes no obligation to update publicly or revise any

forward-looking statement, whether as a result of new information, future

developments or otherwise. Non-GAAP Measures: Manitex International from

time to time refers to various non-GAAP (generally

accepted accounting principles) financial measures in this presentation.

Manitex believes that this information is useful to understanding its

operating results without the impact of special items. See Manitex’s

Second Quarter 2013 Earnings Release on the Investor Relations section of our

website www.manitexinternational.com

for a description and/or reconciliation of these measures.

|

3

“Focused

manufacturer of

engineered lifting

equipment”

Overview

•

Solid quarter with record revenues, net income and EBITDA:

•

Revenues at $63 million, up 19% v Q2-2012.

•

Net income at $2.7 million ($0.22 EPS).

•

EBITDA at $5.5 million up 7.8% v Q2-2012.

•

North America markets more cautious than Q1-2013. Commercial construction

demand steady but helping to offset short term softening in energy

sector. European markets still a challenge. Energy sector medium term

outlook remains very positive.

•

Assuming no significant economic changes, revenue outlook second

half of

2013 similar to first half, indicating full year 2013 of approx.

$250 million (22%

y-o-y growth).

•

Subsequent to end of Q2, announced agreement to acquire Sabre

Manufacturing for $14m. |

4

“Focused

manufacturer of

engineered lifting

equipment”

Business Update

•More cautious short term environment:

•N. American general construction / housing edging along.

•Energy remains soft, and down from strong comparative last year period,

but appears to have steadied at this level. Rig counts in total firmer,

optimistic outlook. •European markets extremely challenging.

•Product demand consistent with recent quarters, high percentage of

shipments of larger tonnage units, order intake reflecting higher

percentage of lower tonnage units Material handling and container

handling equipment softer than prior quarters. •Announced on May

30th a $37 million contract for material handling equipment for US Navy.

Initial shipments will start in 2014. •6/30/13 Backlog $97 million.

Decrease of 26% from 12/31/12, a function of increased production and

lower order intake. Broad based order book although boom trucks continue

to be heavily represented. |

5

“Focused

manufacturer of

engineered lifting

equipment”

Business Update

Sabre Announcement

•

Knox, Indiana-based manufacturer of a comprehensive line of specialized

trailer tanks for liquid and solid storage and containment solutions with

capacities from 8,000 to 21,000 gallons, and with a large installed base in

North America. Its tank trailers are sold to specialist independent tank rental

companies for a variety of end markets such as petrochemical, waste

management and oil and gas drilling.

•

Negotiated purchase price of $14 million consisting of $13 million in cash and

$1 million in MNTX common stock.

•

Sabre trailing twelve month revenue (through 3/31/2013) of $39.1

million and

EBITDA of $4.5 million.

•

Closing, subject to execution of definitive documentation, expected shortly.

•

Cash consideration will be funded by new Comerica Bank Term Loan.

|

6

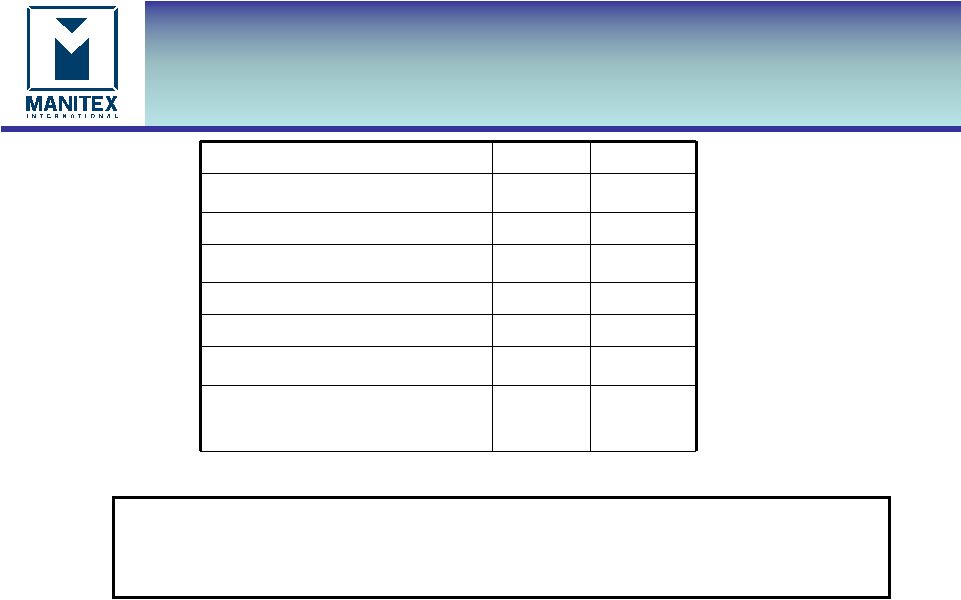

Key Figures

“Focused

manufacturer of

engineered lifting

equipment”

USD thousands

Q2-2013

Q2-2012

Q1-2013

Net sales

$62,554

$52,496

$59,566

% change in Q2-2013 to prior period

19.2%

5.0%

Gross profit

12,260

10,756

10,236

Gross margin %

19.6%

20.5%

17.2%

Operating expenses

7,656

6,560

6,979

Net Income

2,655

2,308

1,911

Earnings per share

$0.22

$0.20

$0.16

Ebitda

5,513

5,116

4,121

EBITDA % of Sales

8.8%

9.7%

6.9%

Working capital

70,179

52,303

64,965

Current ratio

2.6

2.2

2.4

Backlog

96,637

149,564

107,792

% change in Q2-2013 to prior period

(35.4%)

(10.3%) |

7

“Focused

manufacturer of

engineered lifting

equipment”

Q2-2013 Operating Performance

$m

$m

Q2-2012 Net income

2.3

Gross profit impact of increased sales of $10.1 million

(Q2-2013 sales less Q2-2012 sales at Q2-2012 gross profit % ).

2.1

Impact from lower margin

(Q2-2013 gross profit % -

Q2-2012 gross profit % multiplied by Q2-2013 sales)

(0.6)

Increase in gross profit

1.5

Increase in selling expenses

Increase in G&A expenses

(0.6)

(0.5)

Other income / (expense)

(0.1)

Tax

-

Q2-2013 Net income

$2.7 |

8

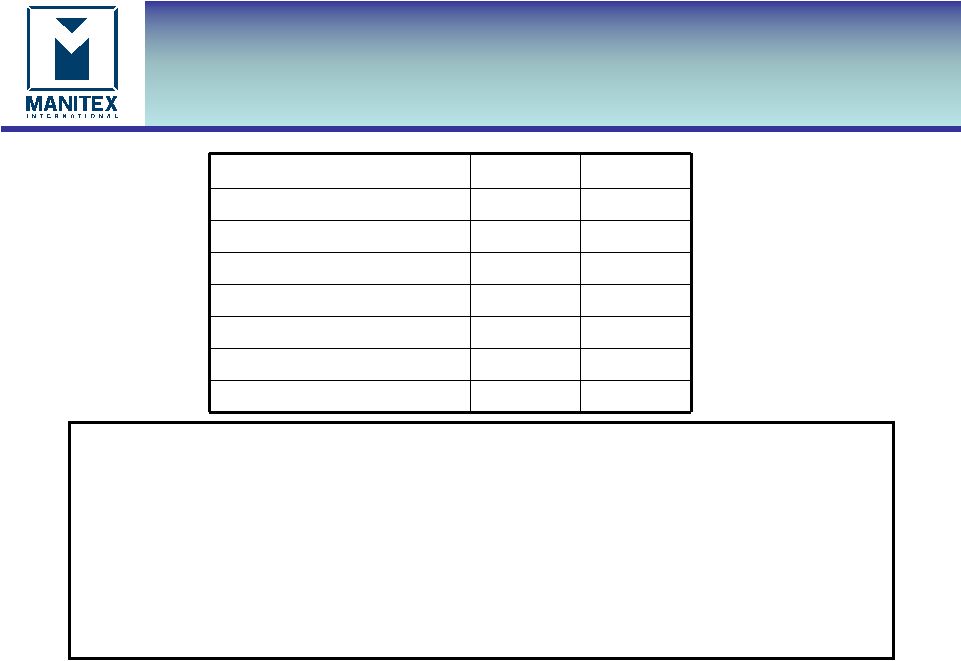

Working Capital

“Focused

manufacturer of

engineered lifting

equipment”

$000

Q2-2013

Q4-2012

Working Capital

$70,179

$61,426

Days sales outstanding (DSO)

56

58

Days payable outstanding (DPO)

49

51

Inventory turns

3.0

3.0

Current ratio

2.6

2.4

Operating working capital

82,036

74,300

Operating working capital % of

annualized LQS

32.8%

32.9%

•Working capital increase ($8.8 million) supporting growth with key

operating working capital ratios steady.

•Operating working capital % of annualized LQS steady at 32.8%

|

9

“Focused

manufacturer of

engineered lifting

equipment”

$000

Q2-2013

Q4-2012

Total Cash

3,171

1,889

Total Debt

52,812

49,138

Total Equity

64,096

59,533

Net capitalization

113,737

106,782

Net debt / capitalization

43.6%

44.2%

EBITDA

5,513

4,102

EBITDA % of sales

8.8%

7.3%

•Total debt of $52.8 million, of which $2.7 million related to acquisitions

and $3.7 million for facilities leases.

•

increase

in

debt

at

6/30/2013

from

12/31/2012

of

$3.7m,

($2.4m

net

of

increase

in

cash)

for working capital purposes.

•N. American revolver facilities, based on available collateral at 6/30/13 was

$44 million. •N. American revolver availability at 6/30/13 of $5.1

million. •EBITDA of $5.5 million for Q2-2013: trailing 12 month

EBITDA of $19.1 million gives Debt / EBITDA ratio of 2.8 times and

interest cover of 7.5 times. Debt & Liquidity

•

Net capitalization is the sum of debt plus equity minus cash

•

Net debt is total debt less cash |

10

Summary

“Focused

manufacturer of

engineered lifting

equipment”

•

Short term macro economic outlook of cautious markets in N America

with modest economic improvement. Anticipate zero growth in Europe.

•

Niche product and market strategy continues to deliver strong growth

potential.

•

Financial performance and strategic developments:

–

Solid Q2-2013, with 19% revenue growth and 10% EPS growth over

Q2-2012.

–

Balance sheet strength for continued growth.

–

Sabre acquisition. |