Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EVERTEC, Inc. | d579856d8k.htm |

| EX-99.2 - EX-99.2 - EVERTEC, Inc. | d579856dex992.htm |

| EX-99.3 - EX-99.3 - EVERTEC, Inc. | d579856dex993.htm |

| EX-99.1 - EX-99.1 - EVERTEC, Inc. | d579856dex991.htm |

Exhibit 99.4

EVERTEC

Regular Quarterly Dividend Initiation

Supplemental Materials

August 7, 2013

Disclaimer

Forward Looking Statements:

Certain statements in this presentation constitute “forward-looking statements” within the meaning of, and subject to the protection of, the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of EVERTEC to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements preceded by, followed by, or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” and “plans” and similar expressions of future or conditional verbs such as “will,” “should,” “would,” “may,” and “could” are generally forward-looking in nature and not historical facts. Any statements that refer to expectations or other characterizations of future events, circumstances or results are forward-looking statements.

Various factors that could cause actual future results and other future events to differ materially from those estimated by management include, but are not limited to: our reliance on our relationship with Popular for a significant portion of our revenues; our ability to renew our client contracts on terms favorable to us; our dependence on our processing systems, technology infrastructure, security systems and fraudulent-payment-detection systems; our ability to develop, install and adopt new technology; a decreased client base due to consolidations in the banking and financial-services industry; the credit risk of our merchant clients, for which we may also be liable; the continuing market position of the ATH® network; our dependence on credit card associations; changes in the regulatory environment and changes in international, legal, political, administrative or economic conditions; the geographical concentration of our business in Puerto Rico; operating an international business in multiple regions with potential political and economic instability; our ability to execute our expansion and acquisition strategies; our ability to protect our intellectual property rights; our ability to recruit and retain qualified personnel; our ability to comply with federal, state, and local regulatory requirements; evolving industry standards; our high level of indebtedness and restrictions contained in our debt agreements; and our ability to generate sufficient cash to service our indebtedness and to generate future profits.

Consideration should be given to the areas of risk described above, as well as those risks set forth under the headings “Forward-Looking Statements” and “Risk Factors” in the Company’s Registration Statement on Form S-1 (File No. 333-186487) and the reports the Company files with the SEC from time to time, in connection with considering any forward-looking statements that may be made by us and our businesses generally. We undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless we are required to do so by law.

Use of Non-GAAP Measures:

This presentation presents EBITDA, Adjusted EBITDA and Adjusted Net Income information. These are supplemental measures of our performance that are not required by, or presented in accordance with, accounting principles generally accepted in the United States of America (“GAAP”). They are not measurements of our financial performance under GAAP and should not be considered as alternatives to total revenues, net income or any other performance measures derived in accordance with GAAP or as alternatives to cash flows from operating activities, as indicators of cash flows or as measures of our liquidity. We present EBITDA and Adjusted EBITDA because we consider them important supplemental measures of our performance and believe they are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. In addition, our presentation of Adjusted EBITDA is consistent with the equivalent measurements that are contained in the Credit Agreement in testing EVERTEC Group’scompliance with covenants therein such as the senior secured leverage ratio. We use Adjusted Net Income to measure our overall profitability because it better reflects our cash flow generation by capturing the actual cash taxes paid rather than our tax expense as calculated under GAAP and excludes the impact of the non-cash amortization and depreciation that was created as a result of the Merger. For more information regarding EBITDA, Adjusted EBITDA and Adjusted Net Income, including a quantitative reconciliation of EBITDA, Adjusted EBITDA and Adjusted Net Income to the most directly comparable GAAP financial performance measure, which is net income, see slide titled “Non-GAAP Reconciliation Summary” on page 4 of this presentation.

2

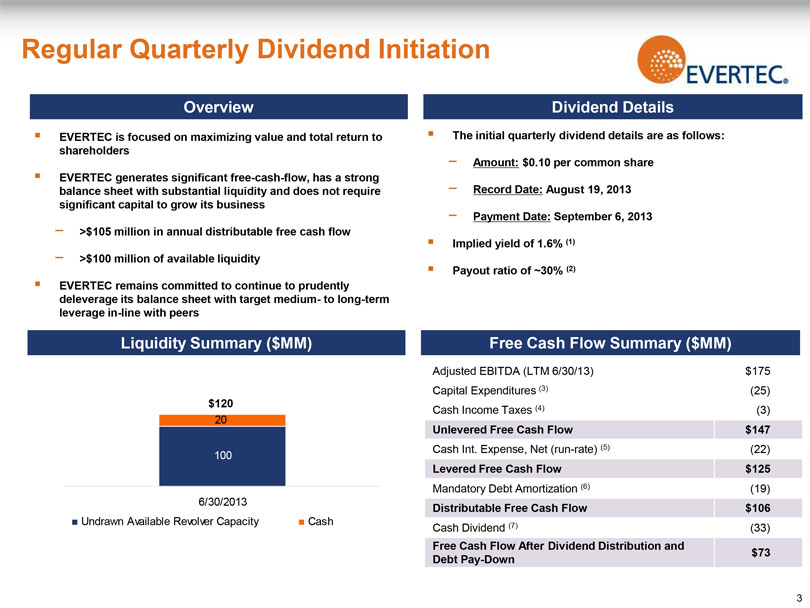

Regular Quarterly Dividend Initiation

Rationale

EVERTEC is focused on maximizing total shareholder value

EVERTEC generates significant free-cash-flow and has a strong balance sheet with substantial liquidity

>$105 million in annual distributable free cash flow

Current payout ratio of ~30% supports continued strategic investments and deleveraging (1)

EVERTEC’s long-term growth does not require significant capital investments

Target medium- to long-term leverage in-line with peers

Liquidity Summary ($MM)

$120 million of liquidity as of Q2-2013 comprised of $100 million undrawn revolver and $20 million of balance sheet cash

$120

20

100

6/30/2013

Revolver Cash

Dividend Details

On August 7, 2013 EVERTEC’s Board of Directors approved the initiation of a regular quarterly dividend program. The initial quarterly dividend details are as follows:

Amount: $0.10 per common share (1.6% implied yield (2))

Record Date: August 19, 2013

Payment Date: September 6, 2013

The Board anticipates declaring this dividend in future quarters on a regular basis; however future declarations are subject to Board of Director approval and may be adjusted as business needs or market conditions change

Free Cash Flow Summary ($MM)

Adjusted EBITDA (LTM 6/30/13) $175 Capital Expenditures (3) (25) Cash Income Taxes (4) (3)

Unlevered Free Cash Flow $147

Cash Int. Expense, Net (run-rate) (5) (22)

Levered Free Cash Flow $125

Mandatory Debt Amortization (6) (19)

Distributable Free Cash Flow $106

Cash Dividend (7) (33)

Free Cash Flow After Dividend Distribution and $73 Debt Pay-Down

3

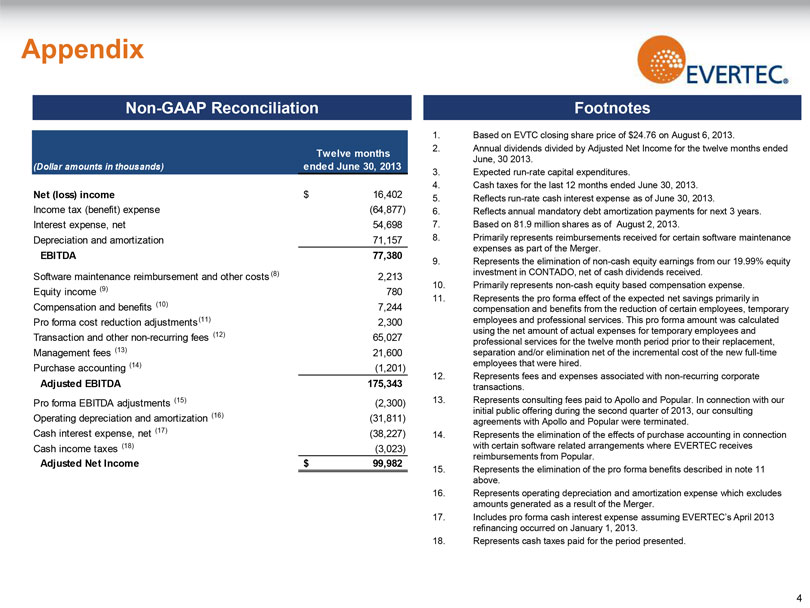

Appendix

Non-GAAP Reconciliation

Twelve months

(Dollar amounts in thousands) ended June 30, 2013

Net (loss) income $ 16,402 Income tax (benefit) expense (64,877) Interest expense, net 54,698 Depreciation and amortization 71,157

EBITDA 77,380

Software maintenance reimbursement and other costs(8) 2,213 Equity income (9) 780 Compensation and benefits (10) 7,244 Pro forma cost reduction adjustments(11) 2,300 Transaction and other non-recurring fees (12) 65,027 Management fees (13) 21,600 Purchase accounting (14) (1,201)

Adjusted EBITDA 175,343

Pro forma EBITDA adjustments (15) (2,300) Operating depreciation and amortization (16) (31,811) Cash interest expense, net (17) (38,227) Cash income taxes (18) (3,023)

Adjusted Net Income $ 99,982

Footnotes

1. Annual dividends divided by Adjusted Net Income for the twelve months ended June, 30 2013.

2. Based on EVTC closing share price of $24.76 on August 6, 2013.

3. Expected run-rate capital expenditures.

4. Cash taxes for the last 12 months ended June 30, 2013.

5. Reflects run-rate cash interest expense as of June 30, 2013.

6. Reflects annual mandatory debt amortization payments for next 3 years.

7. Based on 81.9 million shares as of August 2, 2013.

8. Primarily represents reimbursements received for certain software maintenance expenses as part of the Merger.

9. Represents the elimination of non-cash equity earnings from our 19.99% equity investment in CONTADO, net of cash dividends received.

10. Primarily represents non-cash equity based compensation expense. 11. Represents the pro forma effect of the expected net savings primarily in compensation and benefits from the reduction of certain employees, temporary employees and professional services. This pro forma amount was calculated using the net amount of actual expenses for temporary employees and professional services for the twelve month period prior to their replacement, separation and/or elimination net of the incremental cost of the new full-time employees that were hired.

12. Represents fees and expenses associated with non-recurring corporate transactions.

13. Represents consulting fees paid to Apollo and Popular. In connection with our initial public offering during the second quarter of 2013, our consulting agreements with Apollo and Popular were terminated.

14. Represents the elimination of the effects of purchase accounting in connection with certain software related arrangements where EVERTEC receives reimbursements from Popular.

15. Represents the elimination of the pro forma benefits described in note 11 above.

16. Represents operating depreciation and amortization expense which excludes amounts generated as a result of the Merger.

17. Includes pro forma cash interest expense assuming EVERTEC’s April 2013 refinancing occurred on January 1, 2013.

18. Represents cash taxes paid for the period presented.

4