Attached files

| file | filename |

|---|---|

| 8-K - ROSE 2Q13 EARNINGS RELEASE PRESENTATION - NBL Texas, LLC | rose8k_erpresentation.htm |

Exhibit 99.1

Rosetta Resources Inc.

Second Quarter 2013 Earnings Review

August 6, 2013

Earnings Call Agenda

Overview Jim Craddock

Financial Update John Hagale

Operational Update John Clayton

Closing Remarks Jim Craddock

2

Overview - Jim Craddock

• Closed the Permian Acquisition, adding a new core operating area

and entry into the basin

and entry into the basin

• Acquired additional working interest in core Gates Ranch asset

• Completed successful Eagle Ford discovery wells delineating two

additional leases

additional leases

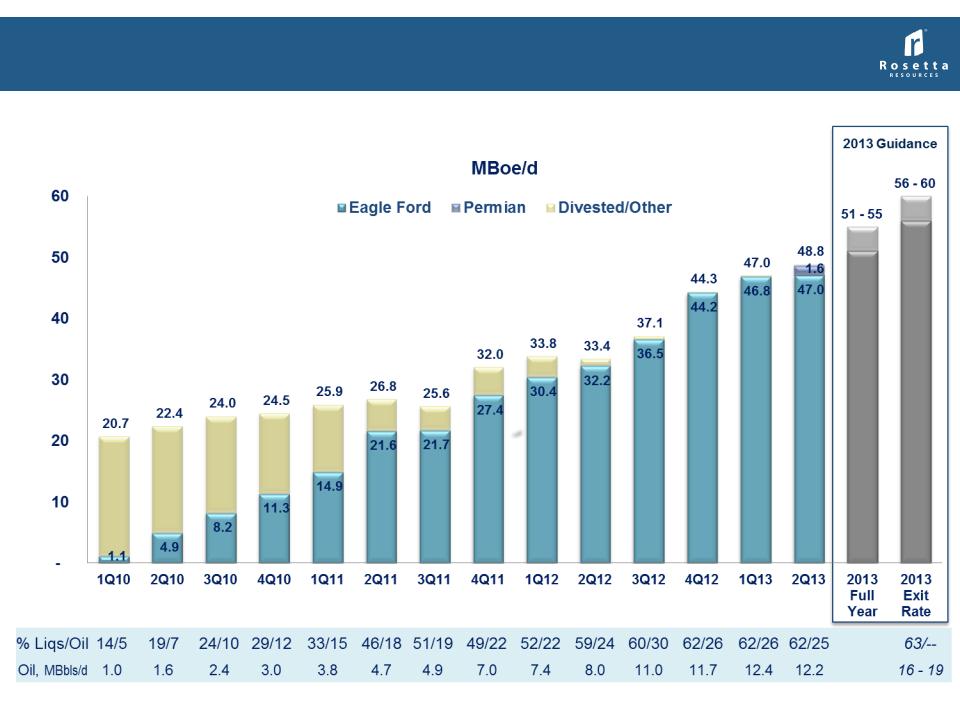

• Set an all-time record in daily equivalent production

• Recorded sequential Eagle Ford daily equivalent production growth

for the 14th consecutive quarter

for the 14th consecutive quarter

3

Financial Update - John Hagale

• Higher adjusted net income and revenues for quarter primarily due to

increased production

increased production

• Net income adversely impacted by additional $6.8 million of transaction

and financing costs related to the Permian acquisition

and financing costs related to the Permian acquisition

• Second quarter revenues reflect 53% from oil sales; 80% from liquids

• Second quarter expenses include contribution from higher cost Permian

assets since May 14 closing date

assets since May 14 closing date

• Active hedging program continued with new swaps and collars in place

4

5

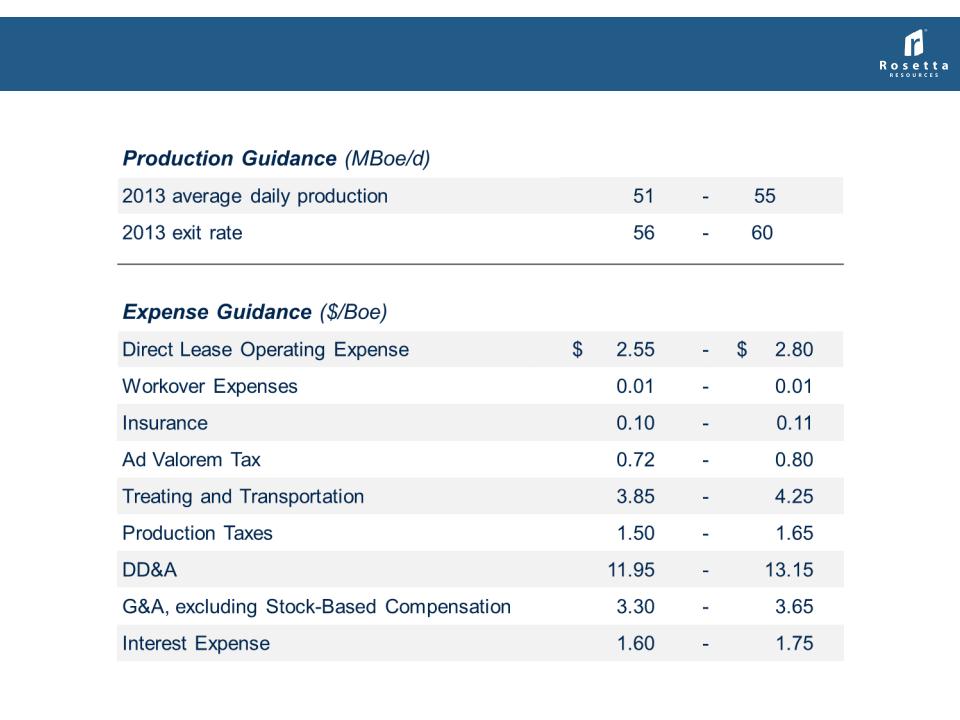

2013 Annual Guidance

Operational Update - John Clayton

• Spent $188 MM in second quarter 2013 capex; drilled 30 gross wells and

completed 22 (18 Eagle Ford)

completed 22 (18 Eagle Ford)

• Second quarter 2013 total production of 48.8 MBoe/d (25% oil / 37% NGLs)

• Operational interruptions adversely impacted quarterly production; curtailment

at Gates Ranch and temporary shut-ins at Klotzman

at Gates Ranch and temporary shut-ins at Klotzman

• Operated five rigs; mostly at Gates Ranch, Briscoe Ranch, Central Dimmit, and

the Karnes Trough area

the Karnes Trough area

• Operated three - four rigs in Permian, Reeves County

• At quarter-end, 45 Eagle Ford and 2 Permian wells drilled awaiting completion

2013 Annual Guidance

• Reaffirmed capital estimate to range from $840 - $900 MM, excluding acquisition

capital

capital

• Reaffirmed annual production guidance to 51 - 55 MBoe/d

6

Quarterly Production Performance

7

Summary

6/30/2013

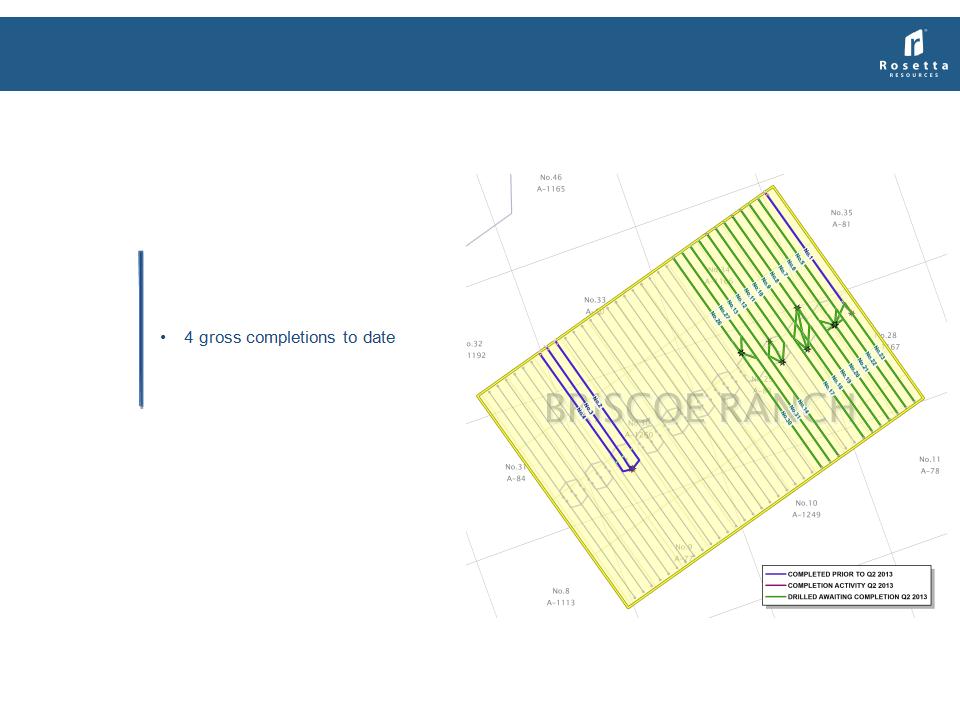

Briscoe Ranch (Column Development Program)

• 3,545 net acres in southern

Dimmit County

Dimmit County

• 64 net well locations remaining

8

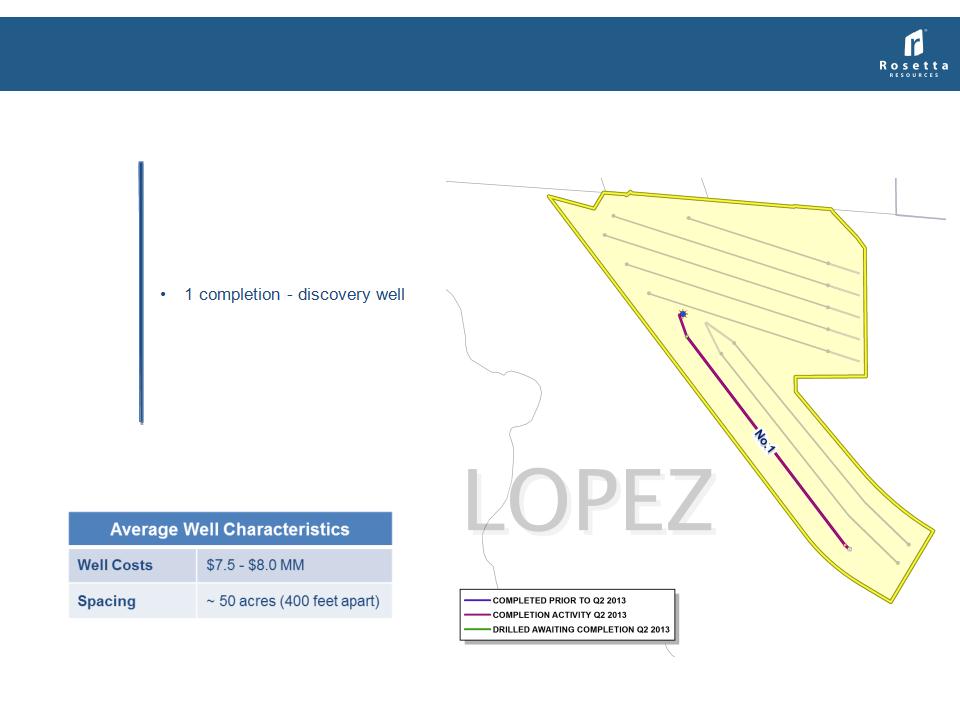

Lopez Farm-In

• 505 net acres in Live Oak County

• Farm-In from Killam Oil

• BPO: 100% WI, 75% NRI

• APO: 65% WI, 48.75% NRI

• 7-day gross stabilized IP 1,966 Boe/d

(46% oil / 24% NGLs)

(46% oil / 24% NGLs)

• 7 net well locations remaining

Summary

6/30/2013

9

2Q 2013: 1 completion

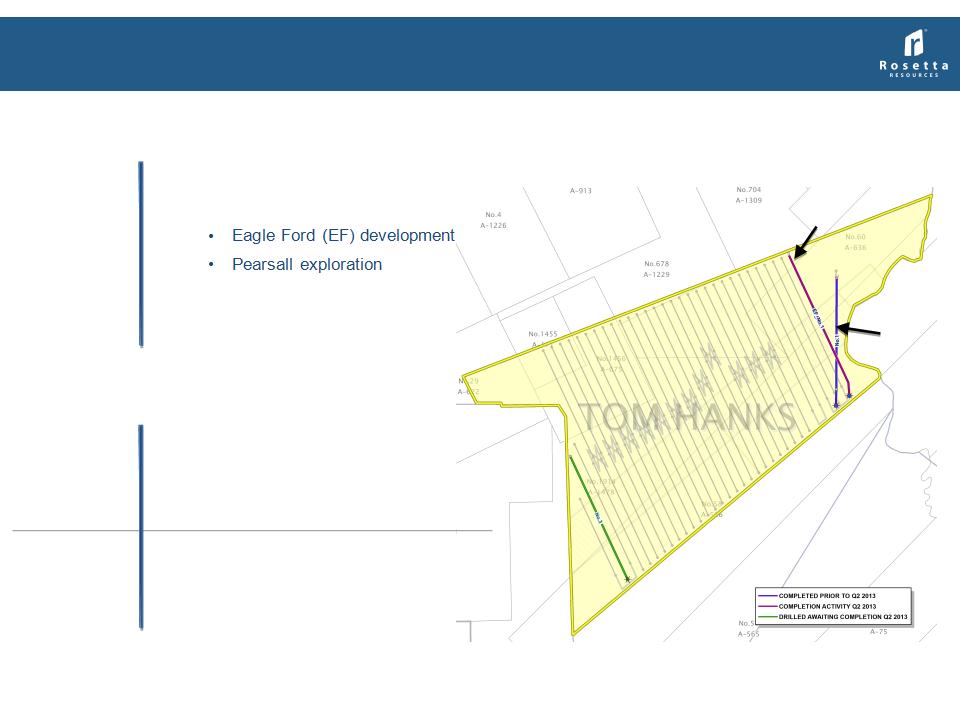

Tom Hanks

• ~3,500 net acres in LaSalle County

• 2 gross total completions

• Well Costs $5.5 - $7.0 MM

• ~ 60-acre spacing (~500 feet apart)

Summary

6/30/2013

10

1 EF well drilled yet to be completed

2Q 2013: 1 EF completion

Eagle

Ford

• 1 completion - discovery well

• 7-day stabilized IP 657 Boe/d (91% oil)

• 44 net well locations remaining

• 1 well drilled awaiting completion

Pearsall

• 1 completion - exploration

• Un-stabilized test rate at 5 MMcf/d

• Gas content includes 1% H2S

Pearsall

Well

Eagle Ford

Well

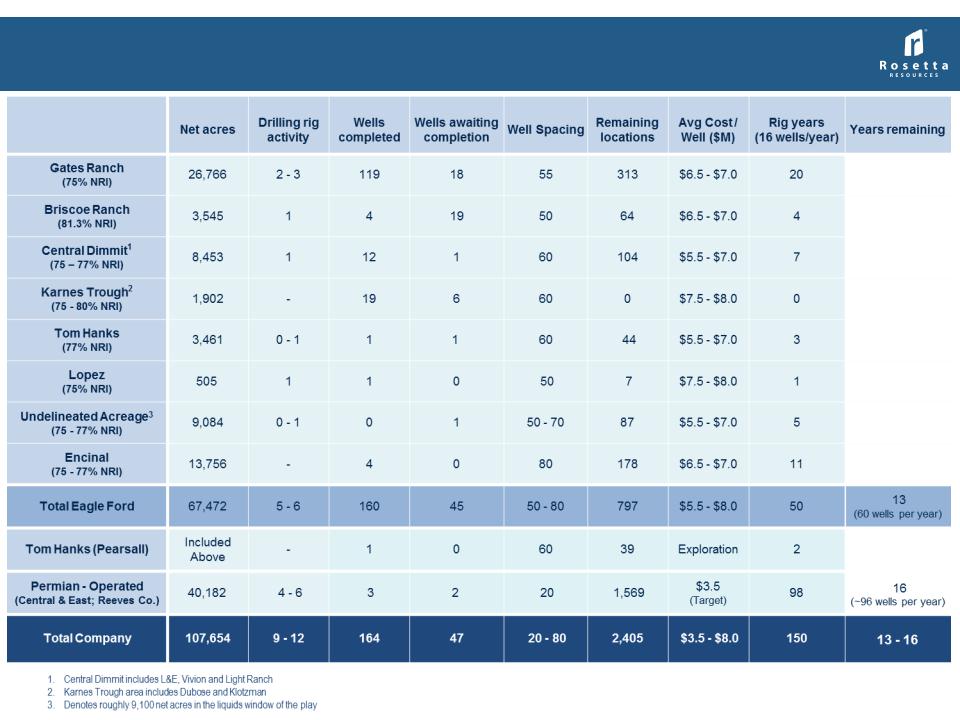

Total Company Inventory

+/- 2,400 wells -- remaining as of 6/30/2013

+/- 2,400 wells -- remaining as of 6/30/2013

11

Forward-Looking Statements and Terminology Used

12