Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cole Real Estate Investments, Inc. | d580530d8k.htm |

| EX-99.3 - EX-99.3 - Cole Real Estate Investments, Inc. | d580530dex993.htm |

| EX-99.1 - EX-99.1 - Cole Real Estate Investments, Inc. | d580530dex991.htm |

2013 Second Quarter

Earnings Presentation www.ColeREIT.com

August 5, 2013

Exhibit 99.2 |

2

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

This presentation is for informational purposes only and is not an offer to buy or the

solicitation of an offer to sell any securities of Cole Real Estate Investments, Inc.

(“Cole”). The tender offer will be made only pursuant to an offer to purchase, letter of

transmittal and related materials that Cole distributed to its stockholders and filed with the

U.S. Securities and Exchange Commission

(“SEC”),

as

they

may

be

amended

from

time

to

time.

The

full

details

of

the

tender

offer,

including

complete

instructions on how to tender stock, are included in such materials. Stockholders are urged to

carefully read the offer to purchase, the letter of transmittal and other related

materials, as they may be amended from time to time, because they contain

important information, including the terms and conditions of the

tender offer. Stockholders may obtain free copies of the offer to

purchase, the letter of transmittal and other related materials that Cole files with the SEC

at the SEC’s website at: http://www.sec.gov

or by calling the information agent for the contemplated tender

offer, who will be identified in the materials

filed with the SEC at the commencement of the tender offer. In addition, copies of the

documents filed by Cole with the SEC will be available free of charge by directing a

written request to Cole Real Estate Investments, 2325 East Camelback Road, Suite 1100,

Phoenix, Arizona 85016, Attention: Investor Relations.

Disclosures

The properties pictured have been acquired by Cole. Corporate tenants may also occupy numerous

properties that are not owned by Cole or Cole-sponsored programs. Cole is not

affiliated or associated with, is not endorsed by, does not endorse, and is not

sponsored by or a sponsor of the tenants or the joint venture partners shown, or of their products or services pictured or

mentioned. The names, logos and all related product and service names, design marks and

slogans are the trademarks or service marks of their respective companies.

Tenants, Trademarks and Logos

Tender Offer |

3

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

In addition to historical information, this presentation contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-

looking statements, which are based on current expectations, estimates and projections about

the industry and markets in which Cole operates, include beliefs of and assumptions

made by Cole’s management, and involve risks and uncertainties that could

significantly

affect

the

financial

results

of

Cole.

Words

such

as

“may,”

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“projects,”

“seeks,”

“estimates,”

“would,”

“could”

and “should”

and variations of such words and similar expressions are

intended to identify such forward-looking statements, which generally are not historical

in nature. Such forward-looking statements

include,

but

are

not

limited

to,

statements

about

the

benefits

of

the

business

combination

transaction

with

Cole

Holdings Corporation, future financial and operating results, and the company’s plans,

objectives, expectations and intentions. All statements that address operating

performance, events or developments that we expect or anticipate will occur in the future are

forward-looking statements. These statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are difficult to predict.

Although we believe the expectations reflected in any forward-looking statements

are based on reasonable assumptions, we can give no assurance that our expectations will be

attained and therefore, actual outcomes and results may differ materially from what is

expressed or forecasted in such forward-looking statements. Some of the

factors

that

could

cause

actual

results

to

differ

materially

from

any

forward-looking

statements

include,

among

others,

(i)

changes in national, international, regional and local economic conditions, (ii) changes in

financial markets, interest rates, credit spreads, and foreign currency exchange rates,

(iii) changes in real estate conditions, (iv) continued ability to source new

investments, (v) risks associated with acquisitions, (vi) construction costs that may exceed

estimates, and construction delays, (vii) lease-up risks, rent relief, and inability

to obtain new tenants upon the expiration or termination of existing leases, (viii)

maintenance of real estate investment trust status, (ix) legal matters, (x) availability of

financing and capital generally, (xi) inability

to

obtain

financing

or

refinance

existing

debt

and

the

potential

need

to

fund

tenant

improvements

or

other

capital

expenditures out of operating cash flows, (xii) changes in demand for properties, and (xiii)

additional risks and factors discussed in reports filed by the Company with the SEC

from time to time. Cole does not make any undertaking with respect to updating any

forward looking statements appearing in this presentation. Forward-Looking Statements

|

4

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Information Overview

2013 Second Quarter Highlights

Page 5

Real Estate Investments

Page 6 -

7

Private Capital Management

Page 8 -

9

Financials

Page 10 –

11

Corporate Strategy

Page 12 -

13 |

5

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

2013 Second Quarter Highlights

A Premier Net Lease Company

–

Highly ranked among net lease peers

–

Best-in-class management platform with capabilities across all aspects of property investment

and management

–

Disciplined

investment

philosophy

and

process

proven

over

market

cycles

–

Market-leading lease duration and substantial investment grade tenancy

–

Well diversified by tenancy, credit quality, property type and geography

Record Operating Results

»

Reported consolidated revenue of $250.3 million and net income of $29.1 million, a 91% and 26%

year-over-year increase from the second quarter of 2012, respectively

»

Reported consolidated AFFO of $0.23 per diluted share, a 44% year-over-year increase from the

second quarter of 2012 »

$266 million of real estate was acquired in the second quarter 2013 with a weighted average annual

lease yield of 7.7% and $1.3 billion of real estate was acquired over the past four quarters

with a weighted average annual lease yield of 7.8% »

$508 million of capital was raised on behalf of our managed REITs in the second quarter 2013 and a

record-breaking month of $509 million of capital raised during July was also achieved

Increased Guidance

»

10% increase in second half AFFO guidance to the new range of $0.42 to $0.47 per diluted share

Increased Dividend

»

Increased the annual distribution rate to $0.72 from $0.70 per share effective with the August

dividend, payable September 3, 2013

»

Represents an 11% increase over the past two quarters

Tender Offer

»

The

modified

“Dutch

auction”

tender

offer

to

purchase

up

to

$250

million

of

shares

will

expire

on

August

8,

2013

Share Repurchase Program

»

Authorized

to

repurchase

up

to

$250

million

of

shares

in

the

open

market

starting

on

the

11

th

business

day

following

completion of the tender offer |

6

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

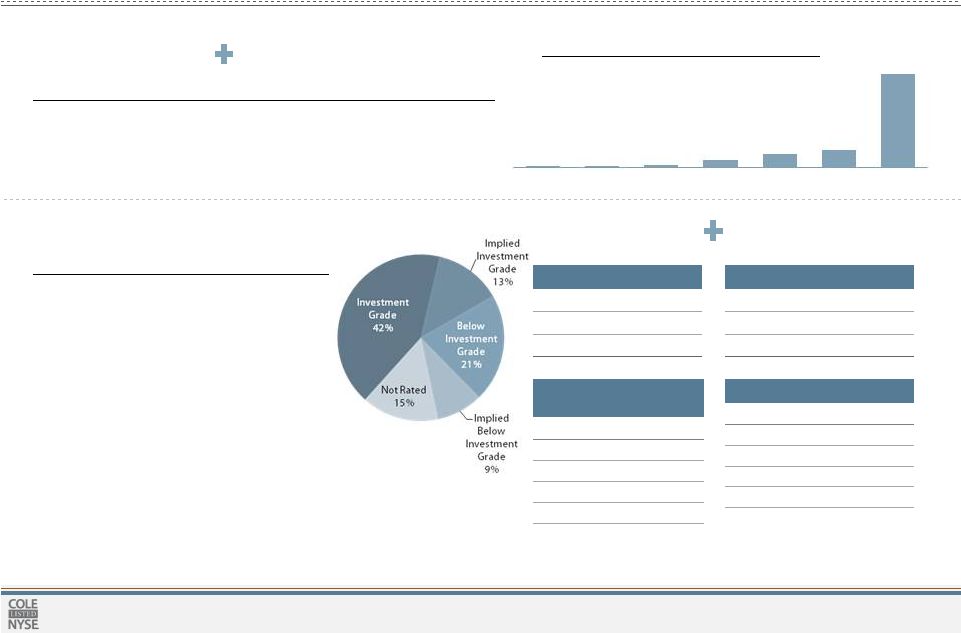

»

42% of Cole's annual rent is derived from

tenants rated investment grade and another

13% from tenants with an implied rating of

investment grade

»

Cole performs extensive upfront credit

analysis and ongoing credit monitoring for all

tenants

»

Implied investment grade ratings are based

on Moody’s Credit Edge or Moody’s KMV in

conjunction with current financial statements

Cole’s business has maintained high portfolio occupancy and one of the

longest weighted average remaining lease terms of all net lease peers,

providing highly visible, predictable cash flows

Real Estate Investments

Market-Leading Lease Duration and Substantial Investment Grade Tenancy

12.2 Years

Weighted

Average

Lease

Term

(1)

Lease Expiration Profile

(1)

55%

Investment

Grade

Tenants

(2)

Example Tenant

Implied Rating

Publix

AA

Cracker Barrel

AA-

Tractor Supply

AA-

Aaron’s Rents

A

Ulta

A+

Rating

% of Total

AAA to AA-

8.2%

A+ to A-

12.6%

BBB+ to BBB-

21.6%

42.4%

Implied Rating

% of Total

AAA to AA-

3.8%

A+ to A-

2.3%

BBB+ to BBB-

7.1%

13.2%

Example

Tenant

Rating

Wells Fargo

AA-

Amazon

AA-

Wal-Mart

AA

Target

A+

Home Depot

A-

42%

Investment Grade

13%

Implied Investment Grade

99.1%

Portfolio Occupancy

0.3%

0.9%

1.2%

5.4%

9.7%

13.0%

69.5%

2013

2014

2015

3-5 Years

5-7 Years

7-10 Years

10+ Years

1. Lease Expiration shows certain information regarding

the lease expirations of Cole’s real estate portfolio, including consolidated joint ventures, as of June 30, 2013, based on annualized rental revenue, during

each of the next ten years and thereafter, excluding unconsolidated JVs and CMBS/Secured

notes receivable.

2. Credit ratings based on annualized rental revenue from

tenants with credit ratings of BBB- or higher. Tenant credit rating may reflect the credit rating of the parent company or a guarantor. Credit ratings

exclude unconsolidated JVs and CMBS/Secured notes receivable. Moody’s Credit Edge

was used to determine implied credit rating for public non-rated tenants. Moody’s KMV was used to determine implied credit

rating for private non-rated tenants. Data for implied ratings as of July 29,

2013. Example tenants are from the Cole portfolio.

|

7

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

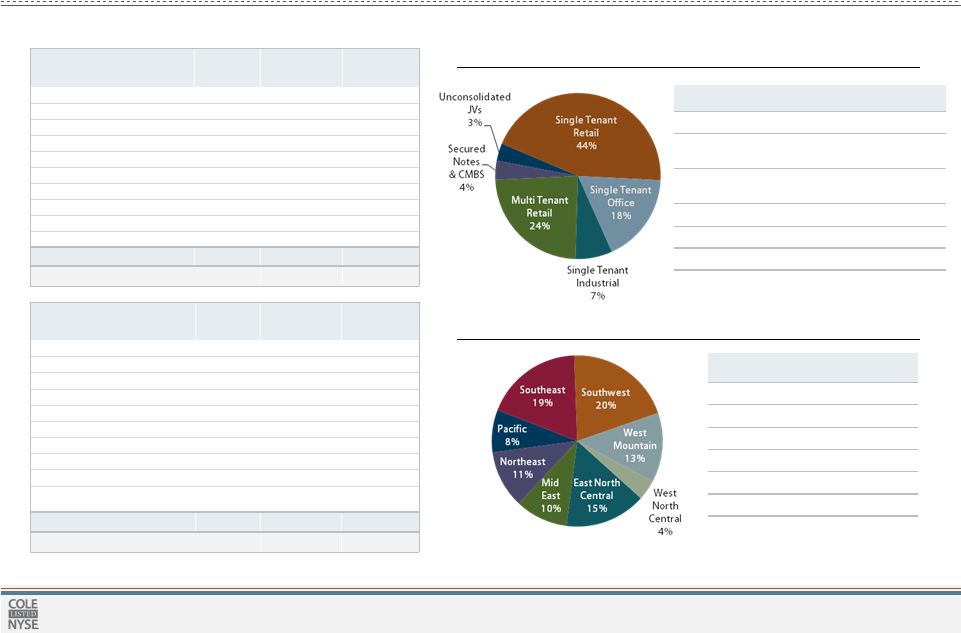

PROPERTY TYPE

PROPERTIES

SQUARE

FEET

ST Retail

886

17.7mm

ST Office and

Industrial

55

15.2mm

MT

Retail

–

Power

Center

36

8.5mm

MT

Retail

–

Grocery

13

1.3mm

MT Retail –

Anchored

24

1.3mm

Total

1,014

44.0mm

Geographic Diversity

TOP 10 STATES BY % OF ANNUALIZED

RENTAL REVENUE

TX

16.9%

GA

5.1%

AZ

8.6%

MI

3.8%

CA

7.1%

NJ

3.6%

FL

7.0%

OH

3.2%

IL

5.4%

VA

3.2%

Total

63.9%

Real Estate Investments

Well Diversified by Tenancy, Investment Type and Geography

Investment Type Diversity

TOP 10 TENANTS

NUMBER OF

LEASES

% OF

ANNUAL RENT

WTD. AVG.

REMAINING

LEASE TERM

WALGREENS

73

4.8%

17.9 YRS

ALBERTSON'S

34

4.2%

16.8 YRS

PETSMART

42

4.2%

8.3 YRS

CVS

54

3.6%

18.1 YRS

BJ'S WHOLESALE CLUB

3

3.4%

17.7 YRS

WAL-MART

9

2.7%

11.0 YRS

APOLLO GROUP

1

2.6%

17.8 YRS

L.A. FITNESS

17

2.5%

11.0 YRS

AMAZON

3

2.5%

13.3 YRS

HOME DEPOT

12

2.3%

14.9 YRS

TOP 10 TOTAL

248

32.8%

TOTAL NUMBER OF TENANTS

567

TOP 10 INDUSTRIES

NUMBER OF

LEASES

% OF

ANNUAL RENT

WTD. AVG.

REMAINING

LEASE TERM

GROCERY

75

9.1%

15.3 YRS

DRUGSTORE

127

8.4%

18.0 YRS

DISCOUNT STORE

228

7.8%

10.1 YRS

FULL SERVICE RESTAURANT

189

6.8%

14.6 YRS

HOME AND GARDEN

69

5.5%

13.4 YRS

PET SUPPLIES

49

4.5%

8.2 YRS

WAREHOUSE CLUB

7

4.3%

16.2 YRS

HEALTHCARE

58

4.0%

11.2 YRS

FINANCIAL SERVICES

61

3.5%

12.0 YRS

LIMITED SERVICE

RESTAURANT

133

3.3%

11.3 YRS

TOP 10 TOTAL

996

57.2%

TOTAL NUMBER OF INDUSTRIES

36

Tables and charts show certain information regarding the tenant and industry

diversification of Cole’s real estate portfolio, including consolidated joint ventures, as of June 30, 2013, based on

annualized rental revenue. |

8

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Private Capital Management

Understanding the Fee Based Business Model

•

Selling commissions are passed through (reallowed) to the selling

firms and financial advisors who have sold shares in the offering. Our

current

traditional

programs

in

offering

pay

a

7%

commission.

(4)

•

A portion of the dealer-manager fees are paid to the participating

broker-dealer (of the financial advisors) and the remainder is retained

by Cole. Our current traditional programs in offering have a 2%

dealer-manager fee.

•

Transaction fees are paid on total purchase price of REIT assets

acquired. Our current traditional programs in offering charge a 2%

acquisition fee.

•

Management fees include recurring asset management advisory fees

as well as performance fees. Our current traditional programs in

offering charge an average annual advisory fee of 0.75% on invested

assets

and

a

performance

fee

of

15%.

(5)

•

Expense reimbursement revenue is offset by allowable organizational

and offering expenses associated with raising capital in a program

offering as well as management expense reimbursement for salaries

as well as certain general and administrative costs.

Premier Platform

»

Cole’s private capital business, Cole Capital™, is a premier alternatives broker-dealer

with fully integrated teams across external and internal sales, marketing, sales analytics,

events, national accounts, due diligence, compliance and shareholder services. Successful

»

Per

Robert

Stanger

&

Co.

industry

reports,

Cole

Capital™

is

the

only

non-traded

REIT

sponsor

to

rank

in

the

top

3

for

the

past

five

years

and

has

raised

over

$8.1

billion

since

2007

(1)

1.

Capital Raise data as of July 31, 2013.

2.

All dollars in thousands and US GAAP. Investors should review the Supplemental Financial Information

for the second quarter of 2013 furnished on Form 8-K on 8/5/2013 for additional information.

Revenue, for the period beginning on the merger date of 4/6/13 through 6/30/13, derived from both Open

and Closed Programs, including CCPT II whose merger with Spirit was completed subsequent to

June 30, 2013. 3.

See “About the Data” for a description of Adjusted Revenue and Normalized EBITDA which are

non-GAAP financial measures. 4.

The Company reallows 100% of selling commissions earned and may reallow all or a portion of its dealer

manager fee to participating broker-dealers as a marketing and due diligence expense

reimbursement.

5.

Advisory fees for current traditional programs in offering are an annualized fee based on the average

monthly invested assets beginning at 0.75% for the first $2 billion, 0.70% over $2 billion up to

$4 billion, and 0.65% over $4 billion. Upon a liquidity event and after investors have received an 8%

cumulative total return, Cole is entitled to receive 15% of the remaining net proceeds. Refer to

each program’s respective prospectus for specific details. |

9

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

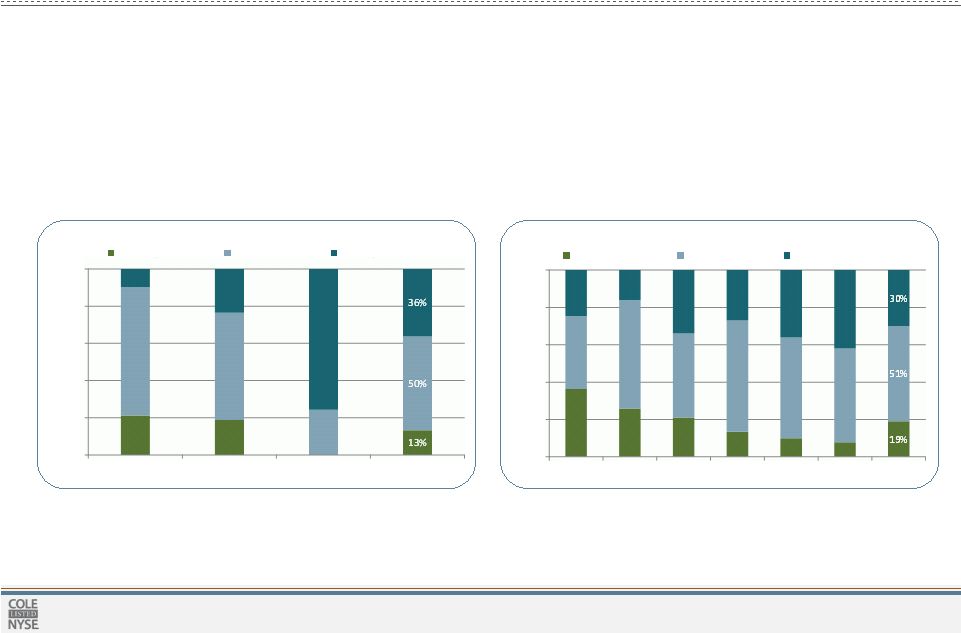

Private Capital Management

Disciplined

»

Our disciplined investment strategy and proven ability to acquire accretive assets provides an

opportunity to attract a long- term investor base that values year-in, year-out

execution Recurring

»

Our

past

results

demonstrate

the

recurring,

repeatable

nature

of

our

revenue

Consistent

»

The sequencing of each new offering provides consistency across the three fee categories

Understanding Revenue Composition

1.

Illustrative annual revenue reflects typical revenue profile associated with standard product

fees and an average capital raise of $100 million per month ending in month 24 with all acquisitions

completed by month 36. Management Fees does not take into account any performance-related

fees, and revenue composition in Year 4 and beyond assumes 100% Management Fees. Offering

Fees (net) is gross offering fees net of all reallowed selling commissions and

dealer-manager fees as well as all expense reimbursements.

2.

Historical annual revenue includes results from current and prior managed REITs. Excludes

revenue associated with 1031 programs. Management Fees excludes performance related fees. Offering

Fees (net) is gross offering fees net of all reallowed selling commissions and

dealer-manager fees as well as all expense reimbursements.

0%

20%

40%

60%

80%

100%

Year 1

Year 2

Year 3

Average

Offering Fees (net)

Transaction Fees

Management Fees

ILLUSTRATIVE

ANNUAL

REVENUE

PROFILE

PER

EACH

NEW

FUND

OFFERING

(1)

0%

20%

40%

60%

80%

100%

Offering Fees (net)

Transaction Fees

Management Fees

HISTORICAL

ANNUAL

REVENUE

PROFILE

FROM

ACTUAL

OFFERINGS

(2)

2007

2008

2009

2010

2011

2012

Average |

10

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Financials

Record Operating Results

Summary Financial Results

($ in thousands, except per share data)

Three Months Ended June 30, 2013

Three Months Ended June 30, 2012

Total

Real Estate

Investment

Private

Capital

Management

Year-Over-Year

% Change

Total

Real Estate

Investment

Net Income

$ 19,948

$ 9,186

26%

$ 23,090

$ 23,090

EBITDA

(1)

$119,291

$ 15,009

44%

$ 93,230

$ 93,230

Normalized EBITDA

(1)

$139,302

$ 15,009

40%

$ 110,004

$ 110,004

Annualized Normalized EBITDA

$ 440,016

Funds From Operations (FFO)

(1)

$ 67,044

9,186

17%

$ 64,991

$ 64,991

FFO per common share, diluted

$ 0.14

$ 0.02

14%

$ 0.14

$ 0.14

Adjusted Funds From Operations (AFFO)

(1)

(2)

$ 95,663

15,098

44%

$ 76,801

$ 76,801

AFFO per common share, diluted

$ 0.20

$ 0.03

44%

$ 0.16

$ 0.16

Weighted average shares outstanding, diluted

473,159,051

For more information reference the supplemental financial information filed on August 5, 2013.

Private Capital Management data is not applicable for the three months ended June 30, 2012 as the acquisition of Cole

Holdings occurred on April 5, 2013.

1.

EBITDA, Normalized EBITDA, FFO and AFFO are non-GAAP measures. See “About the

Data” for a description of our non-GAAP measures and accompanying Supplemental Financial Information for GAAP

reconciliation.

2.

During the three months ended June 30, 2013 and June 30, 2012, the Company capitalized

expenses incurred related to the ongoing maintenance of the properties, including tenant improvements and leasing

commissions, of $983,000 and $2.8 million, respectively. $

29,134 $134,300

$ 154,311

$ 617,244

$ 76,230

$ 0.16

$ 110,761

$ 0.23

491,510,128

$

$ |

11

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

2H13E AFFO PER DILUTED SHARE COMPOSITION

2H13E NORMALIZED EBITDA COMPOSITION ($mm)

$0

$0

Financials

Increased 2013 Second Half Guidance

Note: All dollars in millions, except per share data; All US GAAP except Normalized EBITDA and

AFFO. See “About the Data” for a description of the Non-GAAP financial measures and accompanying

Supplemental Financial Information for GAAP reconciliation. 2H2013E AFFO and NORMALIZED EBITDA

compositions are based on the mid point of the respective financial ranges.

1.Real Estate Investment Revenue includes $9 million from estimated Interest income on real

estate related investments. Estimates assume $550 million of net acquisitions in the second half at a 7.3% cap rate

and include the potential impact of the $250 million tender offer and up to $250 million of

share repurchases. Funding sources for investment activity will come from a combination of property dispositions,

CMBS sales, cash on balance sheet and/or the use of the credit facility with a target total

debt to gross assets ratio not to exceed 50%. 2.Private Capital Management

Revenue (Gross) is presented before reallowed fees and commissions. On a net basis Adjusted Revenues are estimated to be $66 - $78 million.

3.Includes the impact of CCPTII’s merger with Spirit Realty Capital, Inc., which closed

on July 17, 2013. Assumes $1.67 billion of capital raised in 2H13 within Cole’s private capital management business, Cole

Capital , raised predominantly across Cole Corporate Income

Trust, Inc., a single-tenant office and industrial portfolio, and Cole Credit Property Trust IV, Inc., a single and multi-tenant retail portfolio.

TM |

12

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Current Dividend Yield

Equivalent

COLE

Price

NNN

4.6%

$15.55

WPC

4.8%

$15.13

LXP

4.8%

$15.05

O

5.0%

$14.35

CSG

6.2%

$11.65

EPR

6.3%

$11.48

ARCP

6.3%

$11.43

COLE

6.7%

$10.68

SRC

7.2%

$10.02

Average

5.6%

$12.76

Strategic Steps to Enhanced Value

Corporate Strategy

Optimizing Capital Spreads: Equity

Average

Upside

of

33%

Based

on

Peer

Multiples

(1)

1.

Create Investor Liquidity

»

Listed on the NYSE on June 20, 2013

»

$250 million modified “Dutch auction” tender designed to ease investor

transition

2.

Broaden Shareholder

Base

»

Early inclusion in the MSCI U.S. REIT Index (RMS/RMZ) occurred July 3, 2013

»

Based on our analysis, we anticipate the possibility of near term index inclusion

in Dow Jones Real Estate, FTSE NAREIT and various S&P indices

3.

Close the Information Gap

»

2Q13 financials provide first fully consolidated financial picture of the Company

4.

Increase Institutional Ownership

»

Proactive discussions with sell-side analysts regarding equity research coverage

»

Active targeting of, and robust communication with, institutional investors

5.

Maximize the

Opportunity

»

Authorized to repurchase up to $250 million of shares in the open market

starting on the 11th business day following the completion of the tender offer 1.

Source : SNL. Cole multiples computed with an annualized midpoint of 2H2013

guidance of $0.42 to $0.47. Annual distribution assumed for Cole of

$0.72. Average upside calculated as average percentage price change from COLE’s current price to the

Equivalent COLE price at comparable multiples or dividend yields. Please see “About the

Data” for a description of AFFO which is a non-GAAP financial measure.

Data as of 7/31/2013.

Average Upside of 19% Based on Peer Dividend Yields

(1)

2013E

AFFO

Multiple

Equivalent

COLE

Price

O

18.8x

$16.71

NNN

18.2x

$16.17

WPC

17.5x

$15.59

LXP

16.5x

$14.73

ARCP

15.6x

$13.92

CSG

15.5x

$13.76

EPR

13.7x

$12.15

COLE

12.0x

$10.68

SRC

11.9x

$10.59

Average

16.0x

$14.20

Average

Upside

of

19%

Based

on

Peer

Dividend

Yields

(1) |

13

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

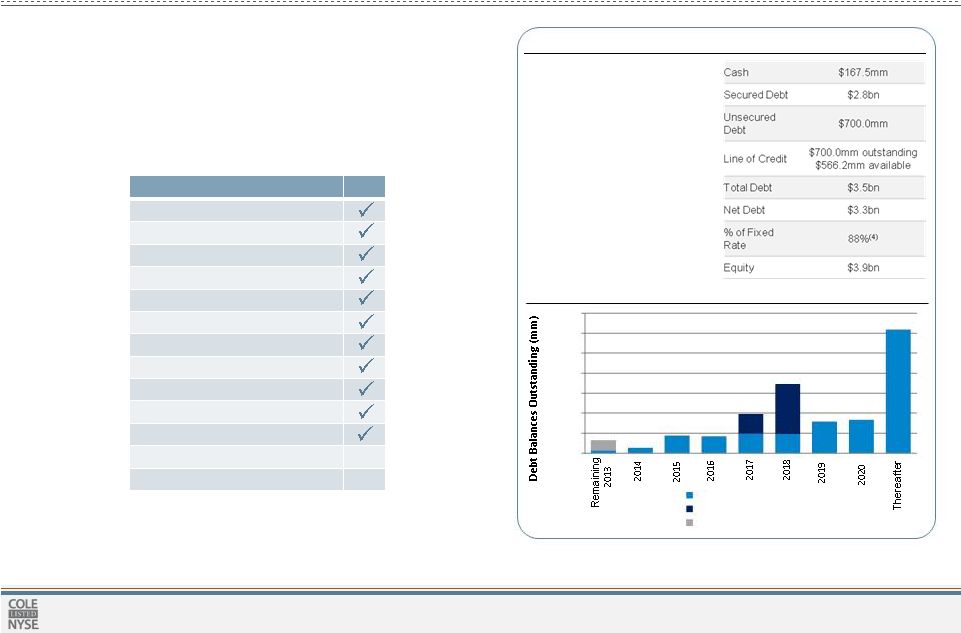

Key

Balance

Sheet

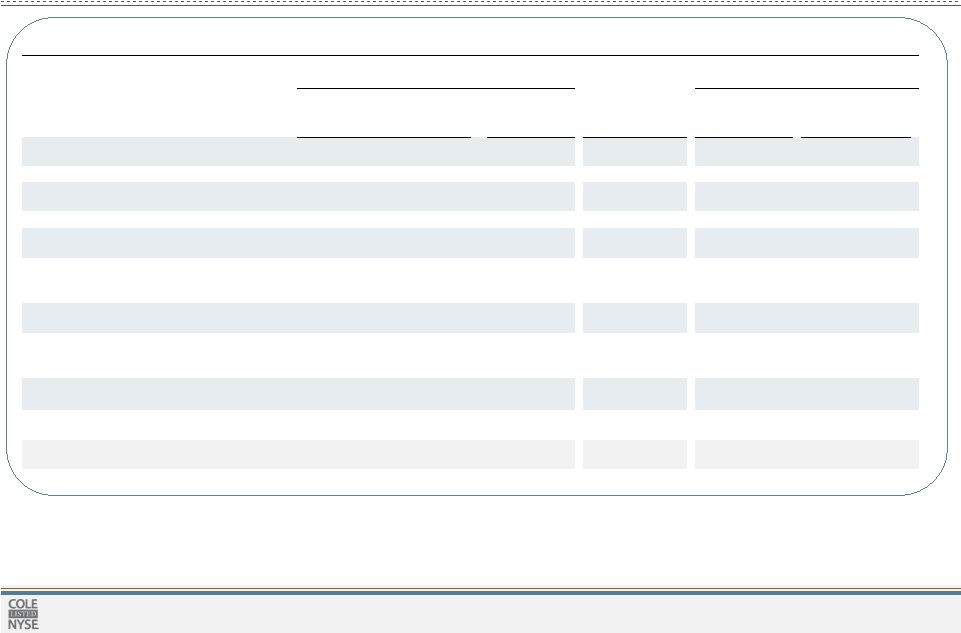

Metrics

and

Capital

Structure

(2)

Debt Maturity Profile

•

39% Debt to Enterprise Value

•

47% Debt to Gross Real Estate and

Related Assets

•

5.4x Net Debt to Normalized

EBITDA Ratio

•

3.2x Interest Coverage Ratio

•

4.22% Weighted average cost of

debt

•

6.0 Weighted average years to

maturity

•

Gross Book Value of

Unencumbered

Properties

$2.0bn

(3)

Capital Structure Objectives

»

Seek unsecured debt issuance

»

Reduce leverage to increase flexibility

»

Obtain investment grade rating

Understanding Ratings Criteria

»

Based upon our analysis of Moody’s rating methodology, we

should be well positioned and appear ready for investment grade

status

Corporate Strategy

Optimizing Capital Spreads: Debt

Key

Financial

Rating

Criteria

(1)

Cole

Liquidity >= 1 year

Weighted Average Debt Maturities < 20%

Average FFO Payout < 90%

Debt + Preferred / Gross Assets < 50%

Net Debt / EBITDA < 8.0x

Gross Assets > $2 Billion

Development Pipeline < 10%

EBITDA Margin > 55%

EBITDA Margin Volatility < 6%

Fixed Charge Coverage > 2.2x

Joint Venture Exposure < 15%

Unencumbered Assets > 60%

30%

Secured Debt / Gross Assets <

20% 36%

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

Mortgage Debt

Credit Facility

Repurchase Agreements

Criteria as reported in Moody’s Investor Service Rating Methodology published July 30,

2010.

Data as of June 30, 2013. Additionally, investors should review the Supplemental Financial

Information for the second quarter of 2013 furnished on Form 8-K on 8/5/2013 for additional information.

Gross Book Value of unencumbered properties includes $1.9 billion of assets pledged to the

credit facility as of June 30, 2013.

Includes the credit facility’s term loan of $500.0 million and $473.0 million of variable

rate debt each subject to interest rate swap agreements. 1.

2.

3.

4. |

14

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Why Cole?

PRIVATE CAPITAL

MANAGEMENT

GROWTH

»

Active portfolio management to monetize

gains and redeploy capital

»

Yield enhancement through property

type

diversification

»

Future deal pipeline and yield potential

via joint ventures

»

Embedded annual rental increases

»

Best-in-class platform built for

size and

scale »

Proven ability to source and acquire high-

quality accretive assets

»

Disciplined acquisition results via rigorous

underwriting and credit discipline

»

Proactive risk management to protect and

enhance NOI

Our focus is on growing AFFO per share while maintaining a balanced risk profile

»

Valuable fee revenue provides diversified income growth

»

Ability to raise cycle-resistant capital capturing growing income investor trends

»

Continuously developing new products and distribution relationships |

15

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Portfolio Highlights

Single-Tenant Retail

Walgreens Portfolio

71 Properties | 30 States | 1.0 M SF

Portfolio Price: $342.2 Million

Lease Yield: 7.8%

BJ’s Wholesale Club

Portfolio

10 Properties | 7 States | 1.0 M SF

Portfolio Price: $177.4 Million

Lease Yield: 7.8%

Family Dollar Portfolio

140 Properties | 26 States | 1.2 M

SF

Portfolio Price: $186.0 Million

Lease Yield: 6.9%

Tractor Supply Portfolio

40 Properties | 20 States | 822,000

SF

Portfolio Price: $120.2 Million

Lease Yield: 8.7%

Kohl’s Portfolio

13 Properties | 8 States | 1.0 M SF

Portfolio Price: $105.3 Million

Lease Yield: 8.0%

L.A. Fitness Portfolio

14 Properties | 7 States | 615,000

SF

Portfolio Price: $116.0 Million

Lease Yield: 10.0%

CVS Portfolio

48 Properties | 21 States | 592,000

SF

Portfolio Price: $207.7 Million

Lease Yield: 7.6%

Albertsons Portfolio

33 Properties | 5 States | 1.9 M SF

Portfolio Price: $276.9 Million

Lease Yield: 8.3%

Note: Owned properties. Lease yield represents the average rental income over the

non-cancellable lease-terms as of close of escrow divided by the purchase price of the property; excluding certain increases subject to

the consumer price index (CPI). Data as of 6/30/13

|

16

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Walmart Portfolio

7 Properties | 6 States | 1.3 M SF

Portfolio Price: $106.7 Million

Lease Yield: 7.2%

On the Border Portfolio

26 Properties | 13 States | 182,000

SF

Portfolio Price: $77.0 Million

Lease Yield: 9.7%

Stripes Portfolio

24 Properties | 2 States | 138,000 SF

Portfolio Price: $80.5 Million

Lease Yield: 8.1%

PetSmart Portfolio

13 Properties | 9 States | 351,000 SF

Portfolio Price: $82.1 Million

Lease Yield : 7.7%

Advance Auto Parts

Portfolio

45 Properties | 10 States | 302,000

SF

Portfolio Price: $70.5 Million

Lease Yield: 8.4%

Lowe’s Portfolio

8 Properties | 8 States |1.1 M SF

Portfolio Price: $77.7 Million

Lease Yield: 7.4%

Outback Steakhouse

Portfolio

20 Properties | 14 States | 126,000

SF

Portfolio Price: $55.9 Million

Lease Yield: 9.3%

Thorntons Oil Portfolio

23 Properties | 4 States | 79,000 SF

Portfolio Price: $60.1 Million

Lease Yield: 7.9%

Portfolio Highlights

Single-Tenant Retail

Note: Owned properties. Lease yield represents the average rental income over the

non-cancellable lease-terms as of close of escrow divided by the purchase price of the property; excluding certain increases subject

to the consumer price index (CPI). Data as of 6/30/13

|

17

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Academy Sports Portfolio

6 Properties | 3 States | 523,000 SF

Portfolio Price: $51.4 Million

Lease Yield: 9.5%

Best Buy Portfolio

10 Properties | 8 States | 362,000

SF

Portfolio Price: $58.3 Million

Lease Yield: 8.3%

Golden Corral Portfolio

22 Properties | 7 States | 234,000 SF

Portfolio Price: $52.1 Million

Lease Yield: 8.4%

Applebee’s Portfolio

19 Properties | 12 States | 95,000 SF

Portfolio Price: $37.7 Million

Lease Yield: 11.3%

Aaron Rents Portfolio

38 Properties | 16 States | 360,000

SF

Portfolio Price: $44.4 Million

Lease Yield: 9.1%

Home Depot Portfolio

5 Properties | 5 States |525,000 SF

Portfolio Price: $45.0 Million

Lease Yield: 8.7%

Cracker Barrel Portfolio

10 Properties | 5 States | 101,000

SF

Portfolio Price: $31.3 Million

Lease Yield: 11.3%

Wendy’s Portfolio

32 Properties | 4 States | 101,000 SF

Portfolio Price: $43.3 Million

Lease Yield: 8.7%

Portfolio Highlights

Single-Tenant Retail

Note: Owned properties. Lease yield represents the average rental income over the

non-cancellable lease-terms as of close of escrow divided by the purchase price of the property; excluding certain increases subject

to the consumer price index (CPI). Data as of 6/30/13

|

18

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Health Now NY

Buffalo MSA | 430,000 SF

Purchase Price: $84.5 Million

Class A, two-tower office property

originally constructed as a build-to-suit

Lease Yield: 8.9%

Portfolio Highlights

Office and Industrial

Amazon Portfolio

3 Properties | 2 States | 3.0 M SF

Portfolio Price: $186.6 Million

Regional distribution centers for

domestic and international orders

Lease Yield: 7.5%

EMC Corporation

Boston MSA | 328,000 SF

Purchase Price: $93.5 Million

Corporate headquarters campus for

EMC affiliate RSA security

Lease Yield: 7.4%

Encana Oil & Gas

Dallas MSA | 319,000 SF

Purchase Price: $120.0 Million

Class A, regional headquarters for leading

energy producer

Lease Yield: 6.5%

Merrill Lynch

Trenton MSA | 482,000 SF

Purchase Price: $135.0 Million

Corporate headquarters for Merrill

Lynch Global Wealth & Investment

Management

Lease Yield: 8.1%

PetSmart

Phoenix MSA | 366,000 SF

Purchase Price: $102.5 Million

Corporate campus comprised of three

mid-rise office towers

Lease Yield: 8.3%

Igloo

Houston MSA | 914,000 SF

Purchase Price: $38.1 Million

Corporate headquarters, distribution,

warehouse and manufacturing facility

Lease Yield: 8.5%

Walmart

Riverside MSA | 496,000 SF

Purchase Price: $91.5 Million

Warehouse and distribution

Lease Yield: 6.8%

Note: Owned properties. Lease yield represents the average rental income over the

non-cancellable lease-terms as of close of escrow divided by the purchase price of the property; excluding certain increases subject

to the consumer price index (CPI). Data as of 6/30/13

|

19

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

AT&T

2 Properties | 2 States | 1.0 M SF

Purchase Price: $234.4 Million

Two class A office regional

headquarters facilities

Lease Yield: 8.3%

Clorox

San Francisco-Oakland MSA |

343,000 SF

Purchase Price: $96.5 Million*

Six-building corporate operations and

R&D center

Lease Yield: 6.9%

The Medicines Company

Newark MSA | 179,000 SF

Purchase Price: $53.0 Million

Headquarters for global pharmaceutical

company

Lease Yield: 8.7%

Hanesbrands

Greensboro MSA | 930,000 SF

Purchase Price: $31.7 Million

Eastern distribution center for apparel

products

Lease Yield: 9.4%

The Home Depot

3 Properties | 3 States | 1.0 M SF

Purchase Price: $76.4 Million

Two Rapid Deployment Centers and a

built-to-suit call center

Lease Yield: 8.5%

CVS Pharmacy

Chicago MSA | 195,000 SF

Purchase Price: $44.3 Million

One of three regional operations

centers for the pharmacy health care

provider

Lease Yield: 8.0%

Banner Life Insurance Co.

Washington DC MSA | 116,000 SF

Purchase Price: $38.2 Million

U.S. headquarters for life insurance

company

Lease Yield: 8.2%

ConAgra Foods

Harrisburg MSA | 719,000 SF

Purchase Price: $28.5 Million

Warehouse and distribution facility for

Chef Boyardee food processing plant

Lease Yield: 8.9%

Portfolio Highlights

Office and Industrial

Note: Owned properties. Lease yield represents the average rental income over the

non-cancellable lease-terms as of close of escrow divided by the purchase price of the property; excluding certain increases subject

to the consumer price index (CPI). Data as of 6/30/13. *Joint Venture. Cole’s ownership

is 90% ($86.9 million) |

20

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Portfolio Highlights

Multi-Tenant Power Centers and Grocery-Anchored Retail

Atascocita Commons

Houston MSA | 318,000 SF

Purchase Price: $56.5 Million

Anchor Tenants: Kohl’s, T.J. Maxx,

Office Depot, Petco, Palais Royal and

Ross

Lease Yield: 7.4%

Camp Creek Marketplace

Atlanta MSA | 426,000 SF

Purchase Price: $76.4 Million

Anchor Tenants: BJ’s Warehouse,

Ross, Marshalls, T.J. Maxx, Staples and

PetSmart

Lease Yield: 8.0 %

Eastland Center

Los Angeles MSA | 811,000 SF

Purchase Price: $145.9 Million

Anchor Tenants: Target, Walmart, Dick’s

Sporting Goods, Marshalls, Burlington

Coat Factory, Office Depot and PetSmart

Lease Yield: 6.5%

Power Center Portfolio

4 Properties* | Phoenix MSA, 1.0M

SF

Portfolio Price: $175.0 Million*

Anchor Tenants: Jo-Ann Fabrics,

Bed Bath & Beyond, Marshalls, DSW,

Nordstrom Rack and Hobby Lobby

Lease Yield: 7.8%

Mueller Regional

Austin MSA | 348,000 SF

Purchase Price: $67.3 Million

Anchor Tenants: The Home Depot, Best

Buy, Bed Bath & Beyond and Marshalls

Lease Yield: 8.2%

Valley Bend

Huntsville MSA | 416,000 SF

Purchase Price: $72.5 Million

Anchor Tenants: Hobby Lobby, Dick’s

Sporting Goods, Marshalls, Bed Bath &

Beyond and PetSmart

Lease Yield: 8.1%

University Plaza

Flagstaff MSA | 165,000 SF

Purchase Price: $17.2 Million

Anchor Tenants: Safeway, Bed Bath &

Beyond, Ross, and PetSmart

Lease Yield: 9.9%

Whittwood Town Center

Los Angeles MSA | 785,000 SF

Purchase Price: $83.5 Million

Anchor Tenants: Target, JCPenney,

Sears, Kohl’s, Vons, PetSmart, World

Market and 24Hour Fitness

Lease Yield: 6.9%

Note: Owned properties. Lease yield represents the average rental income over the

non-cancellable lease-terms as of close of escrow divided by the purchase price of the property; excluding certain increases subject

to the consumer price index (CPI). Data as of 6/30/13. *The Company has interests in three

properties through joint venture arrangements. Cole’s shares of the purchase price is $108.9 million.

|

21

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

Portfolio Highlights

Multi-Tenant Power Centers and Grocery-Anchored Retail

Greenway Commons

Houston MSA | 253,000 SF

Purchase Price: $68.3 Million

Anchor Tenants: Costco, LA Fitness,

Buffalo Wild Wings

Lease Yield: 6.6%

Folsom Gateway II

Sacramento MSA | 115,000 SF

Purchase Price: $36.0 Million

Anchor Tenants: Bed Bath & Beyond,

PetSmart, ULTA, DSW, US Bank

Lease Yield: 7.8%

Fairlane Green

Detroit MSA | 273,000 SF

Purchase Price: $47.0 Million

Anchor Tenants: Bed Bath & Beyond,

Michaels, TJ Maxx, Old Navy, Barnes &

Noble, Pier 1 Imports

Lease Yield: 9.9%

Santa Rosa Commons

Pensacola MSA | 140,000 SF

Purchase Price: $25.5 Million

Anchor Tenants: Publix, TJ Maxx,

PetSmart

Lease Yield: 8.0%

Silverado Plaza

Tucson MSA | 77,000 SF

Portfolio Price: $9.3 Million

Anchor Tenants: Safeway, Wells Fargo

Lease Yield: 7.8%

Hillside Town Center

Chicago MSA | 167,000 SF

Purchase Price: $26.9 Million

Anchor Tenants: HomeGoods,

Michaels, Petco, Staples, Charming

Charlie

Lease Yield: 9.0%

Oxford Exchange

Birmingham MSA | 334,000 SF

Purchase Price: $45.5 Million

Anchor Tenants: Dick’s Sporting Goods,

Hobby Lobby, TJ Maxx, Ross Dress For

Less, PetSmart, Old Navy, Bed Bath &

Beyond

Lease Yield: 8.5%

Barrow Crossing

Atlanta MSA | 280,000 SF

Purchase Price: $37.1 Million*

Belk, PetSmart, Michaels, TJ Maxx,

Staples, Publix, McDonalds

Lease Yield: 8.4%

Note: Owned properties. Lease yield represents the average rental income over the

non-cancellable lease-terms as of close of escrow divided by the purchase price of the property; excluding certain increases subject

to the consumer price index (CPI). Data as of 6/30/13. *Joint venture. Cole’s

ownership is 90% ($33.4 million) |

22

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

About the Data

Supplemental Information

The supplemental financial information package for the

second quarter ended June 30, 2013 that accompanies this presentation, and the Company's Form 10-Q

report for the same period, were filed on August 5, 2013 and are

available on Cole's website at www.colereit.com. Non-GAAP Financial Measures

FFO and AFFO

Funds From Operations (“FFO”) is a non-GAAP financial

performance measure defined by the National Association of Real Estate Investment Trusts

(“NAREIT”) and widely recognized by investors and analysts as

one measure of operating performance of a real estate company. The FFO calculation excludes

items such as real estate depreciation and amortization, gains and

losses on the sale of depreciable real estate and impairments of depreciable real estate.

Depreciation and amortization as applied in accordance with GAAP

implicitly assumes that the value of real estate assets diminishes predictably over time. Since

real estate values have historically risen or fallen with market

conditions, it is management’s view, and we believe the view of many industry investors and

analysts, that the presentation of operating results for real estate

companies by using the historical cost accounting method alone is insufficient. In addition, FFO

excludes gains and losses from the sale of depreciable real estate and

impairment charges on depreciable real estate, which we believe provides management and

investors with a helpful additional measure of the performance of our

real estate portfolio, as it allows for comparisons, year to year, that reflect the impact on

operations from trends in items such as occupancy rates, rental rates,

operating costs, general and administrative expenses, and interest costs. We compute FFO

in accordance with NAREIT’s definition. In addition to FFO, we use

Adjusted Funds From Operations (“AFFO”) as a non-GAAP supplemental financial performance measure to evaluate the operating

performance of our real estate portfolio. AFFO, as defined by our

company, excludes from FFO merger, acquisition, and listing related costs, amortization and

write off of deferred financing costs, straight-line rent

adjustments, above and below market lease intangibles amortization, realized loss on derivatives and debt

prepayment fees, gain on sale of marketable securities, other

amortization or accretion, other gains, adjustments for discontinued operations and our

proportionate share of adjustments for unconsolidated joint ventures,

all of which are required to be expensed or recorded as additions to revenue or other income

in accordance with GAAP. In evaluating the performance of our portfolio

over time, management employs business models and analyses that differentiate the

costs to acquire investments from the investments’ revenues and

expenses. Management believes that excluding the items noted above from AFFO provides

investors with supplemental performance information that is consistent

with the performance models and analysis used by management, and provides investors a

view of the performance of our portfolio over time, including after the

Company ceases to acquire properties on a frequent and regular basis. AFFO also allows

for a comparison of the performance of our portfolio with other REITs

that are not currently engaging in acquisitions and mergers, as well as a comparison of our

performance with that of other REITs, as AFFO, or an equivalent

measure, is routinely reported by REITs, and we believe often used by analysts and investors

for comparison purposes.

For all of these reasons, we believe FFO and AFFO, in

addition to net income and cash flows from operating activities, as defined by GAAP, are helpful

supplemental performance measures and useful in understanding the

various ways in which our management evaluates the performance of our real estate

portfolio over time. However, not all REITs calculate FFO and AFFO the

same way, so comparisons with other REITs may not be meaningful. FFO and AFFO

should not be considered as alternatives to net income or to cash flows

from operating activities, and are not intended to be used as a liquidity measure indicative

of cash flow available to fund our cash needs.

|

23

©

2013 Cole Real Estate Investments, Inc. All Rights Reserved.

About the Data (continued)

Non-GAAP Financial Measures continued

EBITDA and Normalized EBITDA

Normalized EBITDA

as

disclosed

represents

EBITDA,

or

earnings

before

interest,

taxes,

depreciation

and

amortization,

modified

to

include

other

adjustments to GAAP net income for merger, acquisition, and listing related expenses which are

considered non-recurring and gain/losses in real estate and derivatives which are not

considered fundamental attributes of our business plans and do not affect our overall long-term operating

performance.

We

exclude

these

items

from

Normalized

EBITDA

as

they

are

not

the

primary

drivers

in

our

decision

making

process.

In

addition,

our

assessment of our operations is focused on long-term sustainability and not on such non-cash

items, which may cause short term fluctuations in net income but have no impact on cash

flows. We believe that Normalized EBITDA is a useful supplemental measure to investors and analysts for

assessing the performance of our business segments, although it does not represent net income that is

computed in accordance with GAAP. Therefore, Normalized EBITDA should not be considered as an

alternative to net income or as an indicator of our financial performance. We use Normalized

EBITDA as one measure of our operating performance when we formulate corporate goals and evaluate the effectiveness of our

strategies. Normalized EBITDA may not be comparable to similarly titled measures of other

companies. Adjusted Revenue

Adjusted Revenue is a non-GAAP financial measure that represents revenue on a GAAP basis adjusted

to eliminate revenue recorded as reimbursement revenue in accordance with GAAP. Included within

Offering Fee Revenue and Management Fee Revenue is revenue related to expense reimbursements

for offering costs and certain general and administrative costs incurred by the Company, included in general and

administrative expense

of

the

Company,

which

is

reimbursed

by

the

managed

REITs.

We

believe

that

excluding

the

items

noted

above

from

revenue

provides investors with supplemental performance information that is consistent with the performance

models and analysis used by management.

Adjusted

Revenues

should

not

be

considered

as

an

alternative

to

revenue

or

cash

flows

from

operating

activities

computed

on a

GAAP basis as a measure of our profitability. Adjusted Revenues may not be comparable to similarly

titled measures of other companies. GAAP Reconciliations

A reconciliation of net income to FFO, AFFO and Normalized EBITDA and a reconciliation of revenue to

adjusted revenue are provided in the Supplemental Financial Information for the second quarter

of 2013 accompanying this presentation. Lease Yield

Lease yield is calculated as the average annual rental income, adjusted for any rent concessions or

abatements, for the in-place leases over the non- cancellable lease

term

at

the

respective

property

divided

by

the

property

purchase

price,

exclusive

of

acquisition

costs.

In

general,

our

properties

are

subject to long-term triple net or double net leases, and the future costs associated with the

double net leases are unpredictable and may reduce the yield. |