Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Aleris Corp | a2q13earningsrelease8-k.htm |

| EX-99.1 - EARNINGS RELEASE - Aleris Corp | a2q13earningsrelease.htm |

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 1 2nd Quarter 2013 Earnings Presentation August 1st, 2013

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 2 Disclaimers IMPORTANT INFORMATION This information is current only as of its date and may have changed. We undertake no obligation to update this information in light of new information, future events or otherwise. This information contains certain financial projections and forecasts and other forward looking information concerning our business, prospects, financial condition and results of operations, and we are not making any representation or warranty that this information is accurate or complete. See “Forward-Looking Information” below. FORWARD-LOOKING INFORMATION Certain statements in this presentation are “forward-looking statements” within the meaning of the federal securities laws. Statements about our beliefs and expectations and statements containing the words “may,” “could,” “would,” “should,” “will,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “look forward to,” “intend” and similar expressions intended to connote future events and circumstances constitute forward-looking statements. Forward-looking statements include statements about, among other things, future costs and prices of commodities, production volumes, industry trends, demand for our products and services, anticipated cost savings, anticipated benefits from new products or facilities, and projected results of operations. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in or implied by any forward-looking statement. Some of the important factors that could cause actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: (1) our ability to successfully implement our business strategy; (2) the cyclical nature of the aluminum industry, material adverse changes in the aluminum industry or our end-use segments, such as global and regional supply and demand conditions for aluminum and aluminum products, and changes in our customers’ industries; (3) our ability to fulfill our substantial capital investment requirements; (4) variability in general economic conditions on a global or regional basis; (5) our ability to retain the services of certain members of our management; (6) our ability to enter into effective metal, natural gas and other commodity derivatives or arrangements with customers to manage effectively our exposure to commodity price fluctuations and changes in the pricing of metals, especially London Metal Exchange-based aluminum prices; (7) our internal controls over financial reporting and our disclosure controls and procedures may not prevent all possible errors that could occur; (8) increases in the cost of raw materials and energy; (9) the loss of order volumes from any of our largest customers; (10) our ability to retain customers, a substantial number of whom do not have long-term contractual arrangements with us; (11) our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our debt service obligations; (12) competitor pricing activity, competition of aluminum with alternative materials and the general impact of competition in the industry segments we serve; (13) risks of investing in and conducting operations on a global basis, including political, social, economic, currency and regulatory factors; (14) current environmental liabilities and the cost of compliance with and liabilities under health and safety laws; (15) labor relations (i.e., disruptions, strikes or work stoppages) and labor costs; (16) our levels of indebtedness and debt service obligations, including changes in our credit ratings, material increases in our cost of borrowing, an inability to access the credit or capital markets or the failure of financial institutions to fulfill their commitments to us under committed credit facilities; (17) the possibility that we may incur additional indebtedness in the future; and (18) limitations on operating our business as a result of covenant restrictions under our indebtedness. Investors, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward- looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether in response to new information, futures events or otherwise, except as otherwise required by law. NON-GAAP INFORMATION The non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, commercial margin, and variations thereof) are not measures of financial performance calculated in accordance with U.S. GAAP and should not be considered as alternatives to net income (loss) or any other performance measure derived in accordance with GAAP or as alternatives to cash flows from operating activities as a measure of our liquidity. Non-GAAP measures have limitations as analytical tools and should be considered in addition to, not in isolation or as a substitute for, or as superior to, our measures of financial performance prepared in accordance with GAAP. Management believes that certain non-GAAP performance measures may provide investors with additional meaningful comparisons between current results and results in prior periods. Management uses non-GAAP financial measures as performance metrics and believes these measures provide additional information commonly used by the holders of our senior debt securities and parties to the ABL Facility with respect to the ongoing performance of our underlying business activities, as well as our ability to meet our future debt service, capital expenditures and working capital needs. These adjustments are based on currently available information and certain adjustments that we believe are reasonable and are presented as an aid in understanding our operating results. They are not necessarily indicative of future results of operations that may be obtained by the Company. INDUSTRY INFORMATION Information regarding market and industry statistics contained in this presentation is based on information from third party sources as well as estimates prepared by us using certain assumptions and our knowledge of these industries. Our estimates, in particular as they relate to our general expectations concerning the aluminum industry, involve risks and uncertainties and are subject to changes based on various factors, including those discussed under “Risk Factors” in our filings with the Securities and Exchange Commission.

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 3 Second Quarter Performance Overview 2Q13 Adjusted EBITDA of $78 million; up 21% sequentially Higher aero, auto, HEX, and Europe regional plate & coil volumes North America B&C market recovery slower than anticipated Excess industry capacity driving price pressure Metal / scrap spread pressure continues with some signs of easing Steady ramp up at the Zhenjiang rolling mill & Duffel WABS facility Solid AOS related productivity performance; $16 million saved in 2Q13

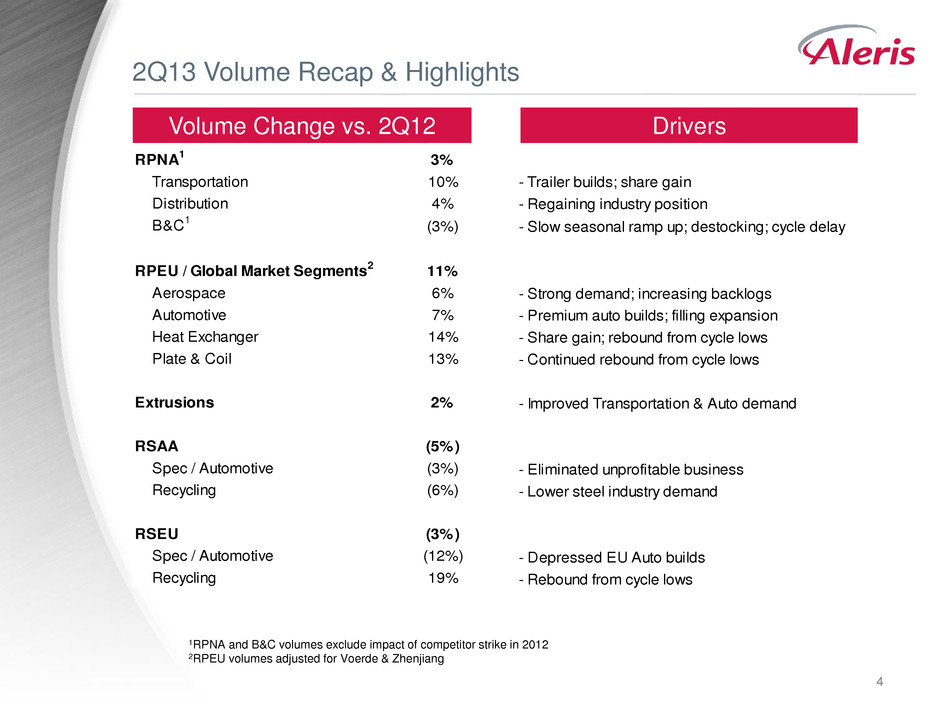

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 4 2Q13 Volume Recap & Highlights Volume Change vs. 2Q12 Drivers RPNA 1 3% Transportation 10% Distribution 4% B&C 1 (3%) RPEU / Global Market Segments 2 11% Aerospace 6% Automotive 7% Heat Exchanger 14% Plate & Coil 13% Extrusions 2% RSAA (5%) Spec / Automotive (3%) Recycling (6%) RSEU (3%) Spec / Automotive (12%) Recycling 19% - Trailer builds; share gain - Regaining industry position - Slow seasonal ramp up; destocking; cycle delay - Strong demand; increasing backlogs - Premium auto builds; filling expansion - Share gain; rebound from cycle lows - Continued rebound from cycle lows - Improved Transportation & Auto demand - Eliminated unprofitable business - Lower steel industry demand - Depressed EU Auto builds - Rebound from cycle lows 1RPNA and B&C volumes exclude impact of competitor strike in 2012 2RPEU volumes adjusted for Voerde & Zhenjiang

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 5 Strategic Growth Project Update Plate shipments of approximately 640 tons during 2Q13 Aerospace qualification underway; targeting 2H14 Zhenjiang Rolling Mill

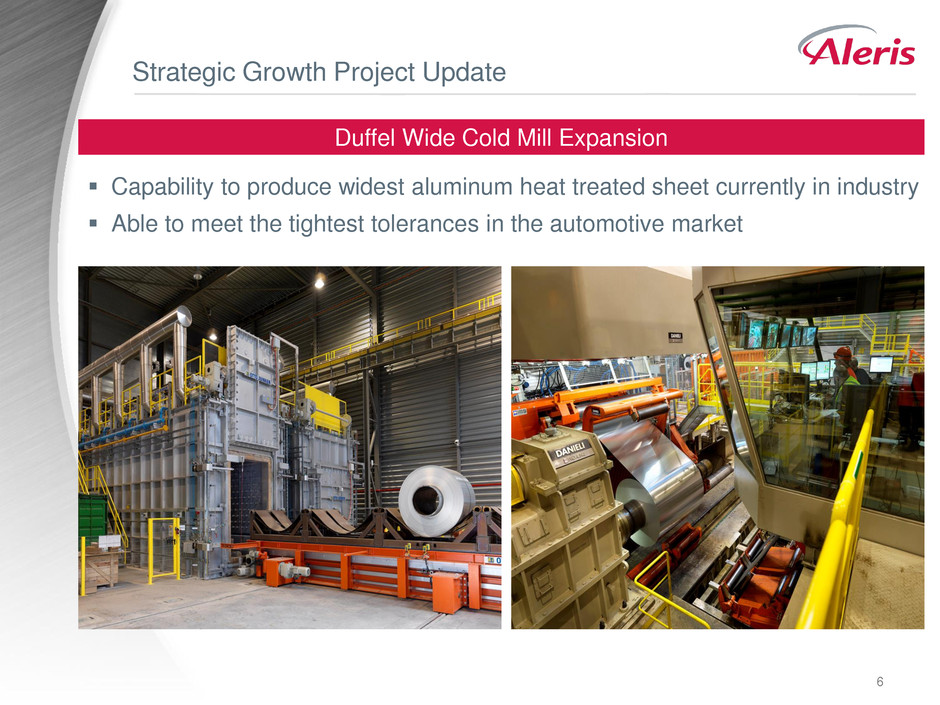

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 6 Strategic Growth Project Update Capability to produce widest aluminum heat treated sheet currently in industry Able to me t the tightest tolerances in the automotive market Duffel Wide Cold Mill Expansion

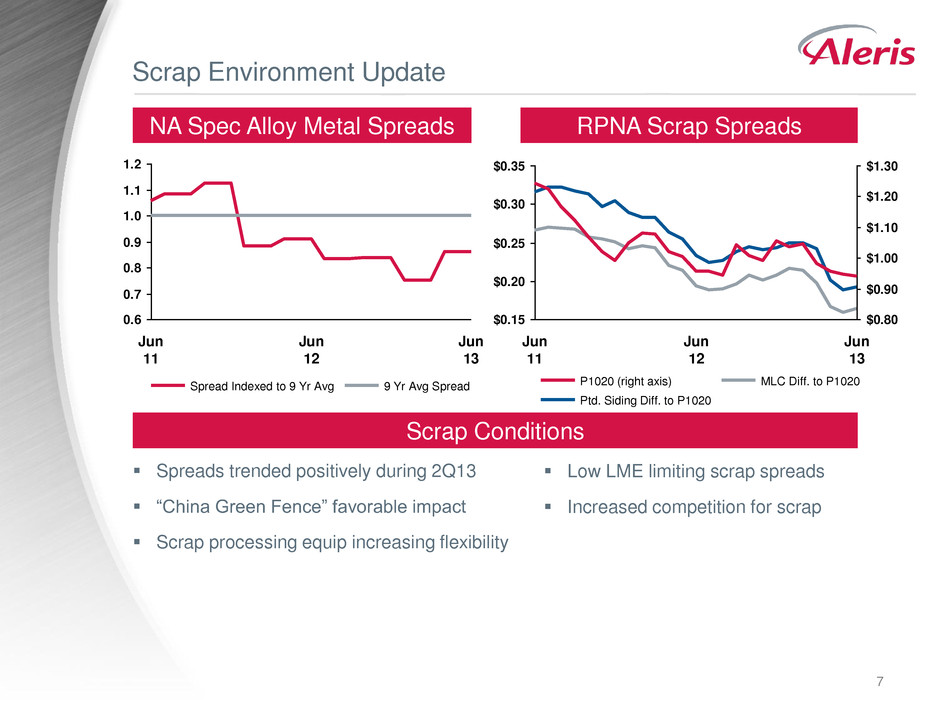

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 7 Scrap Environment Update 0.6 0.7 0.8 0.9 1.0 1.1 1.2 Jun 13 Jun 12 Jun 11 9 Yr Avg Spread Spread Indexed to 9 Yr Avg $0.15 $0.20 $0.25 $0.30 $0.35 $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 Jun 11 Jun 12 Jun 13 P1020 (right axis) Ptd. Siding Diff. to P1020 MLC Diff. to P1020 NA Spec Alloy Metal Spreads RPNA Scrap Spreads Scrap Conditions Spreads trended positively during 2Q13 “China Green Fence” favorable impact Scrap processing equip increasing flexibility Low LME limiting scrap spreads Increased competition for scrap

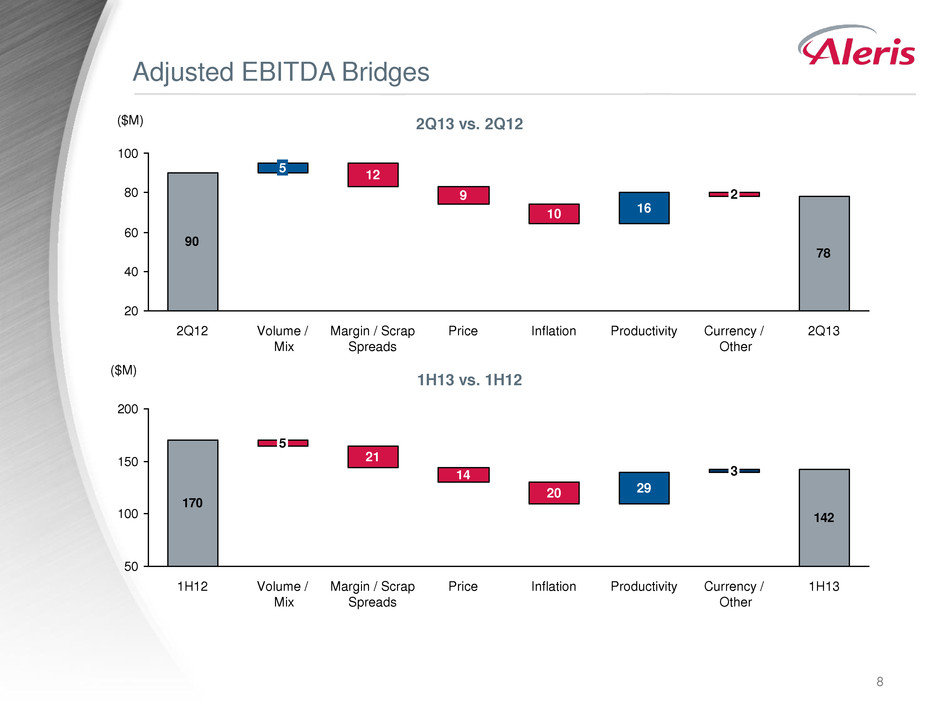

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 8 Adjusted EBITDA Bridges 2Q13 vs. 2Q12 78 90 20 40 60 80 100 2Q13 Currency / Other 2 Productivity 16 Inflation 10 Price 9 Margin / Scrap Spreads 12 Volume / Mix 5 2Q12 1H13 vs. 1H12 142 170 50 100 50 20 1H13 Currency / Other 3 Productivity 29 Inflation 20 Price 14 Margin / Scrap Spreads 21 Volume / Mix 5 1H12 ($M) ($M)

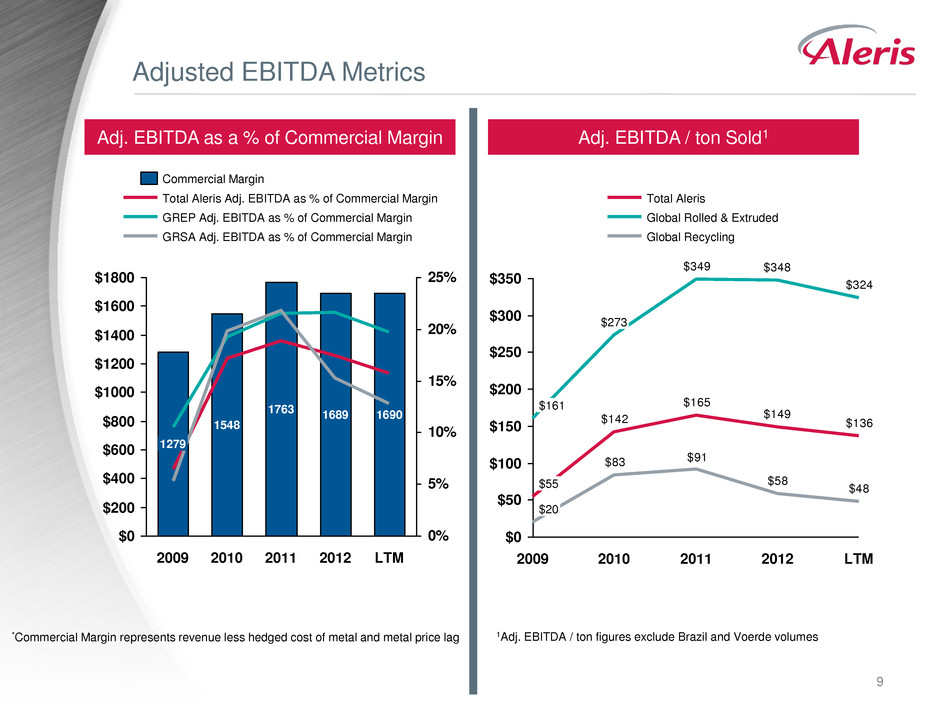

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 9 Adjusted EBITDA Metrics 0% 5% 10% 15% 20% 25% $1800 $1600 $1400 $1200 $1000 $800 $600 $400 $200 $0 LTM 1690 2012 1689 2011 1763 2010 1548 2009 1279 GRSA Adj. EBITDA as % of Commercial Margin GREP Adj. EBITDA as % of Commercial Margin Total Aleris Adj. EBITDA as % of Commercial Margin Commercial Margin Adj. EBITDA as a % of Commercial Margin Adj. EBITDA / ton Sold1 $136 $149 $165 $142 $324 $348$349 $48 $58 $91$83$350 $300 $250 $200 $150 $100 $50 $0 LTM 2012 2011 2010 $273 2009 $20 $161 $55 Global Recycling Global Rolled & Extruded Total Aleris 1Adj. EBITDA / ton figures exclude Brazil and Voerde volumes *Commercial Margin represents revenue less hedged cost of metal and metal price lag

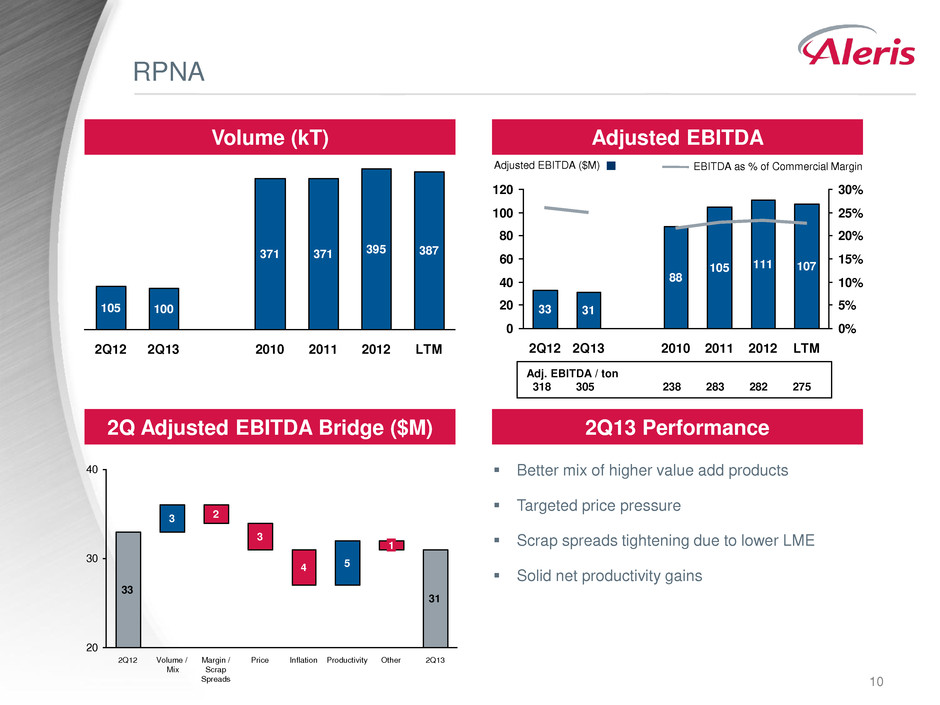

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 10 RPNA Volume (kT) Adjusted EBITDA 2Q13 Performance 2Q Adjusted EBITDA Bridge ($M) 100 2010 371 LTM 387 2012 395 2011 2Q12 105 371 2Q13 31 33 20 30 40 Margin / Scrap Spreads 3 2 Other 1 Productivity 5 Inflation 4 2Q13 Price Volume / Mix 3 2Q12 0 20 40 60 80 100 120 0% 5% 10% 15% 20% 25% 30% 105 2011 2010 88 107 2012 111 LTM 2Q13 31 2Q12 33 Adj. EBITDA / ton 318 305 238 283 282 275 Adjusted EBITDA ($M) EBITDA as % of Commercial Margin Better mix of higher value add products Targeted price pressure Scrap spreads tightening due to lower LME Solid net productivity gains

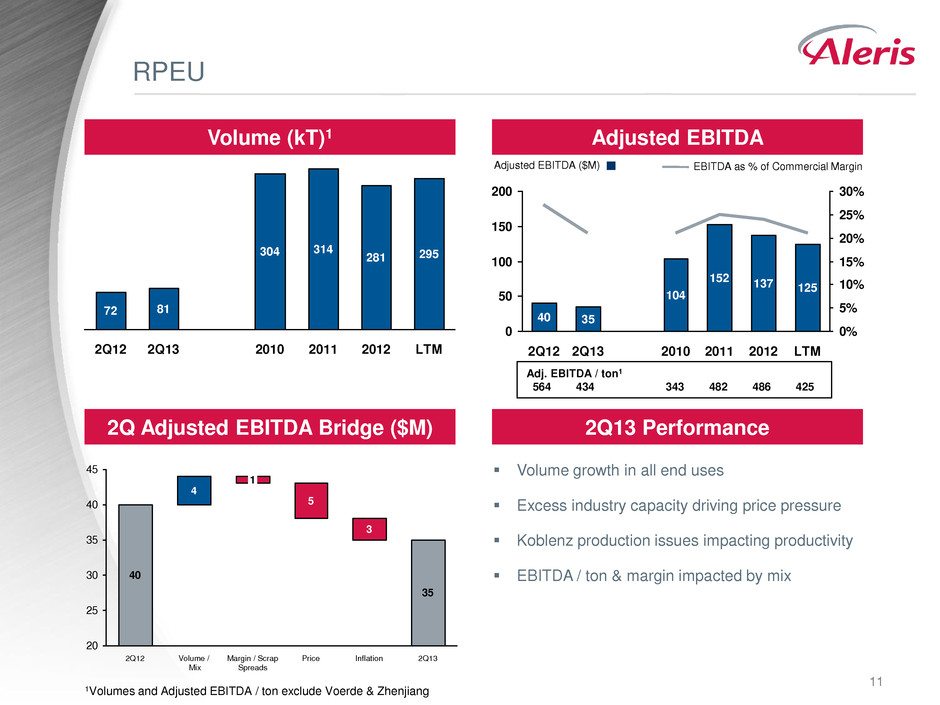

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 11 RPEU Volume (kT)1 Adjusted EBITDA 2Q13 Performance 2Q Adjusted EBITDA Bridge ($M) LTM 295 2012 281 2011 314 2010 304 2Q13 81 2Q12 72 35 40 20 25 30 35 40 45 1 Volume / Mix 4 2Q12 5 Margin / Scrap Spreads Price 3 2Q13 Inflation 0 50 100 150 200 0% 5% 10% 15% 20% 25% 30% LTM 125 2012 137 2010 152 2011 104 2Q13 35 2Q12 40 Adj. EBITDA / ton1 564 434 343 482 486 425 Adjusted EBITDA ($M) EBITDA as % of Commercial Margin Volume growth in all end uses Excess industry capacity driving price pressure Koblenz production issues impacting productivity EBITDA / ton & margin impacted by mix 1Volumes and Adjusted EBITDA / ton exclude Voerde & Zhenjiang

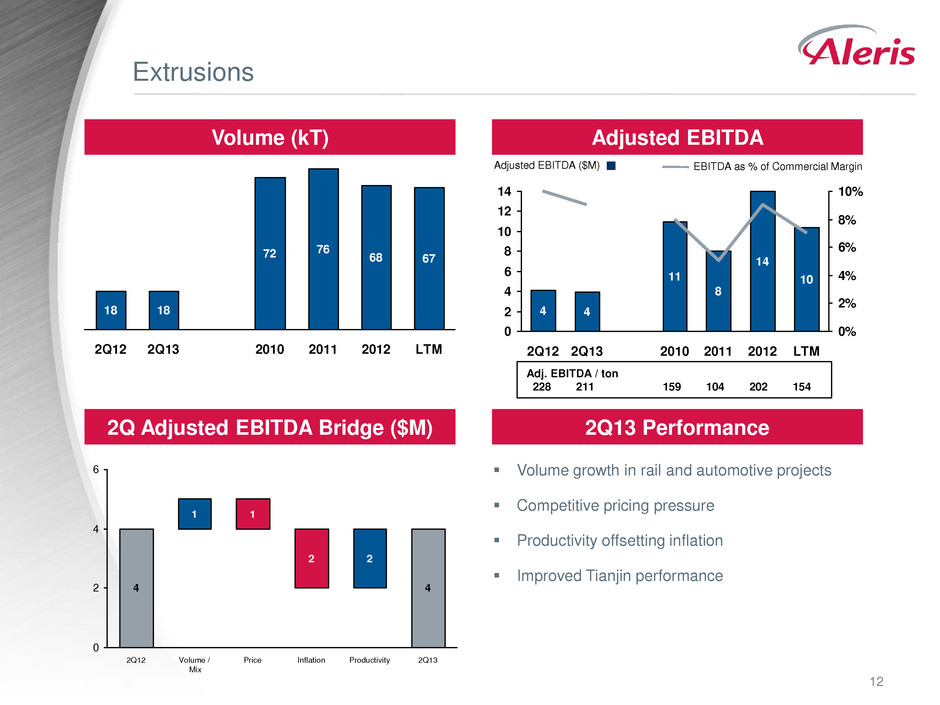

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 12 Extrusions Volume (kT) Adjusted EBITDA 2Q13 Performance 2Q Adjusted EBITDA Bridge ($M) 68 LTM 2010 76 2012 67 2011 72 2Q13 18 2Q12 18 44 0 2 4 6 Price 1 1 2Q12 2 Volume / Mix 2Q13 Productivity 2 Inflation 0 2 4 6 8 10 12 14 0% 2% 4% 6% 8% 10% LTM 10 2012 14 2011 8 2010 11 2Q13 4 2Q12 4 Adj. EBITDA / ton 228 211 159 104 202 154 Adjusted EBITDA ($M) EBITDA as % of Commercial Margin Volume growth in rail and automotive projects Competitive pricing pressure Productivity offsetting inflation Improved Tianjin performance

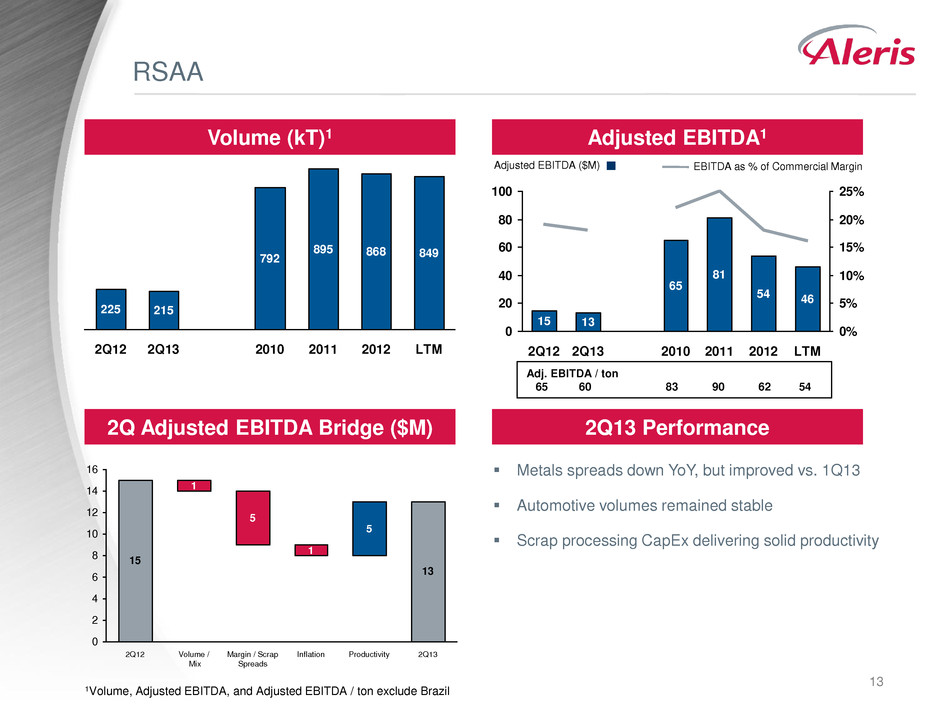

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 13 RSAA Volume (kT)1 Adjusted EBITDA1 2Q13 Performance 2Q Adjusted EBITDA Bridge ($M) LTM 849 2012 868 2011 895 2010 792 2Q13 215 2Q12 225 13 15 0 2 4 6 8 10 12 14 16 5 Volume / Mix 1 2Q12 2Q13 Productivity 5 Inflation 1 Margin / Scrap Spreads 0 20 40 60 80 100 0% 5% 10% 15% 20% 25% LTM 46 2012 54 2011 81 2010 65 2Q13 13 2Q12 15 Adj. EBITDA / ton 65 60 83 90 62 54 Adjusted EBITDA ($M) EBITDA as % of Commercial Margin Metals spreads down YoY, but improved vs. 1Q13 Automotive volumes remained stable Scrap processing CapEx delivering solid productivity 1Volume, Adjusted EBITDA, and Adjusted EBITDA / ton exclude Brazil

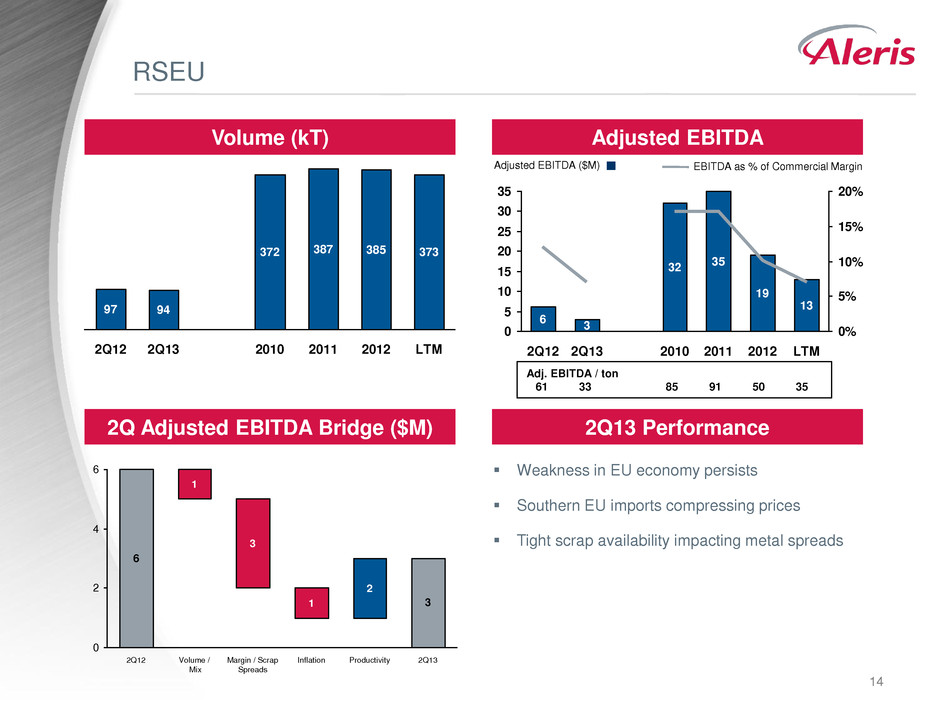

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 14 RSEU Volume (kT) Adjusted EBITDA 2Q13 Performance 2Q Adjusted EBITDA Bridge ($M) 372 2011 387 2010 373 LTM 2012 385 2Q12 2Q13 97 94 6 3 0 2 4 6 Productivity Inflation 2Q13 2 2Q12 Margin / Scrap Spreads Volume / Mix 3 1 1 0 5 10 15 20 25 30 35 0% 5% 10% 15% 20% LTM 13 2012 19 2011 35 2010 32 2Q13 3 2Q12 6 Adj. EBITDA / ton 61 33 85 91 50 35 Adjusted EBITDA ($M) EBITDA as % of Commercial Margin Weakness in EU economy persists Southern EU imports compressing prices Tight scrap availability impacting metal spreads

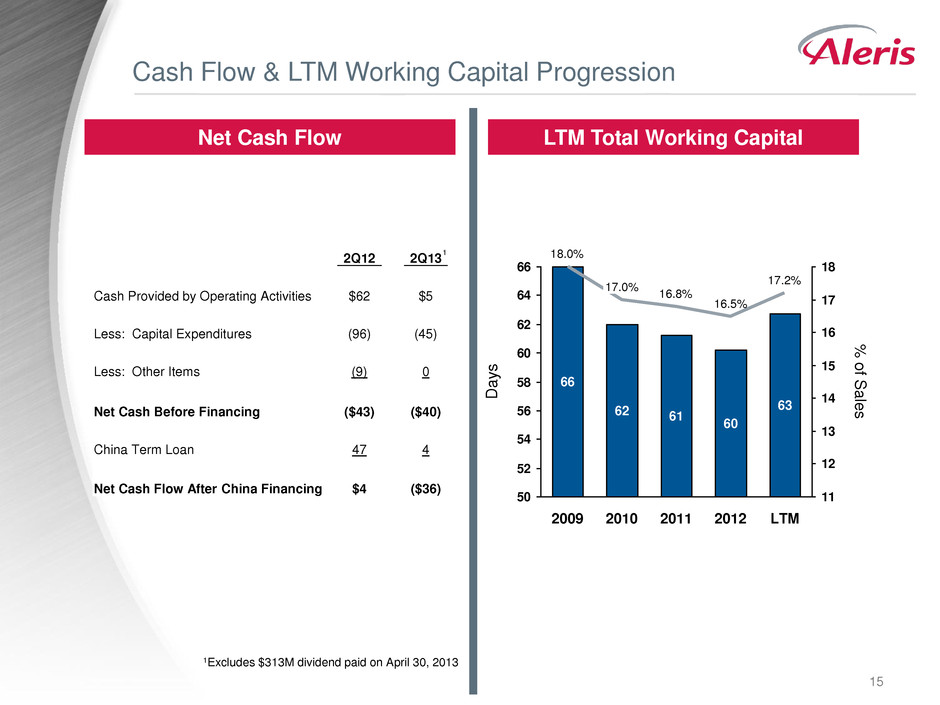

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 15 2Q12 2Q13 Cash Provided by Operating Activities $62 $5 Less: Capital Expenditures (96) (45) Less: Other Items (9) 0 Net Cash Before Financing ($43) ($40) China Term Loan 47 4 Net Cash Flow After China Financing $4 ($36) Cash Flow & LTM Working Capital Progression Net Cash Flow LTM Total Working Capital 50 52 54 56 58 60 62 64 66 11 12 13 14 15 16 17 18 LTM 17.2% 63 2012 16.5% 60 2011 16.8% 61 2010 17.0% 62 2009 18.0% 66 % o f S a le s Da y s 1 1Excludes $313M dividend paid on April 30, 2013

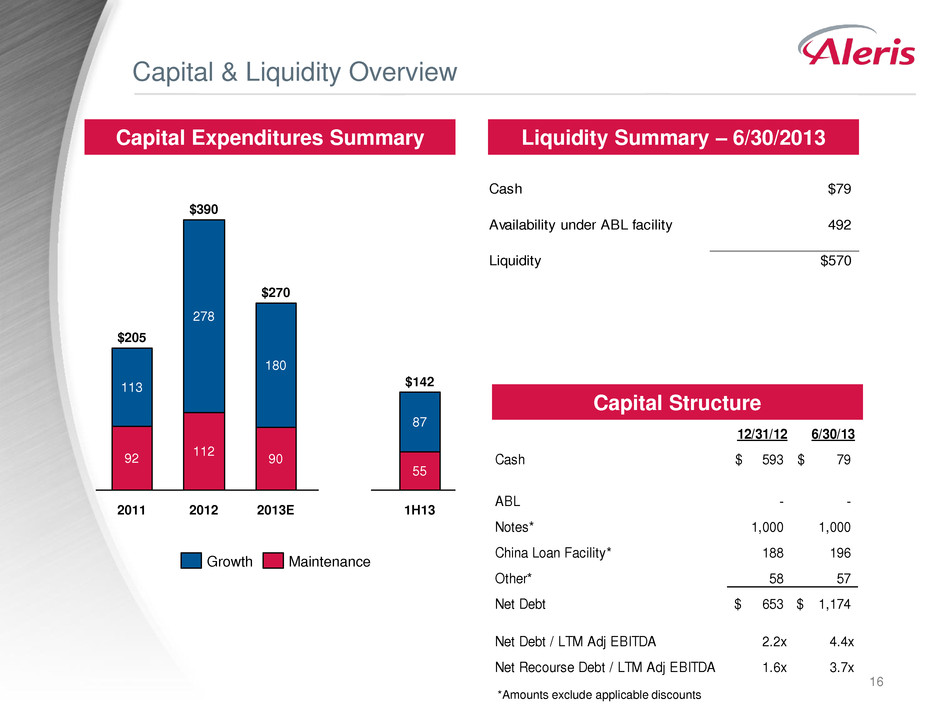

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 16 Capital & Liquidity Overview Capital Expenditures Summary Liquidity Summary – 6/30/2013 Capital Structure $142 87 55 2011 $205 92 113 1H13 2013E $270 90 180 2012 $390 112 278 Maintenance Growth Cash $79 Availability under ABL facility 492 Liquidity $570 12/31/12 6/30/13 Cash 593$ 79$ ABL - - Notes* 1,000 1,000 China Loan Facility* 188 196 Other* 58 57 Net Debt 653$ 1,174$ Net Debt / LTM Adj EBITDA 2.2x 4.4x Net Recourse Debt / LTM Adj EBITDA 1.6x 3.7x *Amounts exclude applicable discounts

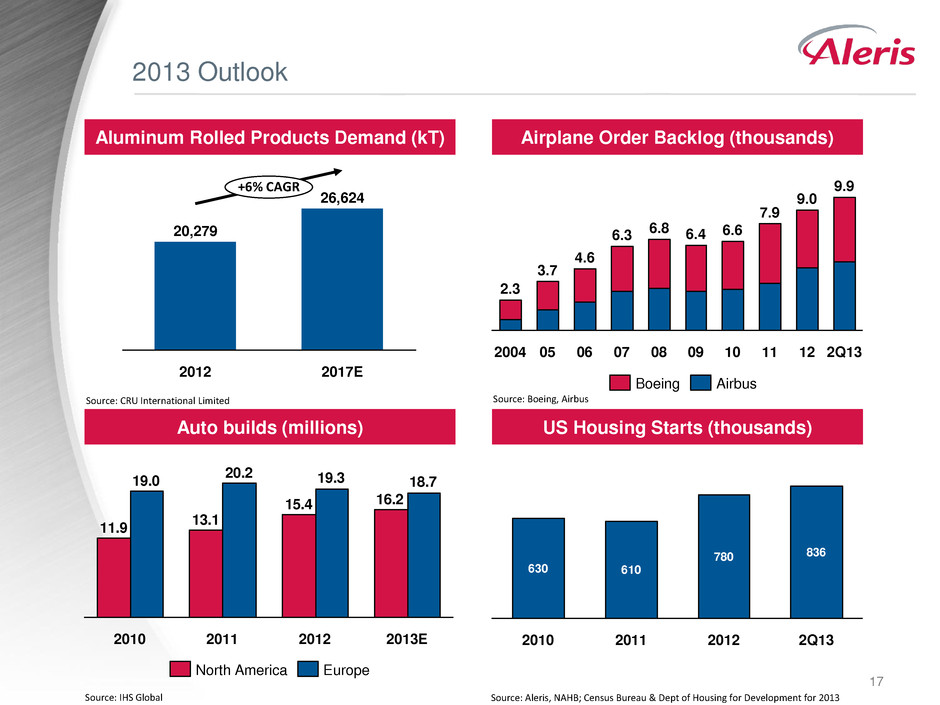

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 17 2013 Outlook Aluminum Rolled Products Demand (kT) Airplane Order Backlog (thousands) US Housing Starts (thousands) Auto builds (millions) +6% CAGR 2017E 26,624 2012 20,279 2Q13 9.9 12 9.0 11 7.9 10 6.6 09 6.4 08 6.8 07 6.3 06 4.6 05 3.7 2004 2.3 Airbus Boeing 2Q13 836 2012 780 2011 610 2010 630 16.215.4 13.1 11.9 18.719.3 20.2 19.0 2013E 2012 2011 2010 Europe North America Source: IHS Global Source: Aleris, NAHB; Census Bureau & Dept of Housing for Development for 2013 Source: Boeing, Airbus Source: CRU International Limited

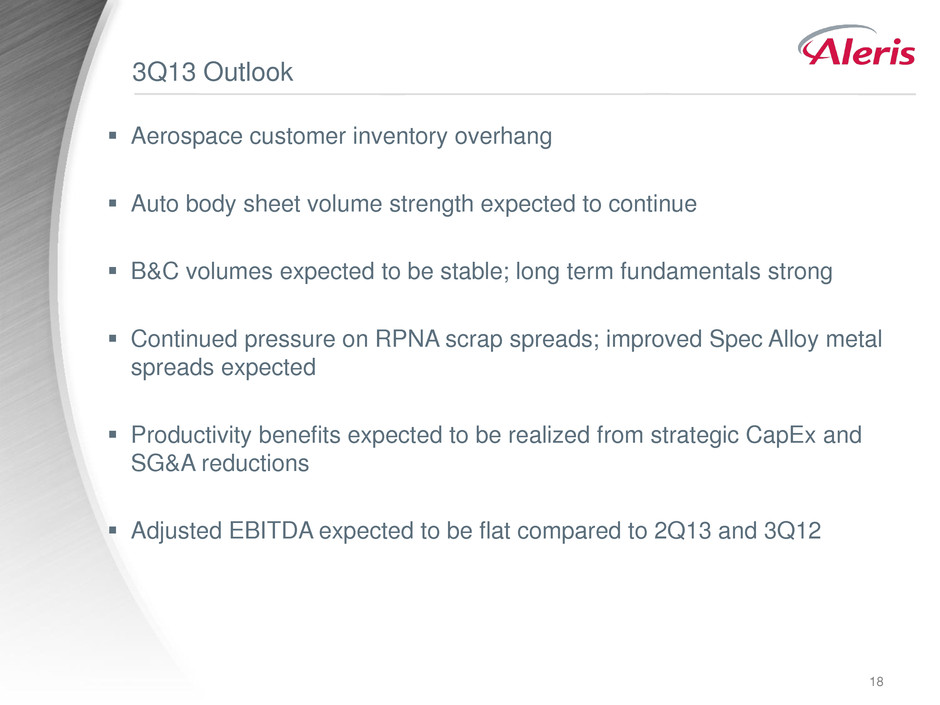

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 18 3Q13 Outlook Aerospace customer inventory overhang Auto body sheet volume strength expected to continue B&C volumes expected to be stable; long term fundamentals strong Continued pressure on RPNA scrap spreads; improved Spec Alloy metal spreads expected Productivity benefits expected to be realized from strategic CapEx and SG&A reductions Adjusted EBITDA expected to be flat compared to 2Q13 and 3Q12

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 19 Appendix

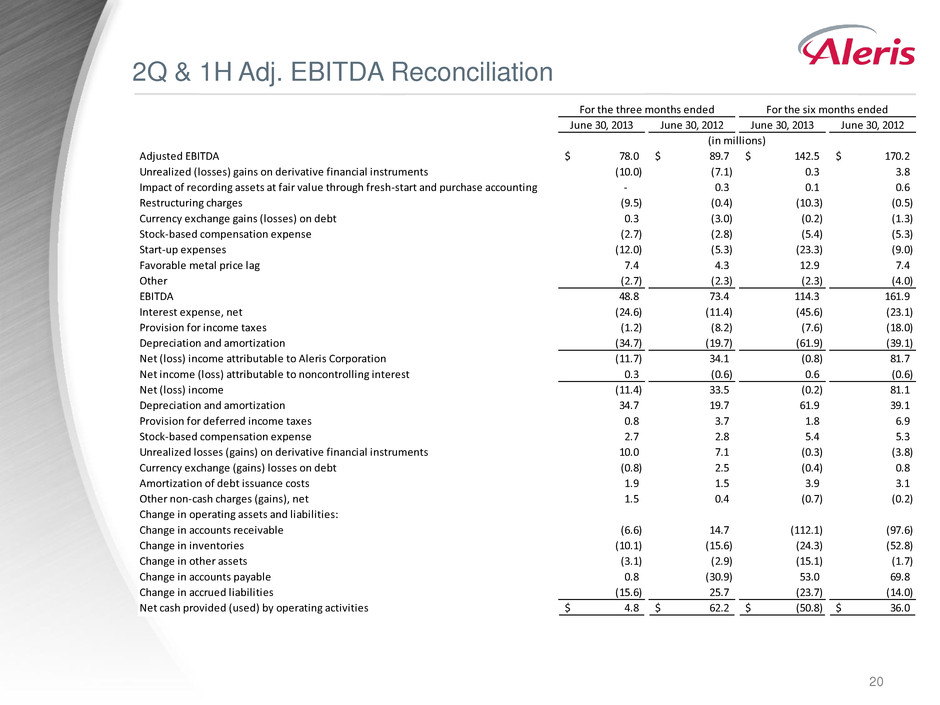

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 20 2Q & 1H Adj. EBITDA Reconciliation June 30, 2013 June 30, 2012 June 30, 2013 June 30, 2012 Adjusted EBITDA 78.0$ 89.7$ 142.5$ 170.2$ Unrealized (losses) gains on derivative financial instruments (10.0) (7.1) 0.3 3.8 Impact of recording assets at fair value through fresh-start and purchase accounting - 0.3 0.1 0.6 Restructuring charges (9.5) (0.4) (10.3) (0.5) Currency exchange gains (losses) on debt 0.3 (3.0) (0.2) (1.3) Stock-based compensation expense (2.7) (2.8) (5.4) (5.3) Start-up expenses (12.0) (5.3) (23.3) (9.0) Favorable metal price lag 7.4 4.3 12.9 7.4 Other (2.7) (2.3) (2.3) (4.0) EBITDA 48.8 73.4 114.3 161.9 Interest expense, net (24.6) (11.4) (45.6) (23.1) Provision for income taxes (1.2) (8.2) (7.6) (18.0) Depreciation and amortization (34.7) (19.7) (61.9) (39.1) Net (loss) income attributable to Aleris Corporation (11.7) 34.1 (0.8) 81.7 Net income (loss) attributable to noncontrolling interest 0.3 (0.6) 0.6 (0.6) Net (loss) income (11.4) 33.5 (0.2) 81.1 Depreciation and amortization 34.7 19.7 61.9 39.1 Provision for deferred income taxes 0.8 3.7 1.8 6.9 Stock-based compensation expense 2.7 2.8 5.4 5.3 Unrealized losses (gains) on derivative financial instruments 10.0 7.1 (0.3) (3.8) Currency exchange (gains) losses on debt (0.8) 2.5 (0.4) 0.8 Amortization of debt issuance costs 1.9 1.5 3.9 3.1 Other non-cash charges (gains), net 1.5 0.4 (0.7) (0.2) Change in operating assets and liabilities: Change in accounts receivable (6.6) 14.7 (112.1) (97.6) Change in inventories (10.1) (15.6) (24.3) (52.8) Change in other assets (3.1) (2.9) (15.1) (1.7) Change in accounts payable 0.8 (30.9) 53.0 69.8 Change in accrued liabilities (15.6) 25.7 (23.7) (14.0) Net cash provided (used) by operating activities 4.8$ 62.2$ (50.8)$ 36.0$ (in millions) For the six months endedFor the three months ended

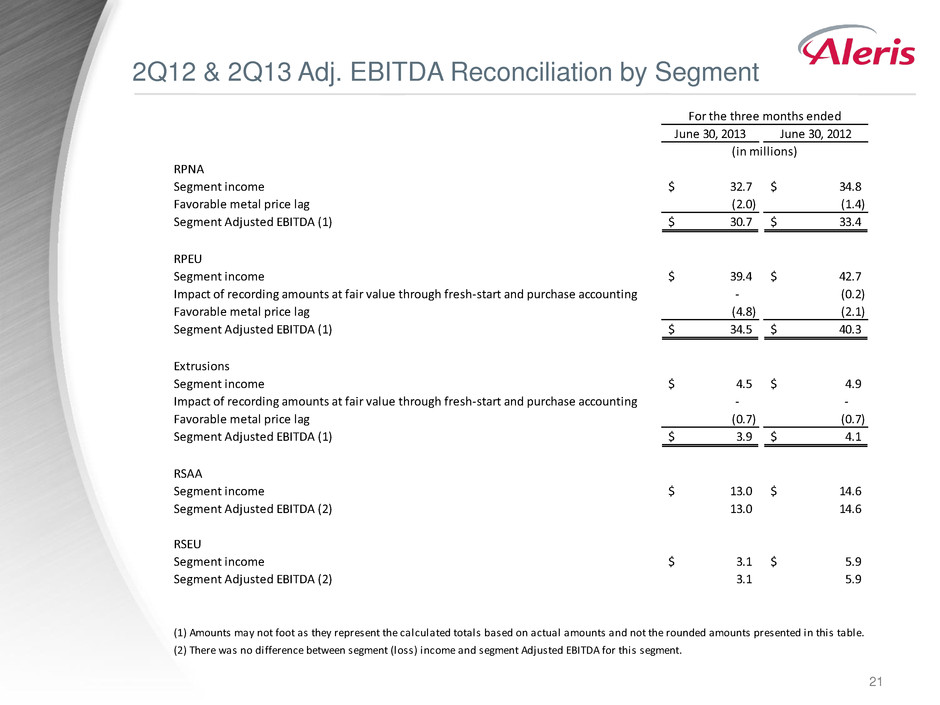

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 21 2Q12 & 2Q13 Adj. EBITDA Reconciliation by Segment June 30, 2013 June 30, 2012 RPNA Segment income 32.7$ 34.8$ Favorable metal price lag (2.0) (1.4) Segment Adjusted EBITDA (1) 30.7$ 33.4$ RPEU Segment income 39.4$ 42.7$ Impact of recording amounts at fair value through fresh-start and purchase accounting - (0.2) Favorable metal price lag (4.8) (2.1) Segment Adjusted EBITDA (1) 34.5$ 40.3$ Extrusions Segment income 4.5$ 4.9$ Impact of recording amounts at fair value through fresh-start and purchase accounting - - Favorable metal price lag (0.7) (0.7) Segment Adjusted EBITDA (1) 3.9$ 4.1$ RSAA Segment income 13.0$ 14.6$ Segment Adjusted EBITDA (2) 13.0 14.6 RSEU Segment income 3.1$ 5.9$ Segment Adjusted EBITDA (2) 3.1 5.9 (1) Amounts may not foot as they represent the calculated totals based on actual amounts and not the rounded amounts presented in this table. (2) There was no difference between segment (loss) income and segment Adjusted EBITDA for this segment. For the three months ended (in millions)

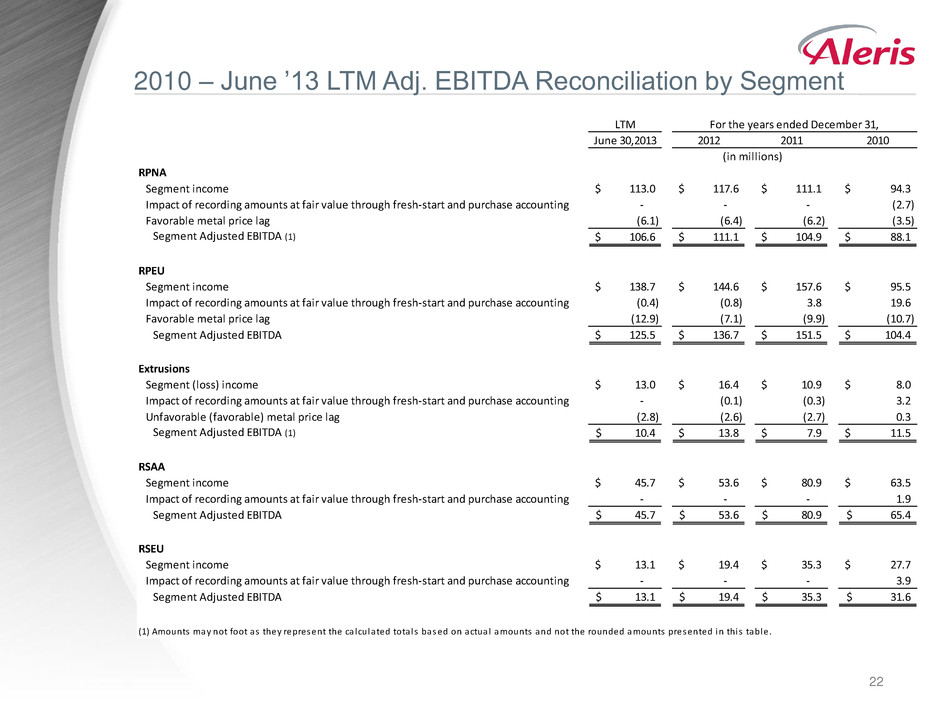

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 22 2010 – June ’13 LTM Adj. EBITDA Reconciliation by Segment LTM June 30,2013 2012 2011 2010 RPNA Segment income 113.0$ 117.6$ 111.1$ 94.3$ Impact of recording amounts at fair value through fresh-start and purchase accounting - - - (2.7) Favorable metal price lag (6.1) (6.4) (6.2) (3.5) Segment Adjusted EBITDA (1) 106.6$ 111.1$ 104.9$ 88.1$ RPEU Segment income 138.7$ 144.6$ 157.6$ 95.5$ Impact of recording amounts at fair value through fresh-start and purchase accounting (0.4) (0.8) 3.8 19.6 Favorable metal price lag (12.9) (7.1) (9.9) (10.7) Segment Adjusted EBITDA 125.5$ 136.7$ 151.5$ 104.4$ Extrusions Segment (loss) income 13.0$ 16.4$ 10.9$ 8.0$ Impact of recording amounts at fair value through fresh-start and purchase accounting - (0.1) (0.3) 3.2 Unfavorable (favorable) metal price lag (2.8) (2.6) (2.7) 0.3 Segment Adjusted EBITDA (1) 10.4$ 13.8$ 7.9$ 11.5$ RSAA Segment income 45.7$ 53.6$ 80.9$ 63.5$ Impact of recording amounts at fair value through fresh-start and purchase accounting - - - 1.9 Segment Adjusted EBITDA 45.7$ 53.6$ 80.9$ 65.4$ RSEU Segment income 13.1$ 19.4$ 35.3$ 27.7$ Impact of recording amounts at fair value through fresh-start and purchase accounting - - - 3.9 Segment Adjusted EBITDA 13.1$ 19.4$ 35.3$ 31.6$ (1) Amounts may not foot as they represent the ca lculated totals based on actual amounts and not the rounded amounts presented in this table. For the years ended December 31, (in millions)

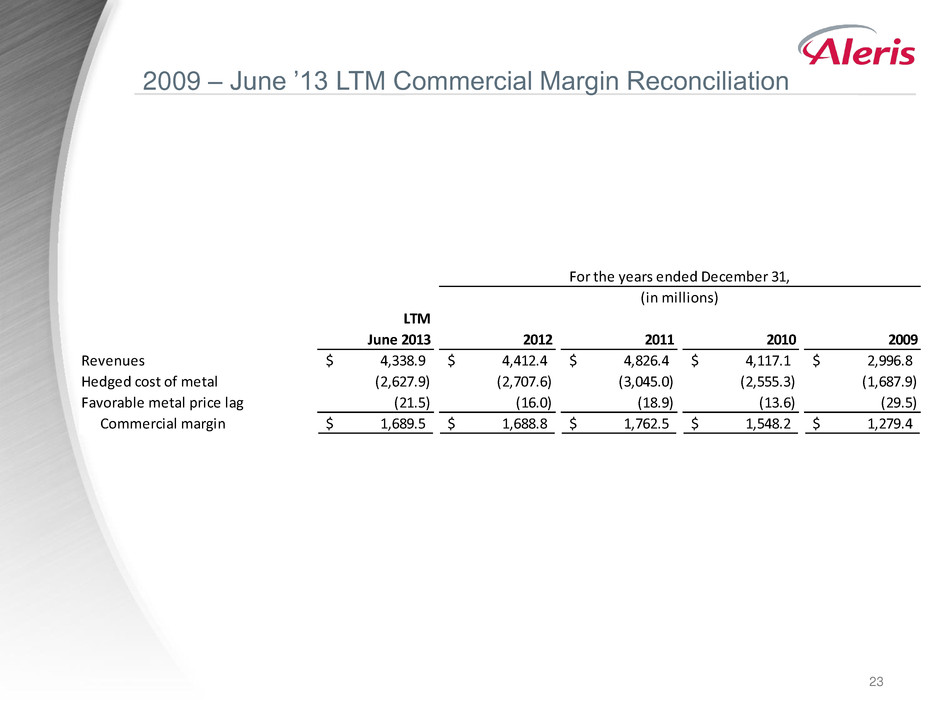

Click to edit Master title style Click to edit Master text styles – Second level • Third level – Fourth level » Fifth level Click to edit Master text styles 23 2009 – June ’13 LTM Commercial Margin Reconciliation LTM June 2013 2012 2011 2010 2009 Revenues 4,338.9$ 4,412.4$ 4,826.4$ 4,117.1$ 2,996.8$ Hedg d cost of metal (2,627.9) (2,707.6) (3,045.0) (2,555.3) (1,687.9) Favorable metal price lag (21.5) (16.0) (18.9) (13.6) (29.5) Commercial margin 1,689.5$ 1,688.8$ 1,762.5$ 1,548.2$ 1,279.4$ For the years ended December 31, (in millions)