Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGAL BELOIT CORP | form8-k2ndqtrearningsrelea.htm |

| EX-99.1 - EXHIBIT EARNINGS RELEASE - REGAL BELOIT CORP | a2q2013earningsannouncement.htm |

Regal Beloit Corporation Second Quarter 2013 Earnings Conference Call July 31, 2013 Mark Gliebe Chairman and Chief Executive Officer Jon Schlemmer Chief Operating Officer Chuck Hinrichs Vice President Chief Financial Officer John Perino Vice President Investor Relations

Safe Harbor Statement This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our management’s judgment regarding future events. In many cases, you can identify forward-looking statements by terminology such as “may,” “will,” “plan,” “expect,” “anticipate,” “estimate,” “believe,” or “continue” or the negative of these terms or other similar words. Actual results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors, including: uncertainties regarding our ability to execute our restructuring plans within expected costs and timing; actions taken by our competitors and our ability to effectively compete in the increasingly competitive global electric motor, power generation and mechanical motion control industries; our ability to develop new products based on technological innovation and the marketplace acceptance of new and existing products; fluctuations in commodity prices and raw material costs; our dependence on significant customers; issues and costs arising from the integration of acquired companies and businesses, including the timing and impact of purchase accounting adjustments; unanticipated costs or expenses we may incur related to product warranty issues; our dependence on key suppliers and the potential effects of supply disruptions; infringement of our intellectual property by third parties, challenges to our intellectual property, and claims of infringement by us of third party technologies; increases in our overall debt levels as a result of acquisitions or otherwise and our ability to repay principal and interest on our outstanding debt; product liability and other litigation, or the failure of our products to perform as anticipated, particularly in high volume applications; economic changes in global markets where we do business, such as reduced demand for the products we sell, currency exchange rates, inflation rates, interest rates, recession, foreign government policies and other external factors that we cannot control; unanticipated liabilities of acquired businesses; cyclical downturns affecting the global market for capital goods; difficulties associated with managing foreign operations; and other risks and uncertainties including but not limited to those described in Item 1A-Risk Factors of the Company’s Annual Report on Form 10-K(A) filed on March 26, 2013 and from time to time in our reports filed with U.S. Securities and Exchange Commission. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. The forward-looking statements included in this presentation are made only as of their respective dates, and we undertake no obligation to update these statements to reflect subsequent events or circumstances. p 2

Non-GAAP Financial Measures We prepare financial statements in accordance with accounting principles generally accepted in the United States (GAAP). We also disclose adjusted diluted earnings per share (EPS), adjusted gross profit, adjusted gross profit as a percentage of net sales, adjusted income from operations, free cash flow and free cash flow as a percentage of net income attributable to Regal Beloit Corporation (collectively, “non-GAAP financial measures”). We use these measures in our internal performance reporting and for reports to the Board of Directors. We also periodically disclose certain of these measures in our quarterly earnings releases, on investor conference calls, and in investor presentations and similar events. We believe that these non-GAAP financial measures are useful measures for providing investors with additional insight into our operating performance. This additional information is not meant to be considered in isolation or as a substitute for our results of operations prepared and presented in accordance with GAAP. These non-GAAP financial measures exclude the effects of certain items that are not comparable from one period to the next. Free cash flow is defined as net cash provided by operating activities less additions to property, plant and equipment. p 3

Agenda p 4 Opening Comments Mark Gliebe Financial Update Chuck Hinrichs Operations Update Jon Schlemmer Summary Mark Gliebe Q&A All

Opening Comments – 2nd Quarter Top Line Sales Performance as Expected – C&I Sales Improved Sequentially – North American Residential HVAC Consistent with Expectations – Strength in Non-HVAC Residential Sales Gross Margin Held Despite Top Line Pressure – Completed EPC Synergy Program as Planned – Shifted Resources to our Simplification Initiative Strong Free Cash Flow* at 127% of Net Income Launched 17 New Products in the Quarter Pursuing Acquisitions and Pipeline is Active p 5 * Non-GAAP Financial Measurement, See Appendix for Reconciliation

End Market Strength in Residential HVAC – Expect Normal Seasonality – Customer Dynamics Offsetting HVAC – Continued Strength in Residential Non-HVAC Slight Improvement in C&I Markets Modest Growth in China C&I Appears to Have Stabilized and Residential Tailwind into 2014 p 6 Opening Comments – 3rd Quarter Outlook

2nd Quarter 2013 Financial Highlights p 7 * Non-GAAP Financial Measurement, See Appendix for Reconciliation Restructuring Charges of $1.4 Million or $0.02 EPS – $1.0 Million COGS, $0.4 Million Operating Expenses Tax Credit of $0.9 Million or $0.02 EPS – Prior Year Credit for China High Technology Tax Incentive ADJUSTED DILUTED EARNINGS PER SHARE* Jun 29, 2013 Jun 30, 2012 GAAP Diluted Earnings Per Share 1.13$ 1.49$ Restructuring Costs 0.02 0.01 Retroactive Tax Credit (0.02) — Adjusted Diluted Earnings Per Share 1.13$ 1.50$ Three Months Ended

2nd Quarter 2013 Financial Highlights Sales Declined 4.9% from Prior Year – In Line with Expectations –Material Price Formulas Impacted Total Net Sales –Currency Exchange Rates Impacted Total Net Sales (0.7%) and International Sales (2.3%) Gross Profit –$3.6 Million Negative Impact of Venezuelan Currency Devaluation on COGS –$2.1 Million LIFO Benefit –$1.0 Million Restructuring Charges p 8

2nd Quarter 2013 Financial Highlights Operating Expenses –$2.9 Million Acquisition Diligence Costs –$1.4 Million Net Bad Debt Expense –$0.4 Million Restructuring Charges –$0.2 Million from Acquired Business Free Cash Flow* 127% of Net Income p 9 * Non-GAAP Financial Measurement, See Appendix for Reconciliation

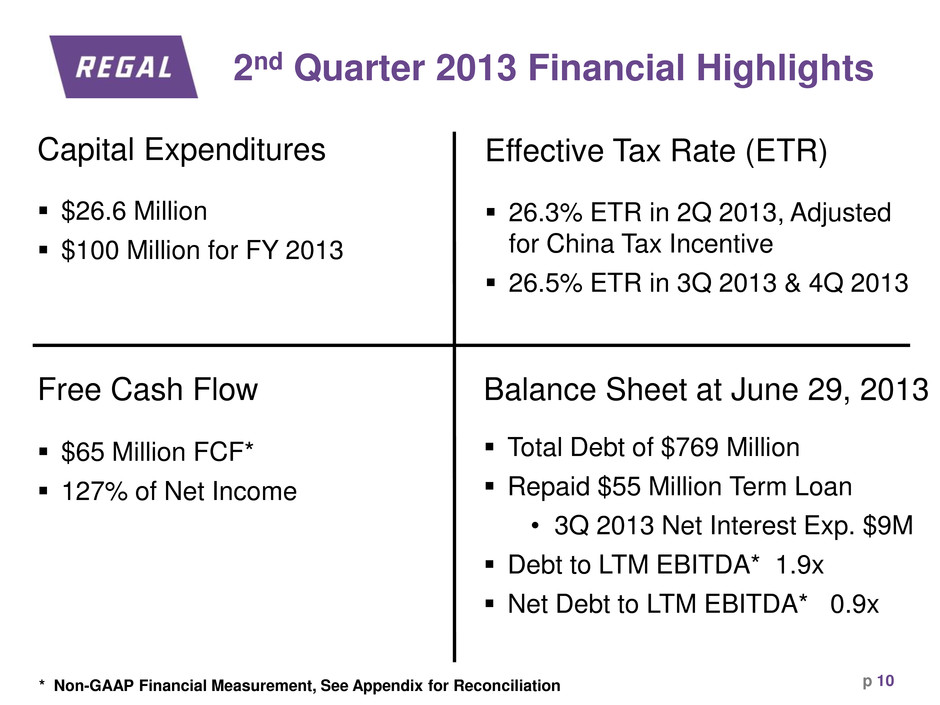

Capital Expenditures $26.6 Million $100 Million for FY 2013 Effective Tax Rate (ETR) 26.3% ETR in 2Q 2013, Adjusted for China Tax Incentive 26.5% ETR in 3Q 2013 & 4Q 2013 Free Cash Flow $65 Million FCF* 127% of Net Income Balance Sheet at June 29, 2013 Total Debt of $769 Million Repaid $55 Million Term Loan • 3Q 2013 Net Interest Exp. $9M Debt to LTM EBITDA* 1.9x Net Debt to LTM EBITDA* 0.9x p 10 * Non-GAAP Financial Measurement, See Appendix for Reconciliation 2nd Quarter 2013 Financial Highlights

3rd Quarter 2013 Guidance GAAP EPS Guidance of $1.08 to $1.16 Adjusted EPS Guidance of $1.10 to $1.18 –After Adding Back $0.02 of Restructuring Charges End Market Strength in Residential HVAC – Expect Normal Seasonality – Customer Dynamics Offsetting – Continued Strength in Residential Non-HVAC Slight Improvement in C&I Markets Modest Growth in China p 11

2nd Quarter 2013 Operations Update North America C&I Stabilized – Down 3.8% Excluding Impact of the Divested Motor Business – Mixed Performance in the End Markets – Reduced Government Spending and Capital Investments Mechanical Sales Decline Driven by Oil & Gas N.A. Residential HVAC Down 6.8% – Material Price Formulas – Strength in Non-HVAC Residential Sales International Sales – Continued Challenges in Europe, India and Australia – Sequential Improvement in China – Increased Focus in Latin America p 12

50 60 37 2011 2012 YTD 2013 Accelerating New Products p 13 21% New Product Launches Customer Recognizing Regal as an Innovative Company Regal Receives 2013 Dealer Design Gold Award

Award Winning Evergreen® EM p 14 Innovative Solutions for the HVAC Aftermarket

Gas Premix Platform Expansion p 15 Expanded Product Line Residential to Commercial System Solution – Motor, Control and Air Mover New Application for Regal Boiler NOx Emission Requirements Driving Growth Smart Compact Design, Quiet Operation, High Efficiency Position to Pursue European Boiler Market

Commercial Energy Efficient Retrofits p 16 2011 – Commercial HVAC 2005 – North America Commercial Refrigeration 2013 – International

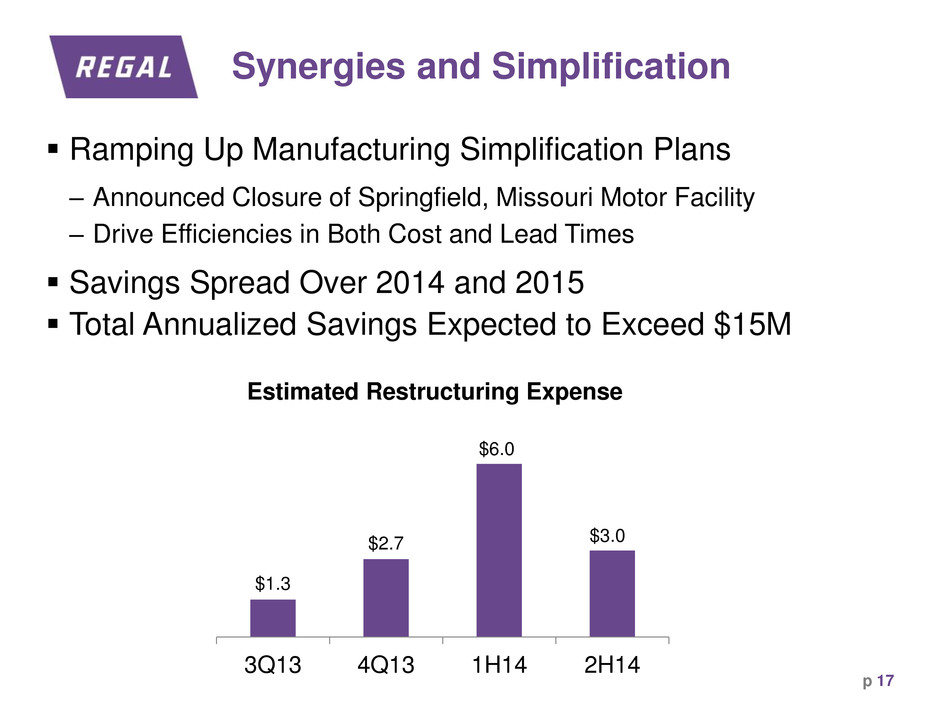

Synergies and Simplification Ramping Up Manufacturing Simplification Plans – Announced Closure of Springfield, Missouri Motor Facility – Drive Efficiencies in Both Cost and Lead Times Savings Spread Over 2014 and 2015 Total Annualized Savings Expected to Exceed $15M p 17 $1.3 $2.7 $6.0 $3.0 3Q13 4Q13 1H14 2H14 Estimated Restructuring Expense

Design Simplification p 18 400 350 200 400 470 8 Stator Assemblies ~ 913 Shafts ~ 2076 End Frames ~ 331 Main Frames ~ 1141 Capacitors ~ 28 Bearings ~ 44 12 Rotor Cores ~ 638 64% Reduction in Part Count

Summary Top Line Sales Performance as Expected Gross Margin Held Despite Top Line Pressure Strong Free Cash Flow Execution on Synergy and Simplification Continue to Launch Innovative New Products Pursuing Acquisitions and Pipeline is Active p 19 Regal Continues to Execute on All Operating Fronts

Questions and Answers p 20

p 21 Appendix Non-GAAP Reconciliations Dollars in Millions Free Cash Flow* Jun 29, 2013 Jun 30, 2012 Jun 29, 2013 Jun 30, 2012 GAAP Net Cash Provided by Operating Activities 91.3$ 135.9$ 157.3$ 204.4$ Additions to Property Plant and Equipment (26.6) (25.0) (47.2) (44.8) Free Cash Flow 64.7$ 110.9$ 110.1$ 159.6$ Free Cash Flow as a Percentage of Net Income Attributable to Regal Beloit 126.6 % 176.9 % 109.4 % 143.3 % Three Months Ended Six Months Ended ADJUSTED DILUTED EARNINGS PER SHARE* Jun 29, 2013 Jun 30, 2012 Jun 29, 2013 Jun 30, 2012 GAAP Diluted Earnings Per Share 1.13$ 1.49$ 2.22$ 2.65$ Purchase Accounting Costs — — — 0.01 Restructuring Costs 0.02 0.01 0.03 0.01 Gain on Disposal of Real Estate — — — (0.02) Retroactive Tax Credit (0.02) — (0.04) — Adjusted Diluted Earnings Per Share 1.13$ 1.50$ 2.21$ 2.65$ Three Months Ended Six Months Ended

Appendix Non-GAAP Reconciliations p 22 EBITDA Reconciliation Dollars in Millions 3Q 2012 4Q 2012 1Q 2013 2Q 2013 LTM Net Income $54.3 $29.9 $49.5 $51.1 $184.8 Plus: Minority Interest 0.9 1.0 1.2 2.5 5.6 Plus: Taxes 17.9 5.7 15.3 17.9 56.8 Plus: Interest Expense 10.6 10.9 10.6 10.7 42.8 Less: Interest Income (0.4) -0.4 -0.7 -1.1 -2.6 Plus: Depreciation 20.9 19.7 20.5 20.7 81.8 Plus: Amortization 11.0 11.3 11.1 11.1 44.5 EBITDA $115.2 $78.1 $107.5 $112.9 $413.7