Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ENTERPRISE GROUP INC | d574462d8k.htm |

| EX-99 - EX-99 - PUBLIC SERVICE ENTERPRISE GROUP INC | d574462dex99.htm |

Public Service Enterprise Group

PSEG Earnings Conference Call

2nd Quarter 2013

July 30, 2013

Exhibit 99.1 |

| 1

Forward-Looking Statement

Certain of the matters discussed in this report constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such

statements are based on management’s beliefs as well as assumptions made by and information

currently available to management. When used herein, the word “anticipate,”

“intend,” “estimate,” “believe,” “expect,” “plan,” “should,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar

expressions are intended to identify forward-looking statements. Factors that may cause

actual results to differ are often presented with the forward-looking statements

themselves. Other factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us

herein are discussed in Item 1. Financial Statements—Note 9. Commitments and Contingent

Liabilities, Item 2. Management’s Discussion and Analysis of Financial Condition and

Results of Operations, and other factors discussed in filings we make with the United States Securities and Exchange Commission (SEC).

These factors include, but are not limited to: All of the forward-looking statements made in this report are qualified by these cautionary

statements and we cannot assure you that the results or developments anticipated by management

will be realized or even if realized, will have the expected consequences to, or effects on, us or our business prospects, financial

condition or results of operations. Readers are cautioned not to place undue reliance on these

forward-looking statements in making any investment decision. Forward-looking

statements made in this report apply only as of the date of this report. While we may elect to update forward-looking statements from time to time,

we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise

required by applicable securities laws. The forward-looking statements contained in

this report are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. •

adverse changes in the demand for or the price of the capacity and energy that we

sell into wholesale electricity markets, •

adverse changes in energy industry law, policies and regulation, including market

structures and a potential shift away from competitive markets toward subsidized

market mechanisms, transmission planning and cost allocation rules, including rules

regarding how transmission is planned and who is permitted to build transmission

in the future, and reliability standards,

•

any inability of our transmission and distribution businesses to obtain adequate

and timely rate relief and regulatory approvals from federal and state regulators,

•

changes in federal and state environmental regulations that could increase our

costs or limit our operations, •

changes in nuclear regulation and/or general developments in the nuclear power

industry, including various impacts from any accidents or incidents experienced at

our facilities or by others in the industry, that could limit operations of our

nuclear generating units, •

actions

or

activities

at

one

of

our

nuclear

units

located

on

a

multi-unit

site

that

might

adversely

affect

our

ability

to

continue

to

operate

that

unit

or

other

units

located

at the same site,

•

any inability to balance our energy obligations, available supply and risks,

•

any deterioration in our credit quality or the credit quality of our

counterparties, including in our leveraged leases, •

availability of capital and credit at commercially reasonable terms and conditions

and our ability to meet cash needs, •

changes in the cost of, or interruption in the supply of, fuel and other

commodities necessary to the operation of our generating units, •

delays in receipt of necessary permits and approvals for our construction and

development activities, •

delays or unforeseen cost escalations in our construction and development

activities, •

any inability to achieve, or continue to sustain, our expected levels of operating

performance, •

any equipment failures, accidents, severe weather events or other incidents that

impact our ability to provide safe and reliable service to our customers,

and any inability to sufficiently obtain coverage or recover proceeds of insurance

on such matters, •

increases in competition in energy supply markets as well as competition for

certain rate-based transmission projects, •

any inability to realize anticipated tax benefits or retain tax

credits,

•

challenges associated with recruitment and/or retention of a qualified

workforce, •

adverse

performance

of

our

decommissioning

and

defined

benefit

plan

trust

fund

investments

and

changes

in

funding

requirements,

and

•

changes in technology and customer usage patterns. |

| 2

GAAP Disclaimer

PSEG presents Operating Earnings in addition to Income from Continuing

Operations/Net Income reported in accordance with accounting principles

generally accepted in the United States (GAAP). Operating Earnings is a

non-GAAP financial measure that differs from Net Income because it

excludes gains or losses associated with Nuclear Decommissioning

Trust

(NDT), Mark-to-Market (MTM) accounting, and other material one-time

items. PSEG presents Operating Earnings because management believes

that it is appropriate for investors to consider results excluding these

items in addition to the results reported in accordance with GAAP.

PSEG believes that the non-GAAP financial measure of Operating Earnings

provides a consistent and comparable measure of performance of its

businesses to help shareholders understand performance trends. This

information is not

intended to be viewed as an alternative to GAAP

information. The last slide in this presentation includes a list

of items

excluded from Income from Continuing Operations/Net Income to reconcile

to Operating Earnings, with a reference to that slide included on each of the

slides where the non-GAAP information appears.

|

| PSEG

2013 Q2 Review

Ralph Izzo

Chairman, President and Chief Executive Officer

EXHIBIT 99.1 |

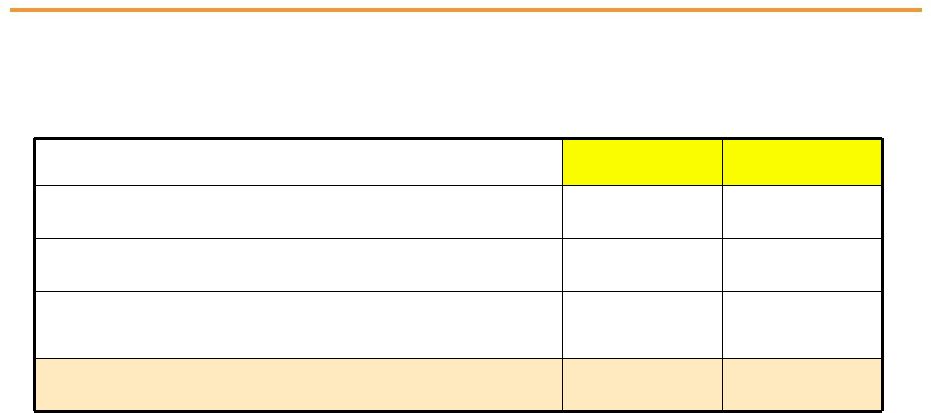

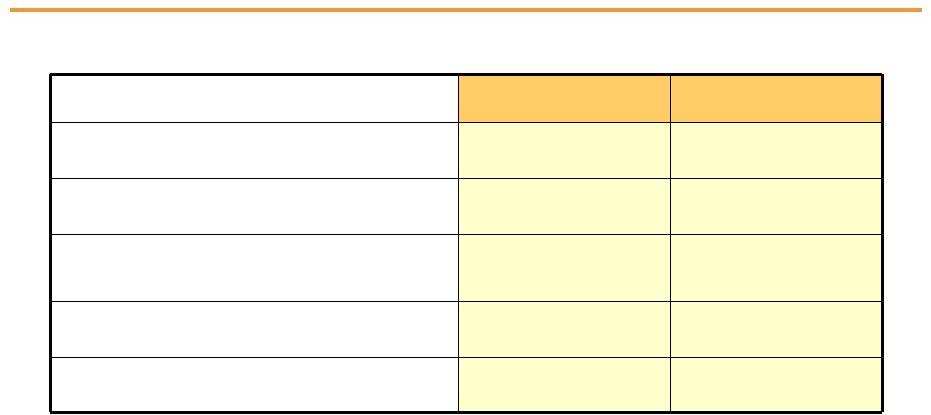

4

Q2 Earnings Summary

$ millions (except EPS)

2013

2012

Operating Earnings

$ 243

$ 215

Reconciling Items, Net of Tax

90

(4)

Income from Continuing Operations/Net

Income

$ 333

$ 211

EPS from Operating Earnings*

$ 0.48

$ 0.43

Quarter ended June

30 * See

Page A for Items excluded from Income from Continuing Operations/Net Income to reconcile to Operating Earnings. |

5

First Half 2013 Earnings Summary

$ millions (except EPS)

2013

2012

Operating Earnings

$ 676

$ 647

Reconciling Items, Net of Tax

(23)

57

Income from Continuing Operations/

Net Income

$ 653

$ 704

EPS from Operating Earnings*

$ 1.33

$ 1.28

Six months ended June 30

* See Page A for Items excluded from Income from Continuing Operations/Net Income to reconcile to

Operating Earnings. |

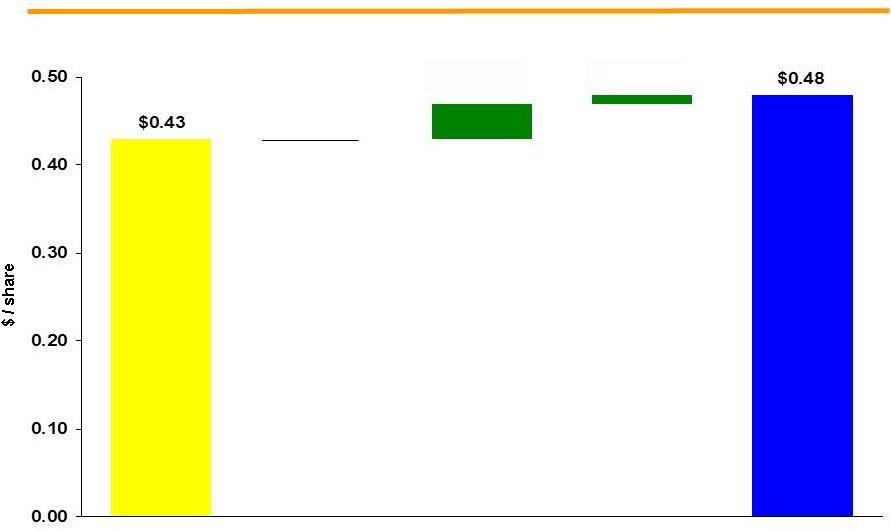

6

PSEG –

Q2 2013 Highlights

Strong Earnings

Operating earnings of $0.48 vs. $0.43 per share in Q2 2012

Power benefitted from higher PJM capacity prices and an improvement in market

prices for energy Increased contribution to earnings from

PSE&G’s investment in transmission Operational Excellence

PSEG Power output was flat in Q2 despite extended refueling at Salem 1

Diversity and location of Power’s fleet provided flexibility to participate in

market PSE&G’s O&M on track to meet full-year

expectations PSEG Disciplined Capital Investment

BPU approved Solar Agreement to extend Solar 4 All and Solar Loan III

investment 54

NJ

municipalities

and

five

counties

have

approved

resolutions

in

support

of

PSE&G’s

Energy Strong proposal to fortify its electric and gas distribution systems

Transmission construction program continues on schedule

Market Developments

2016/2017 RPM auction again recognized the locational advantage of Power’s

assets US District Court decision on LCAPP litigation awaited in both NJ and

MD New LIPA agreement under consideration would broaden and extend original

contract terms |

7

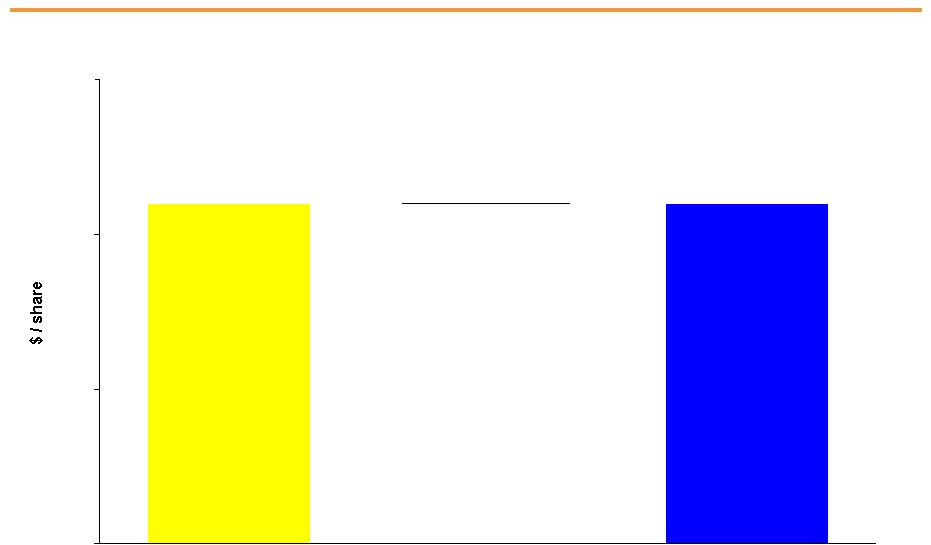

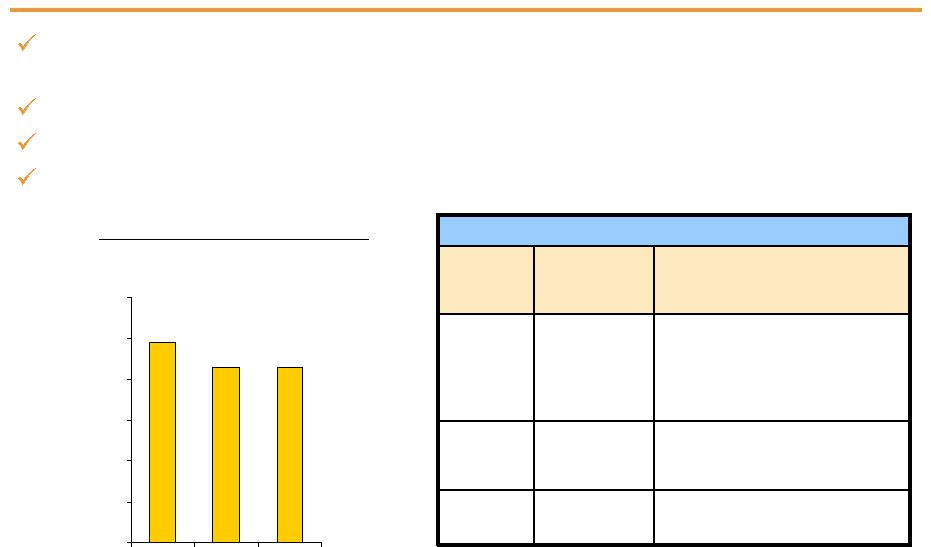

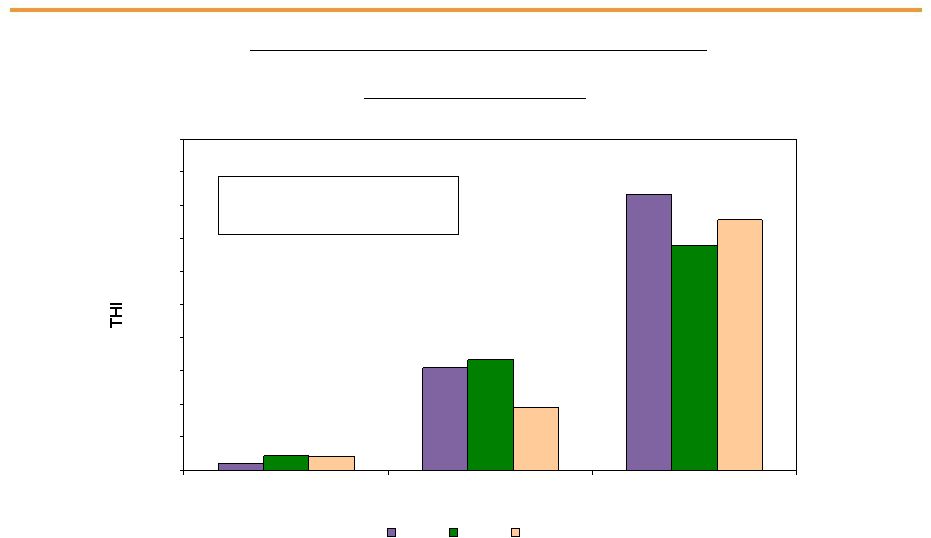

$2.25 -

$2.50E

PSEG –

Maintaining 2013 Guidance

$2.74

* See Slide A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. E = Estimate.

$2.44

Based on our performance year-to-date, we expect operating

earnings for the full year to be at the upper end of guidance

assuming normal weather and unit operations

2011 Operating Earnings*

2012 Operating Earnings*

2013 Operating Earnings Guidance |

PSEG

2013 Q2 Operating Company Review

Caroline Dorsa

EVP and Chief Financial Officer |

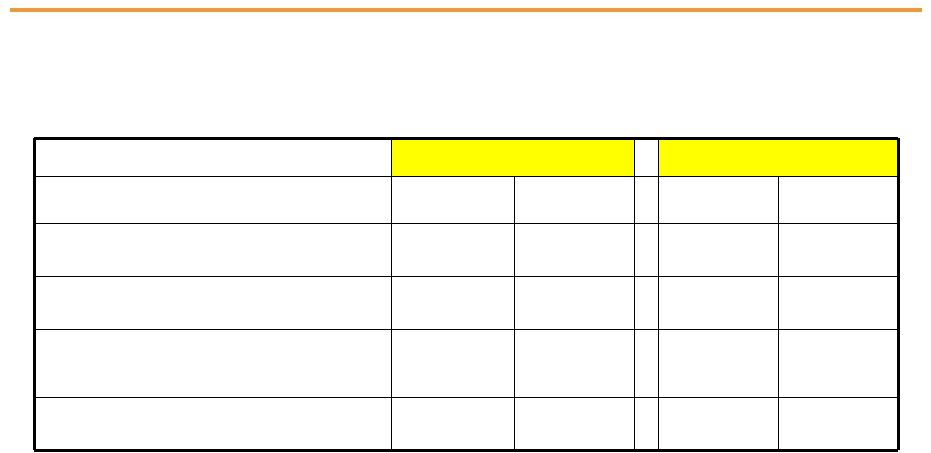

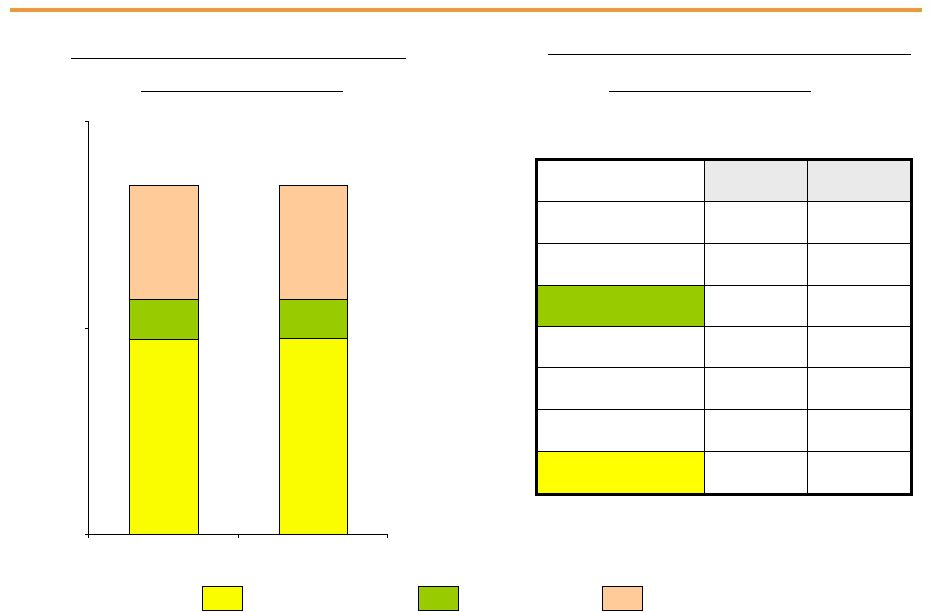

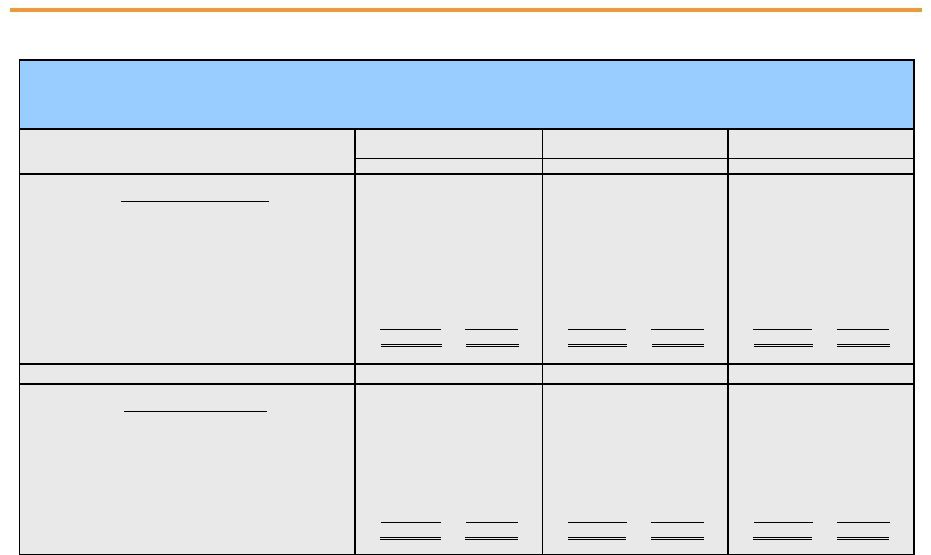

9

Q2 Operating Earnings by Subsidiary

Operating Earnings

Earnings per Share

$ millions (except EPS)

2013

2012

2013

2012

PSEG Power

$ 114

$ 110

$ 0.22

$ 0.22

PSE&G

121

101

0.24

0.20

PSEG Energy Holdings/

Enterprise

8

4

0.02

0.01

Operating Earnings*

$ 243

$ 215

$ 0.48

$ 0.43

Quarter ended June 30

* See Page A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. |

10

PSEG EPS Reconciliation –

Q2 2013 versus Q2 2012

Capacity 0.07

Market Prices

on Un-hedged

Generation 0.04

Lower Pricing

on Hedged

Generation (0.11)

Transmission 0.04

Taxes and

Other 0.01

Net

Weather

(0.01)

Q2 2013

Operating

Earnings*

Q2 2012

Operating

Earnings*

PSEG Power

PSE&G

Energy

Holdings/

Enterprise

Asset Sale

* See Page A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. 0.00

0.04

0.01 |

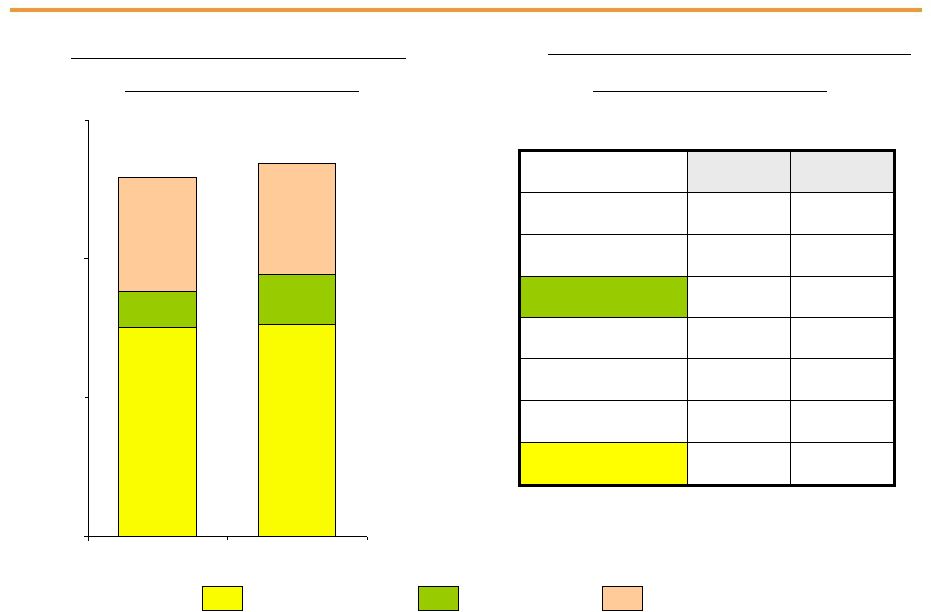

11

First Half Operating Earnings by Subsidiary

Operating Earnings

Earnings per Share

$ millions (except EPS)

2013

2012

2013

2012

PSEG Power

$ 364

$ 306

$ 0.71

$ 0.60

PSE&G

300

298

0.59

0.59

PSEG Energy Holdings/

Enterprise

12

43

0.03

0.09

Operating Earnings*

$ 676

$ 647

$ 1.33

$ 1.28

Six months ended June 30

•See Page A for Items excluded from Income from Continuing Operations/Net

Income to reconcile to Operating Earnings. |

12

PSEG EPS Reconciliation –

YTD 2013 versus YTD 2012

YTD 2013

Operating

Earnings*

YTD 2012

Operating

Earnings*

Capacity 0.12

Net Price (0.05)

Volume 0.02

Gas Send-Out

and Fixed Cost

Recovery 0.04

O&M (0.01)

D&A (0.01)

PSEG Power

Transmission

Net Earnings 0.07

Distribution

O&M (0.02)

Net

Weather 0.01

Taxes

and Other 0.01

Absence

of Tax

Settlement (0.06)

D&A (0.01)

PSE&G

PSEG Energy

Holdings/

Enterprise

Asset Sale 0.01

Absence

of Tax

Settlement

(0.07)

* See Page A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. 0.00

$1.33

(0.06)

0.11

$1.28

0.00

0.25

0.50

0.75

1.00

1.25

1.50 |

PSEG

Power 2013 Q2 Review |

14

PSEG Power –

Q2 2013 EPS Summary

* See Page A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. **Includes the financial impact from

positions with forward delivery months. $ millions (except EPS)

Q2 2013

Q2 2012

Variance

Operating Revenues

$ 1,190

$ 985

$ 205

Operating Earnings

114

110

4

NDT Funds Related

Activity, Net

of Tax 8

4

4

Mark-to-Market, Net of Tax**

80

(10)

90

Storm O&M, Net of Insurance

Recoveries

2

-

2

Income from Continuing

Operations/Net Income

$ 204

$ 104

$ 100

EPS from Operating Earnings*

$ 0.22

$ 0.22

$0.00 |

15

$0.22

$0.22

0.00

0.10

0.20

0.30

Capacity 0.07

Market Prices

on Un-hedged

Generation 0.04

Lower Pricing

on Hedged

Generation (0.11)

PSEG Power EPS Reconciliation –

Q2 2013 versus Q2 2012

Q2 2013

Operating

Earnings*

Q2 2012

Operating

Earnings*

* See Page A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. 0.00 |

16

PSEG Power –

Q2 2013 Generation Measures

7,075

7,147

4,177

4,187

1,454

1,384

0

7,500

15,000

2012

2013

Quarter

ended

June

30

Total Nuclear

Total Coal*

Oil & Natural Gas

* Includes figures for Pumped Storage. Includes Hudson and Mercer when run on gas.

PSEG Power –

Generation (GWh)

12,706

12,718

Quarter

ended

June

30

PSEG

Power

–

Capacity

Factors

(%)

2012

2013

Combined

Cycle

PJM and NY

57%

57%

Coal

NJ (Coal/Gas)

14%

8%

PA

64%

70%

CT

3%

3%

Nuclear

87.2%

87.9% |

17

PSEG Power –

YTD 2013 Generation Measures

15,045

15,284

8,001

2,585

3,590

8,219

0

10,000

20,000

30,000

2012

2013

Six

Months

ended

June

30

Total Nuclear

Total Coal*

Oil & Natural Gas

* Includes figures for Pumped Storage. Includes Hudson and Mercer when run on

gas. PSEG Power –

Generation (GWh)

25,849

26,875

Six

Months

ended

June

30

PSEG

Power

–

Capacity

Factors

(%)

2012

2013

Combined Cycle

PJM and NY

57%

55%

Coal

NJ (Coal/Gas)

8%

13%

PA

63%

78%

CT

3%

19%

Nuclear

92.7%

94.4% |

18

PSEG Power –

Fuel Costs

PSEG Power –

Fuel Costs

Quarter ended June 30

($ millions)

2012

2013

Coal

$39

$30

Oil & Gas

113

160

Total Fossil

152

190

Nuclear

48

52

Total Fuel Cost

$200

$242

Total Generation

(GWh)

12,706

12,718

$ / MWh

15.74

19.03

YTD June 30

($ millions)

2012

2013

Coal

$77

$96

Oil & Gas

241

338

Total Fossil

318

434

Nuclear

98

110

Total Fuel Cost

$416

$544

Total Generation

(GWh)

25,849

26,875

$ / MWh

16.09

20.24 |

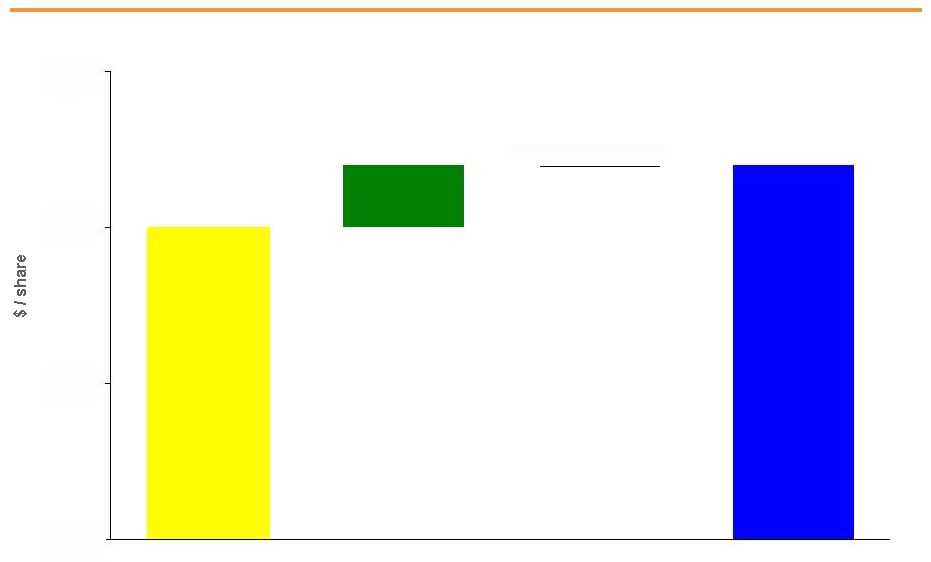

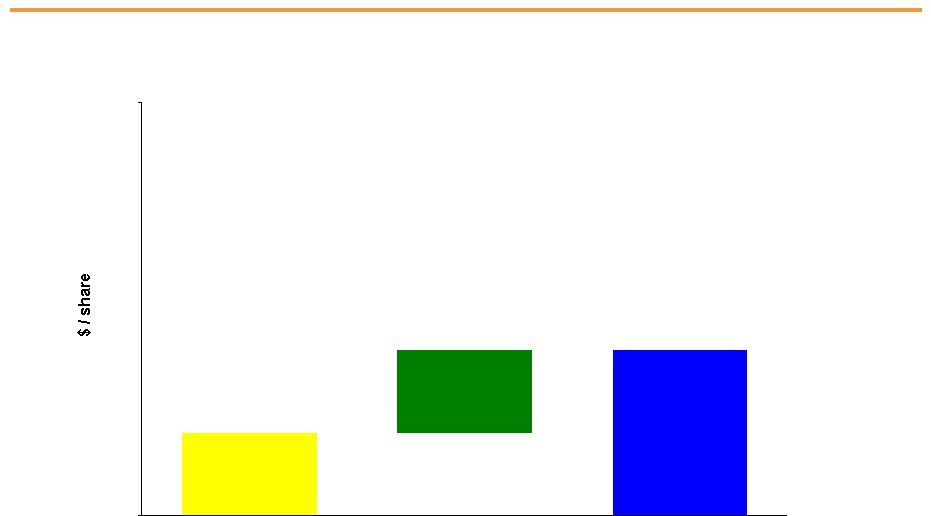

19

$0

$10

$20

$30

$40

$50

$60

2011

2012

2013

$49

$43

$43

PSEG Power –

Gross Margin Performance

Locational

advantage

of

generating

portfolio

offset

lower

prices

in

hedged products

Q2 spot prices higher across PJM-W, PS Zone, ISO-NE and NYISO

Margins

stable

with

higher

capacity

pricing

offsetting

lower

net

pricing

Migration volumes in line with expectations

PSEG Power Gross Margin ($/MWh)

Quarter ended

June 30

Regional Performance

Region

Q2 2013

Gross

Margin ($M)

2013 Performance

PJM

$523

Roll-off of higher priced hedges

offset higher capacity prices versus

a year ago and flat generation

output.

New

England

$15

Higher pricing on flat volume.

New York

$12

Higher pricing on flat volume. |

20

Hedging Update…

Contracted Energy*

*

Hedge

percentages

and

prices

as

of

June

28,

2013.

Revenues

of

full

requirement

load

deals

based

on

contract

price,

including

renewable

energy

credits,

ancillary,

and

transmission

components

but

excluding

capacity.

Hedges

include

positions

with

MTM

accounting

treatment

and

options.

Volume TWh

17

35

35

Base Load

% Hedged

100%

90-95%

50-55%

(Nuclear and Base Load Coal)

Price $/MWh

$51

$49

$49

Volume TWh

11

18

17

Intermediate Coal, Combined

% Hedged

30-35%

0%

0%

Cycle, Peaking

Price $/MWh

$51

$49

$49

Volume TWh

26-28

53-55

52-54

Total

% Hedged

70-75%

55-60%

30-35%

Price $/MWh

$51

$49

$49

Jul -Dec

2013

2014

2015 |

21

PSEG Power –

Q2 2013 Highlights

Q2 output was flat year-over-year, reflecting Salem 1 extended refueling

and a 6 day forced outage at Hope Creek

Nuclear capacity factor was 87.9% for Q2 and 94.4% for the YTD

Equivalent availability factors for CCGT units restored to pre-Sandy levels

near 90% Output of NJ coal units was 38% coal, 62% gas fueled for the

YTD Operations

Regulatory and Market

Environment

Capacity auction results continue to recognize the locational advantage of

Power’s assets: For the 2016/2017 RPM auction, Power cleared

8,637 MW of capacity at an average price of $166/MW-day

Higher spot power prices across PJM, NYISO, and ISO-NE continued in Q2

Remainder of 2013 anticipated base load output hedged at an average price of

$51/MWh Decisions in Federal Court for NJ and MD LCAPP cases pending

Financial

Storm related spending was $22 million pre-tax in Q2, $50 million YTD and $135

million storm-to-date (before insurance recoveries thus far

totalling $44 million) Power’s total debt as a percentage of capital at

June 30 was 28% Power paid at maturity a $300 million, 2.5% senior note in

April |

PSE&G

2013 Q2 Review |

23

PSE&G –

Q2 Earnings Summary

$ millions (except EPS)

Q2 2013

Q2 2012

Variance

Operating Revenues

$ 1,423

$ 1,407

$ 16

Operating Expenses

Energy Costs

580

622

(42)

Operation & Maintenance

369

350

19

Depreciation & Amortization

207

188

19

Taxes Other than Income Taxes

14

20

(6)

Total Operating Expenses

1,170

1,180

(10)

Operating Earnings / Net Income

121

101

20

EPS from Operating Earnings

$ 0.24

$ 0.20

$ 0.04 |

24

PSE&G EPS Reconciliation –

Q2 2013

versus Q2 2012

Q2 2013

Operating

Earnings

Q2 2012

Operating

Earnings

Transmission

Net Earnings

Taxes and

Other 0.01

Net

Weather (0.01)

$0.24

0.00

0.04

$0.20

0.00

0.10

0.20

0.30 |

25

PSE&G –

Monthly Summer Weather Data

83

1,242

3,330

179

1,331

2,718

163

754

3,023

0

400

800

1200

1600

2000

2400

2800

3200

3600

4000

April

May

June

2013

2012

Normal

2013 vs. 2012 vs. Normal

PSE&G Monthly Temperature Humidity Index (THI)

+ 10% Q2 2013 vs. Q2 2012

+ 18% Q2 2013 vs. Normal |

26

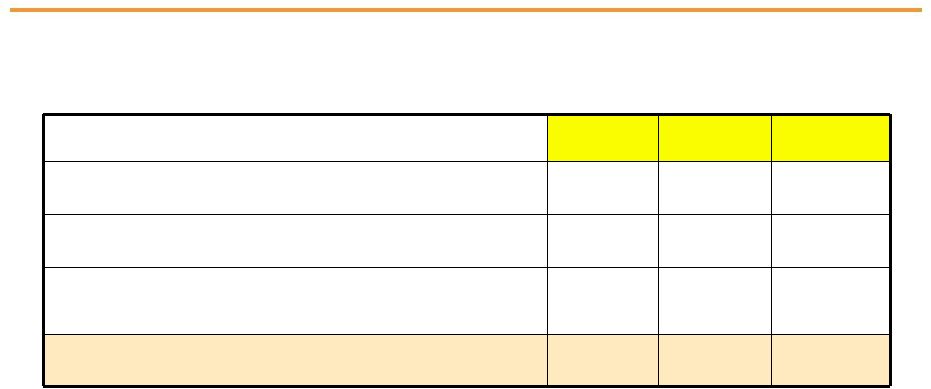

PSEG Capital Expenditures 2013-2015

Capital Spending

($ Millions)

Prior

2013-2015E

Updated

2013-2015E

PSE&G

Transmission

$3,430

$3,430

Distribution

1,330

1,330

Renewables

140

355

PSE&G Total

$4,900

$5,115

Power

1,070

1,070

Other-Renewables

50

50

Other

115

115

PSEG Total

$6,135

$6,350

Revised PSE&G 2013-2015 Capital Spending forecast includes new solar

programs Transmission investment represents over 50% of planned capital spend

over 2013-2015 *Estimate; Updated 2013-2015 Capital Spending revisions do not reflect the Energy Strong filing,

or the $1.5 billion of Transmission hardening. |

27

PSE&G –

Q2 2013 Highlights

Operations

BPU approved Solar Agreement to spend up to $247 million on Solar 4 All

extension and up to $199 million on Solar Loan III program

Continuing regulatory process on Energy Strong infrastructure proposal to invest

$3.9 billion over the next ten years on electric and gas system hardening

and resiliency Advancing plans for Transmission hardening program of $1.5

billion over 10 years Construction of major Transmission lines progressing on

schedule PSE&G is earning its authorized return on equity

PSE&G’s capital budget for 2013-2015 revised to $5.1 billion from $4.9

billion, to reflect approval of expanded investment in solar

Issued $500 million,10-year secured MTNs at 2.375% due May 2023

Financial

Q2

winter

weather

was

significantly

colder

than

Q2

2012

but

only

slightly

colder

than

normal

Q2 summer weather was warmer than Q2 2012 and warmer than normal

A still-slow economy continues to weigh on electric demand; gas demand

improving O&M expected to moderate in second-half 2013

Regulatory and Market

Environment |

PSEG

Energy Holdings/Enterprise 2013 Q2 Review |

29

PSEG Energy Holdings/Enterprise –

Q2 2013 Earnings

Summary

$ millions (except EPS)

Q2 2013

Q2 2012

Variance

Operating Earnings

$ 8

$ 4

$ 4

Lease Related Activity

-

2

(2)

Income from Continuing Operations/

Net Income

$ 8

$ 6

$ 2

EPS from Operating Earnings*

$ 0.02

$ 0.01

$ 0.01

* See Page A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. |

30

PSEG Energy Holdings/Enterprise EPS Reconciliation –

Q2 2013 versus Q2 2012

0.00

0.05

Q2 2013

Operating

Earnings*

Q2 2012

Operating

Earnings*

* See Slide A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. $0.02

0.01

$0.01

Asset

Sale |

31

PSEG Energy Holdings/Enterprise –

Q2 2013 Highlights

Financial

Expanded LIPA management agreement under consideration

Edison Mission Energy agreement to defer lease decisions until

late September

Badger 1 (19 MW) solar farm scheduled to be in service this Fall

Continuing to monetize non-core assets |

PSEG |

33

PSEG Financial Highlights

Maintaining

2013

operating

earnings

guidance

of

$2.25

-

$2.50

per

share

Based

on

financial

results

to

date,

we

expect

operating

earnings

for

the

full

year

to

be

at

the

upper

end of our guidance range assuming normal weather and unit operations

Focused on maintaining operating efficiency and customer reliability

PSE&G’s operating earnings expected to grow at double-digit rate in

2013, and provide ~50% of consolidated operating earnings

Executing PSE&G’s existing $3.4 billion Transmission capital spending

program on schedule –

fueling double-digit growth in PSE&G operating earnings through

2015, based on approved programs

PSE&G pursuing Energy Strong, its $3.9 billion, ten-year infrastructure

spending program to strengthen electric and gas distribution, communications,

and customer reliability and resiliency. In addition, PSE&G plans to

invest $1.5 billion during this time-frame to harden its Transmission

system Financial position remains strong

Positive cash from Power and increasing cash flow from PSE&G supports dividend

growth and funds capital spending program without the need to issue

equity Debt as a percentage of capital was 41.2% at June 30, 2013

Long history of returning cash to the shareholder through the common dividend,

with opportunity for future growth |

34

PSEG 2013 Operating Earnings Guidance -

By Subsidiary

$ millions (except EPS)

2013E

2012A

PSEG Power

$535 –

$600

$644

PSE&G

$580 –

$635

$528

PSEG Energy

Holdings/Enterprise

$25 –

$35

$64

Operating Earnings*

$1,140 –

$1,270

$1,236

Earnings per Share

$2.25 –

$2.50

$2.44

* See Slide A for Items excluded from Income from Continuing Operations/Net Income

to reconcile to Operating Earnings. E = Estimate A =

Actual |

35

PSEG Liquidity as of June 30, 2013

Expiration

Total

Available

Company

Facility

Date

Facility

Usage

Liquidity

($Millions)

PSE&G

5-year Credit Facility

Mar-18

$600

1

$170

$430

5-Year Credit Facility (Power)

Mar-17

$1,600

$54

$1,546

5-Year Credit Facility (Power)

Mar-18

$1,000

2

$0

$1,000

5-Year Bilateral (Power)

Sep-15

$100

$100

$0

5-year Credit Facility (PSEG)

Mar-17

$500

$5

$495

5-year Credit Facility (PSEG)

Mar-18

$500

3

$0

$500

Total

$4,300

$329

$3,971

1

PSE&G Facility to be reduced by $29M on April 15, 2016

$114

2

Power Facility to be reduced by $48M on April 15, 2016

*PSE&G ST Investment

$0

3

PSEG Facility to be reduced by $23M on April 15, 2016

Total Liquidity Available

$4,085

Total Parent / Power Liquidity

$3,655

PSEG /

Power

*PSEG Money Pool ST Investment |

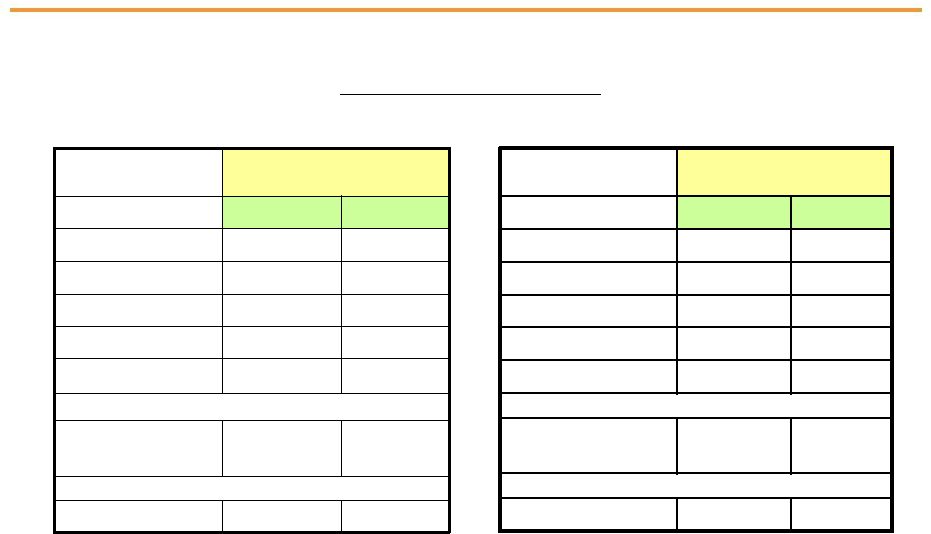

Items

Excluded from Income from Continuing Operations/Net Income to Reconcile to

Operating Earnings Please see Page 2 for an explanation of PSEG’s use of

Operating Earnings as a non-GAAP financial measure and how it differs from

Income from Continuing Operations/Net Income. A

2013

2012

2013

2012

2012

2011

Earnings

Impact

($

Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

8

$

4

$

17

$

9

$

52

$

50

$

80

(10)

(25)

42

(10)

107

Lease Related Activity (PSEG Energy Holdings)

-

2

-

6

36

(173)

Storm O&M, net of insurance recoveries (PSEG Power)

2

-

(15)

-

(39)

-

Gain on Sale of Qwest Building (PSEG Energy Holdings)

-

-

-

-

-

34

Total Pro-forma adjustments

90

$

(4)

$

(23)

$

57

$

39

$

18

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

507

507

Per

Share

Impact

(Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.02

$

0.01

$

0.04

$

0.02

$

0.10

$

0.10

$

Gain

(Loss)

on

MTM

(a)

(PSEG Power)

0.16

(0.02)

(0.05)

0.08

(0.02)

0.21

Lease Related Activity (PSEG Energy Holdings)

-

-

-

0.01

0.07

(0.34)

Storm O&M, net of insurance recoveries (PSEG Power)

-

-

(0.03)

-

(0.08)

-

Gain on Sale of Qwest Building (PSEG Energy Holdings)

-

-

-

-

-

0.06

Total Pro-forma adjustments

0.18

$

(0.01)

$

(0.04)

$

0.11

$

0.07

$

0.03

$

(a) Includes the financial impact from positions with forward delivery

months. Three Months Ended

Six Months Ended

Year Ended

June 30,

June 30,

December 31,

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling Items Excluded from Income from Continuing Operations/Net Income to

Compute Operating Earnings (Unaudited)

Pro-forma Adjustments, net of tax

Gain

(Loss)

on

Mark-to-Market

(MTM)

(a)

(PSEG

Power) |