Attached files

| file | filename |

|---|---|

| 8-K - FIRST CONNECTICUT BANCORP, INC. PRESENTATION 7 29 13 - First Connecticut Bancorp, Inc. | fcb72913.htm |

Keefe, Bruyette & Woods Community Bank Investors Conference July 30, 2013 John J. Patrick, Jr. Chairman, President and CEO Gregory A. White EVP, Chief Financial Officer Michael T. Schweighoffer EVP, Chief Lending Officer A Great Past…Dynamic Present… And a Bright Future

Forward Looking Statements Disclaimer & Forward-Looking Statements Statements in this document and presented orally at the conference, if any, concerning future results, performance, expectations or intentions are forward-looking statements. Actual results, performance or developments may differ materially from forward-looking statements as a result of known or unknown risks, uncertainties and other factors, including those identified from time to time in the Company’s filings with the Securities and Exchange Commission, press releases and other communications. Actual results also may differ based on the Company’s ability to successfully maintain and integrate customers from acquisitions. The Company intends any forward-looking statements to be covered by the Litigation Reform Act of 1995 and is including this statement for purposes of said safe harbor provisions. Readers and attendees are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this presentation. Except as required by applicable law or regulation, the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances that occur after the date as of which such statements are made. The Company’s capital strategy includes deployment of excess capital, the success of which efforts cannot be guaranteed. *

Farmington Bank, founded in 1851, is a wholly owned subsidiary of First Connecticut Bancorp, Inc. Community bank with a strong capital position, positive trends in loan and deposit growth, and solid asset quality Experienced management team focused on organic growth strategy Clear strategic priorities Strong, scalable franchise in central Connecticut Broad risk management program focused on “best practices” Culture that encourages a decision-making process that allows for teamwork, yet places clear responsibility and authority with the individual Executive Summary *

Franchise Overview 21 full service branch offices Executing on de novo strategy of adding 2-3 branches a year through mid-2014, then reassess Strategically located in affluent Hartford, CT suburbs 21 Branches And Expanding First Connecticut Bancorp, Inc. - NASDAQ (FBNK) Farmington Bank - wholly owned subsidiary Headquarters: Farmington, Connecticut Assets: $1.8 billion Loans: $1.6 billion Deposits: $1.5 billion Capital: $231 million (as of 6/30/13) Corporate Profile *

Market Position * Source: SNL Financial *includes limited service branches Note: Deposit data as of 6/30/2012; Pro forma for pending and recently completed transactions Too big to be small……. Too small to be big…….

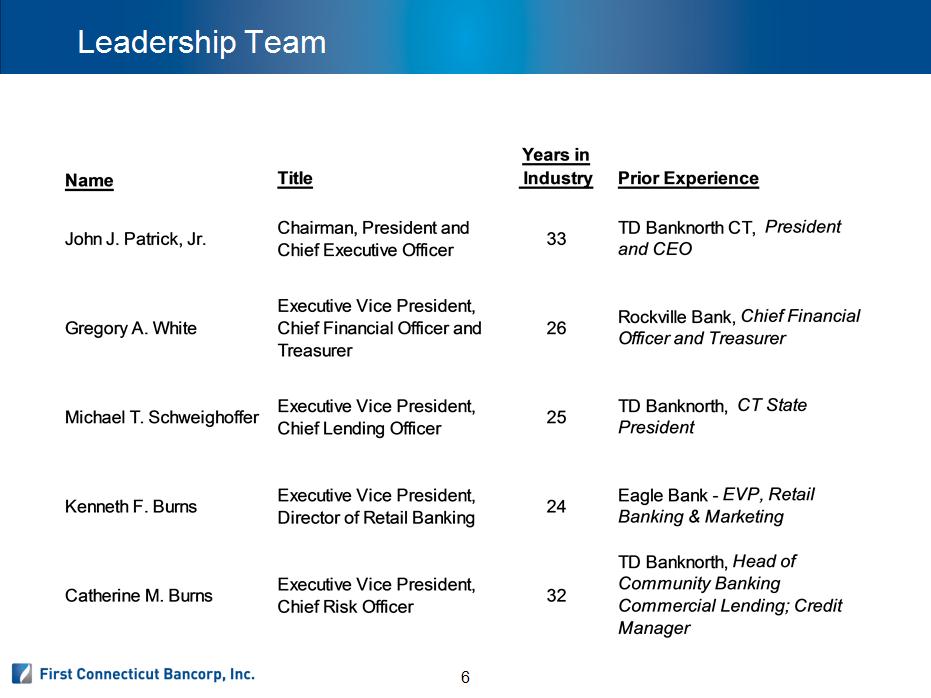

Leadership Team *

Strategic Accomplishments * • Significant deposit growth - 76% growth since 2008 • Strong organic loan growth - 91% growth since 2008 • Established a scalable residential lending platform with goal to become a market leader • Opened 9 de novo branches since April 2010 • Focus on transaction accounts and new households • Transition to retail sales culture • Repositioned liability side of the balance sheet • Enterprise risk management - "best practices" • Strategic initiatives to build "best in class": * growth rates through 6/30/13 Executed Organic Growth Strategy Invested in People, Technology and Franchise Capital • Raised $172 million of capital in June 2011 Geographic Diversification of the Deposit Base • Commercial credit and underwriting • Cash management • S mall business banking • Retail banking • Residential lending • Government banking • Marketing • e - business

Our Core Business * Government Banking

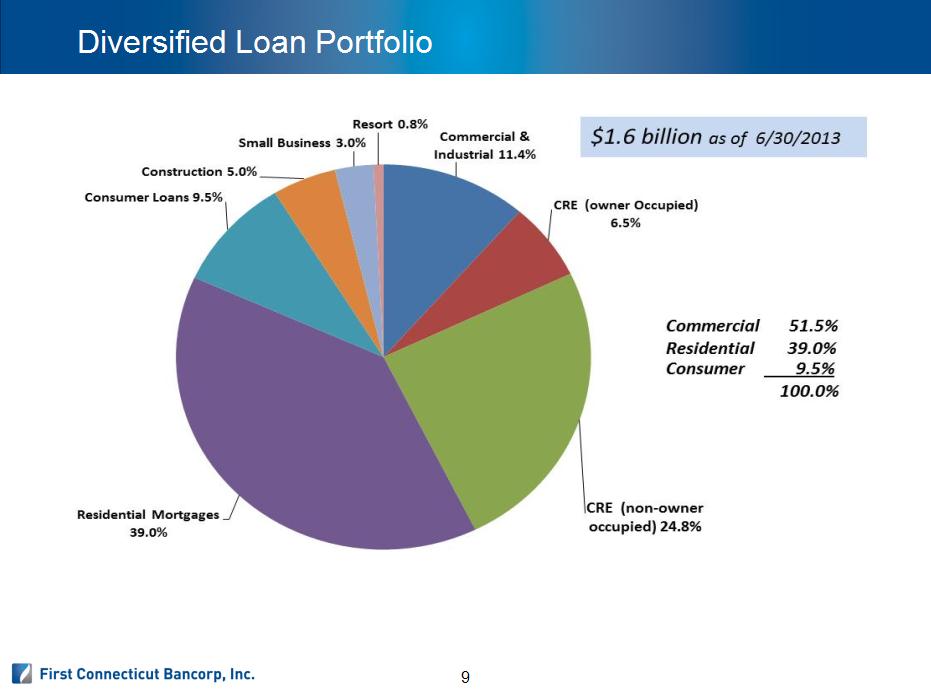

Diversified Loan Portfolio *

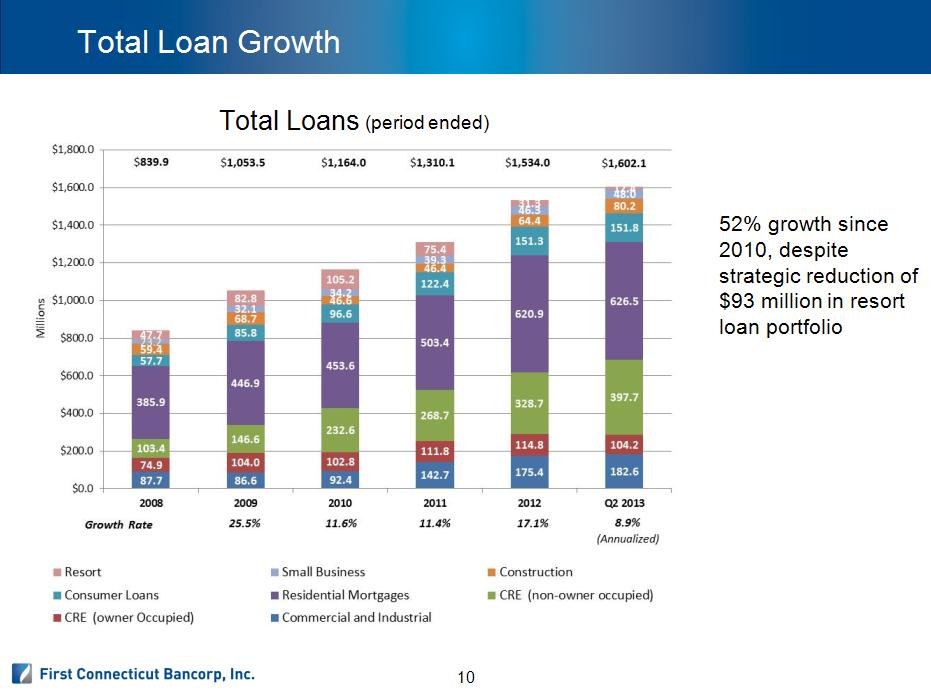

Total Loan Growth 52% growth since 2010, despite strategic reduction of $93 million in resort loan portfolio * Total Loans (period ended)

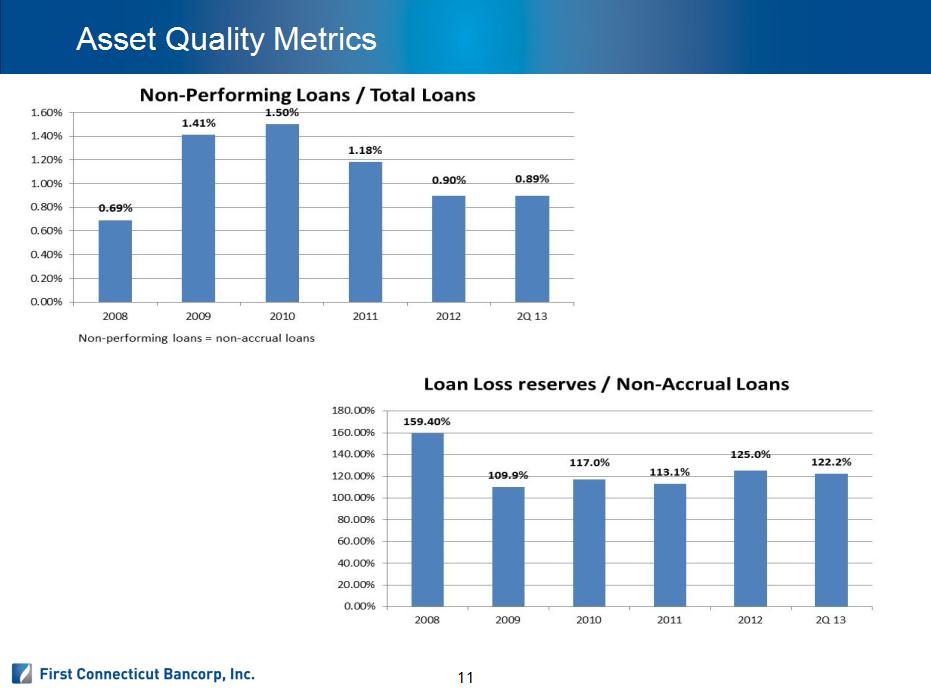

Asset Quality Metrics *

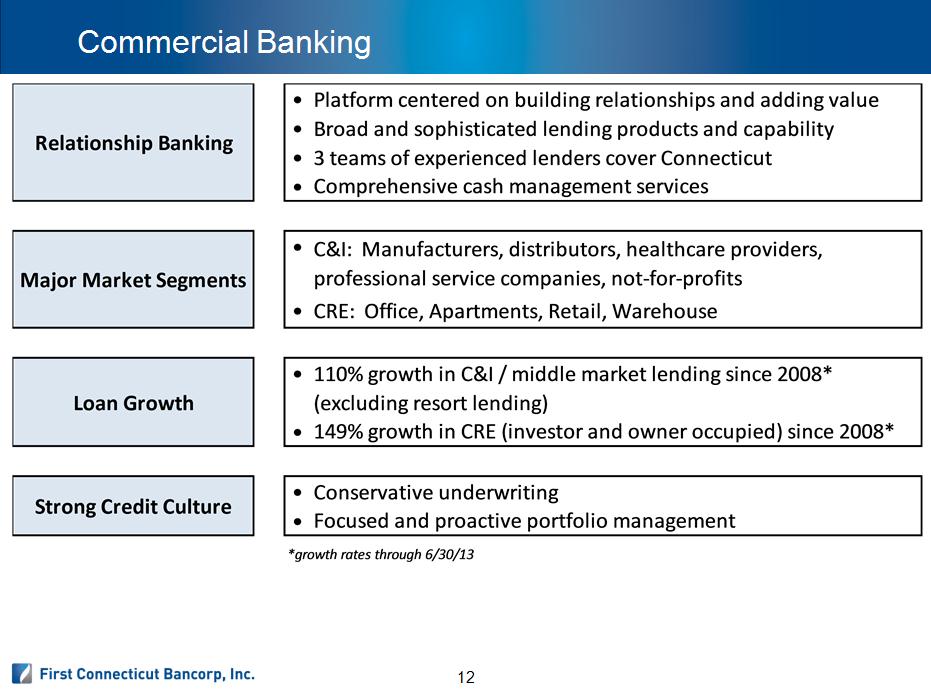

Commercial Banking *

Small Business Lending * • Over 300 unique business development calls made monthly. • All managers and BDO's are credit certified • Small Business Loan outstandings YTD increasing at 14% annualized rate; at $52 million on 6/30/2013 • 159 new applications taken YTD 2013 • Currently # 1 SBA lender in Connecticut. • #1 CDA Urbank lender in CT through 2012 • Preferred SBA status allowing local decisions • On staff SBA specialists provided value added understanding • Expedited approval process; 5.2 days average decision time • Application to close in 26 days on average • Dedicated underwriters using credit scoring with overview General Small Business Lending SBA Lending Efficiencies and Responsiveness

Residential Mortgage and Consumer Lending *

Diversified Deposit Base Deposit Composition 2008 vs 6/30/2013 (000’s) *

Business Deposits * • $34 million in business checking deposit growth YTD, a 32% annualized growth rate; currently at $250 million • 458 overall net new business checking accounts YTD, a 15% annualized growth rate; currently at 6,756 accounts • $46 million in overall business deposit growth YTD, a 34% annualized growth rate; currently at $315 million • 68 new cash management accounts YTD, balances of $125 million in all cash management accounts • Comprehensive cash management services, including account analysis, complete on-line capabilities, lockbox and sweep • 449 net new small business checking accounts YTD, a 19% annualized growth rate; balances of $98 million at 6/30/13 • Total 5,211 non-interest bearing free business checking accounts with average balance per account of $18,860 Overall Business Deposits Commercial Cash Management Small Business

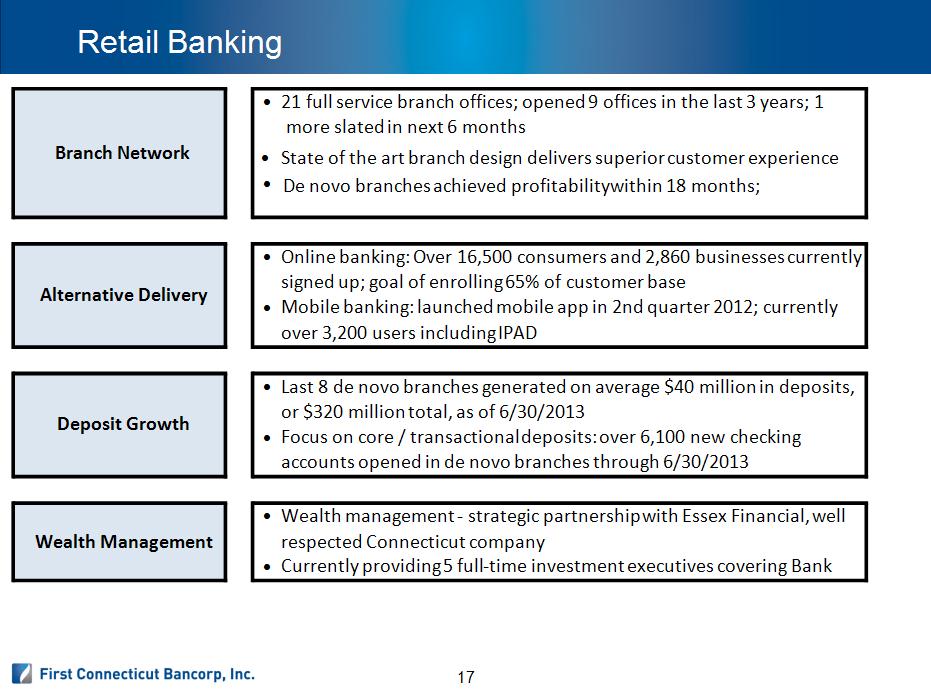

Retail Banking * • 21 full service branch offices; opened 9 offices in the last 3 years; 1 more slated in next 6 months • State of the art branch design delivers superior customer experience • De novo branches achieved profitability within 18 months; • Online banking: Over 16,500 consumers and 2,860 businesses currently signed up; goal of enrolling 65% of customer base • Mobile banking: launched mobile app in 2nd quarter 2012; currently over 3,200 users including IPAD • Last 8 de novo branches generated on average $40 million in deposits, or $320 million total, as of 6/30/2013 • Focus on core / transactional deposits: over 6,100 new checking accounts opened in de novo branches through 6/30/2013 • Wealth management - strategic partnership with Essex Financial, well respected Connecticut company • Currently providing 5 full-time investment executives covering Bank Branch Network Alternative Delivery Deposit Growth Wealth Management

Government Banking * • $20 million in overall government deposit growth YTD 2013, a 24% annualized growth rate. Currently at $188 million • 29 overall net new deposit accounts in government banking YTD 2013, a 29% annualized growth rate • 48 Connecticut towns or cities maintain a deposit account with FB, a 28% statewide market share out of 169 in Connecticut • Began offering significantly enhanced full service cash management services to municipalities in 2011 • 25 net new government banking operating accounts in 2012, an 86% increase; 5 RFP opportunities currently being pursued • $10 million in net new government banking operating account balances as of 6/30/2013 • Began offering new on-line payment system focused on streamlining resident tax payments and back-office reporting • Implemented first customer in February 2013, promising sales activity for the 2013 budget • Existing pipeline of 20 towns or cities reviewing service Overall Government Deposits Government Operating Accounts Government On-line Pay System

Financial Performance * Selected Annual Financial Data (000’s)

Financial Performance * Selected Quarterly Financial Data (000’s)

Financial Performance *

Strategic Direction *

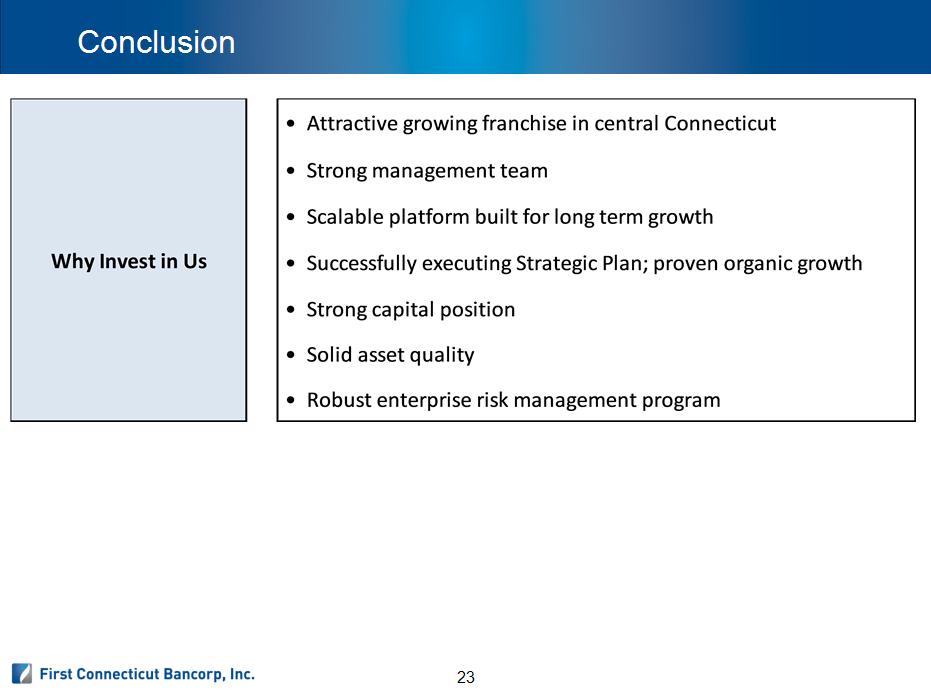

Conclusion *

Supplemental Information Appendix *

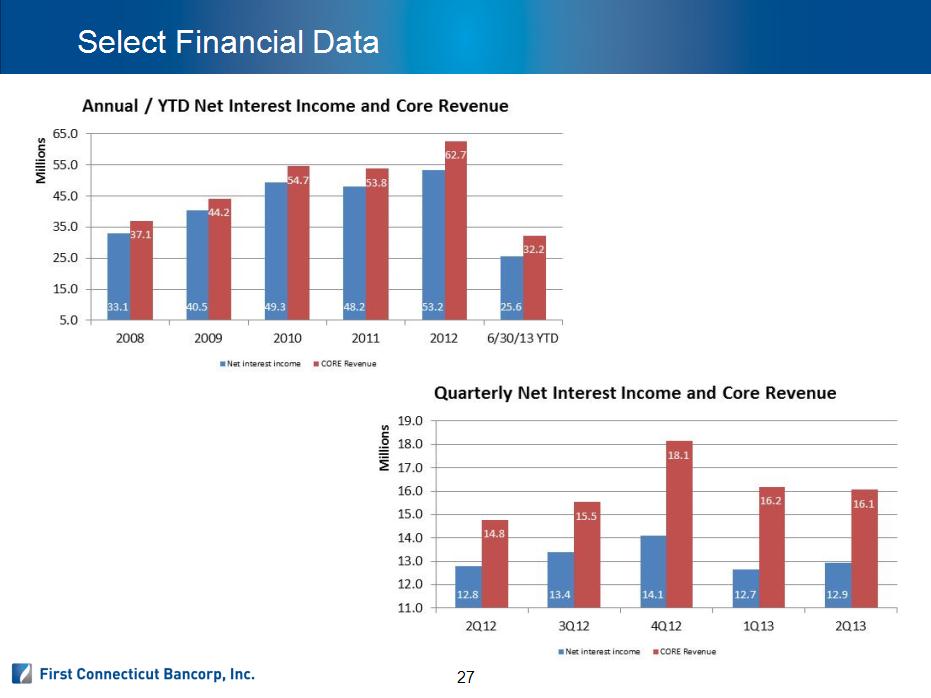

Income Statement 2008 – 2013 (000’s) Select Financial Data *

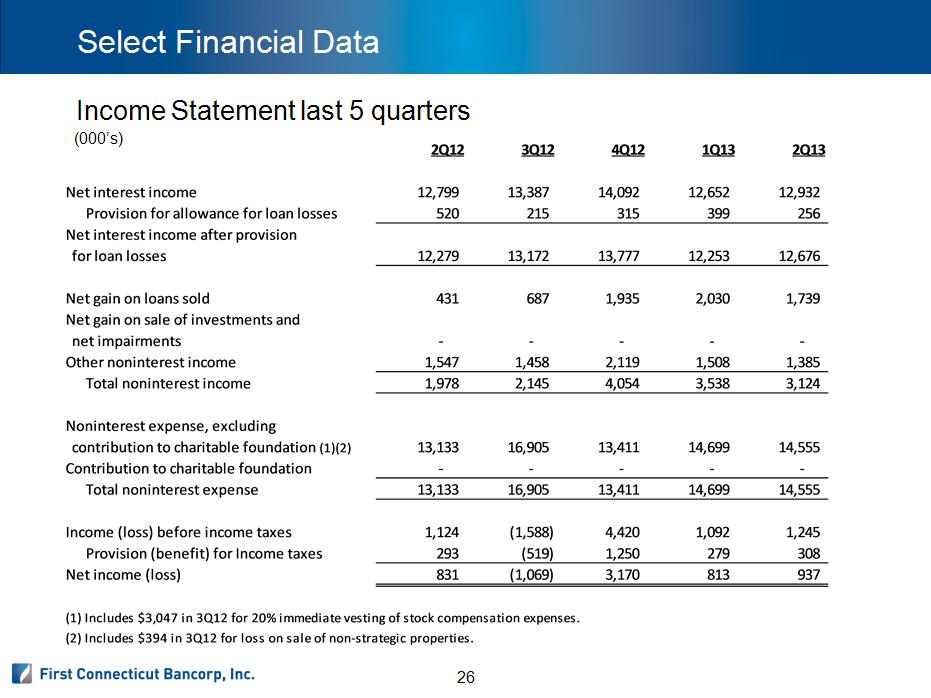

Select Financial Data * Income Statement last 5 quarters (000’s)

Select Financial Data *

Select Financial Data *

Asset Quality Metrics *

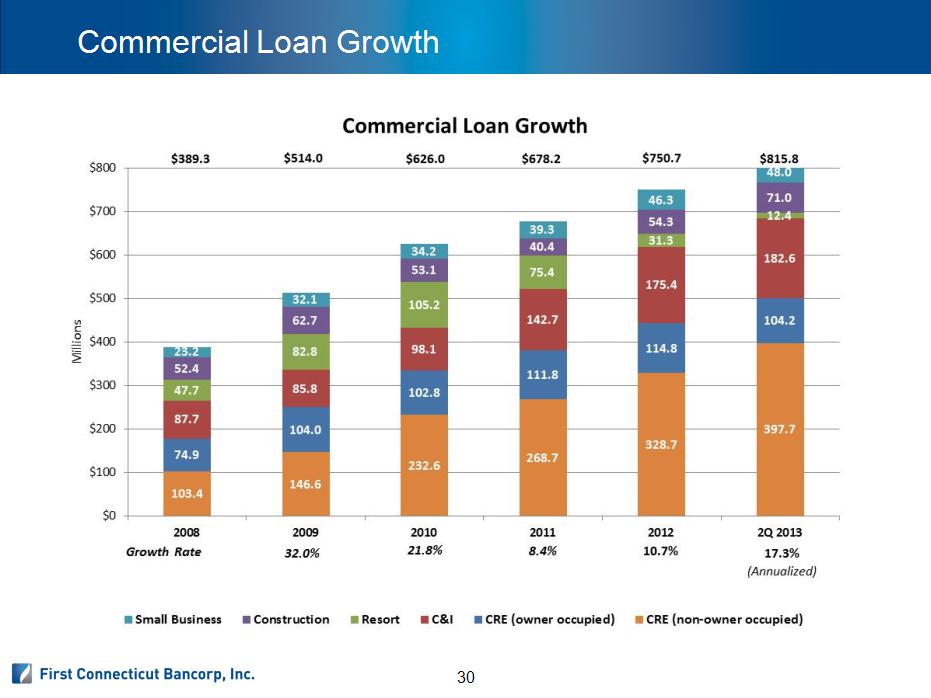

Commercial Loan Growth *

Residential and Consumer Loan Growth *

Deposit Diversification Checking & MMDA / Savings vs Time Deposits (000’s) *

Checking Growth Consumer Checking Growth ($000’s) *

Checking Growth Business Checking Growth ($000’s) *

De Novo Branch Profitability average profitability at $20 million * De Novo Branch Deposit Growth & Point of Profitability (In Millions) average profitability at $20 million

John J. Patrick, Jr. Chairman, President and Chief Executive Officer Gregory A. White Executive Vice President, Chief Financial Officer Investor Information: Jennifer H. Daukas Vice President, Investor Relations Officer 860-284-6359 or jdaukas@farmingtonbankct.com Corporate Contacts *