Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CORPORATE PROPERTY ASSOCIATES 16 GLOBAL INC | a13-17058_18k.htm |

| EX-2.1 - EX-2.1 - CORPORATE PROPERTY ASSOCIATES 16 GLOBAL INC | a13-17058_1ex2d1.htm |

| EX-3.1 - EX-3.1 - CORPORATE PROPERTY ASSOCIATES 16 GLOBAL INC | a13-17058_1ex3d1.htm |

| EX-99.1 - EX-99.1 - CORPORATE PROPERTY ASSOCIATES 16 GLOBAL INC | a13-17058_1ex99d1.htm |

Exhibit 99.2

|

|

W. P. Carey Inc. CPA®:16 – Global Proposed Merger Transaction CPA®:16 – Global Investor Presentation | July 2013 |

|

|

Disclaimer Cautionary Statement Concerning Forward-Looking Statement: Certain of the matters discussed in this communication constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. The forward-looking statements include, among other things, statements regarding intent, belief or expectations and can be identified by the use of words such as “may,” “will,” “should,” “would,” “assume,” “outlook,” “seek,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “estimate” “forecast,” and other comparable terms. These forward-looking statements include, but are not limited to, statements regarding the benefits of the Merger, the financial position and capitalization of the combined company, and the expected timing of completion of the proposed Merger. These statements are based on current expectations, and actual results could be materially different from those projected in such forward-looking statements. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Discussions of some of these other important factors and assumptions are contained in W. P. Carey’s and CPA®:16 – Global’s filings with the SEC and are available at the SEC’s website at http://www.sec.gov, including Item 1A. Risk Factors are in each company’s Annual Report on Form 10-K for the year ended December 31, 2012. These risks, as well as other risks associated with the proposed Merger, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that W. P. Carey will file with the SEC in connection with the proposed Merger. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this communication may not occur. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communication. Except as required under the federal securities laws and the rules and regulations of the SEC, W. P. Carey and CPA®:16 – Global do not undertake any obligation to release publicly any revisions to the forward-looking statements to reflect events or circumstances after the date of this communication or to reflect the occurrence of unanticipated events. Additional Information and Where to find it: This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. W. P. Carey intends to file a registration statement on Form S-4 that will include a joint proxy statement / prospectus and other relevant documents to be mailed by W. P. Carey and CPA®:16 - Global to their respective security holders in connection with the proposed Merger. WE URGE INVESTORS TO READ THE JOINT PROXY STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT W. P. CAREY, CPA®:16 - GLOBAL AND THE PROPOSED MERGER. INVESTORS ARE URGED TO READ THESE DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY. Investors will be able to obtain these materials (when they become available) and other documents filed with the SEC free of charge at the SEC’s website (http://www.sec.gov). In addition, these materials (when they become available) will also be available free of charge by accessing W. P. Carey’s website (http://www.wpcarey.com) or by accessing CPA®:16 - Global’s website (http:www.cpa16.com). Investors may also read and copy any reports, statements and other information filed by W. P. Carey or CPA®:16 - Global, with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. Unless otherwise noted, data referenced in this presentation is as of March 31, 2013 Investing for the long runTM | 2 |

|

|

• CPA®:16 – Global will be acquired by W. P. Carey (NYSE: WPC) in a merger transaction valued at approximately $4.0 billion, including pro-rata debt. • The most recent independently appraised estimated net asset value (“NAV”) for CPA®:16 – Global was $8.70 per share as of December 31, 2012. • CPA®:16 – Global stockholders will receive $11.25 per share in the form of WPC common stock, a 29% premium to NAV, subject to a pricing collar. • Following the merger, CPA®:16 – Global investors will hold shares in a large publicly-traded net lease REIT with total enterprise value (“TEV”) of $10.1 billion. Investing for the long runTM | 3 Transaction Overview |

|

|

Transaction Details Transaction Consideration CPA®:16 – Global stockholders will receive $11.25 per share in the form of WPC common stock (NYSE: WPC). Exchange Ratio Calculation and Collar Each share of CPA®:16 – Global will be converted into WPC common stock based on the following exchange ratio: - Floating exchange ratio and fixed $11.25 share price for CPA®:16 – Global within a collar 12% above and below a WPC reference share price of $69.42 - As a result of the collar, the exchange ratio will not exceed 0.1842 or be less than 0.1447 - Exchange ratio will be set using a volume weighted average price for WPC prior to closing W. P. Carey will assume approximately $1.7 billion of CPA®:16 – Global debt(1) Tax Consequences The merger is intended to be tax-deferred to CPA®:16 – Global stockholders. Lock up on Shares Issued None Pro Forma Ownership CPA®:16 – Global stockholders (excluding the ~18.5% of CPA®:16 – Global shares currently owned by W. P. Carey) will own approximately 28% of the combined company based on the mid-point of the 12% floating exchange ratio collar. Dividend Policy(2) Post-closing, W. P. Carey plans to maintain its conservative dividend policy of a payout ratio of approximately 80% of AFFO. W. P. Carey currently anticipates that the combined company’s annual dividend will increase to a minimum of $3.52 per share. Go Shop The merger agreement contains a 30-day go shop provision pursuant to which the Special Committee of CPA®:16 – Global’s Board of Directors intends to actively solicit potential alternative transactions to the merger. Timing(3) Transaction currently expected to close during Q1 2014, subject to SEC review and stockholder approvals. Investing for the long runTM | 4 (1) 100% share of debt. (2) Reflects anticipated minimum pro forma annual dividend per share following transaction close. Subject to modification. (3) There is no assurance that the proposed merger will close by the anticipated quarter, if at all. |

|

|

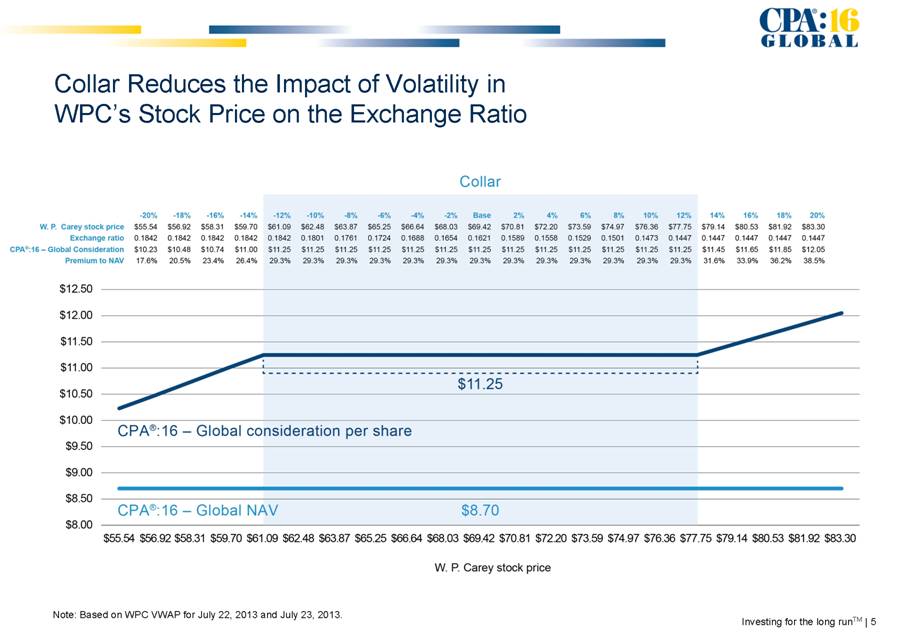

Investing for the long runTM | 5 Collar Reduces the Impact of Volatility in WPC’s Stock Price on the Exchange Ratio Note: Based on WPC VWAP for July 22, 2013 and July 23, 2013. |

|

|

Investing for the long runTM | 6 Benefits of the Transaction • Provides liquidity to CPA®:16 – Global investors through the receipt of shares in a large, publicly-traded global net-lease REIT • Continues W. P. Carey’s strategy to increase its diversified portfolio of net lease assets • Reflects a 29% premium to the most recent CPA®:16 – Global NAV at December 31, 2012 • Collar feature reduces the impact of potential downward changes in W. P. Carey’s stock price on the exchange ratio • Go shop period permits CPA®:16 – Global to solicit alternative transaction proposals • W. P. Carey currently anticipates that the transaction will allow the combined company to increase its annualized dividend to a minimum of $3.52 per share, which will provide CPA®:16 – Global’s yield-oriented investors with continued income |

|

|

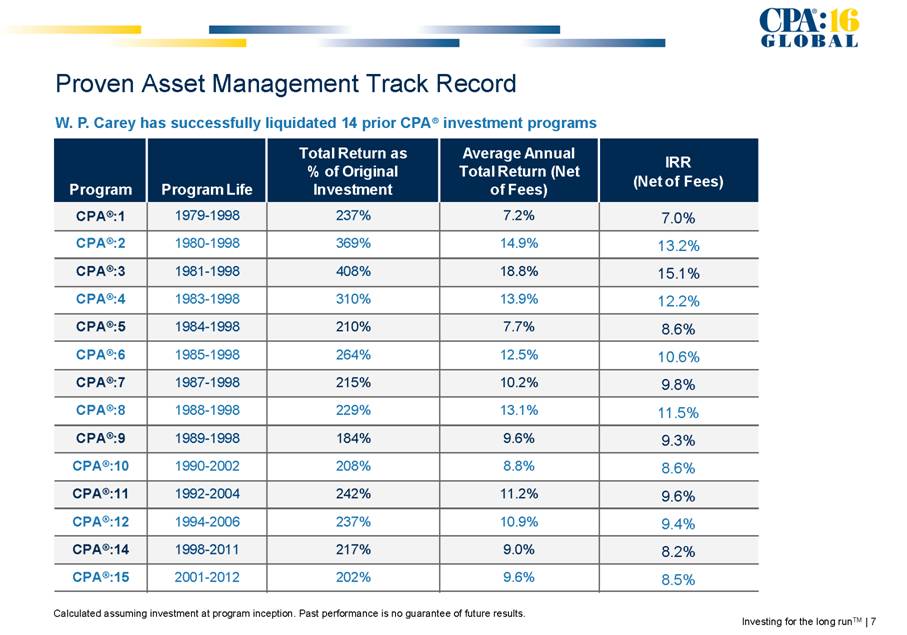

Proven Asset Management Track Record Investing for the long runTM | 7 Calculated assuming investment at program inception. Past performance is no guarantee of future results. W. P. Carey has successfully liquidated 14 prior CPA® investment programs Program Program Life Total Return as % of Original Investment Average Annual Total Return (Net of Fees) IRR (Net of Fees) CPA®:1 1979-1998 237% 7.2% 7.0% CPA®:2 1980-1998 369% 14.9% 13.2% CPA®:3 1981-1998 408% 18.8% 15.1% CPA®:4 1983-1998 310% 13.9% 12.2% CPA®:5 1984-1998 210% 7.7% 8.6% CPA®:6 1985-1998 264% 12.5% 10.6% CPA®:7 1987-1998 215% 10.2% 9.8% CPA®:8 1988-1998 229% 13.1% 11.5% CPA®:9 1989-1998 184% 9.6% 9.3% CPA®:10 1990-2002 208% 8.8% 8.6% CPA®:11 1992-2004 242% 11.2% 9.6% CPA®:12 1994-2006 237% 10.9% 9.4% CPA®:14 1998-2011 217% 9.0% 8.2% CPA®:15 2001-2012 202% 9.6% 8.5% |

|

|

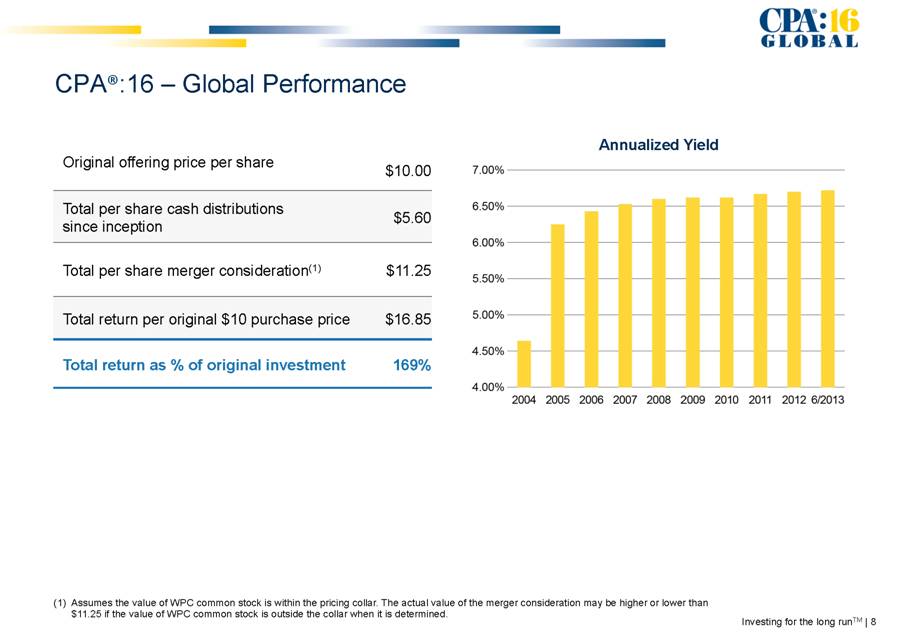

CPA®:16 – Global Performance Investing for the long runTM | 8 Original offering price per share $10.00 Total per share cash distributions since inception $5.60 Total per share merger consideration(1) $11.25 Total return per original $10 purchase price $16.85 Total return as % of original investment 169% (1) Assumes the value of WPC common stock is within the pricing collar. The actual value of the merger consideration may be higher or lower than $11.25 if the value of WPC common stock is outside the collar when it is determined. Annualized Yield |

|

|

The Combined Company |

|

|

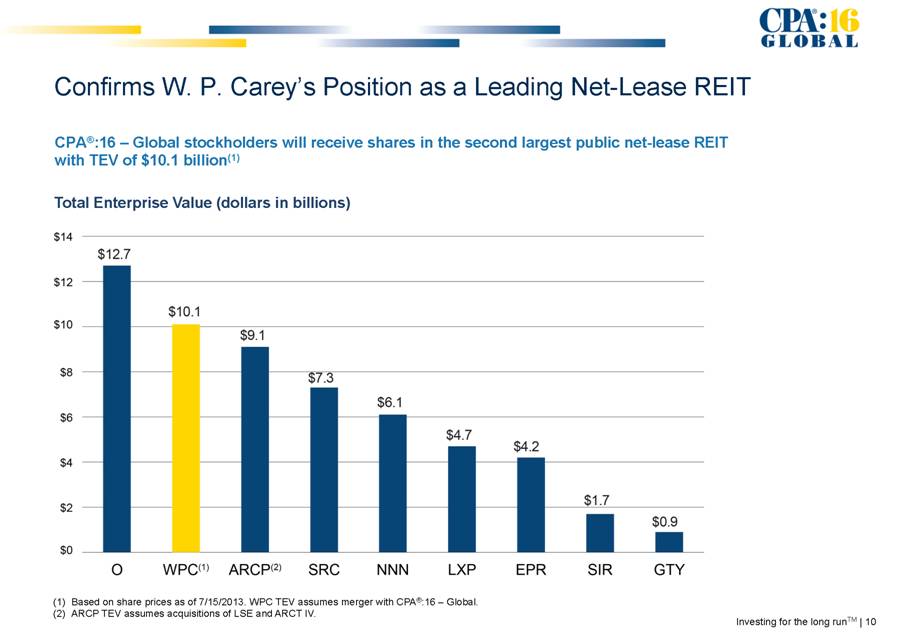

Investing for the long runTM | 10 Confirms W. P. Carey’s Position as a Leading Net-Lease REIT CPA®:16 – Global stockholders will receive shares in the second largest public net-lease REIT with TEV of $10.1 billion(1) Total Enterprise Value (dollars in billions) (1) Based on share prices as of 7/15/2013. WPC TEV assumes merger with CPA®:16 – Global. (2) ARCP TEV assumes acquisitions of LSE and ARCT IV. |

|

|

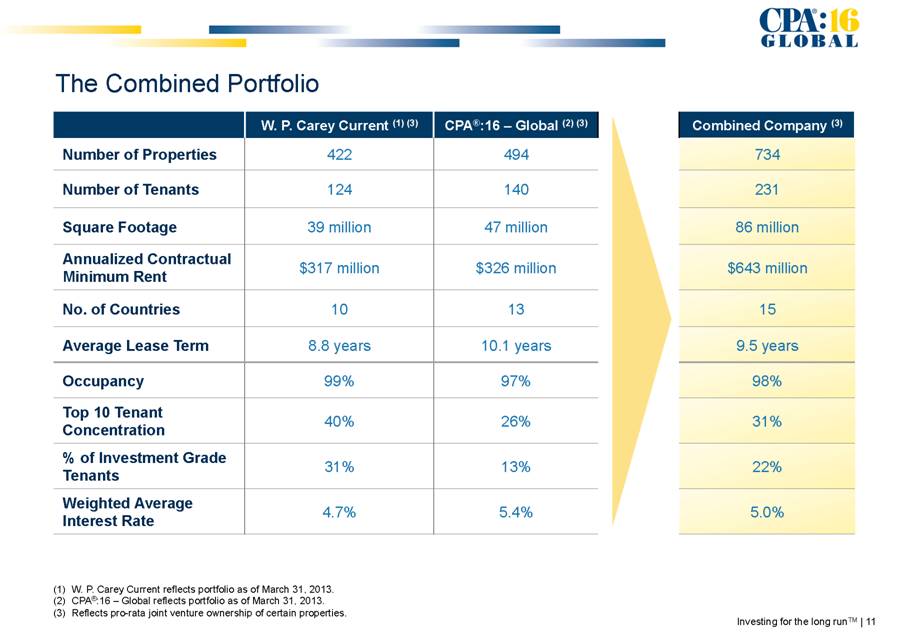

W. P. Carey Current (1) (3) CPA®:16 – Global (2) (3) Combined Company (3) Number of Properties 422 494 734 Number of Tenants 124 140 231 Square Footage 39 million 47 million 86 million Annualized Contractual Minimum Rent $317 million $326 million $643 million No. of Countries 10 13 15 Average Lease Term 8.8 years 10.1 years 9.5 years Occupancy 99% 97% 98% Top 10 Tenant Concentration 40% 26% 31% % of Investment Grade Tenants 31% 13% 22% Weighted Average Interest Rate 4.7% 5.4% 5.0% The Combined Portfolio Investing for the long runTM | 11 (1) W. P. Carey Current reflects portfolio as of March 31, 2013. (2) CPA®:16 – Global reflects portfolio as of March 31, 2013. (3) Reflects pro-rata joint venture ownership of certain properties. |

|

|

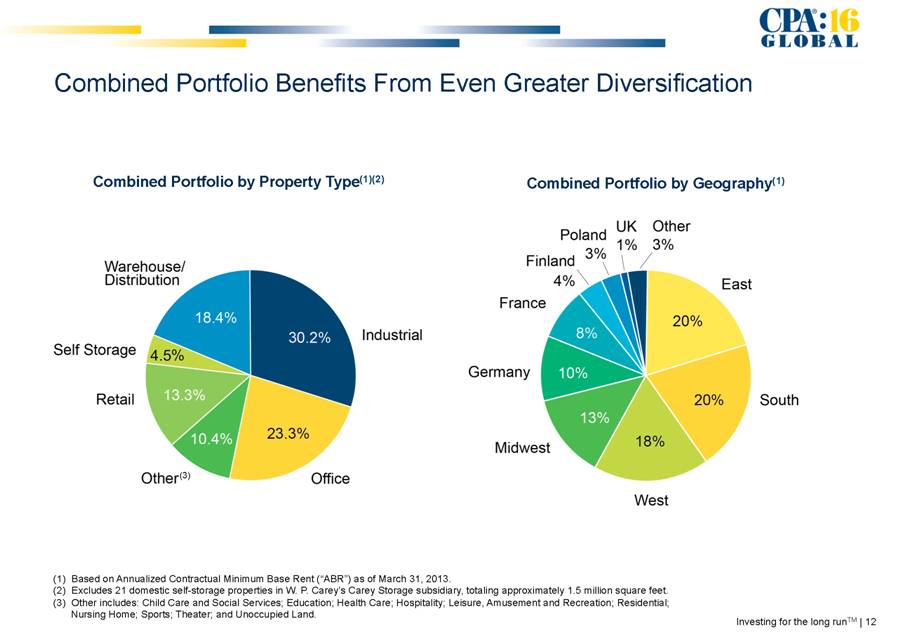

Investing for the long runTM | 12 Combined Portfolio Benefits From Even Greater Diversification Combined Portfolio by Property Type(1)(2) (1) Based on Annualized Contractual Minimum Base Rent (“ABR”) as of March 31, 2013. (2) Excludes 21 domestic self-storage properties in W. P. Carey’s Carey Storage subsidiary, totaling approximately 1.5 million square feet. (3) Other includes: Child Care and Social Services; Education; Health Care; Hospitality; Leisure, Amusement and Recreation; Residential; Nursing Home; Sports; Theater; and Unoccupied Land. Combined Portfolio by Geography(1) |

|

|

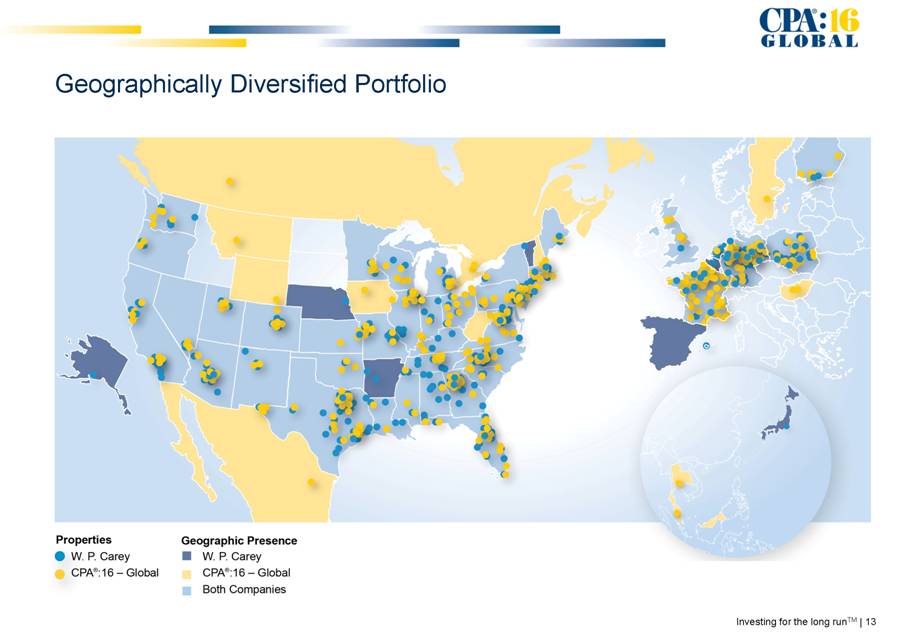

Geographically Diversified Portfolio Investing for the long runTM | 13 |

|

|

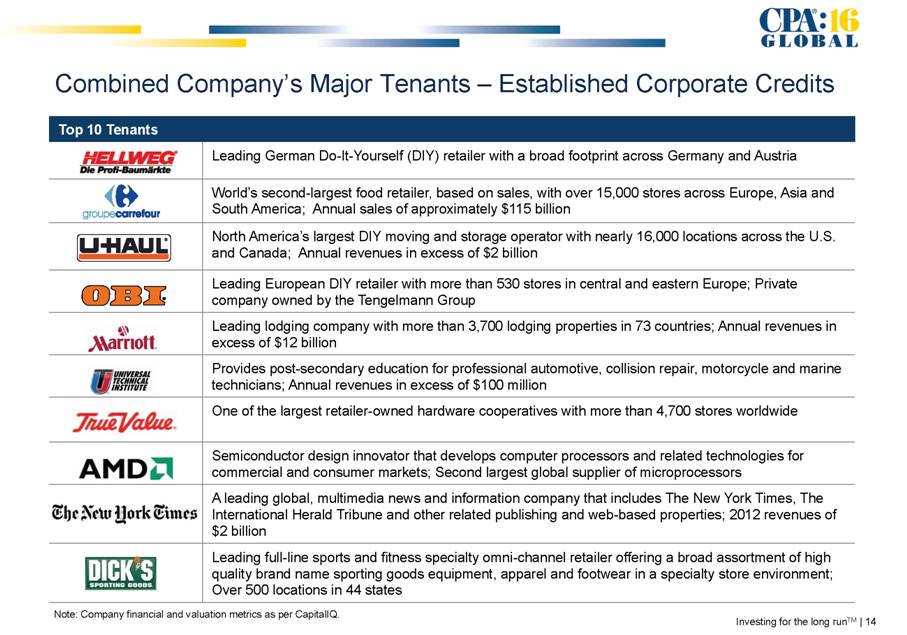

Combined Company’s Major Tenants – Established Corporate Credits Investing for the long runTM | 14 Note: Company financial and valuation metrics as per CapitalIQ. Top 10 Tenants Leading German Do-It-Yourself (DIY) retailer with a broad footprint across Germany and Austria World’s second-largest food retailer, based on sales, with over 15,000 stores across Europe, Asia and South America; Annual sales of approximately $115 billion North America’s largest DIY moving and storage operator with nearly 16,000 locations across the U.S. and Canada; Annual revenues in excess of $2 billion Leading European DIY retailer with more than 530 stores in central and eastern Europe; Private company owned by the Tengelmann Group Leading lodging company with more than 3,700 lodging properties in 73 countries; Annual revenues in excess of $12 billion Provides post-secondary education for professional automotive, collision repair, motorcycle and marine technicians; Annual revenues in excess of $100 million One of the largest retailer-owned hardware cooperatives with more than 4,700 stores worldwide Semiconductor design innovator that develops computer processors and related technologies for commercial and consumer markets; Second largest global supplier of microprocessors A leading global, multimedia news and information company that includes The New York Times, The International Herald Tribune and other related publishing and web-based properties; 2012 revenues of $2 billion Leading full-line sports and fitness specialty omni-channel retailer offering a broad assortment of high quality brand name sporting goods equipment, apparel and footwear in a specialty store environment; Over 500 locations in 44 states |

|

|

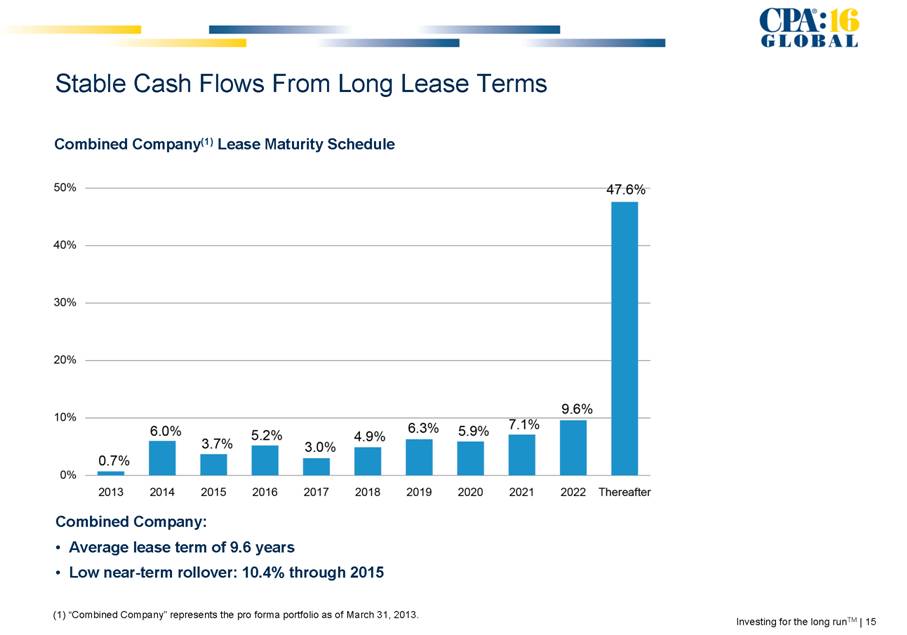

Investing for the long runTM | 15 Stable Cash Flows From Long Lease Terms Combined Company: • Average lease term of 9.6 years • Low near-term rollover: 10.4% through 2015 Combined Company(1) Lease Maturity Schedule (1) “Combined Company” represents the pro forma portfolio as of March 31, 2013. |

|

|

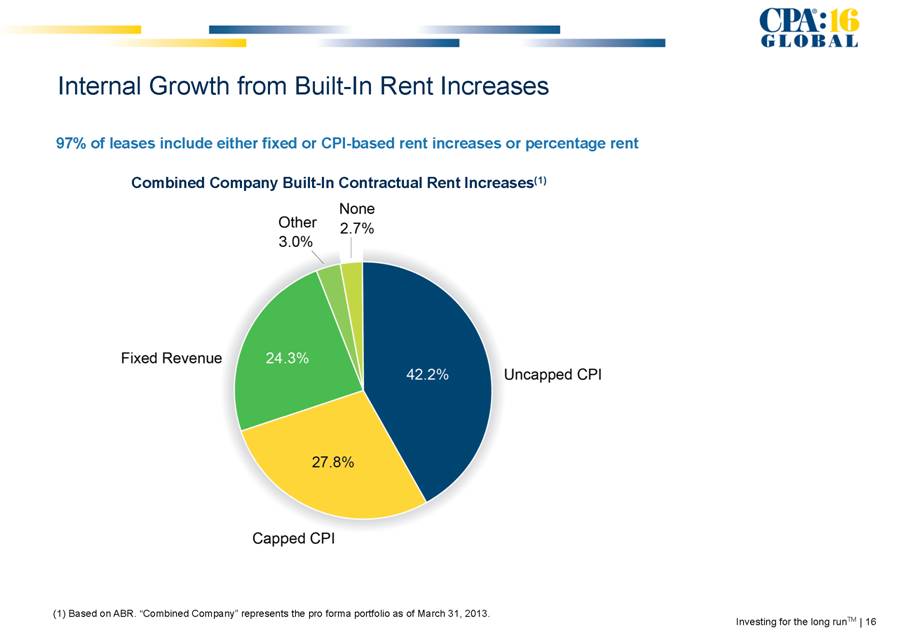

Investing for the long runTM | 16 Internal Growth from Built-In Rent Increases Combined Company Built-In Contractual Rent Increases(1) 97% of leases include either fixed or CPI-based rent increases or percentage rent (1) Based on ABR. “Combined Company” represents the pro forma portfolio as of March 31, 2013. |

|

|

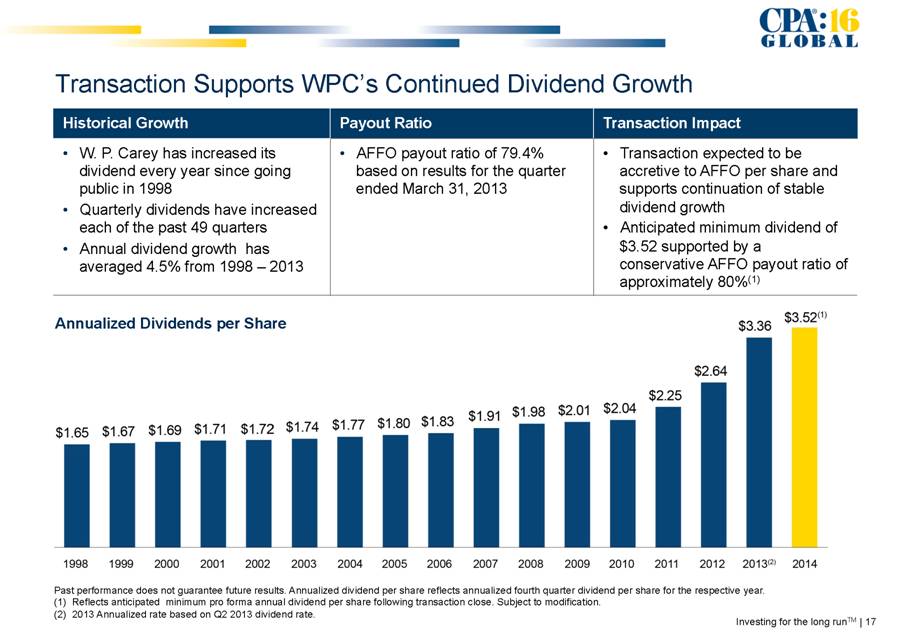

Investing for the long runTM | 17 Transaction Supports WPC’s Continued Dividend Growth Historical Growth Payout Ratio Transaction Impact • W. P. Carey has increased its dividend every year since going public in 1998 • Quarterly dividends have increased each of the past 49 quarters • Annual dividend growth has averaged 4.5% from 1998 – 2013 • AFFO payout ratio of 79.4% based on results for the quarter ended March 31, 2013 • Transaction expected to be accretive to AFFO per share and supports continuation of stable dividend growth • Anticipated minimum dividend of $3.52 supported by a conservative AFFO payout ratio of approximately 80%(1) Annualized Dividends per Share Past performance does not guarantee future results. Annualized dividend per share reflects annualized fourth quarter dividend per share for the respective year. (1) Reflects anticipated minimum pro forma annual dividend per share following transaction close. Subject to modification. (2) 2013 Annualized rate based on Q2 2013 dividend rate. |

|

|

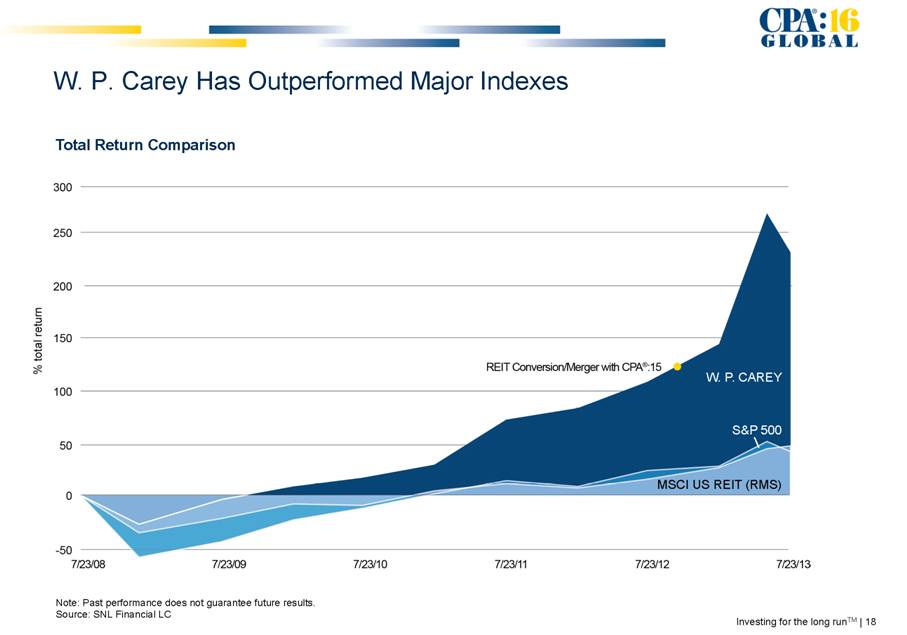

Investing for the long runTM | 18 Note: Past performance does not guarantee future results. Source: SNL Financial LC W. P. Carey Has Outperformed Major Indexes Total Return Comparison W. P. CAREY MSCI US REIT (RMS) S&P 500 |

|

|

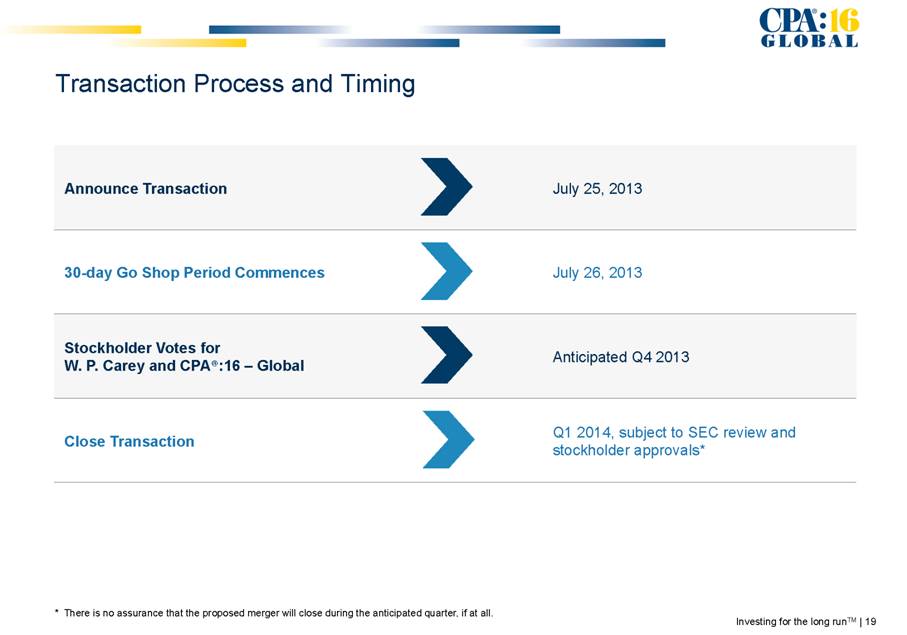

Transaction Process and Timing Investing for the long runTM | 19 * There is no assurance that the proposed merger will close during the anticipated quarter, if at all. Announce Transaction July 25, 2013 30-day Go Shop Period Commences July 26, 2013 Stockholder Votes for W. P. Carey and CPA®:16 – Global Anticipated Q4 2013 Close Transaction Q1 2014, subject to SEC review and stockholder approvals* |

|

|

Compelling Transaction Creating Value for CPA®:16 – Global and W. P. Carey Investors • Provides liquidity to CPA®:16 – Global stockholders at a 29% premium to NAV • Transaction is intended to be tax-deferred for CPA®:16 – Global stockholders • Provides CPA®:16 - Global stockholders with an ability to continue their investment as owners of W. P. Carey • Supports W. P. Carey’s ongoing strategy to increase its diversified portfolio of net lease assets • Transaction is expected to be accretive to AFFO per share, supporting the combined company’s continued stable dividend growth • Substantially increases W. P. Carey’s scale, resulting in a pro forma equity market capitalization of approximately $6.5 billion and a total enterprise value of $10.1 billion Investing for the long runTM | 20 |