Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TOTAL SYSTEM SERVICES INC | d571381d8k.htm |

| EX-99.1 - EX-99.1 - TOTAL SYSTEM SERVICES INC | d571381dex991.htm |

2013

Second Quarter and YTD Results July 23, 2013

©

2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Exhibit 99.2 |

Forward-Looking Statements

This presentation and comments made by management contain forward-

looking statements including, among others, statements regarding

the

expected future operating results of TSYS. These statements are

based on

management’s current expectations and assumptions and are subject to

risks, uncertainties and changes in circumstances. Forward-looking

statements include all statements that are not historical facts and can be

identified by the use of forward-looking terminology such as the words

“believe,” “expect,”

“anticipate,”

“intend,”

“plan,”

“estimate”

or similar expressions. Actual results

may differ materially from those set forth in the forward-looking statements

due to a variety of factors. More information about these risks,

uncertainties and factors may be found in TSYS’

filings with the Securities and Exchange

Commission, including its 2012 Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. TSYS does not

assume any obligation to update any forward-looking statements as a

result of new information, future developments or otherwise.

2

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Use of

Non-GAAP Financial Measures This slide presentation contains certain

non-GAAP financial measures determined by methods other than in

accordance with generally accepted accounting principles. Such non-GAAP

financial measures include the following: revenues before reimbursable

items; operating margin excluding reimbursable items; revenues measured on a

constant currency basis; free cash flow; EBITDA, Adjusted EBITDA and

Adjusted cash earnings per share. The most comparable GAAP measures to these

measures are revenues; operating margin; revenues; cash flows from operating

activities; net income; net income; and earnings per share, respectively.

Management uses these non-GAAP financial measures to assess the

performance of TSYS’ core

business. TSYS believes that these non-GAAP financial measures provide

meaningful additional information about TSYS to assist investors

in evaluating

TSYS’

operating results. These non-GAAP financial measures should not be

considered as a substitute for operating results determined in accordance with

GAAP and may not be comparable to other similarly titled measures of other

companies. The computations of the non-GAAP financial measures used in

this slide presentation are set forth in the Appendix to this slide

presentation. 3

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Phil

Tomlinson Chairman and Chief Executive Officer

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Troy

Woods President & Chief Operating Officer

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

2Q

2013 North America Segment Highlights 6

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Improving Revenue

Operating Income up 10.6%

Margin Expansion: up 210 BPS over 2Q12

Shifting Conversion Pipeline

(*) Revenues Before Reimbursable Items |

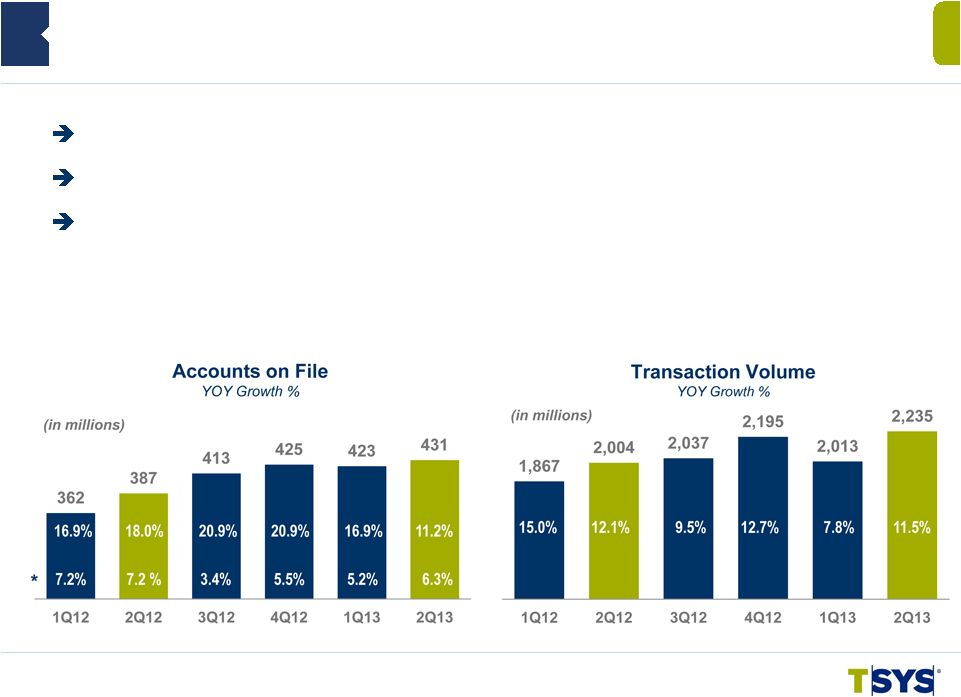

2Q

2013 North America Segment Highlights 7

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

(*)

Growth

Excluding

Prepaid,

Government

Services

and

Single

Use

Accounts

Tenth Straight Quarter of Account On File YOY Growth

Thirteenth Straight Quarter of Transaction YOY Growth

Same Client Transactions up 11.4%: Fifteenth Straight Quarter of

YOY Growth |

©

2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

8

North America Conversion Pipeline

Reporting

Period

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Conversion

Pipeline

Net Total

4Q12

0.20

0.10

11.80

14.10

0.10

75.40

—

0.70

102.40

2013 Total

26.20

1Q13

—

0.10

10.90

0.50

0.70

79.50

9.40

0.30

101.40

2013 Total

11.50

2Q13

—

—

0.50 (1)

0.50

—

79.40

9.20

—

89.60

2013 Total

1.00

(1) Converted 10.7M Accounts 7/13/13

2Q 2013 North America Segment Highlights

(in millions) |

2Q

2013 International Segment Highlights 9

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Revenue $93.2M* –

down 5.9%

–

Up 0.4% on Constant Currency

Currency Headwinds Continue: Q2 $6.2M* YTD $10.2M*

Margin Expansion Continues

1M Account Conversion Pipeline

Renewed Focus on Growth

(*) Revenues Before Reimbursable Items |

2Q

2013 International Segment Highlights 10

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Record Number Accounts Processed

Solid Transaction Growth

Same Client Transaction Growth 9.3% |

2Q

2013 Merchant Segment Highlights 11

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Acquisitions Fueling Growth

Direct Exceeds Indirect

Sequential Quarter Margin Expansion

Bank of America Merchant Services Extended

EMV Certification Complete

Back-end Integration on Schedule

–

Headwind on Margin

(*) Revenues Before Reimbursable Items |

2Q

2013 Merchant Segment Highlights 12

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

(*) Excludes Managed Accounts and ProPay

Record SBS Sales Volume

Indirect Faces Headwinds but Optimistic Growth Still Achievable

POS Transactions, Excluding Deconverted Accounts, Increased 4.8%

|

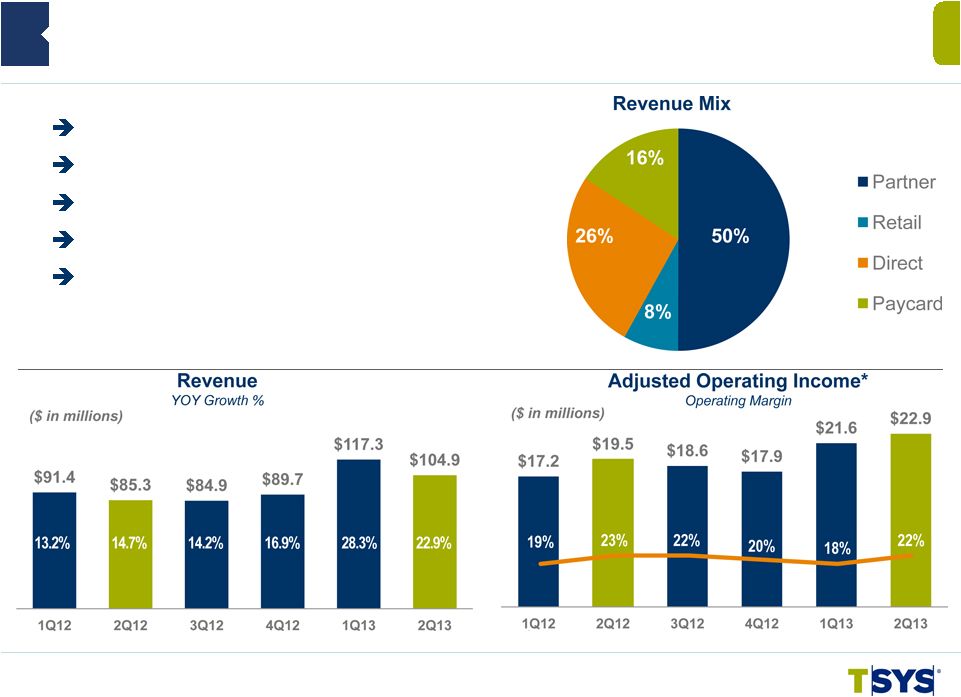

2Q

2013 NetSpend Segment Highlights 13

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Revenue $105M –

up 23%

Significant Sequential Quarter Margin Expansion

Extended Exclusive ACE Agreement 5 Years

Added Over 3,500 Retail Locations

Added 75 New PayCard Clients

(*) Operating Income Excluding Amortization of Acquisition

Intangibles, M&A Costs and Non-recurring Items

|

14

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

2Q 2013 NetSpend Segment Highlights

Gross Dollar Volume

YOY Growth %

Direct Deposit Active Cards

YOY Growth %

Direct Deposit Active Cards up 42%

Total Active Accounts up 38%

Gross Dollar Volume (GDV) up 30% |

Jim

Lipham Chief Financial Officer

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Consolidated Selected Financial Highlights

16

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

$ 478,443

$ 462,651

3.4%

Total Revenues

$ 943,439

$ 923,813

2.1%

417,512

398,691

4.7

Revenues Before Reimbursable Items

821,749

793,870

3.5

95,314

92,096

3.5

Operating Income

170,217

176,927

(3.8)

57,716

66,710

(13.5)

Net Income Attributable to TSYS

Common Shareholders

114,745

123,105

(6.8)

2,727.4

2,406.1

13.4

Total Cardholder Transactions (in millions)

5,175.0

4,656.4

11.1

Basic Earnings Per Share (EPS)

Attributable to TSYS Common

Shareholders:

$0.31

$0.35

(12.9)

As Reported (GAAP)

$0.61

$0.65

(6.0)

$0.34

$0.35

(4.3)

Excluding M&A expenses

$0.67

$0.65

2.9

$0.38

$0.40

(3.5)

Adjusted Cash EPS*

$0.77

$0.73

5.2

$142,324

$140,338

1.4

Adjusted EBITDA*

$267,799

$269,640

(0.7)

YTD

2013

YTD

2012

Percent

Change

(in thousands, except per share data)

2

Qtr

2013

2

Qtr

2012

Percent

Change

(*) Adjusted Cash EPS and Adjusted EBITDA definitions are contained in

Appendix nd

nd |

2013

YTD Revenue Change Revenues Before Reimbursable Items

17

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

12%

16%

4%

0%

5.4%

Internal

Growth

New

Clients

2.9%

Acquisitions

Lost

Business

(5.3%)

Non-recurring

Items

(0.6%)

Price

Compression

(2.3%)

(8.2%)

Reported

3.5%

Currency

(1.3%)

4.7%

8% |

Consumer Credit

208.6

199.4

4.7

208.6

203.8

2.4

Retail

25.9

25.2

2.8

25.9

25.2

2.6

Total Consumer

234.5

224.6

4.5

234.5

229.0

2.4

Commercial

38.6

36.1

6.7

38.6

37.9

1.8

Other

15.3

9.6

60.5

15.3

13.4

14.1

Subtotal

288.4

270.3

6.7

288.4

280.3

2.9

Prepaid /

Stored Value

102.8

105.4

(2.4

)

102.8

107.3

(4.2

)

Government

Services

60.6

30.8

96.4

60.6

59.4

2.1

Commercial Card

Single Use

37.0

34.0

8.8

37.0

31.6

17.0

Total AOF

488.8

440.5

11.0

488.8

478.6

2.1

Consolidated Accounts on File Portfolio Summary

(in millions)

Jun

2013

Jun

2012

%

Change

Jun

2013

Mar

2013

%

Change

18

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

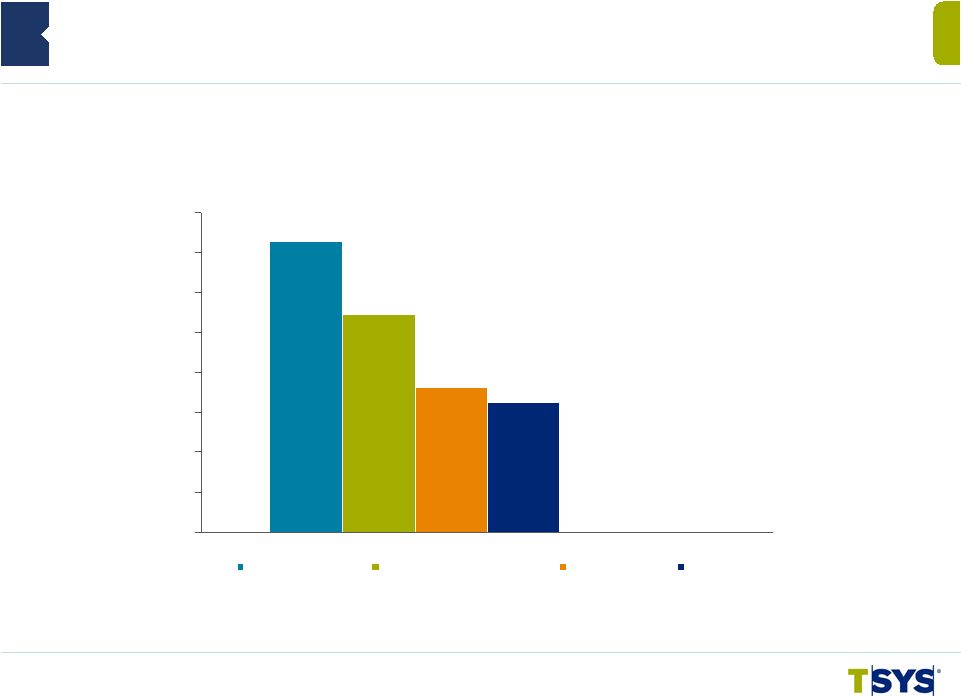

Cash

Flow Strength: 2013 TTM Consolidated Financial Highlights

$545

$410

$271

$244

$0

$75

$150

$225

$300

$375

$450

$525

$600

Adjusted EBITDA

Cash flow from operations

Free cash flow

Net income

19

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

TTM = Trailing Twelve Months

(in millions) |

NetSpend Acquisition

Closed July 1

Approximately $1.4 billion in consideration

–

Includes cash from borrowings and equity

–

Conversion

of

NetSpend

unvested

options

and

nonvested

awards

to

TSYS’

equity

New operating segment named “NetSpend”

One-time M&A costs will also impact second half of 2013 of $11.3 million

Interest expense with new borrowings $23.0-$24.5 million in 2013

Approximately $67 million annual amortization of acquisition intangibles

Synergies

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

20 |

NetSpend Acquisition Financing

May Bond Issuance:

$1,100M*

–

$550M of 5-year notes with a 2.375% coupon

–

$550M of 10-year notes with a 3.750% coupon

July 5-year Term Debt:

$200M

July Credit Facility Revolver Draw:

$100M

Total Acquisition Debt:

$1,400M

Other Outstanding Long-term Debt:

$ 44M

Credit Facility Term Loan Balance:

$143M

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

21

(*)

Shown

at

par

value;

does

not

include

bond

issuance

discounts

or

fees |

2013

Revised Guidance* Range

Range

Percent Change

Total Revenues

$2,137

to

$2,180

14 %

to

17 %

Revenues Before Reimbursable Items

$1,898

to

$1,936

17%

to

20%

Adjusted EBITDA

$639

to

$652

17%

to

19%

Adjusted Cash EPS

$1.69

to

$1.72

16%

to

18%

(in millions, except per share data)

22

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

(*) See Appendix for guidance assumptions |

2013

Guidance Reconciliation Total Revenues

Revenues

Before Reimbursables

Original Guidance

$1,955

to

$1,995

$1,711

to

$1,746

NetSpend Acquisition

197

to

200

197

to

200

Reimbursable Items

(5)

to

(5)

--

--

Currency Translation (Jun YTD)

(10)

to

(10)

(10)

to

(10)

Revised Guidance

$2,137

to

$2,180

$1,898

to

$1,936

(in millions)

23

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

2013

Revised Guidance Revenue Change Revenues Before Reimbursable Items

24

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

30%

15%

0%

Internal

Growth

New

Clients

3-4%

Acquisitions

Lost

Business,

Non-recurring

Items and

Price

Compression

(5-7%)

Guidance

17-20%

Currency

5-7%

15-17%

(1%) |

Closing Remarks

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Q&A

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Appendix

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Appendix: Non-GAAP Items –

Adjusted EBITDA and

Adjusted Cash EPS

•

Adjusted EBITDA is net income excluding equity in income of equity investments,

nonoperating income/(expense), taxes, depreciation, amortization and

stock-based compensation expenses and other non-recurring items..

•

Adjusted cash EPS is adjusted cash earnings divided by weighted average shares

outstanding used for basic EPS calculations. Adjusted cash earnings is net

income excluding the after-tax impact of stock-based compensation

expenses, amortization of acquisition intangibles, and other

non-recurring items. •

The Company believes that these non-GAAP financial measures it presents are

useful to investors in evaluating the Company’s operating performance

for the following reasons: –

adjusted EBITDA and Adjusted cash EPS are widely used by investors to measure a

company’s operating performance without regard to items, such as

interest expense, income tax expense, depreciation and amortization, merger and acquisition expenses

and employee stock-based compensation expense that can vary substantially from

company to company depending upon their respective financing structures and

accounting policies, the book values of their assets, their capital structures and the methods by

which their assets were acquired; and

–

securities

analysts

use

adjusted

EBITDA

and

Adjusted

cash

EPS

as

supplemental

measures

to

evaluate

the

overall

operating

performance of companies.

•

By comparing the Company’s adjusted EBITDA and Adjusted cash EPS in different

historical periods, investors can evaluate the Company’s operating

results without the additional variations caused by employee stock-based compensation expense,

which may not be comparable from period to period due to changes

in the fair market value of the Company’s common stock

(which is influenced by external factors like the volatility of public markets and

the financial performance of the Company’s peers) and is not a key

measure of the Company’s operations. •

The Company’s management uses the non-GAAP financial measures:

–

as measures of operating performance, because they exclude the impact of items not

directly resulting from the Company’s core operations;

–

for planning purposes, including the preparation of the Company’s annual

operating budget; –

to allocate resources to enhance the financial performance of the Company’s

business; –

to evaluate the effectiveness of the Company’s business strategies; and

–

in communications with the Company’s board of directors concerning the

Company’s financial performance. ©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

28 |

Appendix: Non-GAAP Reconciliation –

Revenues Before Reimbursable Items

Three Months

Ended Six Months Ended

6/30/13

6/30/12

6/30/13

6/30/12 Total Revenues

$ 478,443 $

462,651 $

943,439 $

923,813 Reimbursable Items

60,931

63,959

121,690

129,942

Revenues Before Reimbursable Items

$ 417,512

$ 398,692

$ 821,749

$ 793,871

(in thousands)

29

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Three Months Ended

6/30/13 6/30/12

Three Months Ended

6/30/13

6/30/12 Three Months Ended

6/30/13 6/30/12

Operating Income (a)

$ 79,896 $

72,231 $

8,056 $

9,438 $

33,590 $ 32,950

Total Revenues (b)

248,640

239,557

98,087

103,415

136,458

124,903

Reimbursable Items

34,114

33,992

4,878

4,368

23,506

27,202

Revenues Before

Reimbursable Items(c)

214,526

205,565

93,209

99,047

112,952

97,701

Operating Margin (a)/(b)

32.13%

30.15%

8.21%

9.13%

24.62%

26.38%

Operating Margin Excluding Reimbursables (a)/(c)

37.24%

35.14%

8.64%

9.53%

29.74%

33.73%

Appendix: Non-GAAP Reconciliation –

Segment

Operating Margin Excluding Reimbursable Items

North America

International

Merchant

(in thousands)

30

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Six

Months Ended

6/30/13 6/30/12

Percentage

Change

Three

Months Ended

6/30/13 6/30/12

Percentage

Change

Appendix: Non-GAAP Reconciliation –

Constant Currency

(1) Reflects current period results on a non-GAAP basis as if foreign currency

rates did not change from the comparable prior year period. (2) Reflects the

impact of calculated changes in foreign currency rates from the comparable period.

(in thousands)

Consolidated:

Constant Currency (1)

$ 484,810

$ 462,651

4.8%

$953,825

$ 923,813

3.2%

Foreign Currency (2)

(6,367)

---

(10,386)

---

Total Revenues

$478,443

$462,651

3.4%

$943,439

$923,813

2.1%

International Services:

Constant Currency (1)

$ 104,480

$103,415

1.0%

$ 205,665

$ 203,775

0.9%

Foreign Currency (2)

(6,393)

---

(10,482)

---

Total Revenues

$98,087

$103,415

(5.2%)

$195,183

$203,775

(4.2%)

31

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Six

Months Ended

6/30/13 6/30/12

Percentage

Change

Three

Months Ended

6/30/13 6/30/12

Percentage

Change

Appendix: Non-GAAP Reconciliation –

Constant Currency

(1) Reflects current period results on a non-GAAP basis as if foreign currency

rates did not change from the comparable prior year period. (2) Reflects the

impact of calculated changes in foreign currency rates from the comparable period.

(in thousands)

Consolidated:

Constant Currency (1)

$ 423,725

$ 398,692

6.3%

$831,918

$ 793,871

4.8%

Foreign Currency (2)

(6,213)

---

(10,169)

---

Revenues before

reimbursable items

$417,512

$398,692

4.7%

$821,749

$793,871

3.5%

International Services:

Constant Currency (1)

$ 99,449

$99,047

0.4%

$ 196,067

$ 195,538

0.3%

Foreign Currency (2)

(6,240)

---

(10,265)

---

Revenues before

reimbursable items

$93,209

$99,047

(5.9%)

$185,802

$195,538

(5.0%)

32

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Appendix: Non-GAAP Reconciliation –

EBITDA and Adjusted EBITDA

(in thousands)

33

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Three Months Ended

Six Months Ended

Mar

Jun

Sep

Dec

Mar

Jun

Jun

Jun

2012

2012

2012

2012

2013

2013

2013

2012

Net income :

As reported (GAAP) (a)

$57,644

$67,977

$62,043

$62,257

$59,149

$60,561

$119,710

$125,622

Adjusted for:

Deduct: Equity in Income of

Equity Investments

(2,774)

(2,252)

(1,957)

(3,188)

(3,817)

(2,748)

(6,565)

(5,026)

Add: Income Taxes

29,556

24,553

30,228

30,767

17,845

29,947

47,793

54,108

Add: Nonoperating expenses

405

1,818

579

(5)

1,726

7,554

9,279

2,223

Add: Depreciation and

amortization

40,873

43,213

43,243

43,281

42,498

40,546

83,044

84,086

EBITDA

$125,704

$135,309

$134,136

$133,112

$117,401

$135,860

$253,261

$261,013

Adjust for:

Add: Share-based

compensation

3,598

5,029

3,722

6,273

4,593

5,211

9,804

8,627

Add: NetSpend M&A expenses

--

--

--

--

3,481

1,253

4,734

--

Adjusted EBITDA

$129,302

$140,338

$137,858

$139,385

$125,475

$142,324

$267,799

$269,640 |

Appendix: Non-GAAP Reconciliation –

Adjusted Cash EPS

(in thousands)

34

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Three Months Ended

Six Months Ended

Mar

Jun

Sep

Dec

Mar

Jun

Jun

Jun

2012

2012

2012

2012

2013

2013

2013

2012

Net income Available to TSYS

Common Shareholders:

As reported (GAAP) (a)

$56,395

$66,710

$60,312

$60,862

$57,028

$57,716

$114,745

$123,106

Adjusted for amounts

attributable to TSYS common

shareholders (net of taxes):

Acquisition intangible

amortization

3,933

4,409

4,383

4,528

6,096

4,847

10,848

8,355

Share-based compensation

2,363

3,686

2,489

4,169

3,494

3,431

6,917

6,004

Cash earnings

$62,691

$74,805

$67,184

$69,559

$66,618

$65,994

$132,510

$137,465

M&A expenses

--

--

--

--

$5,222

$5,653

$10,875

--

Adjusted cash earnings (b)

$62,691

$74,805

$67,184

$69,559

$71,840

$71,647

$143,385

$137,465

Average common shares

outstanding and participating

securities(c)

188,718

189,070

187,878

186,471

186,807

187,738

187,277

188,894

Basic EPS Available to TSYS

Common Shareholders (a) / (c)

$0.30

$0.35

$0.32

$0.32

$0.31

$0.31

$0.71

$0.73

Adjusted cash EPS Available to

TSYS Common Shareholders

(b) / (c)

$0.33

$0.40

$0.36

$0.37

$0.38

$0.38

$0.77

$0.73 |

Appendix: Non-GAAP Reconciliation –

EBITDA and Adjusted EBITDA

Trailing Twelve

Months Ended

6/30/2013

Net Income

$ 244,010

Adjusted for:

Deduct: Equity in Income of Equity Investments

(11,709)

Add: Income Taxes

108,787

Add: Nonoperating expense

9,854

Add: Depreciation and Amortization

169,568

EBITDA

$ 520,510

Adjust for: Share-based compensation

19,798

NetSpend M&A Operating Expenses

4,734

Adjusted EBITDA

$ 545,042

(in thousands)

35

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Appendix: Non-GAAP Reconciliation –

Free Cash Flow

Trailing Twelve

Months Ended

6/30/2013

Cash Flows from Operating Activities

$ 409,596

Less:

Purchase of Property and Equipment

(31,286)

Additions to Licensed Computer Software from Vendors

(43,434)

Additions to Internally Developed Computer Software

(21,686)

Additions to Contract Acquisition Costs

(42,150)

Free Cash Flow

$ 271,040

(in thousands)

36

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Mar

31, 2013

Dec 31,

2012

Jun 30,

2012

Jun 30,

2013

Sep 30,

2012

Appendix: Non-GAAP Reconciliation –

NetSpend

Adjusted Operating Income

Mar 31,

2012

Operating income (loss) (GAAP)

($ 8,964)

$ 17,430

$ 7,869

$ 17,594

$ 18,332

$ 15,799

Adjusted for:

Add: Amortization of acquisition

intangibles

881

534

446

434

590

431

Add: Settlement (gains) and

other losses

25,315

1,533

10,300

(160)

48

3,423

Add: M&A expenses

--

--

--

--

2,656

3,219

Adjusted operating income

$ 17,232

$ 19,497

$ 18,615

$ 17,868

$ 21,626

$ 22,872

(in thousands)

37

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Three Months Ended |

Appendix: 2013 Revised Guidance Assumptions

The guidance includes:

©2013

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

38

•

NetSpend’s operating results for six months of 2013;

•

Excludes one-time expenses incurred in connection with the NetSpend

acquisition of $16.0 million;

•

Assumes approximately $33.5 million ($67 million on an annual basis)

of acquisition intangible amortization associated with the NetSpend

acquisition;

•

No significant movement in foreign exchange rates; and

•

Minimal synergies for 2013. |