Attached files

| file | filename |

|---|---|

| 8-K - THERMOGENESIS CORPORATION 8-K 7-18-2013 - ThermoGenesis Holdings, Inc. | form8k.htm |

1

2

Cesca Therapeutics is (to our knowledge) the first company to integrate all of the essential: 1. Cell friendly devices, 2. Proprietary cell formulations, and • Strict clinical steps to ensure the autologous therapy is precisely delivered and predictable. 3. Using our own CRO, not only saves significant upfront costs on early trials, but also ensures that the translation of our technology to the clinical trial physicians is completed thoroughly and accurately - ensuring every protocol detail is followed thus improving the probability for safety and efficacy endpoint achievement. Unlike some recent late stage failures by competitors in this space, being closer to the clinical process minimizes the risk that impractical expectations are placed on the treating physician and or patient. We have completed 10 pilot or Phase 1 clinical trials and will advance six (6) indications. (the remaining 4 indications will remain available for licensing) By combining the companies and technologies, we are able to address the US FDA's position on "combination products" as outlined in their multiple guidance documents to industry. This naturally unlocks intrinsic value, and should translate into shareholder value.

3

TotipotentRx has been operational in the clinical space since 2007, and the Founders and senior team have more than 50 years of combined experience in the cell therapy space. TotipotentRx's leadership Board prior to the merger encompasses scientists, physicians, and former healthcare investment bank executives from leading institutions including Deutsche Bank. TotipotentRx has developed 8 different therapeutic combination products, many of them incorporating ThermoGenesis' devices, and has completed 10 clinical trials to date. The therapies are focused in cardiovascular, orthopedics and neurological indications. TotipotentRx is partnered with Fortis Healthcare, one of the world's largest multispecialty hospital chains. The Company has recently opened a state-of-art GMP cell production facility, and operates the only private CRO organization embedded in a research clinical setting within Fortis' Memorial Research Institute. Additionally, TotipotentRxh as an ISO13485 certified manufacturing facility where cell therapy devices can be prototyped and manufactured to commercial scale.

4

5

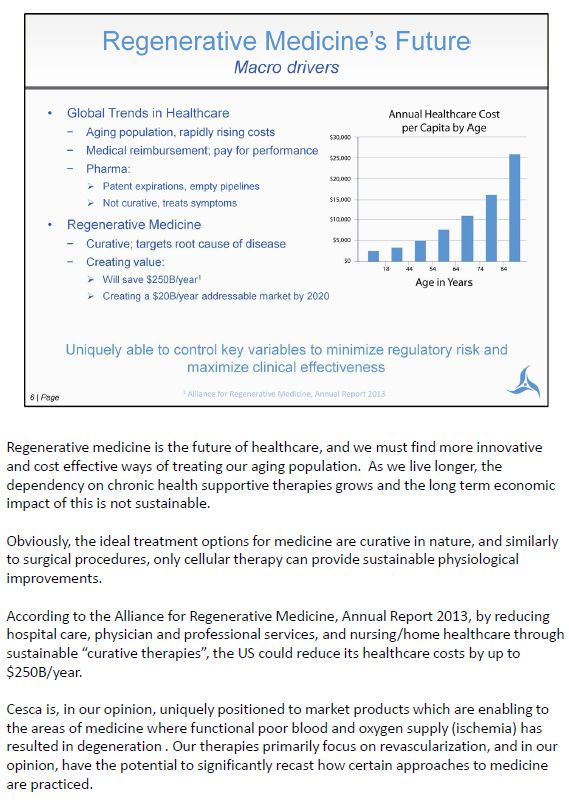

Regenerative medicine is the future of healthcare, and we must find more innovative and cost effective ways of treating our aging population. As we live longer, the dependency on chronic health supportive therapies grows and the long term economic impact of this is not sustainable. Obviously, the ideal treatment options for medicine are curative in nature, and similarly to surgical procedures, only cellular therapy can provide sustainable physiological improvements. According to the Alliance for Regenerative Medicine, Annual Report 2013, by reducing hospital care, physician and professional services, and nursing/home healthcare through sustainable "curative therapies", the US could reduce its healthcare costs by up to $250B/year. Cesca is, in our opinion, uniquely positioned to market products which are enabling to the areas of medicine where functional poor blood and oxygen supply (ischemia) has resulted in degeneration . Our therapies primarily focus on revascularization, and in our opinion, have the potential to significantly recast how certain approaches to medicine are practiced.

6

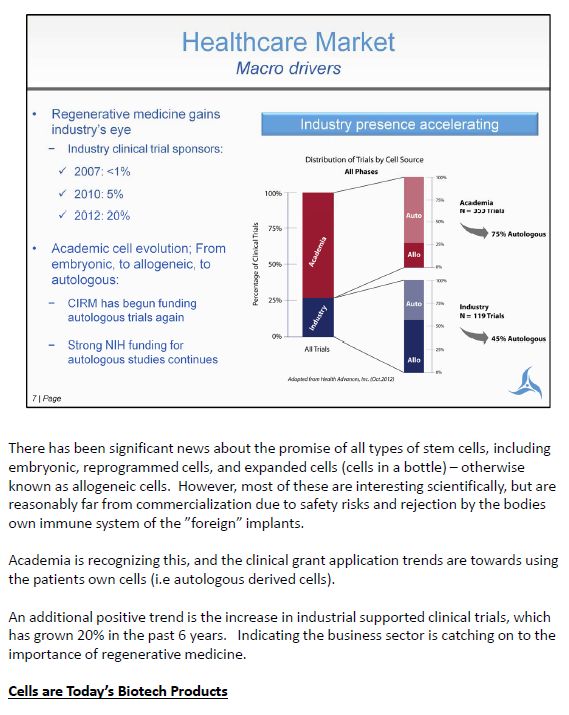

There has been significant news about the promise of all types of stem cells, including embryonic, reprogrammed cells, and expanded cells (cells in a bottle) – otherwise known as allogeneic cells. However, most of these are interesting scientifically, but are reasonably far from commercialization due to safety risks and rejection by the bodies own immune system of the "foreign" implants. Academia is recognizing this, and the clinical grant application trends are towards using the patients own cells (i.e autologous derived cells). An additional positive trend is the increase in industrial supported clinical trials, which has grown 20% in the past 6 years. Indicating the business sector is catching on to the importance of regenerative medicine. Cells are Today's Biotech Products

7

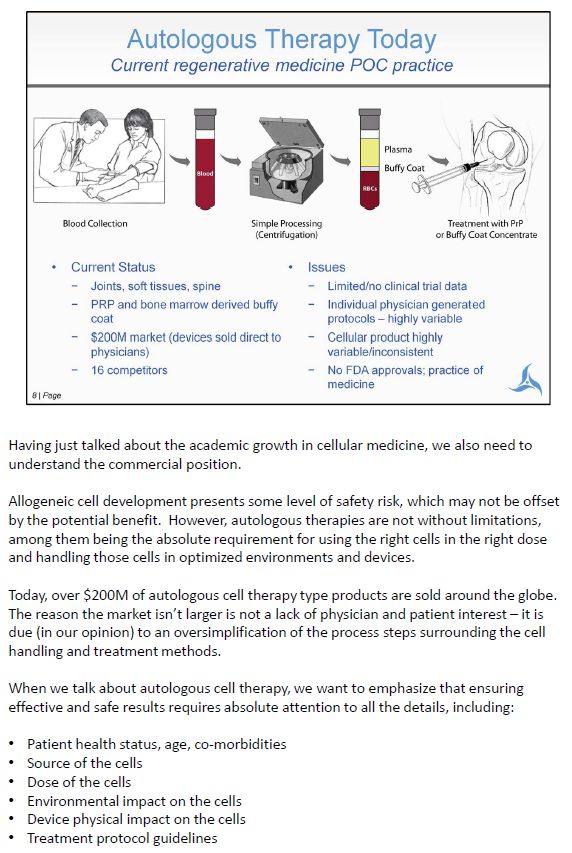

Having just talked about the academic growth in cellular medicine, we also need to understand the commercial position. Allogeneic cell development presents some level of safety risk, which may not be offset by the potential benefit. However, autologous therapies are not without limitations, among them being the absolute requirement for using the right cells in the right dose and handling those cells in optimized environments and devices. Today, over $200M of autologous cell therapy type products are sold around the globe. The reason the market isn't larger is not a lack of physician and patient interest – it is due (in our opinion) to an oversimplification of the process steps surrounding the cell handling and treatment methods. When we talk about autologous cell therapy, we want to emphasize that ensuring effective and safe results requires absolute attention to all the details, including: • Patient health status, age, co-morbidities • Source of the cells • Dose of the cells • Environmental impact on the cells • Device physical impact on the cells • Treatment protocol guidelines

8

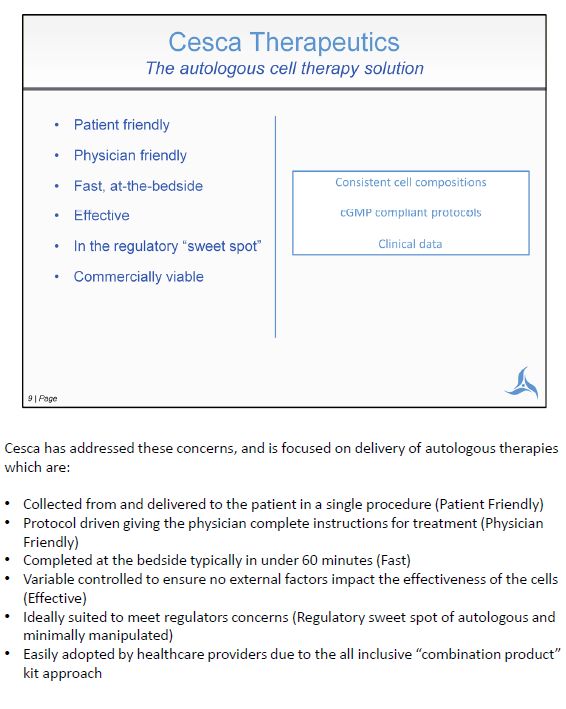

Cesca has addressed these concerns, and is focused on delivery of autologous therapies which are: • Collected from and delivered to the patient in a single procedure (Patient Friendly) • Protocol driven giving the physician complete instructions for treatment (Physician Friendly) • Completed at the bedside typically in under 60 minutes (Fast) • Variable controlled to ensure no external factors impact the effectiveness of the cells (Effective) • Ideally suited to meet regulators concerns (Regulatory sweet spot of autologous and minimally manipulated) • Easily adopted by healthcare providers due to the all inclusive "combination product" kit approach

9

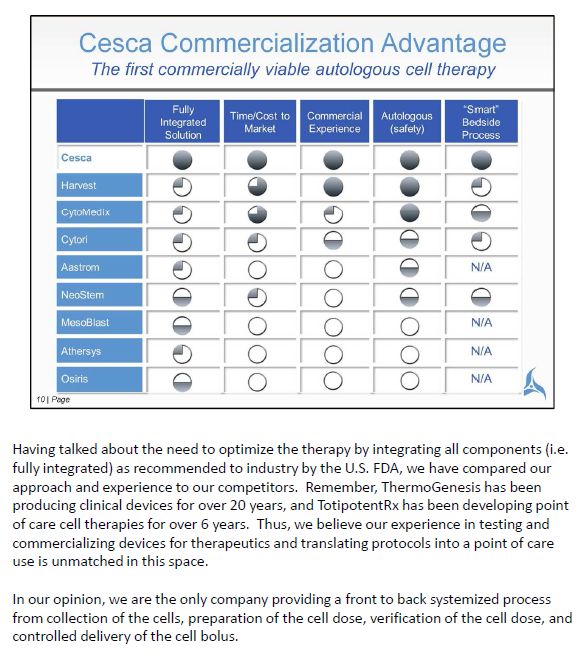

Having talked about the need to optimize the therapy by integrating all components (i.e. fully integrated) as recommended to industry by the U.S. FDA, we have compared our approach and experience to our competitors. Remember, ThermoGenesis has been producing clinical devices for over 20 years, and TotipotentRx has been developing point of care cell therapies for over 6 years. Thus, we believe our experience in testing and commercializing devices for therapeutics and translating protocols into a point of care use is unmatched in this space. In our opinion, we are the only company providing a front to back systemized process from collection of the cells, preparation of the cell dose, verification of the cell dose, and controlled delivery of the cell bolus.

10

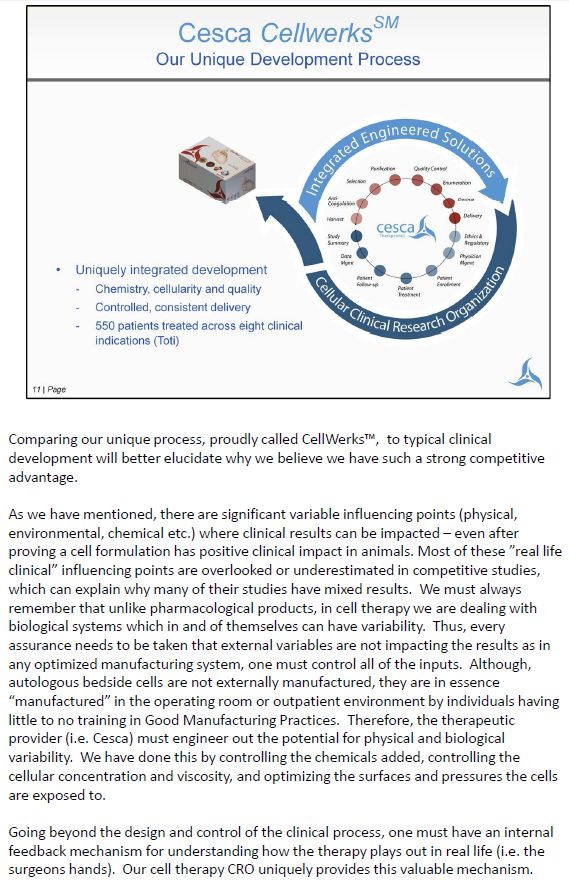

Comparing our unique process, proudly called CellWerks™, to typical clinical development will better elucidate why we believe we have such a strong competitive advantage. As we have mentioned, there are significant variable influencing points (physical, environmental, chemical etc.) where clinical results can be impacted – even after proving a cell formulation has positive clinical impact in animals. Most of these "real life clinical" influencing points are overlooked or underestimated in competitive studies, which can explain why many of their studies have mixed results. We must always remember that unlike pharmacological products, in cell therapy we are dealing with biological systems which in and of themselves can have variability. Thus, every assurance needs to be taken that external variables are not impacting the results as in any optimized manufacturing system, one must control all of the inputs. Although, autologous bedside cells are not externally manufactured, they are in essence "manufactured" in the operating room or outpatient environment by individuals having little to no training in Good Manufacturing Practices. Therefore, the therapeutic provider (i.e. Cesca) must engineer out the potential for physical and biological variability. We have done this by controlling the chemicals added, controlling the cellular concentration and viscosity, and optimizing the surfaces and pressures the cells are exposed to. Going beyond the design and control of the clinical process, one must have an internal feedback mechanism for understanding how the therapy plays out in real life (i.e. the surgeons hands). Our cell therapy CRO uniquely provides this valuable mechanism.

11

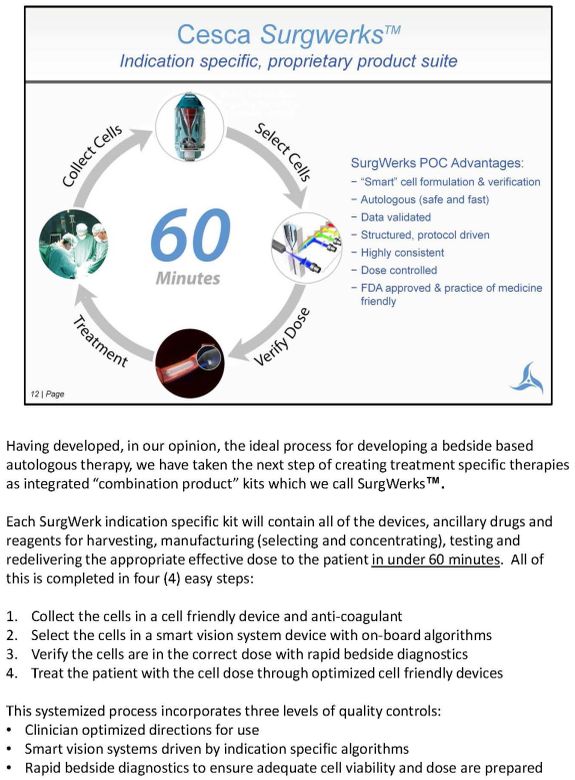

Having developed, in our opinion, the ideal process for developing a bedside based autologous therapy, we have taken the next step of creating treatment specific therapies as integrated "combination product" kits which we call SurgWerks™. Each SurgWerk indication specific kit will contain all of the devices, ancillary drugs and reagents for harvesting, manufacturing (selecting and concentrating), testing and redelivering the appropriate effective dose to the patient in under 60 minutes. All of this is completed in four (4) easy steps: 1. Collect the cells in a cell friendly device and anti-coagulant 2. Select the cells in a smart vision system device with on-board algorithms 3. Verify the cells are in the correct dose with rapid bedside diagnostics 4. Treat the patient with the cell dose through optimized cell friendly devices This systemized process incorporates three levels of quality controls: • Clinician optimized directions for use • Smart vision systems driven by indication specific algorithms • Rapid bedside diagnostics to ensure adequate cell viability and dose are prepared

12

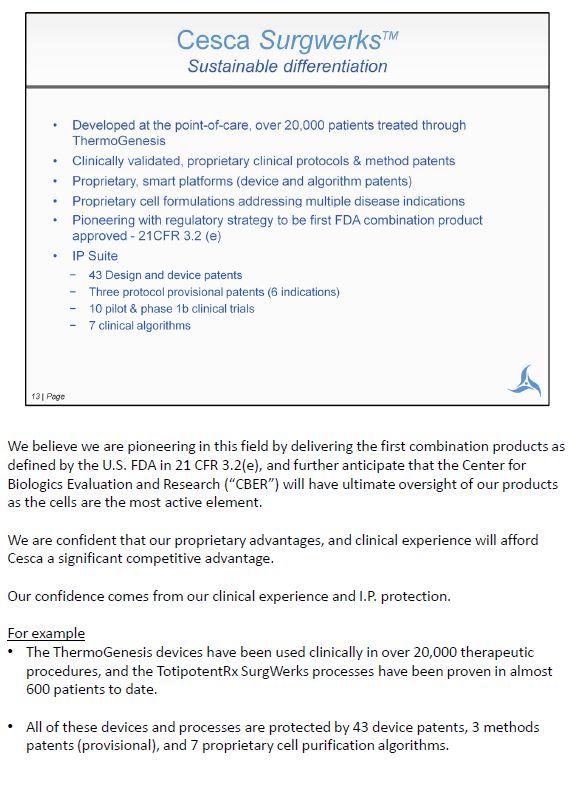

We believe we are pioneering in this field by delivering the first combination products as defined by the U.S. FDA in 21 CFR 3.2(e), and further anticipate that the Center for Biologics Evaluation and Research ("CBER") will have ultimate oversight of our products as the cells are the most active element. We are confident that our proprietary advantages, and clinical experience will afford Cesca a significant competitive advantage. Our confidence comes from our clinical experience and I.P. protection. For example • The ThermoGenesis devices have been used clinically in over 20,000 therapeutic procedures, and the TotipotentRx SurgWerks processes have been proven in almost 600 patients to date. • All of these devices and processes are protected by 43 device patents, 3 methods patents (provisional), and 7 proprietary cell purification algorithms.

13

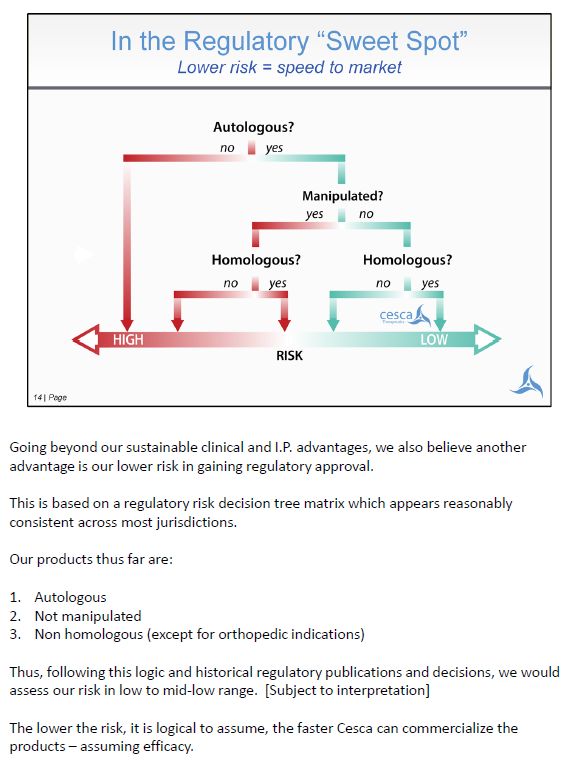

Going beyond our sustainable clinical and I.P. advantages, we also believe another advantage is our lower risk in gaining regulatory approval. This is based on a regulatory risk decision tree matrix which appears reasonably consistent across most jurisdictions. Our products thus far are: 1. Autologous 2. Not manipulated 3. Non homologous (except for orthopedic indications) Thus, following this logic and historical regulatory publications and decisions, we would assess our risk in low to mid-low range. [Subject to interpretation] The lower the risk, it is logical to assume, the faster Cesca can commercialize the products – assuming efficacy.

14

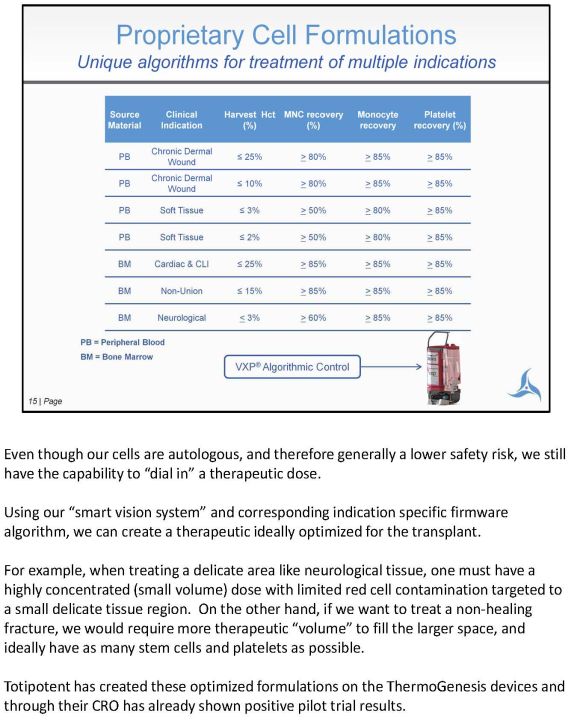

Even though our cells are autologous, and therefore generally a lower safety risk, we still have the capability to "dial in" an therapeutic dose. Using our "smart vision system" and corresponding indication specific firmware algorithm, we can create a therapeutic ideally optimized for the transplant. For example, when treating a delicate area like neurological tissue, one must have a highly concentrated (small volume) dose with limited red cell contamination targeted to a small delicate tissue region. If we want to treat a non-healing fracture on the other hand, we would require more therapeutic "volume" to fill the larger space, and ideally have as many stem cells and platelets as possible. Totipotent has created these optimized formulations on the ThermoGenesis devices and through their CRO has already shown positive pilot trial results.

15

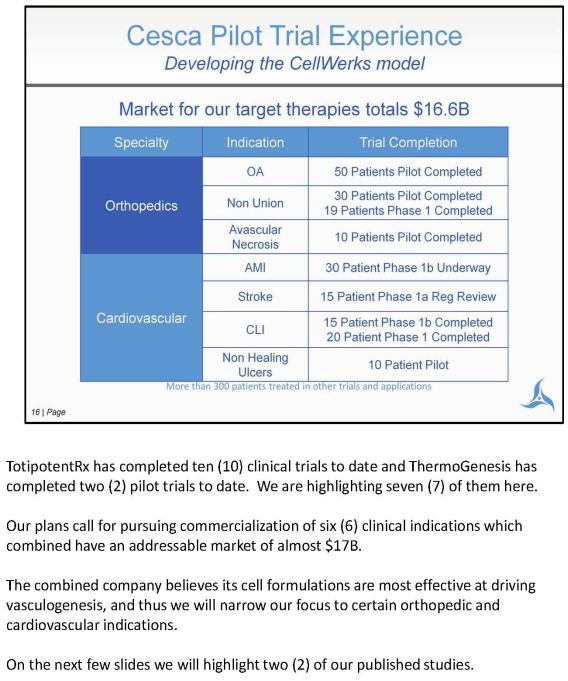

TotipotentRx has completed ten (10) clinical trials to date and ThermoGenesis has completed two (2) pilot trials to date. We are highlighting seven (7) of them here. Our plans call for pursuing commercialization of six (6) clinical indications which combined have an addressable market of almost $17B. The combined company believes its cell formulations are most effective at driving vasculogenesis, and thus we will narrow our focus to certain orthopedic and cardiovascular indications. On the next few slides we will highlight two (2) of our published studies.

16

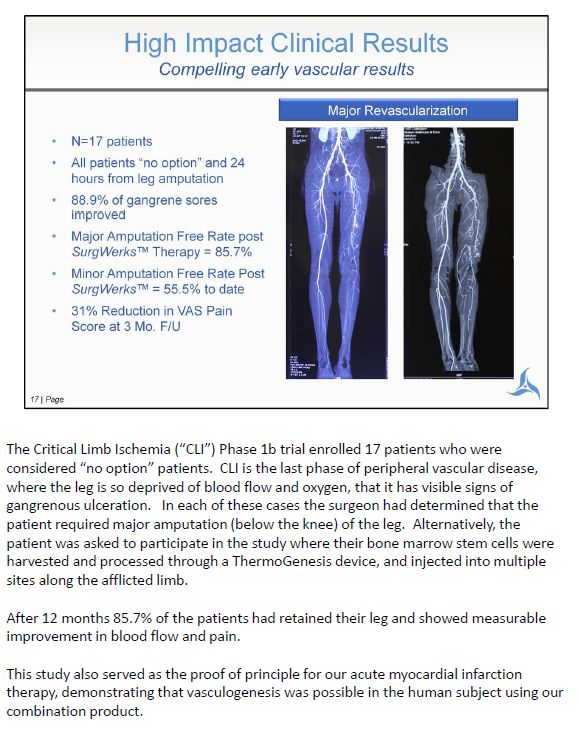

The Critical Limb Ischemia ("CLI") Phase 1b trial enrolled 17 patients who were considered "no option" patients. CLI is the last phase of peripheral vascular disease, where the leg is so deprived of blood flow and oxygen, that it has visible signs of gangrenous ulceration. In each of these cases the surgeon had determined that the patient required major amputation (below the knee) of the leg. Alternatively, the patient was asked to participate in the study where their bone marrow stem cells were harvested and processed through a ThermoGenesis device, and injected into multiple sites along the afflicted limb. After 12 months 85.7% of the patients had retained their leg and showed measurable improvement in blood flow and pain. This study also served as the proof of principle for our acute myocardial infarction therapy, demonstrating that vasculogenesis was possible in the human subject using our combination product.

17

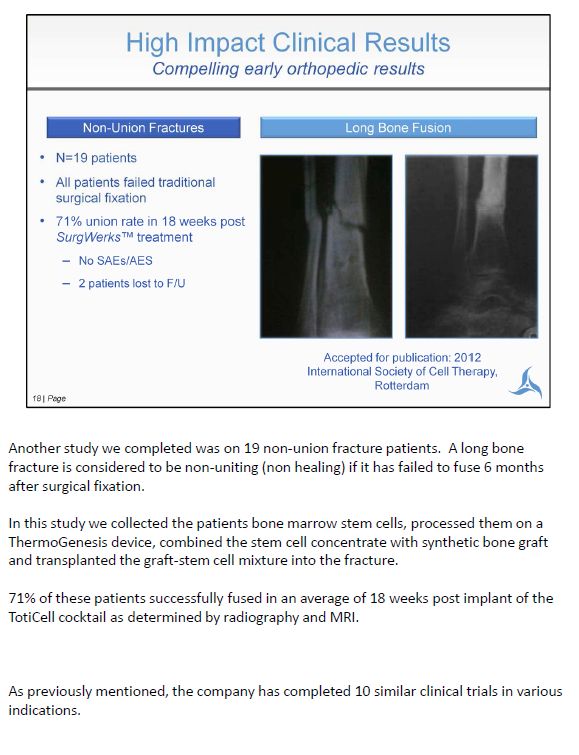

Another study we completed was on 19 non-union fracture patients. A long bone fracture is considered to be non-uniting (non healing) if it has failed to fuse 6 months after surgical fixation. In this study we collected the patients bone marrow stem cells, processed them on a ThermoGenesis device, combined the stem cell concentrate with synthetic bone graft and transplanted the graft-stem cell mixture into the fracture. 71% of these patients successfully fused in an average of 18 weeks post implant of the TotiCell cocktail as determined by radiography and MRI. As previously mentioned, the company has completed 10 similar clinical trials in various indications.

18

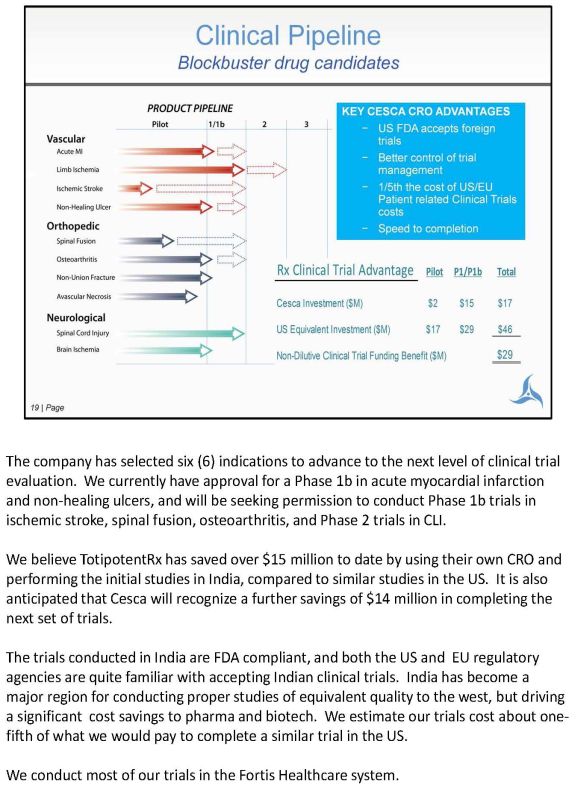

The company has selected six (6) indications to advance to the next level of clinical trial evaluation. We currently have approval for a Phase 1b in acute myocardial infarction and non-healing ulcers, and will be seeking permission to conduct Phase 1b trials in ischemic stroke, spinal fusion, osteoarthritis, and Phase 2 trials in CLI. TotipotentRx has saved over $15 million to date by using their own CRO and performing the initial studies in India, compared to similar studies in the US. It is also anticipated that Cesca will recognize a further savings of $14 million in completing the next set of trials. The trials conducted in India are FDA compliant, and both the US and EU regulatory agencies are quite familiar with accepting Indian clinical trials. India has become a major region for conducting proper studies of equivalent quality to the west, but driving a significant cost savings to pharma and biotech. We estimate our trials cost about onefifth of what we would pay to complete a similar trial in the US. We conduct most of our trials in the Fortis Healthcare system.

19

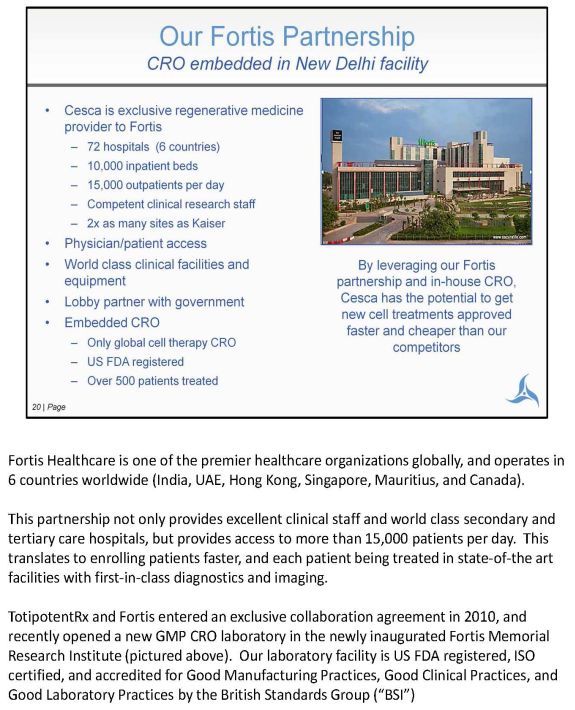

Fortis Healthcare is one of the premier healthcare organizations globally, and operate in 6 countries worldwide (India, UAE, Hong Kong, Singapore, Mauritius, and Canada). This partnership not only provides excellent clinical staff and world class secondary and tertiary care hospitals, but provides access to more than 15,000 patients per day. This translates to enrolling patients faster, and each patient being treated in state-of-the art facilities with first-in-class diagnostics and imaging. TotipotentRx and Fortis entered an exclusive collaboration agreement in 2010, and recently opened a new GMP CRO laboratory in the newly inaugurated Fortis Memorial Research Institute (pictured above). Our laboratory facility is US FDA registered, ISO certified, and accredited for Good Manufacturing Practices, Good Clinical Practices, and Good Laboratory Practices by the British Standards Group ("BSI")

20

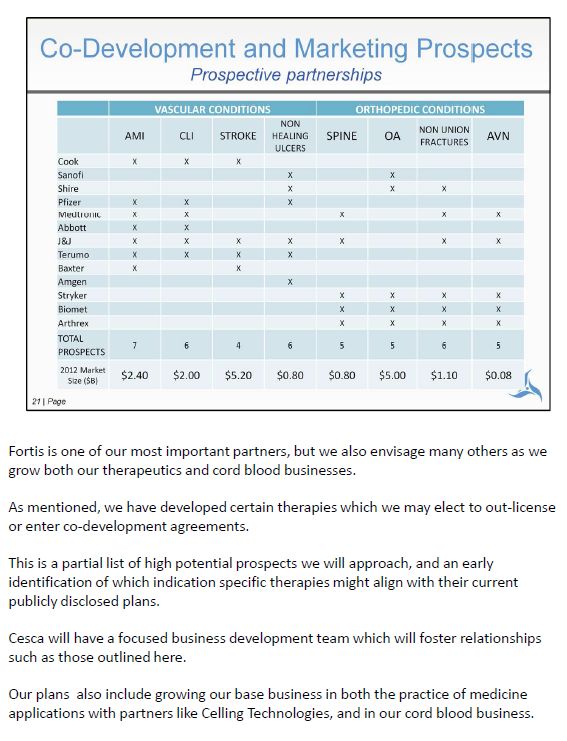

Fortis is one of our most important partners, but we also envisage many others as we grow both our therapeutics and cord blood businesses. As mentioned, we have developed certain therapies which we may elect to out-license or enter co-development agreements. This is a partial list of high potential prospects we will approach, and an early identification of which indication specific therapies might align with their current publicly disclosed plans. Cesca will have a focused business development team which will foster relationships such as those outlined here. Our plans also include growing our base business in both the practice of medicine applications with partners like Celling Technologies, and in our cord blood business.

21

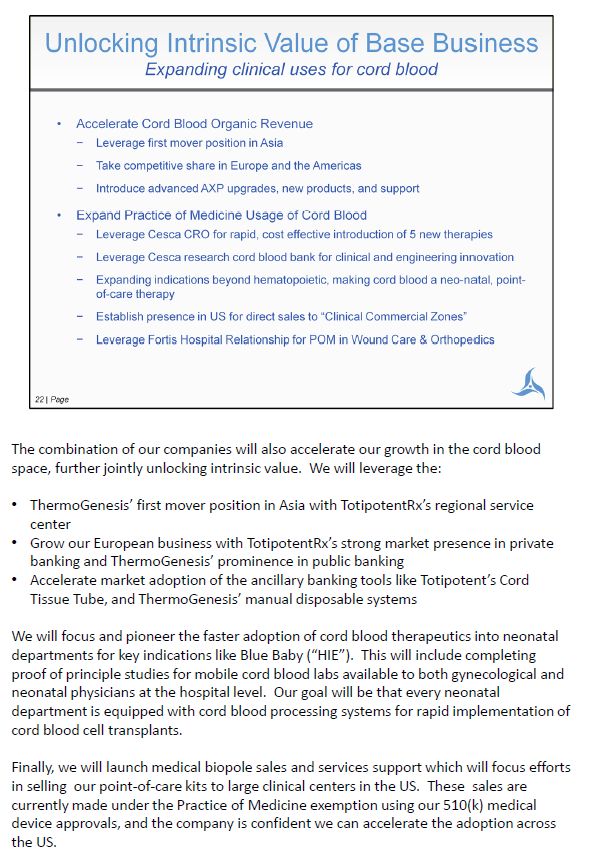

The combination of our companies will also accelerate our growth in the cord blood space, further jointly unlocking intrinsic value. We will leverage the: • ThermoGenesis' first mover position in Asia with TotipotentRx's regional service center • Grow our European business with TotipotentRx's strong market presence in private banking and ThermoGenesis' prominence in public banking • Accelerate market adoption of the ancillary banking tools like Totipotent's Cord Tissue Tube, and ThermoGenesis' manual disposable systems We will focus and pioneer the faster adoption of cord blood therapeutics into neonatal departments for key indications like Blue Baby ("HIE"). This will include completing proof of principle studies for mobile cord blood labs available to both gynecological and neonatal physicians at the hospital level. Our goal will be that every neonatal department is equipped with cord blood processing systems for rapid implementation of cord blood cell transplants. Finally, we will launch medical biopole sales and services support which will focus efforts in selling our point-of-care kits to large clinical centers in the US. These sales are currently made under the Practice of Medicine exemption using our 510(k) medical device approvals, and the company is confident we can accelerate the adoption across the US.

22

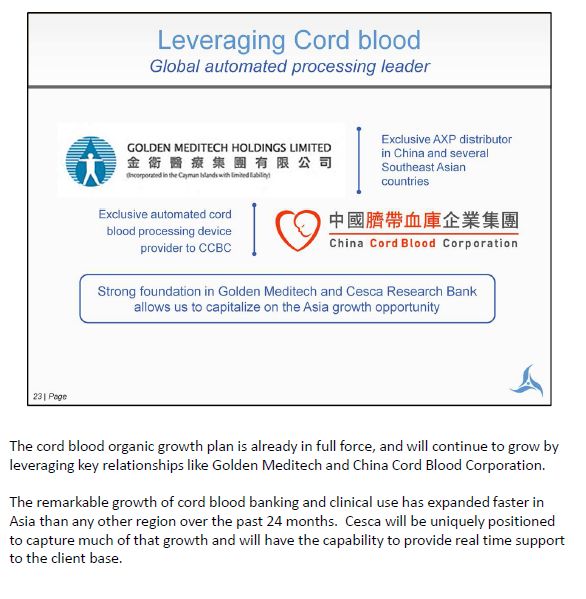

The cord blood organic growth plan is already in full force, and will continue to grow by leveraging key relationships like Golden Meditech and China Cord Blood Corporation. The remarkable growth of cord blood banking and clinical use has expanded faster in Asia than any other region over the past 24 months. Cesca will be uniquely positioned to capture much of that growth and will have the capability to provide real time support to the client base.

23

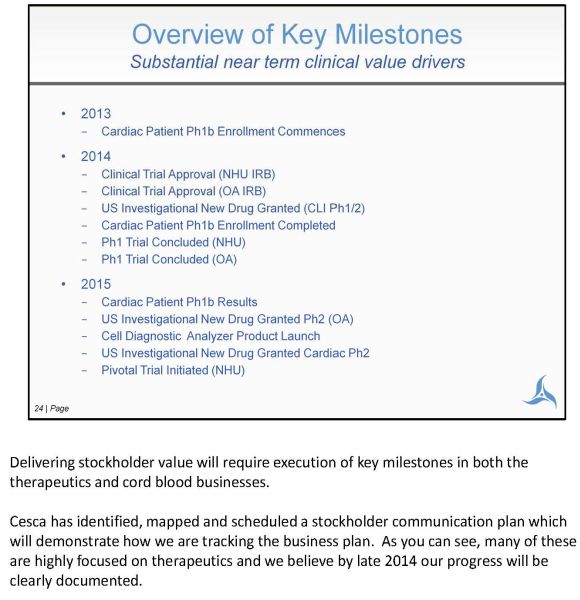

Delivering stockholder value will require execution of key milestones in both the therapeutics and cord blood businesses. Cesca has identified, mapped and scheduled a stockholder communication plan which will demonstrate how we are tracking the business plan. As you can, many of these are highly focused on therapeutics and we believe by late 2014 our progress will be clearly documented.

24

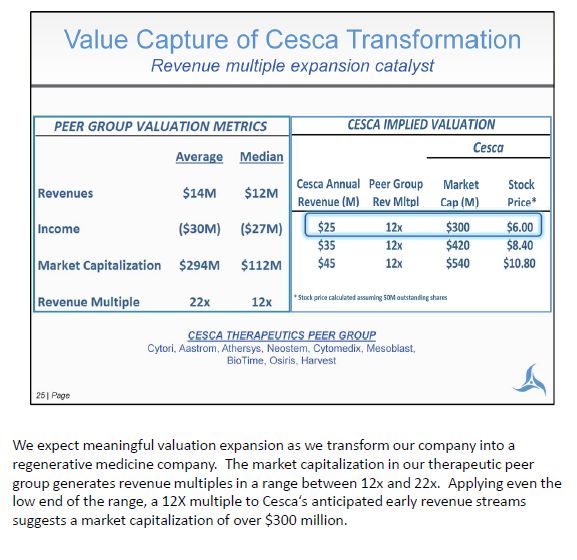

We expect meaningful valuation expansion as we transform our company into a regenerative medicine company. The market capitalization in our therapeutic peer group generates revenue multiples in a range between 12x and 22x. Applying even the low end of the range, a 12X multiple to Cesca's anticipated early revenue streams suggests a market capitalization of over $300 million.

25

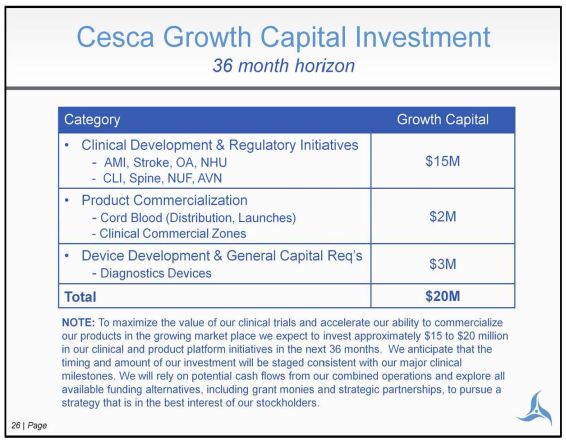

26

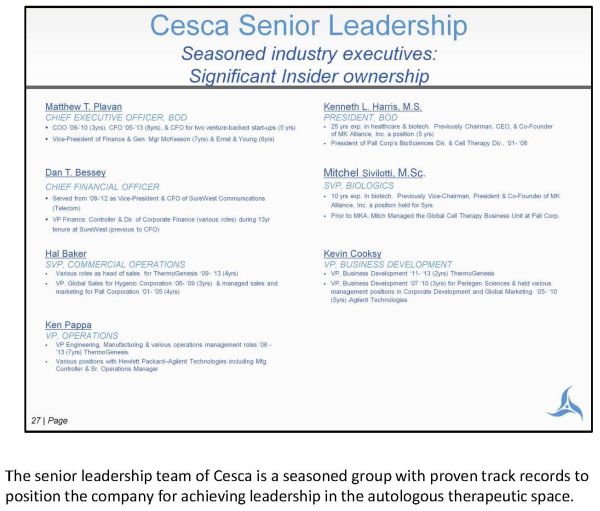

The senior leadership team of Cesca is a seasoned group with proven track records to position the company for achieving leadership in the autologous therapeutic space.

27

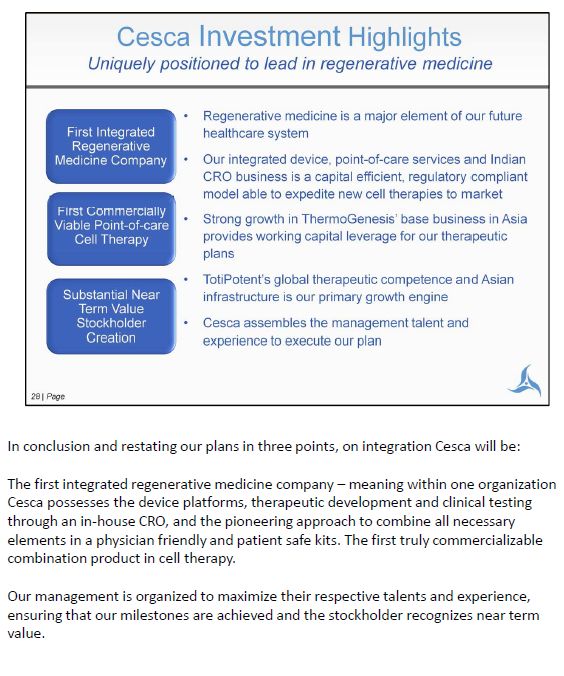

In conclusion and restating our plans in three points, on integration Cesca will be: The first integrated regenerative medicine company – meaning within one organization Cesca possesses the device platforms, therapeutic development and clinical testing through an in-house CRO, and the pioneering approach to combine all necessary elements in a physician friendly and patient safe kits. The first truly commercializable combination product in cell therapy. Our management is organized to maximize their respective talents and experience, ensuring that our milestones are achieved and the stockholder recognizes near term value.

28

29

30