Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASSOCIATED BANC-CORP | d570746d8k.htm |

| EX-99.1 - EX-99.1 - ASSOCIATED BANC-CORP | d570746dex991.htm |

Associated Banc-Corp

2Q 2013 Earnings Presentation

July 18, 2013

Exhibit 99.2 |

Forward-Looking Statements

1 |

Second Quarter 2013 Highlights

•

Net income available to common shareholders of $47 million or $0.28 per

share •

Return on Tier 1 common equity of 9.9%, compared to 9.3% for Q2 2012

2

Solid

Results

Driven

by

Mortgage

Banking

and

Net

Interest

Income

Growth

Net Income

&

ROT1CE

Balance Sheet

Net Interest Income

&

Net Interest Margin

•

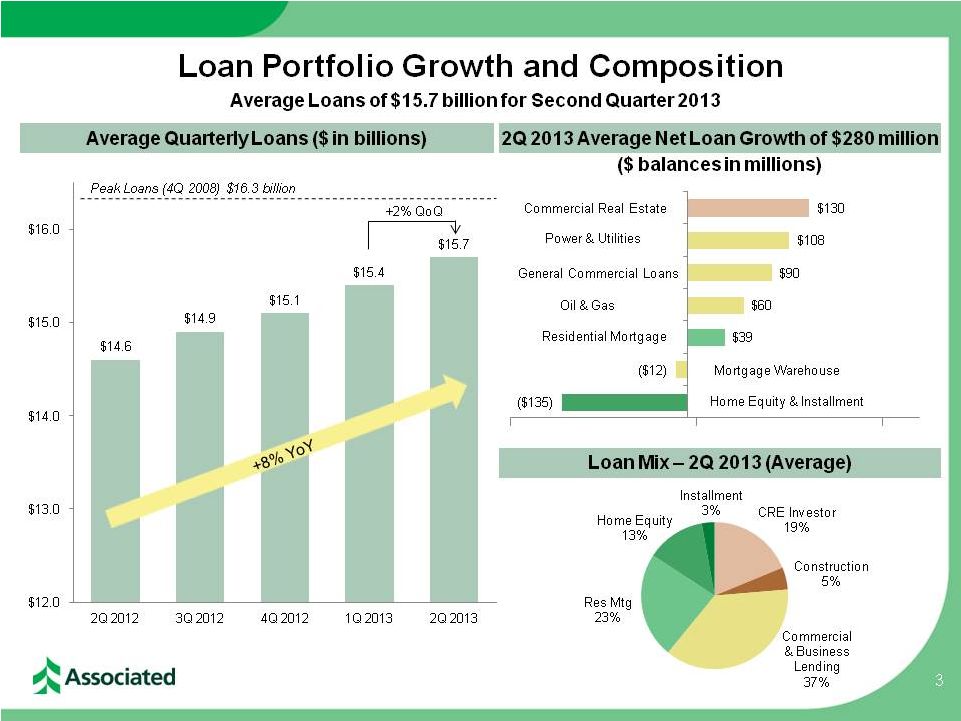

Average loans of $15.7 billion were up $280 million, or 2% from the first

quarter –

Average total commercial loan balances grew 4% from the prior quarter

•

Net interest income of $160 million was up 2% from the first quarter

–

Net interest margin of 3.16% compared to 3.17% in first quarter

Capital

•

Quarterly dividend of $0.08/share

•

Repurchased $30 million of stock during the second quarter

•

Capital ratios remain very strong with a Tier 1 common equity ratio of

11.48%

Noninterest Income

& Expense

•

Noninterest income of $84 million was up 3% from the first quarter

•

Record mortgage banking income of $19 million, up 8% from first quarter

•

Average deposits of $17.1 billion were flat to the first quarter

|

|

Growing Net Interest Income While Margin Compresses

4

Yield on Interest-earning Assets

Cost of Interest-bearing Liabilities

Net Interest Income & Net Interest Margin

($ in millions)

3.80%

3.73%

3.70%

3.52%

3.47%

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

0.65%

0.62%

0.51%

0.45%

0.41%

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

$154

$156

$161

$158

$160

3.30%

3.26%

3.32%

3.17%

3.16%

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

Net Interest

Income

Net Interest

Margin |

Noninterest Income and Expense

5

1

–

Efficiency

ratio

=

Noninterest

expense,

excluding

amortization

of

intangibles,

divided

by

sum

of

taxable

equivalent net interest income plus noninterest income, excluding investment

securities gains, net, and asset

gains,

net.

This

is

a

non-GAAP

financial

measure.

Please

refer

to

our

press

release

tables

for

a

reconciliation of this and other non-GAAP items.

|

Continued Improvement in Credit Quality Indicators

6

($ in millions)

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

Potential problem loans

$ 410

$ 404

$ 361

$ 344

$ 310

Nonaccruals

$ 318

$ 278

$ 253

$ 225

$ 217

Provision for loan losses

$ 0

$ 0

$ 3

$ 4

$ 4

Net charge offs

$ 24

$ 18

$ 21

$ 14

$ 14

ALLL/Total loans

2.26%

2.11%

1.93%

1.84%

1.76%

ALLL/Nonaccruals

104.65%

113.29%

117.61%

127.27%

127.46%

NPA/Assets

1.62%

1.38%

1.23%

1.12%

1.04%

Nonaccruals/Loans

2.16%

1.86%

1.64%

1.45%

1.38%

NCOs / Avg Loans

0.65%

0.47%

0.55%

0.38%

0.35% |

Strong Capital Profile & Improving Earnings

7

Tier 1 Common Equity Ratio

Net Income Available to Common & ROT1CE

Net Income Available

to Common

($ in millions)

Return on Tier 1

Common Equity

•

Current capital levels are well in excess of

“well-capitalized”

regulatory benchmarks

–

Existing capital levels are already above

Basel III capital levels |

2013

Second Half Outlook 8

Loan Trends

•

Quarterly

loan

growth

of

1

–

2%.

•

Continued disciplined loan

pricing

Deposit Trends

Fee Income

Expenses

NIM

Growing the Franchise & Creating Long-Term Shareholder Value

Footprint

Credit

Capital

•

Continued disciplined deposit

pricing

•

Sustained focus on treasury

management solutions to drive

growth in commercial deposits

•

Continued compression over

the second half of the year

•

Modest improvement in core fee-

based revenues with lower net

mortgage banking revenues

•

Flat year-over-year

•

Reduced regulatory costs offset by

continued franchise investments

•

Continuing to invest in our

branches while optimizing our

network

•

Complete Green Bay and Chicago

corporate office consolidations

•

Modest improvement in credit

trends

•

Provision expense to increase

based on quarterly loan growth

•

Disciplined focus on

deploying capital to drive

long-term shareholder value

•

$26 million of 9.25% sub-debt

redeemable in October |