Attached files

| file | filename |

|---|---|

| 8-K - THERMOGENESIS CORP 8-K 7-16-2013 - ThermoGenesis Holdings, Inc. | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - ThermoGenesis Holdings, Inc. | ex99_1.htm |

| EX-99.2 - EXHIBIT 99.2 - ThermoGenesis Holdings, Inc. | ex99_2.htm |

Corporate Presentation

The Merger of ThermoGenesis & TotipotentRX

July 2013

Exhibit 99.3

Filed by: ThermoGenesis Corp.

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: ThermoGenesis Corp.

Commission File No.: 333-82900

CescaTM Therapeutics

Forward Looking Statement

Forward Looking Statement

ThermoGenesis Corp.

Web site: http://www.thermogenesis.com

Contact: Investor Relations

+1-916-858-5107, or

ir@thermogenesis.com

Cesca Therapeutics

Launches only integrated regenerative medicine company

Launches only integrated regenerative medicine company

4 | Page

Cesca Therapeutics

TotipotentRX snapshot

TotipotentRX snapshot

• Developing cellular therapies for vascular, orthopedic and neurological diseases

• Core capabilities in development and clinical testing of cellular therapies

• Pipeline of 10 clinical stage therapies

THERAPEUTICS

DEVICES

CLINICAL SERVICES

5 | Page

Cesca Therapeutics

ThermoGenesis snapshot (Nasdaq: KOOL)

• Leading designer and supplier of clinical technologies for processing, storage

and administration of stem cells

and administration of stem cells

• Core capabilities include quality innovation, design IP, commercialization,

regulatory, and global distribution

regulatory, and global distribution

• ~$18M in annual revenues

Automated

Point-of-Care/

Lab-based

Lab-based

cGMP

Closed Systems

Scalable

6 | Page

Regenerative Medicine’s Future

Macro drivers

Macro drivers

• Global Trends in Healthcare

− Aging population, rapidly rising costs

− Medical reimbursement; pay for performance

− Pharma:

Ø Patent expirations, empty pipelines

Ø Not curative, treats symptoms

• Regenerative Medicine

− Curative; targets root cause of disease

− Creating value:

Ø Will save $250B/year1

Uniquely able to control key variables to minimize regulatory risk and

maximize clinical effectiveness

maximize clinical effectiveness

1 Alliance for Regenerative Medicine, Annual Report 2013

7 | Page

Healthcare Market

Macro drivers

Macro drivers

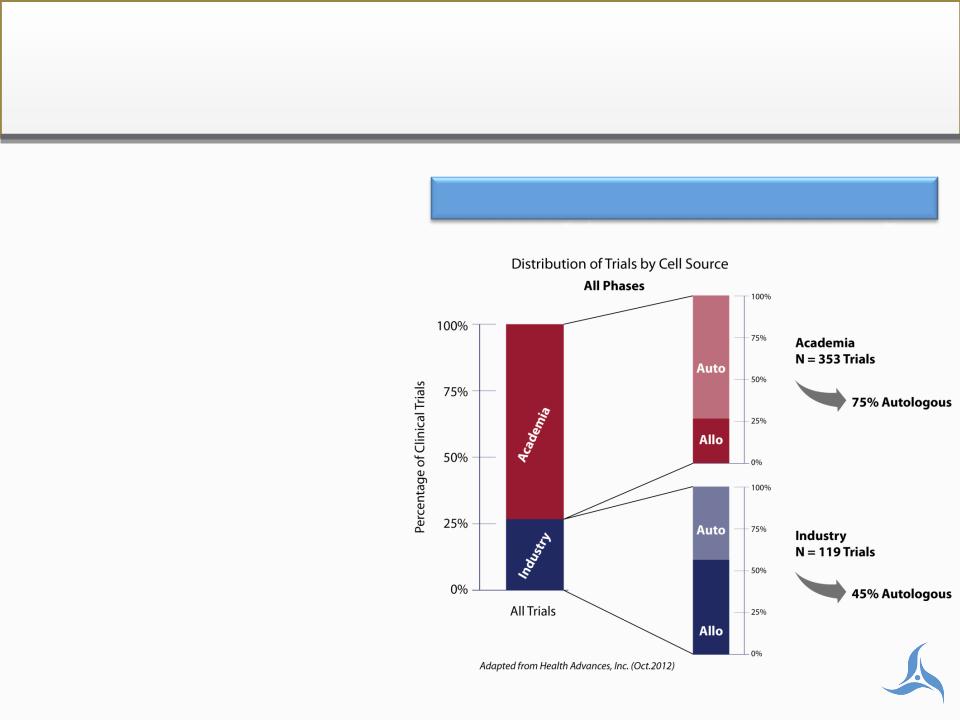

• Regenerative medicine gains

industry’s eye

industry’s eye

− Industry clinical trial sponsors:

ü 2007: <1%

ü 2010: 5%

ü 2012: 20%

• Academic cell evolution; From

embryonic, to allogeneic, to

autologous:

embryonic, to allogeneic, to

autologous:

− CIRM has begun funding

autologous trials again

autologous trials again

− Strong NIH funding for autologous

studies continues

studies continues

Industry presence accelerating

8 | Page

Autologous Therapy Today

Current regenerative medicine POC practice

Current regenerative medicine POC practice

9 | Page

Cesca Therapeutics

The autologous cell therapy solution

The autologous cell therapy solution

• Patient friendly

• Physician friendly

• Fast, at-the-bedside

• Effective

• In the regulatory “sweet spot”

• Commercially viable

Consistent cell compositions

cGMP compliant protocols

Clinical data

10 | Page

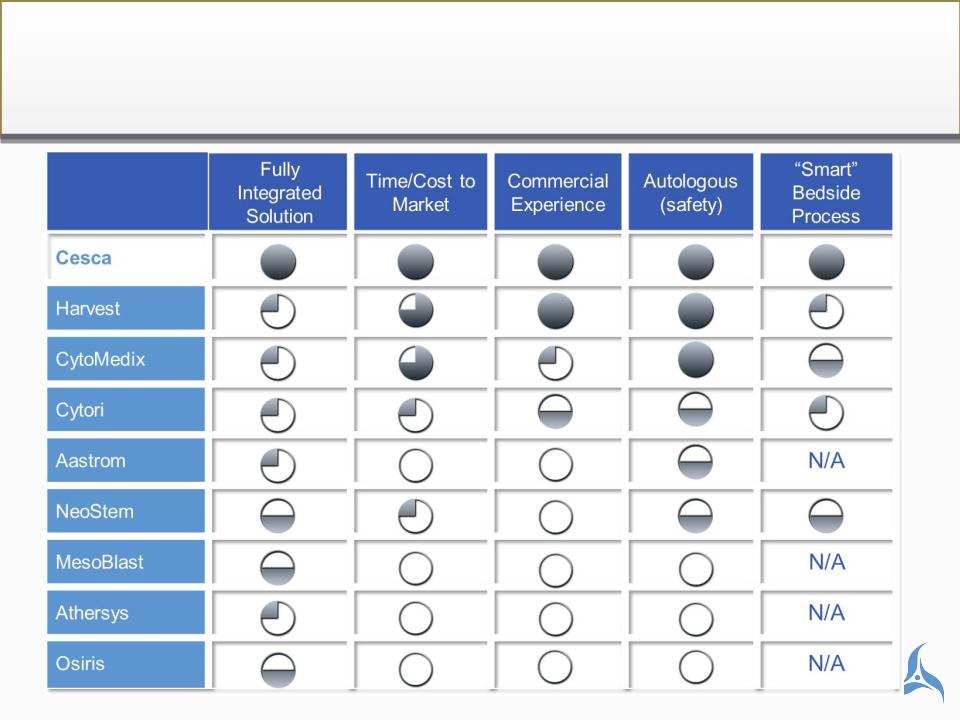

Cesca Commercialization Advantage

The first commercially viable autologous cell therapy

The first commercially viable autologous cell therapy

11 | Page

Cesca CellwerksSM

Our Unique Development Process

Our Unique Development Process

• Uniquely integrated development

- Chemistry, cellularity and quality

- Controlled, consistent delivery

- 550 patients treated across eight clinical

indications (Toti)

indications (Toti)

12 | Page

Cesca SurgwerksTM

Indication specific, proprietary product suite

Indication specific, proprietary product suite

13 | Page

Cesca SurgwerksTM

Sustainable differentiation

Sustainable differentiation

• Developed at the point-of-care, over 20,000 patients treated through

ThermoGenesis

ThermoGenesis

• Clinically validated, proprietary clinical protocols & method patents

• Proprietary, smart platforms (device and algorithm patents)

• Proprietary cell formulations addressing multiple disease indications

• Pioneering with regulatory strategy to be first FDA combination product

approved - 21CFR 3.2 (e)

approved - 21CFR 3.2 (e)

• IP Suite

− 43 Design and device patents

− Three protocol provisional patents (6 indications)

− 10 pilot & phase 1b clinical trials

− 7 clinical algorithms

14 | Page

In the Regulatory “Sweet Spot”

Lower risk = speed to market

Lower risk = speed to market

15 | Page

Proprietary Cell Formulations

Unique algorithms for treatment of multiple indications

Unique algorithms for treatment of multiple indications

|

Source

Material |

Clinical

Indication |

Harvest Hct

(%) |

MNC recovery

(%) |

Monocyte

recovery

|

Platelet

recovery (%) |

|

PB

|

Chronic Dermal

Wound |

≤ 25%

|

> 80%

|

> 85%

|

> 85%

|

|

PB

|

Chronic Dermal

Wound |

≤ 10%

|

> 80%

|

> 85%

|

> 85%

|

|

PB

|

Soft Tissue

|

≤ 3%

|

> 50%

|

> 80%

|

> 85%

|

|

PB

|

Soft Tissue

|

≤ 2%

|

> 50%

|

> 80%

|

> 85%

|

|

BM

|

Cardiac & CLI

|

≤ 25%

|

> 85%

|

> 85%

|

> 85%

|

|

BM

|

Non-Union

|

≤ 15%

|

> 85%

|

> 85%

|

> 85%

|

|

BM

|

Neurological

|

< 3%

|

> 60%

|

> 85%

|

> 85%

|

PB = Peripheral Blood

BM = Bone Marrow

VXP® Algorithmic Control

16 | Page

Cesca Pilot Trial Experience

Developing the CellWerks model

Developing the CellWerks model

|

Specialty

|

Indication

|

Trial Completion

|

|

Orthopedics

|

OA

|

50 Patients Pilot Completed

|

|

Non Union

|

30 Patients Pilot Completed

19 Patients Phase 1 Completed

|

|

|

Avascular

Necrosis |

10 Patients Pilot Completed

|

|

|

Cardiovascular

|

AMI

|

30 Patient Phase 1b Underway

|

|

Stroke

|

15 Patient Phase 1a Reg Review

|

|

|

CLI

|

15 Patient Phase 1b Completed

20 Patient Phase 1 Completed

|

|

|

Non Healing

Ulcers |

10 Patient Pilot

|

Market for our target therapies totals $16.6B

More than 300 patients treated in other trials and applications

17 | Page

High Impact Clinical Results

Compelling early vascular results

Compelling early vascular results

• N=17 patients

• All patients “no option” and 24

hours from leg amputation

hours from leg amputation

• 88.9% of gangrene sores

improved

improved

• Major Amputation Free Rate post

SurgWerks™ Therapy = 85.7%

SurgWerks™ Therapy = 85.7%

• Minor Amputation Free Rate Post

SurgWerks™ = 55.5% to date

SurgWerks™ = 55.5% to date

• 31% Reduction in VAS Pain

Score at 3 Mo. F/U

Score at 3 Mo. F/U

Major Revascularization

18 | Page

• N=19 patients

• All patients failed traditional

surgical fixation

surgical fixation

• 71% union rate in 18 weeks post

SurgWerks™ treatment

SurgWerks™ treatment

– No SAEs/AES

– 2 patients lost to F/U

Long Bone Fusion

Non-Union Fractures

High Impact Clinical Results

Compelling early orthopedic results

Accepted for publication: 2012

International Society of Cell Therapy,

Rotterdam

International Society of Cell Therapy,

Rotterdam

19 | Page

Clinical Pipeline

Blockbuster drug candidates

Blockbuster drug candidates

KEY CESCA CRO ADVANTAGES

− US FDA accepts foreign

trials

trials

− Better control of trial

management

management

− 1/5th the cost of US/EU

Patient related Clinical Trials

costs

Patient related Clinical Trials

costs

− Speed to completion

20 | Page

Our Fortis Partnership

CRO embedded in New Delhi facility

CRO embedded in New Delhi facility

• Cesca is exclusive regenerative medicine

provider to Fortis

provider to Fortis

– 72 hospitals (6 countries)

– 10,000 inpatient beds

– 15,000 outpatients per day

– Competent clinical research staff

– 2x as many sites as Kaiser

• Physician/patient access

• World class clinical facilities and

equipment

equipment

• Lobby partner with government

• Embedded CRO

– Only global cell therapy CRO

– US FDA registered

– Over 500 patients treated

By leveraging our Fortis

partnership and in-house CRO,

Cesca has the potential to get

new cell treatments approved

faster and cheaper than our

competitors

partnership and in-house CRO,

Cesca has the potential to get

new cell treatments approved

faster and cheaper than our

competitors

21 | Page

Co-Development and Marketing Prospects

Prospective partnerships

Prospective partnerships

|

|

VASCULAR CONDITIONS

|

ORTHOPEDIC CONDITIONS

|

||||||

|

|

AMI

|

CLI

|

STROKE

|

NON

HEALING ULCERS |

SPINE

|

OA

|

NON UNION

FRACTURES |

AVN

|

|

Cook

|

X

|

X

|

X

|

|

|

|

|

|

|

Sanofi

|

|

|

|

X

|

|

X

|

|

|

|

Shire

|

|

|

|

X

|

|

X

|

X

|

|

|

Pfizer

|

X

|

X

|

|

X

|

|

|

|

|

|

Medtronic

|

X

|

X

|

|

|

X

|

|

X

|

X

|

|

Abbott

|

X

|

X

|

|

|

|

|

|

|

|

J&J

|

X

|

X

|

X

|

X

|

X

|

|

X

|

X

|

|

Terumo

|

X

|

X

|

X

|

X

|

|

|

|

|

|

Baxter

|

X

|

|

X

|

|

|

|

|

|

|

Amgen

|

|

|

|

X

|

|

|

|

|

|

Stryker

|

|

|

|

|

X

|

X

|

X

|

X

|

|

Biomet

|

|

|

|

|

X

|

X

|

X

|

X

|

|

Arthrex

|

|

|

|

|

X

|

X

|

X

|

X

|

|

TOTAL

PROSPECTS |

7

|

6

|

4

|

6

|

5

|

5

|

6

|

5

|

|

2012 Market

Size ($B) |

$2.40

|

$2.00

|

$5.20

|

$0.80

|

$0.80

|

$5.00

|

$1.10

|

$0.08

|

22 | Page

Unlocking Intrinsic Value of Base Business

Expanding clinical uses for cord blood

Expanding clinical uses for cord blood

• Accelerate Cord Blood Organic Revenue

− Leverage first mover position in Asia

− Take competitive share in Europe and the Americas

− Introduce advanced AXP upgrades, new products, and support

• Expand Practice of Medicine Usage of Cord Blood

− Leverage Cesca CRO for rapid, cost effective introduction of 5 new therapies

− Leverage Cesca research cord blood bank for clinical and engineering innovation

− Expanding indications beyond hematopoietic, making cord blood a neo-natal, point-of-

care therapy

care therapy

− Establish presence in US for direct sales to “Clinical Commercial Zones”

− Leverage Fortis Hospital Relationship for POM in Wound Care & Orthopedics

23 | Page

Leveraging Cord blood

Global automated processing leader

Global automated processing leader

Exclusive automated cord

blood processing device

provider to CCBC

Exclusive AXP distributor

in China and several

Southeast Asian

countries

in China and several

Southeast Asian

countries

Strong foundation in Golden Meditech and Cesca Research Bank

allows us to capitalize on the Asia growth opportunity

allows us to capitalize on the Asia growth opportunity

24 | Page

Overview of Key Milestones

Substantial near term clinical value drivers

Substantial near term clinical value drivers

• 2013

− Cardiac Patient Ph1b Enrollment Commences

• 2014

− Clinical Trial Approval (NHU IRB)

− Clinical Trial Approval (OA IRB)

− US Investigational New Drug Granted (CLI Ph1/2)

− Cardiac Patient Ph1b Enrollment Completed

− Ph1 Trial Concluded (NHU)

− Ph1 Trial Concluded (OA)

• 2015

− Cardiac Patient Ph1b Results

− US Investigational New Drug Granted Ph2 (OA)

− Cell Diagnostic Analyzer Product Launch

− US Investigational New Drug Granted Cardiac Ph2

− Pivotal Trial Initiated (NHU)

25 | Page

Value Capture of Cesca Transformation

Revenue multiple expansion catalyst

Revenue multiple expansion catalyst

CESCA THERAPEUTICS PEER GROUP

Cytori, Aastrom, Athersys, Neostem, Cytomedix, Mesoblast,

BioTime, Osiris, Harvest

BioTime, Osiris, Harvest

26 | Page

Cesca Growth Capital Investment

36 month horizon

36 month horizon

|

Category

|

Growth Capital

|

|

• Clinical Development & Regulatory Initiatives

- AMI, Stroke, OA, NHU

- CLI, Spine, NUF, AVN

|

$15M

|

|

• Product Commercialization

- Cord Blood (Distribution, Launches)

- Clinical Commercial Zones

|

$2M

|

|

• Device Development & General Capital Req’s

- Diagnostics Devices

|

$3M

|

|

Total

|

$20M

|

NOTE: To maximize the value of our clinical trials and accelerate our ability to commercialize

our products in the growing market place we expect to invest approximately $15 to $20

million in our clinical and product platform initiatives in the next 36 months. We anticipate

that the timing and amount of our investment will be staged consistent with our major clinical

milestones. We will rely on potential cash flows from our combined operations and explore all

available funding alternatives, including grant monies and strategic partnerships, to pursue a

strategy that is in the best interest of our stockholders.

our products in the growing market place we expect to invest approximately $15 to $20

million in our clinical and product platform initiatives in the next 36 months. We anticipate

that the timing and amount of our investment will be staged consistent with our major clinical

milestones. We will rely on potential cash flows from our combined operations and explore all

available funding alternatives, including grant monies and strategic partnerships, to pursue a

strategy that is in the best interest of our stockholders.

27 | Page

Cesca Senior Leadership

Seasoned industry executives:

Significant Insider ownership

Seasoned industry executives:

Significant Insider ownership

Matthew T. Plavan

CHIEF EXECUTIVE OFFICER, BOD

§ COO ’08-’10 (3yrs), CFO ‘05-’13 (8yrs), & CFO for two venture-backed start-ups (5 yrs)

§ Vice-President of Finance & Gen. Mgr McKesson (7yrs) & Ernst & Young (6yrs)

Kenneth L. Harris, M.S.

PRESIDENT, BOD

§ 25 yrs exp. in healthcare & biotech. Previously Chairman, CEO, & Co-

Founder of MK Alliance, Inc. a position (5 yrs)

Founder of MK Alliance, Inc. a position (5 yrs)

§ President of Pall Corp’s BioSciences Div. & Cell Therapy Div., ‘01- ‘08

Dan T. Bessey

CHIEF FINANCIAL OFFICER

§ Served from ‘08-’12 as Vice-President & CFO of SureWest Communications

(Telecom)

(Telecom)

§ VP Finance, Controller & Dir. of Corporate Finance (various roles) during 13yr

tenure at SureWest (previous to CFO)

tenure at SureWest (previous to CFO)

Mitchel Sivilotti, M.Sc.

SVP, BIOLOGICS

§ 10 yrs exp. In biotech. Previously Vice-Chairman, President & Co-Founder of MK

Alliance, Inc. a position held for 5yrs

Alliance, Inc. a position held for 5yrs

§ Prior to MKA, Mitch Managed the Global Cell Therapy Business Unit at Pall Corp.

Hal Baker

SVP, COMMERCIAL OPERATIONS

§ Various roles as head of sales for ThermoGenesis ‘09- ‘13 (4yrs)

§ VP, Global Sales for Hygenic Corporation ‘06- ’09 (3yrs) & managed sales

and marketing for Pall Corporation ‘01- ’05 (4yrs)

and marketing for Pall Corporation ‘01- ’05 (4yrs)

Ken Pappa

VP, OPERATIONS

§ VP Engineering, Manufacturing & various operations management roles ‘06 -

’13 (7yrs) ThermoGenesis.

’13 (7yrs) ThermoGenesis.

§ Various positions with Hewlett Packard-Agilent Technologies including Mfg.

Controller & Sr. Operations Manager

Controller & Sr. Operations Manager

Kevin Cooksy

VP, BUSINESS DEVELOPMENT

§ VP, Business Development ‘11- ‘13 (2yrs) ThermoGenesis

§ VP, Business Development ‘07 ‘10 (3yrs) for Perlegen Sciences & held

various management positions in Corporate Development and Global

Marketing ‘05- ‘10 (5yrs) Agilent Technologies

various management positions in Corporate Development and Global

Marketing ‘05- ‘10 (5yrs) Agilent Technologies

28 | Page

Cesca Investment Highlights

Uniquely positioned to lead in regenerative medicine

Uniquely positioned to lead in regenerative medicine

• Regenerative medicine is a major element of our future

healthcare system

healthcare system

• Our integrated device, point-of-care services and Indian

CRO business is a capital efficient, regulatory compliant

model able to expedite new cell therapies to market

CRO business is a capital efficient, regulatory compliant

model able to expedite new cell therapies to market

• Strong growth in ThermoGenesis’ base business in Asia

provides working capital leverage for our therapeutic

plans

provides working capital leverage for our therapeutic

plans

• TotiPotent’s global therapeutic competence and Asian

infrastructure is our primary growth engine

infrastructure is our primary growth engine

• Cesca assembles the management talent and

experience to execute our plan

experience to execute our plan

29 | Page

Cesca Therapeutics

Additional Information

Additional Information

• Non-Solicitation

− This presentation and the information contained herein shall not constitute an offer to sell,

buy or exchange or the solicitation of an offer to sell, buy or exchange any securities, nor

shall there be any sale, purchase or exchange of securities in any jurisdiction in which such

offer, solicitation, sale, purchase or exchange would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offer of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

buy or exchange or the solicitation of an offer to sell, buy or exchange any securities, nor

shall there be any sale, purchase or exchange of securities in any jurisdiction in which such

offer, solicitation, sale, purchase or exchange would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offer of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

• Additional Information

− In connection with the merger, ThermoGenesis intends to file a registration statement

(including a prospectus) on Form S-4 with the Securities and Exchange Commission.

Holders of ThermoGenesis Common Stock and TotipotentRx Corporation common stock

are urged to read the proxy statement/prospectus and any other relevant documents when

filed because they contain important information about ThermoGenesis, TotipotentRx and

the merger. A proxy statement will be sent to holders of our Common Stock and a proxy

statement/prospectus will be sent to holders of TotipotentRx Corporation common stock.

When filed, the proxy statement/prospectus and other documents relating to the proposed

merger can be obtained free of charge from the SEC’s website at www.sec.gov. These

documents can also be obtained free of charge from ThermoGenesis upon written request

to ThermoGenesis, Investor Relations, 2711 Citrus Road Rancho Cordova, CA 95742.

(including a prospectus) on Form S-4 with the Securities and Exchange Commission.

Holders of ThermoGenesis Common Stock and TotipotentRx Corporation common stock

are urged to read the proxy statement/prospectus and any other relevant documents when

filed because they contain important information about ThermoGenesis, TotipotentRx and

the merger. A proxy statement will be sent to holders of our Common Stock and a proxy

statement/prospectus will be sent to holders of TotipotentRx Corporation common stock.

When filed, the proxy statement/prospectus and other documents relating to the proposed

merger can be obtained free of charge from the SEC’s website at www.sec.gov. These

documents can also be obtained free of charge from ThermoGenesis upon written request

to ThermoGenesis, Investor Relations, 2711 Citrus Road Rancho Cordova, CA 95742.

Thank you