Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PLEXUS CORP | a8-kcoverpageq3f13.htm |

| EX-99.1 - EXHIBIT 99.1 - PLEXUS CORP | q3f13pressrelease.htm |

FISCAL THIRD QUARTER 2013 FINANCIAL RESULTS July 18, 2013

SAFE HARBOR & FAIR DISCLOSURE STATEMENT 2 Any statements made during our call today that are not historical in nature, such as statements in the future tense and statements that include "believe," "expect," "intend," "plan," "anticipate," and similar terms and concepts, are forward-looking statements. Forward- looking statements are not guarantees since there are inherent difficulties in predicting future results, and actual results could differ materially from those expressed or implied in the forward-looking statements. For a list of major factors that could cause actual results to differ materially from those projected, please refer to the Company’s periodic SEC filings, particularly the risk factors in our Form 10-K filing for the fiscal year ended September 29, 2012, and the Safe Harbor and Fair Disclosure statement in yesterday’s press release. The Company provides non-GAAP supplemental information. For example, our call today will reference return on invested capital and free cash flow. These non-GAAP financial measures are used for internal management assessments because they provide additional insight into ongoing financial performance and the metrics that are driving management decisions. For a full reconciliation of non-GAAP supplemental information please refer to yesterday’s press release and our periodic SEC filings.

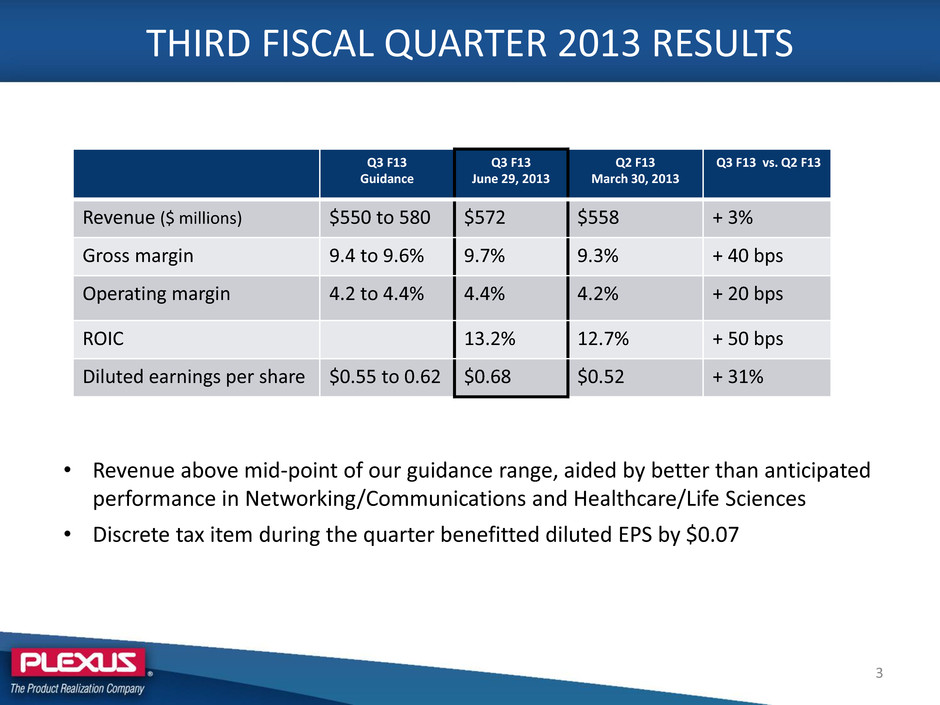

THIRD FISCAL QUARTER 2013 RESULTS 3 Q3 F13 Guidance Q3 F13 June 29, 2013 Q2 F13 March 30, 2013 Q3 F13 vs. Q2 F13 Revenue ($ millions) $550 to 580 $572 $558 + 3% Gross margin 9.4 to 9.6% 9.7% 9.3% + 40 bps Operating margin 4.2 to 4.4% 4.4% 4.2% + 20 bps ROIC 13.2% 12.7% + 50 bps Diluted earnings per share $0.55 to 0.62 $0.68 $0.52 + 31% • Revenue above mid-point of our guidance range, aided by better than anticipated performance in Networking/Communications and Healthcare/Life Sciences • Discrete tax item during the quarter benefitted diluted EPS by $0.07

THIRD QUARTER UPDATES • New business wins—strong performance • Juniper disengagement—no surprises • Oradea Manufacturing facility—move complete • Livingston Manufacturing & Design Center facility—move complete • Fox Cities, WI transformation—on track • Low cost Americas solution in Mexico—final decision phase • Productivity initiatives—margins & working capital performance • Plexus Corp structure—Chief Operating Officer 4

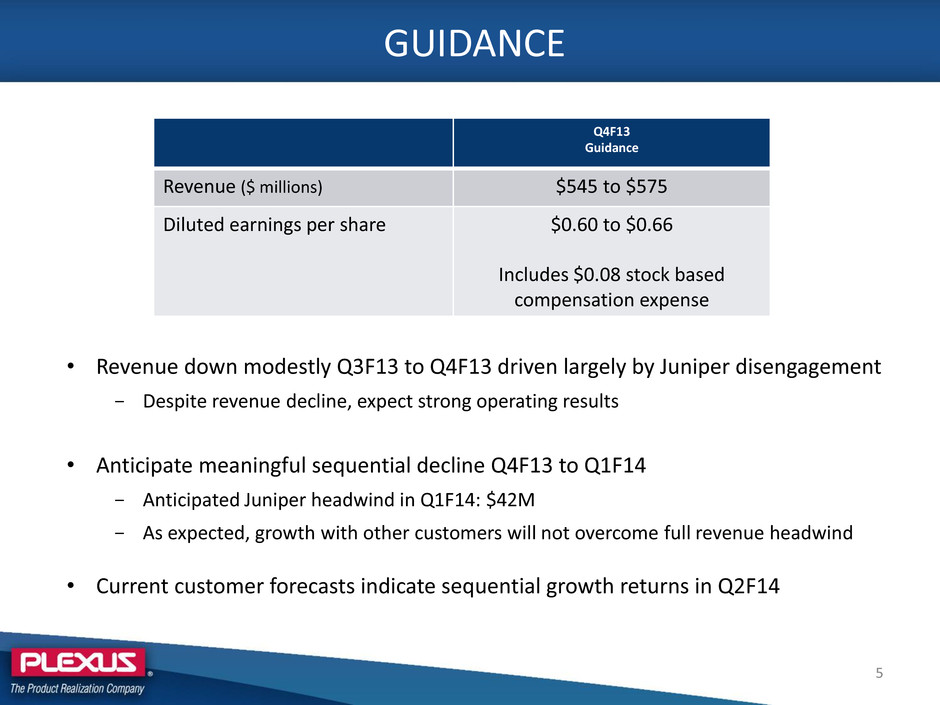

GUIDANCE 5 Q4F13 Guidance Revenue ($ millions) $545 to $575 Diluted earnings per share $0.60 to $0.66 Includes $0.08 stock based compensation expense • Revenue down modestly Q3F13 to Q4F13 driven largely by Juniper disengagement - Despite revenue decline, expect strong operating results • Anticipate meaningful sequential decline Q4F13 to Q1F14 - Anticipated Juniper headwind in Q1F14: $42M - As expected, growth with other customers will not overcome full revenue headwind • Current customer forecasts indicate sequential growth returns in Q2F14

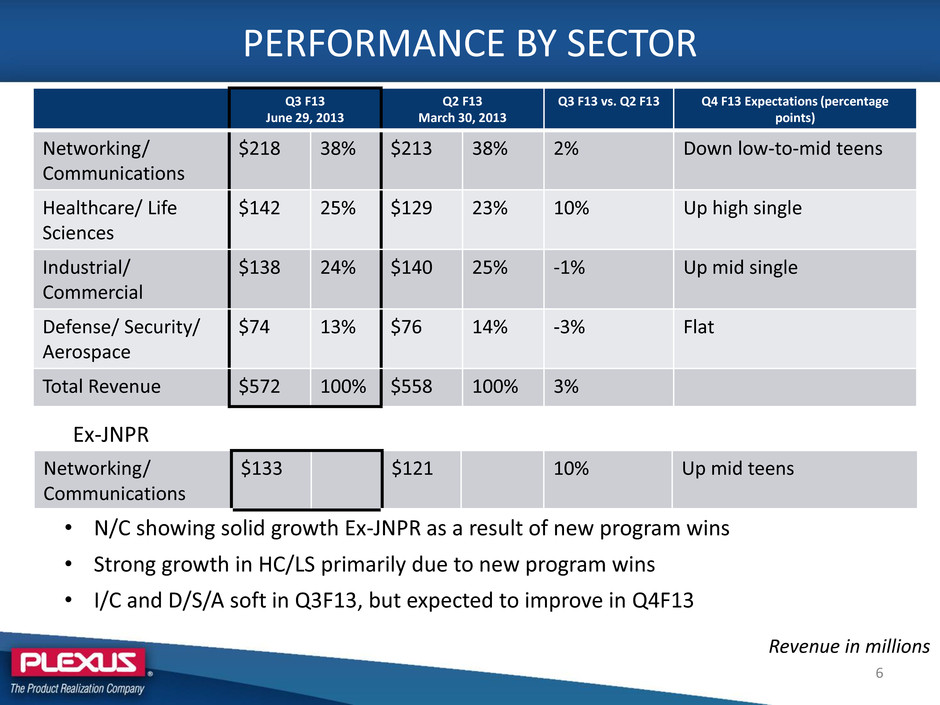

PERFORMANCE BY SECTOR 6 Q3 F13 June 29, 2013 Q2 F13 March 30, 2013 Q3 F13 vs. Q2 F13 Q4 F13 Expectations (percentage points) Networking/ Communications $218 38% $213 38% 2% Down low-to-mid teens Healthcare/ Life Sciences $142 25% $129 23% 10% Up high single Industrial/ Commercial $138 24% $140 25% -1% Up mid single Defense/ Security/ Aerospace $74 13% $76 14% -3% Flat Total Revenue $572 100% $558 100% 3% Revenue in millions • N/C showing solid growth Ex-JNPR as a result of new program wins • Strong growth in HC/LS primarily due to new program wins • I/C and D/S/A soft in Q3F13, but expected to improve in Q4F13 Networking/ Communications $133 $121 10% Up mid teens Ex-JNPR

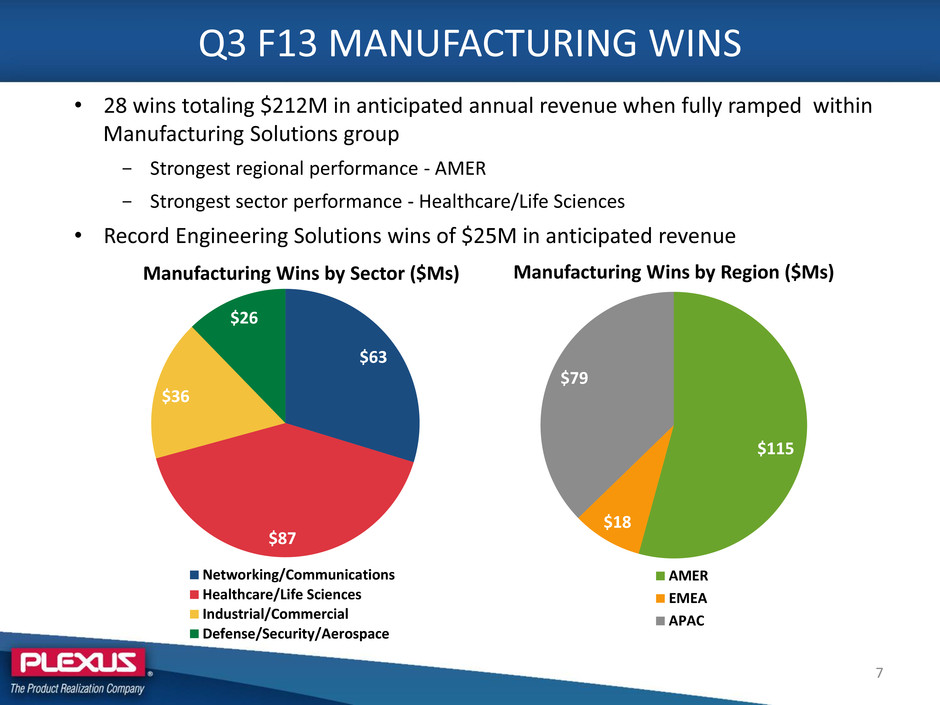

Q3 F13 MANUFACTURING WINS 7 $63 $87 $36 $26 Manufacturing Wins by Sector ($Ms) Networking/Communications Healthcare/Life Sciences Industrial/Commercial Defense/Security/Aerospace $115 $18 $79 Manufacturing Wins by Region ($Ms) AMER EMEA APAC • 28 wins totaling $212M in anticipated annual revenue when fully ramped within Manufacturing Solutions group - Strongest regional performance - AMER - Strongest sector performance - Healthcare/Life Sciences • Record Engineering Solutions wins of $25M in anticipated revenue

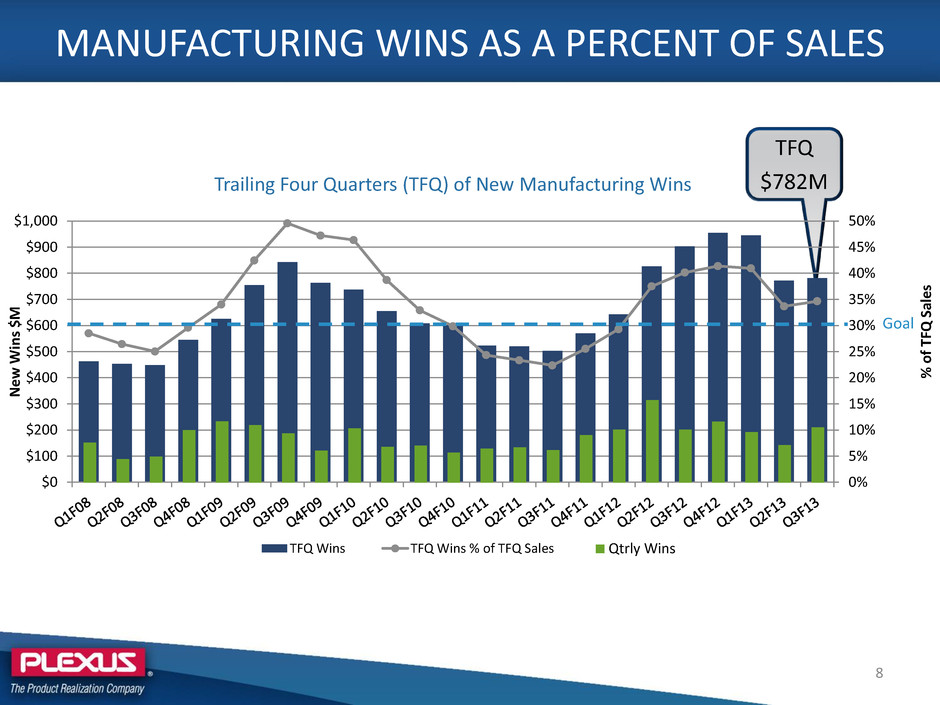

MANUFACTURING WINS AS A PERCENT OF SALES TFQ $782M 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 % o f TF Q S al es Ne w W in s $ M TFQ Wins TFQ Wins % of TFQ Sales Trailing Four Quarters (TFQ) of New Manufacturing Wins Qtrly Wins Goal 8

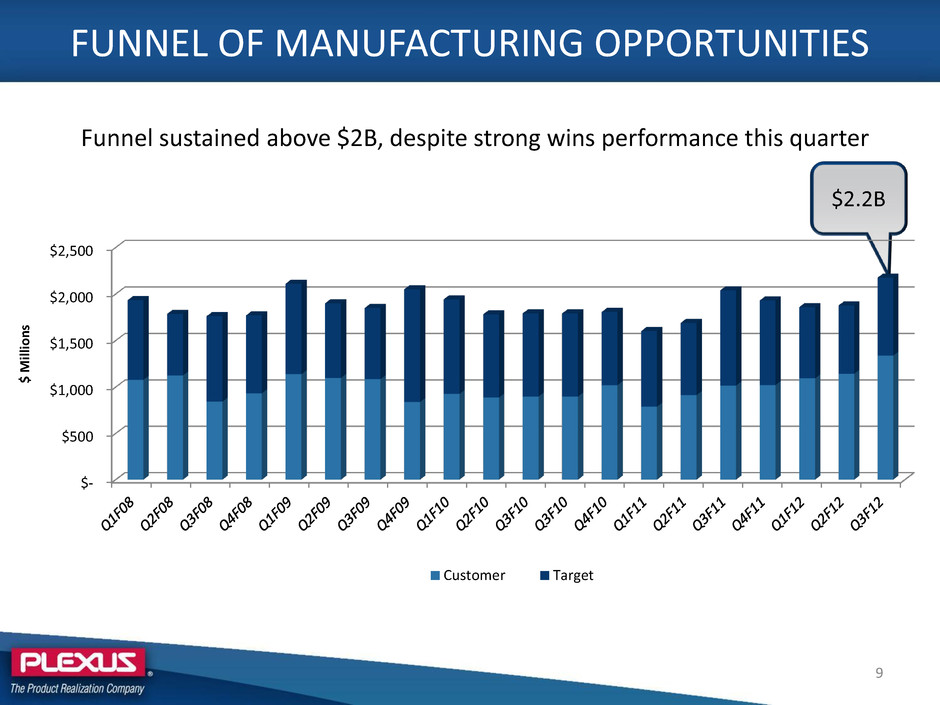

Funnel sustained above $2B, despite strong wins performance this quarter FUNNEL OF MANUFACTURING OPPORTUNITIES 9 $2.2B $- $500 $1,000 $1,500 $2,000 $2,500 $ M ill io n s Customer Target

ORADEA MANUFACTURING SITE • Operational in Oradea, Romania since 2009 • New facility replaces two leased facilities - 72,000 sq. ft. to 300,000 sq. ft. • Enhances growth engine for EMEA 10

ENHANCED UK SOLUTION Livingston Design Center Relocation • 15,000 sq. ft. • Expanded laboratory capabilities New Manufacturing Facility • 47,000 sq. ft. • Prototyping will be co-located with engineering • Complimentary with Kelso, Scotland site Full Product Realization capabilities under one roof 11

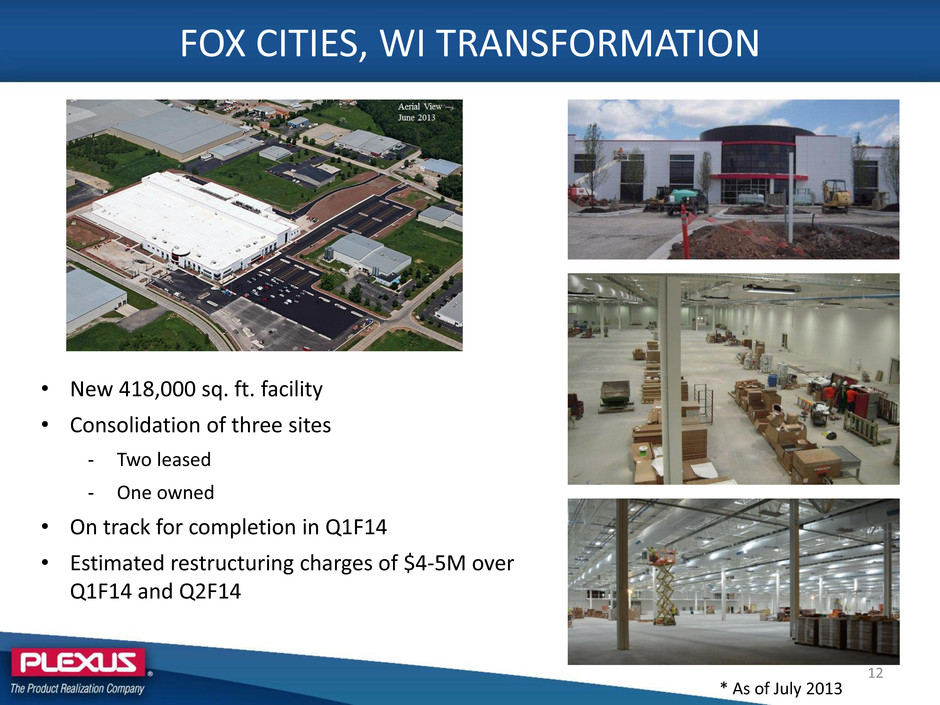

FOX CITIES, WI TRANSFORMATION • New 418,000 sq. ft. facility • Consolidation of three sites - Two leased - One owned • On track for completion in Q1F14 • Estimated restructuring charges of $4-5M over Q1F14 and Q2F14 * As of July 2013 12

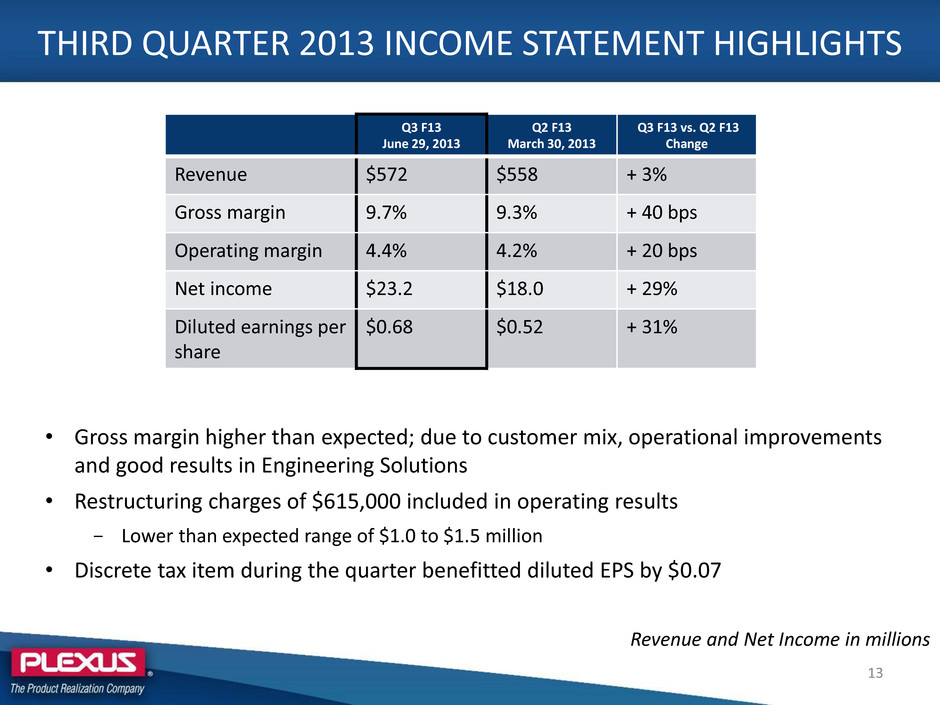

THIRD QUARTER 2013 INCOME STATEMENT HIGHLIGHTS 13 Q3 F13 June 29, 2013 Q2 F13 March 30, 2013 Q3 F13 vs. Q2 F13 Change Revenue $572 $558 + 3% Gross margin 9.7% 9.3% + 40 bps Operating margin 4.4% 4.2% + 20 bps Net income $23.2 $18.0 + 29% Diluted earnings per share $0.68 $0.52 + 31% Revenue and Net Income in millions • Gross margin higher than expected; due to customer mix, operational improvements and good results in Engineering Solutions • Restructuring charges of $615,000 included in operating results - Lower than expected range of $1.0 to $1.5 million • Discrete tax item during the quarter benefitted diluted EPS by $0.07

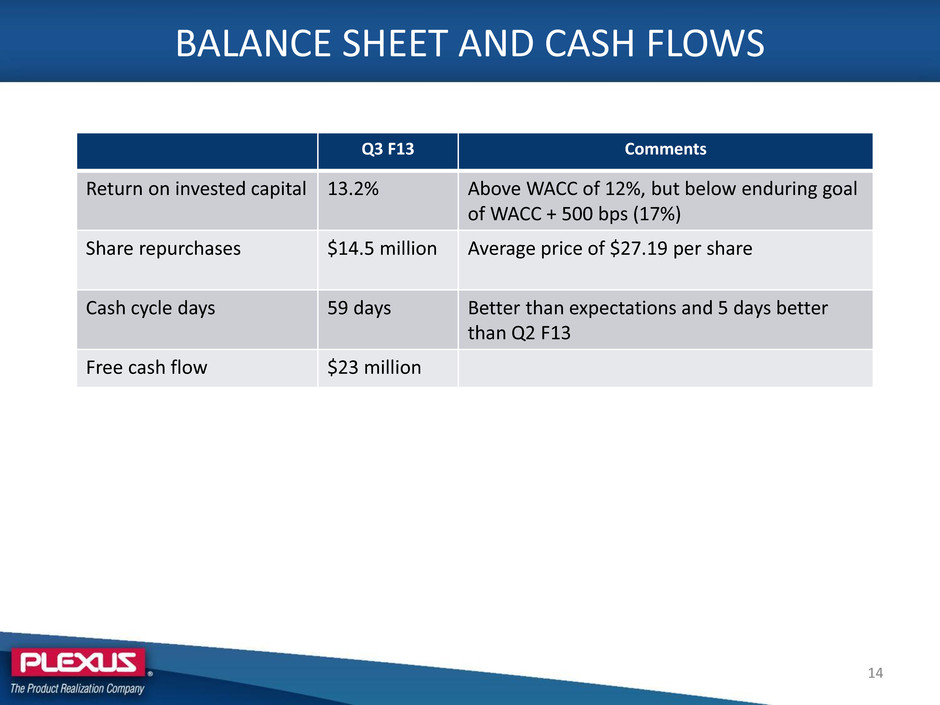

BALANCE SHEET AND CASH FLOWS 14 Q3 F13 Comments Return on invested capital 13.2% Above WACC of 12%, but below enduring goal of WACC + 500 bps (17%) Share repurchases $14.5 million Average price of $27.19 per share Cash cycle days 59 days Better than expectations and 5 days better than Q2 F13 Free cash flow $23 million

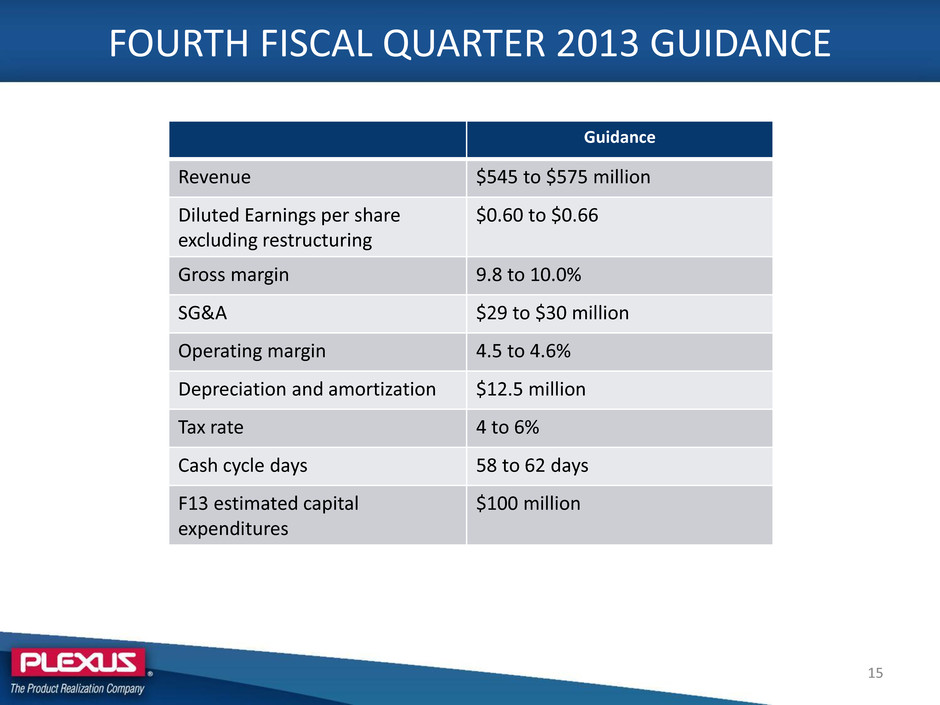

FOURTH FISCAL QUARTER 2013 GUIDANCE 15 Guidance Revenue $545 to $575 million Diluted Earnings per share excluding restructuring $0.60 to $0.66 Gross margin 9.8 to 10.0% SG&A $29 to $30 million Operating margin 4.5 to 4.6% Depreciation and amortization $12.5 million Tax rate 4 to 6% Cash cycle days 58 to 62 days F13 estimated capital expenditures $100 million

WRAP-UP 16 Near-term focus items: • Wrap-up Juniper disengagement (final product & material sales) • Fox Cities, WI transformation over next few quarters • Continue to build revenue momentum into our new Oradea facility • New low cost Americas solution in Mexico (anticipate an announcement) • New wins at target to drive a return to growth in F14 • Deliver results consistent with our Financial Model despite a more challenging growth environment