Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HERON THERAPEUTICS, INC. /DE/ | d565664d8k.htm |

Company Overview

OTCBB: APPA

July 2013

Exhibit 99.1 |

Legal

Disclaimer This presentation contains "forward-looking statements"

as defined by the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve risks and uncertainties,

including uncertainties associated with timely development, approval, launch

and acceptance of new products, satisfactory completion of clinical studies,

establishment of new corporate alliances, progress in research and

development programs and other risks and uncertainties identified in the

Company's filings with the Securities and Exchange Commission. Actual

results may differ materially from the results expected in our forward looking

statements. We caution investors that forward-looking statements

reflect our analysis only on their stated date. We do not intend to

update them except as required by law.

2

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Company:

A.P. Pharma, Inc.

Ticker:

OTCBB: APPA.OB

Stock Price:

$0.39 (7/5/2013)

Market Capitalization:

$119.2

million

1

Cash:

$46

million

2

Debt:

$4.8

million

2

Stock Summary

1

Based on 305.6 million common shares outstanding. Does not include

outstanding warrants for 81.1 million shares with weighted average exercise

price of $0.22/share, nor shares issuable upon conversion of notes

convertible for up to 120.3 million shares based on a rate of 25,000 shares for

every $1,000 of principal, nor currently exercisable employee stock options for up

to 27.1 million shares with weighted average exercise price of

$0.38/share. 2

As of March 31, 2013

3

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Barry

D. Quart, Pharm.D. Chief Executive Officer

Ardea Biosciences

Agouron Pharmaceuticals

Pfizer

Robert Rosen

President &

Chief Commercial Officer

Bayer Healthcare

Sanofi-Synthèlabo

Imclone

Steve Davis

Chief Operating Officer

Ardea Biosciences

Neurogen

Mark Gelder, M.D.

Senior Vice President &

Chief Medical Officer

GE Healthcare

Bayer Healthcare

Wyeth

Senior Management

4

July

2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

A.P.

Pharma Highlights July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

5

Lead product candidate, APF530, is long-acting, injectable

product for chemotherapy-induced nausea and vomiting (CINV)

Incorporates

widely

used

5-HT3

antagonist

-

granisetron

(Kytril

®

)

5-day delivery profile

Reduces both acute-

and delayed-onset CINV with single injection

Patent coverage into 2024

APF530

shown

to

be

non-inferior

to

market

leader

Aloxi

®

1,341-patient, randomized, controlled, Phase 3 study

APF530 targets a large market opportunity, with approximately

7 million doses of chemotherapy annually in US alone*

Recent competitive setbacks could enhance commercial uptake

Could be second, long-acting, injectable product on market

A.P. Pharma has the potential to leverage its Biochronomer™

drug delivery technology, its development capacity and

commercial expertise into other opportunities

*TDR August 2006 internal report |

Clinical Summary

6

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

A

Pivotal, Phase 3, Randomized Clinical Trial of the Efficacy and Safety

of

APF530

Compared

to

Palonosetron

(Aloxi

®

)

for

CINV

1428 chemotherapy

patients stratified by

HEC or MEC

First

Randomization

Primary

Endpoint*

Cycle 1

Cycles 2-4

Second

Randomization

All patients received

dexamethasone as appropriate to

their chemotherapy stratum.

©

2013. A.P. Pharma, Inc. All rights reserved.

7

1,341 patients in primary efficacy

population

Placebo SC +

Palonosetron

0.25 mg IV

APF530 5 mg

SC + Placebo IV

APF530 10 mg

SC + Placebo IV

APF530

5 mg SC

APF530

10 mg SC

APF530

5 mg SC

APF530

10 mg SC

* Primary end point compared complete response between groups in both the acute (day 1) and

delayed (days 2-5) phase; Complete response defined as no emesis and no

rescue medications.

July

2013 |

APF530

Pharmacokinetics July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

8

Granisetron is released rapidly following injection of APF530 and continues to be

released over at least 5-days, with therapeutic concentrations observed

out to 6 days *Data from patent application 20120258164 for transdermal

granisetron Time after Dosing (h)

Minimum

therapeutic

concentration of

granisetron* |

Primary Efficacy Results: Complete Response

Patients Receiving Moderately

Emetogenic Chemotherapy

Acute

Delayed

APF530 10mg

Acute

Delayed

Difference in Complete Response

APF530-Aloxi (97.5% CI)

9

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Primary Efficacy Results: Complete Response

Difference in Complete Response

APF530-Aloxi (98.33% CI)

Acute

Delayed

APF530 10mg

Patients Receiving Highly

Emetogenic Chemotherapy

Acute

Delayed

10

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Safety

Summary 1

Safety results with the 5 mg dose of APF530 studied in separate arm of the phase 3

study are not included 2

>90% of injection site reactions were reported as mild; one patient

discontinued due to injection site reaction Reported in Cycle 1

11

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

APF530 10 mg

Aloxi 0.25 mg

N

%

N

%

Drug Related Serious Adverse Events

0

0

0

0

Discontinued Due to Adverse Event

1

0.2

0

0

Frequent Adverse Events

Gastrointestinal Disorders

Constipation

Diarrhea

Abdominal pain

72

44

13

15.4

9.4

2.8

62

39

28

13.4

8.4

6.0

Nervous System

Headache

47

10.0

45

9.7

Injection Site

Placebo (NaCl)

Bruising

Erythema (redness)

Nodule (lump)

Pain

93

51

50

33

19.9

10.9

10.7

7.1

41

14

3

5

8.9

3.0

0.6

1.1

2

1 |

Efficacy through Multiple Chemotherapy Cycles

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

12

1

Overall Complete Response defined as no emesis and no rescue medications during 0

to 120 hours following chemotherapy

Moderately Emetogenic

Chemotherapy

Highly Emetogenic

Chemotherapy

Overall Complete Response Rates

1

for APF530 10 mg |

Sustained

Efficacy

of

APF530

in

Cycles

1-4

*Sakai et al (Ann Oncol.

2008;19)

Complete Response Rates for Delayed-Onset CINV in Patients

Receiving Highly Emetogenic Chemotherapy

351

315

254

117

100%

90%

72%

33%

240

171

130

95

100%

71%

54%

40%

N =

% of Cycle 1

APF530 500 mg

Palonosetron 0.75 mg*

©

2013. A.P. Pharma, Inc. All rights reserved. CONFIDENTIAL

13

*Source: Majaro Tables, 14_2_1_91b and 14_2_1_14_1

July

2013 |

APF530’s Efficacy with Difficult Chemo Regimens

1

Treatment

Chemotherapeutic Regimen

APF530 10 mg

Aloxi 0.25 mg

Moderately

Emetogenic

Acute

Cyclophosphamide/Doxorubicin

70.7%

65.7%

All other regimens

84.4%

85.0%

Delayed

Cyclophosphamide/Doxorubicin

47.4%

46.3%

All other regimens

72.9%

70.0%

Highly

Emetogenic

Acute

Cisplatin regimens

81.1%

75.5%

Carboplatin/Paclitaxel

85.4%

89.8%

All other regimens

75.4%

67.6%

Delayed

Cisplatin regimens

66.0%

60.4%

Carboplatin/Paclitaxel

70.8%

71.4%

All other regimens

65.2%

57.4%

1

Data from post-hoc analysis. Not statistically significant.

Highlighted MEC regimen changed to HEC in 2011 ASCO Guidelines

14

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Efficacy Maintained With Reanalysis of HEC

Protocol Specified HEC Population

Acute

Delayed

15

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

Acute

Delayed

ASCO 2011 Guideline HEC Population |

Summary of Clinical Results

Bioerodible polymer technology releases granisetron to prevent CINV

over at least 5 days

Large, randomized, Phase 3 study conducted with APF530 showing

non-inferiority to Aloxi with the 10 mg of APF530

For both acute-

and delayed-onset CINV

With both moderately and highly emetogenic chemotherapy

APF530 was well-tolerated

Incidence of adverse events comparable to Aloxi

Injection site reactions where predominately mild

Good response rates were observed in difficult chemotherapy

regimens

Efficacy was maintained with reanalysis using ASCO 2011 guidelines

and through multiple cycles of chemotherapy

TQT study showed APF530 has no effect on QT; differentiated from

Zofran (most common dose restricted) and Anzemet (CINV claim

removed)

16

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Regulatory Status

17

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

APF530

NDA Status Submitted NDA in May 2009 under 505(b)(2) filing pathway

Received Complete Response Letter in March 2010

FDA raised major

issues in three main areas:

Dosing system

Chemistry, Manufacturing, and Controls (CMC)

Clinical/statistical

Resubmitted NDA in September 2012

Addressed issues raised in Complete Response Letter

Received Complete Response Letter March 2013 raising three

main issues:

CMC: correction of PAI issues and revision of one in-vitro release

method Requirement for Human Factors Validation Study with commercial

product Re-analysis of the existing Phase 3 study using the ASCO 2011

guidelines for catagorization of MEC and HEC

18

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

New

Management Team is Addressing the CRL Chemistry, Manufacturing, and

Controls Sites with PAI issues are being eliminated from the supply chain,

with work transferred to well established site with no PAI issues

Secondary benefit of consolidating manufacturing and release efforts:

substantial improvement in COGS

New in-vitro release method has been developed and being validated

Plan to produce three validation batches of finished product in advance of

re-filing to supply Human Factors Study

Human Factors Study

Will be conducted as soon as commercial material available

Re-analysis of Phase 3 using new ASCO 2011 Guidelines

Re-analysis complete

Complete dataset and programs ready to supply to FDA

Re-submission is now planned for 1Q2014

19

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Commercial Opportunity

20

©

2013. A.P. Pharma, Inc. All rights reserved.

July

2013 |

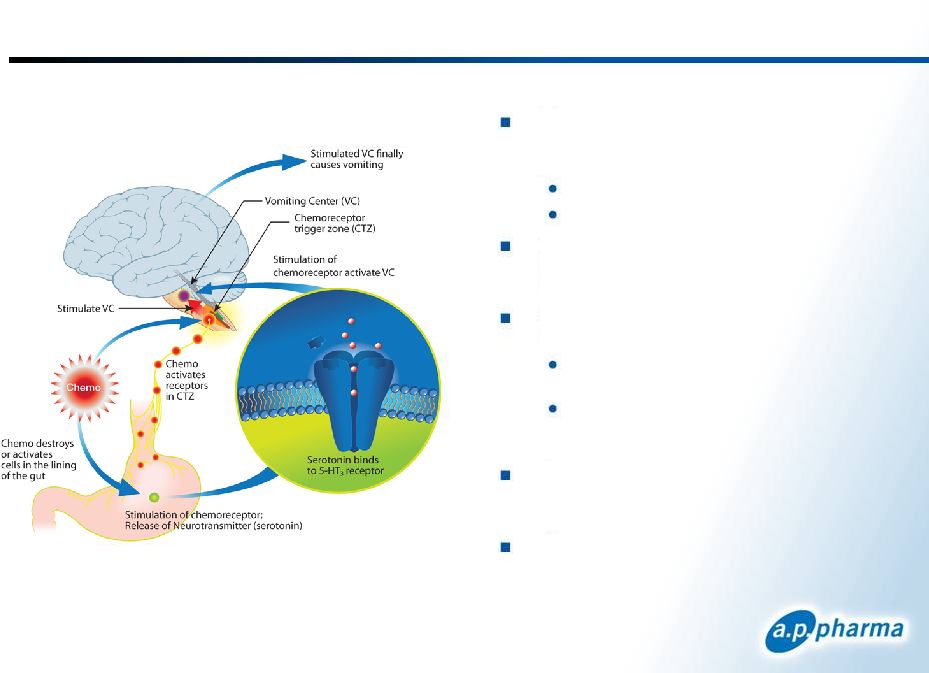

Continuing Unmet Need in CINV

Need for long-acting antiemetic

therapies

Delayed CINV (days 2-5) remains particularly

challenging to manage

Significant portion of patients fail to respond

to Aloxi

Need for antiemetic therapies with

sustained efficacy

CINV risk increases over multiple

chemotherapy cycles

1

Available at:

http://www.cancer.gov/cancertopics/pdq/supportivecare/nausea/HealthProfessional/page6#Section_183

“Despite the use of both first-generation

and

second-generation

5-HT

3

receptor

antagonists, the control of acute CINV, and

especially delayed nausea and vomiting, is

suboptimal,

and

there

is

considerable

opportunity for improvement

with either

the addition or substitution of new agents in

current regimens.”

NCI Statement On The Existing

Unmet

Need

in

CINV

21

©

2013. A.P. Pharma, Inc. All rights reserved.

1

July

2013 |

Addressing Debilitating Effects of CINV

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

22

More than 7 million cycles of

chemotherapy administered each

year*

~27% are highly emetogenic

~46% are moderately emetogenic

Most chemotherapy patients will

undergo 4-15 cycles of

chemotherapy

5-HT3 antagonists are standard-

of-

care for CINV

Recommended in ASCO, NCCN

and ONS guidelines

NK-1 antagonists are only indicated

in combination with 5-HT3

antagonists

An Injectable 5-HT3 antagonist is

co-administered with more than

90% of MEC and HEC regimens

If initial regimen is non-effective,

drugs are added or changed to

address CINV in subsequent cycles

*TDR August 2006 |

5-HT3 Antagonists Have Made a Substantial Impact

The use of high-dose

metoclopramide

Introduction of first-generation

5-HT3 antagonists (short-acting)

Approval of second-generation

5-HT3 antagonist (long-acting)

Approval of first

NK-1 antagonist

Adapted from Hawkins et al, Clinical Journal

of Oncology Nursing 2009, Volume 13, Number 1

FDA withdrawal of Anzemet and 32 mg dose of

ondansetron (Zofran) due to QT prolongation risk

5-HT3 receptor antagonists approved for CINV

©

2013. A.P. Pharma, Inc. All rights reserved.

23

Chemotherapy

Acute CINV

Delayed CINV

Highly

Emetogenic

granisetron (Kytril)

ondansetron (Zofran)

Aloxi

None

Moderately

Emetogenic

granisetron (Kytril)

ondansetron (Zofran)

Aloxi

Aloxi

July 2013 |

24

U.S. CINV Market Dynamics

Source: WK 07/2013

July 2013

* US Oncology data added starting 1/2009.

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

Q2'06

Q4'06

Q2'07

Q4'07

Q2'08

Q4'08

Q2'09

Q4'09

Q2'10

Q4'10

Q2'11

Q4'11

Q2'12

Q4'12

ALOXI

ANZEMET

KYTRIL

KYTRIL Generic (GRANISETRON)

ZOFRAN

ZOFRAN Generic (ONDANSETRON)

EMEND

Injectable Drugs for the Prevention of CINV

Number of Package Units Sold by Quarter |

Aloxi

Market Performance Zofran went

generic

Pricing

Average Selling Price = $175

Medicare Reimbursement = $186*

Wholesale Acquisition Cost ~ $380

Orange Book Patent Exclusivity

One patent expires April 2015

Three patents expire January 2024

25

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

*ASP plus 6%

Aloxi Sales |

~80%

of Aloxi Is Used in Clinics Hospital

Other

Clinics

1

2.2 million units

2

0.5 million units

0

3

0.1 million units

U.S.

Aloxi

Units

by

Class

of

Trade

–

12

Months

Ending

June

30

2012

IMS Health and Source Healthcare Analytics (WKH) data and Eisai Co., Ltd. published

sales figures 26

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

th |

>90% of Aloxi Units Contracted Through GPOs

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

27

2.2 Million Clinic Units

8%

23%

48%

21%

Misc

Onmark

ION

USO

IMS Health and Source Healthcare Analytics (WKH) data and Eisai Co., Ltd. published

sales figures Clinic

Units

by

GPO

–

12

Months

Ending

June

30

th

2012 |

WKH

Data

Oct.

2012

–

Clinic

Analysis

Aloxi Clinical Use Is Largely Concentrated

Cumulative Number of Accounts

32

1% accts

87

4% accts

161

7% accts

252

11% accts

500

22% accts

674

29% accts

904

39% accts

1246

54% accts

2305

100% accts

362

15% accts

80% of units (1.7M) comes from 39% of accounts (904)

50% of units (1.1M) comes from 15% of accounts (362)

28

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200 |

No New

Injectable 5-HT3 Drug on Horizon 29

2012

*Company reports, Leerink Swann; **Clinical Trials.gov NCT01339260 FDC = Fixed Dose Combo;

PDUFA date expected 12-15 months post P3 data 2013

2014

2015

EUR-1025 development program uncertain (once-a-day oral modified-release

formulation of ondansetron) July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

Rolapitant P3

Oral Data

Expected 2H 2013

Rolapitant Oral

FDA Approval

Expected Q4 2014

Rolapitant IV

Study Data 1H 2014

Rolapitant IV

FDA Approval

Expected 2H 2015

FDC P3 Oral

Data Expected Q1 2013

FDC Oral

FDA Approval 1H 2014

Candidate

Class

Indication

Sponsor

Possible Launch

APF530

5-HT3 Extended

release

Prevention

of CINV in MEC/HEC

A.P. Pharma

2H 2014

FDC**

FDC combines netupitant

(NK-1)

with

palonosetron

(Aloxi) in a single oral tablet

Prevention of CINV in MEC/HEC

Eisai / Helsinn

Oral 2H 2014

Rolapitant*

Long-acting NK-1

Prevention

of CINV in MEC/HEC

only in combination with 5-HT3

Tesaro

Oral 2H 2014

IV

2H 2015 |

APF530

Proposed Label July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

30

Proposed indication submitted in NDA

INDICATIONS AND USAGE

1.1 Chemotherapy-Induced Nausea and Vomiting

APF530 is indicated for:

•

Moderately emetogenic cancer chemotherapy (MEC)-

prevention of acute and delayed nausea and vomiting

associated with initial and repeat courses

•

Highly emetogenic cancer chemotherapy (HEC)-

prevention of

acute nausea and vomiting associated with initial and repeat

courses |

CINV

Market July 2013

31

©

2013. A.P. Pharma, Inc. All rights reserved.

*Indications requested in previous submission

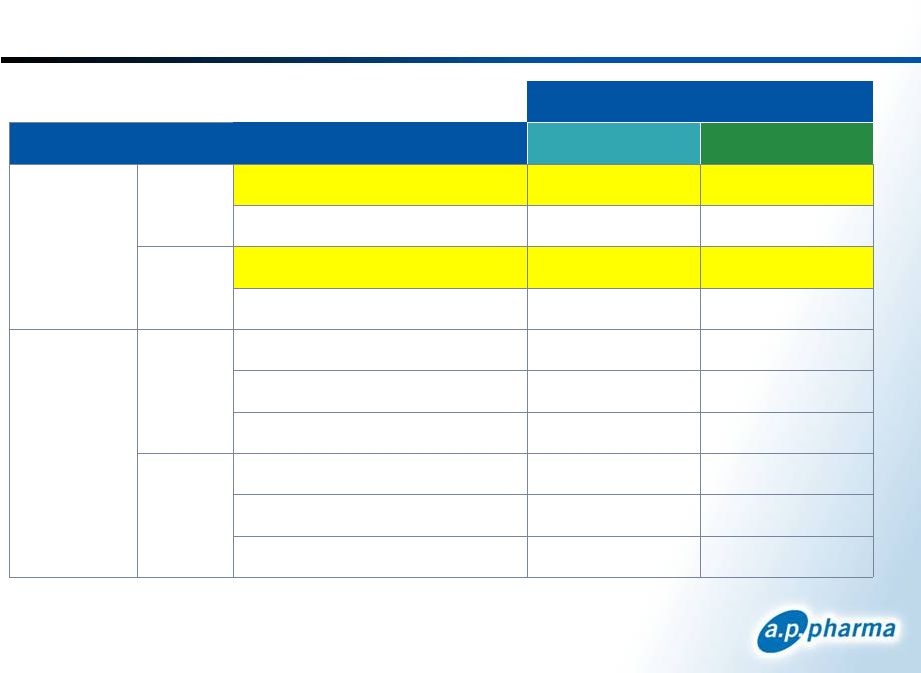

Acute Onset

(0-24 Hours)

Delayed Onset

(24-120 Hours)

Moderately

Emetogenic

Highly

Emetogenic

Moderately

Emetogenic

Highly

Emetogenic

APF530*

Aloxi

Kytril

Zofran |

Summary

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

32

CINV market is a large commercial opportunity, with approximately 7

million doses of chemotherapy per year in US

APF530 demonstrated non-inferiority to the market share leader Aloxi,

with 2012 annual sales of $440M

and ~50% unit market share

APF530 product profile

5-day release PK profile

Good response in difficult chemotherapy regimens

Efficacy through multiple cycles of chemotherapy

Clean QT results

Current market dynamics are stale with minimal investment providing

opportunities to become the market leader

Competitive landscape creates opportunity with the removal of Anzemet

and Zofran 32mg

Greater

than

80%

of

Aloxi

sales

are

in

the

community

setting

and

highly

concentrated consistent with other supportive care products

1. TDR August 2006 internal report; 2. 2012 Eisai Annual Report; 3. Wolters Kluwer

1

2

3 |

A.P.

Pharma Product Lifecycle Considerations 33

APF530 covered by multiple patents

2 patents covering combination of polymer, excipients and drug expire in

2021

3 patents covering APF530 expire in 2024

Polymer-based injectable products are difficult to copy

independent of IP

ANDA FDA requirements for injectable products

Must have same inactive ingredients in the same concentration as

the

reference listed drug

Polymers are complex mixtures of varying-length molecules, making

characterization for “sameness”

very challenging

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |

Financial Summary

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved.

34

Expect cash sufficient to fund through resubmission of APF530 NDA

Summary Statement of Operations

(In thousands, except per share data)

Three Months Ended

March 31, 2013

Revenue

$ –

Operating expenses

12,752

Other income (expenses)

(201)

Net loss

$ (12,953)

Net loss per share

1

$ (0.04)

Condensed Balance Sheet Data

(In thousands)

March 31, 2013

Cash and cash equivalents

$ 45,722

Total assets

$ 48,979

Total stockholders’

equity

$ 41,383

1

Based on 305.1 million weighted average common shares outstanding for the period ended

March 31, 2013. |

Thank You

A.P. Pharma, Inc.

OTCBB: APPA

July 2013

35

July 2013

©

2013. A.P. Pharma, Inc. All rights reserved. |