Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

FOR ANNUAL & TRANSITION REPORTS PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(MARK ONE)

[ x ] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2009

or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File Number: 001-33221

A.P. PHARMA, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 94-2875566 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

| 123 SAGINAW DRIVE, REDWOOD CITY, CALIFORNIA | 94063 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(650) 366-2626

Securities registered pursuant to Section 12(b) of the Act:

| COMMON STOCK | THE NASDAQ CAPITAL MARKET |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Exchange Act. Yes [ ] No [ x ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [ x ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ x ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [ x ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ x ]

The aggregate market value of the voting and non-voting common equity of the registrant held by non-affiliates of the registrant as of June 30, 2009, was $14,349,934(1) based upon the closing sale price on the NASDAQ Global Market reported for such date.

As of February 28, 2010, 39,426,041 shares of registrant’s Common Stock, $.01 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| Document |

Form 10-K Part | |

| Definitive Proxy Statement to be used in connection with the 2010 Annual Meeting of Stockholders. |

III |

| (1) | Excludes 15,265,887 shares held by directors, officers and shareholders whose ownership exceeds 5% of the outstanding shares at June 30, 2009. Exclusion of such shares should not be construed as indicating that the holders thereof possess the power, directly or indirectly, to direct the management or policies of the registrant, or that such person is controlled by or under common control with the registrant. |

Table of Contents

2

Table of Contents

Introduction—Forward-Looking Statements

In this Annual Report on Form 10-K, the “Company,” “A.P. Pharma,” “we,” “us” and “our” refer to A.P. Pharma, Inc.

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. All statements contained in this Form 10-K, other than statements of historical fact, are forward-looking statements. When used in this report or elsewhere by management from time to time, the words “believe,” “anticipate,” “intend,” “plan,” “estimate,” “expect,” “may,” “will,” “should,” “seeks” and similar expressions are forward-looking statements. Such forward-looking statements are based on current expectations, but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements made in this Form 10-K include, but are not limited to, statements about:

• the progress of our research, development and clinical programs and timing of regulatory approval and commercial introduction of APF530 and future product candidates;

• estimates of the dates by which we expect to report results of our clinical trials and the anticipated results of these trials;

• our ability to market, commercialize and achieve market acceptance for APF530 or other future product candidates;

• our ability to establish collaborations for our technology, APF530 and other future product candidates;

• uncertainties associated with obtaining and enforcing patents;

• our estimates for future performance; and

• our estimates regarding our capital requirements and our needs for additional financing.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual events or results may differ materially from those discussed in the forward-looking statements as a result of various factors. For a more detailed discussion of such forward-looking statements and the potential risks and uncertainties that may impact our actual results, see the “Risk Factors” section of this Form 10-K and the other risks and uncertainties described below under the headings: “Our Lead Product Candidate APF530,” “Development Pipeline,” “Our Technology Platform,” “Our Strategy,” “Patents and Trade Secrets,” “Competition,” and under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These forward-looking statements reflect our view only as of the date of this report. Except as required by law, we undertake no obligations to update any forward looking statements. Accordingly, you should also carefully consider the factors set forth in other reports or documents that we file from time to time with the Securities and Exchange Commission.

3

Table of Contents

Company Overview

A.P Pharma is a specialty pharmaceutical company developing pharmaceutical products using our proprietary Biochronomer™ polymer-based drug delivery technology. Our primary focus is on our lead product candidate, APF530, which is being developed for the prevention of chemotherapy-induced nausea and vomiting (CINV). In May 2009, we filed a New Drug Application (NDA) with the U.S. Federal Drug Administration (FDA) under Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act (FDCA) seeking approval for APF530. The FDA is currently reviewing the NDA, and based on the Prescription Drug User Fee Act (PDUFA), has issued an action date of March 18, 2010. We are seeking regulatory approval of APF530 for the prevention of acute CINV for patients undergoing both moderately and highly emetogenic chemotherapy, and for prevention of delayed CINV for patients undergoing moderately emetogenic chemotherapy. There are no guarantees that the FDA will provide its response by March 18, 2010, nor can there be any assurances that any such response will be favorable.

Our core Biochronomer technology, on which APF530 and our other products are based, consists of bioerodible polymers designed to release drugs over a defined period of time. We have completed over 100 in vivo and in vitro studies demonstrating that our Biochronomer technology is potentially applicable to a range of therapeutic areas, including prevention of nausea and vomiting, pain management, control of inflammation and treatment of ophthalmic diseases. We have also completed comprehensive animal and human toxicology studies that have established that our Biochronomer polymers are safe and well tolerated. Furthermore, our Biochronomer technology can be designed to deliver drugs over periods varying from days to several months.

In addition to our lead drug candidate, we have a pipeline of other product candidates that use our Biochronomer technology. Further development of our pipeline products has been temporarily deferred in order to focus both managerial and financial resources on the APF530 NDA and negotiations of a commercialization partnership for APF530. One of these pipeline products, APF112, incorporates the well-known local anesthetic, mepivacaine. It is designed to provide up to 36 hours of relief from post-surgical pain and to minimize the use of morphine-like drugs, or opiates, which are used extensively in the management of post-surgical pain. A second pipeline product, APF580, incorporates a presently unannounced opiate for extended relief of severe pain. An investigational new drug application (IND) for APF580 was successfully filed in the third quarter of 2008.

We were founded in February 1983 as a California corporation under the name AMCO Polymerics, Inc. (AMCO). AMCO changed its name to Advanced Polymer Systems, Inc. in 1984 and was reincorporated in the state of Delaware in 1987. We changed our name to A.P. Pharma, Inc. in May 2001 to reflect our new pharmaceutical focus. Our offices are located at 123 Saginaw Drive, Redwood City, California 94063. Our telephone number is (650) 366-2626. Our website is located at www.appharma.com. Information contained on, or that can be accessed through, our website is not part of this Annual Report on Form 10-K.

4

Table of Contents

Our Lead Product Candidate—APF530

CINV Background

Prevention and control of nausea and vomiting, or emesis, are paramount in the treatment of cancer patients. The majority of patients receiving chemotherapy will experience some degree of emesis if not prevented with an antiemetic. Chemotherapy treatments can be classified as moderately emetogenic, meaning that 30–90% of patients would experience CINV, or highly emetogenic, meaning that over 90% of patients would experience CINV, if they were not treated with an antiemetic prior to chemotherapy. Onset of CINV within the first 24 hours is described as “acute,” and CINV that occurs more than 24 hours after treatment is described as “delayed.” Delayed CINV may persist for several days. Prevention of CINV is significant because the distress caused by CINV can severely disrupt patient quality of life and can lead some patients to delay or discontinue chemotherapy.

Current Therapy

Chemotherapeutic agents activate or destroy cells in the lining of the gut, releasing a neurotransmitter called serotonin. When serotonin binds to 5-hydroxytryptamine type 3 (5-HT3) receptors, the patient experiences nausea and vomiting. Granisetron, like other 5-HT3 antagonists, inhibits the vomiting reflex by preventing serotonin from binding to 5-HT3 receptors. Physicians may combine 5-HT3 antagonists with other agents, such as corticosteroids or neurokinin-1 (NK1) antagonists, to better prevent CINV.

Current treatment options for preventing CINV include 5-HT3 antagonists such as palonosetron (Aloxi®), ondansetron (Zofran®), dolasetron (Anzemet®) and granisetron (Kytril®). Aprepitant (Emend®), an NK1 antagonist, is also used to prevent CINV and is always used in combination with a 5-HT3 antagonist. As shown in the table below, all of the 5-HT3 antagonists are approved for the prevention of acute CINV in patients receiving either moderately or highly emetogenic chemotherapy. Within the last several years, generic versions of granisetron and ondansetron have become available. Only Aloxi is approved for the prevention of delayed CINV in patients receiving moderately emetogenic chemotherapy. No 5-HT3 antagonist is approved for the prevention of delayed CINV in patients receiving highly emetogenic chemotherapy.

5

Table of Contents

According to IMS Health, Aloxi sales for the prevention of CINV were approximately $303 million in 2007, $391 million in 2008 and $437 million in 2009. We believe the total addressable U.S. market when calculated on a branded basis approaches $1 billion for use of 5-HT3 antagonists in the prevention of CINV.

| Chemotherapy Regimen |

Approved 5-HT3 Antagonists for Acute CINV |

Approved 5-HT3 Antagonists for Delayed CINV | ||

| Moderately Emetogenic |

Granisetron (Kytril) Ondansetron (Zofran) Dolasetron (Anzemet) Palonosetron (Aloxi) |

Palonosetron (Aloxi) | ||

| Highly Emetogenic |

Granisetron (Kytril) Ondansetron (Zofran) Dolasetron (Anzemet) Palonosetron (Aloxi) |

None |

Despite evidence that delayed CINV affects as many as 50–70% of patients, and that more patients experience delayed CINV than acute CINV, oncology nurses and physicians are likely to underestimate the magnitude of these problems in the patients for whom they care. This may occur in part since patients often do not report side effects they experience at home following chemotherapy treatments. Even though high percentages of chemotherapy patients experience such delayed nausea and emesis, presently Aloxi is the only 5-HT3 antagonist approved for dealing with this delayed CINV. We believe that APF530, if approved, could become the second long-acting product given in a single administration that is capable of dealing with this important medical need.

Our Solution—APF530

Our lead product candidate, APF530, is being developed for the prevention of acute CINV in patients receiving moderately or highly emetogenic chemotherapy and for the prevention of delayed CINV in patients receiving moderately emetogenic chemotherapy. APF530 is delivered by a single subcutaneous injection and contains the 5-HT3 antagonist granisetron. Granisetron, for infusion and oral tablets, is approved for the prevention of acute CINV, but not delayed CINV. We selected granisetron because it is a potent, well-tolerated drug and the applicable granisetron patent expired in the United States on December 29, 2007.

Granisetron and other 5-HT3 antagonists, as a class, have become the most common antiemetic agents used in chemotherapy. However, no 5-HT3 antagonist formulation is currently approved for the prevention of both acute and delayed CINV for both moderately and highly emetogenic chemotherapy. Results from our APF530 Phase 3 clinical trial demonstrated that we can prevent acute CINV for both moderately and highly emetogenic chemotherapy, and prevent delayed CINV in moderately emetogenic chemotherapy. The efficacy data involving delayed CINV in highly emetogenic chemotherapy showed results for the higher dose of APF530 that were numerically better than Aloxi and were statistically non-inferior. Because Aloxi is not approved for use in this setting, it would be necessary to demonstrate superiority in order to get approval for this use. However, APF530 did not achieve the statistically significant level of superiority necessary to support a claim for this use. If we

6

Table of Contents

obtain regulatory approval for all uses except the prevention of delayed CINV in highly emetogenic chemotherapy, we believe that we should have a product comparable to Aloxi, which despite the limitation of its claim for prevention of delayed CINV to only moderately emetogenic treatments, has achieved considerable commercial success.

Phase 2 Clinical Trial

In September 2005, we completed an open-label Phase 2 clinical trial for APF530. We evaluated the safety, tolerability and pharmacokinetics of APF530 in cancer patients. In addition, efficacy endpoints were evaluated relating to emetic events and the use of additional medication for treating CINV. The trial demonstrated that APF530 was well tolerated; there were no serious adverse events attributed to APF530 and less than 10% of participating patients had injection site reactions, all of which were mild.

Analysis of the efficacy data from our Phase 2 trial, in which patient groups received either moderately or highly emetogenic chemotherapy, was based on complete responders, patients who experienced no vomiting and no use of additional medication for CINV during the observation period. This efficacy data was compared to similar data for Aloxi, as reported from its Phase 3 trials. APF530 indications of efficacy compared favorably with the complete response results in the Aloxi trials data. Based on this comparison, we designed our Phase 3 clinical program to conclusively compare APF530 to Aloxi in a prospective randomized trial design.

Pivotal Phase 3 Clinical Trial Design

In December 2005, we held our end-of-Phase-2 meeting with the FDA, at which we discussed our regulatory approval strategy and our proposed design for the pivotal Phase 3 trial. Following this meeting, we finalized plans for our pivotal Phase 3 trial in accordance with FDA input. The trial’s primary objectives were to demonstrate:

• non-inferiority, or comparability, of APF530 to Aloxi for the prevention of acute CINV following the administration of either moderately emetogenic or highly emetogenic chemotherapy;

• non-inferiority of APF530 in comparison to Aloxi for the prevention of delayed CINV following administration of moderately emetogenic chemotherapy; and

• superiority of APF530 in comparison to Aloxi for the prevention of delayed CINV following administration of highly emetogenic chemotherapy.

7

Table of Contents

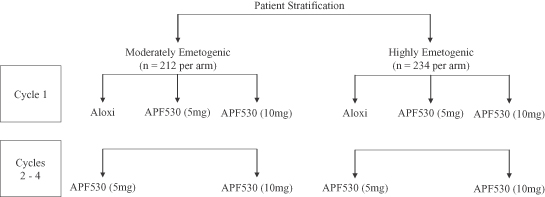

Our pivotal Phase 3 clinical trial was initiated in May 2006 as a multicenter, randomized, observer-blind, actively-controlled, double-dummy, parallel group study that compared the efficacy of APF530 with Aloxi. The trial stratified patients into two groups, one receiving moderately and the other receiving highly emetogenic chemotherapeutic agents in accordance with the Hesketh algorithm, which assigns emetogenic levels based on the chemotherapy agent, drug dosage and combinations employed. In each emetogenic group, patients were randomized during Cycle 1 to receive either APF530 high dose (10 mg), APF530 low dose (5 mg) or the currently approved dose of Aloxi. In subsequent treatment cycles up to three additional cycles (Cycles 2—4), the patients were re-randomized to either of the two APF530 doses. The diagram below provides further graphical representation of the patient stratification design and target enrollment for patient randomization in our clinical trial.

Pivotal Phase 3 Clinical Trial Results

During 2006 and the first half of 2007, all patient enrollments in the pivotal Phase 3 study of APF530 were located within the United States. Beginning in the second half of 2007, enrollments were broadened to include clinical trial sites in India and Poland. The study completed patient enrollment of 1,395 patients in June 2008, and we announced top-line results on September 30, 2008.

The goals of the trial were to demonstrate the safety and efficacy of APF530 in the treatment of CINV following the administration of highly or moderately emetogenic chemotherapy, and to establish an effective dose for APF530, creating a data package suitable for inclusion in the NDA. In the trial, 5 mg and 10 mg doses of granisetron were evaluated in patients, and based on the results, the 10 mg dose appears to provide greater efficacy with a side effect profile similar to the 5 mg dose. As such, we selected the APF530 10 mg dose for inclusion in the NDA.

The trial was structured to compare the two APF530 doses (5 mg and 10 mg) with Aloxi in four different primary efficacy endpoints:

• non-inferiority to Aloxi for the prevention of acute CINV in patients receiving moderately emetogenic chemotherapies;

• non-inferiority to Aloxi for the prevention of delayed CINV in patients receiving moderately emetogenic chemotherapies;

8

Table of Contents

• non-inferiority to Aloxi for the prevention of acute CINV in patients receiving highly emetogenic chemotherapies; and

• superiority to Aloxi for the prevention of delayed CINV in patients receiving highly emetogenic chemotherapies.

The 10 mg dose of APF530 achieved complete response (CR) rates that were numerically higher than Aloxi across all four assessments. These results demonstrated non-inferiority to Aloxi for all four assessments, but did not achieve the superiority endpoint for the delayed CINV assessment for highly emetogenic chemotherapies. Aloxi is not FDA approved for the prevention of delayed CINV in patients receiving highly emetogenic chemotherapies; therefore, APF530 needed to be deemed superior to Aloxi for this endpoint to obtain a corresponding label claim. CR was defined as the absence of emetic episodes or use of anti- emetic rescue medications during a specified period of time. The time periods studied for CINV onset were 0 to 24 hours after chemotherapy, which is known as acute CINV, and 24 to 120 hours after chemotherapy, which is known as delayed CINV.

The results summarized below are the primary endpoints from the study, with such data being drawn from the first cycle of treatment:

Complete Response by Treatment–Cycle 1

| Emetogenicity Level | Treatment Group | Statistics vs. Aloxi (Confidence Interval) | ||||||||

| APF530 (5 mg) |

APF530 (10 mg) |

Aloxi | 5 mg | 10 mg | ||||||

| Moderately emetogenic |

(n=214) | (n=212) | (n=208) | |||||||

| • Acute CINV |

74.8% | 76.9% | 75.0% | NI (-9.8, 9.3) | NI (-7.5, 11.4) | |||||

| • Delayed CINV |

51.4% | 59.0% | 57.7% | I (-17.1, 4.6) | NI (-9.5, 12.1) | |||||

| Highly emetogenic |

(n=229) | (n=240) | (n=238) | |||||||

| • Acute CINV |

77.7% | 81.3% | 80.7% | NI (-12.1, 6.1) | NI (-8.2, 9.3) | |||||

| • Delayed CINV |

64.6% | 68.3% | 66.4% | NS (-12.4, 8.8) | NS (-8.3, 12.2) | |||||

(NI) Non-inferior efficacy was established using a modified Bonferroni step down procedure. APF530 non-inferior to Aloxi (i.e. lower bound of adjusted 95% CI for APF530), Aloxi difference excludes less than or equal to negative 15%. The Confidence Intervals shown for the moderately emetogenic and highly emetogenic levels are 97.5% and 98.3%, respectively. (NS) = No significant difference. (I) = Inferior efficacy.

APF530 was generally well tolerated, with a side effect profile consistent with previous human use of granisetron and only one serious adverse event reported as possibly attributed to APF530. In Cycle 1, the data showed a low incidence of patients discontinuing therapy due to any adverse events (related or unrelated to study drugs): 0.5%, 0.9% and 0.9% in the moderately emetogenic patient group, and 2.0%, 3.5% and 1.2% in the highly emetogenic patient group for APF530 5 mg, APF530 10 mg and Aloxi, respectively. Further, of the patients completing the first cycle, 1,043 went on to receive a total of 2,374 additional doses of APF530 in Cycles 2 to 4. Of these patients, only 2 (or 0.2%) discontinued therapy due to treatment related adverse events.

9

Table of Contents

Additional data from the pivotal Phase 3 trial comparing APF530 with Aloxi was released on November 5, 2008, and is reported below. The additional data provided herein includes predetermined secondary efficacy endpoints and safety data that were not available at the time the top-line data were released. Review of the clinical data package demonstrates the robustness of the APF530 clinical response within and across chemotherapy cycles. Some of the additional key findings follow:

• Collectively, the Phase 3 efficacy and safety data support the conclusion that the APF530 10 mg dose is the most effective dose and therefore was the selected dose for the NDA.

• In patients receiving multiple cycles of APF530, CR rates were observed to generally increase over four cycles of chemotherapy. The data summarized below supports the continued benefits of APF530 over multiple cycles:

Complete Response(1) of APF530 10 mg Dose Over Four Chemotherapy Cycles

| Emetogenicity Level |

Cycle 1 | Cycle 2 | Cycle 3 | Cycle 4 | ||||

| Moderately Emetogenic |

(n=212) | (n=240) | (n=184) | (n=134) | ||||

| • Acute (0-24h) |

76.9% | 77.1% | 78.8% | 83.6% | ||||

| • Delayed (24-120h) |

59.0% | 62.1% | 61.4% | 66.4% | ||||

| • Overall (0-120h) |

54.2% | 58.8% | 60.3% | 63.4% | ||||

| Highly Emetogenic |

(n=240) | (n=263) | (n=202) | (n=148) | ||||

| • Acute (0-24h) |

81.3% | 84.8% | 89.6% | 87.8% | ||||

| • Delayed (24-120h) |

68.3% | 76.0% | 81.2% | 83.8% | ||||

| • Overall (0-120h) |

64.6% | 72.2% | 78.7% | 79.7% |

| (1) | No emetic episodes and no rescue medications |

• The evaluation of “time to first treatment failure,” defined as either time to first emetic episode or use of rescue medication, showed that a greater proportion of patients treated with APF530 10 mg dose (vs. Aloxi) remained “failure free” on days one through five following either moderate or highly emetogenic chemotherapy.

• The Phase 3 trial protocol predefined multiple primary and secondary endpoints, including complete response, complete control (no emesis, no rescue therapy and no-greater-than-mild nausea) and total response (no emesis, no rescue therapy and no nausea) measured over defined time intervals (acute, delayed and overall). Although there were no significant differences between the APF530 10 mg dose vs. Aloxi, the response rates for APF530 10 mg dose were higher than Aloxi in all nine analyses for moderately emetogenic chemotherapy and in five of nine analyses for highly emetogenic chemotherapy.

• The safety profile for APF530 was very similar to that for Aloxi; the most notable adverse event was constipation, observed in 15.4% and 13.4% of patients receiving APF530 10 mg and Aloxi, respectively. Headache was observed in 10.0% and 9.7% of patients receiving APF530 10 mg dose and Aloxi, respectively.

• Investigators were required to observe and record all reactions associated with the subcutaneous injection site on days one and five for each treatment cycle. Overall, greater than 90% of the recorded observations were mild in severity, the most common being redness and bruising. With each additional cycle of treatment, the frequency of injection site reactions decreased, indicating APF530 can safely be administered for multiple cycles.

10

Table of Contents

• During the trial, patients received more than 1,600 separate injections of APF530 10 mg dose. Assessment of any injection site pain was made on days one and five of treatment: on day one, less than 0.1% of injections produced any reports of pain; on day five approximately 4% of injections produced reported pain. All but four of these reports of pain were recorded as mild, with the four recorded as moderate.

Additional data from the pivotal Phase 3 trial was presented at the annual meeting of the American Society of Clinical Oncology on June 1, 2009, and is reported below. Some of the additional key findings follow:

• CR rates for APF530 10 mg dose were generally higher in patients that had received prior chemotherapy when compared to patients that had not received any previous chemotherapy. Additionally, in all instances, CR rates for APF530 in patients receiving prior chemotherapy were numerically higher than those observed for palonosetron. Based on previous clinical studies, many physicians believe that the risk of CINV increases with each additional cycle of chemotherapy. These new data may suggest potential utility for APF530 in treating patients who have received prior chemotherapy.

• Of the highly emetogenic chemotherapy regimens, those containing cisplatin are considered to be the most troublesome due to their ability to cause significant delayed CINV. The CR rates for patients receiving cisplatin based regimens were numerically higher for APF530 10 mg when compared to palonosetron in both acute and delayed CINV. Specifically, in acute CINV, APF530 had an 81.1% CR rate versus 75.5% for palonosetron, and 66.0% versus 60.4%, respectively, in delayed CINV.

• A pharmacokinetic analysis, conducted in a sub-group of patients, confirmed that a single APF530 10 mg dose successfully maintained blood levels of granisetron for the entire five-day period.

New Drug Application

In May 2009, we filed an NDA for APF530 with the FDA under Section 505(b)(2) of the FDCA. In July 2009 the FDA notified us that it had accepted the NDA and, under the PDUFA guidelines, issued an action date of March 18, 2010. There are no guarantees that the FDA will provide its response by March 18, 2010, nor can there be any assurances that any such response will be favorable. If the FDA does not take action on our NDA by the PDUFA date, does not approve our NDA or requests additional work or changes to the NDA, our continued ability to commercialize APF530 could be seriously impaired and our business would be adversely impacted.

Section 505(b)(2) of the FDCA permits the FDA, in its review of an NDA, to rely on previous FDA findings of safety and efficacy of the active ingredient in APF530, granisetron. Section 505(b)(2) applications may be submitted for drug products that represent a modification (e.g., a new indication or new dosage form) of an eligible approved drug and for which investigations other than bioavailability or bioequivalence studies are essential to the drug’s approval. The additional information in 505(b)(2) applications can be provided by literature or by reference to past FDA findings of safety and efficacy for approved drugs, or it can be based upon studies conducted by or for the applicant to which it has obtained a right of reference. The majority of 505(b)(2) applications are filed for new formulations of currently approved drugs, so there is an existing understanding—on the part of the FDA, as well as the medical community—of their safety and efficacy.

11

Table of Contents

Development Pipeline

In addition to our lead program, we have a pipeline of other product candidates using our Biochronomer technology. Further development of our pipeline products has been temporarily deferred in order to focus both managerial and financial resources on the development of APF530.

| Product Candidate |

Potential Application | Drug | Targeted Duration | Status | ||||

| APF112 |

Post-surgical pain relief | Mepivacaine | Up to 36 hours | Phase 2 | ||||

| APF580 |

Pain relief - human | Undisclosed Opiate | At least seven days | Preclinical | ||||

| APF580 |

Pain relief - veterinary | Undisclosed Opiate | At least seven days | Preclinical | ||||

APF112

APF112 utilizes our Biochronomer delivery technology to target post-surgical pain relief. The product is designed to provide up to 36 hours of localized pain relief by delivering mepivacaine directly to the surgical site. Mepivacaine is a well-known, short-acting, local anesthetic with an excellent safety profile. APF112 is designed to prolong the anesthetic effect of mepivacaine and thus minimize or eliminate the use of opiates. Opiates are currently used in the majority of surgical procedures as a means of managing post-operative pain, and while they are powerful and useful drugs, they may have side effects such as addiction, nausea, disorientation, sedation, constipation, vomiting, urinary retention and, in some situations, life-threatening respiratory depression. If efficacy in treating post-surgical pain can be demonstrated, we believe that there will be substantial potential for this product, as there are approximately 20 million surgical procedures performed annually in the United States for which the product could potentially be utilized.

During 2004, our Phase 2 clinical trial was conducted in surgeries for inguinal hernia repair, which is considered a moderately to severely painful procedure. The results indicated excellent safety and tolerability. The pharmacokinetics of APF112 showed sustained release of mepivacaine systemically over a period of three days (72 hours). No significant difference was shown between the two doses of APF112 and the standard of care (bupivacaine) in terms of pain scores and the amount of additional pain medication used. Mean Visual Analog Scale pain scores (VAS scores) in the standard of care group (bupivacaine) were significantly lower in this study when compared with other previously published studies in similar hernia trials. Based on published data, VAS scores for the standard of care in similar inguinal hernia studies ranged from 4.5 to 6.7, whereas in this study the mean score for the bupivacaine arm was 2.9 within the first 24 hours post-surgery. We believe that with a revised Phase 2 protocol we can demonstrate that APF112 is effective in controlling post-surgical pain. If we are successful in obtaining the required capital to support this program, we intend to reactivate and complete additional preclinical work on APF112 towards a revised protocol, followed by initiation of a Phase 2b clinical trial. Assuming successful completion of our Phase 2b clinical trial, we plan to explore corporate partnering opportunities to continue the development of APF112.

APF580

APF580 incorporates an opiate into our Biochronomer technology and is designed to provide analgesia lasting at least seven days from a single injection. It is targeted for situations where the intensity and duration of pain require use of an opiate rather than a local anesthetic. APF580 may find use in acute and chronic pain settings, improve patient compliance and reduce the

12

Table of Contents

risk of drug abuse. Our initial animal pharmacokinetic studies completed in 2006 present a promising profile, supporting future product development for post-surgical and chronic pain applications. In September of 2008 we filed an IND for APF580 with the FDA. If we are successful in obtaining the required capital to support this program, we plan to initiate a Phase 1 clinical trial of APF580. In addition, we announced in September 2009 that we entered into a licensing and development agreement with Merial Limited for a variant of APF580 for long-acting pain management in companion animals.

Our Technology Platform

We have made significant investments in the development of our bioerodible drug delivery technologies, which have produced tangible results. Specifically, we have developed a broad family of polymers with unique attributes, known collectively as poly (ortho esters), under the trade name Biochronomer. This technology has been specifically designed for use in drug delivery applications with a number of technical advantages, such as: ease of manufacturing, flexible delivery times, various physical forms and multiple potential applications due to a neutral pH environment for acid sensitive actives (nucleic acids, proteins, etc.).

Due to the inherent versatility of our Biochronomer technology, products can be designed to deliver drugs at a variety of implantation sites including: under the skin, at the site of a surgical procedure, in joints, in the eye or in muscle tissue. Our Biochronomer technology can provide sustained levels of drugs in systemic circulation for prolonged efficacy.

Reproducibility. Our Biochronomer technology is formed by the coupling of various monomers into a polymer chain. Our process knowledge underlying the commercial manufacture of our Biochronomers is based on extensive, well-documented, development studies. Commercial manufacturing campaigns to date have demonstrated that our Biochronomers may be produced in a highly reproducible manner.

Flexible Delivery Times. The Biochronomer “links,” or bonds, are stable at neutral pH conditions. Upon coming into contact with water-containing media, such as internal body fluids, the water reacts with these bonds. This reaction is known as hydrolysis. During the hydrolysis of the Biochronomer links, acidic elements are produced in a local micro-environment, in a controlled manner, without impacting the overall neutrality of the drug delivery technology. These elements assist in the continued, controlled erosion of the polymer with a simultaneous, controlled release of the active drug contained within the Biochronomer. By varying the amount of the acidic elements in the Biochronomer, different rates of hydrolysis may be effectively realized. In this manner, delivery times ranging from days to weeks to several months can be achieved.

Various Physical Forms. Our Biochronomers can be prepared in a variety of physical forms, ranging from hard, glassy materials to semi-solids that are injectable at room temperature, by proper selection of monomers. A significant advantage of our Biochronomer technology is that drugs can be incorporated by simple mixing procedures allowing the production of formulations in the form of injectable gels, microspheres, coatings and strands. All of these physical forms can be used in the controlled delivery of drugs without the undesirable incorporation of organic solvents in the final product.

Multiple Potential Applications. We have completed over 100 in vivo and in vitro studies demonstrating that our Biochronomer technology is potentially applicable to a range of therapeutic areas, including pain management, prevention of nausea, control of inflammation and treatment of ophthalmic diseases. We have also completed comprehensive animal and human toxicology

13

Table of Contents

studies that have established that our Biochronomer polymers are safe and well tolerated. All of our current development programs utilize the same semi-solid poly (ortho ester) delivery vehicle. The present forms of these products are stored under refrigeration. We are actively developing products that can be stored at room temperature.

Our Strategy

Our primary near-term objective is to obtain regulatory approval of the NDA for APF530 from the FDA. Longer-term, we intend to become a leading specialty pharmaceutical company focused on improving the effectiveness of existing pharmaceuticals using our proprietary drug delivery technologies. Implementation of the following activities will be subject to our success in obtaining additional capital. Key elements include:

• Maximize the value of our lead product, APF530. We believe that establishing a partnership with a pharmaceutical company for the commercialization of APF530 will maximize the value of APF530 for our shareholders. We intend to secure significant upfront license fees, followed by milestone payments and royalties. We also plan to evaluate either a single commercial partnership or multiple partnerships for the United States and the rest of world.

• Expand product pipeline. We plan to expand our product pipeline by leveraging our existing technology. We intend to develop new products based on our Biochronomer polymer-based drug delivery technology. Our research has indicated that our Biochronomer technology has potential applications across a range of therapeutic areas including: prevention of nausea, pain management, control of inflammation and treatment of ophthalmic diseases. With further work on our technology platforms, we may be able to develop products that deliver proteins, peptides, soluble RNA and RNA interference.

• Enter into strategic partnerships. We believe that selective partnering of our future product development programs can enhance the success of our product development and commercialization efforts, and enable diversification of our product portfolio by having partners fund the major portion of our late stage clinical trials. Additionally, such partnering will enable us to leverage the sales capabilities of our partners to commercialize our products.

• Minimize product development risk and time-to-market. We plan to apply our proprietary drug delivery technologies to improve the effectiveness of approved pharmaceutical products. By using our technologies to administer drugs for which clinical efficacy and safety data are available, we believe we will be able to reduce the cost and development risk inherent in traditional pharmaceutical product development.

Manufacturing and Supply

We do not currently own or operate manufacturing facilities for the production of clinical or commercial quantities of any of our product candidates. We rely on a small number of third-party manufacturers to produce our compounds and expect to continue to do so to meet the preclinical and clinical requirements of our potential products and for all of our commercial needs. We do not have long-term agreements with any of these third-parties. We require in our manufacturing and processing agreements that all third-party contract manufacturers and processors produce active pharmaceutical ingredients (APIs) and finished products in accordance with the FDA’s current Good Manufacturing Practices (cGMP) and all other applicable laws and regulations. We maintain confidentiality agreements with potential and existing manufacturers in order to protect our proprietary rights related to our drug candidates.

14

Table of Contents

With regard to our lead product candidate, APF530, we source the API, granisetron, from two suppliers. We use one supplier to source raw materials and prepare our proprietary polymer and another supplier to formulate the bulk drug product. We ship the bulk APF530 to a contract manufacturer for filling into cartridges. This supplier is one of a small number of companies with the ability to perform the syringe filling function with a highly viscous material like APF530. To date, APF530 has been manufactured in small quantities for preclinical studies and clinical trials. If APF530 is approved for commercial sale, we will need to manufacture such product in larger quantities. Significant scale-up of manufacturing may require additional process development and validation studies, which the FDA must review and approve. The commercial success of APF530, in the near-term, will be dependent upon the ability of our contract manufacturers to produce a product in commercial quantities at competitive costs of manufacture. If APF530 receives regulatory approval, we plan to scale-up manufacturing through our third-party manufacturers for APF530 in order to realize important economies of scale. These scale-up activities would take time to implement, require additional capital investment, process development and validation studies, and FDA approval. We cannot guarantee that we will be successful in achieving competitive manufacturing costs through such scale-up activities.

Sales and Marketing

A key part of our business strategy is to form collaborations with pharmaceutical partners. In the past, we have successfully partnered our development stage programs with leading pharmaceutical companies. In general, we grant limited marketing exclusivity in defined markets for defined periods to our partners. However, after development is completed and a partner commercializes a formulated product utilizing our delivery technologies, we can exert only limited influence over the manner and extent of our partner’s marketing efforts.

The status of our partnering arrangements is:

• In September 2009, we entered into a licensing and development agreement with Merial Limited for a long-acting pain management product for use with companion animals. The Company received an upfront payment and will receive on-going development funding and potential future milestones and royalties.

• In October 2009, we announced the termination of our license agreement with RHEI Pharmaceuticals, Inc. (RHEI) following its failure to make a milestone payment in connection with acceptance for filing of an NDA for APF530 by the FDA. We had granted an exclusive license in October 2006 to RHEI to seek regulatory approval and sell APF530 in China, Taiwan, Hong Kong and Macau.

• We have and will continue to engage in potential partnership discussions with domestic and international pharmaceutical companies.

Patents and Trade Secrets

Patents and other proprietary rights are important to our business. It is our policy to seek patent protection for our inventions, and to rely upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop and maintain our competitive position.

As part of our strategy to protect our current products and to provide a foundation for future products, we have filed a number of U.S. patent applications on inventions relating to the composition of a variety of polymers, specific products, product groups and processing technology. We have a total of 27 issued U.S. patents and an additional 49 issued (or registered) foreign pat -

15

Table of Contents

ents. The patents on our bioerodible technologies expire between January 2016 and November 2023. In addition, we have filed patent applications on further improvements to our polymer technology, which, if issued, would provide additional exclusivity beyond these dates.

Although we believe the bases for these patents and patent applications are sound, they are untested, and there is no assurance that they will not be successfully challenged. There can be no assurance that any patent previously issued will be of commercial value, that any patent applications will result in issued patents of commercial value, or that our technology will not be held to infringe patents held by others.

We also rely on unpatented trade secrets and know-how to protect certain aspects of our production technologies. Our employees, consultants, advisors and corporate partners have entered into confidentiality agreements with us. These agreements, however, may not necessarily provide meaningful protection for our trade secrets or proprietary know-how in the event of unauthorized use or disclosure. In addition, others may obtain access to, or independently develop, these trade secrets or know-how.

Competition

The pharmaceutical industry is highly competitive. Many of our competitors have substantially greater financial, research, development, manufacturing, sales, marketing, and distribution resources than we currently do. In addition, they may have significantly more experience in drug development, obtaining regulatory approval, and establishing strategic collaborations. We expect any future products we develop to compete on the basis of, among other things, product efficacy and safety, time to market, price, extent of adverse side effects experienced and convenience of administration and drug delivery. We also expect to face competition in our efforts to identity appropriate collaborators or partners to help commercialize our product candidates in our target commercial areas.

APF530 is expected to face significant competition for the prevention of delayed CINV, principally from Eisai/MGI Pharma’s Aloxi (palonosetron). In addition to Aloxi, APF530 will compete with entrenched products for the prevention of acute CINV, including Roche’s Kytril (granisetron), GlaxoSmithKline’s Zofran (ondansetron) and Aventis’ Anzemet (dolasetron). Generic versions of certain of these products are also marketed by other companies. We are also aware of several companies which have developed, or are developing, both generic and new formulations of granisetron, including additional transdermal formulations such as ProStrakan’s Sancuso® (granisetron transdermal patch) and Hana Biosciences’ Zensana™ (oral ondansetron), which has been licensed to Par Pharmaceuticals.

APF112 is expected to face competition from two injectable controlled release bupivicane products, Durect Corporation’s Posidur™ and Pacira Pharmaceutical’s Exparel™ DepoBupivacaine.

There are several companies that are developing new formulations of existing drugs using novel drug delivery technologies. The following are some of our major competitors among drug delivery system developers: Alkermes, Inc., Depomed, Inc., Durect Corporation and Pacira Pharmaceuticals, Inc.

Government Regulation and Product Approvals

The manufacturing and marketing of our potential products and our ongoing research and development activities are subject to extensive regulation by the FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries.

16

Table of Contents

United States Regulation

Before any of our products can be marketed in the United States, they must be approved by the FDA. To secure approval, any drug we develop must undergo rigorous preclinical testing and clinical trials that demonstrate the product candidate’s safety and effectiveness for each chosen indication for use. These extensive regulatory processes control, among other things: the development, testing, manufacture, safety, efficacy, record keeping, labeling, storage, approval, advertising, promotion, sale and distribution of biopharmaceutical products.

In general, the process required by the FDA before investigational drugs may be marketed in the United States involves the following steps:

• preclinical laboratory and animal tests;

• submission of an IND, which must become effective before human clinical trials may begin;

• adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug for its intended use;

• pre-approval inspection of manufacturing facilities and selected clinical investigators; and

• FDA approval of an NDA, or of an NDA supplement (for subsequent indications).

Preclinical Testing

In the United States, drug candidates are tested in animals until adequate proof-of-safety is established. These preclinical studies generally evaluate the mechanism of action of the product and assess the potential safety and efficacy of the product. Tested compounds must be produced according to applicable cGMP requirements and preclinical safety tests must be conducted in compliance with FDA and international regulations regarding good laboratory practices (GLP). The results of the preclinical tests, together with manufacturing information and analytical data, are generally submitted to the FDA as part of an IND, which must become effective before human clinical trials may commence. The IND will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA requests an extension or raises concerns about the conduct of the clinical trials as outlined in the application. If the FDA has any concerns, the sponsor of the application and the FDA must resolve the concerns before clinical trials can begin. Submission of an IND may not result in FDA authorization to commence a clinical trial. A separate submission to the existing IND must be made for each successive clinical trial conducted during product development, and the FDA must grant permission for each clinical trial to start and continue. Regulatory authorities may require additional data before allowing the clinical studies to commence or proceed from one Phase to another, and could demand that the studies be discontinued or suspended at any time if there are significant safety issues. Furthermore, an independent institutional review board (IRB), for each medical center proposing to participate in the conduct of the clinical trial must review and approve the clinical protocol and patient informed consent before the center commences the study.

17

Table of Contents

Clinical Trials

Clinical trials for new drug candidates are typically conducted in three sequential phases that may overlap. In Phase 1, the initial introduction of the drug candidate into human volunteers, the emphasis is on testing for safety or adverse effects, dosage, tolerance, metabolism, distribution, excretion and clinical pharmacology. Phase 2 involves studies in a limited patient population to determine the initial efficacy of the drug candidate for specific targeted indications, to determine dosage tolerance and optimal dosage and to identify possible adverse side effects and safety risks. Once a compound shows evidence of effectiveness and is found to have an acceptable safety profile in Phase 2 evaluations, pivotal Phase 3 trials are undertaken to more fully evaluate clinical outcomes and to establish the overall risk/benefit profile of the drug, and to provide, if appropriate, an adequate basis for product labeling. During all clinical trials, physicians will monitor patients to determine effectiveness of the drug candidate and to observe and report any reactions or safety risks that may result from use of the drug candidate. The FDA, the IRB (or their foreign equivalents), or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects are being exposed to an unacceptable health risk.

The data from the clinical trials, together with preclinical data and other supporting information that establishes a drug candidate’s safety, are submitted to the FDA in the form of an NDA, or NDA supplement (for approval of a new indication if the product candidate is already approved for another indication). Under applicable laws and FDA regulations, each NDA submitted for FDA approval is usually given an internal administrative review within 60 days following submission of the NDA. If deemed complete, the FDA will “file” the NDA, thereby triggering substantive review of the application.

The FDA can refuse to file any NDA that it deems incomplete or not properly reviewable. The FDA has established internal substantive review goals of six months for priority NDAs (for drugs addressing serious or life threatening conditions for which there is an unmet medical need) and ten months for regular NDAs. The FDA, however, is not legally required to complete its review within these periods, and these performance goals may change over time. Moreover, the outcome of the review, even if generally favorable, is not typically an actual approval, but a “complete response” that describes additional work that must be done before the NDA can be approved. The FDA’s review of an NDA may involve review and recommendations by an independent FDA advisory committee. The FDA may deny approval of an NDA, or NDA supplement, if the applicable regulatory criteria are not satisfied, or it may require additional clinical data and/or an additional pivotal Phase 3 clinical trial. Even if such data are submitted, the FDA may ultimately decide that the NDA or NDA supplement does not satisfy the criteria for approval.

Data Review and Approval

Satisfaction of FDA requirements or similar requirements of state, local, and foreign regulatory agencies typically takes several years and requires the expenditure of substantial financial resources. Information generated in this process is susceptible to varying interpretations that could delay, limit, or prevent regulatory approval at any stage of the process. Accordingly, the actual time and expense required to bring a product to market may vary substantially. We cannot assure you that we will submit applications for required authorizations to manufacture and/or market potential products or that any such application will be reviewed and approved by the appropriate regulatory authorities in a timely manner, if at all. Data obtained from clinical activities is not always conclusive and may be susceptible to varying interpretations, which could delay, limit, or prevent regulatory approval. Success in early stage clinical trials does not ensure success in later stage clinical trials. Even if a product candidate receives regulatory approval, the approval may be significantly limited to specific disease states, patient populations, and dosages, or have conditions placed on them that restrict the commercial applications, advertising, promotion, or distribution of these products.

18

Table of Contents

Once issued, the FDA may withdraw product approval if ongoing regulatory standards are not met or if safety problems occur after the product reaches the market. In addition, the FDA may require testing and surveillance programs to monitor the effect of approved products which have been commercialized, and the FDA has the power to prevent or limit further marketing of a product based on the results of these post-marketing programs. The FDA may also request additional clinical trials after a product is approved. These so-called Phase 4 studies may be made a condition to be satisfied after a drug receives approval. The results of Phase 4 studies can confirm the effectiveness of a product candidate and can provide important safety information to augment the FDA’s voluntary adverse drug reaction reporting system. Any products manufactured or distributed by us pursuant to FDA approvals would be subject to continuing regulation by the FDA, including record-keeping requirements and reporting of adverse experiences with the drug. Drug manufacturers and their subcontractors are required to register their establishments with the FDA and certain state agencies, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMPs which impose certain procedural and documentation requirements upon us and our third-party manufacturers. We cannot be certain that we, or our present or future suppliers, will be able to comply with the cGMP regulations and other FDA regulatory requirements. If our present or future suppliers are not able to comply with these requirements, the FDA may halt our clinical trials, require us to recall a drug from distribution, or withdraw approval of the NDA for that drug. Furthermore, even after regulatory approval is obtained, later discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market.

The FDA closely regulates the marketing and promotion of drugs. Approval may be subject to post-marketing surveillance and other record-keeping and reporting obligations, and involve ongoing requirements. Product approvals may be withdrawn if compliance with regulatory standards is not maintained or if problems occur following initial marketing. A company can make only those claims relating to safety and efficacy that are approved by the FDA. Failure to comply with these requirements can result in adverse publicity, warning letters, corrective advertising and potential civil and criminal penalties. Physicians may prescribe legally available drugs for uses that are not described in the product’s labeling and that differ from those tested by us and approved by the FDA. Such off-label uses are common across medical specialties. Physicians may believe that such off-label uses are the best treatment for many patients in varied circumstances. The FDA does not regulate the behavior of physicians in their choice of treatments. The FDA does, however, restrict manufacturers’ communications on the subject of off-label use.

Section 505(b)(2) Applications

Some of our product candidates may be eligible for submission of applications for approval under the FDA’s Section 505(b)(2) approval process, which requires less information than the NDAs described above. Section 505(b)(2) was enacted as part of the Drug Price Competition and Patent Term Restoration Act of 1984, also known as the Hatch-Waxman Act. Section 505(b)(2) applications may be submitted for drug products that represent a modification (e.g., a new indication or new dosage form) of an eligible approved drug and for which investigations other than bioavailability or bioequivalence studies are essential to the drug’s approval. Section 505(b)(2) applications may rely on the FDA’s previous findings for the safety and effectiveness of the listed drug, scientific literature and information obtained by the 505(b)(2) applicant needed to support the modification of the listed drug. For this reason, preparing Section 505(b)(2) applications is generally less costly and time-consuming than preparing an NDA based entirely on new data and information from a full set of clinical trials. The law governing Section 505(b)(2) or FDA’s current policies may change in such a way as to adversely affect our applications for approval that seek to utilize the Section 505(b)(2) approach. Such changes could result in additional costs associated with additional studies or clinical trials and delays.

19

Table of Contents

The FDA provides that reviews and/or approvals of applications submitted under Section 505(b)(2) will be delayed in various circumstances. For example, the holder of the NDA for the listed drug may be entitled to a period of market exclusivity during which the FDA will not approve, and may not even review, a Section 505(b)(2) application from other sponsors. If the listed drug is claimed by a patent that the NDA holder has listed with the FDA, the Section 505(b)(2) applicant must submit a patent certification. If the 505(b)(2) applicant certifies that the patent is invalid, unenforceable or not infringed by the product that is the subject of the Section 505(b)(2) application, and within 45 days of its notice to the entity that holds the approval for the listed drug and the patent holder, the certification is challenged, the FDA will not approve the Section 505(b)(2) application until the earlier of a court decision favorable to the Section 505(b)(2) applicant or the expiration of 30 months. The regulations governing marketing exclusivity and patent protection are complex, and it is often unclear how they will be applied in particular circumstances.

In addition, both before and after approval is sought, we and our collaborators are required to comply with a number of FDA requirements. For example, we are required to report certain adverse reactions and production problems, if any, to the FDA, and to comply with certain limitations and other requirements concerning advertising and promotion for our products. Also, quality control and manufacturing procedures must continue to conform to cGMPs after approval, and the FDA periodically inspects manufacturing facilities to assess compliance with continuing cGMP. In addition, discovery of problems, such as safety problems, may result in changes in labeling or restrictions on a product manufacturer or NDA holder, including removal of the product from the market.

DEA Regulation

Our research and development processes involve the controlled use of hazardous materials, including chemicals. Some of these hazardous materials are considered to be controlled substances and subject to regulation by the U.S. Drug Enforcement Agency (DEA). Controlled substances are those drugs that appear on one of five schedules promulgated and administered by the DEA under the Controlled Substances Act (CSA). The CSA governs, among other things, the distribution, recordkeeping, handling, security and disposal of controlled substances. We must be registered by the DEA in order to engage in these activities, and are subject to periodic and ongoing inspections by the DEA and similar state drug enforcement authorities to assess ongoing compliance with the DEA’s regulations. Any failure to comply with these regulations could lead to a variety of sanctions, including the revocation, or a denial of renewal, of the DEA registration, injunctions or civil or criminal penalties.

Third-Party Payor Coverage and Reimbursement

Although none of our product candidates has been commercialized for any indication, if they are approved for marketing, commercial success of our product candidates will depend, in part, upon the availability of coverage and reimbursement from third-party payors at the federal, state and private levels. Government payor programs, including Medicare and Medicaid, private health care insurance companies and managed care plans have attempted to control costs by limiting coverage and the amount of reimbursement for particular procedures or drug treatments. The U.S. Congress and state legislatures from time to time propose and adopt initiatives aimed at cost containment. Ongoing federal and state government initiatives directed at lowering the total cost of health care will likely continue to focus on health care reform, the cost of prescription pharmaceuticals and on the reform of the Medicare and Medicaid payment systems. Examples of how limits on drug coverage and reimbursement in the United States may cause reduced payments for drugs in the future include:

• changing Medicare reimbursement methodologies;

20

Table of Contents

• fluctuating decisions on which drugs to include in formularies;

• revising drug rebate calculations under the Medicaid program; and

• reforming drug importation laws.

Some third-party payors also require pre-approval of coverage for new or innovative devices or drug therapies before they will reimburse health care providers that use such therapies. While we cannot predict whether any proposed cost-containment measures will be adopted or otherwise implemented in the future, the announcement or adoption of these proposals could have a material adverse effect on our ability to obtain adequate prices for our product candidates and operate profitably.

Foreign Approvals

In addition to regulations in the United States, we will be subject to a variety of foreign regulations governing clinical trials and commercial sales and distribution of our products. Whether or not we obtain FDA approval for a product, we must obtain approval of a product by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country, and the time may be longer or shorter than that required for FDA approval. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary greatly from country to country.

We have not started the regulatory approval process in any jurisdiction other than the United States and we are unable to estimate when, if ever, we will commence the regulatory approval process in any foreign jurisdiction. Foreign approvals may not be granted on a timely basis, or at all. Regulatory approval of prices is required in most countries other than the United States. The prices approved may be too low to generate an acceptable return to us. If we fail to obtain approvals from foreign jurisdictions, the geographic market for our product candidates would be limited.

Employees

In May 2009, we implemented a reduction in force, releasing 11 members of our workforce.

As of February 28, 2010, we had 21 full-time employees, one of whom holds a Ph.D. degree and three full-time contract workers. There were 17 employees engaged in research and development and quality control, and four individuals working in finance, information technology, human resources and administration.

We consider our relations with our employees to be good. None of our employees are covered by a collective bargaining agreement.

21

Table of Contents

Our business is subject to various risks, including those described below. You should consider carefully these risk factors and all of the other information included in this Form 10-K. Any of these risk factors could materially adversely affect our business, operating results and financial condition. These risks are not the only ones we face. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment in our securities. Before you decide whether to purchase any of our common stock you should carefully consider the risk factors set forth below as may be updated from time to time by our future filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Risks Related To Our Business

We have a history of losses, we expect to generate losses in the near future, and we may never achieve or maintain profitability.

We have incurred recurring losses and had an accumulated deficit of $141.1 million as of December 31, 2009. We expect to continue to generate substantial losses over at least the next several years as we:

• expand drug product development efforts;

• conduct preclinical testing and clinical trials; and

• pursue additional applications for our existing delivery technologies.

To achieve and sustain profitability, we must, alone or with others, successfully develop, obtain regulatory approval for, manufacture, market and sell our products. We will incur substantial expenses in our efforts to develop and commercialize products and we may never generate sufficient revenue to become profitable or to sustain profitability.

We are substantially dependent upon the success of our APF530 product candidate. Clinical trial results and the NDA for this product may not lead to regulatory approval.

We have invested a significant portion of our time and financial resources in the development of our most advanced product candidate, APF530, which prevents chemotherapy-induced nausea and vomiting (CINV). Our near-term ability to generate revenues and our future success, in large part, depends on the development and commercialization of APF530.

We will not be able to commercialize our lead product candidate, APF530, until we obtain regulatory approval in the United States or foreign countries. To satisfy U.S. Food and Drug Administration (FDA) or foreign regulatory approval standards for the commercial sale of APF530, we must have demonstrated in adequate and controlled clinical trials that APF530 is safe and effective. APF530 is designed to provide at least five days prevention of CINV. In September and November 2008, we announced results of our pivotal Phase 3 human clinical trial of APF530 that achieved most of its primary and secondary endpoints. In May 2009 we submitted our new drug application (NDA) for approval of APF530 to the FDA. The NDA was accepted for review by the FDA in July 2009 and based on the Prescription Drug User Fee Act (PDUFA), the FDA has issued an action date of March 18, 2010. There are no guarantees that the FDA will provide its response by March 18, 2010, and we

22

Table of Contents

cannot assure you that any such response will be favorable. If the FDA does not take action on our NDA by the PDUFA date, does not approve our NDA or requests additional work or changes to the NDA, our continued ability to commercialize APF530 could be seriously impaired and our business would be adversely impacted. Obtaining regulatory approval of APF530 for the prevention of acute CINV for both moderately and highly emetogenic chemotherapy, and for the prevention of delayed CINV in moderately emetogenic chemotherapy, is subject to many variables. For example, the FDA’s review may not produce positive decisions as to:

• whether APF530 is safe and effective in its proposed use(s), and whether its benefits outweigh the risks;

• whether the proposed labeling (package insert) for APF530 is appropriate, and what it should contain; and

• whether the methods used in manufacturing APF530 and the controls used to maintain its quality are adequate to preserve its identity, strength, quality and purity.

Deficiencies on any of the above, or other factors, could prevent or delay obtaining regulatory approval of APF530, which would impair our reputation, increase our costs and prevent us from earning revenue.

We may not obtain regulatory approval for APF530 or any of our product candidates. Regulatory approval may also be delayed or cancelled or may entail limitations on the indicated uses of a proposed product.

The regulatory process, particularly for pharmaceutical product candidates like ours, is uncertain, can take many years and requires the expenditure of substantial resources. Any product that we or our collaborative partners develop must receive all relevant regulatory agency approvals or clearances, if any, before it may be marketed in the United States or other countries. In particular, human pharmaceutical therapeutic products are subject to rigorous preclinical and clinical testing and other requirements by the FDA in the United States and similar health authorities in foreign countries. We may not receive necessary regulatory approvals or clearances to market APF530 or any other product candidate.

Data obtained from preclinical and clinical activities is susceptible to varying interpretations that could delay, limit or prevent regulatory agency approvals or clearances. For example, the FDA may require additional clinical data to support approval, such as confirmatory studies, carcinogenicity studies and other data or studies to address questions or concerns that may arise during the FDA review process. Delays or rejections also may be encountered as a result of changes in regulatory agency policy during the period of product development and/or the period of review of any application for regulatory agency approval or clearance for a product. Delays in obtaining regulatory agency approvals or clearances could:

• significantly harm the marketing of any products that we or our collaborators develop;

• impose costly procedures upon our activities or the activities of our collaborators;

• diminish any competitive advantages that we or our collaborative partners may attain; or

• adversely affect our ability to receive royalties and generate revenue and profits.

23

Table of Contents

Even though we submitted our NDA for approval of APF530 to the FDA and intend to apply for approval of most of our other products in the United States under Section 505(b)(2) of the FDCA, which applies to reformulations of approved drugs and that may require smaller and shorter safety and efficacy testing than that for entirely new drugs, the approval process will still be costly, time-consuming and uncertain. We filed the NDA for APF530 under Section 505(b)(2) of the FDCA (which has a PDUFA action date of March 18, 2010), to rely on previous FDA findings of safety and efficacy of the active ingredient in APF530, granisetron. While we believe that Section 505(b)(2) is applicable to APF530, it is possible that the FDA may disagree and require us to submit a “stand-alone” or “full” Section 505(b)(1) NDA, which would require significantly more clinical studies and or other data collection or analysis. There are no guarantees that the FDA will provide its response by March 18, 2010, and we cannot assure you that any such response will be favorable.

We, or our collaborators, may not be able to obtain necessary regulatory approvals on a timely basis, if at all, for any of our potential products. Even if granted, regulatory approvals may include significant limitations on the uses for which products may be marketed. Failure to comply with applicable regulatory requirements can, among other things, result in warning letters, imposition of civil penalties or other monetary payments, delay in approving or refusal to approve a product candidate, suspension or withdrawal of regulatory approval, product recall or seizure, operating restrictions, interruption of clinical trials or manufacturing, injunctions and criminal prosecution.

In addition, the marketing and manufacturing of drugs and biological products are subject to continuing FDA review, and later discovery of previously unknown problems with a product, its manufacture or its marketing may result in the FDA requiring further clinical research or restrictions on the product or the manufacturer, including withdrawal of the product from the market.

Additional capital will be needed to enable us to implement our business plan, and we may be unable to raise capital when needed, which would force us to limit or cease our operations and related product development programs. Raising such capital may have to be accomplished on unfavorable terms, possibly causing dilution to our existing stockholders.

We believe that our existing cash, and cash equivalents on hand at December 31, 2009 will be sufficient to fund our operating expenses through the fourth quarter of 2010, based on our anticipated spending levels and other known sources of funding. However, our operating plan may change, and we may need additional funds sooner than anticipated to meet operational needs and capital requirements for product development and commercialization. If we are unable to complete a collaborative arrangement, equity offering, or otherwise obtain sufficient financing, we may be required to further reduce, defer, or discontinue our activities or may not be able to continue as a going concern entity. In addition, we may modify our operating plans to require additional funds in 2010. The amount of additional funding that we may require in 2010 depends on various factors, including the results of on-going regulatory review by the FDA of our APF530 NDA (which currently has a PDUFA date of March 18, 2010), our ability to establish a partnership with a pharmaceutical company for the commercialization of APF530, the time and costs related to manufacturing APF530, if approved, and competing technological and market developments. We do not currently have the financial resources to launch AP530. If AP530 is approved, we anticipate pursuing either a collaborative arrangement with a partner who will provide the necessary financial resources and expertise to launch AP530 or anticipate obtaining additional funding and resources that would be required to launch AP530 without a partner. There can be no assurance that AP530 will be approved and, if approved, that we will be successful in obtaining the additional necessary financial resources and expertise, with or without a partner, that will be required to launch AP530. Regardless of the FDA’s response with respect to the APF530 NDA, we believe we will require additional funding, from a collaborative arrangement, equity offer -

24

Table of Contents