Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SAExploration Holdings, Inc. | v349482_8k.htm |

July 2013 S AFETY . A CQUISITION . E XPERIENCE . NASDAQ: SAEX; SAEXW

T HIS PRESENTATION INCLUDES CERTAIN FORWARD - LOOKING STATEMENTS , INCLUDING STATEMENTS REGARDING FUTURE FINANCIAL PERFORMANCE , FUTURE GROWTH AND FUTURE ACQUISITIONS . T HESE STATEMENTS ARE BASED ON SAE MANAGEMENTS ’ CURRENT EXPECTATIONS OR BELIEFS AND ARE SUBJECT TO UNCERTAINTY AND CHANGES IN CIRCUMSTANCES . A CTUAL RESULTS MAY VARY MATERIALLY FROM THOSE EXPRESSED OR IMPLIED BY THE STATEMENTS HEREIN DUE TO CHANGES IN ECONOMIC , BUSINESS , COMPETITIVE AND / OR REGULATORY FACTORS , AND OTHER RISKS AND UNCERTAINTIES AFFECTING THE OPERATION OF SAE’ S BUSINESS . T HESE RISKS , UNCERTAINTIES AND CONTINGENCIES INCLUDE : FLUCTUATIONS IN THE LEVELS OF EXPLORATION AND DEVELOPMENT ACTIVITY IN THE OIL AND GAS INDUSTRY ; BUSINESS CONDITIONS ; WEATHER AND NATURAL DISASTERS ; CHANGING INTERPRETATIONS OF GAAP ; OUTCOMES OF GOVERNMENT REVIEWS ; INQUIRIES AND INVESTIGATIONS AND RELATED LITIGATION ; CONTINUED COMPLIANCE WITH GOVERNMENT REGULATIONS ; LEGISLATION OR REGULATORY ENVIRONMENTS ; REQUIREMENTS OR CHANGES ADVERSELY AFFECTING THE BUSINESS IN WHICH SAE IS ENGAGED ; FLUCTUATIONS IN CUSTOMER DEMAND ; CHANGES IN SCOPE OR SCHEDULE OF CUSTOMER PROJECTS ; TERMINATION OF CONTRACTS AT THE CONVENIENCE OF CLIENTS ; MANAGEMENT OF RAPID GROWTH ; INTENSITY OF COMPETITION FROM OTHER PROVIDERS OF SEISMIC ACQUISITION SERVICES ; GENERAL ECONOMIC CONDITIONS ; GEOPOLITICAL EVENTS AND REGULATORY CHANGES ; AND OTHER FACTORS SET FORTH IN SAE’ S FILINGS WITH THE S ECURITIES AND E XCHANGE C OMMISSION . T HE INFORMATION SET FORTH HEREIN SHOULD BE READ IN LIGHT OF SUCH RISKS . SAE IS NOT UNDER ANY OBLIGATION TO , AND EXPRESSLY DISCLAIMS ANY OBLIGATION TO , UPDATE OR ALTER ITS FORWARD - LOOKING STATEMENTS , WHETHER AS A RESULT OF NEW INFORMATION , FUTURE EVENTS , CHANGES IN ASSUMPTIONS OR OTHERWISE . T HIS PRESENTATION SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES , NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY JURISDICTIONS IN WHICH SUCH OFFER , SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION . S AFE H ARBOR 2

• F OUNDED IN 2006 ; E XECUTIVE MANAGEMENT TEAM HAS 85 + YEARS OF COMBINED INDUSTRY EXPERIENCE • P ROVIDES F ULL RANGE OF 2 D, 3 D AND 4 D LAND AND SHALLOW WATER MARINE SEISMIC DATA SERVICES • S PECIALIZES IN LOGISTICALLY - COMPLEX , CHALLENGING ENVIRONMENTS • 100 % OF REVENUE IS EARNED ON A FULLY - FUNDED , CONTRACTED BASIS - N O SPECULATIVE SHOOTING • S TRONG Q UALITY , H EALTH , S AFETY , E NVIRONMENTAL (“QHSE”) R ECORD C OMPANY O VERVIEW 3 S UMMARY F INANCIAL P ROFILE • G ROWTH IN REVENUE AND EBITDA ( 2010 – 2012 ; Q 1 2013 ) • M IDPOINT EBITDA 1 TARGETS OF $ 48 MM AND $ 54 MM FOR FY 2013 AND FY 2014 , RESPECTIVELY • O PERATING CASH FLOW ROSE TO $ 8 . 6 MM FOR 3 MOS . ENDED 3 / 31 / 13 FROM $ 5 . 9 MM FOR 3 MOS . ENDED 3 / 31 / 12 • 6 / 30 / 13 BACKLOG = $ 285 MM ; BIDS OUTSTANDING = $ 389 MM • $ 123 . 6 MM OF NEW CONTRACTS ANNOUNCED DURING Q 2 2013 G EOGRAPHY • F OCUS ON N ORTH A MERICA , S OUTH A MERICA , S OUTHEAST A SIA • O PERATES IN MOST OF THE PROLIFIC OIL PRODUCING REGIONS IN THE WORLD P UBLIC C OMPANY • W ENT PUBLIC IN J UNE 2013 VIA MERGER WITH T RIO M ERGER C ORP . • P OST MERGER : 13.4 MM SHARES OUTSTANDING , 14 MM WARRANTS OUTSTANDING 1) F OR MORE INFO ON EBITDA TARGETS PLEASE REFER TO SLIDE 5

R EVENUE O VERVIEW ($ IN MMS ) 4 $133.8 $180.8 $257.4 $61.8 $84.8 $0 $50 $100 $150 $200 $250 $300 2010 2011 2012 Q1' 12 Q1' 13 $ 5.9 (N.Z) $ 10.8 (New Guinea ) $ 37.9 (Peru) $ 53.2 (Colombia) $ 32.5 (Canada) $ 27.5 (Bolivia) $ 89.6 (U.S .) 2012 R EVENUE BY R EGION R EVENUE G ROWTH SAE SERVES MANY OF THE W ORLD ’ S L ARGEST I NTERNATIONAL OIL C OMPANIES G LOBAL P RESENCE

$14.5 $18.5 $30.9 $12.3 $14.1 $48.0 $54.0 $0 $25 $50 $75 2010 2011 2012 Q1' 12 Q1' 13 2013E 2014E “ M ODIFIED ” EBITDA PROFILE 5 1) “ MODIFIED ” EBITDA IS N ON - GAAP 2) 2013 AND 2014 EBITDA BASED ON MID - POINTS OF EBITDA TARGETS M ODIFIED EBITDA 1,2 EBITDA T ARGET RANGE 3,4 C ONTINGENT S HARE R ANGE M INIMUM M AXIMUM M INIMUM M AXIMUM EBITDA FOR FY ENDED 12/31/13 $ 46,000,000 TO $50,000,000 248,016 TO 496,032 EBITDA FOR FY ENDED 12/31/14 $ 52,000,000 TO $56,000,000 248,016 TO 496,032 3) C ONTINGENT SHARES WILL BE EARNED ON A STRAIGHT LINE BASIS BETWEEN THE MINIMUM AND MAXIMUM EBITDA TARGETS 4) EBITDA WILL EXCLUDE ACQUISITIONS AND BE CALCULATED AS GAAP INCOME BEFORE PROVISION FOR INCOME TAXES , PLUS INTEREST EXPENSE , LESS INTEREST INCOME , PLUS DEPRECIATION AND AMORITIZATION , PLUS ANY EXPENSES ARISING SOLELY FROM THE M ERGER CHARGED TO INCOME IN SUCH FISCAL YEAR . I N ADDITION , ANY TRIO EXPENSES INCURRED PRIOR TO THE CLOSING THAT ARE INCLUDED IN S URVIVING C ORP .’ S 2013 INCOME STATEMENT WILL BE EXCLUDED FOR PURPOSES OF EBITDA CALCULATION . • EBITDA MORE THAN DOUBLED (2010 - 2012) • P ROJECTED EBITDA GROWTH OF 32%+ (2012 - 2014), BASED ON MIDPOINT OF 2014 TARGET OF $54 MM . • S UBSTANTIALLY ALL GROWTH HAS BEEN ORGANIC • 100% OF SAE’ S REVENUE IS EARNED ON A CONTRACT BASIS ; NO SPEC . DATA AMORTIZATION = NO OVERSTATED EBITDA • O VER THE LAST 2 YEARS , SAE HAS MIGRATED TO A ~ 50/50 RENT VS . OWN EQUIPMENT PROFILE SAE’ S STOCKHOLDERS MAY EARN UP TO AN ADDITIONAL 992,064 SHARES IF THE FOLLOWING MODIFIED EBITDA TARGETS ARE MET :

S EISMIC M ARKET O PPORTUNITY 16% < 4% 80% 12% 8% 40% 25 - 30% $600 B M ARKET $ 16 - 19 B M ARKET E XPLORATION G EOPHYSICS D EVELOPMENT 10 - 15% D ATA L IBRARY S ALES D ATA P ROCESSING L AND E QUIPMENT L AND A CQUISITION S ERVICES M ARINE E QUIPMENT M ARINE A CQUISITION S ERVICES S OURCE : ION G EOPHYSICAL C ORPORATION 4 TH A NNUAL J OHNSON R ICE & C OMPANY E NERGY C ONFERENCE O CTOBER 3, 2012 I NVESTOR P RESENTATION W ORLDWIDE ANNUAL E&P CAPITAL SPENDING ESTIMATED A T ~ $600 BILLION . S EISMIC INDUSTRY REPRESENTS A $16 TO $19 BILLION ANNUAL REVENUE OPPORTUNITY . L AND ACQUISITION SERVICES SEGMENT OF THE SEISMIC MARKET REPRESENTS A $4.4 TO $5.3 BILLION ANNUAL MARKET . 6

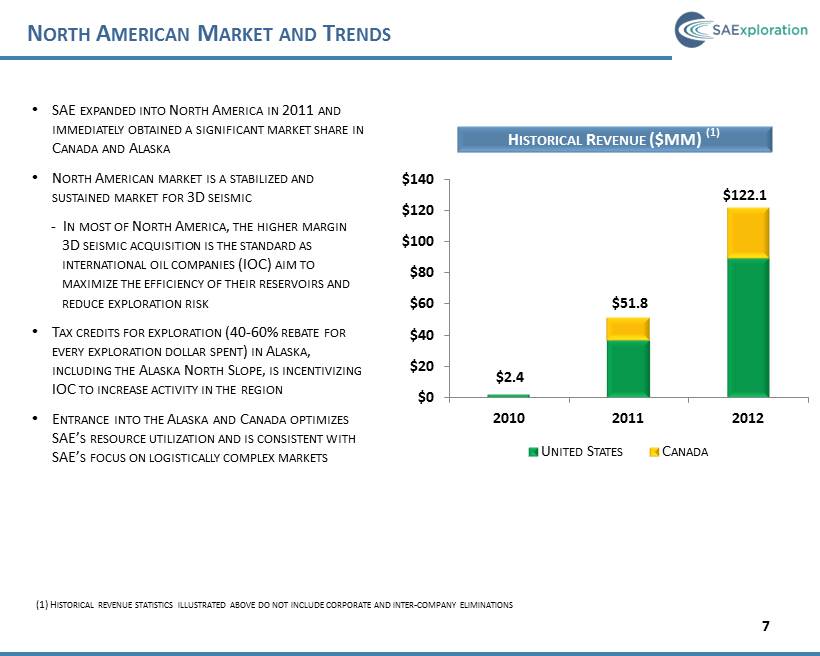

N ORTH A MERICAN M ARKET AND T RENDS • SAE EXPANDED INTO N ORTH A MERICA IN 2011 AND IMMEDIATELY OBTAINED A SIGNIFICANT MARKET SHARE IN C ANADA AND A LASKA • N ORTH A MERICAN MARKET IS A STABILIZED AND SUSTAINED MARKET FOR 3D SEISMIC - I N MOST OF N ORTH A MERICA , THE HIGHER MARGIN 3D SEISMIC ACQUISITION IS THE STANDARD AS INTERNATIONAL OIL COMPANIES (IOC) AIM TO MAXIMIZE THE EFFICIENCY OF THEIR RESERVOIRS AND REDUCE EXPLORATION RISK • T AX CREDITS FOR EXPLORATION (40 - 60% REBATE FOR EVERY EXPLORATION DOLLAR SPENT ) IN A LASKA , INCLUDING THE A LASKA N ORTH S LOPE , IS INCENTIVIZING IOC TO INCREASE ACTIVITY IN THE REGION • E NTRANCE INTO THE A LASKA AND C ANADA OPTIMIZES SAE’ S RESOURCE UTILIZATION AND IS CONSISTENT WITH SAE’ S FOCUS ON LOGISTICALLY COMPLEX MARKETS H ISTORICAL R EVENUE ($MM) (1) (1) H ISTORICAL REVENUE STATISTICS ILLUSTRATED ABOVE DO NOT INCLUDE CORPORATE AND INTER - COMPANY ELIMINATIONS 7 $2.4 $51.8 $122.1 $0 $20 $40 $60 $80 $100 $120 $140 2010 2011 2012 U NITED S TATES C ANADA

S OUTH A MERICAN M ARKET AND T RENDS • IOC’ S THROUGHOUT S OUTH A MERICA SEEK EXPERIENCED SEISMIC PROVIDERS WITH COMPLEX ENVIRONMENT KNOW - HOW , STRONG QHSE RECORDS AND EXCELLENT RELATIONS WITH LOCAL COMMUNITIES - SAE HAS A STRONG QHSE RECORD - SAE HAS NUMEROUS PERSONNEL DEVOTED TO BUILDING STRONG COMMUNITY AND GOVERNMENT RELATIONS • S TABILIZING POLITICAL ENVIRONMENTS PROVIDE CONFIDENCE AND HIGH GROWTH POTENTIAL TO THESE MARKETS • S OUTH A MERICAN COUNTRIES CONTINUE TO EXPAND AND DEVELOP ; DEMANDING SIGNIFICANTLY MORE ENERGY TO FUEL THIS GROWTH - SAE IS TAKING ADVANTAGE OF THIS GROWTH BY EXPANDING INTO B RAZIL IN 2013 AND CONTINUING TO GROW IN C OLOMBIA , P ERU AND B OLIVIA • T HE S OUTH A MERICAN MARKET HELPS OPTIMIZE SAE’ S EQUIPMENT UTILIZATION BY THE OFFSETTING N ORTH A MERICAN AND S OUTH A MERICAN OPERATING SEASONS H ISTORICAL R EVENUE ($MM) (1) 8 $104.4 $90.5 $118.6 $0 $20 $40 $60 $80 $100 $120 2010 2011 2012 Colombia Peru Bolivia (1) H ISTORICAL REVENUE STATISTICS ILLUSTRATED ABOVE DO NOT INCLUDE CORPORATE AND INTER - COMPANY ELIMINATIONS

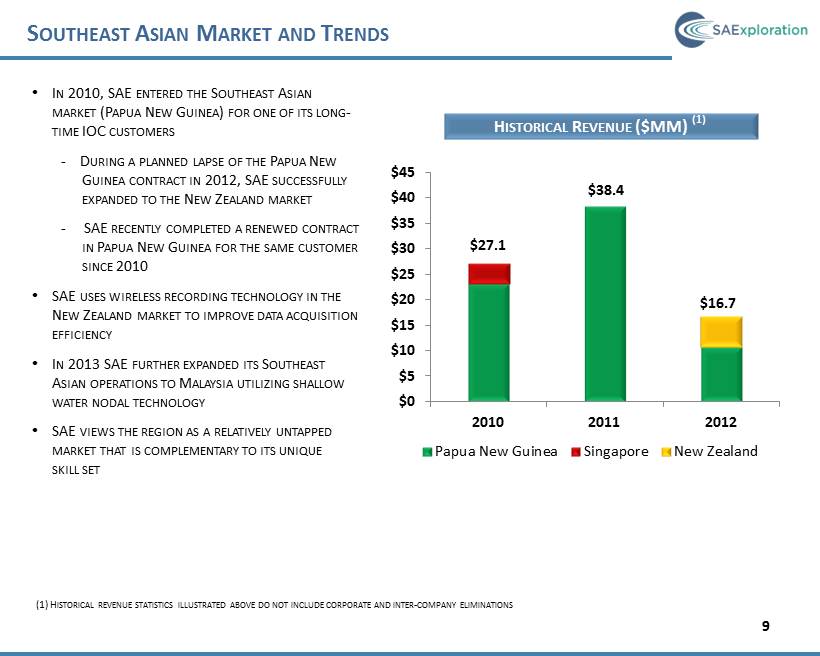

S OUTHEAST A SIAN M ARKET AND T RENDS • I N 2010, SAE ENTERED THE S OUTHEAST A SIAN MARKET (P APUA N EW G UINEA ) FOR ONE OF ITS LONG - TIME IOC CUSTOMERS - D URING A PLANNED LAPSE OF THE P APUA N EW G UINEA CONTRACT IN 2012, SAE SUCCESSFULLY EXPANDED TO THE N EW Z EALAND MARKET - SAE RECENTLY COMPLETED A RENEWED CONTRACT IN P APUA N EW G UINEA FOR THE SAME CUSTOMER SINCE 2010 • SAE USES WIRELESS RECORDING TECHNOLOGY IN THE N EW Z EALAND MARKET TO IMPROVE DATA ACQUISITION EFFICIENCY • I N 2013 SAE FURTHER EXPANDED ITS S OUTHEAST A SIAN OPERATIONS TO M ALAYSIA UTILIZING SHALLOW WATER NODAL TECHNOLOGY • SAE VIEWS THE REGION AS A RELATIVELY UNTAPPED MARKET THAT IS COMPLEMENTARY TO ITS UNIQUE SKILL SET 9 $27.1 $38.4 $16.7 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 2010 2011 2012 Papua New Guinea Singapore New Zealand H ISTORICAL R EVENUE ($MM) (1) (1) H ISTORICAL REVENUE STATISTICS ILLUSTRATED ABOVE DO NOT INCLUDE CORPORATE AND INTER - COMPANY ELIMINATIONS

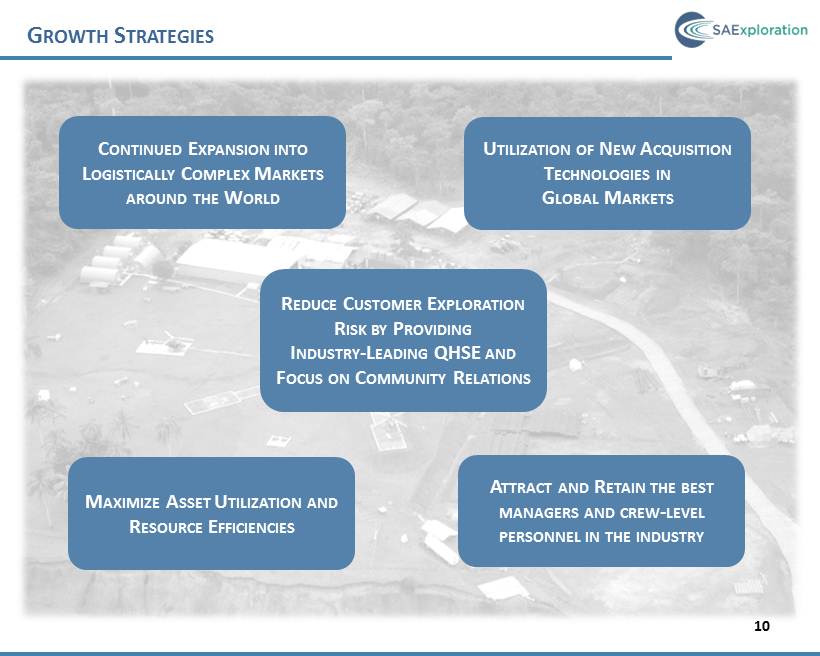

G ROWTH S TRATEGIES 2012 10 C ONTINUED E XPANSION INTO L OGISTICALLY C OMPLEX M ARKETS AROUND THE W ORLD A TTRACT AND R ETAIN THE BEST MANAGERS AND CREW - LEVEL PERSONNEL IN THE INDUSTRY U TILIZATION OF N EW A CQUISITION T ECHNOLOGIES IN G LOBAL M ARKETS M AXIMIZE A SSET U TILIZATION AND R ESOURCE E FFICIENCIES R EDUCE C USTOMER E XPLORATION R ISK BY P ROVIDING I NDUSTRY - L EADING QHSE AND F OCUS ON C OMMUNITY R ELATIONS

C ONTACT 11 D EVIN S ULLIVAN S ENIOR V ICE P RESIDENT (212) 836 - 9608 DSULLIVAN @ EQUITYNY . COM T HOMAS M EI A CCOUNT E XECUTIVE (212) 836 - 9614 TMEI @ EQUITYNY . COM B RENT W HITELEY C HIEF F INANCIAL O FFICER AND G ENERAL C OUNSEL 713 - 816 - 6392 BWHITELEY @ SAEXPLORATION . COM

A PPENDIX • H ISTORICAL FINANCIAL RESULTS / EBITDA RECONCILIATION • H ISTORICAL BALANCE SHEET • H ISTORICAL CASH FLOWS 12

H ISTORICAL F INANCIAL R ESULTS (U.S. dollars in thousands) 2010 2011 2012 2012 2013 (As restated) (As restated) Revenue $ 133,792 $ 180,765 $ 257,359 $ 61,787 $ 84,766 Direct operating expenses 115,238 151,618 212,540 46,911 66,052 Gross profit 18,554 29,147 44,819 14,876 18,714 Selling, general, and administrative exp. 7,390 16,117 25,714 5,443 7,466 Depreciation and amortization expense 177 190 720 139 265 (Gain) Loss on sale of assets - (2) 148 (77) 61 Income from operations 10,987 12,842 18,237 9,371 10,922 Other income (expense): Other expense, net (329) 459 (1,133) 93 (137) Interest expense, net (674) (624) (3,786) (368) (3,385) Loan prepayment fee - - (2,209) - - Foreign exchange gain (loss), net 337 150 320 91 (457) Total other income (expense), net (666) (15) (6,808) (184) (3,979) Income before income taxes 10,321 12,827 11,429 9,187 6,943 Provision for income taxes 4,500 3,319 1,444 1,434 2,015 Net income $ 5,821 $ 9,508 $ 9,985 $ 7,753 $ 4,928 EBITDA reconciliation Net income $ 5,821 $ 9,508 $ 9,985 $ 7,753 $ 4,928 Depreciation and amortization 3,493 4,110 12,470 2,782 4,395 Interest (income) expense, net 674 624 3,573 (1) 368 2,765 (1) Income tax expense (benefit) 4,500 3,319 1,444 1,434 2,015 Non-recurring major expense - 964 (2) 3,437 (3) - - EBITDA $ 14,488 $ 18,525 $ 30,909 $ 12,337 $ 14,103 (1) Excludes $620,000 and $213,000 of amortization of loan issuance costs which are included in depreciation and amortization in March 2013 and December 2012, respectively (2) Principally the costs related to contemplated acquisitions (3) Principally the costs associated with deferred financing costs and fee for early payment of debt Fiscal Years Ended December 31, Three Months Ended March 31, 13

H ISTORICAL B ALANCE S HEET (1,2) (U.S. dollars in thousands) 2011 (1) 2012 (1) March 31, 2013 (2) Current assets Cash and cash equivalents $ 4,978 $ 15,721 $ 21,406 Restricted cash 108 3,701 402 Accounts receivable, net 33,872 27,585 56,825 Prepaid expenses 2,589 8,553 7,661 Deferred costs on contracts 3,000 5,911 3,708 Deferred tax asset, net 2,244 902 898 Total current assets 46,791 62,373 90,900 Property and equipment, net 41,068 70,456 68,210 Goodwill and other intangible assets, net 3,813 3,784 3,678 Deferred loan issuance costs, net - 9,066 8,484 Other assets 1,947 2,296 2,235 Total assets $ 93,619 $ 147,975 $ 173,507 Current liabilities Accounts payable $ 44,216 $ 12,309 $ 27,984 Accrued liabilities 2,723 5,435 4,776 Income and other taxes payable 3,964 5,896 7,181 Accrued payroll and related liabilities 2,383 3,247 6,754 Notes payable - current portion 7,393 853 800 Deferred revenue - current portion 3,756 6,145 8,590 Capital lease - current portion 915 818 860 Total current liabilities 65,350 34,703 56,945 Long-term portion of notes payable, net - 78,493 78,820 Long-term portion of capital leases 1,669 1,054 897 Deferred revenue - non-current portion 6,429 3,175 2,117 Deferred tax liabilities, net 1,553 241 219 Warrant liability - 1,244 1,293 Total liabilities 75,001 118,910 140,291 Total stockholders' equity (incl. conv. preferred stock) 18,618 29,065 33,216 Total liabilities and stockholders' equity $ 93,619 $ 147,975 $ 173,507 (1) Fiscal years ending December 31 (2) March 31, 2013 balance sheet is unaudited 14

H ISTORICAL S UMMARY C ASH F LOW S TATEMENTS 2010 2011 2012 2012 2013 (As restated) (As restated) Operating activities: Net income $5,821 $9,508 $9,985 $7,753 $4,928 Adjustments to reconcile net income to net cash (used in) provided by operating activities: Depreciation and amortization 3,493 4,110 12,470 2,782 4,395 Payment in kind interest - - - - 488 Write off of loan issuance costs - - 1,229 - - Deferred income taxes (1,135) (477) (1,566) (18) (5) Loss (gain) on sale of property and equipment - (2) 148 (77) 61 Share-based compensation - - 21 - 57 Unrealized loss on change in fair value of warrants - - - - 49 Changes in operating assets and liabilities, net of effects of acquisition 4,671 5,522 (23,775) (4,546) (1,403) Net cash (used in) provided by operating activities 12,850 18,661 (1,488) 5,894 8,570 Investing activities: Purchase of property and equipment (8,844) (22,231) (49,949) (13,693) (1,749) Acquisition of business, net of cash received - (1,322) (760) - - Proceeds from sale of property and equipment 1,005 23 849 - - Net cash used in investing activities (7,839) (23,530) (49,860) (13,693) (1,749) Financing activities: Principal borrowings on notes payable 2,284 4,139 118,247 21,546 - Repayments on notes payable, other (4,100) (650) (44,362) (14,214) (200) Repayments of advances from related parties (928) (895) (1,917) (150) (53) Advances from related parties 1,648 1,192 - 576 - Repayments of capital lease obligations (170) (47) (1,122) (110) (213) Dividend payments (154) (537) (168) (14) (42) Payments of loan issuance costs - - (8,657) - - Net cash provided by financing activities (1,420) 3,202 62,021 7,634 (508) Effects of exchange rate changes on cash 430 (587) 70 1,018 (628) Net change in cash and cash equivalents 4,021 (2,254) 10,743 853 5,685 Cash at the beginning of period 3,211 7,232 4,978 4,978 15,721 Cash at the end of period $7,232 $4,978 $15,721 $5,831 $21,406 Fiscal Years Ended December 31, Three Months Ended March 31, 15