Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MITEL NETWORKS CORP | d563640d8k.htm |

| EX-99.2 - EX-99.2 - MITEL NETWORKS CORP | d563640dex992.htm |

Exhibit 99.1

MITEL NETWORKS CORPORATION

NOTICE OF THE ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an Annual General Meeting (the “Meeting”) of the shareholders of Mitel Networks Corporation (“Mitel”) will be held on Wednesday, July 31, 2013 at The Brookstreet Hotel, 525 Legget Drive, Ottawa (Kanata), Ontario, Canada, K2K 2W2, commencing at 2:30 p.m., Ottawa time, for the following purposes:

| 1. | To place before the Meeting the consolidated financial statements for the fiscal year ended April 30, 2013 together with the auditor’s reports thereon. |

| 2. | To elect directors for the ensuing year (“Annual Resolution No. 1”). |

| 3. | To reappoint Deloitte LLP as our independent auditor (and, for purposes of U.S. securities laws, our independent registered public accounting firm) and to authorize the directors to fix the auditor’s remuneration (“Annual Resolution No. 2”). |

To transact such further and other business as may properly come before the Meeting or any adjournment thereof.

A copy of the full text of each of the proposed Annual Resolution No. 1 and Annual Resolution No. 2 is attached as Schedule A and Schedule B respectively to the Proxy Circular that accompanies this Notice. Any action on the items of business described above may be considered at the Meeting or at any adjournment or postponement of the Meeting. Please note that our proxy materials are also available through the Internet at http://investor.mitel.com. In the interest of convenience to you and of minimizing the environmental impact associated with printing and mailing our proxy material and annual reports in the future, you may indicate your preference for receiving all future materials electronically, by indicating as such in the manner provided for on the enclosed proxy card or, for beneficial holders, on the voting instruction form.

Shareholders of record attending the Meeting should be prepared to present government-issued picture identification for admission. Shareholders owning common shares through a broker, bank, or other record holder should be prepared to present government-issued picture identification and evidence of share ownership as of the record date, such as an account statement, voting instruction form issued by the broker, bank or other record holder, or other acceptable document, for admission to the Meeting. Check-in at the Meeting will begin at 2:00 p.m., Ottawa time, and you should plan to allow ample time for check-in procedures.

As owners of Mitel, your vote is very important, regardless of the number of shares you own. Whether or not you are able to attend the Meeting in person, it is important that your shares be represented. We request that you vote as soon as possible on-line at www.investorvote.com or in writing by following the instructions noted on the proxy card or, for beneficial shareholders, the voting instruction form, included with this notice. Your proxy card or voting instruction form, as applicable, must be received by 5:00 p.m., Ottawa time, two days before the Meeting, Monday, July 29, 2013. For specific information regarding voting of your common shares, please refer to the section entitled “Voting of Proxies” in the accompanying Proxy Circular.

Thank you for your continued interest in Mitel.

DATED at Ottawa, Ontario this 20th day of June, 2013.

BY ORDER OF THE BOARD OF DIRECTORS

Richard D. McBee, President and Chief Executive Officer

TABLE OF CONTENTS

| Page | ||||||||

| A. | INFORMATION ON VOTING AND PROXIES | 1 | ||||||

| 1. | Who May Vote | 1 | ||||||

| 2. | Solicitation of Proxies | 1 | ||||||

| 3. | Appointment of Proxies | 1 | ||||||

| 4. | Revocation of Proxies | 3 | ||||||

| 5. | Voting of Proxies | 4 | ||||||

| 6. | Authorized Capital and Voting Shares | 4 | ||||||

| 7. | Security Ownership of Certain Beneficial Owners and Management | 4 | ||||||

| B. | CORPORATE GOVERNANCE PRINCIPLES AND PRACTICES | 6 | ||||||

| 8. | Applicable Governance Requirements and Guidelines | 7 | ||||||

| 9. | Composition of the Board | 7 | ||||||

| 10. | Independence and Other Considerations for Director Service | 7 | ||||||

| 11. | Mandate of the Board and Corporate Governance Guidelines | 9 | ||||||

| 12. | Ethical Business Conduct | 9 | ||||||

| 13. | Board Committees | 10 | ||||||

| 14. | Communication with the Board | 12 | ||||||

| C. | COMPENSATION DISCUSSION AND ANALYSIS | 12 | ||||||

| 15. | Director Compensation | 12 | ||||||

| 16. | Executive Officer Compensation | 14 | ||||||

| 17. | Stock Option and Other Compensation Plans | 17 | ||||||

| 18. | Employment Agreements, Termination and Change of Control | 23 | ||||||

| D. | INTEREST OF MANAGEMENT, NOMINEES AND OTHERS IN MATERIAL TRANSACTIONS | 25 | ||||||

| 19. | Transactions Involving Related Parties | 25 | ||||||

| 20. | Kanata Research Park Corporation | 25 | ||||||

| 21. | Other Parties Related to Dr. Matthews | 26 | ||||||

| 22. | Registration Rights | 26 | ||||||

| 23. | Shareholders’ Agreement | 26 | ||||||

| E. | BUSINESS TO BE TRANSACTED AT THE MEETING | 28 | ||||||

| 24. | Financial Statements | 28 | ||||||

| 25. | Annual Resolution No. 1 – Election of Directors | 28 | ||||||

| 26. | Annual Resolution No. 2 – Appointment and Remuneration of Auditors | 31 | ||||||

| F. | OTHER MATTERS | 31 | ||||||

EXPLANATORY NOTE REGARDING THE CONTENT AND FORMAT OF THIS DOCUMENT

Mitel qualifies as a foreign private issuer for purposes of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). Instead of filing annual and periodic reports on forms available for foreign private issuers, we file an annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. As a Canadian corporation and foreign private issuer in the U.S. that is not subject to the requirements of Section 14(a) of the Exchange Act or Regulation 14A, our Management Proxy Circular (the “Proxy Circular” or the “Circular”) and related materials have been prepared in accordance with Canadian corporate and securities law requirements.

A copy of our annual report on Form 10-K for the year ended April 30, 2013 was mailed contemporaneously with this Proxy Circular and is also available at http://investor.mitel.com. You may also review and print the Form 10-K and all exhibits from the SEC’s website at www.sec.gov or from SEDAR at www.sedar.com. In addition, we will send a complete copy of the annual report on Form 10-K (including all exhibits, if specifically requested), to any shareholder (without charge) upon written request addressed to: Investor Relations, Mitel Networks Corporation, 350 Legget Drive, Ottawa, Ontario, Canada, K2K 2W7. All of our public documents are filed with SEDAR and may be found on the following website: www.sedar.com. Information on or accessible through our website is not incorporated into this Proxy Circular and you should not consider any information on, or that can be accessed through, our website as part of this Proxy Circular.

Additional financial information is contained in our audited consolidated financial statements for the year ended April 30, 2013 and management’s discussion and analysis of financial condition and results of operations for the year ended April 30, 2013. Copies of our financial statements and management’s discussion and analysis of financial condition and results of operations are available upon request to Investor Relations, Mitel Networks Corporation, 350 Legget Drive, Ottawa, Ontario, Canada, K2K 2W7.

In this Proxy Circular, we refer to Mitel Networks Corporation, the Canada Business Corporations Act corporation whose shares you own (together with its subsidiaries, where applicable), as “Mitel”. Additionally, we sometimes refer to Mitel as “we,” “us,” “our,” “our corporation,” or “the Corporation.” References to “GAAP” mean generally accepted accounting principles in the United States.

Unless indicated otherwise, all dollar amounts included in this Proxy Circular are expressed in U.S. dollars.

MITEL NETWORKS CORPORATION

350 Legget Drive

Ottawa, Ontario

K2K 2W7

MANAGEMENT PROXY CIRCULAR

JUNE 20, 2013

| A. | INFORMATION ON VOTING AND PROXIES |

| 1. | Who May Vote |

You are entitled to vote at the annual meeting if you were a holder of common shares (“Common Shares”) of Mitel Networks Corporation at the close of business on June 11, 2013. Each Common Share is entitled to one vote.

| 2. | Solicitation of Proxies |

This Proxy Circular is furnished in connection with the solicitation of proxies by or on behalf of the management of Mitel, a corporation governed by the Canada Business Corporations Act (the “CBCA”), for use at the annual meeting, or any adjournment or adjournments of the meeting (the “Meeting”) of the shareholders of Mitel (each, a “Shareholder”) to be held on Wednesday, July 31, 2013 at The Brookstreet Hotel, 525 Legget Drive, Ottawa (Kanata), Ontario, K2K 2W2, commencing at 2:30 p.m., Ottawa time, for the purposes set out in the notice of the Meeting (the “Notice of Meeting”) accompanying this Proxy Circular.

The enclosed proxy is being solicited by or on behalf of the management of Mitel and the cost of such solicitation will be borne by us. It is expected that the solicitation of proxies will be primarily by mail communication by our directors, officers or employees. Except as otherwise stated, the information contained in this Proxy Circular is given as of June 7, 2013.

| 3. | Appointment of Proxies |

The persons named in the enclosed form of proxy or voting instruction form are directors or officers of Mitel. If you wish to appoint some other person or company (who need not be a shareholder) to represent you at the Meeting, you may do so by striking out the name of the persons named in the enclosed form of proxy or voting instruction form and inserting the name of your appointee in the blank space provided or complete another form of proxy and, in either case, deliver the completed and signed form in the envelope provided by 5:00 p.m., Ottawa time, on Monday, July 29, 2013, being two business days preceding the date of the Meeting. It is the responsibility of the Shareholder appointing some other person to represent the Shareholder to inform such person that he or she has been so appointed. The proxy or voting instruction form must be signed by the Shareholder or the Shareholder’s attorney authorized in writing or, if the Shareholder is a corporation, by an officer or attorney of that corporation, duly authorized.

1

Registered Shareholders

A registered Shareholder is the person in whose name a share certificate is registered. If you are a registered Shareholder, you are entitled to vote your shares in one of two ways:

| (a) | Attend the Meeting – You may attend the Meeting and vote in person. |

| (b) | By Proxy - If you do not plan to attend the Meeting in person, you may vote by proxy in one of two ways: |

| i. | By authorizing the management representatives of Mitel named in the proxy form to vote your Common Shares. You may convey your voting instructions by: |

| • | Internet – Go to www.investorvote.com and follow the instructions. You will need the 15 digit control number which is located on your proxy form; or |

| • | Mail – Complete the proxy form in full, sign and return it in the envelope provided by 5:00 p.m., Ottawa time, on Monday, July 29, 2013 being two business days preceding the date of the Meeting. The shares represented by your proxy will be voted in accordance with your instructions as indicated on your form of proxy and on any ballot that may be called at the Meeting. |

| ii. | You have the right to appoint some other person to attend the Meeting and vote your Common Shares on your behalf. You may do this either by: |

| • | Internet – Go to www.investorvote.com and follow the instructions. You will need the 15 digit control number which is located on your proxy form; or |

| • | Mail – Print your appointee’s name in the blank space on the proxy form and indicate how you would like to vote your Common Shares. Complete the proxy form in full, sign and return it in the envelope provided. Your proxyholder will decide how to vote on amendments or variations to the matters to be voted on at the Meeting. |

Non-Registered Shareholders

Your shares may not be registered in your name but in the name of an intermediary (which is usually a bank, trust company, securities dealer or broker, or trustee or administrator of self-administered RRSPs, RRIFs, RESPs and similar plans). If your shares are registered in the name of an intermediary, you are a non-registered Shareholder.

Mitel has distributed copies of the Notice of Meeting, this Circular and the form of proxy (collectively, the “Meeting Materials”) to intermediaries for distribution to non-registered Shareholders. Unless you have waived your right to receive the Meeting Materials, intermediaries are required to deliver them to you as a non-registered Shareholder of Mitel and to seek your instructions regarding how to vote your shares. Typically, a non-registered Shareholder will be given a voting instruction form which must be completed and signed by the non-registered Shareholder in accordance with the instructions on the form. The purpose of these procedures is to allow non-registered Shareholders to direct the voting of those shares that they own but which are not registered in their own name.

As a non-registered Shareholder, you may vote in person at the Meeting or by proxy in one two ways.

| (a) | Attend the Meeting - |

| i. | If you hold a Share Ownership Statement, simply attend the Meeting and vote; |

| ii. | If you received a proxy form from your intermediary, insert your name in the blank space provided on the form, sign the proxy form if it is not signed by the intermediary and return the completed proxy form in the enclosed envelope. Your proxy form must be received by Computershare Investor |

2

| Services, Inc. from your intermediary by 5:00 p.m. EST two days before the Meeting, being Monday, July 29, 2013, in order for you to attend the Meeting to vote the shares covered by the proxy form. When you arrive at the Meeting, you should advise the staff that you are a proxy appointee; or |

| iii. | If you received a voting instruction form, follow the instructions on it. |

| (b) | By Proxy - If you hold a Share Ownership Statement or if you received a proxy form from your intermediary and do not plan to attend the Meeting in person, you may vote by proxy in one of two ways: |

| i. | By authorizing the management representatives of Mitel named in the proxy form to vote your Common Shares. You may convey your voting instructions by: |

| • | Internet – Go to www.proxyvote.com and follow the instructions. You will need the 12 digit control number which is located on your proxy form. |

| • | Mail – Complete the proxy form in full, sign and return it in the envelope provided by 5:00 p.m., Ottawa time, on Monday, July 29, 2013 being two business days preceding the date of the Meeting. The shares represented by your proxy will be voted in accordance with your instructions as indicated on your form of proxy and on any ballot that may be called at the Meeting. |

| ii. | You have the right to appoint some other person to attend the Meeting and vote your Common Shares on your behalf. You may do this either by: |

| • | Internet – Go to www.proxyvote.com and follow the instructions. You will need the 12 digit control number which is located on your proxy form. |

| • | Mail – Print your appointee’s name in the blank space on the proxy form and indicate how you would like to vote your Common Shares. Complete the proxy form in full, sign and return it in the envelope provided. Your proxyholder will decide how to vote on amendments or variations to the matters to be voted on at the Meeting. |

| iii. | If you received a voting instruction form, follow the instructions on it. |

Proxies returned by intermediaries as “non-votes” because the intermediary has not received instructions from the non-registered Shareholder with respect to the voting of certain shares will be treated as not entitled to vote on any matter before the Meeting and will not be counted as having been voted in respect of any such matter. Shares represented by intermediary “non-votes” will, however, be counted in determining whether there is a quorum present at the Meeting.

4. Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Shareholder may revoke a proxy pursuant to subsection 148(4) of the CBCA by voting again on a later date by depositing an instrument in writing executed by the Shareholder or by the Shareholder’s attorney authorized in writing (or, if the Shareholder is a corporation, by an authorized officer or attorney of such corporation authorized in writing) at the registered office of Mitel at any time up to and including the last business day preceding the day of the Meeting at which such proxy is to be used, or with the Chairman of the Meeting on the day of, but prior to commencement of, the Meeting, or in any other manner permitted by law and, upon either of such deposits, such proxy shall be revoked. If the instrument of revocation is deposited with the Chairman of the Meeting on the day of the Meeting, the instrument will not be effective with respect to any matter on which a vote has already been cast pursuant to such proxy.

A non-registered Shareholder may revoke a voting instruction form that has been given to an intermediary at any time by written notice to the intermediary or to the service company that the intermediary uses, in sufficient time for the intermediary to act on it. In addition, a non-registered Shareholder may change his or her vote by attending the Meeting and voting in person, provided the non-registered Shareholder has followed one of the procedures outlined above under “Non-Registered Shareholders”.

3

5. Voting of Proxies

The form of proxy accompanying this Circular affords a Shareholder an opportunity to specify that the shares registered in the Shareholder’s name shall be voted FOR or WITHHELD in accordance with your instructions as indicated on your form of proxy. In the absence of instructions, your shares will be voted FOR each of the matters to be considered at the Meeting. Votes WITHHELD and abstentions are counted as present or represented for purposes of determining the presence or absence of a quorum at the Meeting but are not included in the number of shares present or represented and voting on each matter.

The form of proxy accompanying this Circular confers discretionary authority upon the nominees named in the enclosed form of proxy with respect to amendments or variations of matters identified in the Notice of Meeting or other matters which may properly come before the Meeting. As of the date of this Circular, management of Mitel knows of no amendment or variation of the matters referred to in the Notice of Meeting or other business that will be presented at the Meeting. If any such matters should properly come before the Meeting, each nominee named in the enclosed form of proxy will vote on those matters in accordance with his or her best judgment.

6. Authorized Capital and Voting Shares

The authorized capital of the Corporation consists of an unlimited number of Common Shares and an unlimited number of Preferred Shares, issuable in series (the “Preferred Shares”). As of June 11, 2013 (the “Record Date”), Mitel had 53,702,749 Common Shares issued and outstanding and no Preferred Shares issued and outstanding. Each Common Share carries one vote in respect of each matter to be voted upon at the Meeting. Only holders of outstanding Common Shares of record at the close of business on the Record Date will be entitled to vote at the Meeting.

7. Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of our Common Shares as of June 7, 2013 and shows the number of shares and percentage of outstanding Common Shares owned by:

| • | each person or entity who is known by us to own beneficially 5% or more of our Common Shares; |

| • | each member of our Board; |

| • | each of our named executive officers (each, an “NEO”); and |

| • | all members of our Board and our executive officers as a group. |

Beneficial ownership is determined in accordance with United States Securities and Exchange Commission (“SEC”) rules, which generally attribute beneficial ownership of securities to each person or entity who possesses, either solely or shared with others, the power to vote or dispose of those securities. These rules also treat as outstanding all shares that a person would receive upon exercise of stock options or warrants, or upon conversion of convertible securities held by that person that are exercisable or convertible within 60 days of the determination date, which in the case of the following table is August 6, 2013. Shares issuable pursuant to exercisable or convertible securities are deemed to be outstanding for computing the percentage ownership of the person holding such securities but are not deemed outstanding for computing the percentage ownership of any other person. The percentage of beneficial ownership for the following table is based on 53,702,749 Common Shares outstanding as of June 7, 2013. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all Common Shares shown as beneficially owned by them.

4

| Amount and Nature of Beneficial Ownership |

||||||||||

| Title of Class |

Name and Address of Beneficial Owner (1) |

Number | % | |||||||

| Five Percent Shareholders: |

||||||||||

| Common Shares |

Matthews Group (2) |

|||||||||

| Dr. Terence H. Matthews |

264,271 | 0.5 | % | |||||||

| Kanata Research Park Corporation (formerly Wesley Clover Corporation) |

12,080,610 | 22.5 | % | |||||||

|

|

|

|

|

|||||||

| Total |

12,344,881 | 23.0 | % | |||||||

|

|

|

|

|

|||||||

| Common Shares |

Francisco Partners Group (3) |

|||||||||

| Francisco Partners Management, LLC |

306,288 | 0.6 | % | |||||||

| Francisco Partners GP II Management (Cayman) Limited |

62,470 | 0.1 | % | |||||||

| Francisco Partners GP III Management, LLC |

858 | 0.0 | % | |||||||

| Arsenal Holdco I S.a.r.l. |

14,508,268 | 27.0 | % | |||||||

| Arsenal Holdco II S.a.r.l. |

5,589,278 | 10.4 | % | |||||||

|

|

|

|

|

|||||||

| Total |

20,467,162 | 38.0 | % | |||||||

|

|

|

|

|

|||||||

| Common Shares |

Morgan Stanley Principal Investments, Inc. (4) |

3,963,809 | 7.4 | % | ||||||

| Common Shares |

Wellington Management Company, LLP(5) |

3,526,428 | 6.6 | % | ||||||

| Common Shares |

Executive Officers and Directors: |

|||||||||

| Dr. Terence H. Matthews (2) |

12,344,881 | 23.0 | % | |||||||

| Richard D. McBee |

1,017,499 | 1.9 | % | |||||||

| Peter D. Charbonneau (6) |

192,515 | 0.4 | % | |||||||

| Benjamin H. Ball (3) |

20,467,162 | 38.0 | % | |||||||

| Andrew J. Kowal (3) |

20,467,162 | 38.0 | % | |||||||

| Jean-Paul G. Cossart (7) |

142,341 | 0.23 | % | |||||||

| John McHugh |

122,876 | 0.2 | % | |||||||

| Henry L. Perret |

165,224 | 0.3 | % | |||||||

| Steven E. Spooner (8) |

186,820 | 0.4 | % | |||||||

| Graham Bevington |

64,752 | 0.1 | % | |||||||

| Ronald G. Wellard |

107,084 | 0.2 | % | |||||||

| Jon Brinton |

33,895 | 0.1 | % | |||||||

| All directors and executive officers as a group (15 persons) (9) |

34,942,383 | 65.0 | % | |||||||

| (1) | Except as otherwise indicated, the address for each beneficial owner is c/o Mitel Networks Corporation, 350 Legget Drive, Ottawa, Ontario, Canada, K2K 2W7. |

| (2) | The “Matthews Group” means Dr. Matthews and certain entities, including Kanata Research Park Corporation, controlled by Dr. Matthews. Includes stock options to acquire 264,271 Common Shares that are currently exercisable and 12,080,610 Common Shares owned by Kanata Research Park Corporation. Dr. Matthews has voting and investment power over the Common Shares owned by Kanata Research Park Corporation and therefore beneficially owns the Common Shares held by Kanata Research Park Corporation. The address for the Matthews’ Group and Dr. Matthews is 350 Legget Drive, Kanata, Ontario, Canada K2K 2W7. |

| (3) | The “Francisco Partners Group” means Francisco Partners Management, LLC and certain of its affiliates. Includes 20,160,874 Common Shares and stock options to acquire 306,288 Common Shares that are exercisable. Benjamin Ball and Andrew Kowal, both partners of Francisco Partners Management, LLC, have voting and investment power over the Common Shares owned by each of Francisco Partners, Francisco Partners GP II Management (Cayman) Limited, Francisco Partners GP III Management, LLC, Arsenal Holdco I S.a.r.l. and Arsenal Holdco II S.a.r.l. and therefore beneficially own the Common Shares held by each of these entities. The address for each of the Francisco Partners Group, Benjamin Ball and Andrew Kowal is c/o Francisco Partners Management, LLC, One Letterman Drive, Building C-Suite 410, San Francisco, California, 94129. |

| (4) | The number of shares, 3,963,809 was reported in Form 13F filed with the SEC as at March 31, 2013. The address for Morgan Stanley Principal Investments, Inc. is 1585 Broadway, New York, New York, 10036. |

5

| (5) | The number of shares, 3,526,428 was reported in Form 13F with the SEC as at March 31, 2013. The address for Wellington Management Company, LLP is 280 Congress Street, Boston, Massachusetts, 02210. |

| (6) | Of this total, 2,019 Common Shares are registered to Peter Charbonneau Trust #2, a trust of which Mr. Charbonneau is the sole trustee, and 13,927 Common Shares are registered to Mr. Charbonneau’s spouse, Joan Charbonneau. Mr. Charbonneau disclaims beneficial ownership of the 13,927 Common Shares registered to Joan Charbonneau. Includes options to acquire 161,293 Common Shares from us at exercise prices ranging from $2.61 to $6.50. |

| (7) | Includes options to acquire 142,341 Common Shares granted to Scivias s.a.r.l. at exercise prices ranging from $2.61 to $6.50. Mr. Cossart has voting and investment power over the Common Shares owned by Scivias s.a.r.l. |

| (8) | Of this total, 5,100 Common Shares are registered to the Spooner Children Trust, a trust of which Mr. Spooner is one of three trustees, and 135,417 Common Shares issuable upon the exercise of options at exercise prices ranging from $3.75 to $8.79. |

| (9) | In calculating this total, the Common Shares held by Mr. Ball and held by Mr. Kowal have been counted only once, as all such shares are held by and through the Francisco Partners Group. |

For the purpose of this table, which contains information that is also included in our Form 10-K filing for the fiscal year ended April 30, 2013, the term “executive officer” has the meaning ascribed to it under Rule 405 promulgated under the U.S. Securities Act of 1933, as amended (the “1933 Act”). The information with respect to beneficial ownership is based upon information furnished by each director or executive officer or information contained in insider reports made with the Canadian Securities Administrators.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires directors, executive officers (as defined under the 1933 Act as noted above), and Shareholders owning more than 10% of a company’s outstanding shares (other than certain banks, investment funds and other institutions holding securities for the benefit of third parties or in customer fiduciary accounts), to file reports of ownership and changes of ownership with the SEC. Section 16(a) does not apply to Mitel because it is a foreign private issuer under U.S. securities laws. Our officers and directors and 10% shareholders are required to file reports of ownership of our Common Shares and changes of such ownership with the Canadian Securities Administrators. We believe that our directors and executive officers have made all required filings with Canadian Securities Administrators.

B. CORPORATE GOVERNANCE PRINCIPLES AND PRACTICES

Mitel is a Canadian reporting issuer and qualifies as a foreign private issuer for purposes of the Exchange Act. Our Common Shares are listed on the National Association of Securities Dealers Automated Quotations (“Nasdaq”) and on the Toronto Stock Exchange (“TSX”). As a result, we are subject to, and comply with, a number of legislative and regulatory corporate governance requirements, policies and guidelines, including those of the Nasdaq, TSX, the Canadian Securities Administrators and the SEC.

In addition to compliance with governance requirements, Mitel and its management place significant emphasis on the structure of the board of directors (the “Board”) and the committees of the Board in order to promote effective corporate governance of the Corporation. We have adopted corporate governance guidelines, mandates for each of the Board, Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, as well as position descriptions for a chairman of the Board, a lead director and a Chief Executive Officer.

We have established a Global Business Ethics and Compliance Office headed by a Compliance Officer with assistance from the Legal Department and Internal Audit Department. The responsibilities of the Compliance Officer include (but are not limited to):

| • | ensuring annual distribution and certification of our Code of Business Conduct to all of our employees, directors, officers and representatives which requires each individual to certify their compliance with the Code; |

| • | monitoring our ethics and business practices company-wide by coordinating audits, performance assessments and providing training programs; |

| • | monitoring and promoting anonymous hotlines to report suspected violations; and |

| • | reporting to the Board and/or a Committee of the Board. |

6

We have adopted an Insider Trading Policy for directors, officers and employees who may from time to time be in possession of material, non-public information.

Certain employees who are involved in the preparation and review of financial statements and regulatory filings execute, on an annual basis, certifications in support of the certification obligations of the Chief Executive Officer and the Chief Financial Officer pursuant to the Sarbanes Oxley Act of 2002. The certification process complements the due diligence process administered by us to support reporting obligations under the Sarbanes Oxley Act of 2002.

Our significant governance principles and practices, all of which are described below, are set forth in governance documentation available on our website at http://investor.mitel.com. These include the Mandate for the Board of Directors, Audit Committee Charter, Compensation Committee Charter, Nominating and Corporate Governance Committee Charter, Corporate Governance Guidelines and Code of Business Conduct. We will provide a copy of any of these governance documents to any person, without charge, who requests a copy in writing to Investor Relations, Mitel Networks Corporation, 350 Legget Drive, Ottawa, Ontario, Canada, K2K 2W7.

8. Applicable Governance Requirements and Guidelines

Rule 5620(c) of the Nasdaq’s corporate governance rules generally requires that a listed company’s by-laws provide for a quorum for any meeting of the holders of the company’s common shares of at least 33 1/3% of the company’s outstanding common shares. Rule 5605(d) of the Nasdaq’s corporate governance rules generally requires that the compensation of a listed company’s executive officers must be determined, or recommended to the board of directors for determination, either by independent directors constituting a majority of the board’s independent directors in a vote in which only independent directors participate or by a compensation committee comprised solely of independent directors. Rule 5605(e)(1) of the Nasdaq’s corporate governance rules generally requires that director nominees must be selected or recommended for the board of director’s selection either by independent directors constituting a majority of the board’s independent directors in a vote in which only independent directors participate or by a nominations committee comprised solely of independent directors.

Pursuant to the Nasdaq’s corporate governance rules, Mitel, as a foreign private issuer, has elected to comply with practices that are permitted under Canadian law in lieu of the provisions of Rule 5620(c), Rule 5605(d) and Rule 5605(e)(1). Our by-laws provide that a quorum of Shareholders is present at a meeting of Shareholders if the holders of at least 25% of the shares entitled to vote at the meeting are present in person or represented by proxy, provided that a quorum shall be not less than two persons. The Board determines the compensation of our executive officers, with the assistance of the Compensation Committee of the Board. The Nominating and Corporate Governance Committee of the Board is generally responsible for selecting director nominees, except that pursuant to the terms of the shareholders’ agreement among Francisco Partners Group and the Matthews Group effective at the closing of our initial public offering, each of them may nominate some members of the Board (See the discussion under the heading, “Shareholders Agreement”, in Section D of this Circular).

9. Composition of the Board

Mitel’s Board currently consists of eight members and the directors have approved a fixed number of eight directors to be elected at the Meeting. Our articles of incorporation provide that the Board is to consist of a minimum of three and a maximum of fifteen directors as determined from time to time by the directors, and permit the directors to appoint additional directors in accordance with the CBCA within any fixed number from time to time. Under the CBCA, one quarter of our directors must be resident Canadians as defined in the CBCA. The Board regularly assesses the need for additional directors in order to ensure that the Board is composed of individuals with diverse backgrounds, experience, competencies and independence as evaluated against criteria established from time to time by the Board.

10. Independence and Other Considerations for Director Service

Six of our nominated directors are considered “independent”, as defined under the Nasdaq rules and for purposes of Canadian securities laws. Our independent directors are Peter Charbonneau, Benjamin Ball, Andrew Kowal, Jean-Paul Cossart, John McHugh and Henry Perret. For purposes of the Nasdaq rules, an independent director means a person other than an executive officer or employee of the company or any other individual having a relationship

7

which, in the opinion of the company’s Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. A director is considered to be independent for the purposes of Canadian securities laws if the director has no direct or indirect material relationship to the company. A material relationship is a relationship that could, in the view of the board, be reasonably expected to interfere with the exercise of a director’s independent judgment. Certain individuals, such as employees and executive officers of Mitel, are deemed by Canadian securities laws to have material relationships with the Corporation.

Our non-independent nominated directors are Richard McBee and Terence Matthews. Our Board determined that Richard McBee is non-independent due to his “insider” position as Chief Executive Officer and President of the Corporation. Terence Matthews, chairman of our board of directors, has also been determined to be a non-independent director by virtue of the fact that Mitel conducts significant business with several companies that Dr. Matthews either controls or has made a significant investment in. As chairman, Dr. Matthews’ role is to promote the Board’s effectiveness in providing oversight to the Corporation. In particular, the chairman has the responsibility to:

| • | preside over Board meetings in an efficient and effective manner that is compliant with governance policies and procedures; |

| • | in conjunction with the Chief Executive Officer, communicate and maintain relationships with the Corporation, its shareholders and other stakeholders; |

| • | set Board meeting agendas based on input from directors and senior management; |

| • | work cooperatively with the lead director in fulfilling the lead director’s mandate and, in the event of a conflict in their duties, yield to the lead director; and |

| • | carry out other duties, as requested by the Board or the Chief Executive Officer. |

For purposes of the Nasdaq rules and Canadian securities laws, Dr. Matthews is deemed not to be an independent director. Accordingly, we also have a lead director, Peter Charbonneau. The responsibility of the lead director is to provide independent leadership to the Board and to ensure that it functions in an independent and open manner. Together with the chairman of the Board, the lead director ensures that the Board understands its responsibilities and communicates effectively with its subcommittees and with management. Our Lead Director is also chairman of our Nominating and Corporate Governance Committee, of which all of the members are independent. At the regularly scheduled Nominating and Corporate Governance Committee meetings, the Lead Director ensures that the independent directors have in-camera discussions.

The attendance record of each director of the Board for all board meetings since May 1, 2012 is as follows:

| Director |

Attendance During Fiscal 2013 | |||||||

| Meetings Attended | Percentage | |||||||

| Dr. Terence H. Matthews |

11 of 11 | 100 | % | |||||

| Richard D. McBee |

11 of 11 | 100 | % | |||||

| Benjamin H. Ball |

11 of 11 | 100 | % | |||||

| Peter D. Charbonneau |

11 of 11 | 100 | % | |||||

| Jean-Paul Cossart |

11 of 11 | 100 | % | |||||

| Andrew J. Kowal |

10 of 11 | 91 | % | |||||

| John McHugh |

11 of 11 | 100 | % | |||||

| Henry L. Perret |

11 of 11 | 100 | % | |||||

8

11. Mandate of the Board and Corporate Governance Guidelines

The mandate of Mitel’s Board is to oversee corporate performance and to provide quality, depth and continuity of management so that we can meet our strategic objectives. In particular, our Board focuses its attention on the following key areas of responsibility:

| • | appointing and supervising the Chief Executive Officer and other senior officers; |

| • | supervising strategy implementation and performance; |

| • | monitoring our financial performance and reporting; |

| • | identifying and supervising the management of the Corporation’s principal business risks; |

| • | monitoring the legal and ethical conduct of the Corporation; |

| • | maintaining shareholder relations; and |

| • | developing and supervising our governance strategy. |

The Board discharges many of its responsibilities through its standing committees: the Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee. Other committees may be formed periodically by the Board to address specific issues that are not on-going in nature. The duties and responsibilities delegated to each of the standing committees are prescribed in the respective charter of each standing committee.

Position Descriptions

The Board has developed and implemented a written position description for each of the chairman, the lead director and the Chief Executive Officer. Committees of the Board each have a committee charter that sets out the mandate of the committee, which includes the responsibilities of the chair of each committee.

Orientation and Continuing Education

Director orientation and continuing education is conducted by the Nominating and Corporate Governance Committee. All newly elected directors are provided with a comprehensive orientation on our business and operations. This includes familiarization with our reporting structure, strategic plans, significant financial, accounting and risk issues, compliance programs, policies and management and the external auditor. Existing directors are periodically updated in respect of these matters.

For the purposes of orientation, new directors are given the opportunity to meet with members of the executive management team to discuss the Corporation’s business and activities. The orientation program is designed to assist the directors in fully understanding the nature and operation of our business, the role of the Board and its committees, and the contributions that individual directors are expected to make.

12. Ethical Business Conduct

The Board has established the Code of Business Conduct, which governs the conduct of our Board, executives, employees, contractors and agents. A copy of the Code may be obtained by contacting the Mitel Global Business Ethics and Compliance Office and is also available on our website at http://investor.mitel.com.

Responsibility for ensuring compliance with the Code rests with our Global Business Ethics and Compliance Office (the “Compliance Office”), under the guidance of its director, who is also the general counsel of the Corporation. The Compliance Office ensures that the Code is distributed throughout the Corporation, monitors the ethics of our business practices, investigates potential breaches of the Code and engages in education on compliance with the Code. The Audit Committee periodically reviews the ethics monitoring conducted by the Compliance Office and updates the Code as required. The chair of the Audit Committee reports the results of his or her reviews to the Board following Audit Committee meetings and keeps the Board apprised of matters considered by the committee.

9

Directors are prohibited by the Code from engaging in transactions on our behalf in which that director has, or a family member of that director has, a substantial beneficial interest. Among other things, this means that a director may not hold a financial interest in a customer, supplier or competitor of ours or our subsidiaries; notwithstanding this prohibition, a director may own $25,000 worth of stock or two percent of a publicly owned corporation, whichever is greater. Permission to deviate from these rules must be obtained from the Board. Moreover, prior to commencing service on our Board, directors are required to disclose all potential conflicts of interest to the corporate secretary. If potential conflicts arise during a director’s tenure on the Board, such conflicts must be immediately disclosed to the corporate secretary. Where a conflict of interest exists, a director is required by statute to abstain from voting on the matter and, by corporate policy, is also required to recuse him or herself from any discussion on any matter in respect of which a conflict of interest precludes the director from voting.

13. Board Committees

The Board has established three committees to assist it in carrying out its responsibilities: the Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee.

The Audit Committee

The Audit Committee is composed of three directors namely, Peter Charbonneau (Chairman), Jean-Paul Cossart and Henry Perret. Peter Charbonneau was appointed to the Audit Committee in February 2002, Jean-Paul Cossart was appointed in July 2008 and Henry Perret was appointed in March 2010. The Board has determined that each of these directors meets the independence requirements of the rules and regulations of the Nasdaq and the SEC. The Board has determined that each of these directors is financially literate. Peter Charbonneau (Chairman) has been identified as an “audit committee financial expert” as such term is defined by applicable U.S. securities laws.

The Audit Committee assists the Board in fulfilling its financial oversight obligations including responsibility for overseeing the integrity of our financial statements, legal and regulatory compliance, auditor independence and qualification, the work and performance of our financial management, internal auditor and external auditor and for overseeing the systems of disclosure controls and procedures and the system of internal controls regarding finance, accounting, legal compliance, risk management and ethics that management and the Board have established.

The Audit Committee has access to all books, records, facilities and personnel and may request any information about the Corporation as it may deem appropriate. It also has the authority to retain and compensate special legal, accounting, financial and other consultants or advisors to advise the committee. The Audit Committee also reviews and approves related party transactions and prepares reports for the Board on such related party transactions.

All members of the Audit Committee have experience reviewing financial statements and dealing with related accounting and auditing issues. The members of the Audit Committee have the following relevant education and experience:

| • | Peter Charbonneau is a general partner in Skypoint Capital Corporation, an early-stage technology venture capital firm. He previously served as the Chief Financial Officer and Chief Operating Officer of Newbridge Networks Corporation. Mr. Charbonneau currently chairs the audit committees for TrueContext Corporation (now ProntoForms Corporation) and CBC/Radio-Canada. He is a member of the audit committees for Teradici Corporation, Jennerex, Inc. and CounterPath. Mr. Charbonneau has also served as a director and audit committee member at other companies, including Telus Corporation, BreconRidge Corporation, March Networks Corporation and Cambrian Systems, Inc. From 1977 to 1986, Mr. Charbonneau worked as an accountant at Deloitte LLP (as it is now known). Mr. Charbonneau holds a Bachelor of Science from the University of Ottawa, an MBA from the University of Western Ontario and is a Fellow of the Institute of Chartered Accountants of Ontario. |

| • | Jean-Paul Cossart is an Associate Director of Infoteria sas of France, a company that provides technological coaching. Prior to his involvement with Infoteria, Mr. Cossart was Vice President Strategy and Marketing of Cofratel sa, a former subsidiary of France Telecom that provides PBX and |

10

| LAN integration for the enterprise market. Mr. Cossart also held several positions at Alcatel sa and currently serves on the board of directors of DragonWave Inc., Benbria and Toushay, Inc. He was also a member of the executive committee of the French chapter of the Institute of Directors, United Kingdom. Mr. Cossart holds an Electronic Engineering degree from Supélec (Ecole Supérieure d’Electricité). |

| • | Henry Perret is the President and Chief Executive Officer of the Capital Area Food Bank of Texas. Previously, he was with Zarlink Semiconductor, where he was Senior Vice President and General Manager of the Communication Products Group. Mr. Perret has previously served as Chief Executive Officer and Chief Financial Officer for Legerity, Inc. and has held financial roles at Actel Corporation, Applied Materials, Inc., National Semiconductor Corporation, Raytheon Semiconductor and General Electric Company. Mr. Perret holds a Bachelor of Science Degree in Business Administration with a concentration in Accounting from San Jose State University. |

The Compensation Committee

The Compensation Committee is currently composed of two directors namely, Benjamin Ball (Chairman) and John McHugh. Benjamin Ball was appointed to the Compensation Committee in October 2007, and John McHugh was appointed in March 2010. Both members of the Compensation Committee are independent, as determined by the Board in accordance with Nasdaq “independence” rules, including the Chairman who is responsible for the leadership of the committee and the fulfilment by the committee of its mandate.

The Compensation Committee assists the Board in discharging the Board’s oversight responsibilities relating to the compensation, development, succession and retention of the Chief Executive Officer and key employees and the establishment of fair and competitive compensation and performance incentive plans.

All current members of the Compensation Committee have experience reviewing executive compensation. The members of the Compensation Committee have the following relevant education and/or experience:

| • | Benjamin Ball is a partner of Francisco Partners Management, LLC, which is a leading private equity firm focused exclusively on investing in the information technology market. Mr. Ball currently sits on the Compensation Committees for several private companies, such as Webtrends Inc., Watchguard Technologies, Inc., EF Johnson Technologies, Inc. and Foundation 9 Entertainment, Inc. Mr. Ball has been a director of these and other private companies where he has been responsible for hiring and retaining C-level executives for each company. |

| • | John McHugh is an Executive Consultant. Prior to his current role, Mr. McHugh was the Chief Marketing Officer for Brocade Communications Systems, Inc. Prior to that, Mr. McHugh held Vice President and General Manager roles at Nortel Networks and Hewlett-Packard Company. In his capacity as an executive of each of these companies over the last 15 years, Mr. McHugh has reviewed, designed and implemented numerous executive compensation plans for a variety of business scenarios. |

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is currently composed of six directors namely, Peter Charbonneau (Chairman), Benjamin Ball, Jean-Paul Cossart, Andrew Kowal, John McHugh and Henry Perret. The committee was formed and the members were each appointed in March, 2010. All of the members of the Nominating and Corporate Governance Committee are independent directors, as determined by the Board in accordance with Nasdaq “independence” rules, including the Chairman, ensuring the committee receives diverse input into the Corporation’s board nomination process and functions independently.

The Nominating and Corporate Governance Committee assists the Board in identifying and/or recommending director candidates for election at the next annual meeting of Shareholders. The committee also oversees and assesses the functioning of the Board and the committees of the Board, and the implementation and assessment of effective corporate governance principles. The committee conducts annual surveys of directors regarding effectiveness of the Board, the Chairman and each director, each committee and its chairman, and the individual directors. The committee also annually assesses the effectiveness of the Board and each committee as a whole and makes recommendations to the Board.

11

14. Communication with the Board

Shareholders or others may contact the Board by mail to:

The Board of Directors

c/o the Corporate Secretary’s Office

Mitel Networks Corporation

350 Legget Drive

Ottawa, Ontario, Canada

K2K 2W7

C. COMPENSATION DISCUSSION AND ANALYSIS

15. Director Compensation

Except as noted below, from May 1, 2012 to October 31, 2012, all non-employee directors received the annual service retainers and fees for attending meetings set forth below:

| Annual service on the Board (other than Chair) |

$ | 25,000 | ||

| Annual service as Chair of the Board |

$ | 100,000 | ||

| Annual service as member of the audit committee (other than Chair) |

$ | 10,000 | ||

| Annual service as Chair of the audit committee |

$ | 15,000 | ||

| Annual service as a member of other standing committees |

$ | 7,500 | ||

| Meeting fees (varies depending on whether in person, by phone and by Committee) |

$ | 500 – $2,000 | ||

| Annual service on the Board) |

10,000 stock options | |||

| Initial grant for new directors |

5,000 stock options |

Effective November 1, 2012, the non-employee director compensation plan was changed to a strictly role-based approach, and fees are set forth below:

| Annual service on the board of directors (other than Chair) |

$ | 40,000 | ||

| Annual service as Chair of the board of directors |

$ | 115,000 | ||

| Annual service as member of the audit committee (other than Chair) |

$ | 15,000 | ||

| Annual service as Chair of the audit committee |

$ | 25,000 | ||

| Annual service as a member of the compensation committee (other than Chair) |

$ | 10,000 | ||

| Annual service as Chair of the compensation committee |

$ | 15,000 | ||

| Annual service as a member of the nominating and corporate governance committee (other than Chair) |

$ | 8,000 | ||

| Annual service as Chair of the nominating and corporate governance committee |

$ | 12,000 | ||

| Annual service on the Board |

10,000 stock options | |||

| Initial grant for new directors |

5,000 stock options | |||

Richard McBee, who is also our CEO, does not receive annual service retainers or fees for serving as a director.

In fiscal 2013, each director could elect to receive up to $20,000 of the above retainers and fees as cash. Effective fiscal 2014, each director may elect to receive up to $40,000 of the above retainers as cash. The remaining balance is to be received in the form of stock options. Stock options are granted pursuant to our 2006 Equity Incentive Plan.

In order to place a limit on the number of options to which a Director is entitled, when the closing price of the Corporation’s Common Shares on the Nasdaq on the date of grant is above $4.00 per share, the methodology of

12

calculation for the number of stock options to be granted will continue to be the amount of fees owed divided by the Black-Scholes value of a stock option on the day of grant. However, when the closing price of the Company’s shares on the Nasdaq on the date of grant is $4.00 per share or less, each director will be granted the lesser of:

| 1) | The amount of fees owed divided by $1.82, which is the approximate Black-Scholes value of a stock option granted when the Corporation’s stock price is $4.00; and |

| 2) | The amount of fees owed divided by the Black-Scholes value of a stock option on the day of grant. |

The strike price of each stock option is the closing price per Common Share on the Nasdaq on the date of grant. There were 3,396 options exercised by directors during the fiscal year ended April 30, 2013.

The Compensation Committee has reviewed directors’ compensation for fiscal year 2013 and following years and, in fiscal 2012, retained Radford (an AON Consulting Company) (“Radford”) for assistance to ensure our director compensation package remains competitive within our industry. See Section 16 “Executive Officer Compensation”.

A director is reimbursed for any out-of-pocket expenses incurred in connection with attending board or committee meetings, as well as Canadian tax return preparation fees for non-Canadian directors.

There are no loans or other indebtedness outstanding from the Corporation or any subsidiary to any of its directors, nor has any director received any financial assistance from us or from any of our subsidiaries.

In accordance with our Insider Trading Policy, an NEO or director is not permitted to purchase financial instruments, including for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

The following table sets forth a summary of compensation paid during the fiscal year ended April 30, 2013 to the non-executive directors:

| Name |

Fees earned ($) |

Share- based awards ($) |

Option- based awards ($) |

Option- based awards ($) |

Non- equity incentive plan awards ($) |

Pension value ($) |

All other compensation ($) |

Total ($) | ||||||||||||||||||||||||

| Benjamin H. Ball (1) |

— | — | — | 63,750 | — | — | — | 63,750 | ||||||||||||||||||||||||

| Peter D. Charbonneau |

20,000 | — | — | 76,750 | — | — | — | 96,750 | ||||||||||||||||||||||||

| Jean-Paul Cossart (2) |

20,000 | — | — | 56,875 | — | — | — | 76,875 | ||||||||||||||||||||||||

| Andrew J. Kowal (1) |

— | — | — | 53,750 | — | — | — | 53,750 | ||||||||||||||||||||||||

| Terence H. Matthews |

— | — | — | 114,750 | — | — | — | 114,750 | ||||||||||||||||||||||||

| John McHugh |

— | — | — | 64,250 | — | — | — | 64,250 | ||||||||||||||||||||||||

| Henry L. Perret |

— | — | — | 70,000 | — | — | — | 70,000 | ||||||||||||||||||||||||

| Norman Stout(3) |

— | — | — | 17,000 | — | — | — | 17,000 | ||||||||||||||||||||||||

| Donald Smith(4) |

— | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| (1) | Stock options granted in connection with Mr. Ball and Mr. Kowal acting as directors of the Corporation were granted to Francisco Partners Management, LLC of which Mr. Ball and Mr. Kowal are partners. |

| (2) | Stock options granted in connection with Mr. Cossart acting as a director of the Corporation were granted to Scivias s.a.r.l., a company in which Mr. Cossart is a shareholder. |

| (3) | Mr. Stout did not stand for re-election at the last Annual General Meeting held in July, 2012. |

| (4) | Mr. Smith did not stand for re-election at the last Annual General Meeting held in July, 2012. Mr. Smith, our former CEO, did not receive any compensation for his role as a member of our board of directors. |

16

16. Executive Officer Compensation

Mitel’s compensation program for executive officers is designed to attract, retain, motivate and engage highly skilled and experienced individuals who excel in their field. The objective of the program is to focus our executives on the key business factors that affect shareholder value.

Compensation for executive officers is comprised primarily of three main components:

| • | base salary; |

| • | annual or short-term incentive plans; and |

| • | long-term incentive plans. |

We set cash and equity compensation based on compensation paid to executives at comparable companies. The Compensation Committee reviews our executive officers’ overall compensation packages on an annual basis.

We also retain independent compensation consultants from time to time to assist in determining executive compensation packages. The nature and scope of the services rendered by the consultants include:

| • | assisting in identifying members of our peer group for comparison purposes; |

| • | helping to determine compensation levels at the peer group companies; |

| • | providing advice regarding executive compensation best practices and market trends; |

| • | assisting with the redesign of any compensation program, as needed; |

| • | preparing for and attending selected management or committee meetings; and |

| • | providing advice throughout the year. |

In fiscal 2012, we retained Radford to provide us with survey data and other benchmark information related to trends and competitive practices in executive compensation. As noted above under “Director Compensation”, Radford also assisted the Corporation in reviewing our director compensation package. Radford was originally retained by the Corporation in April, 2006. Executive and director compensation related fees billed by Radford to the Corporation in fiscal years 2013 and 2012 were nil and $62,000, respectively. The reference market used to benchmark executive compensation included companies who operate in a similar industry segment. The comparable companies used to benchmark our executive compensation included Aastra Technologies Limited, ADTRAN, Inc., CAE Inc., Constellation Software Inc., Comtech Telecommunications Inc., Extreme Networks, Inc., F5 Networks, Inc., MacDonald, Dettwiler and Associates Ltd., Open Text Corporation, Plantronics, Inc., Polycom, Inc., Sierra Wireless Inc., Smart Technologies ULC, Tellabs, Inc. and ViaSat, Inc. The Compensation Committee set our executive officers’ total overall cash compensation at a level that was at or near the 50th percentile of the cash compensation paid to executives with similar roles at comparable companies. Equity compensation was also targeted at the 50th percentile of comparable companies.

The Compensation Committee applies the following criteria in determining or reviewing recommendations for compensation for executive officers in order to ensure an objective assessment of our executives’ compensation:

Base Salaries. Individual salaries are determined by each officer’s experience, expertise, performance and expected contributions to the Corporation. The Compensation Committee uses industry studies and comparables for reference purposes to assist in setting a range of base salaries for positions, however, these studies and comparables are only one factor that is reviewed in determining base salary for each executive officer position.

Annual or Short-Term Incentive Plans. Mitel utilizes cash bonuses to reward the achievement of corporate objectives and to recognize individual performance. The amount of annual performance incentive or “at risk” component of an executive officers’ compensation increases with the level of responsibility and impact that the executive officer has had and can have on overall performance. The Chief Executive Officer provides the Compensation Committee with an assessment of each executive’s performance annually.

14

For the fiscal year ended April 30, 2013, the Corporation’s NEOs consisted of: Richard D. McBee, Chief Executive Officer and President; Steven E. Spooner, Chief Financial Officer; Graham Bevington, Executive Vice President International Sales, Service and Marketing; Ronald G. Wellard, Executive Vice President and General Manager, Mitel Communications; and Jon Brinton, General Manager, Mitel Network Solutions. In addition, Philip Keenan, our former Vice-President Sales, Service and Marketing, Americas, was an NEO up to the time of his departure in February, 2013. The annual performance incentive targets for the fiscal year ended April 30, 2013, for the NEOs ranged between 50% and 120% of base salary. The financial objectives for Mr. McBee, Mr. Spooner and Mr. Wellard consist of annual revenue and Adjusted EBITDA for the Corporation. The financial objectives for Mr. Bevington and Mr. Brinton include annual revenue and contribution margin for their respective regions. The targets for the financial objectives were established by our Compensation Committee and approved by the Board.

The Board and the Compensation Committee assess the risks associated with the structuring of our NEO’s respective compensation arrangements to ensure that none of the arrangements encourages a particular NEO or group of NEOs to take undue risk on behalf of the Corporation to maximize their respective compensation. The various elements of our NEO compensation packages are given appropriate weighting to ensure that there is commonality across the compensation arrangements of our NEOs while structuring incentive arrangements to incent particular NEOs within their respective spheres of influence, whether based on the performance of the Corporation as a whole or the performance of the region for which the NEO has responsibility.

Long-Term Incentive Plans. The Compensation Committee believes that equity based long-term incentive compensation is a fundamental component of Mitel’s executives’ compensation program. Grants of options under our equity incentive plans assist us in retaining employees and attracting critical key talent by providing them with an opportunity for capital investment in the Corporation. In addition, the granting of options ensures that the interests of our executive officers are aligned with those of our Shareholders. Options are granted primarily based on the extent of the individual’s responsibility and performance and are also granted to attract new executive officers and to recognize job promotions.

The Chief Executive Officer recommends levels of option grants for the NEOs to the Compensation Committee based on skills, responsibilities and performance. Previous grants of options are also taken into consideration. The Compensation Committee approves grants of options after discussion and analysis of the material provided to it.

Fiscal 2014 Compensation. There have been no changes made to our NEO’s compensation structure for fiscal 2014.

During the fiscal year ended April 30, 2013, there were 375,000 options granted to the NEOs at a strike price of $4.22 per share. During the fiscal year ended April 30, 2013, there were 5,000 options exercised by the NEOs, all at $3.75 per share. There are no loans or other indebtedness outstanding from us or from any of our subsidiaries to any of our executive officers nor has any executive officer received any financial assistance from us or any of our subsidiaries.

In accordance with our Insider Trading Policy, an NEO or director is not permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director

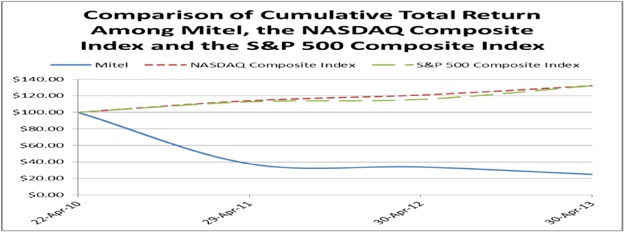

Performance Graph

The following graph compares the total cumulative return of a Shareholder who invested $100 in Mitel common shares at April 22, 2010 (the date Mitel became a public company (the “IPO Date”)) to April 30, 2013, with the total cumulative return of $100 on the S&P 500 and the Nasdaq Composite Indices since the IPO Date.

15

| Apr 30/10 | Apr 30/11 | Apr 30/12 | April 30/13 | |||||||||||||

| Mitel |

85.10 | 37.80 | 33.93 | 25.00 | ||||||||||||

| S&P 500 Composite |

98.20 | 112.80 | 115.66 | 132.18 | ||||||||||||

| Nasdaq Composite |

97.70 | 114.10 | 120.93 | 132.14 | ||||||||||||

The NEO compensation is not based on performance of the Corporation’s share price, and, therefore the NEO total compensation may not compare to the trend shown in the performance graph. Prior to fiscal 2012, our annual incentive plans for our NEOs were partially based on the financial performance of the Corporation. Annual performance incentive targets for our NEOs are primarily based on the financial performance of the Corporation in order to provide added incentive to our NEOs to focus on their respective roles within the Corporation and their ability to continue to strengthen the Corporation’s performance (see Annual or Short-term Incentive Plans above). We expect the same or similar criteria to be applied in respect of our NEOs for fiscal 2014.

The following table sets forth a summary of compensation paid during the fiscal year ended April 30, 2013 to our NEOs:

Summary Compensation Table

| Name and Principal Position | Year | Salary ($)(1) |

Non-equity annual incentive plan ($) |

Option- based Awards ($)(2) |

Pension Value ($)(3) |

All Other Compensation ($) |

Total($) | |||||||||||||||||||||

| Richard D. McBee |

2013 | 660,000 | 509,752 | 191,000 | — | 18,000 | 1,378,752 | |||||||||||||||||||||

| Chief Executive Officer (4) |

2012 | 600,000 | 414,472 | — | — | 18,000 | 1,032,472 | |||||||||||||||||||||

| 2011 | 190,154 | 100,000 | 4,634,577 | — | 5,538 | 4,930,269 | ||||||||||||||||||||||

| Steven E. Spooner |

2013 | 436,185 | 247,360 | 191,000 | 4,477 | 11,958 | 890,980 | |||||||||||||||||||||

| Chief Financial Officer (5) |

2012 | 423,215 | 294,327 | 225,000 | 4,352 | 11,950 | 958,844 | |||||||||||||||||||||

| 2011 | 398,947 | — | 111,079 | 3,989 | 11,592 | 525,607 | ||||||||||||||||||||||

| Graham Bevington |

2013 | 243,258 | 187,156 | 57,300 | 22,167 | 20,640 | 530,521 | |||||||||||||||||||||

| Executive Vice President International Sales (6) |

2012 | 207,038 | 171,214 | 75,000 | 18,012 | 16,550 | 487,814 | |||||||||||||||||||||

| 2011 | 205,391 | 148,026 | 133,295 | 18,958 | 17,344 | 523,014 | ||||||||||||||||||||||

| Ronald G. Wellard |

2013 | 331,314 | 128,190 | 124,150 | 3,384 | 7,972 | 595,010 | |||||||||||||||||||||

| Executive Vice President, General Manager, Mitel Communications Solutions (7) |

2012 | 308,698 | 161,362 | 150,000 | 3,167 | 7,966 | 631,193 | |||||||||||||||||||||

| 2011 | 317,336 | — | 133,295 | 3,173 | 10,722 | 464,526 | ||||||||||||||||||||||

16

| Name and Principal Position | Year | Salary ($)(1) |

Non-equity annual incentive plan ($) |

Option- based Awards ($)(2) |

Pension Value ($)(3) |

All Other Compensation ($) |

Total($) | |||||||||||||||||||||

| Jon Brinton |

2013 | 225,000 | 132,218 | 57,300 | — | 6,480 | 420,998 | |||||||||||||||||||||

| General Manager Mitel Network Solutions (8) |

2012 | 195,000 | 119,801 | 37,000 | — | 6,480 | 361,981 | |||||||||||||||||||||

| 2011 | 180,000 | 138,538 | 31,080 | — | 6,240 | 355,858 | ||||||||||||||||||||||

| Phil Keenan |

2013 | 264,614 | 165,185 | 95,500 | — | 485,439 | 1,010,738 | |||||||||||||||||||||

| Former Executive Vice President Sale, Service and Marketing Americas (9) |

2012 | 230,770 | 40,000 | 75,000 | — | 8,000 | 538,697 | |||||||||||||||||||||

| 2011 | 160,000 | 85,453 | 55,600 | — | 5,000 | 306,053 | ||||||||||||||||||||||

| (1) | Fiscal 2011 salary for Mr. Spooner, Mr. Bevington and Mr. Wellard includes the effect of the voluntary reduced work program, which ran from February 2009 to April 2011. |

Compensation to Mr. Spooner and Mr. Wellard is paid in Canadian dollars, but converted to U.S. dollars at the average rate for the relevant period. The Canadian dollar salaries for 2013, 2012 and 2011 are as follows: Mr. Spooner (2013 – C$437,701, 2012 – C$425,000, 2011 – C$378,439) and Mr. Wellard (2013 – C$332,466, 2012 – C$310,000, 2011 – C$293,531).

Compensation to Mr. Bevington is paid in British pounds sterling but converted to U.S. dollars at the average rate for the relevant period. The British pounds sterling earnings, base and commission, for 2013, 2012 and 2011 for Mr. Bevington are as follows: 2013 - £154,000, 2012 - £130,000, 2011 - £123,094.

| (2) | Except for 515,175 inducement options granted to Mr. McBee in fiscal 2011, all other options were granted under the 2006 Equity Incentive Plan. |

| (3) | Pension value for Mr. Spooner and Mr. Wellard consists of contributions to defined contribution plan. Pension value for Mr. Bevington consists of contributions under a defined benefit plan up to November 2012, and contributions to a defined contribution plan thereafter. |

| (4) | Mr. McBee joined the Corporation as a director and CEO in January 2011. Mr. McBee does not receive compensation in his role as a director. All Other Compensation for Mr. McBee is in respect of a car allowance. |

| (5) | All Other Compensation for Mr. Spooner is in respect of a car allowance. |

| (6) | All Other Compensation for Mr. Bevington is in respect of a car allowance. |

| (7) | All Other Compensation for Mr. Wellard is primarily in respect of a car allowance. |

| (8) | All Other Compensation for Mr. Brinton is in respect of a car allowance. |

| (9) | All Other Compensation for Mr. Keenan includes $6,769, $8,000 and $5,000 in fiscal 2013, 2012 and 2011, respectively, in respect of a car allowance and $478,670 in respect of severance relating to his February 2013 departure. |

17. Stock Option and Other Compensation Plans

2006 Equity Incentive Plan

The Corporation adopted an employee stock option plan on September 7, 2006 (the “2006 Equity Incentive Plan”).

The 2006 Equity Incentive Plan provides that the Compensation Committee has the authority to determine the individuals to whom options will be granted, the number of Common Shares subject to option grants and other terms and conditions of option grants. Prior to March 5, 2010, the 2006 Equity Incentive Plan provided that, unless otherwise determined by the Compensation Committee, one-quarter of the Common Shares that an option holder is entitled to purchase become eligible for purchase on each of the first, second, third and fourth anniversaries of the date of grant, and that options expire on the fifth anniversary of the date of grant. The 2006 Equity Incentive Plan was amended on March 5, 2010 such that, unless otherwise determined by the Compensation Committee, any options granted after that date will vest as to one-sixteenth of the Common Shares that an option holder is entitled to purchase on the date which is three months after the date of grant and on each subsequent quarter, and that options expire on the seventh anniversary of the date of grant. The 2006 Equity Incentive Plan provides that in no event may an option remain exercisable beyond the tenth anniversary of the date of grant.

The 2006 Equity Incentive Plan provides flexibility and choice in the types of equity compensation awards, including options, deferred share units, restricted stock units, performance share units and other share-based awards. The principal purpose of the 2006 Equity Incentive Plan is to assist us in attracting, retaining and motivating employees, directors, officers and consultants through performance related incentives.

17

The initial aggregate number of Common Shares that could be issued under the 2006 Equity Incentive Plan and all other security-based compensation arrangements of the Corporation was 5,600,000 Common Shares (the “Initial Option Pool”) provided that an additional number of Common Shares of up to three percent of the number of Common Shares then outstanding may be added to such Initial Option Pool each year for three years starting on March 5, 2011. Effective on each of March 5, 2011 and March 5, 2012, the Compensation Committee approved a 3% increase to the Initial Option Pool such that the total aggregate number of Common Shares that may be issued under the 2006 Equity Incentive Plan and all other security-based compensation arrangements of the Corporation was 8,796,294. Upon listing the Corporation’s Common Shares on the TSX on June 27, 2012, the 3% increase became automatic in accordance with the terms of the 2006 Equity Incentive Plan. Therefore, effective March 5, 2013, the 3% increase brought the total number of Common Shares available for issue under the 2006 Equity Incentive Plan and all other security-based compensation arrangements of the Corporation to 10,406,469. Common Shares subject to outstanding awards under the 2006 Equity Incentive Plan which lapse, expire or are forfeited or terminated and will, subject to plan limitations, again become available for grants under this plan.

As of June 7, 2013, options to acquire 5,863,267 Common Shares were issued and outstanding under the 2006 Equity Incentive Plan. During fiscal 2013, we issued options to acquire 946,589 Common Shares under the 2006 Equity Incentive Plan and 1,732,832 options to acquire Common Shares vested under the 2006 Equity Incentive Plan.

Inducement Options

On January 19, 2011, Richard McBee was granted 515,175 stock options as a component of his employment compensation. These stock options were granted as an inducement material to his entering into employment with Mitel and will vest on the same vesting schedule as options granted under the 2006 Equity Incentive Plan. The grant of the options was approved by all of the independent directors of the board in reliance on Nasdaq Listing Rule 5635(c)(4), which exempts employment inducement grants from the general requirement of the Nasdaq Listing Rules that equity-based compensation plans and arrangements be approved by Shareholders. These options are outside of the pool of stock options available for grant under the 2006 Equity Incentive Plan and all other security-based compensation arrangements. As of June 7, 2013, all of these options were outstanding.

Total Options Outstanding

As of June 7, 2013, options to acquire 6,378,442 Common Shares under the 2006 Equity Inventive Plan and inducement options granted to Mr. McBee were issued and outstanding, representing in the aggregate approximately 12% of the Corporation’s outstanding Common Shares.

The following table sets out information in respect of our 2006 Equity Incentive Plan as of April 30, 2013:

| Plan Category(1) |

Number of Securities to be issued upon exercise of outstanding options (a) |

Weighted average exercise price of outstanding options (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|||||||||

| 2006 Equity Incentive Plan |

5,927,051 | $ | 5.15 | 3,574,064 | (2) | |||||||

| (1) | The 2006 Equity Incentive Plan has been approved by Mitel Shareholders. |