Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bank of Marin Bancorp | form8k-june2013.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - Bank of Marin Bancorp | exhibit991pressrelease.htm |

Acquisition of NorCal Community Bancorp / Bank of Alameda Investor Presentation | July 2, 2013

2 Forward Looking Statements The discussion of financial results included in this folder includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “1933 Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, (the “1934 Act”). Those sections of the 1933 Act and 1934 Act provide a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about their financial performance so long as they provide meaningful, cautionary statements identifying important factors that could cause actual results to differ significantly from projected results. Our forward-looking statements may include descriptions of plans or objectives of Management for future operations, products or services, and forecasts of its revenues, earnings or other measures of economic performance. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “intend,” “estimate” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Forward-looking statements are based on Management’s current expectations regarding economic, legislative, and regulatory issues that may impact our earnings in future periods. Factors which could have a material effect on our operations and future prospects and the resulting company, include but are not limited to: (1) the businesses of Bank of Marin Bancorp and/or NorCal Community Bancorp may not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; (2) expected revenue synergies and cost savings from the merger may not be fully realized or realized within the expected time frame; (3) revenues following the merger may be lower than expected; (4) customer and employee relationships and business operations may be disrupted by the merger; (5) the ability to obtain required regulatory and shareholder approvals, and the ability to complete the merger on the expected timeframe may be more difficult, time-consuming or costly than expected; (6) changes in interest rates, general economic conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve; the quality and composition of the loan and securities portfolios; demand for loan products; deposit flows; competition; demand for financial services in the companies’ respective market areas; their implementation of new technologies; their ability to develop and maintain secure and reliable electronic systems; and accounting principles, policies, and guidelines, and (7) other risk factors detailed from time to time in filings made by Bank of Marin Bancorp with the SEC. Forward-looking statements speak only as of the date they are made. We do not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made or to reflect the occurrence of unanticipated events.

3 Transaction Highlights • Logical extension into contiguous East Bay market − Bank of Alameda is the premier community bank in Alameda − Creates the 4th largest community bank in the San Francisco Bay Area (1) • Complementary community-focused business banking models built around strong core deposit bases − Noninterest bearing deposits of 39% and 32% for BMRC and Bank of Alameda, respectively • Enhances loan portfolio diversification and adds mortgage banking product line • Customers will benefit from broader product offerings and higher lending limits Strategic Rationale Financially Attractive • Healthy EPS accretion: 4% in 2014 & 8% in 2015 • Internal rate of return in excess of 15% • Tangible book value dilution earned back in less than 4 years • Effective use of capital: enhanced profitability & shareholder value, as well as strong pro forma capital ratios (1) Based on 6/30/12 deposits market share data per FDIC S.O.D. The Bay Area is defined as the nine counties surrounding the San Francisco Bay, including Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma

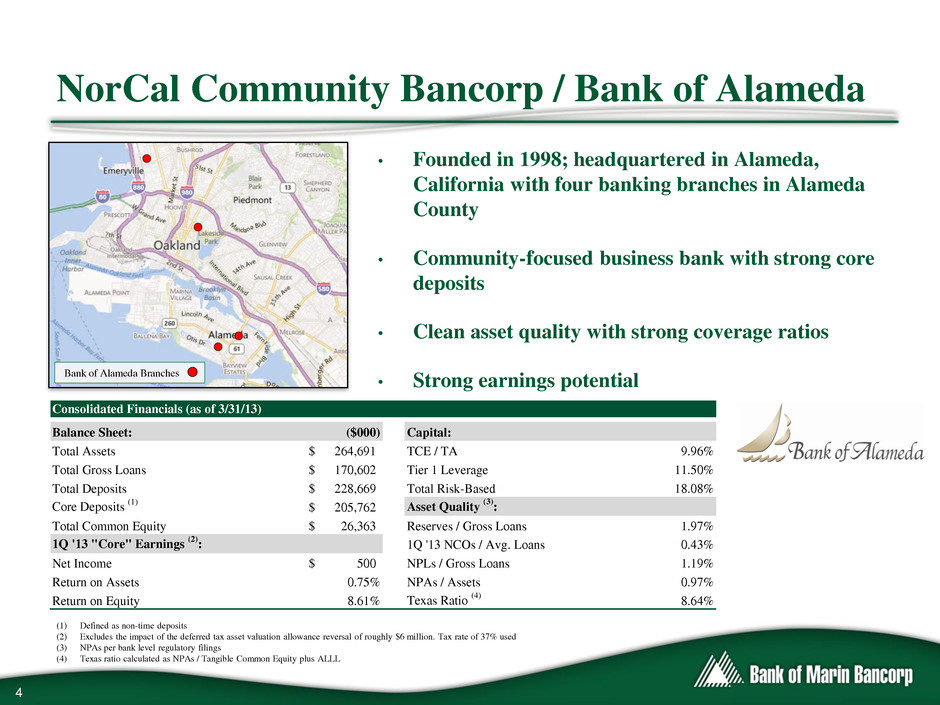

4 Consolidated Financials (as of 3/31/13) Balance Sheet: ($000) Capital: Total Assets 264,691$ TCE / TA 9.96% Total Gross Loans 170,602$ Tier 1 Leverage 11.50% Total Deposits 228,669$ Total Risk-Based 18.08% Core Deposits (1) 205,762$ Asset Quality (3) : Total Common Equity 26,363$ Reserves / Gross Loans 1.97% 1Q '13 "Core" Earnings (2) : 1Q '13 NCOs / Avg. Loans 0.43% Net Income 500$ NPLs / Gross Loans 1.19% Return on Assets 0.75% NPAs / Assets 0.97% Return on Equity 8.61% Texas Ratio (4) 8.64% NorCal Community Bancorp / Bank of Alameda Bank of Alameda Branches • Founded in 1998; headquartered in Alameda, California with four banking branches in Alameda County • Community-focused business bank with strong core deposits • Clean asset quality with strong coverage ratios • Strong earnings potential (1) Defined as non-time deposits (2) Excludes the impact of the deferred tax asset valuation allowance reversal of roughly $6 million. Tax rate of 37% used (3) NPAs per bank level regulatory filings (4) Texas ratio calculated as NPAs / Tangible Common Equity plus ALLL

5 Strategic Rationale / Expanding Bay Area Presence • Provides solid foothold in the attractive East Bay market − Alameda County has a population of over 1.5 million − Population growth is projected at a healthy 4.12% from 2012-2017 compared with 3.41% for California overall • Alameda County economy is rapidly improving − Unemployment rate peaked in August 2010 at 11.7%; down to 7.0% as of April of this year − The labor market is expected to experience healthy growth, driven by the Professional and Business Services sector • Enhances loan portfolio diversification − Adds mortgage banking product line − Manufacturing, transportation and wholesale industries are significant components of the market • Opportunity to better serve Bank of Alameda’s customers through expanded service offerings and higher lending limits Bank of Marin Branches (17) Bank of Alameda Branches (4)

6 Alameda County Deposit Market Share # of Deposits Market Rank Institution (ST) Branches in Mkt. ($M) Share (%) 1 Wells Fargo & Co. (CA) 42 $8,701 27.76% 2 Bank of America Corp. (NC) 42 6,259 19.96 3 JPMorgan Chase & Co. (NY) 42 3,574 11.40 4 Citigroup Inc. (NY) 26 2,296 7.32 5 Fremont Bancorp. (CA) 12 1,496 4.77 6 BNP Paribas 20 1,455 4.64 7 U.S. Bancorp (MN) 31 1,351 4.31 8 First Republic Bank (CA) 3 758 2.42 9 Mitsubishi UFJ Finl Grp Inc. 7 709 2.26 10 East West Bancorp Inc. (CA) 5 690 2.20 11 HSBC 3 544 1.74 12 Mechanics Bank (CA) 5 539 1.72 13 Zions Bancorp. (UT) 5 309 0.98 14 NorCal Community Bancorp (CA) 4 230 0.73 15 City National Corp. (CA) 4 171 0.55 Total for Institutions in Market 293 $31,349 Strong Deposit Market Share • Premier community bank in the City of Alameda, 12% market share • Alameda County’s demographics are strong relative to California and the United States, similar to existing Bank of Marin markets • Bank of Marin will rank 4th in the Bay Area* among community banks, by deposit market share Source: SNL Financial; deposits and deposit market share data is as of June 30, 2012 *The Bay Area is defined as the nine counties surrounding the San Francisco Bay, including Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma • Bank of Marin will enter Alameda County with four branches to be ranked 3rd in deposit market share among community banking institutions

7 Transaction Overview Transaction Value (1): $32.7 million Price Per Share (1): $3.07 Consideration Mix (1): 51% Stock (410,566 shares) 49% Cash ($16.1 million) Structure: Fixed cash & exchange ratio within a collar (2) Termination Fee: $970,000 Walk-away Provisions: BMRC stock rising 15% or declining 15% relative to the KBW Regional Bank Index (double-trigger) Loan Discount: 5.0% Core Deposit Intangible: 0.50% of non-time deposits Trust Preferred Securities: Retain $8 million of floating rate trust preferred securities Combined Transaction Costs: ~$4.5 million after tax (3) Cost Savings: Approximately 33% of noninterest expense (4) 75% to be realized in 2014, 100% thereafter Board Seat: One board seat Due Diligence: Completed, including extensive loan review Expected Closing: Fourth quarter of 2013 (1) Based on BMRC’s stock price of $40.51 as of 7/1/13; includes cash out of in-the-money options of approximately $60,400 (2) See merger consideration schedule in the appendix for more detail (3) Includes ~$1.6 million in after-tax costs related to data processing contract termination fees (4) Assumes an NIE base of approximately $10.0 million pre-tax

8 Acquisition of Comparable Deal Transaction Multiples NorCal Medians (1) Price / Tangible Book Value Per Share (2) : Price / MRQ Annualized Earnings Per Share (3) : Core Deposit Premium: Transaction Metrics 2014 Estimated Core EPS Accretion (4) : 2015 Estimated EPS Accretion: Internal Rate of Return: Tangible Book Value Per Share Earnback (5) : Consolidated Capital Ratios (as of 3/31/13) TCE / TA: Leverage Ratio: Tier 1 Ratio: Total Risk-based Capital Ratio: 1.24x 20.3x 10.87% Pro Forma 9.85% 9.90% 2.9%2.9% 12.80% 13.96% 11.97% 12.98% 1.24x 16.4x 9.96% 11.50% 3.9% 7.8% > 15% < 4 Years 16.06% 18.08% 10.99% Pro Forma Financial Impact (1) Includes 15 whole bank transactions announced since 12/31/11, with targets headquartered in the Western states of AK, AZ, CA, CO, HI, ID, MT, NM, NV, OR, UT, WA, and WY, target assets between $100 million and $500 million and target NPAs / Assets less than 3.5%. Price / earnings for comparable deal metrics are for LTM earnings (2) Based on stated tangible book value per share of $2.48 as of 3/31/13 (3) Based on MRQ core earnings of $0.5 million, excluding the impact of the deferred tax asset valuation allowance reversal. Tax rate of 37% used (4) Excludes one time expenses (5) Calculated as the number of years that the initial tangible book value dilution will be earned back based on incremental earnings from the merger Initial tangible book value per share dilution includes all estimated merger expenses

9 Conclusion • Acquisition is in line with Bank of Marin’s strategic plan • Combined company results in the 4th ranked community bank by deposit market share headquartered in the Bay Area • Provides Bank of Marin with an entrance into an attractive East Bay market • Excellent financial metrics; 8% EPS accretion in 2015 and strong pro forma capital ratios • Complementary business banking models with strong core deposit bases • Increased size and scale favorably positions the company for further acquisitions and growth strategies • Transaction will enhance BMRC’s long-term shareholder value

Appendix

11 Other Transaction Accts. 50% NIB Deposits 38% Time Deposits <$100K 4% Time Deposits >$100K 8% Other Transaction Accts. 58% NIB Deposits 32% Time Deposits <$100K 5% Time Deposits >$100K 5% Other Transaction Accts. 49% NIB Deposits 39% Time Deposits <$100K 3% Time Deposits >$100K 9% 1-4 Family Resi. 15% Owner Occupied CRE 18% Non-Owner Occupied CRE 41% C&I 11% Other 15% 1-4 Family Resi. 16% Owner Occupied CRE 18% Non-Owner Occupied CRE 41% C&I 11% Other 14% 1-4 Family Resi. 23% Owner ccupied CRE 22% Non-Owner Occupied CRE 36% C&I 8% Other 11% Loan and Deposit Mix Bank of Marin Bancorp Pro Forma Bank of Alameda Gross Loans: $1.07B 1Q ‘13 Yield on Loans: 5.11% Gross Loans: $0.17B 1Q ’13 Yield on Loans: 4.99% Gross Loans: $1.24B Bank of Marin Bancorp Pro Forma Bank of Alameda Total Deposits: $1.23B 1Q ’13 Cost of Deposits: 0.11% Total Deposits: $0.23B 1Q ’13 Cost of Deposits: 0.13% Total Deposits: $1.46B L o a n s D ep o si ts Source: SNL Financial, regulatory fillings as of 3/31/13

12 Dollars in thousands, except per share BMRC Price Change Parent Average Price Exchange Ratio Per Share Value of Stock Per Share Cash Consideration Blended Per Share Consideration Required Stock Amount Aggregate Stock Consideration Aggregate Cash Consideration Aggregate Merger Consideration Stock Percentage Cash Percentage 25.00% $48.76 0.07379 $3.60 $3.01 $3.30 392,634 $19,145 $16,016 $35,161 54.45% 45.55% 20.00% $46.81 0.07379 $3.45 $3.01 $3.23 392,634 $18,379 $16,016 $34,395 53.44% 46.56% 15.00% $44.86 0.07379 $3.31 $3.01 $3.16 392,634 $17,614 $16,016 $33,630 52.38% 47.62% 14.00% $44.47 0.07443 $3.31 $3.01 $3.16 396,040 $17,612 $16,016 $33,628 52.37% 47.63% 13.00% $44.08 0.07509 $3.31 $3.01 $3.16 399,552 $17,612 $16,016 $33,628 52.37% 47.63% 12.00% $43.69 0.07576 $3.31 $3.01 $3.16 403,117 $17,612 $16,016 $33,628 52.37% 47.63% 10.00% $42.91 0.07716 $3.31 $3.01 $3.16 410,566 $17,617 $16,016 $33,634 52.38% 47.62% 5.00% $40.96 0.07716 $3.16 $3.01 $3.09 410,566 $16,817 $16,016 $32,833 51.22% 48.78% 3.85% $40.51 0.07716 $3.13 $3.01 $3.07 410,566 $16,632 $16,016 $32,648 50.94% 49.06% 0.00% $39.01 0.07716 $3.01 $3.01 $3.01 410,566 $16,016 $16,016 $32,032 50.00% 50.00% -5.00% $37.06 0.07716 $2.86 $3.01 $2.93 410,566 $15,216 $16,016 $31,232 48.72% 51.28% -10.00% $35.11 0.07716 $2.71 $3.01 $2.86 410,566 $14,415 $16,016 $30,431 47.37% 52.63% -12.00% $34.33 0.07894 $2.71 $3.01 $2.86 420,037 $14,420 $16,016 $30,436 47.38% 52.62% -13.00% $33.94 0.07985 $2.71 $3.01 $2.86 424,879 $14,420 $16,016 $30,437 47.38% 52.62% -14.00% $33.55 0.08077 $2.71 $3.01 $2.86 429,775 $14,419 $16,016 $30,435 47.38% 52.62% -15.00% $33.16 0.08172 $2.71 $3.01 $2.86 434,830 $14,419 $16,016 $30,435 47.38% 52.62% -20.00% $31.21 0.08172 $2.55 $3.01 $2.78 434,830 $13,571 $16,016 $29,587 45.87% 54.13% -25.00% $29.26 0.08172 $2.39 $3.01 $2.70 434,830 $12,723 $16,016 $28,739 44.27% 55.73% Acquisition Consideration Fixed exchange ratio if average price is between $35.11 and $42.91 Floating exchange ratio if average price is between $42.92 and $44.86 Fixed exchange ratio (1) Floating exchange ratio if average price is between $33.16 and $35.10 Fixed exchange ratio (2) (1) At a Parent Average Price > $46.81 and a 15% over performance of BMRC stock relative to the KBW Regional Bank Index, BMRC may elect to terminate the transaction unless Bank of Alameda adjusts the exchange ratio to equal $3.31 / Parent Average Price (2) At a Parent Average Price < $33.16 and a 15% underperformance of BMRC stock relative to the KBW Regional Bank Index, Bank of Alameda may elect to terminate the transaction unless BMRC adjusts the exchange ratio to equal $2.71 / Parent Average Price Note 1: This schedule excludes cash out of in-the-money options of approximately $60,400 Note 2: Shaded row represents consideration at the closing price of $40.51 as of 7/1/13

13 Market Demographics by County Total Est. Pop. Median HH Population Change (%) Income ($) Unemployment County (Millions) 2012 - 2017 2012 Rate (%) Alameda 1.53 4.12% $64,994 7.00% Contra Costa 1.07 4.58 76,520 7.00 San Francisco 0.82 5.44 65,214 5.40 Sonoma 0.49 2.51 61,962 6.50 Solano 0.42 1.57 65,986 8.10 Marin 0.26 3.48 85,293 4.60 Napa 0.14 1.82 64,129 5.90 United States 313.13 3.47% $50,157 7.50% California 37.71 3.41% $57,385 9.00% 6.0% 8.0% 10.0% 12.0% 14.0% Jan-10 Jan-11 Jan-12 Jan-13 Alameda County U.S. California 9.0% 7.0% 7.5 An Overview of the Local Economy Source: SNL Financial and Bureau of Labor Statistics Note: Deposits and deposit market share data is as of June 30, 2012 Workforce Sector Breakdown (# of employees) Finance 12% Mfg. & Trade 26% Health Care 12% Services 40% Government 10% Source: East Bay Economic Development Alliance’s “Special Report on the East Bay Workforce: East Bay Economic Outlook 2013” Unemployment

14 Additional Information about the Acquisition and where to Find It In connection with the proposed acquisition, BMRC will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 to register the shares of BMRC common stock to be issued to the shareholders of NorCal. The registration statement will include a proxy statement/prospectus which will be sent to the shareholders of NorCal seeking their approval of the acquisition and related matters. In addition, BMRC may file other relevant documents concerning the proposed acquisition with the SEC. Shareholders of NorCal are urged to read the registration statement on Form S-4 and the proxy statement/prospectus included within the registration statement and any other relevant documents to be filed with the SEC in connection with the proposed acquisition because they will contain important information about BMRC, NorCal and the proposed transaction. Investors and shareholders may obtain free copies of these documents through the website maintained by the SEC at www.sec.gov. Free copies of the proxy statement/prospectus also may be obtained by directing a request by telephone or mail to Bank of Marin Bancorp, 504 Redwood Blvd, Suite 100, Novato CA, 94947 , Attention: Investor Relations (telephone: (415) 763-4523 ), or by accessing Bank of Marin’s website at www.bankofmarin.com under “Investor Relations.” The information on Bank of Marin’s website is not, and shall not be deemed to be, a part of this release or incorporated into other filings it makes with the SEC. Participants in the Solicitation BMRC and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of NorCal in connection with the acquisition. Information about the directors and executive officers of BMRC is set forth in the proxy statement for BMRC’s 2013 annual meeting of shareholders filed with the SEC on April 11, 2013. Additional information regarding the interests of these participants and other persons who may be deemed participants in the acquisition may be obtained by reading the proxy statement/prospectus regarding the acquisition when it becomes available. Additional Information