Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Aly Energy Services, Inc. | aly_8k.htm |

EXHIBIT 99.1

Presented to GHS 1000 Energy Conference June 25, 2013

1

During this presentation, and in response to your questions, certain items may be discussed which are not based entirely on historical facts. Any such items should be considered forward-looking statements. Any forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update such statements to reflect events or circumstances arising after such date. All such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ from those anticipated. We have described the most significant of these risks and uncertainties in our reports filed with the Securities and Exchange Commission. This presentation may include certain non-GAAP financial information, which is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The non-GAAP financial measures may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. This presentation is presented solely for information purposes. This presentation is not an offer to sell, or a solicitation of an offer to buy, any securities.

2

Aly Operating, Inc. (“Aly Operating”) was founded by Micki Hidayatallah and incorporated in Delaware in July 2012 Aly Operating completed its platform acquisition of Austin Chalk Petroleum Services Corp. (“ACPS”) in October 2012 In May 2013, the shareholders of Aly Operating executed a share exchange with the shareholders of a public company pursuant to which the company was renamed Aly Energy Services, Inc. Currently, Aly Energy Services, Inc. trades on the OTCBB under the symbol ALYE Subsequent to the share exchange, Aly Operating shareholders own approximately 92% of the total shares outstanding of Aly Energy Services, Inc.

3

To provide our customers with the highest quality and most advanced equipment with Best in Class service in a safe environment at competitive prices To grow both organically and through acquisitions by: Diversifying our customer base Expanding our geographic footprint Increasing the inventory of our assets Increasing the products and services we offer our customers

4

OPERATIONS

5

Lead personnel Best In Class equipment Dedication to service and full service offerings Manufacturing & retrofitting capability Highly mobile product offerings

6

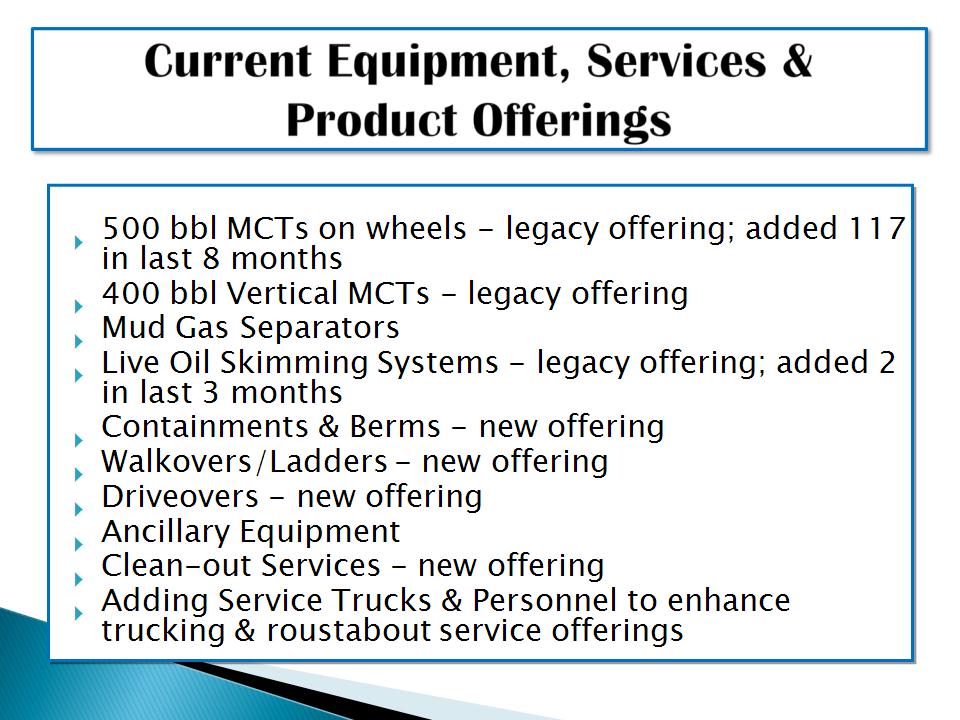

500 bbl MCTs on wheels – legacy offering; added 117 in last 8 months 400 bbl Vertical MCTs – legacy offering Mud Gas Separators Live Oil Skimming Systems – legacy offering; added 2 in last 3 months Containments & Berms – new offering Walkovers/Ladders – new offering Driveovers – new offering Ancillary Equipment Clean-out Services – new offering Adding Service Trucks & Personnel to enhance trucking & roustabout service offerings

7

500 bbl MCTs on wheels (Mud Circulating Tanks) 400 bbl Vertical MCTs (Mud Circulating Tanks)

8

Skimming Systems

9

Mud Gas Separators and Skimming Systems on Location South Texas

10

Containments & Berms Walkovers/Ladders

11

Walkovers/Ladders

12

Driveovers

13

Clean-out Services

14

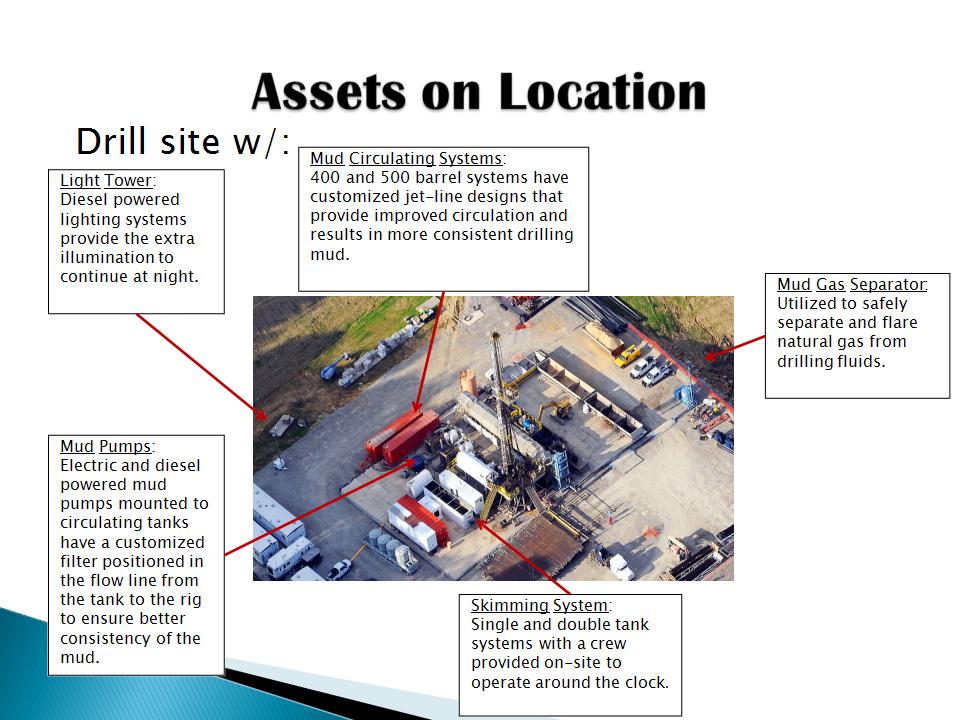

Drill site w/: Mud Circulating Systems: 400 and 500 barrel systems have customized jet-line designs that provide improved circulation and results in more consistent drilling mud. Mud Gas Separator: Utilized to safely separate and flare natural gas from drilling fluids. Skimming System: Single and double tank systems with a crew provided on-site to operate around the clock. Mud Pumps: Electric and diesel powered mud pumps mounted to circulating tanks have a customized filter positioned in the flow line from the tank to the rig to ensure better consistency of the mud. Light Tower: Diesel powered lighting systems provide the extra illumination to continue at night.

15

Giddings, Texas Dilley, Texas San Angelo, Texas

16

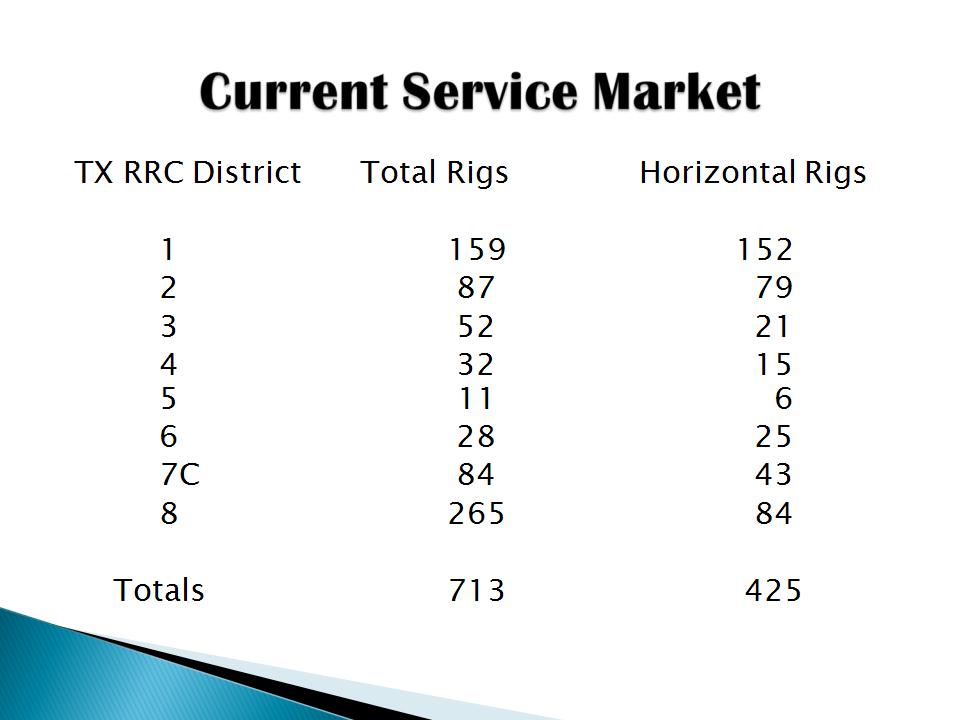

TX RRC District Total Rigs Horizontal Rigs 1 159 152 2 87 79 3 52 21 4 32 15 5 11 6 6 28 25 7C 84 43 8 265 84 Totals 713 425

17

Rig Vacuums – will add to our surface equipment rental inventory Compressors & Generators – have plans to add to our existing product offerings Solids Control equipment and services Flow back and Well Testing services

18

FINANCIALS

19

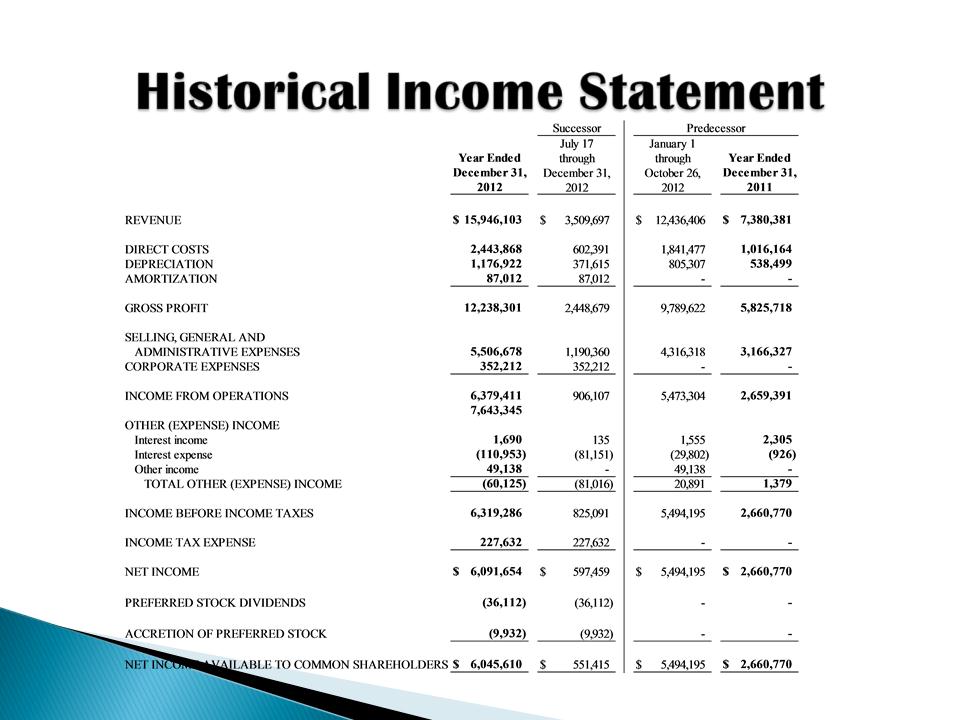

20

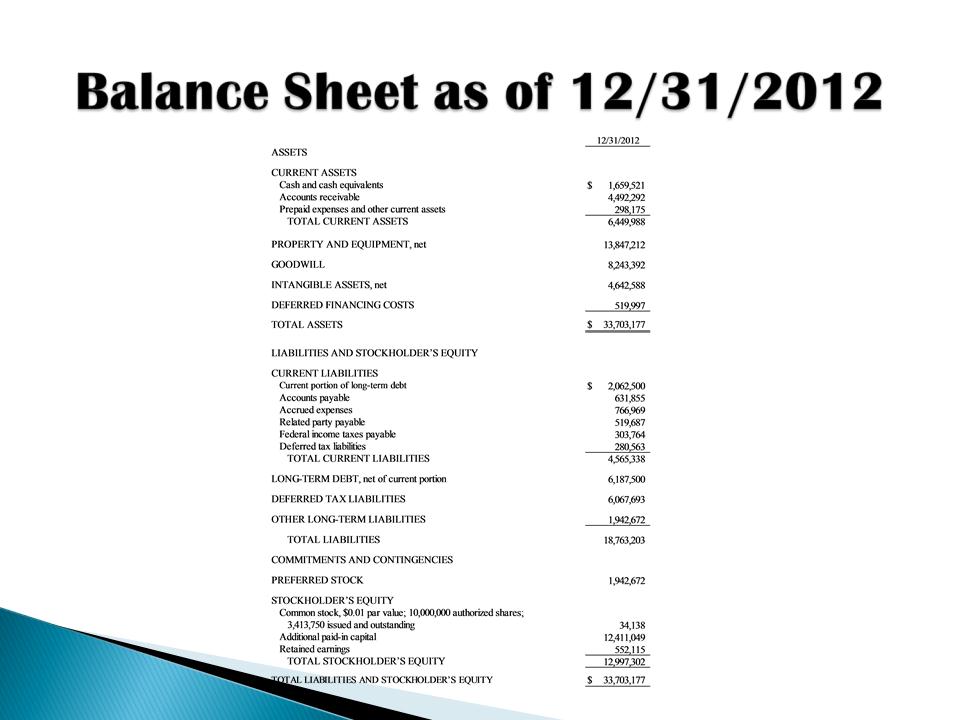

21

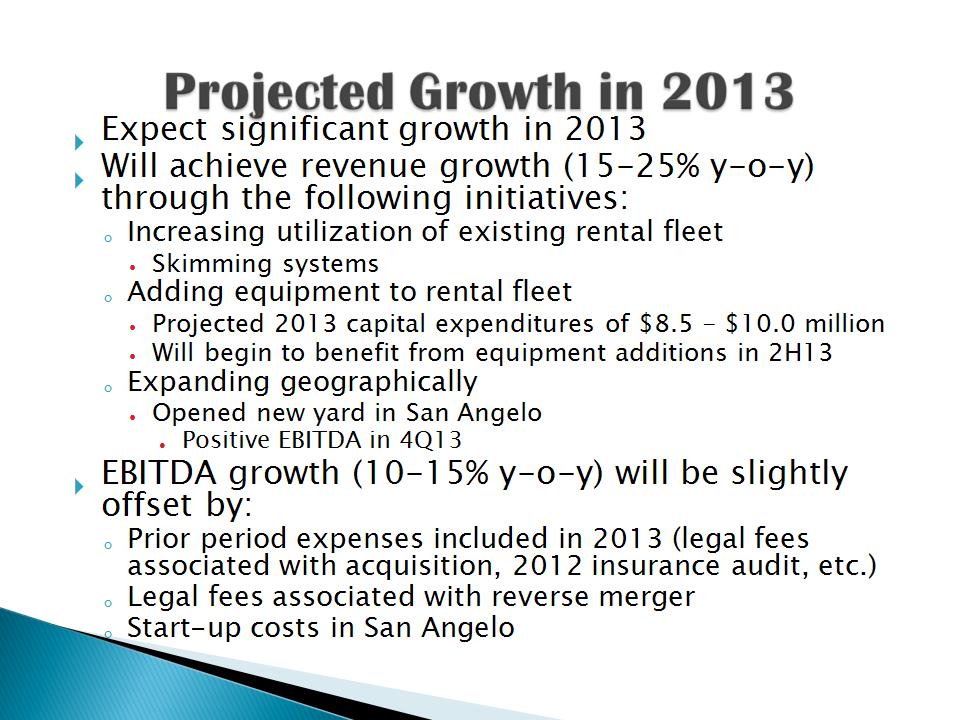

Expect significant growth in 2013 Will achieve revenue growth (15-25% y-o-y) through the following initiatives: Increasing utilization of existing rental fleet Skimming systems Adding equipment to rental fleet Projected 2013 capital expenditures of $8.5 - $10.0 million Will begin to benefit from equipment additions in 2H13 Expanding geographically Opened new yard in San Angelo Positive EBITDA in 4Q13 EBITDA growth (10-15% y-o-y) will be slightly offset by: Prior period expenses included in 2013 (legal fees associated with acquisition, 2012 insurance audit, etc.) Legal fees associated with reverse merger Start-up costs in San Angelo

22

Proven, Experienced Management Team Aly Energy Services is led by two oilfield service veterans, each with over 20 years in the industry, that were critical in the expansion of Allis-Chalmers from a $5mm revenue company in 2001 to over $650mm in 2010 Management has a clear vision and strategy for growth, with ability to organically grow oilfield services businesses as well as to identify, acquire and integrate strategic opportunities.

23

Differentiated Product Offering with High Quality Services Aly Energy Services has a unique set of assets that have been specifically engineered to provide customers with superior performance Aly’s approach to manufacturing enables it to provide highly-engineered and high quality products to its customers Aly has a high standard of service and is a recognized leader in quality and services in its operating regions

24

Geographically Located in High Growth Areas Strategically located in Central Texas with access to several prolific oil and liquids resource, including the Eagle Ford Shale and Woodbine, which are areas of current operations. Recently opened a new service facility in West Texas to service the increasing activity in the Cline and Wolfcamp formations which could eventually have as many horizontal drilling opportunities as the Eagle Ford.

25

Favorable Industry Dynamics Favorable long-term industry fundamentals, with robust exploration and production spending for the foreseeable future, as global exploration and production capital expenditure is expected to increase from $261billion to $420 billion 2011 to 2017 Increased need for drilling and completion services due to rising intensity of production (more wells for the same production) is driving demand

26

High Quality Customer Base and Demand Demand for Aly equipment continues to exceed capacity and Aly currently subleases equipment in order to meet customer demands Additional equipment not currently in the fleet is continually requested by key customers

27