Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WEYERHAEUSER CO | d554781d8k.htm |

WEYERHAEUSER

Exhibit 99.1

June 2013 Strategic Announcements |

2

Forward-Looking Statements

Forward-Looking Statements and Non-GAAP

Financial Measures

This presentation contains statements concerning the company's, Longview's and the combined company's

future results and performance that are forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, including, without limitation, with

respect to future prospects, developments, business strategies, closing of the acquisition, financing the

acquisition, benefits and impacts of the acquisition (including cost savings, operational and other

synergies and impacts on revenues, earnings, cash flow and funds from operations and funds

available for distribution), capital structure, potential transactions involving WRECO or the

structure of any such transaction (if any),dividend increases and harvests and export markets. The words “anticipate,”

“believe,” “could,” “will,” “plan,” “expect” and

“would” and similar terms and phrases, including references to assumptions, have been

used in this presentation to identify forward-looking statements. These forward-looking

statements are made based on management’s expectations and beliefs concerning future

events of us, Longview and the combined company and are subject to uncertainties and factors

relating to our operations and business environment, all of which are difficult to predict and many of which

are beyond the company’s control. Many factors could cause the actual results to differ

materially from those projected including, without limitation, the effect of general economic

conditions, including employment rates, housing starts, interest rate levels, availability of

financing for home mortgages and strength of the U.S. dollar, market demand for our products, which is related to the

strength of the various U.S. business segments and U.S. and international economic conditions,

performance of our manufacturing operations, including maintenance requirements, the

level of competition from domestic and foreign producers, the successful execution of our

internal performance plans, including restructurings and cost reduction initiatives, raw material prices, energy prices,

the effect of weather, the risk of loss from fires, floods, windstorms, hurricanes, pest infestation

and other natural disasters, transportation costs, federal tax policies, the effect of

forestry, land use, environmental and other governmental regulations, legal proceedings,

performance of pension fund investments and related derivatives, the effect of timing of retirements and changes in

market price of our common stock on charges for share-based compensation, changes in accounting

principles and the other risk factors described under "Risk Factors" in our annual

report on Form 10-K filed with the SEC on February 19, 2013 and the matters described in

our quarterly report on Form 10-Q for the quarter ended March 31, 2013 and our Current Report on Form 8-K dated

June 17, 2013, in each case filed with the SEC. These forward-looking statements are based on

various assumptions and may not be accurate because of risks and uncertainties surrounding

these assumptions. Factors listed above, as well as other factors, may cause actual

results to differ significantly from these forward-looking statements. There is no guarantee that any of the events

anticipated by these forward-looking statements will occur. If any of the events occur, there is

no guarantee what effect they will have on company operations or financial condition. The

company will not update these forward-looking statements after the date of presentation.

Nothing on our website is included or incorporated by reference herein.

Included in this presentation are certain non-GAAP financial measures, including EBITDA and FAD,

designed to complement the financial information presented in accordance with generally

accepted accounting principles in the United States of America because management believes such

measures are useful to investors. Our non-GAAP financial measures are not necessarily comparable to

other similarly titled captions of other companies due to potential inconsistencies in the metrics of

calculation. For a reconciliation of net earnings (loss) to EBITDA and cash provided by

operating activities to FAD, see the Appendix to this presentation.

Non-GAAP Financial Measures |

3

Participants

DAN FULTON:

President & Chief Executive Officer

PATTY BEDIENT:

Executive Vice President &

Chief Financial Officer

DOYLE SIMONS:

Weyerhaeuser Board Member

President & Chief Executive Officer,

effective August 1, 2013

TOM GIDEON:

Executive Vice President

Timberlands |

4

Strategic Announcements

•

Weyerhaeuser acquires approximately 645,000 acres of high-

quality timberlands in Washington and Oregon (Longview

Timber LLC)

•

Board intends to raise quarterly dividend per share by 10%

from $0.20 to $0.22 in August, payable in September, in

conjunction with and subject to completion of the acquisition

•

Board authorizes exploration of strategic alternatives for

Weyerhaeuser Real Estate Company (WRECO)

•

Doyle Simons appointed president and chief executive officer,

effective Aug. 1, 2013

–

Serving as CEO Elect, effective immediately |

Longview Timber: Transaction Summary

•

Agreed to acquire approximately 645,000 acres of high-

quality timberlands in WA and OR (Longview Timber LLC)

•

Purchase price of $2.65B (includes the assumption of

debt)

•

Transaction structured as stock purchase

Transaction

and Purchase Price

•

Contemplate raising $2.45B Weyerhaeuser equity and

long-term debt issuance

•

Mix of ~50% equity and ~50% debt

•

Financing supported by a committed senior unsecured

bridge facility from Morgan Stanley

Financing Plan

•

Closing of acquisition expected in July 2013

Timing

•

In conjunction with and subject to completion of

acquisition, Board intends to raise the quarterly dividend

per share by 10% from $0.20 to $0.22 per share

Dividend Increase

5 |

6

Compelling Strategic Rationale

•

Unique, high-value timberlands, predominantly west of the

Cascade mountain range

•

Leverages Weyerhaeuser’s core competencies (logistics,

silviculture, marketing & merchandising)

•

Expect approximately $20 million in annual cost and

operational synergies

•

Expected to be immediately accretive to FAD per share

•

Board intends to raise quarterly dividend per share by 10%

from $0.20 to $0.22 in conjunction with the transaction

•

Enhances ability to further increase the dividend |

Longview Timber:

Unique, High-Value Timberlands

High-value timber holdings

with scale

•

Predominantly west of the Cascade

mountain range (>90% of value)

•

Highly complementary and

contiguous with Weyerhaeuser

timberlands

•

Favorable age class

•

Primarily Douglas fir

7 |

Longview Timber: Property Description

•

Productive lands

•

Vast majority of combined commercial

forest area in high site class

•

Favorable age class distribution

•

Opportunity for high front-end harvest

•

Older age classes provide export-

quality logs

•

Superior logging operability

•

Flatter terrain

•

Well-roaded

Source: Management Estimates

Age Class

8

Douglas fir

66%

Hemlock

20%

Other

14%

Commercial Forest Area Timber Species |

9

U.S. West Coast Timberlands: Higher Value

Than Other Geographies

•

Highly productive lands with significant

merchantable volume

•

Predominantly managed for saw timber

•

Access to both domestic and export markets

•

Douglas fir a preferred species with unique

attributes

–

High strength and stiffness for its weight

–

Used for residential construction and industrial purposes

|

Increases Strategically Located Timberlands

with Access to Export

•

Advantaged in international log

markets

–

Strategically located West Coast

timberlands

–

Well-developed infrastructure and sales

relationships

–

Approximately 20% of Timberlands

revenue from export log sales

•

Uniquely valued in premium

Japanese market for post and

beam houses

–

Log size large enough to meet market

requirements

–

Attractive color and grain

10

Japan

78%

China

15%

Korea

7%

WY 2012 Export Log Revenues |

11

Compelling Cost and Operational Synergies –

Approximately $20 Million

•

Expect to reach annual synergies of approximately $20 million

within two years of closing

•

Leverage scale infrastructure and logistics

•

Increased high-value export logs

•

Enhanced harvest flexibility

–

Immediate/Near-Term: Reduced operating and G&A costs, and

improved marketing and revenue opportunities

–

Longer-Term: Apply silviculture and forestry expertise to

improve productivity and enhance value |

12

Enhancing Weyerhaeuser’s Timberlands Exposure

•

Total

timberlands

holdings

rise

to

approx.

7

million

acres

•

Growing Pacific Northwest acreage by 33%

•

Pacific Northwest will increase to almost 40% of total acreage

Source: Management Estimates

Pacific Northwest Timberlands Holdings

Acres (millions)

0

0.5

1

1.5

2

2.5

3

Q1'13

Longview Timber

WY Current Holdings |

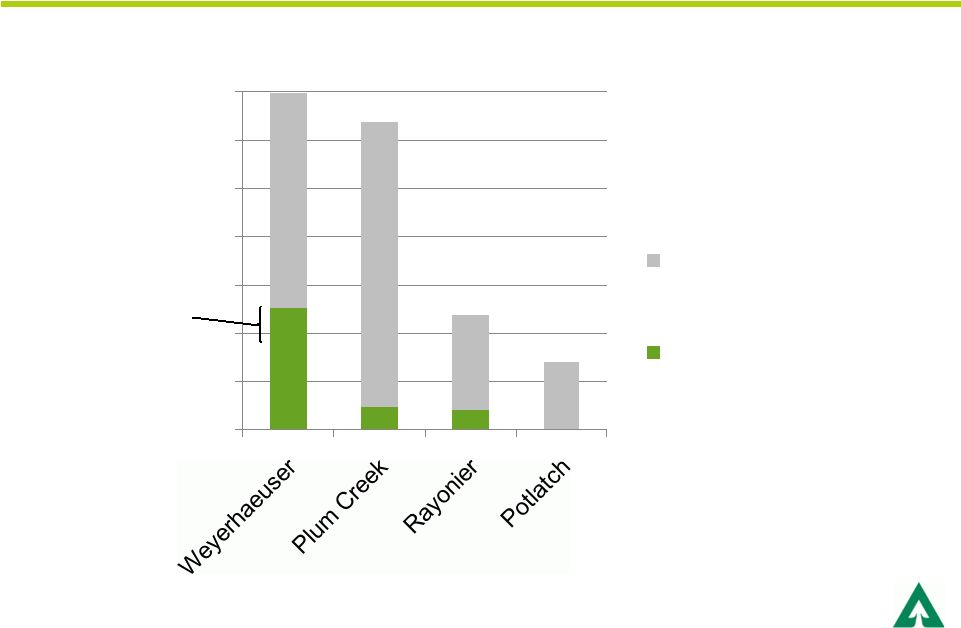

13

0

1

2

3

4

5

6

7

Acres (millions)

Other

Pacific Northwest

(west of Cascades)

Public Timber REIT Ownership By Geography

Longview

Timber

Source: WY, 2012 10Ks |

14

Longview Timber LLC –

GAAP Reconciliation

Source: First Quarter 2013 Financial Statements for Longview Timber LLC

First Quarter 2013 (in millions)

Longview EBITDA

1

$43.1

Depletion, depreciation & amortization

(32.1)

Total other expense, net (primarily interest

expense) (14.9)

Provision for taxes

(0.7)

Net earnings (loss) (GAAP)

($4.6)

Longview FAD

2

$20.4

Cash provided by (used in) investing activities

0.8

Cash provided by operating activities (GAAP)

$21.2

1.

EBITDA is defined as net income adjusted for taxes, other income (expense), depletion, depreciation

and amortization. EBITDA is a non- GAAP measure that management uses to evaluate the

performance of the company. EBITDA should not be considered in isolation from and is not

intended to represent an alternative to GAAP results. 2.

Funds Available for Distribution (FAD) is defined as cash provided by operating activities less cash

provided by investing activities. FAD is a non-GAAP measure that management uses to

evaluate the cash flows of the company. FAD should not be considered in isolation from and is

not intended to represent an alternative to GAAP results.

|

15

Financing Strategy

•

Expect to raise $2.45 billion in conjunction with the

acquisition

–

Approximately 50% equity and 50% debt

•

Committed senior unsecured bridge facility from

Morgan Stanley

•

Weyerhaeuser remains committed to an investment-

grade credit rating

•

Strong capital structure supports a sustainable and

growing dividend |

16

Enhances Weyerhaeuser’s Ability to

Increase Dividend

•

Weyerhaeuser remains committed to a sustainable,

growing dividend

•

Board intends to increase dividend per share by 10% from

$0.20 to $0.22 in August 2013, payable in September 2013

•

Longview Timber cash flows and synergies support ability to

further increase dividend |

17

•

Unique, high-value timberlands, predominantly west of the

Cascade mountain range

•

Leverages Weyerhaeuser’s core competencies (logistics,

silviculture, marketing & merchandising)

•

Expect approximately $20 million in annual cost and

operational synergies

•

Expected to be immediately accretive to FAD per share

•

Board intends to raise quarterly dividend per share by 10%

from $0.20 to $0.22 in conjunction with the transaction

•

Enhances ability to further increase the dividend

Longview Timber Acquisition Summary |

18

Weyerhaeuser Real Estate Company (WRECO)

•

Board authorizes exploration of strategic alternatives for

Weyerhaeuser Real Estate Company (WRECO)

•

WRECO is one of the 20 largest homebuilders in the

country, located in some of the fastest-growing markets

•

Alternatives include, but not limited to, continuing to

operate WRECO, merger, sale or spin-off

•

Prudent time to explore strategic alternatives given

improving housing market fundamentals

Maximizing the Value of Our Homebuilding and

Real Estate Development Business for Shareholders |

19

Strategic Announcements

•

Weyerhaeuser acquires approximately 645,000 acres of

high-quality timberlands in Washington and Oregon

•

Board intends to raise quarterly dividend from

$0.20 to $0.22 per share in August, payable in September,

in conjunction with the acquisition

•

Board authorizes exploration of strategic alternatives for

Weyerhaeuser Real Estate Company (WRECO)

•

Doyle Simons appointed president and chief executive

officer, effective Aug. 1, 2013

–

Serving as CEO Elect, effective immediately

Maximizing Value for Shareholders |

WEYERHAEUSER |

21

U.S. TIMBERLAND:

West Coast has highest values

•

Pacific Northwest region has two distinct zones: Coast and Inland

•

West Coast dominated by Douglas fir, a preferred species in export

and domestic markets

•

Majority of sawtimber in the Inland and South goes to domestic mills

U.S. FORESTLAND REGIONS

West

Inland

West Coast |