Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DEAN FOODS CO | d551565d8k.htm |

FOCUS

June 2013

Exhibit 99.1 |

Forward-looking statements

The following statements made in this presentation are “forward-looking”

and are made pursuant to the safe harbor provision

of the Private Securities Litigation Reform Act of 1995: statements relating to (1)

projected sales (including specific product lines and the company as a

whole), profit margins, net income, earnings per share, and covenant compliance, (2) our

branding initiatives, (3) our innovation and research and development plans, (4) our

cost-savings initiatives, including plant closures and route reductions,

and our ability to accelerate any such initiatives, (5) our plans related to

our leverage and cash flow, (6) our planned capital expenditures, (7) the

status of our litigation matters, (8) the impact of divestitures including

the sale of Morningstar and tax payments related thereto, and the spin-off of a

portion of our interest in The WhiteWave Foods Company, and (9) the

timing or amount of any future disposition of our remaining interest in The WhiteWave Foods

Company. These statements involve risks and uncertainties that may cause results to

differ materially from those set forth in this presentation. Financial

projections are based on a number of assumptions. Actual results could be materially different

than projected if those assumptions are erroneous. Sales, operating income,

net income, debt covenant compliance, financial performance and adjusted

earnings per share can vary based on a variety of economic, governmental and

competitive factors, which are identified in our filings with the Securities and

Exchange Commission, including our Forms 10- K

and

10-Q

(which

can

be

accessed

on

our

website

at

www.deanfoods.com

or

on

the

website

of

the

Securities

and

Exchange Commission at www.sec.gov). Our ability to profit from our branding

initiatives depends on a number of factors, including consumer acceptance of

our products. All forward-looking statements in this presentation speak only as of the

date of this presentation. We expressly disclaim any obligation

or undertaking to release publicly any updates or revisions to

any such statements to reflect any change in our expectations with regard thereto or

any changes in the events, conditions or circumstances on which any such

statement is based. Any disposition of the Company’s remaining ownership interest in

The WhiteWave Foods Company would be subject to various conditions, including the

existence of satisfactory market conditions and Board approval, and in the

case of a tax-free disposition, the maintenance of the Company’s private letter

ruling from the Internal Revenue Service. Certain pro forma adjusted and historical

non-GAAP financial measures contained in this presentation, including

adjusted diluted earnings per share, free cash flow, adjusted EBITDA, consolidated adjusted

operating income and consolidated adjusted net income, are from continuing

operations and have been adjusted to eliminate the net expense or net gain

related to certain items identified in our earnings press releases, including the

Morningstar divestiture. A full reconciliation of these measures calculated

according to GAAP and on an adjusted basis is contained in such press

release, which is publicly available on our website at www.deanfoods.com/investors and at the end

of this presentation.

2 |

Today’s agenda Who we

are Leadership team, vision and direction

Business strategy and company advantages

Financial performance

Conclusion

3 |

Who

we are Trusted regional brands: 50+

Manufacturing facilities: 75+

Total employees: 19,000

3.0B gallons produced annually

Over 37,000 points of distribution

More than 2/3 of U.S. households

purchase a Dean Foods branded

product

annually

1

NYSE: DF

Market cap: $2.0B

2

Revenues: $9.0+B

Headquarters: Dallas

4

1.

Source IRI

2.

As of 6/3/2013 |

Today’s agenda Who we

are Leadership team, vision and direction

Business strategy and company advantages

Financial performance

Conclusion

5 |

Marty

Devine Chief Operating Officer

Strong management team and vision

Gregg Tanner

Chief Executive Officer

Rachel Gonzalez

EVP, General Counsel

Barbara Carlini

Chief Information Officer

Kim Warmbier

EVP, Chief HR Officer

Shay Braun

SVP, Procurement &

Operations Support

Chris Bellairs

EVP, Chief Financial Officer

To be the most

admired and

trusted provider of

wholesome, great-

tasting dairy

products at every

occasion

6 |

Operational imperatives

Never compromise on quality, safety or customer service

Volume

Performance

Cost

Productivity

Effective

Pricing

Drive volume growth

at appropriate

economic returns

Gain share through

low cost, high service,

valued brands model

Augment volumes

with differentiated

products like TruMoo®

Build on unique

opportunities to create

a cost-advantaged

position

Expedite closure of

under-utilized plants,

routes

Use cost savings to

enable future growth

Improve pricing tools

and protocols to ensure

pass-through of

commodity inflation

Reduce commodity-

driven volatility

2012 success drives

2013 performance

7 |

Today’s agenda Who we

are Leadership team, vision and direction

Business strategy and company advantages

Financial performance

Conclusion

8 |

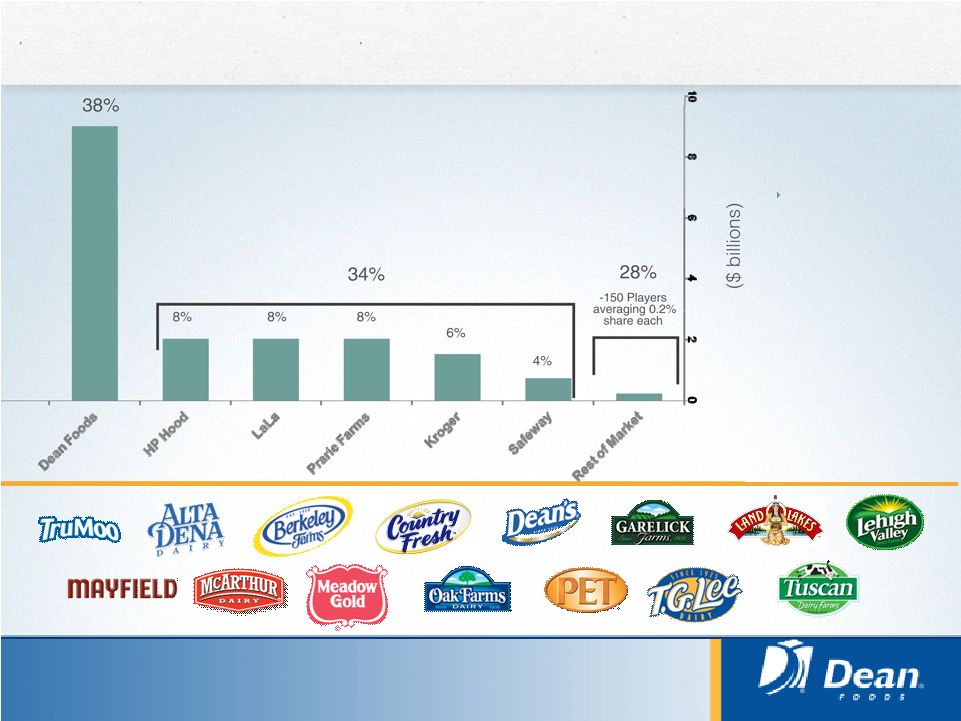

Dean

Foods at a glance Largest U.S. processor and

distributor of fluid milk, 5x

the size of the next largest

competitor

Portfolio of trusted brands,

complementary products –

milk, ice cream, cultured

dairy products, creamers,

ice cream mix, and other

dairy

Best-in-class nationwide

distribution platform with

extensive refrigerated

“direct store delivery”

systems

Cost control is part of our

DNA

9 |

Distribution:

Broad nationwide distribution across channels

The country’s only

coast-to-coast processor and distributor of fresh milk 75+

manufacturing facilities 6,500 direct-store-delivery routes

Large Format 69%

Small Format 11%

Foodservice 13%

School/Govt 7%

10 |

Portfolio: Strength across the dairy case Dean Foods

- fluid milk and

more

Dean Foods’

percent of national

branded share has increased

over the past three years

Ice cream, cultured products,

creamers, juice, tea and water

fill out the Dean Foods portfolio

3%

FRESH

CREAM (1)

2%

ESL & ESL

CREAMERS (2)

4%

CULTURED

5%

OTHER

BEVERAGES (3)

9%

ICE CREAM (4)

2%

OTHER (5)

26%

DEAN BRANDED WHITE

40%

PL WHITE AND FLAVORED

74%

FLUID MILK

(1) Includes half-and-half and whipping cream

(2) Includes creamers and other ESL fluids

(3) Includes fruit juice, fruit-flavored drinks, iced tea and water

(4) Includes ice cream, ice cream mix and ice cream novelties

(5) Includes items for resale such as butter, cheese, eggs and milkshakes

8%

TRUMOO

11 |

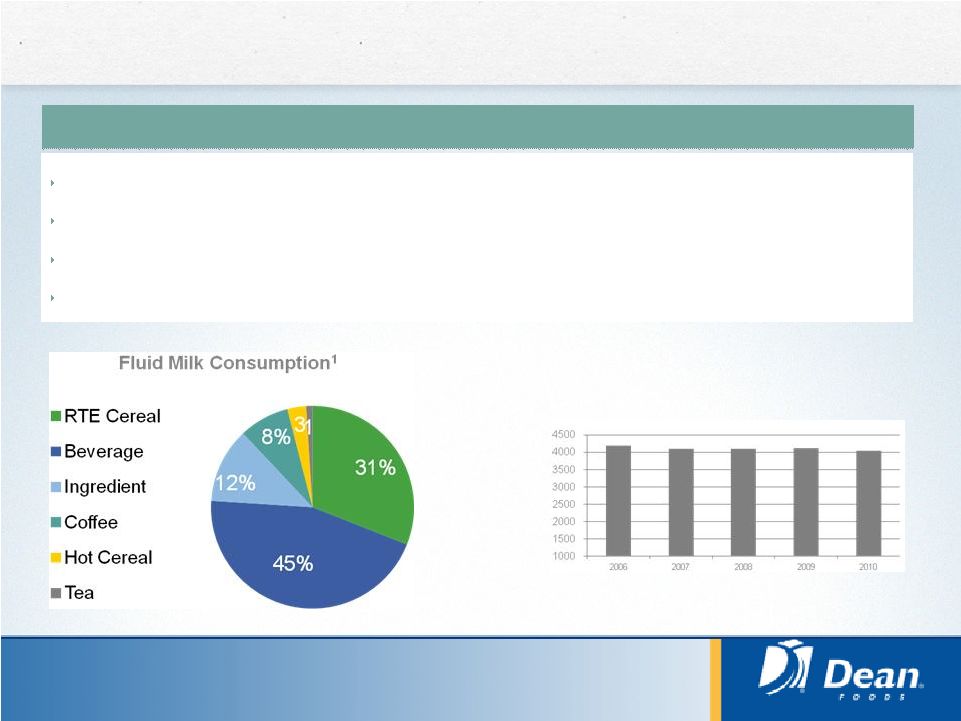

White milk is a compelling, sustainable market opportunity

Fluid Milk Category Dynamics

Ubiquitous: in 90% of U.S. homes, over $20B of annual U.S. retail

sales¹ Strong health & wellness credentials

One of the largest, most profitable categories for retailers

Industry remains fragmented, large sophisticated platform provides significant competitive

advantages Relatively Stable Long-term

White Milk Consumption Trend²

12

1.

Symphony IRI Group, “Refrigerated Conventional White Milk Overview: Category

Decline Review”, July, 2010. 2.

IRI

Panel,

Total

All

Outlet,

Calendar

Year

2009

–

2012,

2006-2008

from

IRI

study

published

in

2011 |

Scale: Dean Foods is the largest player in milk

We have the #1

or #2 position,

as measured by

sales of

branded white

milk, in 80% of

the IRI defined

geographies in

which we

operate

13 |

Brands:

Leveraging TruMoo

Flavored milk is a $1B category, and TruMoo is

the largest flavored milk brand

TruMoo was recently ranked as the fourth most

successful consumer packaged goods brand of

2012 by Information Resources, Inc. (IRI)

TruMoo is Dean Foods’

largest national brand at

$636M of retail and school sales in 2012

No high fructose corn syrup, lower total sugar,

low fat, all the great nutrition of milk

Retail volumes up 7.6% in 2012

Marketing is working: TruMoo is at 75% HH

awareness, 14% trial, and repeat rates are at

60% and growing (above CPG norms)

1.SymphonyIRI MULO data ending 52 W/E 12/31/12

14

1 |

Portfolio:

Ice cream

Strong regional ice cream business

Over $800 million in annual sales

Mix of regional brands, foodservice, and private label

Company-owned frozen distribution network

15 |

Dean

Foods: Focused, disciplined, profitable

Extend our sustainable competitive advantages

Our relative size and capabilities afford us significant advantages versus our

competitive set –

we plan to extend those advantages

Continued focus on cost, volume outperformance, effective pricing

Lay the foundation for longer-term growth

Focus on cash flow generation and total shareholder returns

16 |

Extend our

sustainable competitive advantages: Manufacturing and Procurement

Accelerating

cost

reduction

across

the

P&L

–

targeting

$120

million

in

2013 savings

Large

network

provides

opportunities

to

reduce

capacity

to

drive

efficiency

and

unit costs lower –

in the process of closing 10-15% of production facilities

Three plant closures announced late last year

Buena Park fluid milk, Shreveport announced this year

Two additional announcements this week

17

Leading network drives in-plant efficiency

through ongoing continuous improvement

program that works to alleviate efficiency

bottlenecks and propagate best practices

through employee-led initiatives

Leveraging the volume of our overall

purchases to obtain favorable pricing across

non-dairy commodities –

typically a 10-15%

cost advantage |

Extend our

sustainable competitive advantages: Distribution

We have a significant opportunity to drive additional distribution savings

Leveraging technology

XataNet GPS units provide detailed analysis of location, speed, stop length, etc.

Also eliminates roughly 45 min per day of driver paperwork

RoadNet enables significant improvements in routing efficiency

We are instituting the same

continuous improvement

processes in distribution that

have been delivering

manufacturing savings

Large opportunity to reduce and

variablize our distribution assets

18 |

Extend our

sustainable competitive advantages: Pricing and Selling

Passthrough is an effective hedge against

most milk commodity volatility

Prices are reset monthly in concert with changes

in Class I mover

Customers expect and accept these changes

We have developed and are implementing

technology to increase precision of pricing

across all SKUs

Leveraging risk management capabilities to

offer customers innovative pricing solutions

Reducing overhead to drive competitiveness

19 |

Building long-term opportunities to grow

Investing in the R&D pipeline

Historical spending was skewed toward WhiteWave and Morningstar

We have the opportunity to utilize our broad manufacturing and distribution

capabilities for expansion into new value-added products and

extensions Expect to begin increasing the innovation we bring to market in

24+ months TruMoo demonstrates that

consumers value additional

benefits in fluid dairy

Open to strategic partnering with

others to drive growth and further

leverage our DSD network

20 |

Focus on cash flow generation & total shareholder returns

Mid-single Avg EBIT Growth

Liability Mgmt

Cap-Ex Reduction Over Time

21

We expect $75-$100 million of normalized 2013 Free Cash Flow before one-time

items and litigation payments

Next 3-5

Years

Expect to provide more clarity on go-forward capital priorities by year

end *Free cash flow is a non-GAAP measure and is defined as net

cash provided by continuing operations less capital expenditures

|

Today’s agenda

Who we are

Leadership team, vision and direction

Business strategy and company advantages

Financial performance

Conclusion

22 |

Financial performance

Net Sales

$2.3B**

$9.3B*

$74M** +12%

$256M*

727M

3.0B

Operating Profit

2012 Total Shareholder Return: +47%

3/31/13 Leverage Ratio

***

: 2.13x

Market Capitalization: $2.0B

1 Quarter

2012

*On

a

rebased

basis,

excluding

among

other

items

the

results

of

Morningstar

and

WhiteWave,

See

Reconciliation

of

Non-GAAP

Financial

Measures

in

the

appendix to this presentation for computation and reconciliations

**See Reconciliation of Non-GAAP Financial Measures in the first quarter 2013 press

release earnings tables for computations and reconciliations

***

Excludes

WhiteWave

stand-alone

debt

and

any

amount

that

may

be

payable

in

connection

with

taxes

related

to

the

Morningstar

sale

23

Gallons

st |

Volume and operating profit performance

Adjusted Operating Income per Gallon ($)

*See Reconciliation of Non-GAAP Financial Measures in our earnings releases for

the relevant quarters and in the appendix to this presentation

for computations

and reconciliations

24 |

2010

Dramatic debt and leverage reduction

Ongoing Dean Foods

Net Debt

$ Millions

Total Leverage

Ratio 5.13x

4.64x 3.54x*

2.13x*

•

3/31 Net debt of $1.0B, excluding

WWAV, leverage at 2.13x*

•

$2.6B of Dean Foods’

net debt

reduction over past 12 months

driven by Morningstar sale,

WWAV IPO and strong operating

cash flows

•

Upcoming tax payments

primarily related to the

Morningstar sale will increase

leverage

•

Opportunity to monetize 34.4

million WWAV shares to further

reduce debt

Overview

2011

2012

2013

* Excludes WhiteWave stand-alone debt and any amount that may be

payable in connection with taxes related to the Morningstar sale

25 |

2013

Expectations Low-to-Mid single digit growth

$0.45 to $0.55 per share

Approximately $430 –

460 million

Approximately $150 –

175 million

FY 13 Capital

Expenditures

FY 13 Adjusted

Diluted EPS*

FY 13 Adjusted

Operating Income*

FY 13 Adjusted EBITDA*

26

$0.11 -

$0.15

Q2

Adjusted

Diluted

EPS*

* See Reconciliation of Non-GAAP Financial Measures in the Q1 2013 earnings release

earnings tables

for computation |

Today’s agenda

27

Who we are

Leadership team, vision and direction

Business strategy and company advantages

Financial performance

Conclusion |

Summary

We have built sustainable competitive advantages

through our scale and capabilities. We are working to

extend these advantages.

We are putting pieces in place to build for the future

through:

Reducing and variablizing our cost structure

Improving pricing tools and protocols to reduce volatility

Increasing R&D and innovation efforts

We believe profit growth, combined with a focus on

free cash flow generation and rewarding shareholders

will result in superior returns

We aim to be a predictable, sustainable creator of

value for shareholders, with fewer surprises and less

volatility

Thank you for your interest

28 |

Appendix:

Reconciliation of Non-GAAP Financial Measures

29

DEAN FOODS COMPANY

Reconciliation of GAAP to Adjusted Operating Income

(Unaudited)

(In thousands)

Three months ended

March 31, 2013

Adjustments to GAAP

GAAP

Asset write-down

and (gain) loss on

sale of assets

Facility closing

and reorganization

costs

Deal, integration

and separation

costs

WhiteWave

separation and

discontinued

operations

Adjusted

Operating income (loss):

Ongoing Dean Foods

68,981

$

290

$

4,620

$

340

$

-

$

74,231

$

WhiteWave

41,994

-

-

5,479

(47,473)

-

Facility closing and reorganization costs

(5,610)

-

5,610

-

-

-

Other operating income (expense)

(33,915)

33,915

-

-

-

-

Total operating income

71,450

$

34,205

$

10,230

$

5,819

$

(47,473)

$

74,231

$

Twelve months ended

December 31, 2012

Adjustments to GAAP

GAAP

Asset write-down

and (gain) loss on

sale of assets

Facility closing

and reorganization

costs

Deal, integration

and separation

costs

WhiteWave

separation and

discontinued

operations

Adjusted

Operating income (loss):

Ongoing Dean Foods

233,558

$

5,983

$

-

$

24,654

$

(8,111)

$

256,084

$

WhiteWave

192,557

-

-

1,085

(193,642)

-

Facility closing and reorganization costs

(55,787)

-

55,787

-

-

-

Other operating income (expense)

57,459

(57,459)

-

-

-

-

Total operating income

427,787

$

(51,476)

$

55,787

$

25,739

$

(201,753)

$

256,084

$

|

Appendix:

Reconciliation of Non-GAAP Financial Measures (cont)

30

Three months ended

March 31, 2012

Adjustments to GAAP

GAAP

Asset write-down

and (gain) loss on

sale of assets

Facility closing

and reorganization

costs

Deal, integration

and separation

costs

WhiteWave

separation and

discontinued

operations

Adjusted

Operating income (loss):

Ongoing Dean Foods

68,079

$

-

$

-

$

-

$

(2,234)

$

65,845

$

WhiteWave

46,995

-

-

-

(46,995)

-

Facility closing and reorganization costs

(25,435)

-

25,435

-

-

-

Other operating income (expense)

-

-

-

-

-

-

Total operating income

89,639

$

-

$

25,435

$

-

$

(49,229)

$

65,845

$

Three months ended

June 30, 2012

Adjustments to GAAP

GAAP

Asset write-down

and (gain) loss on

sale of assets

Facility closing

and reorganization

costs

Deal, integration

and separation

costs

WhiteWave

separation and

discontinued

operations

Adjusted

Operating income (loss):

Ongoing Dean Foods

69,001

$

-

$

-

$

4,000

$

(1,262)

$

71,739

$

WhiteWave

45,085

-

-

-

(45,085)

-

Facility closing and reorganization costs

(6,217)

-

6,217

-

-

-

Other operating income (expense)

-

-

-

-

-

-

Total operating income

107,869

$

-

$

6,217

$

4,000

$

(46,347)

$

71,739

$

|

Appendix:

Reconciliation of Non-GAAP Financial Measures (cont)

31

Three months ended

September 30, 2012

Adjustments to GAAP

GAAP

Asset write-down

and (gain) loss on

sale of assets

Facility closing

and reorganization

costs

Deal, integration

and separation

costs

WhiteWave

separation and

discontinued

operations

Adjusted

Operating income (loss):

Ongoing Dean Foods

46,224

$

5,983

$

-

$

8,000

$

(3,448)

$

56,759

$

WhiteWave

50,435

-

-

-

(50,435)

-

Facility closing and reorganization costs

(6,080)

-

6,080

-

-

-

Other operating income (expense)

56,339

(56,339)

-

-

-

-

Total operating income

146,918

$

(50,356)

$

6,080

$

8,000

$

(53,883)

$

56,759

$

Three months ended

December 31, 2012

Adjustments to GAAP

GAAP

Asset write-down

and (gain) loss on

sale of assets

Facility closing

and reorganization

costs

Deal, integration

and separation

costs

WhiteWave

separation and

discontinued

operations

Adjusted

Operating income (loss):

Ongoing Dean Foods

50,254

$

-

$

-

$

12,654

$

(1,167)

$

61,741

$

WhiteWave

50,042

-

-

1,085

(51,127)

-

Facility closing and reorganization costs

(18,055)

-

18,055

-

-

-

Other operating income (expense)

1,120

(1,120)

-

-

-

-

Total operating income

83,361

$

(1,120)

$

18,055

$

13,739

$

(52,294)

$

61,741

$

|

FOCUS

June

2013 |