Attached files

| file | filename |

|---|---|

| EX-99.1 - MEDIA RELEASE - IHS Inc. | exh991-06102013.htm |

| 8-K - 8-K - IHS Inc. | ihs8k6-10x13.htm |

© IHS 2013 June 10, 2013

© IHS 2013 Safe harbor: refer to IHS.com for detailed information Statements in this presentation that are not reported financial results or other historical information are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. They include, for example, statements about our business outlook, assessment of market conditions, anticipated trends in our business strategies, future plans, future sales, prices for our major products, capital spending, and tax rates. These forward-looking statements are not guarantees of future performance. They are based on management’s current expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. The risks and uncertainties relating to the forward-looking statements in this presentation include, but are not limited to, our ability to successfully integrate acquisitions and manage risks associated with changes in demand for our products and services as well as changes in our targeted industries, our ability to develop new products and services, pricing and other competitive pressures, changes in laws and regulations governing our business, and the other factors described under the caption “Risk Factors” in IHS Inc.’s most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, along with our other filings with the U.S. Securities and Exchange Commission. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements to conform our prior statements to actual results or revised expectations. -------------- Throughout this presentation, we refer to non-GAAP financial measures intended to supplement our financial statements that are based on U.S. generally accepted accounting principles (GAAP). Examples of non-GAAP measures include “EBITDA,” “Adjusted EBITDA,” “Free Cash Flow,” and “Adjusted Free Cash Flow,” and Definitions of our non-GAAP measures, as well as reconciliations of comparable GAAP measures to non-GAAP measures, are provided with the schedules to our quarterly earnings releases. Our most recent non-GAAP reconciliations were furnished as an exhibit to a Form 8-K on March 21, 2013, and are available on our website (www.ihs.com). 2

© IHS 2013 Transaction creates significant value for IHS shareholders • IHS has signed definitive agreement to acquire R.L. Polk for $1.4 billion, subject to customary closing conditions • Attractive and flexible financing will give sufficient liquidity at close to ensure IHS continues to fully support the business and fund future growth • Asset purchased at attractive multiples relative to current IHS trading multiples providing immediate value to IHS shareholders • Combination creates strong annual free cash flow that should exceed a $500 million annual run rate within the next 6 quarters • This will allow IHS to rapidly de-lever and reach 2.5x leverage within 6 quarters 3

© IHS 2013 • Significant scale with mid to high single-digit revenue growth with ~$400 million of current annual revenue ~75% recurring revenue with 90%-plus renewal rates Principally focused in North America with ~9% in EMEA, ~3% in APAC • Adjusted EBITDA margin in mid-20 percent range with clear path to accretive margins in the next 6-8 quarters • Cash generative with high free cash flow conversion • Significantly accretive to 2014 Adjusted EPS excluding purchase price amortization • Headquartered in Detroit, MI, with ~1,300 employees in 15 offices globally R.L. Polk brings to IHS an attractive financial profile and accretive growth trajectory 4

© IHS 2013 Combination of R.L. Polk and IHS creates significant and unique new value for customers as we leverage all IHS capabilities • Combination creates a single global automotive information supply chain connecting all major segments of the automotive industry • With this comprehensive industry insight, IHS will drive full vehicle lifecycle analytics from product planning through manufacturing, sales and aftermarket • Acquisition gives IHS the ability to provide full global visibility to the automotive value chain • This will deepen existing relationships with our automotive customers and create new value in new ways for other core IHS capital-intensive, high-growth industry sectors, e.g., electronics, chemicals, plastics and energy 5

© IHS 2013 R. L. Polk is the auto industry information leader What Is R. L. Polk Information pioneer and “data of record” provider to the entire automotive industry What R. L. Polk Does Provide actionable automotive market intelligence, extensive vehicle history information, powerful tools and analytics When & Why R. L. Polk Is Used Businesses and consumers across the auto ecosystem use R. L. Polk’s products every day to make smarter decisions How R. L. Polk Does It Synthesizing the fragmented big data “exhaust” of the auto industry into meaningful, insightful and reliable information solutions 6

© IHS 2013 R.L. Polk Overview: Product offerings R.L. Polk Polk Division (~40% of rev) CARFAX (~60% of rev) • Provides sales and registration data to the global automotive industry • Products and services include: o Market analysis and forecasting for vehicle sales o VIN interpretation and vehicle verification services • Provider of vehicle history information to dealers that purchase and sell used cars • Products and services include: o Vehicle History Report o Critical data feeds for a range of end markets 7

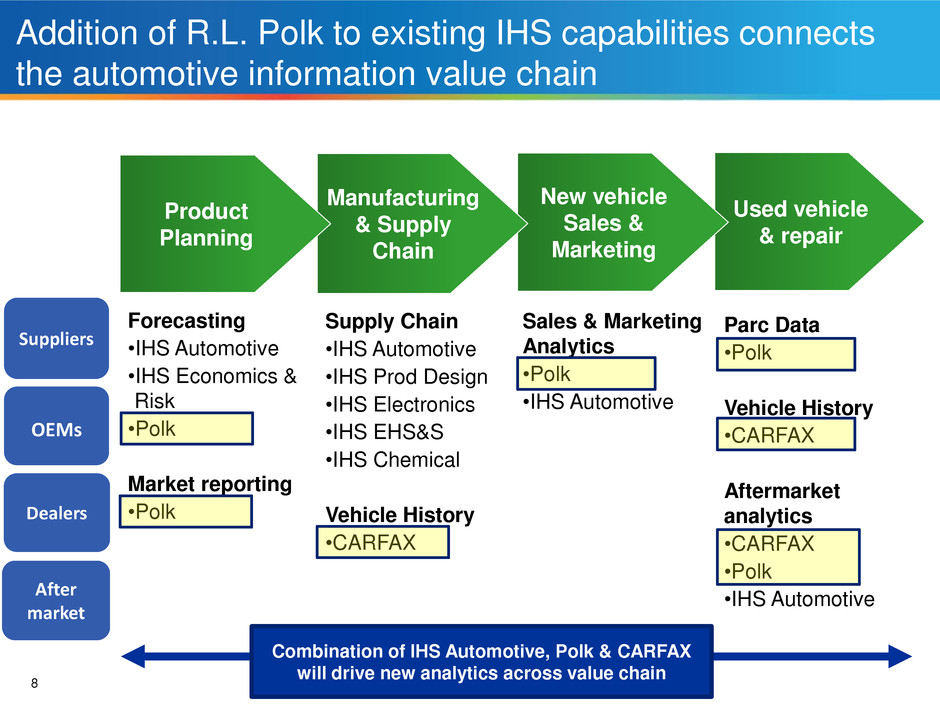

© IHS 2013 Addition of R.L. Polk to existing IHS capabilities connects the automotive information value chain Used vehicle & repair Forecasting •IHS Automotive •IHS Economics & Risk •Polk Market reporting •Polk Sales & Marketing Analytics •Polk •IHS Automotive Parc Data •Polk Vehicle History •CARFAX Aftermarket analytics •CARFAX •Polk •IHS Automotive OEMs Suppliers After market Dealers Supply Chain •IHS Automotive •IHS Prod Design •IHS Electronics •IHS EHS&S •IHS Chemical Vehicle History •CARFAX New vehicle Sales & Marketing Manufacturing & Supply Chain Product Planning Combination of IHS Automotive, Polk & CARFAX will drive new analytics across value chain 8

© IHS 2013 Global automotive market is growing and transforming • Automotive: We anticipate the global auto market to be a high- growth market for decades to come with significant growth in high- value emerging markets • Electronics & Media: Cars are now high-tech electronics devices. Safety and emissions regulations, technology innovation in powertrain and transmission and the consumer desire for best-in-class infotainment will relentlessly drive this trend. • Chemicals and Supply Chain: Globalization of platform programs and regulatory and technological changes (e.g., light-weighting of vehicles) are driving dramatic transformations and realignments in the supply chain and materials supply. • EHS&S: Complex manufacturing processes and extended global supply chains are driving a need for enhanced environmental compliance and risk management solutions among OEMs and suppliers. 9

© IHS 2013 Industry Sectors Energy and Natural Resources Chemicals Electronics Transportation Additional End Markets Functional W or k flo w s Strategy, Planning and Analysis Energy Technical Product Design Supply Chain EHS and Sustainability 2007 2008 2009 2010 2011 2012 2005 2006 We have focused investment on products and platforms in high-value workflows and core industry sectors 2013 10

© IHS 2013 Consistent margin expansion potential We are ready for R.L. Polk: IHS global infrastructure and processes are now in place to allow us to efficiently scale We have driven scale and efficiency across each area of the business to allow successful delivery of growth and leverage $ Time Delivery Capacity 3 Infrastructure Costs 4 2 Cost of Sales 1 Organic Growth 11

© IHS 2013 We have been building IHS Automotive for the past five years to enable scaling Strategic opportunity • Industry annual spend measured in trillions • Industry annual growth of 9% to 12% • Up to $1B of additional growth opportunity Scaling the automotive industry sector • 2008-2012: Deployed significant capital to acquire market- leading auto assets • 2010-2011: Integrated information, analytics & expertise • 2011-2012: Launched branded IHS Automotive • 2011-2012: Launched common commercial platform • 2010-2012: Accelerated subs growth to high single-digit / low double-digits • 2013: IHS acquires Polk 12

© IHS 2013 Financing • Purchase price: $1.4B 10% equity Stock issuance has a 2-year lock up. 50% of shares can be sold after year one and 100% of shares can be sold after year two Remainder is cash funding from cash on hand, cash from an existing revolver and a new bank term loan Strong partnership with our lead banks makes it possible to put together highly attractive financing for this strategic transaction Use of debt reflects strong combined free cash flow and high levels of free cash flow conversion Enables IHS to undertake this prudent and cost-efficient approach with the ability to de-lever rapidly Transaction parameters 13

© IHS 2013 Financing Considerations • IHS stated financial goals have NOT changed…we have targeted 2.5x leverage, subject to temporary elevation for strategic activity • We re-iterate that target and have clear path to rapidly reduce debt from 3.5x leverage at close to 2.5x leverage over 6 quarters • Pricing on term loan also makes it very cost effective with key terms broadly similar to existing credit facility in terms of rates, covenants and tenor • Gives IHS flexibility to continue to evaluate opportunities to put into place permanent financing at attractive rates within the next 4 to 6 quarters 14

© IHS 2013 We see tremendous opportunity for IHS Automotive • Combination of IHS Automotive and R.L. Polk creates a single global automotive information supply chain, connecting all major segments of the automotive industry • We will drive global expansion of R.L. Polk, leveraging our global infrastructure and customer relationships • We will drive product line extensions, leveraging the capabilities of IHS Automotive and R.L. Polk • We will drive industry analytics by connecting the capabilities of IHS Automotive, Polk division and CARFAX to provide end-to-end complete value chain insight • We will leverage scale and best practices to drive operational excellence 15