Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENCORE CAPITAL GROUP INC | d550073d8k.htm |

ENCORE CAPITAL GROUP, INC.

2013 INVESTOR DAY

Exhibit 99.1 |

PROPRIETARY

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

2

The statements in this presentation that are not historical facts, including, most

importantly,

those

statements

preceded

by,

or

that

include,

the

words

“will,”

“may,”

“believe,”

“projects,”

“expects,”

“anticipates”

or the negation thereof, or similar

expressions,

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

(the

“Reform

Act”).

These

statements

may

include,

but

are

not

limited

to,

statements

regarding

our

future

operating

results,

earnings

per

share,

and

growth.

For

all

“forward-looking

statements,”

the

Company

claims the protection of the safe harbor for forward-looking statements

contained in the Reform Act.

Such forward-looking statements involve risks, uncertainties and other

factors which may cause actual results, performance or achievements of the Company

and its subsidiaries to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements. These risks, uncertainties and other factors are discussed in

the reports filed by the Company with the Securities and Exchange

Commission, including the most recent reports on Forms 10-K,

10-Q

and

8-K,

each

as

it

may

be

amended

from

time

to

time.

The

Company

disclaims any intent or obligation to update these forward-looking

statements. |

PROPRIETARY

PRESENTING TODAY

Brandon Black

Former CEO

Ken Vecchione

Chief Executive Officer

Paul Grinberg

Chief Financial Officer

Ashish Masih

SVP, Legal Collections / AACC

Integration Lead

3 |

PROPRIETARY

ENCORE IS A LEADING PLAYER IN THE CONSUMER DEBT BUYING

AND RECOVERY INDUSTRY

4

We deploy capital to acquire

delinquent consumer receivables...

Purchaser of defaulted consumer

credit portfolios & delinquent tax liens

Work with consumers to help them

repay their obligations over time

Employ analytics to segment

consumers on an individual basis

Have relationships with 1 in 7

American consumers

Collected $987M in total cash

collections TTM through Q12013

... and generate predictable cash

flows over a multi-year time horizon

Total Cash

Collections

Portfolio

Purchase

Price

Illustrative yearly cash collections

Years

1-2

Years

3-4

Years

5-6

Years

7-8

2-3x |

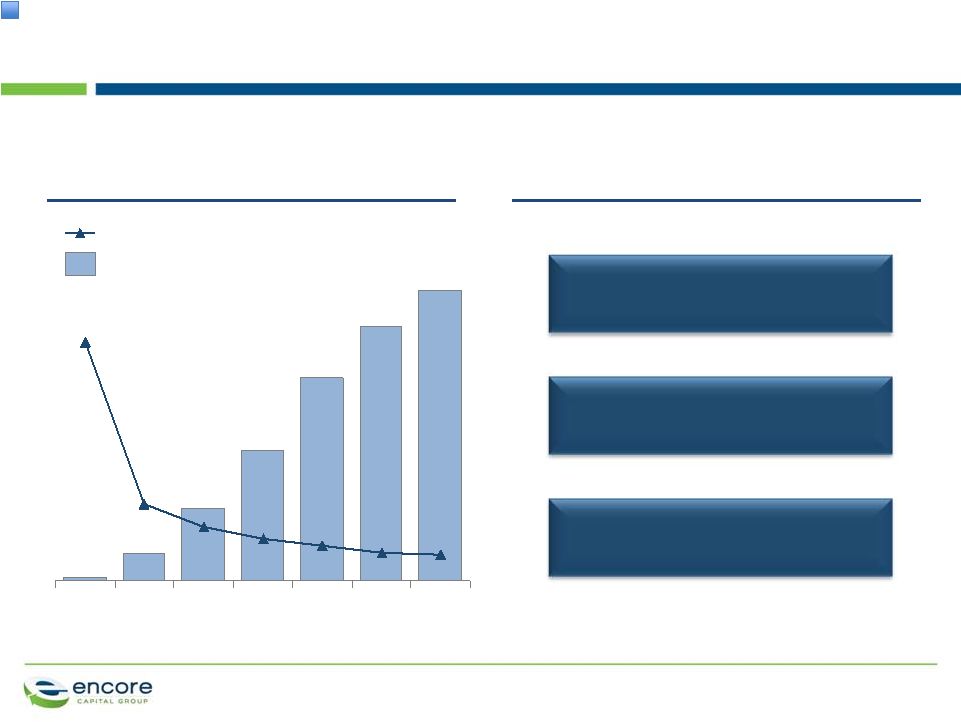

PROPRIETARY

ENCORE HAS REALIZED STRONG, SUSTAINABLE FINANCIAL RESULTS

5

Cash Collections ($M)

Cost to Collect (%)

Adjusted EBITDA

($M)

Earnings Per Share

($)

12

948

11

761

10

09

487

08

398

07

355

12

40.4

11

42.2

10

43.7

09

47.6

08

07

51.5

12

577

11

444

10

343

09

260

08

205

07

175

12

3.04

11

2.36

10

1.89

09

1.28

08

0.55

07

0.52

Strong business

fundamentals...

...driving

profitable

growth

1

2

604

50.2

1.

Adjusted

EBITDA

is

a

non-GAAP

number

which

the

Company

considers

to

be

and

utilizes

as

a

meaningful

indicator

of

operating

performance

See

Reconciliation

of

Adjusted

EBITDA

to

GAAP Net Income at the end of this presentation. 2. Per Fully Diluted Share from

Continuing Operations Note:

Growth

rate

percentages

for

Cash

Collections,

Adjusted

EBITDA,

and

EPS

signify

compounded

annual

growth

rate

from

2007

-

2012 |

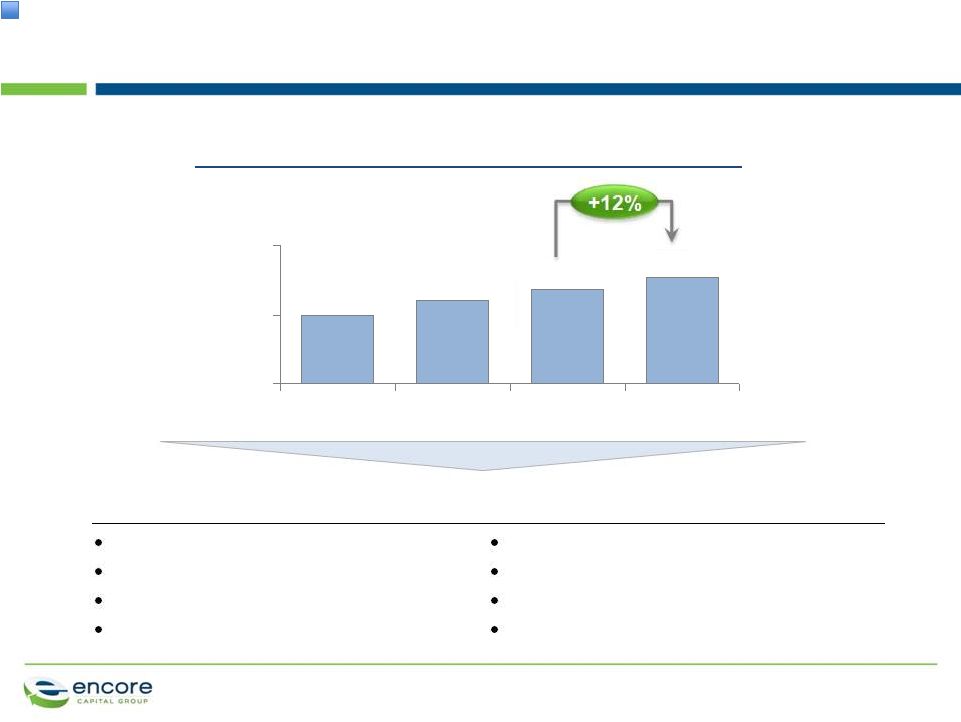

ENCORE HAS GROWN TO BE THE INDUSTRY LEADER

6

•

Continuously refining analytics

•

Relentlessly lowering cost to collect

•

Constantly testing different asset

classes

Consistent earnings growth with

ability to succeed in any market

environment

Heritage and history

Today and our path forward

•

Gaining scale and critical

regulatory expertise

Industry consolidator

•

Underpinning every action with

principled intent

Continued leadership in

improving consumer experience

PROPRIETARY |

PROPRIETARY

WE DRIVE CONSISTENT EARNINGS GROWTH

7

1. Consensus estimates from Zacks and taken from 90 days before earnings

announcement Note: Q2 2007 actual EPS includes the add back of a one time

after tax payment of $6.9M to eliminate future Contingent Interest payments under its Secured Financing Facility. Charge

represented a $.30 reduction in EPS for the quarter

Encore EPS vs. Consensus

The Encore of today

•

Disciplined purchases at

returns in excess of hurdle

rates

•

Enhanced analytics to

drive improving liquidations

•

Improved cost to collect

through efficient operations

•

Expansion into other asset

classes

1 |

ENCORE PROVIDES A PRINCIPLED AND ESSENTIAL SERVICE

Contingency

collection agency

Collection

time frame

•

4-6 months

Consumer

experience

Pressure

•

Artificial deadlines

•

Multiple

exchanges of

sensitive data

•

Counter productive

incentives

Outcome

•

Consumer is

confused and

frustrated

8

•

84 months to

recover financially

Partnership

•

Create partnership

strategy and set goals

•

Tailor solutions to

individuals

•

Single point of contact

•

Maximizes repayment

likelihood, and

ensures fair treatment

vs.

Relationship is

transactional

•

Attempt to collect during

initial delinquency cycle

•

Consumer is "charged-

off" by issuer on day

181 of cycle

•

No longer considered a

'customer' by creditor

Original creditor

PROPRIETARY |

PROPRIETARY

OUR INVESTMENTS REFLECT OUR PRINCIPLES AND DESIRE TO TREAT

CONSUMERS FAIRLY AND WITH RESPECT

9

•

Acknowledging limitations of our consumers’

household balance sheets to align recovery plans

•

Deploying specialized surveys to test consumer

satisfaction

•

Built specialized non-collections work groups to serve

consumer needs

•

Established Consumer Credit Research Institute to

better understand the financially stressed consumer

•

Living the Consumer Bill of Rights

•

Creating resources and directing financially stressed

consumers to best external references

•

Founded Consumer Experience Council

Understanding

our consumers

Making focused

investments

Improving

consumer

experience |

PROPRIETARY

WELCOMING KEN VECCHIONE

Ken Vecchione

Chief Executive Officer

10 |

PROPRIETARY

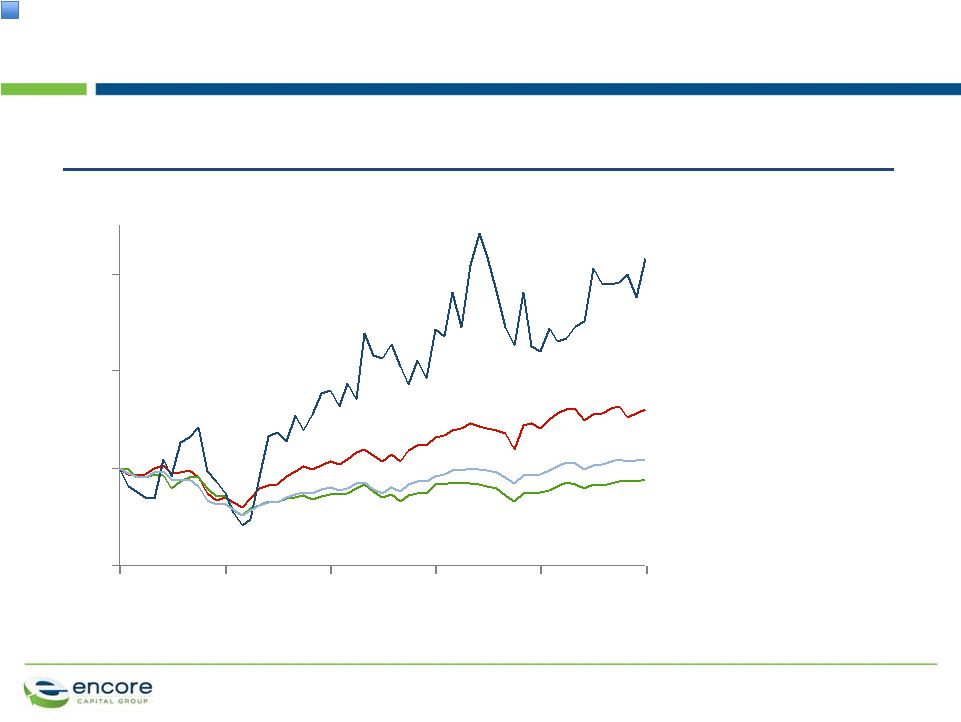

ENCORE HAS DELIVERED INDUSTRY LEADING TOTAL SHAREHOLDER

RETURN OVER THE PAST 5 YEARS

11

Total Shareholder Return (Dec. 2007-Dec. 2012)

0

100

200

300

2010

2009

2008

2013

2012

2011

10%

S&P Top Quartile

1

:

(2%)

Nasdaq Finance:

26%

Encore Capital:

2%

S&P Index:

(%)

1. Top Quartile tracks the dollar weighted average of the companies which fall in the 70th – 80th

percentile range of the S&P 500 |

PROPRIETARY

1,967

1,571

1,389

1,160

1,063

892

0

500

1,000

1,500

2,000

($M)

2012

2011

2010

2009

2008

2007

ENCORE HAS RAPIDLY GAINED SCALE AND POSITIONED ITSELF

FOR SUSTAINED GROWTH

12

Note: Excludes the ~$1B in Estimated Remaining Collections of AACC

Estimated Remaining Collections in core receivables

+17% |

200

400

600

0

($M)

2012

562

2011

387

2010

362

2009

257

2008

230

2007

209

THIS SCALE HAS BEEN CREATED BY MARKET LEADING INVESTMENTS

13

+22%

Capital deployed in core receivables

PROPRIETARY |

PROPRIETARY

ENCORE HAS CONSISTENTLY IMPROVED OPERATIONS BY

MASTERING THE DETAILS

14

Proactive investments in compliance

& engagement with regulators has

enhanced effectiveness

Operating with principled intent

Investing to build industry leading

compliance functions and practices

Proactively engaging with the

CFPB on policy matters

Persistent focus on operating

efficiencies have lowered costs

40.4

42.2

43.7

47.6

50.2

51.5

2012

2011

2010

2009

2008

2007

Total Cost to Collect (%) |

ENCORE HAS A STRONG MANAGEMENT TEAM WITH A LONG

TRACK RECORD OF SUCCESS

15

Amy Anuk

SVP,

Business

Development

Jack Nelson

CEO, Propel

Ken Vecchione

Chief

Executive

Officer

Paul Grinberg

Chief

Financial

Officer

Ashish Masih

SVP, Legal

Collections

Jim Syran

SVP, Operations &

Marketing

Carl Eberling

Chief

Information

Officer

Steve Gonabe

SVP,

Human

Resources

Brandon Homuth

SVP, Global

Operations

Sheryl Wright

SVP, External Affairs

Greg Call

SVP,

General

Counsel

Christopher Trepel

Chief Scientific

Officer

Manu Rikhye

SVP, Indian

Operations

GK Sinha

SVP, Human

Resources

PROPRIETARY

|

ENCORE IS WELL POSITIONED TO MAINTAIN ITS MOMENTUM AND

CONTINUE DELIVERING TOP QUARTILE TSR

16

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

•

Specialized call

centers

•

Efficient international

operations

•

Internal legal

platform

Operational Scale

& Cost Leadership

2

Strong Capital

Stewardship

3

•

Consumer

intelligence

•

Data driven,

predictive modeling

•

Portfolio valuation at

consumer level

•

Consumer Credit

Research Institute

Superior

Analytics

1

•

Uniquely scalable

platform

•

Strategic investment

opportunities in near-

in geographic and

paper type

adjacencies

Extendable

Business Model

4

•

Sustained success

at raising capital

-

Low cost of debt

-

Sustainable

borrowing capacity

and cash flow

generation

•

Prudent capital

deployment

PROPRIETARY |

PROPRIETARY

WE ARE POISED FOR CONTINUED GROWTH

Paul Grinberg

Chief Financial Officer

17 |

PROPRIETARY

SUPERIOR ANALYTICS DRIVES PROFITABLE GROWTH

18

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

Operational Scale

& Cost Leadership

2

Strong Capital

Stewardship

3

•

Consumer

intelligence

•

Data driven,

predictive modeling

•

Portfolio valuation at

consumer level

•

Consumer Credit

Research Institute

Superior

Analytics

1

Extendable

Business Model

4 |

OUR SUPERIOR ANALYTICS STEM FROM OUR INVESTMENTS TO

BETTER UNDERSTAND CONSUMERS...

19

Industrialized

behavioral

science

R&D that

includes field

experiments

and new theory

development

Reporting and

alerts

Basic

consumer

segmentation

and targeting

Statistical

analysis and

forecasting

Simple

models to

increase

collection

returns

Predictive

modeling and

optimization

Advanced

models focused

on consumer

behavior and

financial ability

2001

2005

2012

PROPRIETARY |

PROPRIETARY

Encore’s individual

underwriting approach

to portfolio valuation

accommodates our

specialized operational

strengths

Low willingness

Low ability

High willingness

High capability

High willingness

Moderate capability

High willingness

Low capability

Low willingness

High ability

Low willingness

Moderate ability

...WHICH IS CLEARLY SEEN IN OUR APPROACH TO CONSUMER LEVEL

PORTFOLIO VALUATION

20

•

Enforce legal contract

through formal channels

•

Remind consumers through

legal messaging

•

Hardship strategies and removal

from the collections process

•

Significant discounts

and many small

payments

•

Payment plans and

opportunities to build

longer relationships

•

Strong partnership and

recovery opportunities |

PROPRIETARY

0

500

1,000

1,500

# of transactions

Total profitable

deals

2

~1,200

Principal

recovered, but

not all

servicing costs

~80

Principal not

fully recoverd

~10

Total purchase

transactions

~1,290

OUR SUPERIOR ANALYTICS HAVE LED TO A STRONG PORTFOLIO

PURCHASING TRACK RECORD

21

Deal accuracy since 2000 (~1290 total deals

)

~93% of

total

1. Actual and forecast 2. Defined as deals where principal and servicing cost were

recovered. 1 |

PROPRIETARY

THROUGH OUR INVESTMENTS IN ANALYTICS OUR EFFECTIVENESS

HAS INCREASED BY 11%

22

Improved liquidation in our call center channel

1. Of like portfolios through call center channel 2. 2008 = 100

Note: Assumes 8% marginal cost to collect through call center channel, 40% tax

rate, 2.3x CCM, 25M diluted shares outstanding Indexed liquidation

rate 2

+11%

111

100

80

90

100

110

120

2012 Vintage

2008 Vintage

Impact of 11% improvement in

liquidation (2008-2012)

•

In

2012,

we

collected

$442M

through our call center channel

•

In 2008, we would have only

collected

$398M

•

~$44M

in incremental cash

collections

•

~$0.50

in incremental EPS

1 |

PROPRIETARY

OPERATIONAL SCALE & COST LEADERSHIP EXPAND MARGINS

23

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

•

Specialized call

centers

•

Efficient international

operations

•

Internal legal

platform

Operational Scale

& Cost Leadership

2

Strong Capital

Stewardship

3

Superior

Analytics

1

Extendable

Business Model

4 |

PROPRIETARY

36.5

40.4

42.2

43.7

47.6

50.2

51.5

2007

Q1 2013

2012

2011

2010

2009

2008

Internal Legal investments

WE HAVE THE INDUSTRY LEADING COST PLATFORM, DRIVEN BY

CONTINUING OPERATIONAL IMPROVEMENTS

24

Increased specialization in call centers

Scaling Indian call center

Improving analytics

Overall Cost to Collect (%) |

PROPRIETARY

CONTINUING INVESTMENTS IN LOWER-COST INTERNAL LEGAL

COLLECTIONS EXPECTED TO FURTHER DRIVE DOWN COSTS

25

Quicker ability to respond to

new regulation

Increased control over

consumer experience

Enhanced liquidation

Additional benefits from

Internal Legal investments

Internal Legal channel expected to

lower costs once scale achieved

’17E

’16E

’15E

’14E

’13E

’12

’11

Internal Legal Collections ($M)

Internal Legal Cost to Collect (%)

$2

$19

$50

$90

$140

$175

$200

164%

53%

37%

29%

24%

19%

18% |

PROPRIETARY

STRONG CAPITAL STEWARDSHIP ENHANCES RETURNS

26

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

Operational Scale

& Cost Leadership

2

Strong Capital

Stewardship

3

Superior

Analytics

1

Extendable

Business Model

4

•

Sustained success

at raising capital

-

Low cost of debt

-

Sustainable

borrowing capacity

and cash flow

generation

•

Prudent capital

deployment |

PROPRIETARY

•

Debt is our working capital

–

Capital deployment business

which generates strong cash

flows

EFFICIENT CAPITAL STEWARDSHIP IS CRITICAL TO ENCORE'S

SUCCESS

27

•

Strong cash flow allows for

TSR driving investments

–

Reinvest in wide range of

receivables

–

Return capital to shareholders

when it is highest return option

Prudent investment in

adjacencies to supplement

core growth

•

Reinvest

in core

•

Adjacent

Spaces

External

capital

Portfolio

purchases

Collections

process

Cash flow

•

Return to

shareholders |

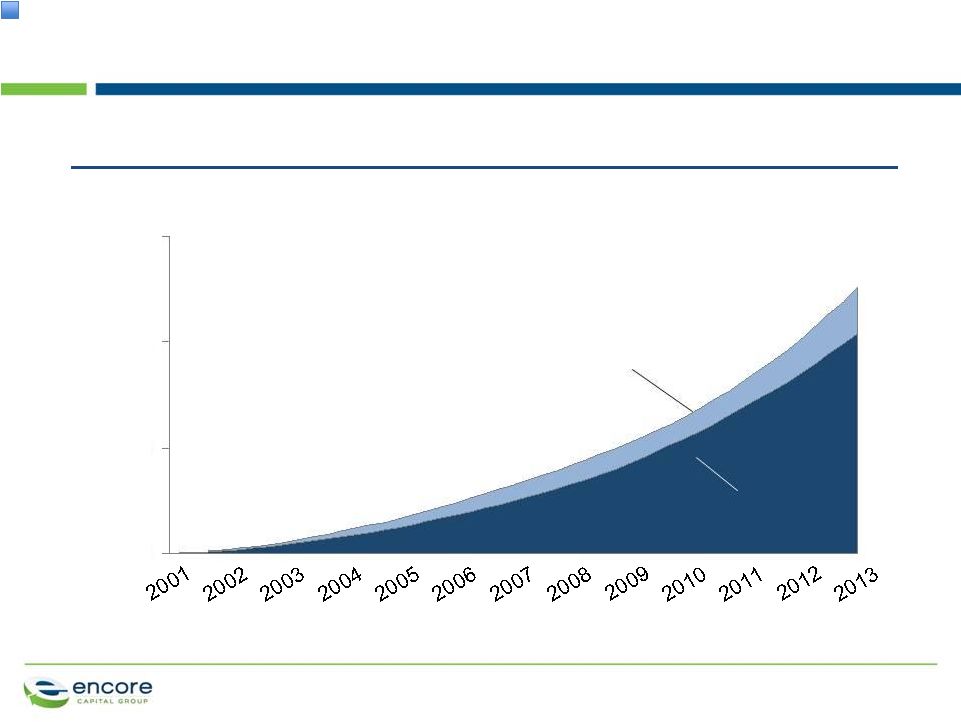

PROPRIETARY

Estimated Remaining Collections (ERC) vs. Net Debt

WE HAVE A STRONG ABILITY TO QUICKLY RAISE CAPITAL WHICH

IS SUPPORTED BY OUR ESTIMATED REMAINING COLLECTIONS

28

1. Assumes liquidation cost to collect of 30% and a tax rate of 39.2%; Q1 2013

values as of 10-q filings; Assumes pro forma $1B of ERC from AACC 2.

Includes revolver, senior, and net convertible debt less cash Net Debt

3,000

2,000

1,000

0

($M)

2007

2008

2009

2010

2011

2012

Q1 2013

w/AACC

Gross

ERC

less

Cost

to

Collect

and

Taxes

1

Gross ERC |

PROPRIETARY

Initial

projections

WE BELIEVE THAT OUR CURRENT ESTIMATE OF REMAINING

COLLECTIONS IS CONSERVATIVE

29

Cumulative Collections -

initial expectation vs. actual

($M)

0

2,000

4,000

6,000

Actual cash

collections |

PROPRIETARY

OUR ABILITY TO RAISE ADDITIONAL CAPITAL ALLOWS US TO

PURSUE SUPPLEMENTAL GROWTH IN ADJACENT SPACES

30

...and structure our debt to maximize

flexibility for future growth

No impact on ability to

purchase core US receivables

•

Propel facilities are incremental

to, and separate from, our core

debt facilities

•

We will continue to pursue and

deploy separate pools of capital

Note: Core debt includes revolver, term loan, Prudential notes, and convertible

notes plus accordion We have the debt markets expertise

to fund new opportunities...

1,500

1,000

500

0

Total debt availability ($M)

Current

975

2007

330

Core debt

1,275

300

Separate Propel

facilities |

PROPRIETARY

THE

TRADITIONAL

DEBT

TO

EBITDA

METRIC

IS

NOT

THE

CORRECT

WAY

TO

LOOK

AT

OUR

LEVERAGE

31

Debt / EBITDA multiple

Note: Does not include Debt / EBITDA resulting from Cabot

4.6x

4.4x

3.1x

4.0x

4.7x

7.8x

4.5x

0.0x

2.0x

4.0x

6.0x

8.0x

2010

Q12013

TTM

2012

2011

2009

2008

2007

Pro forma

with AACC |

PROPRIETARY

Getting to Adjusted EBITDA ($M)

ADJUSTED

EBITDA

IS

THE

BEST

MEASURE

OF

THE

FUNDAMENTAL

ECONOMICS OF OUR BUSINESS

32

Adjusted EBITDA explained

Cash Collections less

adj.

operating cost

True measure of cash

generation

Metric our lenders use to

evaluate our business and

write our covenants

Recovery of the portfolio

purchase price taken out to

get to EBITDA

³

1. Includes ~$12M of tax liens income. 2. Includes ~$15M of one time charges such

as stock based compensation expense, acquisition related expenses, and cash inflow of other services

income from tax lien transfer operation segment. 3. See end of presentation for

reconciliation of Adjusted EBITDA to GAAP Net Income Note: Represents 2012

performance; Tax Liens Cash includes $1.7 M of cash inflow of other service income from tax lien transfer operation segment.

Recovery of

principal &

other

²

Operating

costs

383

Cash

Collections

¹

960

160

EBITDA

417

Adjusted

EBITDA

577 |

PROPRIETARY

1.2x

1.2x

0.9x

1.1x

1.2x

1.5x

1.5x

0.0x

0.5x

1.0x

1.5x

2.0x

Q12013

TTM

2012

2011

2010

2009

2008

2007

DEBT

TO

ADJUSTED

EBITDA

IS

THE

CORRECT

LEVERAGE

METRIC

AND IS THE BASIS FOR HOW LENDERS UNDERWRITE OUR DEBT

33

Note: Does not include Debt / Adjusted EBITDA resulting from Cabot; See end of

presentation for reconciliation of Adjusted EBITDA to GAAP Net Income Debt /

Adjusted EBITDA multiple 2.0x leverage capacity

Pro forma

with AACC |

PROPRIETARY

ENCORE'S CAPITAL DEPLOYMENT IS FOCUSED ON DELIVERING

ATTRACTIVE AND SUSTAINABLE TOTAL SHAREHOLDER RETURN

34

All investments viewed through lens of

Total Shareholder Return

Deployment priorities

Reinvestments in core

receivables business

•

All investments bound by IRR guidelines

•

Maintain operational flexibility with a

range of core asset classes

Principles for capital deployment

Investments in

near-in adjacent spaces

•

Prudent investment in adjacent spaces

which leverage our core competencies

Return of capital

to shareholders

•

Recognize there are times when best

investment is to return cash |

PROPRIETARY

OUR CORE MARKET REMAINS ATTRACTIVE

35

•

Competitors driven from marketplace by increasing

operating costs, high costs of capital, and lower

liquidation levels

•

Issuers selling to a smaller, more select group of

buyers

Market demand

Continued

consolidation

•

Issuers expected to resume normal selling patterns

once audits are complete

•

Resale market is robust as competitors leave the

industry

Market supply

Favorable

dynamics |

PROPRIETARY

2014 Expected

$620 –

$700M

$400 –

$450M

$120 –

$140M

$100 –

$110M

2013 Expected

$550M

$110M

$695M

GOING

FORWARD,

WE

EXPECT

TO

DEPLOY

$620

–

$700

MILLION

PER YEAR

36

Encore capital deployment (2013-2014)

Cabot

¹

Propel

Core US

$35M

1. Represents only Encore's economic interest in Cabot, which is 42.8% of total. 2013 figure

represents only last 5 months of Cabot capital deployment in 2013. Total amount of

expected capital deployment for Cabot is $200M and $230 - $250M for 2013 and 2014 respectively. |

EXTENDABLE BUSINESS MODEL EXPANDS REVENUE

OPPORTUNITIES

37

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

Operational Scale

& Cost Leadership

2

Strong Capital

Stewardship

3

Superior

Analytics

1

•

Uniquely scalable

platform

•

Strategic investment

opportunities in near-

in geographic and

paper type

adjacencies

Extendable

Business Model

4

PROPRIETARY |

PROPRIETARY

International

New asset

classes

Expand core

footprint

Bankrupt

accounts

Focus on

bankruptcy

Outsourcing

services

Expand

along value

system

Secured

loans

Cover

different

type of debt

Performing

loans

Expand along the

debt life cycle

Chapter 13

Chapter 7

Pre-charge off

delinquencies

Early

delinquencies

Auto

debt

Tax

liens

Mortgage

debt

Countries with

mature credit

systems

Emerging

markets

Contingency

collections

First party

collection

services

Municipal

obligations

Student

loans

Utilities

Expand

geographically

WE CONTINUE TO EXPLORE ADJACENCIES TO SUPPLEMENT OUR

GROWTH

38

Defaulted

National

Existing asset

classes

Purchase

Unsecured

Defaulted

Credit

cards

Telecom

and other

utilities

Penetrate

existing market

Consumer

loans |

PROPRIETARY

New asset

classes

Bankrupt

accounts

Outsourcing

services

International

Secured

loans

Performing

loans

AND HAVE FOCUSED ON DEALS AND INITIATIVES THAT ALIGN

WITH OUR CORE BUSINESS

39

$83.6M

investment

in BK paper

in 2012

Expand

geographically

Focus on

bankruptcy

Cover

different

type of debt |

WE HAVE MADE SIGNIFICANT PROGRESS EXECUTING OUR PLANS

FOR PROPEL

40

Our plan

Existing

market

•

Working to penetrate the

80% of the Texas market

that doesn't use tax lien

transfers

1

What we've delivered

•

Developed & implemented

model for direct mailing

•

Started outbound calling

w/existing Encore facilities

•

Lobbying to introduce

legislation in other states

that will create new markets

2

•

Successfully worked with

Nevada to pass legislation

•

Advancing legislative push

to other states

•

Purchased tax lien

certificates in three states

New

opportunities

•

Exploring alternative tax lien

models that will allow us to

expand into new markets

3

New

markets

PROPRIETARY |

PROPRIETARY

RESULTING IN GROWTH IN THE SIZE OF OUR PORTFOLIO WHILE

MAINTAINING AN EXCEPTIONALLY LOW RISK PROFILE

41

$8,750 average balance

8-year term

6-year weighted average life

13-15% typical interest rate

Texas portfolio characteristics

$230,000 average property value

4.6% average LTV at origination

1.0% foreclosure rate

Zero losses

Propel portfolio size

154

137

121

99

0

100

200

Q1 2013

2012

2011

2010

($M) |

PROPRIETARY

AACC INTEGRATION

Ashish Masih

SVP, Legal Collections / AACC Integration Lead

42 |

PROPRIETARY

Acquisition of

competitors’

assets

Practice

makes perfect

Operational

advantages

WE ARE POISED TO BE INDUSTRY LEADERS AS CONSOLIDATION

OCCURS

43

Accurate

valuations |

PROPRIETARY

WE HAVE A STRONG TRACK RECORD ACQUIRING PORTFOLIOS

FROM OTHER DEBT PURCHASERS SIMILAR TO AACC

44

$90M portfolio purchased in 2005

$100+M portfolio purchased in 2012

Initial

expectations:

$59M

Results to date:

$77M

Initial

expectations:

$199M

Results to date:

$237M

2005

2007

2009

2011

Jun-12

Sep-12

Dec-12

Mar-13

2013

100

0

300

200

Cash Collections ($M)

80

60

40

20

0

Cash Collections ($M) |

Largely satisfies our 2013

purchasing goals with

attractive vintages

45

THE ASSET ACCEPTANCE DEAL IS WELL ALIGNED WITH OUR

STRATEGY AND ADDS $1 BILLION TO ERC

Allows us to be selective in

purchases for the remainder

of the year

Able to leverage best

practices across the two

platforms to drive synergies

PROPRIETARY |

WE CAN

LEVERAGE OUR PLATFORM AND CAPABILITIES TO REALIZE SUBSTANTIAL SYNERGY VALUE AT

AACC : Leverage Encore's

lower cost platform to expand margins on cash

collections

2

Match Encore's

lower collection

cost in 9 months

: Integrate AACC's

strong internal legal platform

to drive additional

overall operating efficiencies

3

Accelerate migration

to internal legal

platform by ~2 years

Source of value

Impact

Deeper consumer insight and analytics:

More focused segmentation and targeting,

resulting in better collections

CCM target

of ~2.0 –

2.5x

1

46

PROPRIETARY

Lower cost structure

Internal legal collections |

PROPRIETARY

AACC'S INTERNAL LEGAL PLATFORM ACCELERATES ROLLOUT OF

OUR PLATFORM AND HELPS US ACHIEVE END-STATE FASTER

47

Encore

today

Combined

company today

Encore internal legal placement forecast

Internal legal collections during year ($M)

% of total legal placements at end of year

$2

$90

$19

$50

$140

$175

$200

8%

21%

37%

48%

50%

50%

50%

2011

2017

2016

2015

2014

2013

2012 |

WE HAVE A PLAN FOR A SEAMLESS INTEGRATION WITH AACC

48

Jul

Aug

Sep

Oct

Retention

agreements

Synergy

identification

Integration

planning

Nov

Dec

Jan

Pre-close

Jun

Call center rationalization

Support function rationalization

Law firm

management

Internal Legal platform integration

Finance integration

HR

integration

Consolidated Internal Legal platform

Close of AACC transaction

Collections agency rationalization

PROPRIETARY |

PROPRIETARY

CABOT ACQUISITION

Ken Vecchione

Chief Executive Officer

49 |

WE WAITED UNTIL WE FOUND AN OPPORTUNITY THAT FIT OUR

CRITERIA

50

Growth

potential

•

Cabot

specializes in the growing semi-performing debt

segment, which has very favorable repayment characteristics

Market leader

•

Cabot is the leading player in the U.K. debt purchase market

•

Cabot purchased

~£130M

of charged off debt in 2012

Leverages

Encore's

capabilities

•

Cabot can further benefit from Encore's strength in analytics

•

Opportunity to leverage our Indian operations for U.K collections

Strong

management

team

•

Cabot has an experienced and skilled management

team that can continue to grow its U.K. operations

Available for

the right price

•

Partnership with J.C. Flowers enables Encore to purchase a

controlling interest in Cabot at a reasonable price

PROPRIETARY |

PROPRIETARY

Market leader in U.K. debt management

•

Over 14 years of collections growth

•

Operations in Great Britain and Ireland

Specializes in higher balance, “semi-

performing”

(i.e., paying) accounts

•

Favorable repayment characteristics

Key statistics as of March 31, 2013:

•

£7.7B face-value of debt acquired for £706M

•

ERC = £934M

•

3.6M customer accounts

•

2012 collections = £161M

•

2012 capital deployment =

£130M

1

Cabot was the leading purchaser

of debt in the U.K. in 2012

CABOT IS THE LEADING PURCHASER OF DEBT IN THE U.K.

1. £31M funded by Anacap

For FY 2012

51

91

42

0

50

100

150

(£M)

Arrow

Lowell

Cabot

130

1 |

PROPRIETARY

ENCORE PROVIDES CABOT WITH SEVERAL SYNERGY

OPPORTUNITIES

Leverage

Encore's

operations

and know-

how

•

Enhance collections by leveraging

Encore's efficient operations,

including our operations in India

•

Leverage Encore's experience in

secondary and tertiary debt to

pursue new investments in the U.K.

•

Leverage Encore’s favorable

financing to fund growth

Leverage

Encore's

analytics

•

Deploy Encore's superior analytical

capabilities to the Cabot platform

•

Focus on improving account

segmentation and specialized

collection strategies

52

Invest in

different

segments |

PROPRIETARY

ENCORE'S ACQUISITION OF CABOT WILL PROVIDE A VEHICLE TO

CONTINUE ITS STRONG EARNINGS GROWTH

Growing market

•

Encore can deploy capital in a growing market

Profitable market

•

Portfolio IRRs are strong and favorable

Timeline

•

Deal expected to close in Q3 of 2013

Encore EPS

•

Supports Encore's 15% long-term EPS growth

¹

53

1. Calculation of EPS excludes one-time transaction and integration costs and non-cash

interest associated with the Company’s 2012 convertible debt offering. For forward-looking

EPS projections, such one-time costs or charges are not presently quantified

|

PROPRIETARY

ENCORE IS WELL POSITIONED TO MAINTAIN MOMENTUM AND

CONTINUE DELIVERING TOP QUARTILE TSR

54

Management Team •

Learning Organization •

Principled Intent

Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion

Top Quartile Total Shareholder Return

Specialized call

centers

Efficient international

operations

Internal legal

platform

Operational Scale

& Cost Leadership

2

Sustained success

at raising capital

Strong Capital

Stewardship

3

Consumer

intelligence

Data driven,

predictive modeling

Portfolio valuation at

consumer level

Consumer Credit

Research Institute

Superior

Analytics

1

Uniquely scalable

platform

Strategic investment

opportunities in near-

in geographic and

paper type

adjacencies

Extendable

Business Model

4

-

Low cost of debt

-

Sustainable

borrowing capacity

and cash flow

generation

Prudent capital

deployment |

PROPRIETARY

55

APPENDIX |

PROPRIETARY

RECONCILIATION OF ADJUSTED EBITDA

Reconciliation of Adjusted EBITDA to GAAP Net Income

(Unaudited, In Thousands)

Three Months Ended

PROPRIETARY

56

3/31/08

6/30/08

9/30/08

12/31/08

3/31/09

6/30/09

9/30/09

12/31/09

3/31/10

6/30/10

9/30/10

12/31/10

GAAP net income, as reported

6,751

6,162

3,028

(2,095)

8,997

6,641

9,004

8,405

10,861

11,730

12,290

14,171

(Gain) loss from discontinued operations, net of tax

(422)

(89)

46

(483)

(457)

(365)

(410)

(901)

(687)

(684)

(315)

28

Interest expense

5,200

4,831

5,140

5,401

4,273

3,958

3,970

3,959

4,538

4,880

4,928

5,003

Contingent interest expense

-

-

-

-

-

-

-

-

-

-

-

-

Pay-off of future contingent interest

-

-

-

-

-

-

-

-

-

-

-

-

Provision for income taxes

4,227

4,161

2,429

(1,781)

5,670

3,936

5,676

4,078

6,080

6,356

6,474

9,057

Depreciation and amortization

438

482

396

391

410

402

443

516

522

591

650

789

Amount applied to principal on receivable portfolios

40,212

35,785

35,140

46,364

42,851

48,303

49,188

47,384

58,265

64,901

63,507

53,427

Stock-based compensation expense

1,094

1,228

860

382

1,080

994

1,261

1,049

1,761

1,446

1,549

1,254

Adjusted EBITDA

57,500

52,560

47,039

48,179

62,824

63,869

69,132

64,490

81,340

89,220

89,083

83,729

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

6/30/12

9/30/12

12/31/12

3/31/13

GAAP net income, as reported

13,679

14,775

15,310

17,134

11,406

16,596

21,308

20,167

19,448

(Gain) loss from discontinued operations, net of tax

(397)

(9)

(60)

101

6,702

2,392

-

-

-

Interest expense

5,593

5,369

5,175

4,979

5,515

6,497

7,012

6,540

6,854

Provision for income taxes

8,349

9,475

9,834

10,418

11,660

12,846

13,887

13,361

12,571

Depreciation and amortization

904

958

1,054

1,165

1,240

1,420

1,533

1,647

1,846

Amount applied to principal on receivable portfolios

85,709

83,939

73,187

69,462

104,603

101,813

105,283

90,895

129,487

Stock-based compensation expense

1,765

1,810

2,405

1,729

2,266

2,539

1,905

2,084

3,001

Acquisition related expense

-

-

-

-

489

3,774

-

-

1,276

Adjusted EBITDA

115,602

116,317

106,905

104,988

143,881

147,877

150,928

134,694

174,483

Note: The periods 3/31/08 through 12/31/08 have been adjusted to reflect the retrospective application

of ASC 470-20. All periods have been adjusted to show discontinued ACG operations. |