Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOME LOAN SERVICING SOLUTIONS, LTD. | d548742d8k.htm |

Investor Presentation

June 2013

Exhibit 99.1 |

2

FORWARD-LOOKING STATEMENT:

This presentation contains forward-looking statements that involve substantial

risks and uncertainties. All statements, other than statements of historical

facts, included in this presentation, including, without limitation,

statements regarding the assumptions we make about our business and economic model, our

dividend policy, including expected yields, business strategy and other plans and

objectives for our future operations, are forward looking statements. These

forward-looking statements are subject to inherent risks and

uncertainties in predicting future results and conditions that could cause the actual results to differ

materially from those projected in these forward-looking statements. We have

included important factors in the cautionary statements made in our Annual

Report on Form 10-K, particularly under the headings “Risk

Factors”

and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” that we believe could cause actual results or

events to differ materially from those expressed or implied by the forward

looking statements that we make in this presentation. In light of the significant uncertainties in

these forward-looking statements, you should not regard these statements as a

representation or warranty by us or any other person that we will achieve

our objectives and plans in any specified time frame, or at all. Unless

required by law, we undertake no obligation to publicly update or revise any forward-looking

statements to reflect new information or future events or otherwise.

NON-GAAP MEASURES:

In addition to financial measures prepared in accordance with generally accepted

accounting principles (“GAAP”), this presentation also contains

references to cash generated available for distribution, servicing revenue

and servicing expense, which are non-GAAP performance measures. We

believe these non-GAAP performance measures may provide additional

meaningful comparisons between current results and results in prior periods.

Non-GAAP performance measures should be viewed in addition to, and not as an

alternative for, the Company’s reported results under accounting principles

generally accepted in the United States. |

3

Leadership Team

William C. Erbey

Chairman of the Board

John P. Van Vlack

President and Director

James E. Lauter

Chief Financial Officer

Richard Delgado

Treasurer

Michael J. McElroy

General Counsel

Bryon E. Stevens

Investor Relations & Capital Markets |

4

HLSS is an independent acquirer of high-quality mortgage servicing

assets Mortgage servicing advances

Fees from servicing non-agency mortgage loans (Rights to MSRs)

Objective is to generate a stable, recurring, fee-based earnings stream

Low

fixed

infrastructure

costs

given

all

key

servicing

functions

performed

by

Ocwen

Equity

market

capitalization

has

grown

from

~$200

million

at

IPO

in

March

2012

to

$1.3 billion¹

today

Conservative leverage and robust cash flow

HLSS Overview

Current

Ocwen

portfolio

includes

over

$100

billion

UPB

available

for

purchase

Demonstrated ability to close purchases simultaneous to funding prevents

earnings drag

WKSI eligibility simplifies future equity offerings and facilitates access to

capital Focused on adding similar non-agency mortgage assets (subprime

and Alt-A) HLSS's assets represent a 5% first-priority claim against

residential real estate $4.1 billion of assets collateralized by $92.5

billion UPB of loans serviced Opportunity to invest in stable non-agency

mortgage assets largely inaccessible to debt and equity investors

Unique business model with downside protection and potential to increase earnings

Liquidity

risk

mitigated

by

match

funded

capital

structure

–

assets

self-liquidate

at

par

1

Based on the closing share price of $22.84 per share on May 31, 2013

Business

Value

Proposition

Growth Plan |

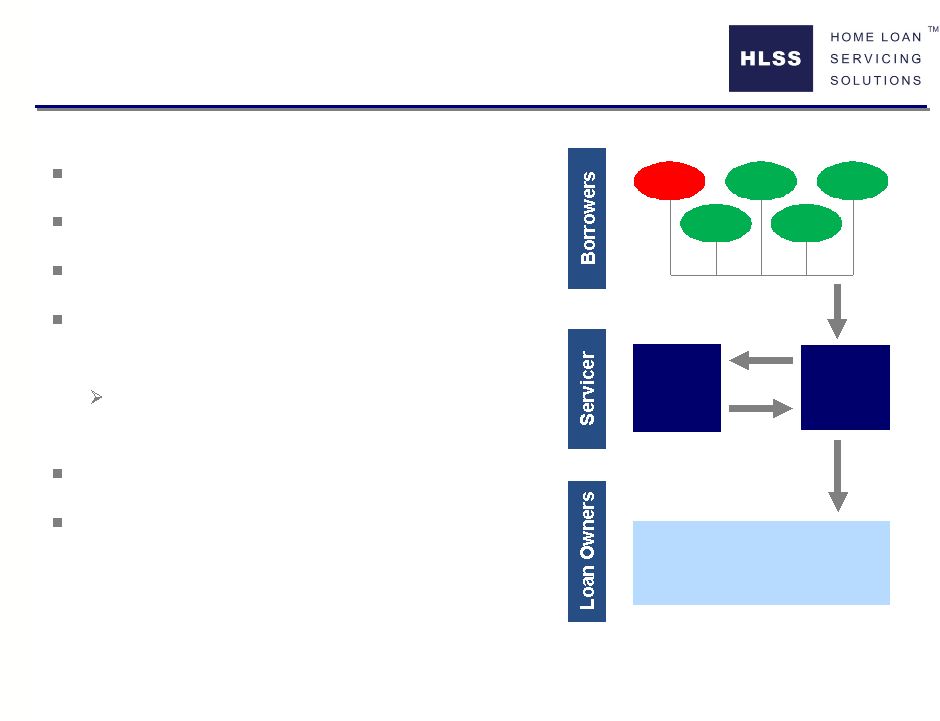

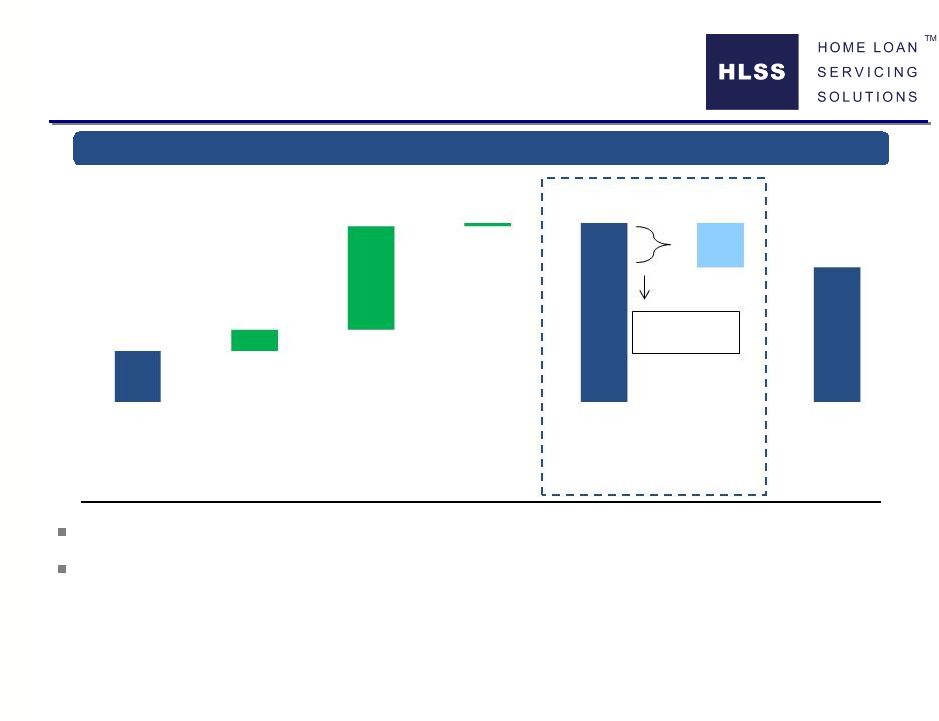

5

Mortgage Servicing

Back office for non-agency mortgage market

Receives payments from homeowner

Distributes payments to loan owner

Advance payments for delinquent borrowers

(Servicing Advances)

Repaid from borrower payments and

liquidation proceeds

Paid fixed fee (MSR Asset)

No exposure to mortgage credit losses

Borrower

Borrower

Borrower

Borrower

Borrower

Monthly P&I

+Liquidation Proceeds

Monthly P&I

+ Liquidation Proceeds

–

Servicing Fees

–

Advances Repaid

Bond Holders

Servicer

Servicing

Advances

New

Repaid |

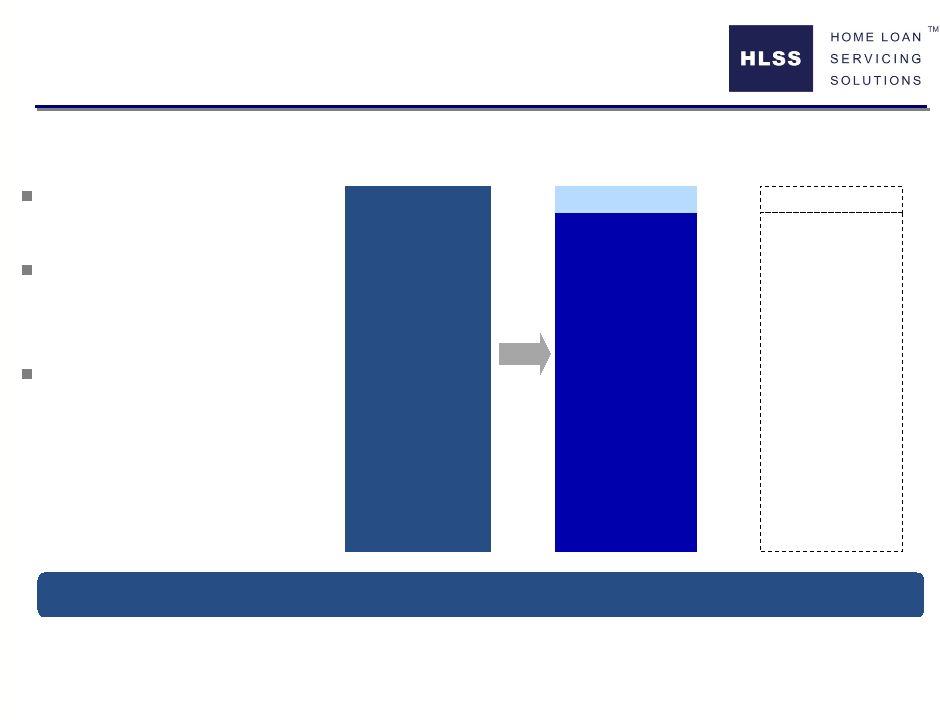

6

$92.5 Billion

UPB

$88.4 Billion

$4.1 Billion

~95% decline in real estate value would be required to impair HLSS's assets

95.6%

Downside

Protection

HLSS Assets

Minimal credit risk due to over

collateralization

Advances recovered at “top-

of-the-waterfall”

from loan

proceeds

If loan proceeds are ever

insufficient, recovery is from

collections on other loans in

RMBS trust

Assets Are a 5% First-Priority Claim |

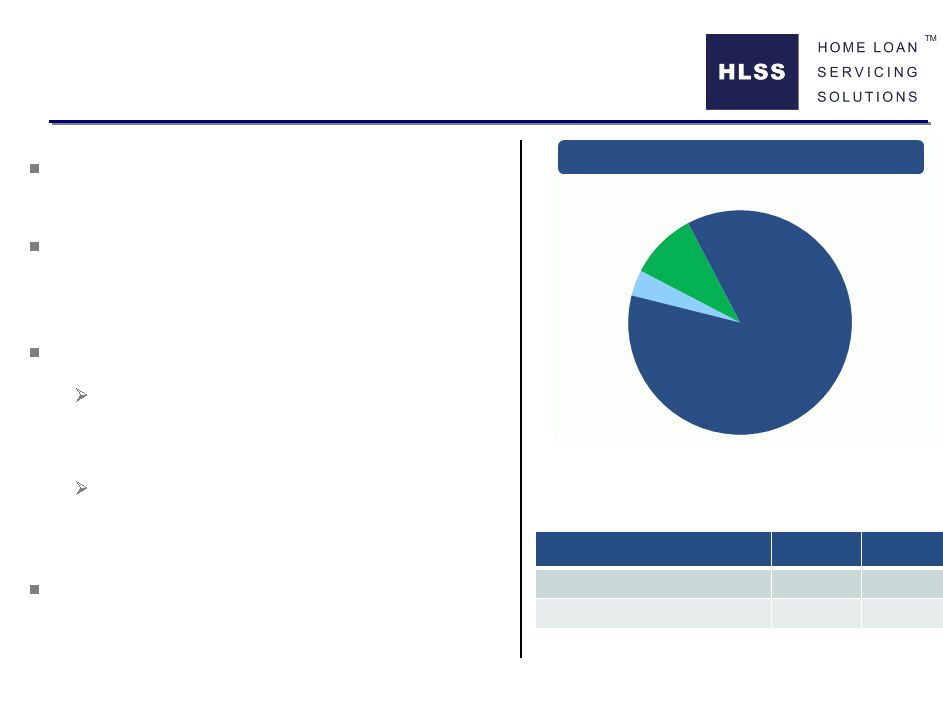

7

Limited Valuation Risk

Cash &

Reserves

$151.7

Total Assets of $4.1 billion are 23 times over-

collateralized by ending UPB of $92.5 billion

90% of assets are Servicing Advances or

Cash which are carried at par and have no

valuation risk

10% of assets have a stable valuation history

Rights to MSRs represent the present

value of future servicing fees, less

expenses

Low prepayment rate that is not

correlated with interest rates for this

portfolio of non-agency mortgages

No change in servicing asset valuations since

inception

($ in Millions)

1

Rights to

MSRs

$393.8

Total Assets

$4,069.8

100%

Servicing Advances & Cash

$3,676.0

90%

MSRs

393.8

10%

1

Reserves associated with the Advance Financing Facility

Servicing

Advances

$3,524.3

March 31, 2013 |

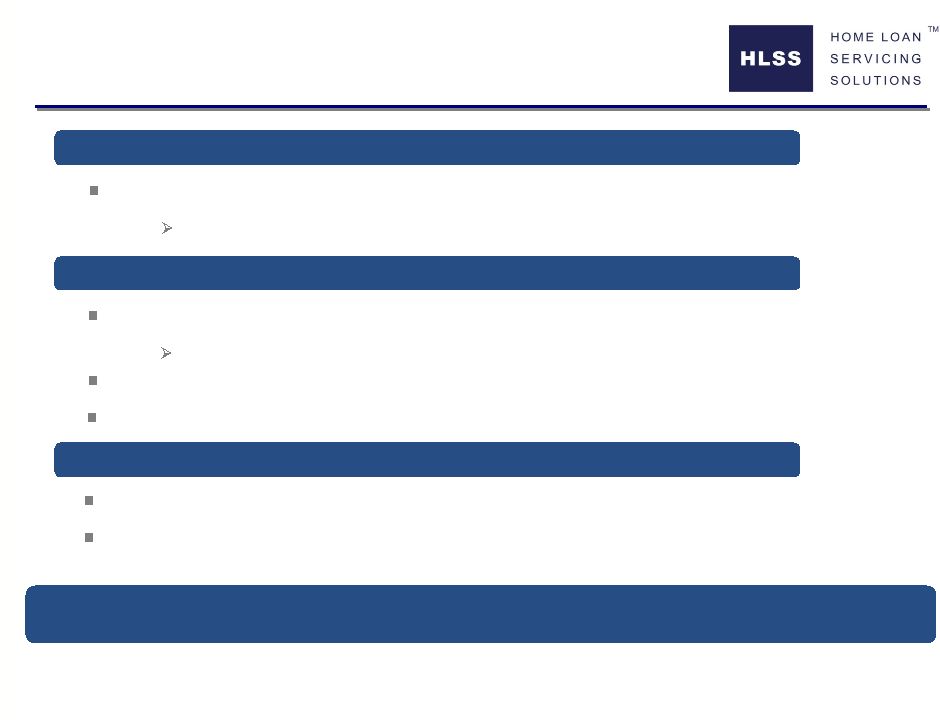

8

Stable Revenue and Expenses

Predictable Revenue Stream

Known Expense Structure

Hedged Financing Cost

Fixed rate notes with maturities matched to expected borrowing needs

Variable rate exposure hedged via LIBOR swaps extending 60 months

Stability

of

revenue,

borrowing

cost

and

asset

valuations

result

in

predictable

earnings

MSR amortization is based on prepayment speeds which have decreased

Ocwen bears operational risk and servicing cost volatility

Expenses based on asset value

Sub-servicing fees paid to Ocwen also based on UPB

Revenues based on asset value

Contractual annual revenue based on UPB |

9

23 bps

Subservicing

Fee paid to

Ocwen

17 bps

Incentive Fee

6 bps

Base Fee

~74%

Downside

Protection

~26%

Base Fee

HLSS's largest expense can be

reduced by up to ~74% to

stabilize earnings

Protects against higher interest

expense if Servicing Advances

increase

HLSS benefits from lower

interest expense if Servicing

Advances decrease

Incentive fee exceeds interest

expense, allowing HLSS's

earnings to withstand outsized

stress scenarios

Subservicing Fee Adjusts to

Support Targeted Yield

Note: Amounts based on 50bps servicing fee earned and 27 bps retained fee in Q1

2013. The incentive fee is the servicing fee minus the base fee and the retained fee |

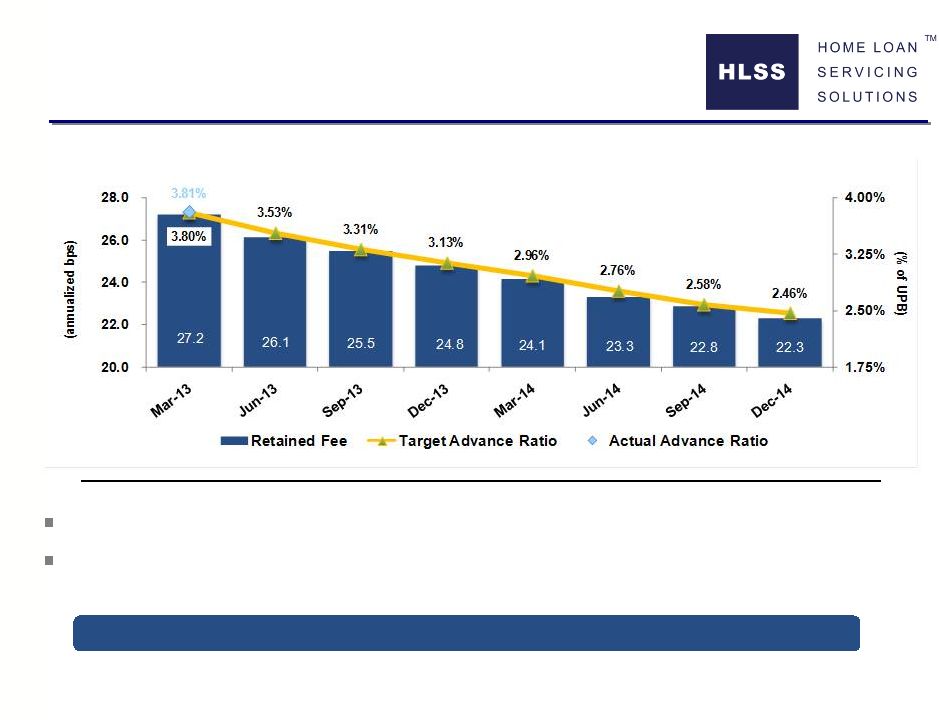

10

Ocwen Contract Ties Servicing

Fees to Advance Ratio

Scheduled step-downs in the retained fee and advance ratio

Fee split constructed to achieve a targeted yield at HLSS

Retained fees are servicing fees net of subservicing expenses paid to Ocwen

If the advance ratio is exceeded in any month, the performance-based incentive

fee is reduced at the annual rate of 5.33% on excess servicing

advances |

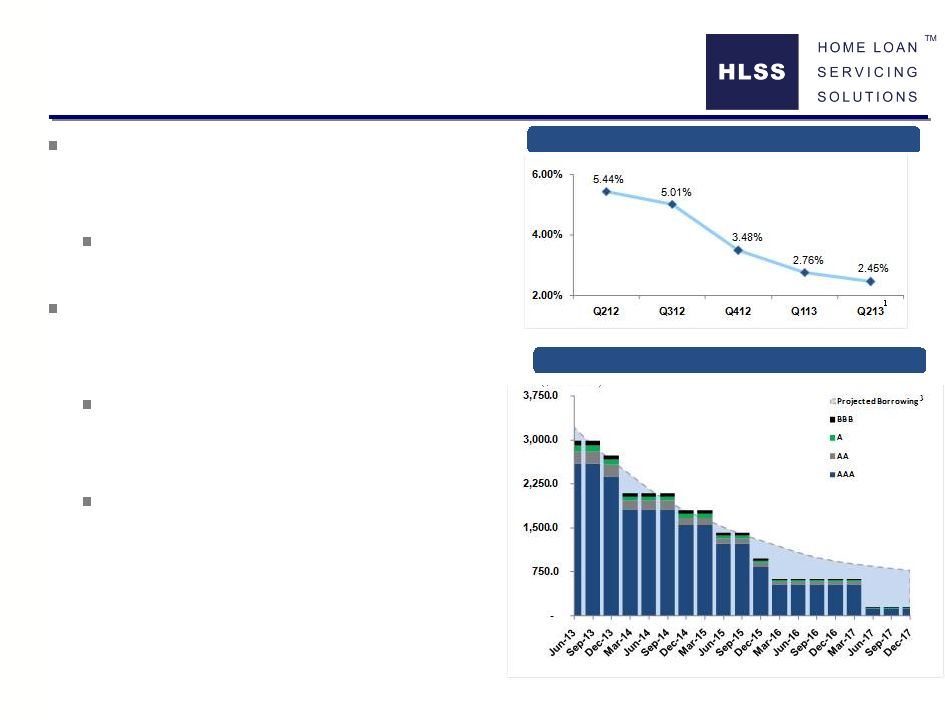

Fixed Rate Financing Stabilizes

Earnings

($ in Millions)

Financing costs have decreased as

lenders have come to recognize the credit

quality and stability of HLSS’s assets

Decreased financing costs have

contributed to increased earnings

HLSS seeks to lock-in interest expense by

financing servicing advances under fixed

rate ABS notes with terms up to 5-years

Additional variable funding note

capacity from banks with LIBOR swaps

to hedge interest rate exposure

Each acquisition is an opportunity to

dynamically rebalance fixed rate notes,

variable capacity and hedges

Fixed

Rate

Term

Note

Capacity

Lower Effective Interest Rate

1

Estimate based on March 31, 2013 borrowing adjusted for the issuance of $850 million

in term

notes

and

$346

million

in

incremental

borrowing

for

the

May

21,

2013

flow

purchase

2

Excludes VFN Capacity

3

Projected borrowing is calculated based on a 91% borrowing rate on projected

servicing advances for the current portfolio, assuming the targeted advance

ratios in the respective subservicing supplements and an annual prepayment

speed of 13.5% 1

11

2 |

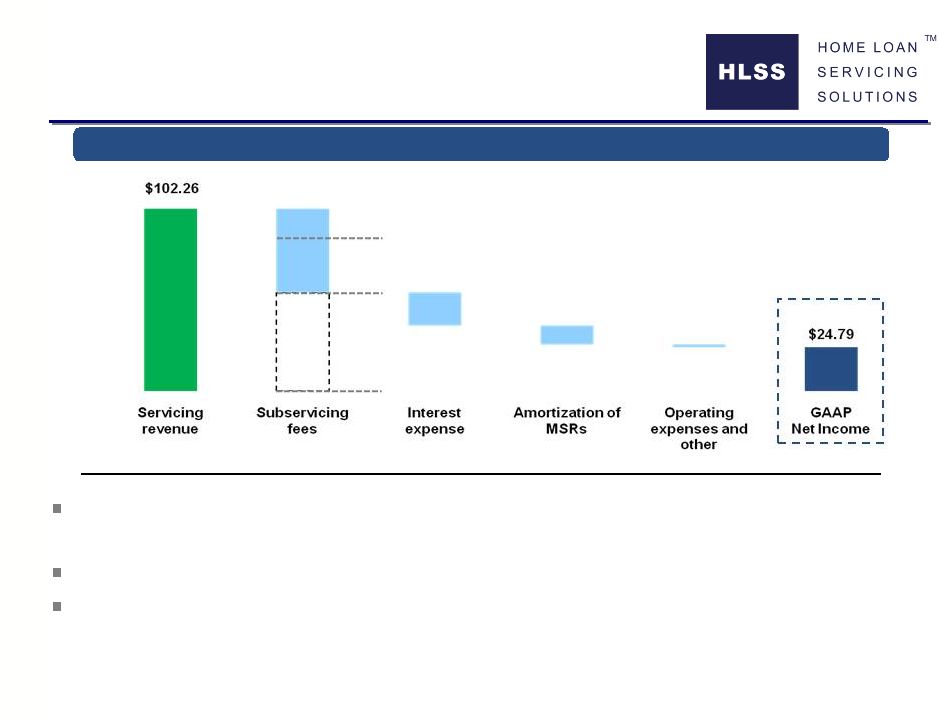

12

Components of Income

Incentive

Results for the first quarter include a $0.03 per share impact due to a lower

amortization rate of 12.7% versus the 15.0% expected rate

The

incentive

fee

represents

74%

of

total

subservicing

fees

paid

to

Ocwen

Earnings exceeded dividends declared during the quarter by $3.2 million

First Quarter 2013 Earnings

2

($ in Millions)

47.05

Basis points

per UPB¹

(Annualized):

1

Calculated using average UPB for 1Q 2013

2

Operating expenses and taxes, net of interest income and related party

revenue Retained Fee

50 bps

23 bps

9 bps

5 bps

1 bps

12 bps

Base

18.24

10.64

1.54 |

13

Cash generated available for distribution is 4x dividend declared during Q1

Cash

available

for

reinvestment

of

$65.89

million

allows

HLSS

to

replenish

and

grow

its servicing portfolio through additional purchases from Ocwen

($ in Millions)

First Quarter 2013 Cash Flow

Components of Cash Flow

Servicing

advances

decreased

by

$307.1

million,

excluding

the

most

recent

purchase,

freeing

up

the

cash

“haircut”

component

of

financing

1

$24.79

$87.50

$65.89

10.64

50.34

1.73

21.61

Net Income

Amortization of

MSRs

Decrease in

advance haircut

Changes in

other assets /

liabilities

Cash generated

available for

distribution

Dividends

declared

Cash

available for

reinvestment

4x Dividend

Coverage

1 |

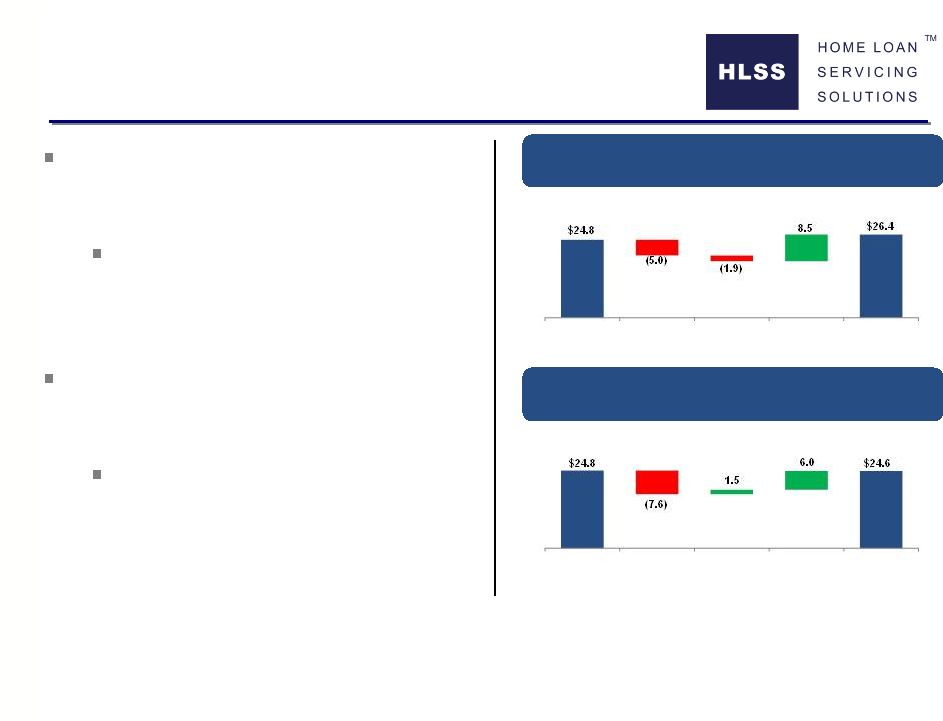

14

600bps Increase in LIBOR

HLSS Expects to Maintain Yield

Under Economic “Shocks”

Estimated Impact of a Spike in Delinquencies

and Advances on Net Income

1

Estimated Impact of a Spike in

LIBOR on Net Income

2

($ in Millions)

($ in Millions)

20% Increase in Servicing Advance Ratio

Q1 2013

Net Income

Equity Yield

on Advance

Haircut

Reduction of

Subservicing

Fee

Q1 2013

Adjusted Net

Income

Increase in

Interest

Expense

Q1 2013

Net Income

Increase in

Interest

Income

Realized

Gain on

LIBOR

Swaps

Q1 2013

Adjusted Net

Income

Increase in

Interest

Expense

HLSS’s contract with Ocwen is designed to

stabilize earnings if delinquencies and

servicing advances increase

20% increase in Servicing Advance

Ratio resulting from a severe economic

environment not expected to reduce

earnings

Fixed rate term borrowing and interest rate

hedges are designed to stabilize earnings if

interest rates increase

600bps LIBOR spike on variable

borrowing largely offset by realized

gains on interest rate swaps

This analysis is based on results for the quarter ended March 31, 2013. Results for prior periods

and the estimated adjustments are not necessarily indicative of results or the impact of adjustments for future periods.

1

“

Increase in Interest Expense” reflects estimated increase in borrowing cost to finance higher

Servicing Advances assuming no changes in interest rates or prepayment speeds. “Equity Yield on Advance Haircut”

reflects the foregone earnings (based on current earnings yield) resulting from the reduction in

income-earning MSR assets as more capital is invested in the equity component of Servicing Advances. “Reduction

in Subservicing Fee” reflects the amount the Performance Fee (a component of the Subservicing Fee)

would be reduced pursuant to arrangements in place.

2

“Increase in Interest Expense” reflects impact of rate increase on variable rate borrowing on

Servicing Advances based on the current note structure and assumes no change in asset values. “Increase in Interest

Income“ reflects the increase in interest earned on reserve accounts and corporate cash.

“Realized Gain on LIBOR Swaps” is based on swaps in place during Q1 2013 and assumes hedge accounting; it does not

include the change in swap deposits.

|

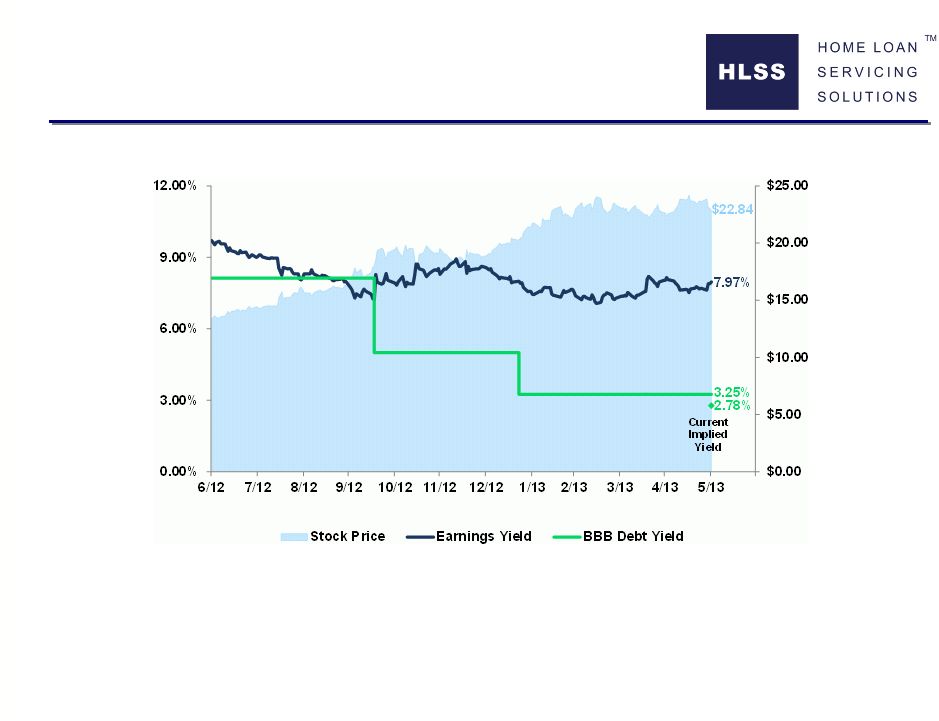

15

Equity and Debt Yields

Note: Earnings yields based on annualized per-share earnings guidance of $0.325 (Q1 2012 earnings

transcript), $0.325 (Q2 2012 earnings transcript), $0.385 (Q3 2012 earnings transcript), $0.405

(11/15/2012 press release), $0.425 (Q4 2012 earnings transcript) and $0.455 (Q1 2013 earnings transcript); calculation at a given date

contains most recent guidance divided by the share price. Debt yields based on

the most recent, 3-year BBB-rated servicing advance securitization at each respective date. Current implied yield point based on interpolation of

recently priced 2-year BBB-rated and 4-year BBB-rated servicing advance

securitizations. Prospective purchasers should not place undue reliance on expectations or guidance shown above, and

the presentation of guidance and results from prior periods should not be regarded as a representation that similar or better results will be achieved in future periods. |

16

Investment Highlights

Attractive risk-adjusted returns relative to other yield oriented

investments 7.4%

annualized

dividend

yield

based

on

current

share

price

23 times over-collateralization virtually eliminates credit risk

Asset

composition

–

90%

servicing

advances

and

cash

–

mitigates

valuation

risk

Profits purchased up front –

targeted return not dependent on asset appreciation or

valuations

Ocwen retains all operating risk under an incentive contract designed to stabilize

HLSS earnings

Solid downside protection with limited exposure to a down economy but opportunity

to increase dividend in an improving economy with rising interest

rates Cash flow in excess of dividend used to replenish and increase asset

base in accretive flow transactions

High Quality Assets

Stable Earnings Stream

Large Positive Alpha

Based on the closing share price of $22.84 per share on May 31, 2013.

1

1 |