Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TRANSATLANTIC PETROLEUM LTD. | d546468d8k.htm |

SunTrust

Robinson Humphrey “Play-by-Play”

Oil & Gas Conference

May 30, 2013

Exhibit 99.1 |

FORWARD

LOOKING STATEMENTS 2

Outlooks, projections, estimates, targets and business plans in this presentation or

any related subsequent discussions are forward-looking statements. Actual

future results, including TransAtlantic Petroleum Ltd.’s own production growth and mix; financial results; the amount and mix of capital expenditures;

resource additions and recoveries; finding and development costs; project and drilling

plans, timing, costs, and capacities; revenue enhancements and cost

efficiencies; industry margins; margin enhancements and integration benefits; and the

impact of technology could differ materially due to a number of factors. These

include market prices for natural gas, natural gas liquids and oil products; estimates of reserves and economic assumptions; the ability to produce and

transport natural gas, natural gas liquids and oil; the results of exploration and

development drilling and related activities; economic conditions in the countries

and provinces in which we carry on business, especially economic slowdowns; actions by

governmental authorities, receipt of required approvals, increases in taxes,

legislative and regulatory initiatives relating to fracture stimulation activities, changes in environmental and other regulations, and renegotiations of

contracts; political uncertainty, including actions by insurgent groups or other

conflict; the negotiation and closing of material contracts; shortages of drilling

rigs, equipment or oilfield services; and other factors discussed here and under the

heading “Risk Factors" in our Annual Report on Form 10-K for the year

ended December 31, 2012 and our Quarterly Report on Form 10-Q for the three months

ended March 31, 2013, which are available on our website at

www.transatlanticpetroleum.com and www.sec.gov. See also TransAtlantic’s audited

financial statements and the accompanying management discussion and analysis.

Forward-looking statements are based on management’s knowledge and reasonable expectations on the date hereof, and we assume no duty

to update these statements as of any future date. The

information set forth in this presentation does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities of the

Company. The information published herein is provided for informational purposes only.

The Company makes no representation that the information and opinions expressed

herein are accurate, complete or current. The information contained herein is current as of the date hereof, but may become outdated or

subsequently may change. Nothing contained herein constitutes financial, legal, tax, or

other advice.

The SEC has generally permitted oil and gas companies, in their filings with the SEC,

to disclose only proved reserves that a company has demonstrated by actual

production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We may use the

terms “estimated ultimate recovery,” “EUR,” “probable,”

“possible,” and “non-proven” reserves, “prospective resources” or “upside” or other descriptions of

volumes of resources or reserves potentially recoverable through additional drilling or

recovery techniques that the SEC’s guidelines may prohibit us from

including in filings with the SEC. These estimates are by their nature more speculative

than estimates of proved reserves and accordingly are subject to substantially

greater risk of actually being realized by the Company. There is no certainty that any portion of estimated prospective resources will be

discovered. If discovered, there is no certainty that it will be commercially viable to

produce any portion of the estimated prospective resources.

Boe (barrel of oil equivalent) is derived by converting natural gas to oil in the ratio

of six thousand cubic feet (Mcf) of natural gas to one barrel (bbl) of oil. Boe

may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1

bbl is based on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the wellhead. |

COMPANY

OVERVIEW TransAtlantic Petroleum Ltd. is an international energy company engaged in

the acquisition, development,

exploration

and

production

of

crude

oil

and

natural

gas

in

Turkey

and

Bulgaria.

3

NYSE-MKT:

Toronto:

TAT

TNP

Share Price

(1)

:

$0.84

Market Cap

(1)

:

$310 million

Enterprise Value

(1)

:

$330 million

Proved Reserves

(2)

:

11.6 MMboe

SEC PV-10

(3)

:

$511.0 million

(1)

Market data as of 5/24/2013.

(2)

DeGoyler and MacNaughton reserves as of 12/31/2012 based on $108.30/barrel and

$8.94/Mcf. (3)

Please see reconciliation of PV-10 to standardized measure at end of

presentation. Executive Management

Chairman & CEO:

N. Malone Mitchell, 3rd

President:

Ian J. Delahunty

VP, CFO:

Wil F. Saqueton

VP, Legal:

Jeffrey S. Mecom |

COMPANY

OBJECTIVES Work in countries with favorable fiscal terms where

we earn world market prices

•

Türkiye (Turkey)

•

Bulgaria

4

Acquire assets with known production or verifiable

“show”

wells

•

Utilize technology to enhance or commercialize

•

Earn early cash flow from sales

•

Evaluate, plan & monitor from Dallas, Texas headquarters

–

Seismic, horizontal, and stimulation

–

12.5% Royalty, no production tax

–

Oil: Brent less $7-10, Natural gas: +/-

$10/mcf

–

Currently imports nearly all oil and natural gas

–

2.5% Royalty (until 1.5x payout), no production tax

–

Natural gas: +/-

$9/mcf

–

Currently imports nearly all oil and natural gas |

2013 PLAN

OF ACTION 5

Financial Overview

•

$130 million capital budget

•

Operate within cash flow, cash on hand and credit

availability

•

Accelerate with consummation of a joint venture

Southeastern Türkiye

•

Drill horizontal wells to increase productivity

•

3D seismic of Molla blocks

•

Expand 2012 discoveries (Goksu, Bahar, and Alibey)

•

Resume development at Selmo with horizontal wells

•

Arar acquisition of more than 150,000 acres in Molla

area, 100% working interest and operatorship

Northwestern Türkiye

•

Tekirdag development project: low risk gas

production growth, 2 well horizontal trial

•

Hayrabolu: exploration and delineation wells,

overpressure below 1,500 meters

•

Final exploitation of Edirne blocks (NW Thrace)

•

Limited development within TPAO (Turkish

Petroleum) joint blocks

•

3D on Osmanli structure near Thrace area “kitchen”

Bulgaria

•

Expect to resume activity 3Q 2013

•

Reviewing other prospects outside Türkiye |

CURRENT

OPERATIONS 6

125 miles

200 kilometers |

1Q 2013

RESULTS 7

Net sales (Boed)

4,144

Realized oil price (per bbl)

$103.00

Realized natural gas price (per mcf)

$10.12

Net income ($MM)

$3.0

Adjusted EBITDAX ($MM)

$19.5

Cash and cash equivalents ($MM)

$19.4

Debt ($MM)

$39.8

Note: Results are for the three months ending March 31, 2013. Realized prices are

unhedged. Net income and Adjusted EBITDAX are from continuing operations. Please see reconciliation of

Adjusted EBITDAX to net income at end of presentation. |

ASSET

CHARACTERISTICS 8

Natural

Gas

18%

Oil

82%

Undeveloped

44%

Developed

56%

Oil

64%

Natural

Gas

36%

Selmo

45%

Thrace

20%

Other

20%

(1)

DeGolyer and MacNaughton reserves as of 12/31/2012, based on $108.30/barrel and

$8.94/Mcf. Goksu

9%

Molla 6%

Growth

Profile

(1)

1Q13 Production Profile

Reserve

Profile

(1) |

TÜRKIYE: SOUTHEAST

9

Action Plan

•

Drill horizontal wells to

increase productivity

•

3D seismic of Molla

blocks

•

Expand 2012

discoveries (Goksu,

Bahar and Alibey)

•

Resume development at

Selmo with horizontal

wells

•

Prepare to drill on

licenses acquired in May

2013

TransAtlantic’s properties in southeastern Türkiye have common geology with

Syria and Iraq. GAZIANTEP

MOLLA –

ARPATEPE

SELMO

BAKUK -

IDIL |

MOLLA

– ARPATEPE AREA

10

TransAtlantic’s

Arpatepe Field

TransAtlantic’s

Selmo Field

TransAtlantic’s

Bahar Field

TransAtlantic’s

Goksu Field

Shell/TPAO

Saribugday-1

Perenco’s

Kestal Field

(EUR 15 MMbo)

TransAtlantic’s

May 2013 Acquisition

TransAtlantic’s

Molla Field

TransAtlantic

3D Seismic Area

Bati Raman Field

Largest oil field in Türkiye |

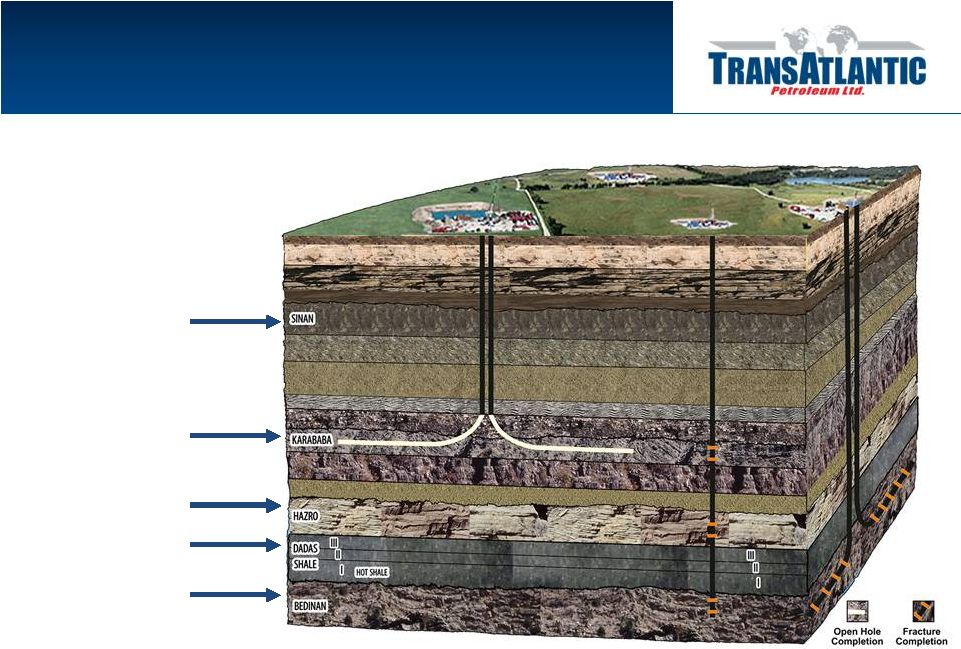

MOLLA

– ARPATEPE STACKED PAY POTENTIAL

11

Demonstrated

horizontal success with

Goksu 3H over

250 BOPD after ~5

months of production

Vertical discovery

(Bahar-1) IP after frac

at ~600 BOPD;

Horizontal currently

drilling

Tested 150 BOPD

(Bahar-1)

Potential resource

play

Oil

shows

–

untested

Selmo producing zone |

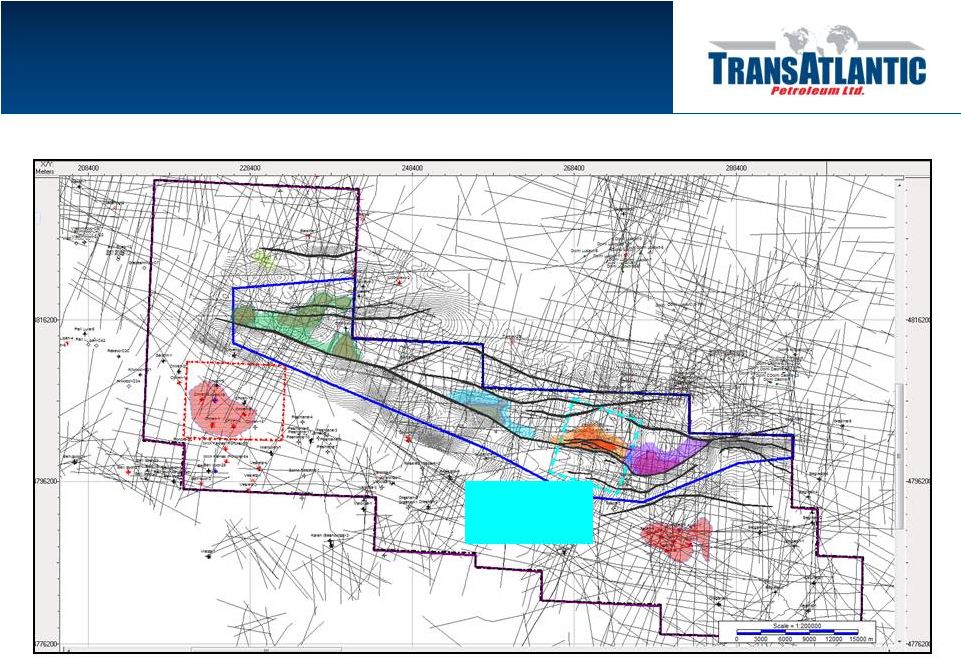

MOLLA

– ARPATEPE AREA GRAVITY MAP

12

Field discoveries align well with gravity data; meaningful structural and stratigraphic

running room Kastel Field

(EUR 15 MMbo)

Bahar Field

(2P Reserves: 2.5 MMbo)

Goksu Field

(2P Reserves: 2.9 MMbo)

(1)

DeGolyer and MacNaughton reserves as of 12/31/2012, based on $108.30/barrel and

$8.94/Mcf. Arpatepe JV (TAT 50%)

Proved Structures

Gravity-Indicated Structures

TAT 100%

Molla 3D

Bati Raman Field

Largest oil field in Türkiye |

SELMO

REMAPPING 13

Selmo Overview

•

Extensive work has been done to remap and model

Selmo to identify bypassed oil due to the extremely

fractured nature of the field

•

New dynamic model incorporates updated substructure

mapping with production and pressure histories to

determine the areas of the field that will most benefit

from a horizontal drilling campaign

•

We believe horizontal wellbores will allow pressure

drawdown that is more uniform across the length of the

wellbore and prevent water coning or premature

breakthrough of water

•

2013 budget provides for four horizontal wells in the

Middle Sinan Dolomite (MSD) and one horizontal well

in the Lower Sinan Dolomite (LSD) |

SELMO

REMAPPING, CONTINUED 14

Selmo Horizontal Well Example

Middle Sinan Dolomite Structure |

TÜRKIYE: NORTHWEST

15

Thrace Basin Natural Gas

Türkiye Corporation

(41.5% owned)

West

Northwest

Joint Area

with TPAO

(50%/50% )

Action Plan

•

Tekirdag development

project: low risk gas

production growth, 2 well

horizontal trial

•

Hayrabolu: evaluate

exploration and delineation

wells, overpressure below

1,500 meters

•

Final exploitation of Edirne

blocks (NW Thrace)

•

Limited development within

TPAO (Turkish Petroleum)

joint blocks

•

3D on Osmanli structure

near Thrace area “kitchen” |

THRACE

BASIN: MEZARDERE FORMATION 16

Basin map illustrates source, kitchen, trap and pressure dynamics

TEKIRDAG

HAYRABOLU

YILDIRIM

GO

–

TEPE

OSMONLI |

THRACE

BASIN: TEKIRDAG DEVELOPMENT 17

Development Program Characteristics:

•

Initial 88-well vertical development program covering approximately 5,000 acres of

the Tekirdag Field Area •

Plan 17 wells in Tekirdag area and 8 wells in Hayrabolu during 2013 (will likely adjust

downward to shift capital to recently acquired licenses in the southeast)

•

Two well horizontal test could reduce well count by 75%

•

Gross

well

costs

expected

to

range

between

$2.0

million

and

$3.0

million,

depending

upon

depth

and

completion

design

•

Gross

expected

ultimate

recovery

expected

to

exceed

70

Bcf

(1)

(1)

Internal estimate prepared 10/1/12

HAYRABOLU

TEKIRDAG

15 miles

25 kilometers |

THRACE

BASIN: TEKIRDAG DEVELOPMENT 18

Each horizontal well could replace 4-5 vertical wells, significantly improving the

economics of the field |

BULGARIA

19

Action Plan

Koynare (Deventci)

•

Currently finalizing 50% JV

•

Expect to drill Deventci-R2 in 2013

•

Conventional gas discovery in Jurassic-aged Orzirovo

•

If successful, plan to build pipeline to connect to central

grid at +/-$9/Mcf, shoot additional 3D seismic of the

multiple structures along Koynare fault trend

Stefanetz

•

November 2011 drilled a ~10,500 foot (3,200 meter)

Peshtene-R11 exploration well to core and test

Etropole formation

•

Awaiting revision to parliamentary legislation regarding

hydraulic fracture stimulation

Near the best oil and natural gas fields in the country

and existing natural gas infrastructure

ETROPOLE

SHALE

KOYNARE

CONCESSION

160,000 ACRES

DEVENRCI-R1

PESHTENE-R11

STEFENETZ

CONCESSION

(APPLICATION)

395,000 ACRES |

INVESTMENT CONSIDERATIONS

Constructive Outlook

•

Horizontal and multi-stage completions have potential to

significantly increase production and improve economics from

known oil and natural gas deposits

•

More fields are present than originally believed (Goksu, Bahar

and Yildirim)

•

Expect improvements in drilling efficiency to improve well

economics and increase well count

•

JV would accelerate development

•

Incremental production will largely fall to bottom line without

significant increase in G&A or LOE

20

Strong Fundamentals

•

Very good pricing and netbacks

•

Terms remain favorable in Turkey and Bulgaria

•

Ramping up drilling activity to increase production

•

Newly acquired properties offer additional prospects |

INVESTOR

CONTACT INFORMATION Taylor B. Miele

Director of Investor Relations

(214) 265-4746

taylor.miele@tapcor.com

Wil F. Saqueton

VP

-

Chief

Financial

Officer

(214) 265-4743

wil.saqueton@tapcor.com

Ian J. Delahunty

President

(214) 265-4780

ian.delahunty@tapcor.com

21 |

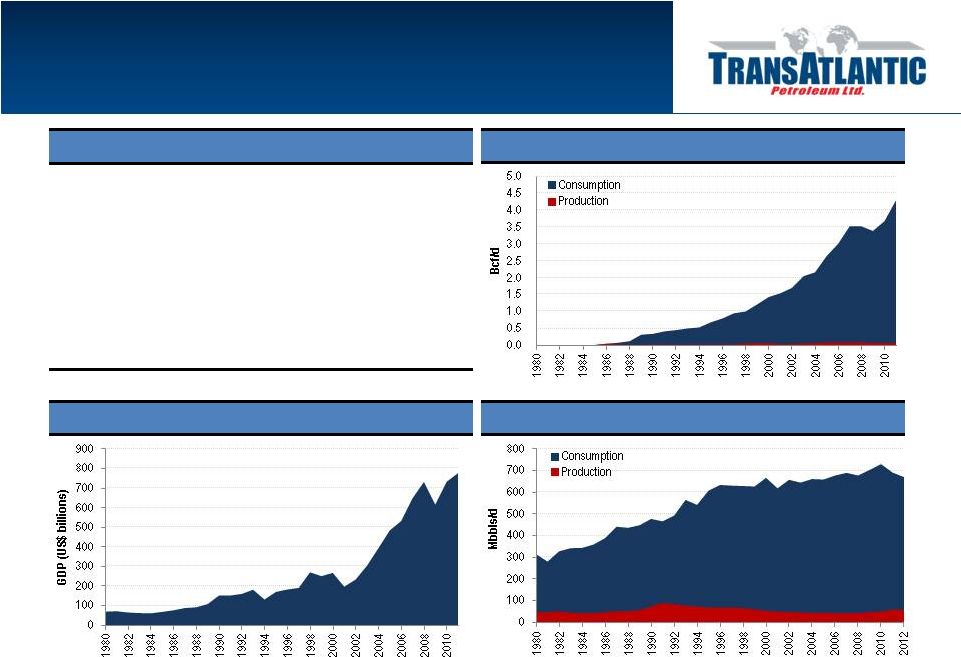

Crude

Oil Supply/Demand WHY TURKEY?

22

Opportunity Set

Undersupplied:

•

Produces ~8% of crude oil consumed

•

Produces ~2% of natural gas consumed

Underexplored:

•

Known petroleum systems and attractive

geology

•

Opportunity for modern technology to make a

difference

Pro-Business:

•

Relatively laissez faire

•

12.5% royalty, 20% corporate tax

Source: US Energy Information Administration (EIA)

Source:

US

Energy

Information

Administration

(EIA).

Most

recent

data

available

is

2011.

Source: World Bank. Most recent data available is 2011.

Natural Gas Supply/Demand

Gross Domestic Product |

MOLLA:

MARDIN POTENTIAL; GOKSU DISCOVERY 23

Molla: Mardin Formation Overview

•

Fractured Cretaceous carbonate present across the region

•

Initial vertical discoveries bolstered by recent application of horizontal drilling

processes •

Total

1P

reserves

of

0.6

MMbbls

(1)

;

Total

2P

reserves

of

2.9

MMbbls

(1)

•

Cumulative production over 60,000 bbls

•

Initial flow rates were 400-500 BOPD in February 2012

•

Flowing ~250 BOPD after 5 months of production

•

Cumulative production over 70,000 bbls

•

TransAtlantic’s first horizontal completion, 1,600 foot lateral

•

Drilled and completed for approximately $3.5 million

•

Initial production 250 BOPD

•

Drilled and completed for approximately $2.5 million

•

Westerly field extension

(1)

DeGolyer and MacNaughton reserves as of 12/31/2012, based on $108.30/barrel and

$8.94/Mcf. Goksu-2

Goksu-3H

Goksu-4H |

MOLLA:

BEDINAN AND HAZRO DISCOVERY (1)

DeGolyer and MacNaughton reserves as of 12/31/2012, based on $108.30/barrel and

$8.94/Mcf. 24 |

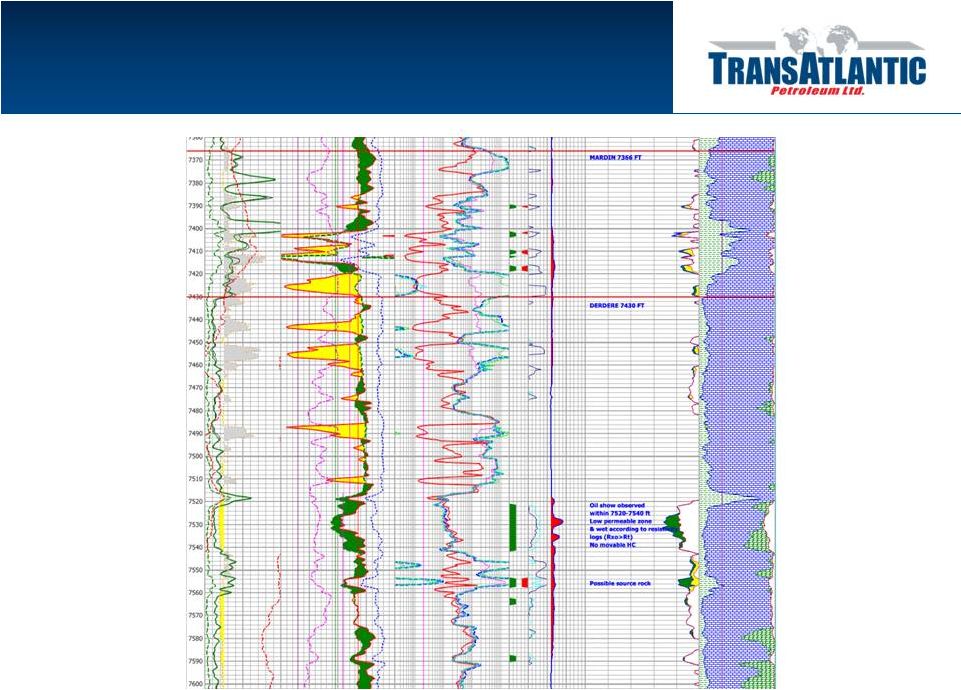

MOLLA:

BAHAR-1 MARDIN TARGETS 25 |

MOLLA:

BAHAR-1 HAZRO TARGETS 26 |

MOLLA:

BAHAR-1 BEDINAN TARGET 27 |

THRACE

BASIN: TEKIRDAG DEVELOPMENT 28

Development Program Characteristics:

•

Initial 88-well vertical development program covering approximately 5,000 acres of

the Tekirdag Field Area •

Plan 17 wells in Tekirdag area and 8 wells in Hayrabolu during 2013 (will likely adjust

downward to shift capital to recently acquired licenses in the southeast)

•

Two well horizontal test could reduce well count by 75%

•

Gross

well

costs

expected

to

range

between

$2.0

million

and

$3.0

million,

depending

upon

total

depth

and

completion

design

•

Gross

expected

ultimate

recovery

expected

to

exceed

70

Bcf

(1)

(1)

Internal estimate prepared 10/1/12.

HAYRABOLU

TEKIRDAG

15 miles

25 kilometers |

THRACE

BASIN: HAYRABOLU TREND 29

11,000 prospective acres |

BULGARIA

SEISMIC AND WELL DATABASE 30

Deventci 3D

Seismic Survey

75 km^2 |

BULGARIA:

DEVENTCI-R1 DISCOVERY WELL 31 |

HEDGE

PROFILE 32

Data as of 3/31/2013. |

EBITDAX

RECONCILIATION 33

For the three

months ended

$US millions

March 31, 2013

Net income from continuing operations

$3.0

Less:

Interest and other, net

0.5

Income tax expense

2.3

Exploration, abandonment, and impairment

3.9

Seismic

0.1

Foreign exchange loss

0.5

Share-based compensation

0.4

Unrealized derivative gain

(0.5)

Accretion of asset retirement obligation

0.1

Depreciation, depletion and amortization

9.0

Net other items

0.2

Adjusted EBITDAX from continuing operations

$19.5

This presentation references estimated EBITDAX, which is a non-GAAP financial

measure that represents earnings from continuing operations before income

taxes, interest, depreciation, depletion, amortization, impairment, abandonment

and exploration expense. The Company

believes EBITDAX assists management and investors in comparing the

Company’s performance and ability to fund capital expenditures and working

capital requirements on a consistent basis without regard to depreciation,

depletion and amortization, impairment of natural gas and oil properties and

exploration expenses, which can vary significantly from period to period.

In addition, management uses EBITDAX as a financial measure to evaluate the

Company’s operating performance. EBITDAX is also widely used by

investors and rating agencies.

EBITDAX is not a measure of financial performance under GAAP. Accordingly,

it should not be considered as a substitute for net income, income from

operations, or cash flow provided by operating activities prepared in

accordance with GAAP. Net income, income from operations, or cash flow provided

by operating activities may vary materially from EBITDAX. Investors should

carefully consider the specific items included in the computation of

EBITDAX. The Company has disclosed EBITDAX to permit a comparative

analysis of its operating performance and debt servicing ability relative to

other companies. |

PV-10

RECONCILIATION 34

$US thousands

Total PV-10:

$511,075

Future income taxes:

(106,411)

Discount of future income

taxes at 10% per annum:

31,213

Standardized measure:

$435,880

The PV-10 value of the estimated future net revenue are not intended to represent

the current market value of the estimated oil and natural gas reserves we own.

Management believes that the presentation of PV-10, while not a financial measure in accordance with U.S. GAAP, provides

useful information to investors because it is widely used by professional analysts and

sophisticated investors in evaluating oil and natural gas companies. Because

many factors that are unique to each individual company impact the amount of future income taxes estimated to be paid,

the use of a pre-tax measure is valuable when comparing companies based on

reserves. PV-10 is not a measure of financial or operating performance under

U.S. GAAP. PV-10 should not be considered as an alternative to the

standardized measure as defined under U.S. GAAP. The following table

provides a reconciliation of our PV-10 to our standardized measure: |