Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mondelez International, Inc. | d545685d8k.htm |

| EX-99.1 - EX-99.1 - Mondelez International, Inc. | d545685dex991.htm |

Citi

Global Consumer Conference

May 29, 2013

Exhibit 99.2 |

Forward-looking statements

2

This slide presentation contains a number of forward-looking statements.

The words “will,”

“expect,”

“opportunity,”

“growth,”

“reinvent,”

“reaffirm,”

and similar expressions are

intended to identify our forward-looking statements. Examples of

forward-looking statements include, but are not limited to, statements

we make about our future growth and expansion, including growth or expansion

in organic net revenue, operating income, operating EPS, operating income

margin, and gross margin; our plans for achieving such growth and expansion;

our expenditures for emerging markets investments and funding ongoing

restructuring and the results of such expenditures; and our 2013 guidance.

These forward-looking statements involve risks and uncertainties, many of which

are beyond our control, and important factors that could cause actual

results to differ materially from those in our forward-looking

statements include, but are not limited to, continued global economic

weakness, increased competition, continued volatility of commodity and other

input costs, pricing actions, risks from operating globally, and tax law

changes. For additional information on these and other factors that could affect our

forward-looking

statements,

see

our

risk

factors,

as

they

may

be

amended

from

time

to

time, set forth in our filings with the SEC, including our most recently filed

Annual Report on

Form

10-K.

We

disclaim

and

do

not

undertake

any

obligation

to

update

or

revise

any

forward-looking

statement

in

this

slide

presentation,

except

as

required

by

applicable

law

or regulation. |

Irene

Rosenfeld Chairman & CEO |

Mondelez

International

is

a

unique

investment vehicle…

Advantaged

Geographic

Footprint

Fast-

Growing

Categories

Favorite

Snacks

Brands

Strong

Routes-to-

Market

Proven

Innovation

Platforms

World-Class

Talent &

Capabilities

4 |

…with top-tier revenue and earnings

potential

Operating EPS Growth

5%-7%

Double-Digit

(constant FX)

Organic Net Revenue Growth

Long-Term Targets

Operating Income Growth

High Single-Digit

(constant FX)

5 |

Double Digit

Growth

Low-to-Mid

Single Digit

Growth

$35B

Developed

Markets

Emerging

Markets

By Geography

$35B

Low-to-Mid

Single Digit

Growth

Mid-to-High

Single Digit

Growth

Chocolate

Biscuits

Gum &

Candy

Beverages

Ch./Groc.

By Category

5% -

7%

Organic Growth

6

Top-tier revenue growth is clearly achievable |

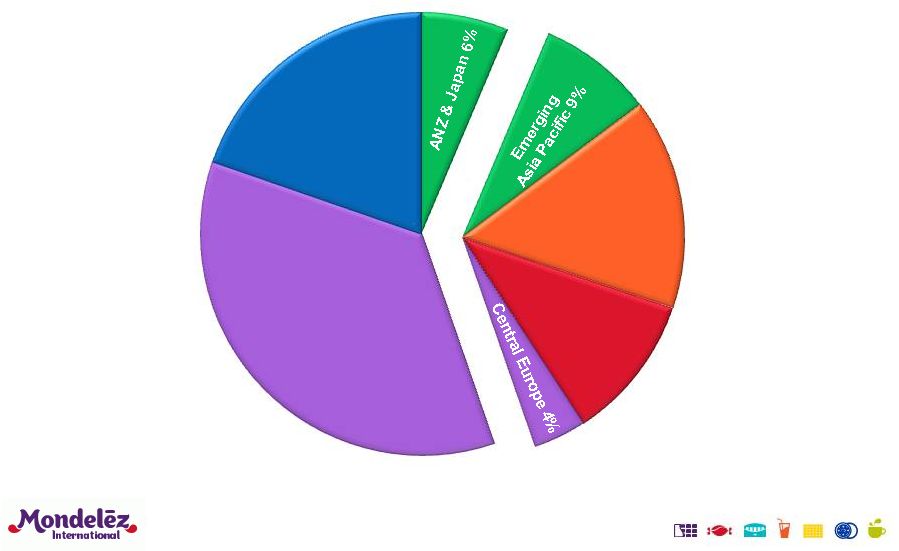

Latin America

15%

EEMEA

11%

Europe,

excluding

Central Europe

35%

North America

20%

Nearly 40% of portfolio in emerging

markets

7

Developed

Markets

~60%

Emerging

Markets

~40%

$35 Billion in

2012 Net Revenues |

Emerging markets are highly attractive

8

GDP per Capita

($ in thousands)

GDP per Capita

($ in thousands)

Consumption vs. GDP per Capita

Source: Euromonitor 2011

Snacks

categories

growing

at

high

single

digits

/

double

digits

Rising GDP fuels rapidly growing per capita snacks consumption

Opportunity for high rates of return

Chocolate

Biscuits |

Race is

on to secure and expand positions in emerging markets

9

Companies that fortify strong positions over the next

3 to 5 years will win

Nestle statement on 9/25/12

Hershey statement on 2/20/13

Kellogg statement on 2/20/13

“We're placing a big bet in China

and anticipate it will be Hershey's

number two market, behind only the

US in the coming five years”

“Russia has the potential to be the number

one consumer market in Europe by 2020…

Adding in Pringles …

provides a fantastic

platform for us to capitalize on growth in this

market in the years ahead”

“Africa and Middle East are growth

engines for the future. Nestle’s

objective is to triple the business

by 2020 at constant currency” |

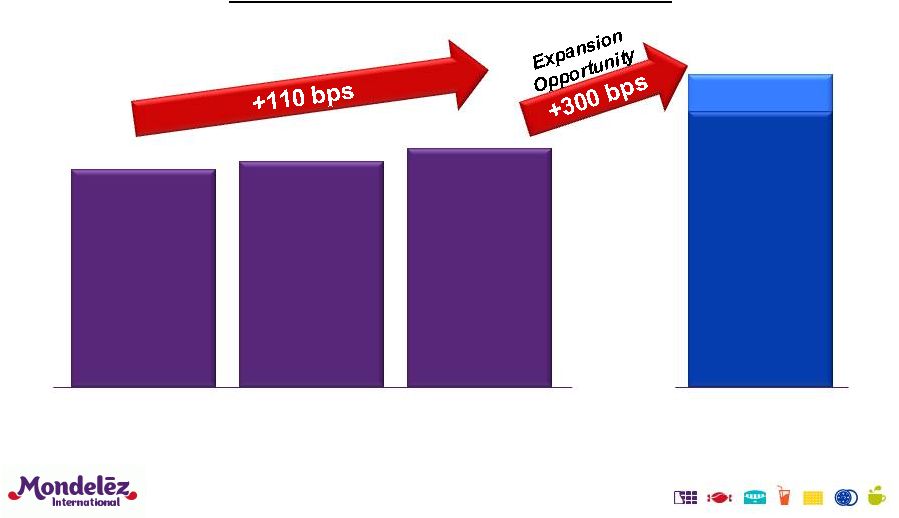

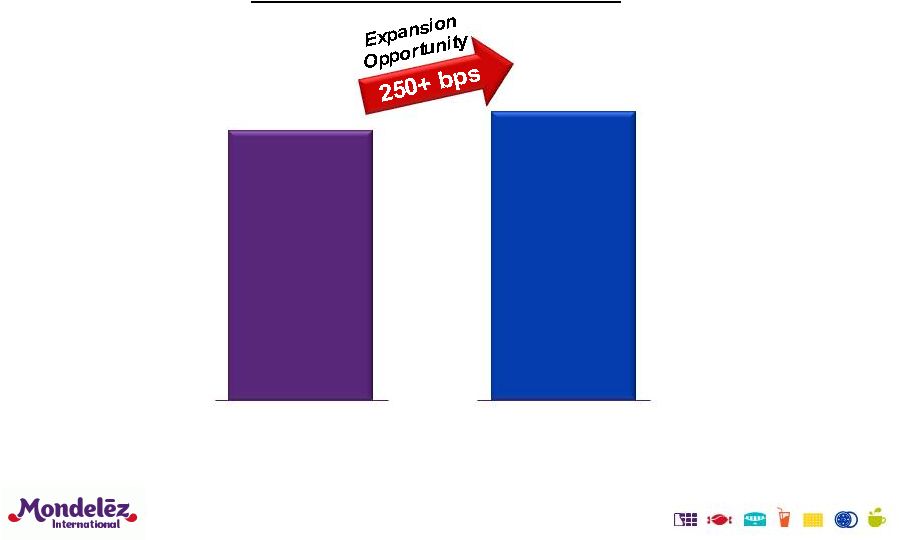

Steady

improvement in OI margin with significant expansion opportunity

Adjusted

Operating

Income

Margin

2011

2012

11.5%

12.2%

2010

11.1%

Peer Average

14%-16%

10

Note: Please see the GAAP to non-GAAP reconciliations provided at the end of

this presentation. |

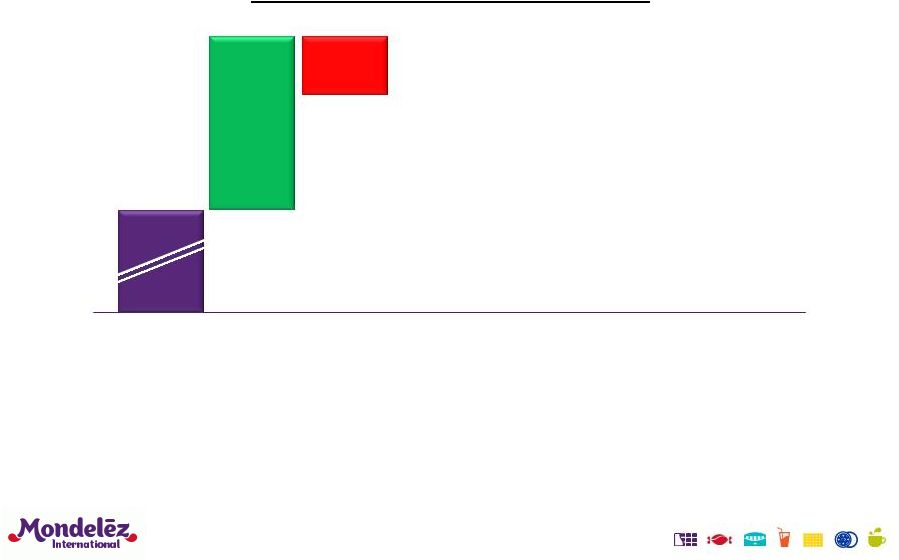

11

Significant base margin expansion

opportunity

(1) Please see the GAAP to non-GAAP reconciliations provided at the end

of this presentation. Adjusted Operating Income Margin

2012

Base

Margin

Expansion

+60 to

+90 bps

Annually

12.2%

(1) |

Opportunity is largely in North America

and Europe

12

Adjusted Operating Income Margin

13.9%

18%-21%

2012

Peer Average

North America

Europe

13.0%

13%-16%

2012

Peer Average

LA, AP, EEMEA

Combined

14.3%

12%-14%

2012

Peer Average

Note: Please see the GAAP to non-GAAP reconciliations provided at the end of

this presentation. |

Gross

margin is our biggest opportunity Peer Average

40%+

2012

37.6%

Adjusted

Gross

Profit

Margin

13

Note: Please see the GAAP to non-GAAP reconciliations provided at the end of

this presentation. |

NORTH

AMERICA: Significant opportunity for margin expansion

13.8%

13.9%

18%-21%

2011

2012

Peer Average

Adjusted Segment

Operating Income Margin

14

14.0%

2010

Drive Power Brands and

product mix

Cost Management and Overheads

•

Target 4%+ COGS productivity

•

Remove dis-synergies

Reinvent Supply Chain

•

Install new technology

•

Repatriate production

Key Drill Sites

Note: Please see the GAAP to non-GAAP reconciliations provided at the end of

this presentation. |

NORTH AMERICA: Cost

management and overhead reduction opportunities

l

Cost Management

–

Lean Six Sigma productivity

–

Increase procurement savings

l

Overhead Reduction

–

Reduce/eliminate dis-synergies

–

Capture synergies between U.S. and Canada

–

Leverage SAP; eliminate redundant systems

15 |

NORTH AMERICA: Reinventing

the supply chain drives gross margin expansion

l

Introduce new technology to improve throughput

l

Repatriate production from co-manufacturers

l

Complete closure of Lakeshore Bakery (Toronto)

16 |

EUROPE: Continue steady margin progress

12.3%

13.0%

13%-16%

2011

2012

Peer Average

Adjusted Segment

Operating Income Margin

17

11.8%

2010

Expand Gross Margin

•

Drive Power Brands and

product mix

•

Target 4%+ COGS productivity

•

Streamline supply chain

Reduce overheads

•

Integrate Central Europe into

category model

•

Leverage service centers in

low cost locations

Key Drill Sites

Note: Please see the GAAP to non-GAAP reconciliations provided at the end of

this presentation. |

EUROPE:

Significant supply chain optimization

opportunity

18

Net Revenue Per Plant

($ millions)

All Other

Plants

Average

% of plants

A Plants

15%

85%

Peer Average

$400

$200

$390

$150

$180 |

EUROPE: Continue to drive overhead

efficiencies

19

Overhead reductions primary driver of margin

improvement since 2009

Unlocked scale through category model

Achieved synergies integrating LU and Cadbury

Consolidated business on fully-harmonized SAP system

Integrating Central European countries into category model

Deliver best-in-class cost by leveraging low cost locations

Aiming to further optimize overhead structure |

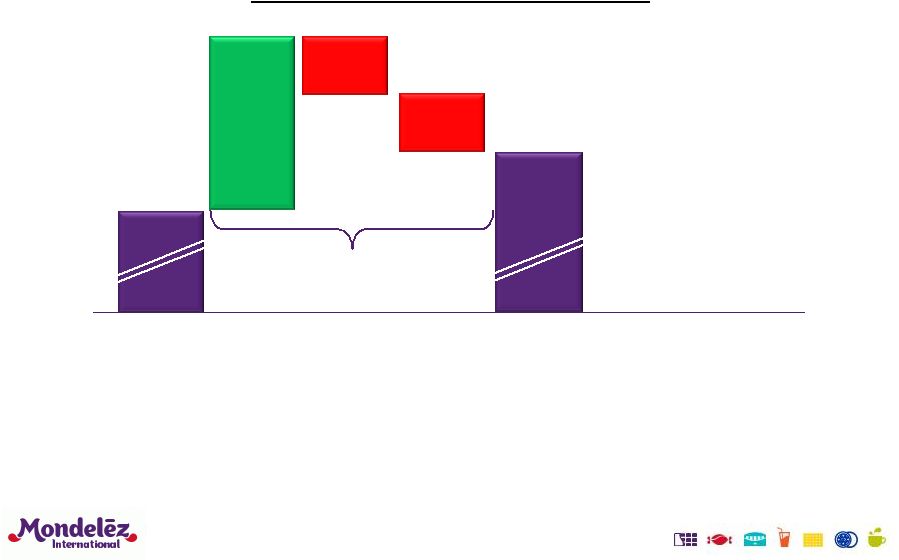

20

Stepping up investments in emerging

markets to create value

(1) Please see the GAAP to non-GAAP reconciliations provided at the end

of this presentation. Adjusted Operating Income Margin

2012

Base

Margin

Expansion

Emerging

Markets

Investments

+60 to

+90 bps

Annually

(20) to

(30) bps

Annually

12.2%

(1) |

Focused emerging markets investments

provide growth and attractive returns

Opportunities:

Disciplined approach with attractive

returns

IRR well in excess of cost of capital

21

$200

$200-

$300

2014

2015+

$100

2013

Payback

Boost Power Brand Support

~1 year

RTM, Sales Expansion

1-2 years

White Space Entries

3-5 years

($ millions)

Incremental Investments

in Emerging Markets |

22

Funding ongoing restructuring to improve

long-term cost structure

(1) Please see the GAAP to non-GAAP reconciliations provided at the end

of this presentation. Adjusted Operating Income Margin

2012

Base

Margin

Expansion

Emerging

Markets

Investments

Ongoing

Restructuring

+60 to

+90 bps

Annually

(20) to

(30) bps

Annually

(20) to

(30) bps

Annually

12.2%

(1) |

Ongoing restructuring will continue to

drive long-term efficiency

23

$100

$200-

$300

2014

2015+

2013

•

Moving to “Pay as You Go”

model once 2012–2014

program completed

•

Included in long-term growth

algorithm and guidance

($ millions)

Ongoing

Restructuring Investments

$100 |

Expect

moderate margin expansion over the next three years …

24

(1) Please see the GAAP to non-GAAP reconciliations provided at the end

of this presentation. Adjusted Operating Income Margin

2012

Base

Margin

Expansion

Emerging

Markets

Investments

Ongoing

Restructuring

+60 to

+90 bps

Annually

(20) to

(30) bps

Annually

(20) to

(30) bps

Annually

~13%

2015

+20 to +30 bps

Annual Average

12.2%

(1) |

…

with more significant opportunities

longer term

25

Adjusted Operating Income Margin

2012

Base

Margin

Expansion

Emerging

Markets

Investments

Ongoing

Restructuring

+60 to

+90 bps

Annually

(20) to

(30) bps

Annually

(20) to

(30) bps

Annually

~13%

2015

Target

14-16%

Base

Margin

Expansion

+40 to

+60 bps

Annually

+20 to +30 bps

Annual Average

12.2%

(1)

* On a constant currency basis

(1) Please see the GAAP to non-GAAP reconciliations provided at the end

of this presentation. Double Digit EPS Growth* |

Reaffirming 2013 guidance

•

Organic revenue growth at the low end of 5-7% range

–

Coffee pricing and capacity constraints tempering 1H growth by ~1.5 pp

–

Revenue growth in 2H expected to accelerate

•

On

track

to

deliver

Operating

EPS

of

$1.55

to

$1.60

(+14%

-

18%

on

a

constant currency basis)

–

1H margin tempered versus year-ago

•

Negative impact of Venezuela devaluation and PY one-time items

•

Dis-synergies and stepped up emerging markets investments

•

Q2 cycling a difficult PY comparison

–

Stronger 2H margin

•

Revenue growth increases leverage

•

Lower impact of dis-synergies

–

Full year margin likely to be flat

–

Tax favorabilities enable head start on investment

26 |

Delivering significant shareholder value

27

Operating EPS Growth

5%-7%

Double-Digit

(constant FX)

Organic Net Revenue Growth

Long-Term Targets

Operating Income Growth

High Single-Digit

(constant FX)

Targeting

14%

–

16%

Margins |

28 |

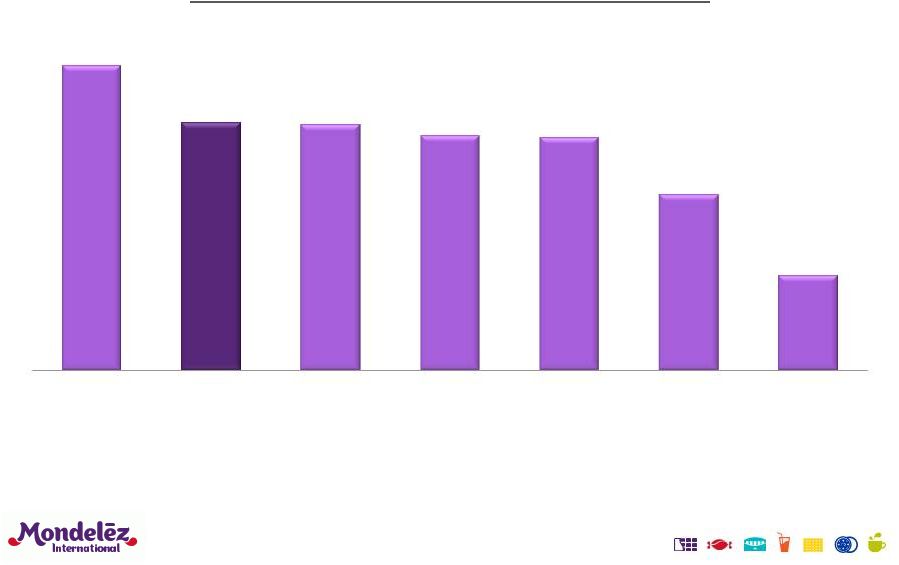

Appendix: Operating Income Margin –

Total Company

29

Total

Company

Operating

Income

Margins

(fiscal year 2012)

(1)

1)

Reflects trading operating profit ex asset impairments

* Please see the GAAP to non-GAAP reconciliations provided at the end of this

presentation. Source: Company Reports.

23.5%

23.4%

18.6%

18.5%

16.1%

15.9%

15.3%

14.9%

14.4%

14.2%

12.2%*

CL

KO

PG

HSY

GIS

CPB

NESN

PEP

K

HNZ

BN

ULVR

MDLZ

14.7%

13.8% |

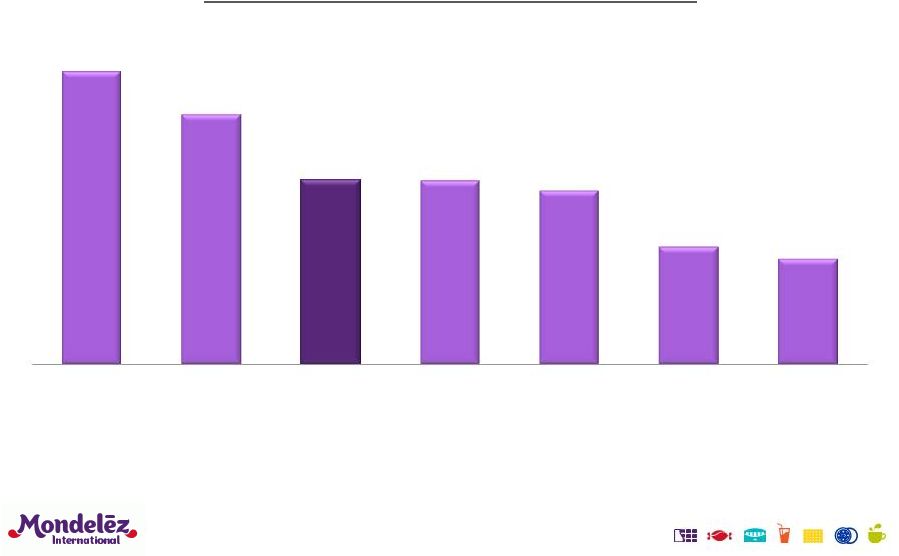

Appendix: Operating Income Margin –

North America

30

North

America

Operating

Income

Margins

(fiscal year 2012)

(1)

(2)

(3)

(4)

(5)

(10)

1)

Reflects PepsiCo NA Food.

2)

Reflects North America, excluding CIS. Reflects deduction for partial

corporate expense. 3)

Reflects North America.

4)

Reflects US.

5)

Reflects Global, which is about 99% North America.

6)

Reflects US Simple Meals, US Beverages, North America Foodservice and half of

Global Baking & Snacking. 7)

Reflects North America and Latin America, excluding globally managed businesses

(mainly Water, Nutrition, Nespresso, Professional). Reflects trading

operating profit ex asset impairments 8)

Reflects Global, which is about 90% North America. Reflects deduction for corporate

expense. 9)

Reflects North America. Excludes Pringles integration costs.

10)

Reflects

North

America

and

Latin

America.

Reflects

deduction

for

partial

corporate

expense.

(6)

(7)

(8)

(9)

* Please see the GAAP to non-GAAP reconciliations provided at the end of this

presentation. Source: Company Reports.

27.1%

22.5%

21.0%

20.7%

20.0%

19.9%

18.6%

18.2%

16.6%

14.2%

13.9%*

PEP

BN

HNZ

GIS

SJM

CPB

NESN

HSY

K

ULVR

MDLZ |

Appendix: Operating Income Margin –

Europe

31

Europe

Operating

Income

Margins

(fiscal

year

2012)

(1)

(2)

(5)

(4)

(3)

(6)

1)

Reflects Europe, including Russia.

2)

Reflects Europe, including Central Europe, Russia and Turkey, but excluding

globally managed businesses (mainly Water, Nutrition, Nespresso,

Professional). Reflects trading operating profit ex asset impairments.

3)

Reflects Europe, including Central Europe. Reflects deduction for partial

corporate expense. 4)

Reflects

Europe,

including

Central

Europe.

Reflects

deduction

for

partial

corporate

expense.

5)

Reflects

Europe,

including

Russia.

Excludes

Pringles

integration

costs.

6)

Reflects Europe, including Russia and South Africa.

* Please see the GAAP to non-GAAP reconciliations provided at the end of this

presentation. Source: Company Reports.

17.7%

16.0%

15.7%

14.2%

13.0%*

11.3%

10.3%

HNZ

NESN

BN

ULVR

MDLZ

K

PEP |

Appendix: Operating Income Margin –

Latin America

32

Latin

America

Operating

Income

Margins

(fiscal

year

2012)

(1)

(2)

(5)

(3)

(4)

(6)

1)

Reflects North America and Latin America, excluding globally managed businesses

(mainly Water, Nutrition, Nespresso, Professional). Reflects trading

operating profit ex asset impairments. 2)

Reflects Latin America. Excludes Pringles integration costs.

3)

Reflects Latin America Foods.

4)

Reflects

North

America

and

Latin

America.

Reflects

decision

for

partial

corporate

expense.

5)

Reflects Rest of World (Latin America, Middle East and Africa).

6)

Reflects Latin America, Middle East and Africa, and CIS. Reflects decision for

partial corporate expense.

* Please see the GAAP to non-GAAP reconciliations provided at the end of this

presentation. Source: Company Reports.

18.6%

15.1%*

15.0%

14.3%

14.2%

10.7%

5.8%

NESN

MDLZ

K

PEP

ULVR

HNZ

BN |

Appendix: Operating Income Margin –

Asia Pacific

33

Asia

Pacific

Operating

Income

Margins

(fiscal

year

2012)

1)

Reflects Asia. Reflects deduction for partial corporate expense.

2)

Reflects Asia, Oceania, Africa, excluding globally managed businesses (mainly

Water, Nutrition, Nespresso, Professional). Reflects trading operating

profit ex asset impairments. 3)

Reflects Asia, Middle East and Africa, excluding South Africa.

4)

Reflects Asia, Africa, Middle East, Turkey, Russia, Ukraine and Belarus.

Reflects deduction for partial corporate expense.

5)

Reflects Asia Pacific. Excludes Pringles integration costs.

6)

Reflects Asia Pacific.

(1)

(2)

(5)

(3)

(4)

(6)

* Please see the GAAP to non-GAAP reconciliations provided at the end of this

presentation. Source: Company Reports.

22.1%

18.9%

13.9%*

13.9%

13.1%

8.9%

8.0%

BN

NESN

MDLZ

PEP

ULVR

K

HNZ |

Appendix: Operating Income Margin –

EEMEA

34

EEMEA

Operating

Income

Margins

(fiscal year 2012)

(1)

(2)

(5)

(4)

1)

Reflects Asia, Oceania, Africa, excluding globally managed businesses (mainly

Water, Nutrition, Nespresso, Professional). Reflects trading operating

profit ex asset impairments. 2)

Reflects Asia, Middle East and Africa, excluding South Africa.

3)

Reflects Asia, Africa, Middle East, Turkey, Russia, Ukraine and Belarus.

Reflects deduction for partial corporate expense.

4)

Reflects Rest of World (Latin America, Middle East and Africa).

5)

Reflects Latin America, Middle East, Africa and CIS. Reflects deduction for

partial corporate expense.

(3)

* Please see the GAAP to non-GAAP reconciliations provided at the end of this

presentation. Source: Company Reports.

18.9%

13.9%*

13.9%

13.1%

10.7%

5.8%

NESN

MDLZ

PEP

ULVR

HNZ

BN |

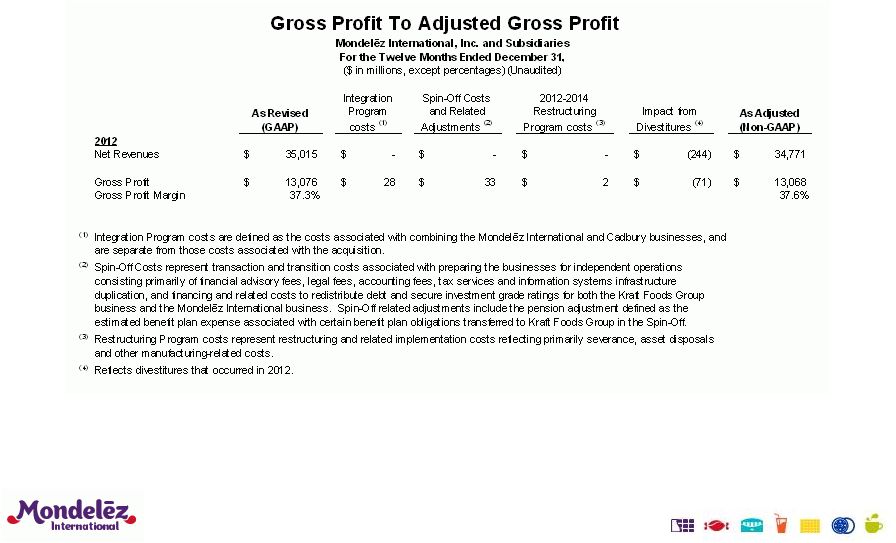

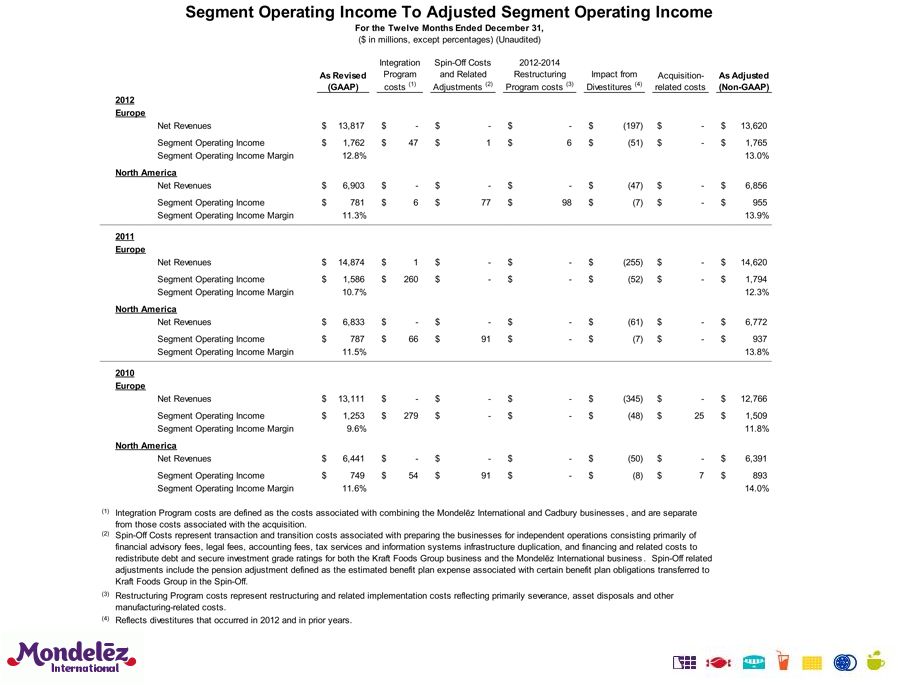

GAAP

to Non-GAAP Reconciliation 35 |

GAAP

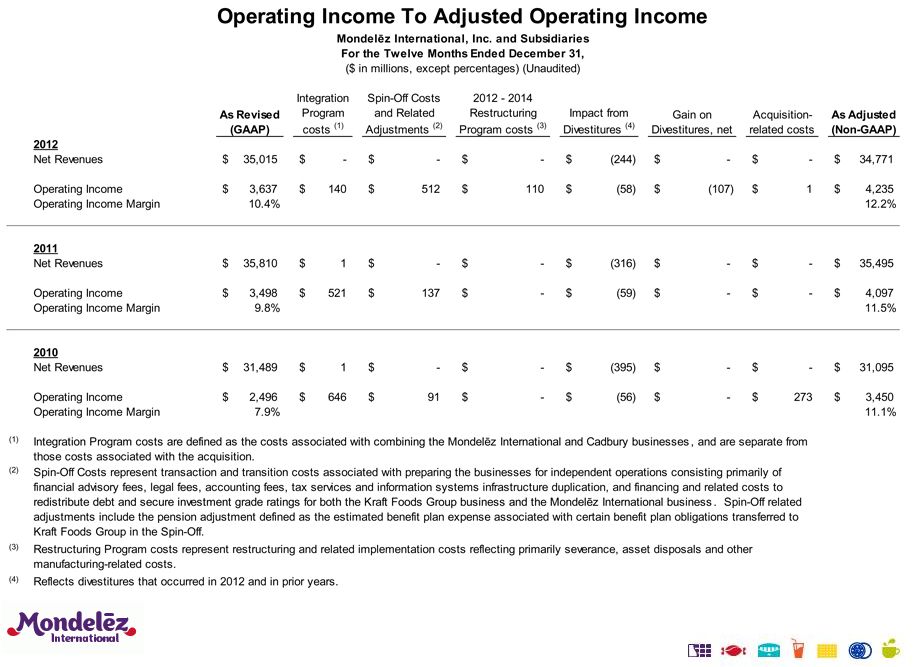

to Non-GAAP Reconciliation 36 |

GAAP

to Non-GAAP Reconciliation 37 |

GAAP

to Non-GAAP Reconciliation 38 |