Attached files

| file | filename |

|---|---|

| 8-K - CUSTOMERS BANCORP, INC. FORM 8-K - Customers Bancorp, Inc. | customers8k.htm |

Exhibit 99.1

2013 Annual Shareholders Meeting

Effortless Banking

2

This presentation as well as other written or oral communications made from time to time by us, may contain certain forward-looking

information within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These

statements relate to future events or future predictions, including events or predictions relating to our future financial performance, and

are generally identifiable by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,”

“target,” or “anticipates” or the negative thereof or comparable terminology, or by discussion of strategy or goals or other future events,

circumstances or effects. These forward-looking statements regarding future events and circumstances involve known and unknown

risks, uncertainties and other factors that may cause our actual results, levels of activity, financial condition, performance or

achievements to be materially different from any future results, levels of activity, financial condition, performance or achievements

expressed or implied by such forward-looking statements. This information is based on various assumptions, estimates or judgments by

us that may not prove to be correct.

information within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These

statements relate to future events or future predictions, including events or predictions relating to our future financial performance, and

are generally identifiable by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,”

“target,” or “anticipates” or the negative thereof or comparable terminology, or by discussion of strategy or goals or other future events,

circumstances or effects. These forward-looking statements regarding future events and circumstances involve known and unknown

risks, uncertainties and other factors that may cause our actual results, levels of activity, financial condition, performance or

achievements to be materially different from any future results, levels of activity, financial condition, performance or achievements

expressed or implied by such forward-looking statements. This information is based on various assumptions, estimates or judgments by

us that may not prove to be correct.

Important factors to consider and evaluate in such forward-looking statements include:

· changes in competitive and market factors that might affect our results of operations;

· changes in laws and regulations, including without limitation changes in capital requirements under the Basel III capital

proposals;

· changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;

· our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

· the timing of acquisition or investment transactions;

· our failure to complete any or all of the transactions described herein on the terms currently contemplated;

· local, regional and national economic conditions and events and the impact they may have on us and our customers;

· targeted or estimated returns on assets and equity, growth rates and future asset levels

· our ability to attract deposits and other sources of liquidity and capital;

· changes in the financial performance and/or condition of our borrowers;

· changes in the level of non-performing and classified assets and charge-offs;

· changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory

and accounting requirements, as well as changes in borrowers payment behavior and creditworthiness;

and accounting requirements, as well as changes in borrowers payment behavior and creditworthiness;

· changes in our capital structure resulting from future capital offerings or acquisitions;

· inflation, interest rate, securities market and monetary fluctuations;

· the affects on our mortgage warehouse lending and retail mortgage businesses of changes in the mortgage origination

markets, including changes due to changes in monetary policies, interest rates and the regulation of mortgage originators, services

and securitizers;

markets, including changes due to changes in monetary policies, interest rates and the regulation of mortgage originators, services

and securitizers;

Forward Looking Statements

3

Forward Looking Statements

· timely development and acceptance of new banking products and services and perceived overall value of these products and

services by users;

services by users;

· changes in consumer spending, borrowing and saving habits;

· technological changes;

· our ability to grow, increase market share and control expenses, and maintain sufficient liquidity;

· volatility in the credit and equity markets and its effect on the general economy;

· the potential for customer fraud, especially in our mortgage warehouse lending business;

· effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public

Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;

Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;

· the businesses of the Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such

integration being more difficult, time-consuming or costly than expected;

integration being more difficult, time-consuming or costly than expected;

· our ability to integrate currently contemplated and future acquisition targets may be unsuccessful, or may be more

difficult, time-consuming or costly than expected; and

difficult, time-consuming or costly than expected; and

· material differences in the actual financial results of merger and acquisition activities compared with expectations.

These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future

results, levels of activity, financial condition, performance or achievements. Accordingly, there can be no assurance that actual results

will meet our expectations or will not be materially lower than the results contemplated in this presentation. You are cautioned not to

place undue reliance on these forward-looking statements, which speak only as of the date of this document or, in the case of

documents referred to or incorporated by reference, the dates of those documents. We do not undertake any obligation to release

publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or to reflect

the occurrence of unanticipated events, except as may be required under applicable law.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future

results, levels of activity, financial condition, performance or achievements. Accordingly, there can be no assurance that actual results

will meet our expectations or will not be materially lower than the results contemplated in this presentation. You are cautioned not to

place undue reliance on these forward-looking statements, which speak only as of the date of this document or, in the case of

documents referred to or incorporated by reference, the dates of those documents. We do not undertake any obligation to release

publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or to reflect

the occurrence of unanticipated events, except as may be required under applicable law.

4

Investment Highlights

§ Profitable, well-capitalized $3.5 billion bank in attractive markets in New

England, New York, New Jersey, and Pennsylvania

England, New York, New Jersey, and Pennsylvania

§ Clean bank with Non-Covered NPAs of 0.77%

§ 10.0% - 12.0% ROE driven by prudent organic loan growth, increased revenue

and stable noninterest expense

and stable noninterest expense

§ Strong organic growth and acquisition opportunities in current markets

§ Management team with extensive community banking and M&A experience

§ Significant management and Board ownership

§ Recognized as #1 ranked bank by Bank Director Magazine in the 2013 Growth

Leader Rankings

Leader Rankings

§ NASDAQ listing

5

Timeline of Recent Events

§ $100 million of capital raised in early September 2012 has been deployed to profitably grow

loan portfolio

loan portfolio

§ Strong first quarter 2013 earnings results with core ROAA of 1.15%(1), core ROAE of

12.4%(1)

12.4%(1)

§ Hired a team of 6 bankers and plan on hiring 2 more in New York to run Private Banking

operations at 99 Park Avenue

operations at 99 Park Avenue

– Targeted to bring in ~$700 million in deposits and a sizable middle market lending book

within 24 months

within 24 months

§ Acquired a team of 15 bankers, a $157 million loan portfolio (and $200 million in loan

commitments), as well as a market presence in Boston and Providence from a deal with

Flagstar

commitments), as well as a market presence in Boston and Providence from a deal with

Flagstar

– Targeted to grow to ~$1.0 billion loan portfolio over 5 years

§ Opening office in low to moderate income neighborhood of Philadelphia

Source: SNL Financial and Company data.

(1) Core ROAA and ROAE excludes after tax impact of $2 million charge for warehouse fraud (tax rate of 35%). Including $2 million charge, reported ROAA of 0.98% and ROAE of 10.6%.

6

Key Profitability Targets

|

Criteria

|

Target

|

Mar 31,

2013 |

|

MRQ Peer

Median(3) |

|

Delta

|

|

Return on Assets

|

0.90% to 1.00%

|

1.15%(1)

|

|

1.07%

|

|

7.5% Higher

|

|

Return on Equity

|

10% or greater

|

12.4%(1)

|

|

10.3%

|

|

20.4%

Higher |

|

Net Interest

Margin |

3.00% to 3.25%

|

3.26%

|

|

3.55%

|

|

8.2%

Lower

|

|

Efficiency Ratio

|

50%

|

51%

|

|

62%

|

|

18.1%

Lower |

|

|

|

|

|

|

|

|

|

Current P/TBV(2)

|

1.10x

|

|

1.62x

|

|

47.3%

Upside |

|

Source: SNL Financial and Company data.

(1)Core ROAA and ROAE excludes after tax impact of $2 million charge for warehouse fraud (tax rate of 35%). Including $2 million charge, reported ROAA of 0.98% and ROAE of 10.6%.

(2)P/TBV as of 5/6/13.

(3)Peers consists of Northeast and Mid-Atlantic banks and thrifts with assets between $2.0 billion and $6.0 billion and most recent quarter core ROAA greater than 90bps. Excludes merger targets and MHCs. Please see

appendix for more information.

appendix for more information.

7

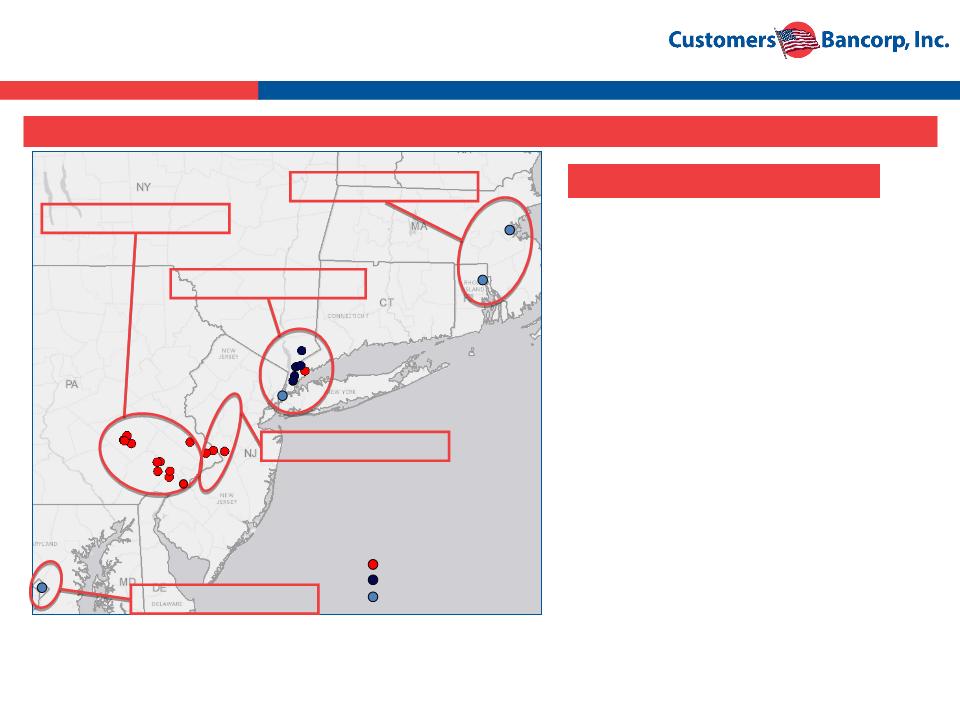

Customers Bancorp

Providence

Boston

CMS

New York

Philadelphia

Loan Production Offices

Current Company Overview

Source: SNL Financial and Company data. Note: Loan production office in Washington D.C. scheduled to open June 1, 2013. Branch in northeastern Philadelphia scheduled to open in Q3 2013.

*Source: SNL Financial as of 6/30/2012. Represents deposits pro forma for the acquisition of CMS Bancorp (expected to close in Q1 2014). Actual deposits transferred may be different.

§ $3.5 billion institution with 14 branches with a target market

from Boston to Washington D.C.

from Boston to Washington D.C.

– New York City area (Westchester County and Manhattan)

– Philadelphia area (Bucks, Berks, Chester, Delaware and

Philadelphia Counties in southeastern Pennsylvania and

Mercer county in New Jersey)

Philadelphia Counties in southeastern Pennsylvania and

Mercer county in New Jersey)

– Boston area (Operations in Boston and Providence)

– Pending CMS bank acquisition would add 6 branches in New

York MSA

York MSA

§ Unique “high-touch, high-tech” value proposition to

customer base

customer base

– Exceptional customer service supported by state-of-the-art

technology

technology

§ Operates a national mortgage warehouse business as well

as multifamily real estate lending in the New York City area

as multifamily real estate lending in the New York City area

Reading

Current Markets

Washington D.C.

Manhattan

8

Illustrative Five-Year Strategic Plan Envisions a

$8-$10bn Asset Bank in Target Markets

$8-$10bn Asset Bank in Target Markets

Source: SNL Financial and Company data. Note: Loan production office in Washington D.C. scheduled to open June 1, 2013. Branch in northeastern Philadelphia scheduled to open in Q3 2013.

5 Year Targets

~$1.0 billion in assets

~$3.0 billion in assets

Trenton

~$1.0 billion in assets

~$4.0 billion in assets

~$1.0 billion in assets

CMS

Customers Bancorp

Loan Production Offices

Providence

Reading

Washington D.C.

Philadelphia

|

Region

|

|

Target Asset Size

(in billions)

|

|

Pennsylvania

|

|

$4.0

|

|

New England

|

|

$0.5-$1.0

|

|

New York

|

|

$1.0-$2.0

|

|

Connecticut / White Plains

|

|

$1.0

|

|

New Jersey

|

|

$0.5-$1.0

|

|

Washington DC

|

|

$1.0

|

|

Total

|

|

~$8.0-$10.0

|

Boston

9

Seasoned Management Team

§ Experienced and cohesive management team with an average of 30 years experience

– 9 out of 15 senior executives previously worked at Sovereign

§ Significant management and Board ownership (~20% as of March 31, 2013)

*Indicates joined management team since last capital raise in September 2012

10

Source: Company documents.

Cash

Management

Residential

Real Estate

Credit

Cards

Commercial

Real Estate

Commercial

Banking

Private

Banking

Retail

Branches

Cash

Management

Residential

Real Estate

Credit

Cards

Commercial

Real Estate

Commercial

Banking

Private

Banking

Retail

Branches

Banking

Group

Group

Client

Makes

One Call

Makes

One Call

Client

Client

Makes

Many Calls

Makes

Many Calls

Call

Center

Center

Customers

“Only Client” Model

Other Banks

“Traditional Service”

Model

Model

Single Point of

Contact

Contact

Multiple Points of

Contact

Contact

Single Point of Contact - Our Advantage

11

Deposit Strategy - High Touch, High Tech

Concierge Banking

§ Takes banker to the

customer’s home or

office, 12 hours a day,

7 days a week

customer’s home or

office, 12 hours a day,

7 days a week

§ Appointment banking

approach

approach

§ Customer access to

private bankers

private bankers

§ “Virtual Branches” out

of sales offices

of sales offices

Sales Force

§ Experienced

bankers who own

a portfolio of

customers

bankers who own

a portfolio of

customers

§ Customer

acquisition &

retention strongly

incentivized

acquisition &

retention strongly

incentivized

Pricing

§ Low cost banking model

allows for more pricing

flexibility

allows for more pricing

flexibility

§ Significantly lower

overhead costs vs. a

traditional branch

overhead costs vs. a

traditional branch

§ Pricing/profitability

measured across

relationship

measured across

relationship

Technology

§ Implementation of

technology suite allows

for unique product

offerings:

technology suite allows

for unique product

offerings:

§ Remote account

opening & deposit

capture

opening & deposit

capture

§ Internet/mobile

banking

banking

§ Free ATM deployment

in U.S.

in U.S.

§ Deposit generation greatly driven by hiring teams of private bankers and providing

them with cutting edge technology and flexible pricing authority

them with cutting edge technology and flexible pricing authority

§ A business model designed to attract and retain top talent

Cost of Funds

Plus: Branch Operating Expense

Less: Fees

= All-in Cost < Competitors

Goal: All-in cost less than wholesale funding cost over the long-term

12

Delivering Organic Growth - Deposits

Source: Company data.

CAGR: 91%

CAGR: 65%

CAGR: 34%

Branch Deposit Growth

Average DDA Growth

Cost of Deposits

Deposits per Branch

CAGR: -22%

13

Lending Strategy - Local Lending Plus

Specialty Niche

Specialty Niche

Commercial Lending

Small Business

§ Target companies with less than

$5.0 million annual revenue

$5.0 million annual revenue

§ Loans (incl. SBA loans) originated

by branch network and specialist

small business relationship

managers

by branch network and specialist

small business relationship

managers

§ Top 10 in Delaware Valley for SBA

loans

loans

§ Warehouse Lending

§ Diversify earning assets and

revenue stream

revenue stream

§ Lower interest rate and credit risk

line of business

line of business

Business Banking

§ Target companies with up to $100

million annual revenues

million annual revenues

§ Very experienced teams

Multifamily & CRE

§ Focus Markets: New York &

Philadelphia MSAs

Philadelphia MSAs

§ Average Loan Size: $7.0 million

Real Estate Secured Lending

§ Select home equity and residential

mortgage

mortgage

§ Conservative underwriting

standards

standards

§ No indirect auto, unsecured loans

or credit cards

or credit cards

Consumer Lending

Specialty Lending

§ Mortgage Banking(1)

§ Diversified revenue source

(1) Business unit expected to begin generating revenues in Q3 2013.

14

Delivering Organic Growth - Loans

($ in millions)

Loans Held for Investment (excludes Warehouse Loans)

Source: Company documents.

(1)Consists of C&I and owner occupied CRE.

(2)Consists of non-owner occupied CRE.

§ Experienced C&I team acquired from local and regional banks; centralized credit

committee approval for all loans

committee approval for all loans

15

Significant Warehouse Lender

§ Exit by larger mortgage warehouse lenders has created opportunity to provide credit at attractive spreads

§ Warehouse segment led by professionals with over 25+ years experience in the sector

§ Generally low-risk lending business due to high quality collateral, historically quick turnover of originated loans

and no put-back risk to Customers

and no put-back risk to Customers

– Customers has no credit losses since inception in 2009

– Recent possible fraud loss due to suspected collusion between closing agent and mortgage banker; $2

million charge taken against fraud with potential for recovery through liens and court orders

million charge taken against fraud with potential for recovery through liens and court orders

– Additional checks and procedures added to further enhance risk management process

§ Strong growth over the past two years; currently have approximately 80-85 clients nationwide

– Deposit relationship and source of fee income

§ Warehouse lending currently comprises approximately 38% of average assets. Longer term goal (2-3 years)

for warehouse lending to comprise 25% or less

for warehouse lending to comprise 25% or less

Source: Company documents.

(1) Average outstanding for the respective quarter.

16

§ No charge-offs on loans originated since 2009

§ Less than 0.8% of NPAs from non-FDIC covered and acquired loans

§ Strong credit and risk management cultures

Minimal Credit Issues

Source: Company documents.

*Excludes accruing TDRs and loans 90 days+ past due and still accruing.

($ in millions)

Non-covered Nonperforming Assets

17

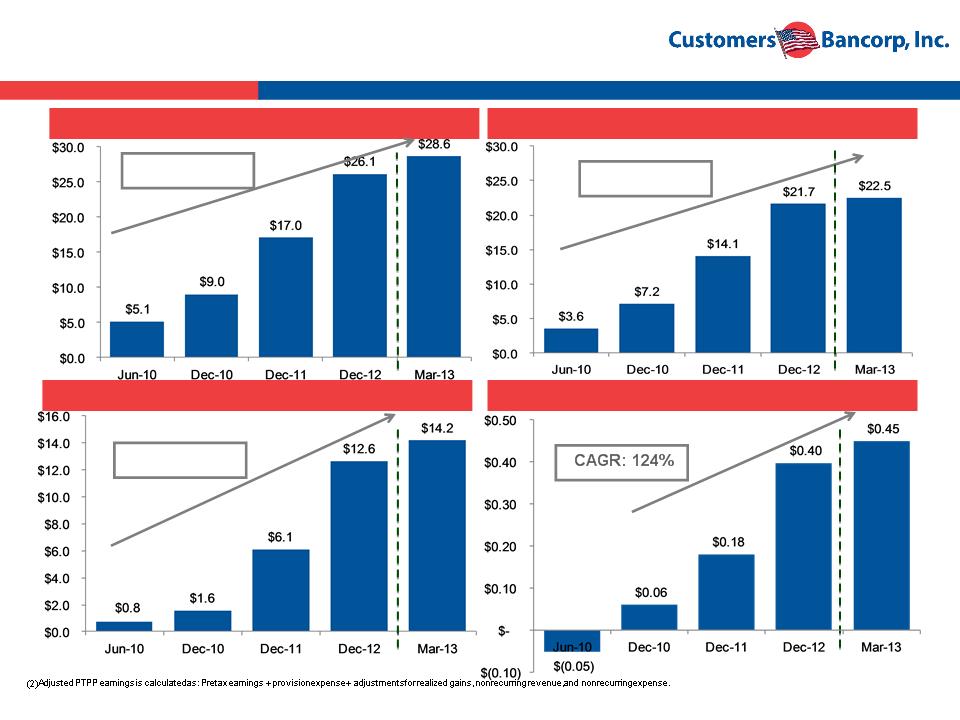

Disciplined and Profitable Growth

Revenue ($mm) (1)

Adjusted PTPP Earnings ($mm) (2)

Core EPS (3)

Source: SNL Financial and Company data.

(1)Revenue equals net interest income plus noninterest income.

(3)Core income, on a diluted per-share basis. Core income is net income before extraordinary items, less net income attributable to noncontrolling interest, the after-tax portion of income from investment (non-trading)

securities and nonrecurring items. The assumed tax rate was the effective tax rate for the respective quarter. CAGR calculated from Dec-10 to Mar-13.

securities and nonrecurring items. The assumed tax rate was the effective tax rate for the respective quarter. CAGR calculated from Dec-10 to Mar-13.

Net Interest Income ($mm)

CAGR: 87%

CAGR: 94%

CAGR: 190%

18

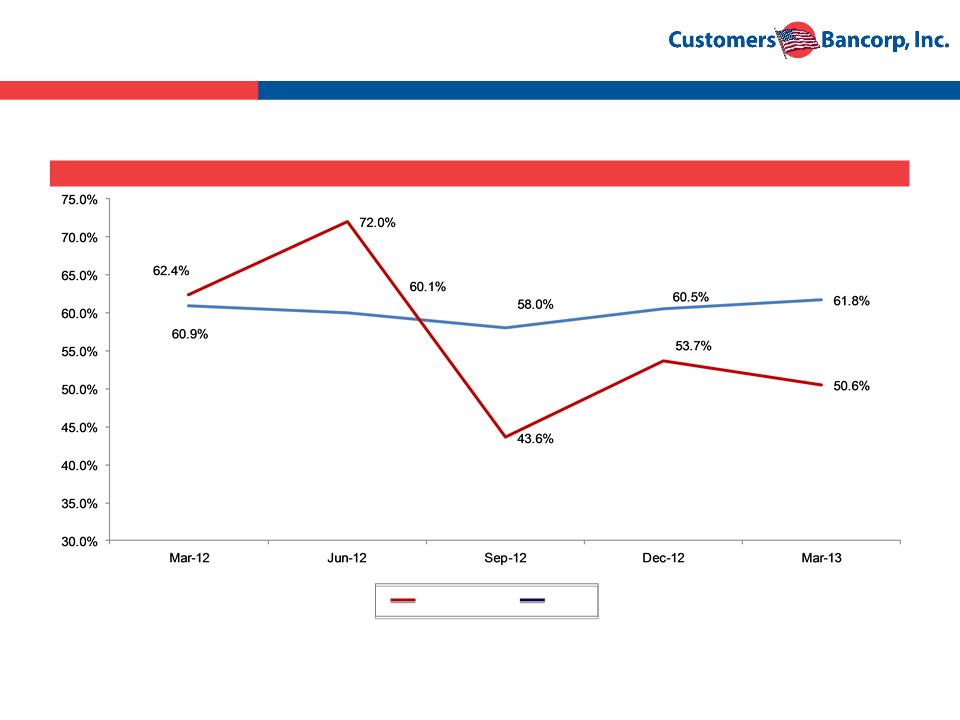

Efficient Cost Structure

Customers

Peers

Source: SNL Financial and Company data.

Peers consists of Northeast and Mid-Atlantic banks and thrifts with assets between $2.0 billion and $6.0 billion and most recent quarter core ROAA greater than 90bps. Excludes merger targets and MHCs. Please see

appendix for more information.

appendix for more information.

Efficiency ratio calculated as noninterest expense before foreclosed property expense, amortization of intangibles, and goodwill impairments as a percent of net interest income (fully taxable equivalent, if available) and

noninterest revenues, excluding only gains from securities transactions and nonrecurring items.

noninterest revenues, excluding only gains from securities transactions and nonrecurring items.

(1)Efficiency ratio excludes impact of $2 million charge for warehouse fraud. Including $2 million charge, efficiency ratio would be 57.5%.

§ 18% more efficient than peers leading to higher ROAE vs. peers

Efficiency Ratio: Customers Bancorp vs. Peers

(1)

19

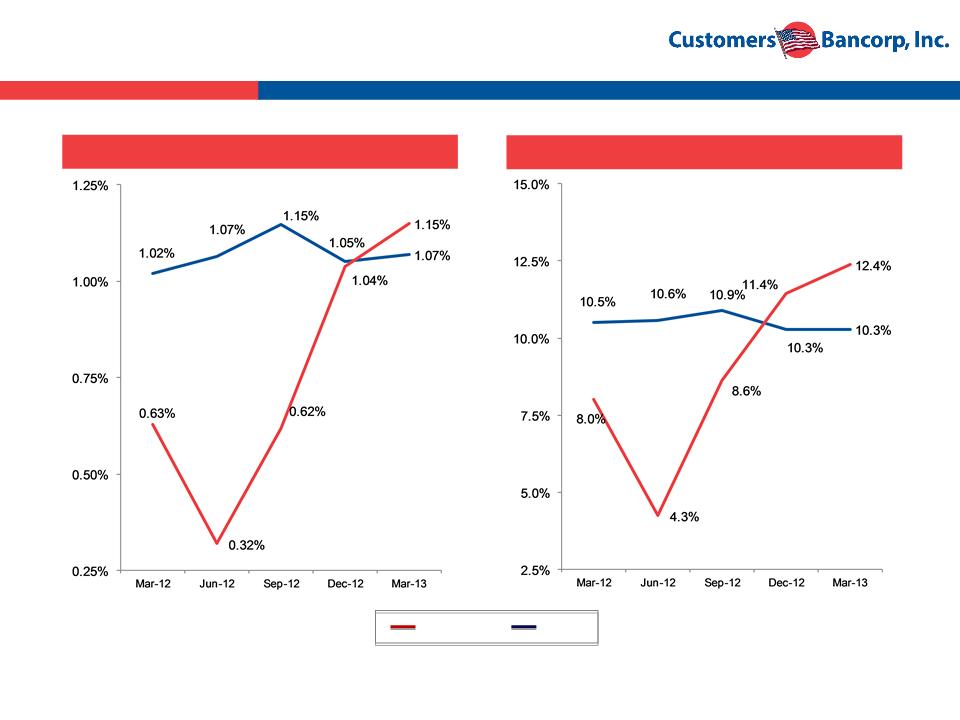

Superior Financial Returns

Source: SNL Financial and Company data.

Peers consists of Northeast and Mid-Atlantic banks and thrifts with assets between $2.0 billion and $6.0 billion and most recent quarter core ROAA greater than 90bps. Excludes merger targets and

MHCs. Please see appendix for more information.

(1)Core ROAA and ROAE excludes after tax impact of $2 million charge for warehouse fraud (tax rate of 35%). Including $2 million charge, reported ROAA of 0.98% and ROAE of 10.6%.

Core ROAE

Core ROAA

Customers

Peers

(1)

(1)

§ Operating leverage has created inflection point in profitability and returns

20

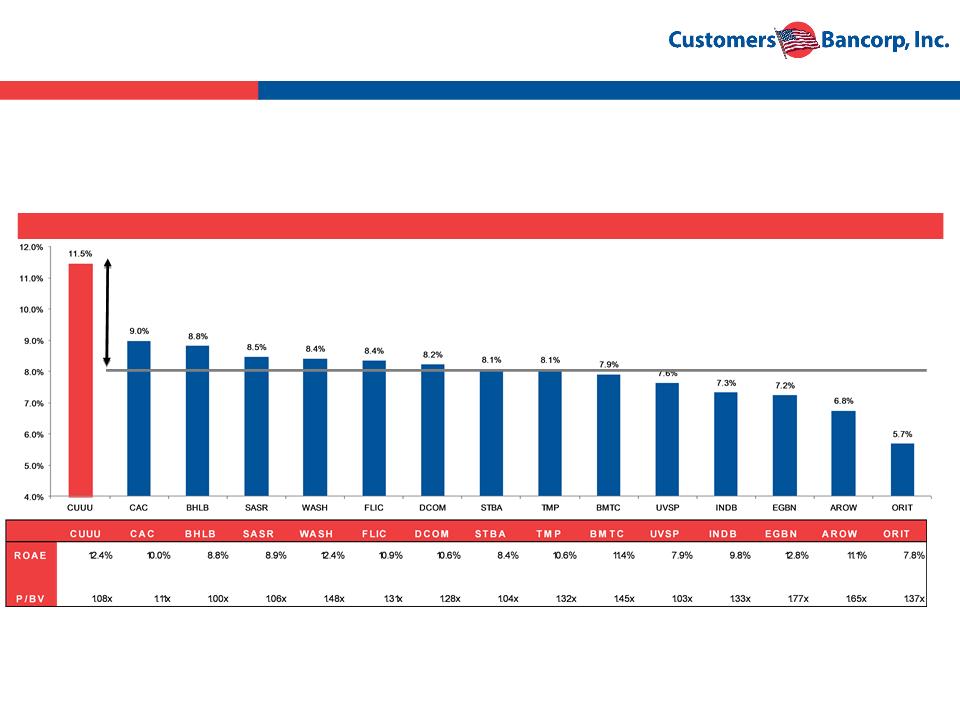

High Return on Investment

Source: SNL Financial and Company data. Market data as of 5/6/13. Peers consists of Northeast and Mid-Atlantic banks and thrifts with assets between $2.0 billion and $6.0 billion and most recent

quarter core ROAA greater than 90bps. Excludes merger targets and MHCs. Please see appendix for more information.

Customers Bancorp ROAE excludes after tax impact of $2 million charge for warehouse fraud (tax rate of 35%). Including $2 million charge, reported ROAE of 10.6%.

Return on Investment

Peer Median: 8.1%

§ Return on Investment for Customers Bancorp 42% higher than peer group

§ Return on Investment calculated as Return on Average Equity (MRQ) divided by Price/Book

Value

Value

42% Higher

21

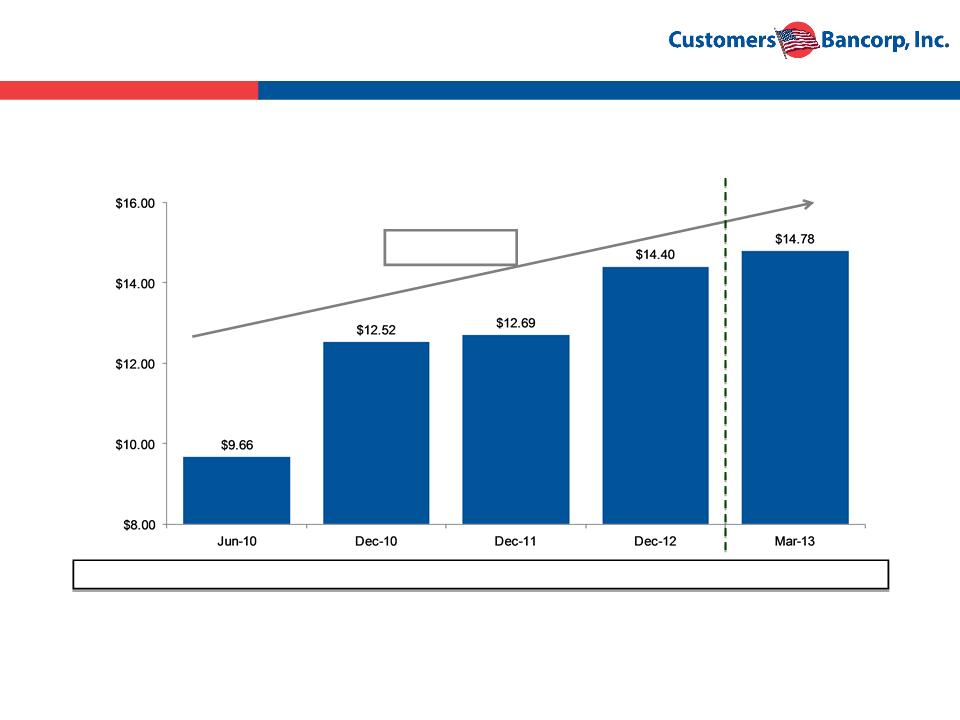

Enhancing Shareholder Value

§ Over 50% increase in tangible book value per share in the past 11 quarters(1)

BV/Share

$9.66

$12.52

$13.02

$14.60

$14.98

Source: SNL Financial, Company documents.

(1) December 2012 and March 2013 data includes effects of September 2012 common stock offering at $14.00 per share.

CAGR: 17%

22

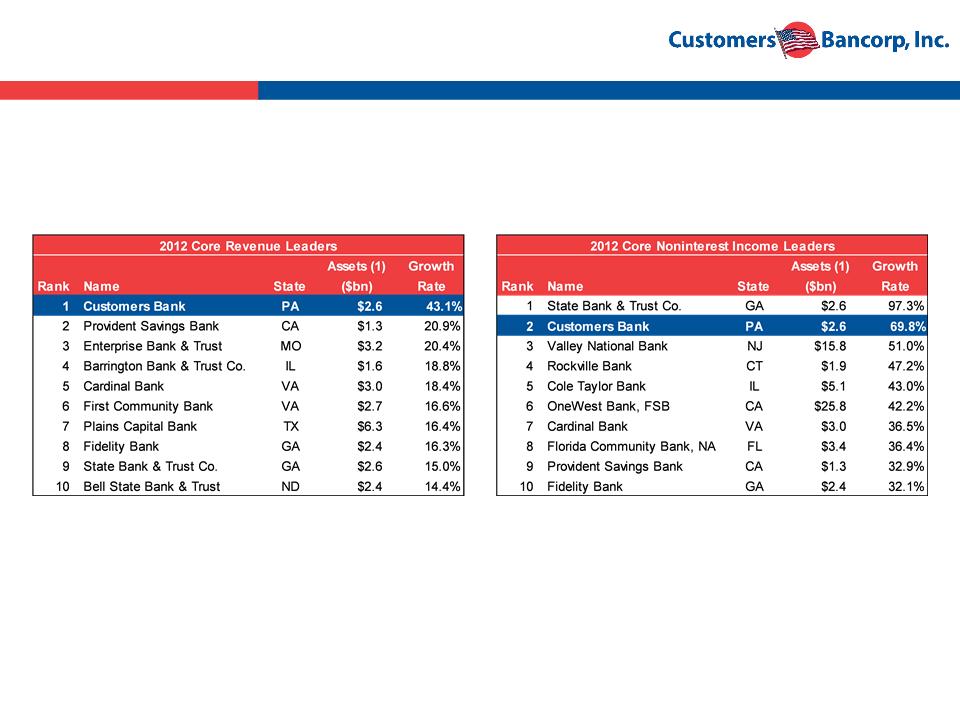

Bank Director Magazine 2013 Growth

Leader Rankings

Leader Rankings

Source: Bank Director Magazine, 2nd Quarter 2013 issue. (1) Assets as of 9/30/12.

§ Ranked #1 overall by Bank Director Magazine in the 2013 Growth Leader Rankings

§ Rankings independently conducted by Fiserv based on commercial banks, savings banks and

BHCs with assets greater than $1.0 billion

BHCs with assets greater than $1.0 billion

23

Investment Highlights

§ Profitable, well-capitalized $3.5 billion bank in attractive markets in New

England, New York, New Jersey, and Pennsylvania

England, New York, New Jersey, and Pennsylvania

§ Clean bank with Non-Covered NPAs of 0.77%

§ 10.0% - 12.0% ROE driven by prudent organic loan growth, increased revenue

and stable noninterest expense

and stable noninterest expense

§ Strong organic growth and acquisition opportunities in current markets

§ Management team with extensive community banking and M&A experience

§ Significant management and Board ownership

§ Recognized as #1 ranked bank by Bank Director Magazine in the 2013 Growth

Leader Rankings

Leader Rankings

§ NASDAQ listing

24

Appendix

25

Peer Group Comparison

High Performance Regional Peers

Source: SNL Financial, Company documents. Market data as of 5/6/13. Consists of Northeast and Mid-Atlantic banks and thrifts with assets between $2.0 billion and $6.0 billion and most recent quarter core ROAA greater than

90bps. Excludes merger targets and MHCs.

90bps. Excludes merger targets and MHCs.

Note: Customers Bancorp P/Estimated EPS ratios based on mid-point of publicly disclosed estimates by Customers Bancorp in the earnings call on 4/22/13.

(1)Customers Bancorp Core ROAA and ROAE excludes after tax impact of $2 million charge for warehouse fraud (tax rate of 35%). Including $2 million charge, reported ROAA of 0.98% and ROAE

of 10.6%.

of 10.6%.

(2)Customers Bancorp NPAs/Assets calculated as non-covered NPAs divided by total assets. Non-covered NPAs excludes accruing TDRs and loans 90+ days past due and still accruing.

26

GAAP Reconciliation

Source: Company documents.

(1) One-time adjustment for 1Q13 reflects $2.0 million loss due to warehouse mortgage fraud. One-time adjustment for 4Q11 reflects interest and loan commitment fee reversals due to timing differences and other

miscellaneous expenses due to timing differences.

miscellaneous expenses due to timing differences.

2013 Annual Shareholders Meeting

Effortless Banking