Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED MAY 21, 2013 - Qumu Corp | rimage132392_8k.htm |

1 NASDAQ: RIMG Qumu: How Business Does Video Exhibit 99.1

2 This presentation contains “forward - looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on managements’ current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward - looking statements may include statements regarding future financial results and performance, achievements, plans and objectives, product development, product potential, dividend payments and share repurchases. No forward - looking statement can be guaranteed, and actual results may differ materially from those projected. Rimage undertakes no obligation to update any forward - looking statement, whether as a result of new information, future events or otherwise. Forward - looking statements in this presentation should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors and cautionary statements set forth in our Form 10 - K for the year ended December 31, 2012, in our other filings with the SEC and in our press release issued April 24, 2013 announcing first quarter 2013 results. These reports and the press release are available on our website at www.rimage.com . In addition, a reconciliation of non - GAAP earnings per share measure may be found under the link “Non - GAAP Financial Reconciliation” in the Investors section of our website at www.rimage.com . Forward - Looking Statements and Non - GAAP Earnings Measures

3 Who We Are • We provide the tools, infrastructure and service enterprises require to better create, distribute, secure and measure video • Our innovative solutions release the power in video to fully engage and empower employees, partners, clients and their customers • Social business trends are driving increased use of video for enterprise communication and collaboration We deliver video with value

4 • Qumu expected to grow greater than 50% in 2013 • Positioned for consolidated revenue growth in 2013 • Strong cash position - $48 million at March 31, 2013 – Cash flow from operations expected to approach breakeven levels in 2013 • Disc publishing business is profitable, generates cash and delivers a recurring revenue stream • Current market cap is approximately $69 million – Cash on hand $48 million at March 31, 2013, no debt – Disc Publishing will generate approximately $10 million of cash flow in 2013 – Qumu revenues will grow greater than 50% in 2013 • Repurchased 15% of outstanding shares in 2012 – 778K shares remaining on existing authorization Investment Considerations

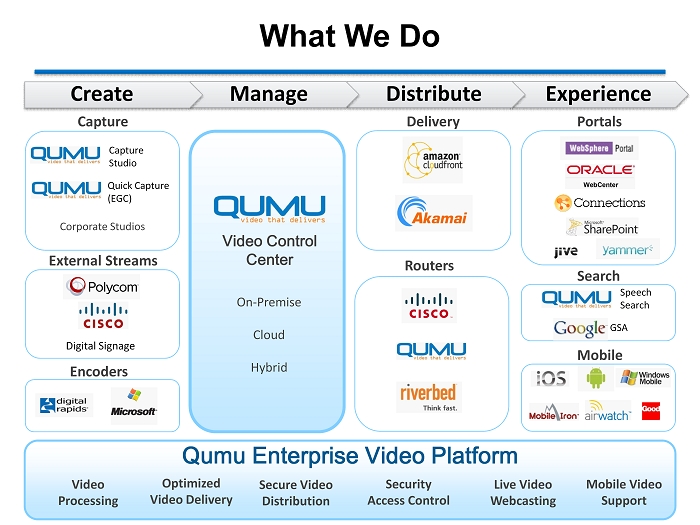

5 What We Do Optimized Video Delivery Security Access Control Live Video Webcasting Mobile Video Support Video Processing Secure Video Distribution Create Manage Distribute Experience Portals Search Mobile GSA Speech Search On - Premise Cloud Hybrid Video Control Center Delivery Routers External Streams Encoders Capture Corporate Studios Capture Studio Quick Capture (EGC) Digital Signage Qumu Enterprise Video Platform

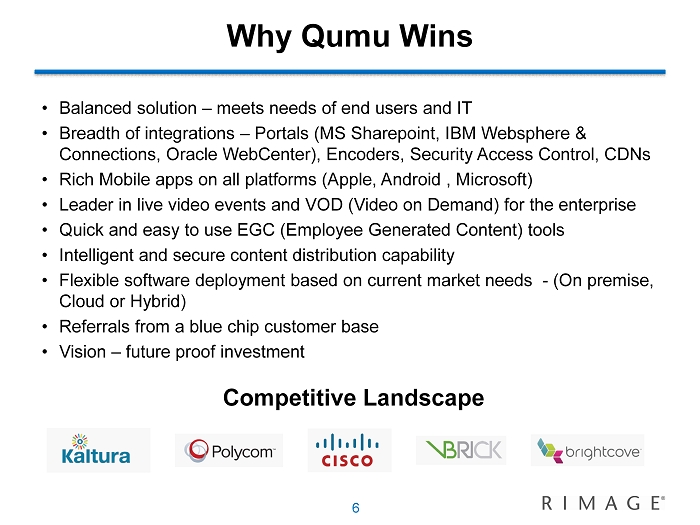

6 • Balanced solution – meets needs of end users and IT • Breadth of integrations – Portals (MS Sharepoint , IBM Websphere & Connections, Oracle WebCenter), Encoders, Security Access Control, CDNs • Rich Mobile apps on all platforms (Apple, Android , Microsoft) • Leader in live video events and VOD (Video on Demand) for the enterprise • Quick and easy to use EGC (Employee Generated Content) tools • Intelligent and secure content distribution capability • Flexible software deployment based on current market needs - (On premise, Cloud or Hybrid) • Referrals from a blue chip customer base • Vision – future proof investment Why Qumu Wins Competitive Landscape

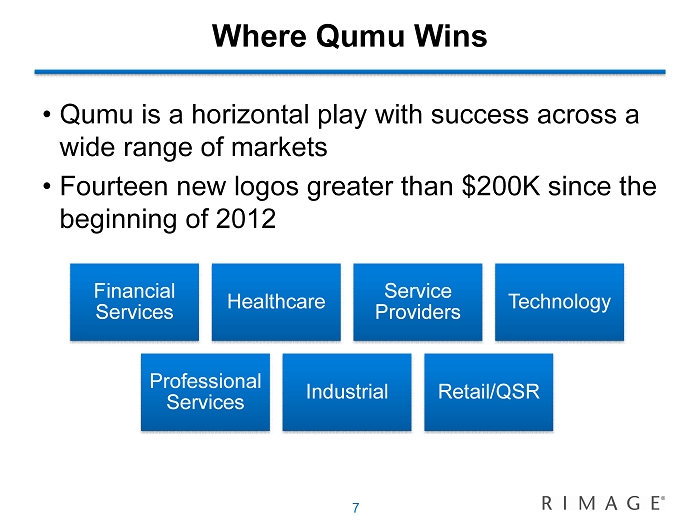

7 • Qumu is a horizontal play with success across a wide range of markets • Fourteen new logos greater than $200K since the beginning of 2012 Where Qumu Wins Financial Services Healthcare Service Providers Technology Professional Services Industrial Retail/QSR

8 • “Social Business” – major component of today’s business strategy and a growing multi - billion dollar market • Social business is: – Bringing global workforces together and aligning them around key initiatives and change – Rapidly finding expertise and information – Proactively sharing knowledge and best practices – Insightful – employees, customers, partners, competitors – IT confidently empowering BYOD and embracing the cloud – Necessary to compete, ROI Why Now • “Video” – a catalyst for social business – Personal, vivid and transparent – Real in a way that words in an email will never be – E xtreme content – it isn’t easy

9 • By 2016, large companies will stream more than 16 hours of video per worker, per month. – Gartner Marketscape , 2012 • Use of live and on - demand video will increase by more than 40% during the next few years. – Gartner Marketscape , 2012 • 59% of C - level decision makers prefer online video to reading text. More than 80% said they are watching more online video today than they were a year ago. – Forbes Video in the C - Suite Study • 92 % of users say they need video in their enterprise portal. 88% are uploading video now to their enterprise portal, but 74% report problems doing so. – 2013 Qumu uSamp survey • 62.4% of survey respondents indicated a preference for video over all other types of communication for company all hands meetings, HR training sessions, and when trying to understand technical topics. – Ragan Communications 2012 survey Why Now

10 Companies are incorporating video into a multitude of business applications: • C - suite town hall meetings • Collaboration and knowledge sharing • Social video sharing portals • Video blogging • Sales training and enablement • New product release training • Safety and Compliance training • Customer service videos • Employee on - boarding and training Why Now

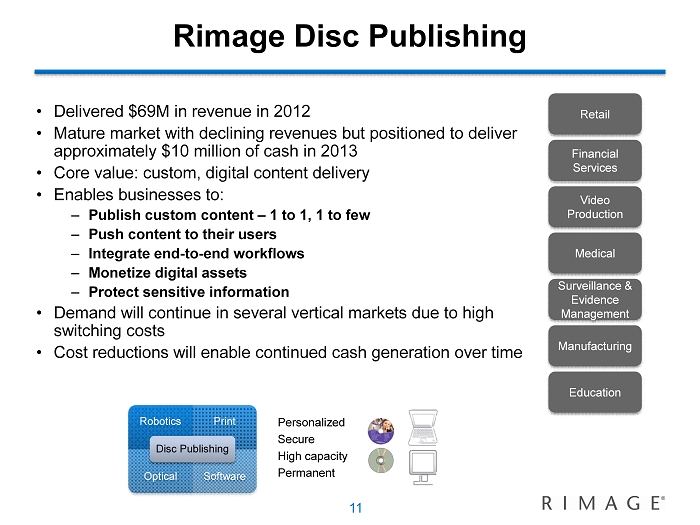

11 • Delivered $69M in revenue in 2012 • Mature market with declining revenues but positioned to deliver approximately $10 million of cash in 2013 • Core value: custom, digital content delivery • Enables businesses to: – Publish custom content – 1 to 1, 1 to few – Push content to their users – Integrate end - to - end workflows – Monetize digital assets – Protect sensitive information • Demand will continue in several vertical markets due to high switching costs • Cost reductions will enable continued cash generation over time Rimage Disc Publishing Personalized Secure High capacity Permanent Retail Financial Services Video Production Medical Manufacturing Education Robotics Print Optical Software Disc Publishing Surveillance & Evidence Management

12 • Expanded Qumu’s business – Improved sales execution and lead generation – Expanded sales in Europe and Asia – Fourteen logos > $200K since the beginning of 2012 – Grew contracted commitments – Q4 2012 backlog $12.7 million, up more than $11 million from Q1 2012 – H2 2012 revenue more than tripled from H1 – Q1 2013 revenue up 216% from Q1 2012 • Continued progress in product offerings – Launched Signal (secure download product, cloud) – Expanded enterprise integrations with leading portal providers – Forrester Wave Leader, Enterprise Video Platforms - Qumu named most feature - rich application vs. competition • Continued investor returns through expanded buyback – Repurchased 1.5 million shares ($10 million) - almost 15% of outstanding shares 2012 - 2013 Milestones 2013 Forrester Wave Report Leader, Enterprise Video Platforms

13 Financial Results & Outlook $18.1 $17.0 $18.1 $16.4 $15.1 $1.4 $1.3 $2.8 $4.3 $4.3 Q1 Q2 Q3 Q4 Q1 Disc Publishing Qumu 2013 Revenues in millions Transformation underway: Qumu represents an increasing share of total company revenue. For 2013, Company expects overall revenue growth with Qumu revenue growing greater than 50%; partially offset by decline in disc publishing revenue. 2012 $(0.70) $(0.70) $(0.30) $(0.20) $(1.00) $(2.00) $(1.00) $- $1.00 $2.00 Q1 Q2 Q3 Q4 Q1 2013 2012 Cash from Operations in millions Q1 cash balance $48 million. Cash used in operations <$2M in 2012. For 2013, Company expects that cash generated from disc publishing will be mostly offset by cash used to grow Qumu.

14 • Qumu expected to grow greater than 50% in 2013 • Positioned for consolidated revenue growth in 2013 • Strong cash position - $48 million at March 31, 2013 – Cash flow from operations expected to approach breakeven levels in 2013 • Disc publishing business is profitable, generates cash and delivers a recurring revenue stream • Current market cap is approximately $69 million – Cash on hand $48 million at March 31, 2013, no debt – Disc Publishing will generate approximately $10 million of cash flow in 2013 – Qumu revenues will grow greater than 50% in 2013 • Repurchased 15% of outstanding shares in 2012 – 778K shares remaining on existing authorization Investment Considerations

15 NASDAQ: RIMG How Business Does Video