Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - Qumu Corp | rimage101201_ex31-1.htm |

| EX-23.1 - CONSENT OF KPMG LLP - Qumu Corp | rimage101201_ex23-1.htm |

| EX-21.1 - SUBSIDIARIES OF RIMAGE CORPORATION - Qumu Corp | rimage101201_ex21-1.htm |

| EX-10.18 - FORM OF NON-EMPLOYEE DIRECTOR RESTRICTED STOCK UNIT AGREEMENT - Qumu Corp | rimage101201_ex10-18.htm |

| EX-32 - CERTIFICATION OF CEO/CFO PURSUANT TO SECTION 906 - Qumu Corp | rimage101201_ex32.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - Qumu Corp | rimage101201_ex31-2.htm |

|

|

|

FORM 10-K |

|

U.S. SECURITIES AND EXCHANGE COMMISSION |

|

WASHINGTON, DC 20549 |

|

|

|

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE |

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009 |

|

OR |

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE |

|

|

|

COMMISSION FILE NO. 000-20728 |

|

|

|

RIMAGE CORPORATION |

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

Minnesota |

|

41-1577970 |

|

|

State or other jurisdiction of incorporation or organization |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

7725 Washington Avenue South, Minneapolis, Minnesota |

|

55439 |

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number: |

|

(952) 944 - 8144 |

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

Common Stock, $.01 par value |

|

|

|

|

|

Preferred Stock Purchase Rights |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: |

None |

Indicate

by checkmark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Indicate

by checkmark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

Large Accelerated Filer o Accelerated Filer x

Non-Accelerated Filer o Smaller Reporting Company o

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes o No x

The aggregate market value of common stock held by non-affiliates of the registrant, computed by reference to the last quoted price at which such stock was sold on such date as reported by the Nasdaq Stock Market as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $155,700,000.

As of February 28, 2009, 9,471,885 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2010 Annual Meeting of Shareholders, to be filed within 120 days after the end of the fiscal year covered by this report, are incorporated by reference into Part III hereof.

1

|

|

|

|

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

3 |

||

|

|

|

|

|

|

|

|

3 |

|

|

|

|

3 |

|

|

|

|

4 |

|

|

|

|

4 |

|

|

|

|

5 |

|

|

|

|

5 |

|

|

|

|

5 |

|

|

|

|

6 |

|

|

|

6 |

||

|

|

6 |

||

|

|

11 |

||

|

|

11 |

||

|

|

12 |

||

|

|

12 |

||

|

|

|

|

|

|

|

12 |

||

|

|

|

|

|

|

Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

12 |

|

|

|

12 |

||

|

|

12 |

||

|

|

13 |

||

|

|

14 |

||

|

|

15 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

16 |

|

|

|

16 |

||

|

|

16 |

||

|

|

19 |

||

|

|

20 |

||

|

|

22 |

||

|

|

22 |

||

|

|

22 |

||

|

|

23 |

||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

49 |

|

|

|

49 |

||

|

|

50 |

||

|

|

|

|

|

|

|

50 |

||

|

|

|

|

|

|

|

50 |

||

|

|

50 |

||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters |

|

50 |

|

|

Certain Relationships and Related Transactions and Directors Independence |

|

51 |

|

|

|

51 |

||

|

|

|

|

|

|

|

51 |

||

|

|

|

|

|

|

|

51 |

||

|

|

|

|

|

|

|

52 |

||

2

General Information

|

|

|

|

BUSINESS |

Rimage Corporation (“Rimage” or the “Company”) is a leading provider of high-performance digital publishing systems that are used by businesses to produce recordable CD, DVD and Blu-ray Discs™ with customized digital content on an on-demand basis. Rimage’s publishing systems, which include equipment to handle a full range of low-to-high production volumes, incorporate robotics, software and custom printing technology for disc labeling. Rimage focuses its digital publishing solutions on a set of vertical markets with special needs for customized, on-demand digital information, including digital photography, medical imaging, business services, law enforcement and video workflows.

Incorporated as IXI, Inc. in Minnesota in February 1987, Rimage has focused on digital storage production equipment since its inception. Since 1995, Rimage has focused its business on development and sale of its CD recordable (“CD-R”) publishing systems, and since 2000, its DVD recordable (“DVD-R”) publishing systems. Blu-ray capabilities were integrated into key products in late 2006 to address the needs of customers desiring the substantial increase in storage capacity provided by this technology.

Rimage’s products are designed to enable the automation of data distribution and archiving processes. In some cases, this results in reductions of labor, training and inventory costs for users of the products; in other cases, it enables totally new and innovative applications. Rimage products provide compelling solutions for distribution and archiving of information on recordable CD, DVD and Blu-ray media for just-in-time, on-demand and mass customization of discs with unique content and labels.

The principal benefits to users of Rimage’s products include unattended operation, reduced labor costs and higher throughput and quality than alternative systems. One of the essential elements of Rimage’s marketing and development strategy is to provide users with a path for future product upgrades to obtain improved products or products with additional capabilities, such as drives that will accommodate new media types, drives with faster recording speeds and opportunities to upgrade to improved printing technologies. Rimage has made a long-term commitment to its customers by providing maintenance service contracts, replacement parts and repair service for current, as well as past products.

Sales of Rimage’s digital publishing systems comprised 40%, 39%, and 52% of its revenue from operations during 2009, 2008 and 2007, respectively. Rimage’s other major sources of revenue are recurring in nature and consist of consumables (ribbons, ink cartridges and Rimage-branded blank recordable CD, DVD and Blu-ray media), parts and maintenance contract sales.

Rimage’s digital publishing systems have been divided into two primary product lines: the Producer line of equipment for higher volume requirements for production of recordable CD, DVD or Blu-ray media, and the Desktop line of lower-cost products for office and other desktop applications. The Producer line of hardware products continues to generate a significant portion of Rimage’s revenue, comprising 34% of total revenues during 2009 at $27.9 million, 33% during 2008 at $30.3 million and 43% during 2007 at $46.8 million. The Desktop line of hardware products contributed 6% of total revenues in 2009 at $5.1 million, 6% in 2008 at $5.8 million and 9% in 2007 at $9.4 million. The balance of revenue in each year was generated through sale of Rimage-branded blank recordable CD, DVD and Blu-ray media, ribbons, ink cartridges, parts, repair services and maintenance contracts. These recurring revenues comprised 60% of total revenues during 2009 at $50.3 million, 61% during 2008 at $55.3 million and 48% during 2007 at $52.6 million. The decrease in recurring revenues has been driven by the economic downturn compressing demand for many products including the CD, DVD, and Blu-ray media products created by Rimage customers.

The Producer III Series. The Producer III Series of digital publishing systems, introduced in 2006, represent the latest generation of the high-performance Producer line and consists of a family of products that cover a broad range of applications for the publishing and duplication of CD, DVD and Blu-ray discs with digital content. The Company augmented its Producer product line with the introduction in 2007 of the Professional Series line of digital publishing systems. Each product in the Producer line incorporates recorders capable of recording on CD, DVD or Blu-ray media, customized robotics, a thermal or thermal re-transfer printer for on-disc color printing, software and computer hardware components.

Rimage offers its Producer line of products in seven basic configurations to meet the varying needs of its commercial customers. The Rimage 8100 system, part of the Producer III Series of publishing systems introduced in 2006, provides industry leading speed and throughput for on-demand production of CD, DVD or Blu-ray discs with digital content. The Rimage 8100 system utilizes up to four simultaneous data streams and four recorders and provides for a capacity of 300 discs. The Rimage 7100 system, also part of the Producer III Series, has two recorders. The Rimage 6100 system, introduced in 2008 as an expansion of the Producer III Series, has a

3

single recorder. The Rimage 8100 and Rimage 7100 systems have a control center embedded inside the unit, while the Rimage 6100 is available with an embedded control center or may be purchased without a control center. The Rimage 8100, 7100, and the single-recorder 6100 systems are each available with either Rimage’s Everest or Prism printers. The Professional Series systems include the 5300N and 5100N, designed as network-attached publishing systems that feature an embedded control center, an Everest printer and a small product size and footprint. Rimage introduced two new digital publishing systems to its Professional Series line of products effective March 1, 2010. The Rimage Professional Series 5400N and Rimage Professional Series 3400 offer an entry point for on-demand disc publishing and are compact, all-in one solutions designed specifically for retail applications and disc publishing in front office settings. Both systems utilize two recorders, three input bins and an Everest printer. The Rimage Professional Series 5400N has a control center embedded inside the unit, while the Rimage Professional Series 3400 does not contain a control center. The Professional Series 5400N and 3400 line of systems will replace the 5300N and 5100N as product offerings over the course of 2010.

The Everest printer was developed to meet the need of customers for an on-demand surface printer able to produce color and monochrome labels with quality similar to offset and silkscreen printing systems. Everest produces images on recordable CD, DVD and Blu-ray media that are indelible and cover the full surface of the media. In 2008, Rimage introduced the Everest 600 printer which enables users to print labels with 600 dpi print resolution for printing photo quality images and clear, crisp text. Rimage’s Prism printer provides high-speed, laser quality monochrome and spot color printing on standard recordable CD and DVD media for in-house, customized printing. The Producer line also includes Autoprinters that incorporate either an Everest or Prism printer.

The markets and applications for Rimage’s Producer line of products include digital photography, medical imaging, business services, law enforcement and video workflows. List prices for the Producer line of publishing products available during 2009 currently range from $10,500 to $37,950. List prices for the recently introduced Professional Series 5400N and 3400 range from $6,950 to $12,950.

The Desktop Series. Rimage’s Desktop Series of CD-R/DVD-R products feature economical pricing, a compact “desktop” design, software, network compatibility and stand-alone, plug-and-play technology ideal for office environments. The Company introduced the two-drive recorder Rimage 2000i Desktop publishing system and Rimage 480i thermal inkjet printer in June 2004. Co-developed by the Company and Hewlett-Packard, the Rimage 480i inkjet printer features 4800 dpi resolution for high clarity color printing on CD-R/DVD-R discs. The current list price for the Rimage 2000i Desktop publishing system is $3,450.

During 2009 and through March 31, 2010, Rimage has and will utilize the following principal means of distributing its products: A two-tier distribution channel of distributors to value added resellers in Europe, the U.S. and Latin America; a distributor or OEM to end-user distribution channel in Asia Pacific, some areas in Europe and some U.S. market applications; and direct sales to select accounts using its own sales force. Rimage’s channel partners, primarily consisting of distributors, value added resellers and other strategic partners, currently generate the majority of the Company’s sales.

Effective April 1, 2010, Rimage is terminating its distributor relationships with distributors in the United States, Germany, and the United Kingdom. The termination of these distributors is part of the Company’s plan to improve the efficiency of its sales channels. Following termination of the distributors, the Company will sell product in these regions to end-user customers primarily through value-added resellers or other strategic partners and also directly to select accounts through its own sales force.

Rimage has historically focused its sales and marketing efforts on high-volume CD-R and DVD-R publishing solutions for its Producer product line in such areas as banking and finance, wholesale photo processing labs, medical imaging, and retail photography. Rimage plans to continue to expand its position in some of these markets while also focusing on new applications with high-growth potential in business services, law enforcement and video workflows. The Company’s sales and marketing organization is focused on penetrating these targeted markets and strengthening marketing support for new products.

During 2009, 2008 and 2007, Rimage derived 18%, 15% and 14% of its respective revenues from one of its distributors, and derived 10%, 11% and 9% of its revenues from a second distributor during the same respective periods. Sales to one of the Company’s strategic partners represented 11%, 10% and 9% of revenues during 2009, 2008 and 2007, respectively. The agreement governing these sales is the Company’s standard distributor agreement (in the case of the distributors) or standard form of purchase order in the case of the strategic partner.

Rimage conducts foreign sales through its U.S. operation and its subsidiaries in Germany and Japan, Rimage Europe GmbH and Rimage Japan Co., Ltd., respectively. Foreign sales constituted approximately 41% of Rimage’s revenues for the year ended December 31, 2009, 42% for the year ended December 31, 2008 and 36% of revenues for the year ended December 31, 2007.

Rimage competes with a number of manufacturers of CD-R/DVD-R/Blu-ray production equipment and related products. Primary competitors of the Company currently include Primera Technology, Inc., Teac, Microtech Systems, Inc., and Seiko Epson Corporation. Rimage is able to compete effectively in the sale of digital publishing systems because of technological leadership in

4

automated solutions and its early start within the CD-R/DVD-R production equipment industry. Rimage believes that its quality printing capabilities for recordable CD, DVD and Blu-ray media, its transporter mechanisms, its software, its serviceability, and its integration tools differentiate its products from those of competitors. Rimage also competes with online distribution and alternative technologies in the storage media industry such as high capacity hard drives, tape drives and flash memory. Rimage believes that within its targeted markets its technology has advantages over these alternative technologies in terms of usability, reliability, performance, security and cost.

Rimage’s manufacturing operations consist primarily of the assembly of products from components purchased from third parties. Some parts are standard components and others are manufactured to Rimage’s specifications. Rimage’s employees at its facility in Edina, Minnesota conduct assembly and testing operations. Components include DVD-R drives, Blu-ray recorders, printers, circuit boards, electric motors, machined and molded parts, precision sheet metal assemblies, computer components and other mechanical parts. The Company depends upon a single-source supplier for its Everest printers and, beginning in March 2010, its Rimage Professional Series 5400N and Rimage Professional Series 3400 systems. The Company currently purchases these products pursuant to its standard form of purchase order, submitted to the supplier from time to time as the products are needed.

Although Rimage believes it has identified alternative assembly contractors for most of its subassemblies and products, an actual change in such contractors would likely require a period of training and testing. Accordingly, a sudden interruption in a supply relationship or the production capacity of one or more of such contractors could result in increased costs, delivery delays, loss of sales and quality control issues as the Company seeks to secure alternative sources of supply.

At December 31, 2009, 27 full-time employees were involved in research and development at Rimage. This staff, with software, electrical, mechanical and drafting capabilities, engages in research and development of new products and development of enhancements to existing products. In addition, Rimage partners with third-parties to utilize their competencies in creating products to enhance its product offering.

The industries served by Rimage are subject to rapid technological changes. Other technologies, including online distribution and alternative data storage media exist or are under development, including high capacity hard drives, tape drives and flash memory. All these forces may affect the usage of recordable CD, DVD and Blu-ray media. Rimage believes that it must continue to innovate and anticipate advances in the storage media industry in order to remain competitive.

Rimage’s expenditures for research and development were $7.1 million, $5.3 million and $5.9 million in 2009, 2008 and 2007, representing 8.6%, 5.7% and 5.4% of revenues, respectively. Rimage anticipates its expenditures in research and development in 2010 will remain similar to the levels experienced during 2009 to support a sustained level of new product development initiatives and improve existing products.

Patents and Government Regulation

Rimage currently maintains 27 U.S. and foreign patents and has a total of four U.S. and foreign patents pending. In addition, Rimage protects the proprietary nature of its software primarily through copyright and license agreements and through close integration with its hardware offerings. It is Rimage’s policy to protect the proprietary nature of its newly developed products whenever they are likely to become significant sources of revenue. No assurance can be given that Rimage will be able to obtain patent or other protection for its products. In addition, Rimage has registered and may in the future register trademarks and other marks used in its business.

As the number of Rimage’s products increases and the functionality of those products expands, Rimage believes that it may become increasingly subject to attempts by others to duplicate its proprietary technology and to the possibility of infringement of Rimage patents. In addition, although Rimage does not believe that any of its products infringe on the rights of others, third parties have claimed, and may in the future claim, Rimage’s products infringe on their rights and these third parties may assert infringement claims against Rimage in the future. Rimage may litigate to enforce patents issued to it and to defend against claimed infringement of the rights of others or to determine the ownership, scope, or validity of Rimage’s proprietary rights and the rights of others. Any claim of infringement against Rimage could involve significant liabilities to third parties, could require Rimage to seek licenses from third parties, and could prevent Rimage from manufacturing, selling or using its products.

The FCC requires some of Rimage’s equipment to meet radio frequency emission standards. Rimage takes steps to ensure proper compliance of all products.

Blu-ray Disc™ is a trademark of the Blu-ray Disc Association.

5

At December 31, 2009, Rimage had 186 full-time employees, of which 27 were involved in research and development, 79 in production, testing, repair and customer service, and 80 in sales, marketing, administration and management. None of Rimage’s employees are represented by a labor union or covered by a collective bargaining agreement.

Cautionary Note Regarding Forward-Looking Statements

We make statements from time to time regarding our business and prospects, such as projections of future performance, statements of management’s plans and objectives, forecasts of market trends, and other matters that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements containing the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimates,” “projects,” “believes,” “expects,” “anticipates,” “intends,” “target,” “goal,” “plans,” “objective,” “should” or similar expressions identify forward-looking statements. Forward-looking statements may appear in documents, reports, filings with the Securities and Exchange Commission (SEC), news releases, written or oral presentations made by our authorized officers or other representatives. For such statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Our future results, including results expressed in or implied by forward-looking statements, involve a number of risks and uncertainties. Forward-looking statements are not guarantees of future actions, results or performance. Any forward-looking statement made by or on behalf of us speaks only as of the date on which such statement is made. We do not undertake any obligation to update or keep current any forward-looking statement to reflect events or circumstances arising after the date of such statement.

In addition to other matters identified or described by us from time to time in filings with the SEC, there are many important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or the results expressed in or implied by any forward-looking statements. These important factors are described below under Item 1A. Risk Factors.

|

|

|

|

RISK FACTORS |

If any of the following risks actually occur, our results of operations, cash flows and the market price of our common stock could be negatively impacted. Although we believe that we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our performance or financial condition.

Adverse economic conditions, particularly those affecting our customers, distributors and resellers, will harm our business.

Unfavorable changes in economic conditions, including recession, inflation, lack of access to capital, lack of consumer confidence or other changes have resulted and may continue to result in lower spending among customers in the industries we serve. Unfavorable economic conditions have also resulted and may continue to result in decreased sales to our distributors and resellers.

Further, we sell our products throughout the United States, as well as in several foreign countries. Our business may be adversely affected by factors in the United States and other countries, such as disruptions in financial markets or downturns in economic activity in specific countries or regions, or in the various industries in which we operate; social, political or labor conditions in specific countries or regions; or adverse changes in the availability and cost of capital, interest rates, tax rates, or regulations. These factors are beyond our control, but may result in further decreases in spending among customers and softening demand for our products.

Declining demand for our products would adversely affect our revenue. Further, challenging economic conditions also may impair the ability of our customers to pay for products and services they have purchased. As a result, our cash flow may be negatively impacted and our allowance for doubtful accounts and write-offs of accounts receivable may increase.

Technology in our industry evolves rapidly, potentially causing our products to become obsolete, and we must continue to enhance existing systems and develop new systems or we will lose sales.

Rapid technological advances, rapidly changing customer requirements and fluctuations in demand characterize the current market for our products. Further, online distribution and alternative data storage media is available, including high capacity hard drives, tape drives and flash memory. Our existing and development-stage products may become obsolete if our competitors introduce newer or more appealing technologies. If these technologies are patented or proprietary to our competitors, we may not be able to access these technologies. We believe that we must continue to innovate and anticipate advances in the storage media industry in order to remain competitive. If we fail to anticipate or respond to technological developments or customer requirements, or if we are significantly delayed in developing and introducing products, our business will suffer lost sales.

6

Our market is competitive and such competition may result in price reductions, lower gross profits and loss of market share.

The storage media industry is becoming more competitive, and we face the potential for increased competition in developing and selling our recordable CD, DVD and Blu-ray publishing systems in both the U.S. and in foreign markets. Our competitors may have or could develop or acquire significant marketing, financial, development and personnel resources. Our current primary competitors include Primera Technology, Inc., Teac America, Inc., Seiko Epson Corporation and Microtech Systems, Inc. To remain competitive, we believe that we must continue to provide:

|

|

|

|

|

|

• |

Technologically advanced systems that anticipate and satisfy the demands of end-users; |

|

|

|

|

|

|

• |

Continuing advancements in our recordable CD, DVD and Blu-ray digital publishing systems; |

|

|

|

|

|

|

• |

A responsive and effective sales force; |

|

|

|

|

|

|

• |

A dependable and efficient distribution and reseller network; |

|

|

|

|

|

|

• |

Superior customer service; and |

|

|

|

|

|

|

• |

High levels of quality and reliability. |

We cannot assure you that we will be able to compete successfully against our current or future competitors. The storage media industry has increased visibility, which may lead to large, well-known, well-financed companies entering into this market. Increased competition from manufacturers of systems or consumable supplies may result in price reductions, lower gross profit margins, and increased discounts to customers and loss of market share and could require increased spending by us on research and development, sales and marketing and customer support.

If our products fail to compete successfully with other existing publishing systems or newly-developed products for the storage media or content distribution industries, our business will suffer.

The success of our products depends upon our end users choosing our recordable CD, DVD and Blu-ray technology for their storage media needs. However, online distribution and alternative data storage media exist, such as high capacity hard drives, tape drives and flash memory. Further, additional media is under development. If end users perceive any technology that is competing with ours as more reliable, higher performing, less expensive or having other advantages over our technology, the demand for our products could decrease. Additionally, some of our competitors may make strategic acquisitions or establish cooperative relationships with suppliers or companies that produce complementary products. Competition from other publishing systems, online distribution or other storage media is likely to increase. If our products do not compete successfully with existing or new competitive products, our business will suffer.

We sell a significant portion of our products internationally, which exposes us to risks associated with foreign operations.

We sell a significant amount of our products to customers outside the United States, particularly in Europe, Asia and Latin America. International sales accounted for 41% of our revenues for the year ended December 31, 2009, 42% of our revenues for the year ended December 31, 2008, and 36% for the year ended December 31, 2007. We expect that shipments to international customers, including customers in Europe, Asia and Latin America, will continue to account for a significant portion of our net sales. Sales outside the United States involve the following risks, among others:

|

|

|

|

|

|

• |

Foreign governments may impose tariffs, quotas and taxes; |

|

|

|

|

|

|

• |

The demand for our products will depend, in part, on local economic health. |

|

|

|

|

|

|

• |

Political and economic instability may reduce demand for our products; |

|

|

|

|

|

|

• |

Restrictions on the export or import of technology may reduce or eliminate our ability to sell in certain markets; |

|

|

|

|

|

|

• |

Potentially limited intellectual property protection in certain countries may limit our recourse against infringing products or cause us to refrain from selling in certain markets; |

|

|

|

|

|

|

• |

We may face difficulties in managing our international operations; |

|

|

|

|

|

|

• |

The burden and cost of complying with a variety of foreign laws; |

|

|

|

|

|

|

• |

We may decide to price our products in foreign currency denominations; |

|

|

|

|

|

|

• |

Our contracts with foreign distributors and resellers cannot fully protect us against political and economic instability; |

|

|

|

|

|

|

• |

We may face difficulties in collecting receivables; and |

|

|

|

|

|

|

• |

We may not be able to control our international distributors’ efforts on our behalf. |

The financial results of our German and Japanese subsidiaries are translated into U.S. dollars for consolidation with our overall financial results. Additionally, we hedge against currency fluctuations associated with foreign currency denominated transactions (principally the Euro) with Rimage Europe. Despite our hedging activity, currency translations and fluctuations may adversely affect the financial performance of our consolidated operations. Currency fluctuations also may increase the relative price of our product in foreign markets and thereby could also cause our products to become less affordable or less price competitive than those of foreign

7

manufacturers. These risks associated with foreign operations may have a material adverse effect on our revenue from or costs associated with international sales.

If our domestic or international intellectual property rights are not adequately protected, others may offer products similar to ours which could depress our product selling prices and gross profit or result in loss of market share.

We believe that protecting our proprietary technology is important to our success and competitive positioning. In addition to common law intellectual property rights, we rely on patents, trade secrets, trademarks, copyrights, know-how, license agreements and contractual provisions to establish and protect our intellectual property rights. However, these legal means afford us only limited protection and may not adequately protect our rights or remedies to gain or keep any advantages we may have over our competitors.

We cannot assure you that others may not independently develop the same or similar technologies or otherwise obtain access to our technology and trade secrets.

Our competitors, who may have or could develop or acquire significant resources, may make substantial investments in competing technologies, or may apply for and obtain patents that will prevent, limit, or interfere with our ability to manufacture or market our products. Further, although we do not believe that any of our products infringe the rights of others, third parties have claimed, and may in the future claim, our products infringe on their rights, and these third parties may assert infringement claims against us in the future. We may litigate to enforce patents issued to us and to defend against claimed infringement of the rights of others or to determine the ownership, scope, or validity of our proprietary rights and the rights of others. Any claim of infringement against us could involve significant liabilities to third parties, could require us to seek licenses from third parties, and could prevent us from manufacturing, selling or using our products.

Costly litigation may be necessary to enforce patents issued to us, to protect trade secrets or “know-how” we own, to defend us against claimed infringement of the rights of others or to determine the ownership, scope, or validity of our proprietary rights and the rights of others. Any claim of infringement against us may involve significant liabilities to third parties, could require us to seek licenses from third parties, and could prevent us from manufacturing, selling, or using our products. The occurrence of this litigation, or the effect of an adverse determination in any of this type of litigation, could have a material adverse effect on our business, financial condition and results of operations. Further, the laws of some of the countries in which our systems are or may be sold may not protect our systems and intellectual property to the same extent as the United States or at all. Our failure to protect or enforce our intellectual property rights could have a material adverse effect on our business, results of operations and financial condition.

Our sales will decline, and our business will be materially harmed, if our sales and marketing efforts are not effective.

Historically, we have distributed our products to end users through a two-tier system of distributors and resellers and through our own sales force to select accounts.

Effective April 1, 2010, we will terminate several distributor relationships as part of our plan to improve the efficiency of our sales channels. Following termination of the distributors, we will sell product to end-user customers primarily through value-added resellers, other strategic partners, a web-based ordering tool and also directly to select accounts through our own sales force. Although we have communicated with our customers regarding these changes, we may encounter difficulties in transitioning customer relationships from terminated distributors. Because we will be performing much of the sales and marketing to this larger customer group, we may also encounter difficulties in managing a more complex sales and marketing function that meets the needs of our customers, and may also experience challenges in maintaining an appropriate number of trained personnel. If we are not able to effectively market our products to customers or service these customers through our new distribution channels, our sales may decline and our business may be harmed.

For sales that are made to customers through value-added resellers or other strategic partners, we depend on these businesses to provide effective sales and marketing support to our products. Our distributors and resellers are independent businesses that we do not control. Our agreements with distributors and resellers do not contain requirements that a certain percentage of such parties’ sales are of our products. Further, some of our channel partners are small organizations with limited capital, and our success in distributing our products to end-users will depend upon the continued viability and financial stability of these entities. These channel partners may choose to devote their efforts to other products in different markets or reduce or fail to devote the necessary resources to provide effective sales and marketing support of our products, any of which could harm our business by reducing sales to customers.

We believe that our future growth and success will depend upon the success of our sales and marketing efforts as well as those of our value-added resellers or other strategic partners.

If we do not maintain adequate inventories of component parts or finished goods, or if we fail to adequately forecast demand, the likely resulting delays in producing our publishing systems products would damage our business.

8

We forecast production based on past sales and our estimates of future demand. In the event that we significantly underestimate our needs or encounter an unexpectedly high level of demand for our systems or our suppliers are unable to deliver our orders of components in a timely manner, we may be unable to fill our product orders on time which could harm our reputation and result in reduced sales.

We rely on single-source suppliers, which could cause delays, increases in costs or prevent us from completing customer orders, all of which could materially harm our business.

We assemble our Producer Series and Desktop Series products using materials and components supplied by various subcontractors and suppliers. We purchase critical components for our systems, including our Everest printers, DVD-R drives, Blu-ray drives, circuit boards, electric motors, machined and molded parts, precision sheet metal assemblies and mechanical parts from third parties. Some of our subcontractors and suppliers are the sole source of these components and these third parties may also own technology and manufacturing know-how required to manufacture critical components. If any of our suppliers is unable to ship critical components, we would be unable to assemble and ship products to our resellers or end-user customers. If the price of these components increases for any reason, or if these suppliers are unable or unwilling to deliver, we may have to find another source, which could result in interruptions, increased costs, delays, loss of sales and quality control problems. We purchase these components pursuant to our standard form of purchase order, submitted to the supplier from time to time as the components are needed.

The termination or interruption of any of these relationships, or the failure of these manufacturers or suppliers to supply products or components to us on a timely basis or in sufficient quantities, likely would cause us to be unable to meet orders for our products and harm our reputation and our business. For the majority of our critical components, we have identified alternative suppliers. The Company depends upon a single-source supplier for its Everest printers and, beginning in March 2010, its Rimage Professional Series 5400N and Rimage Professional Series 3400 systems. For these products, it is more difficult to identify an alternative supplier because of the proprietary information and technology held by the current supplier. If we were unable to effectively transition the technology and proprietary information used by our current suppliers to alternative suppliers, the design and manufacture of components and products to our specifications may be significantly delayed, resulting in potential production delays and significant expense. Further, if we obtain a new supplier for a component or product or use an alternative component in our product, we may need to conduct additional testing of our products to ensure the product meets our quality and performance standards. Any delays in delivery of our product to end-users, distributors or resellers could be extended, and our costs associated with the change in product manufacturing could increase.

The failure of our components suppliers to supply us with the components consistent with our requirements as to quality, quantity and timeliness could materially harm our business by causing delays, loss of sales, increases in costs and lower gross profit margins.

Our products must be compatible with products designed and manufactured by others and, in the event of design changes or the introduction of new products by them or us, our products must continue to be compatible with products of others.

Our Producer Series and Desktop Series of digital publishing systems incorporate computer and related computer equipment, hardware and software manufactured by others. Our products are designed to provide end users with a fully-integrated publishing system and therefore, our products must operate with the computer and related equipment of others to function properly for end users. Problems with the products of others may adversely affect the performance and reliability of our publishing system products and damage our reputation with end users. Further, if there are changes in our products, changes in the computer or computer related equipment integrated into our products or if we offer new products, we must maintain compatibility and interoperability of our products with the products of others. We cannot assure you that we will be able to adapt our products to be compatible with any newly designed product of another party. We would likely incur substantial costs to test and “de-bug” any newly designed product that we integrate into our products. Further, our new product development efforts may be hampered by our need to maintain compatibility with the products of others, and we may incur additional expense designing for compatibility.

Our publishing systems may have manufacturing or design defects that we discover after shipment, which could negatively affect our revenues, increase our costs and harm our reputation.

Our publishing systems are complex and may contain undetected and unexpected defects, errors or failures. If these product defects are substantial, the result could be product recalls, an increased amount of product returns, loss of market acceptance and damage to our reputation, all of which could increase our costs and cause us to lose sales. We carry general commercial liability insurance covering our products with policy limits per occurrence and in the aggregate that we have deemed to be sufficient. We cannot predict, however, whether this insurance is sufficient, or if not, whether we will be able to obtain sufficient insurance to cover the risks associated with our business or whether such insurance will be available at premiums that are commercially reasonable. In addition, these insurance policies must be renewed annually. Although we have been able to obtain liability insurance, such insurance may not be available in the future on acceptable terms, if at all. A successful claim against us or settlement by us in excess of our insurance coverage or our inability to maintain insurance in the future could have a material adverse effect on our business, results of operations, liquidity and financial condition.

9

If our systems fail to comply with domestic and international government regulations, or if these regulations result in a barrier to our business, we could lose sales.

Our systems must comply with various domestic and international laws, regulations and standards. In the event that we are unable or unwilling to comply with any such laws, regulations or standards, we may decide not to conduct business in certain markets. Particularly in international markets, we may experience difficulty in securing required licenses or permits on commercially reasonable terms, or at all. Failure to comply with existing or evolving laws or regulations, including export and import restrictions and barriers, or to obtain timely domestic or foreign regulatory approvals or certificates could result in lost sales.

Fluctuations in our future operating results may negatively affect the market price of our common stock.

We have experienced fluctuations in our quarterly operating results, and we expect those fluctuations to continue due to a variety of factors. Some of the factors that influence our quarterly operating results include:

|

|

|

|

|

|

• |

The number and mix of products sold in the quarter; |

|

|

|

|

|

|

• |

The timing of major projects; |

|

|

|

|

|

|

• |

The availability and cost of components and materials; |

|

|

|

|

|

|

• |

Timing, costs and benefits of new product introductions; |

|

|

|

|

|

|

• |

Customer order size and shipment timing; |

|

|

|

|

|

|

• |

Seasonal factors affecting timing of purchase orders; |

|

|

|

|

|

|

• |

Promotions by ourselves or competitors, and the timing of the promotion; |

|

|

|

|

|

|

• |

The impact to the marketplace of competitive products and pricing; and |

|

|

|

|

|

|

• |

The timing and level of operating expenses; |

|

|

|

|

|

|

• |

General economic and market conditions including market uncertainty. |

Because of these factors, our quarterly operating results are difficult to predict and are likely to vary in the future. If our operating results are below financial analysts’ or investors’ expectations, the market price of our common stock may fall abruptly and significantly.

If we fail to retain and attract highly skilled managerial and technical personnel, we may fail to remain competitive.

Our future success depends, in significant part, upon the continued service and performance of our senior management and other key personnel. The loss of the services of our management team, some of whom have significant experience in our industry, and other key personnel could impair our ability to effectively manage our company and to carry out our business plan. We do not carry life insurance on any of our executive officers. In addition, competition for skilled employees in our industry is intense. Our future success also depends on our continuing ability to attract, retain and motivate highly qualified managerial, technical and sales personnel. Our inability to retain or attract qualified personnel could have a significant negative effect and thereby materially harm our business and financial condition.

Our stock price may be volatile, and a shareholder’s investment could decline in value.

Our stock price has fluctuated in the past and may continue to fluctuate significantly, making it difficult for an investor to resell shares or to resell shares at an attractive price. The market prices for securities of technology companies, like Rimage, have historically been highly volatile. Future events concerning us or our competitors could cause such volatility, including:

|

|

|

|

|

|

• |

Actual or anticipated variations in our operating results; |

|

|

|

|

|

|

• |

Investments required in infrastructure and/or personnel to meet long-term strategic objectives; |

|

|

|

|

|

|

• |

Technological innovations or new commercial products introduced by us or our competitors; |

|

|

|

|

|

|

• |

Developments concerning proprietary rights; |

|

|

|

|

|

|

• |

Changes in senior management; |

|

|

|

|

|

|

• |

Potential acquisition or strategic alliance activities; |

|

|

|

|

|

|

• |

Investor perception of us and our industry; |

|

|

|

|

|

|

• |

General economic and market conditions including market uncertainty; |

|

|

|

|

|

|

• |

National or global political events; and |

|

|

|

|

|

|

• |

Public confidence in the securities markets and regulation by or of the securities markets. |

In addition, the stock market is subject to price and volume fluctuations that affect the market prices for companies in general, and small-capitalization, high-technology companies in particular, which are often unrelated to the operating performance of these companies. Any failure by us to meet or exceed estimates of financial analysts is likely to cause a decline in our common stock price.

10

Further, recent economic conditions have resulted in significant fluctuations and significant declines in stock prices for many companies, including Rimage. We cannot predict when the stock markets and the market for our common stock may stabilize.

Future sales of shares of our common stock in the public market may negatively affect our stock price.

Future sales of our common stock, or the perception that these sales could occur, could have a significant negative effect on the market price of our common stock. In addition, upon exercise of outstanding options, the number of shares outstanding of our common stock could increase substantially. This increase, in turn, could dilute future earnings per share, if any, and could depress the market value of our common stock. Dilution and potential dilution, the availability of a large amount of shares for sale, and the possibility of additional issuances and sales of our common stock may negatively affect both the trading price of our common stock and the liquidity of our common stock. These sales also might make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that we would deem appropriate.

Provisions of Minnesota law, our bylaws and other agreements may deter a change of control of our company and may have a possible negative effect on our stock price.

Certain provisions of our Minnesota law, our bylaws and other agreements may make it more difficult for a third- party to acquire, or discourage a third-party from attempting to acquire, control of our company, including:

|

|

|

|

|

|

• |

The provisions of Minnesota law relating to business combinations and control share acquisitions; |

|

|

|

|

|

|

• |

The provisions of our bylaws regarding the business properly brought before shareholders; |

|

|

|

|

|

|

• |

The right of our Board of Directors to establish more than one class or series of shares and to fix the relative rights and preferences of any such different classes or series; |

|

|

|

|

|

|

• |

Our shareholder rights plan, which would cause substantial dilution to any person or group attempting to acquire our company on terms not approved in advance by our Board of Directors; |

|

|

|

|

|

|

• |

The provisions of our stock option plans allowing for the acceleration of vesting or payments of awards granted under the plans in the event of specified events that result in a “change in control”; and |

|

|

|

|

|

|

• |

The provisions of our agreements provide for severance payments to our executive officers in the event of certain terminations following a “change in control.” |

These measures could discourage or prevent a takeover of our company or changes in our management, even if an acquisition or such changes would be beneficial to our shareholders. This may have a negative effect on the price of our common stock.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

Keeping abreast of, and in compliance with, changing laws, regulations and standards relating to corporate governance and public company disclosure requirements, including the Sarbanes-Oxley Act of 2002 and in particular Section 404 of that Act relating to management certification of internal controls, the regulations of the Securities and Exchange Commission and the rules of the Nasdaq Stock Market have required an increased amount of management attention and external resources. We intend to invest all reasonably necessary resources to comply with evolving corporate governance and public disclosure standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

|

|

|

|

UNRESOLVED STAFF COMMENTS |

None.

|

|

|

|

PROPERTIES |

Rimage headquarters are located in a facility of 58,500 square feet at 7725 Washington Avenue South, Edina, Minnesota 55439. This facility is used for manufacturing, engineering, service, sales, marketing and administration.

In July 2006, Rimage entered into a facility lease of approximately 18,200 square feet in Dietzenbach, Germany, used for service, sales and light assembly. The current term of the lease in Germany expires June 30, 2011, and monthly base rent is €14,833 (or approximately $22,000 U.S. dollars). Additionally, in May 2008, the Company entered into a facility lease of approximately 2,689 square feet in Tokyo, Japan, used for sales and service. The current term of the lease in Japan expires April 30, 2010, and monthly base rent is ¥ 1,685,441 (or approximately $18,000 U.S. dollars).

11

|

|

|

|

LEGAL PROCEEDINGS |

The Company is exposed to a number of asserted and unasserted legal claims encountered in the ordinary course of its business. Although the outcome of any such legal actions cannot be predicted, management believes that there are no pending legal proceedings against or involving the Company for which the outcome is likely to have a material adverse effect upon its financial position or results of operations.

|

|

|

|

[RESERVED] |

|

|

|

|

MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Rimage’s common stock is traded on the Nasdaq Global Market under the symbol “RIMG”. The following table sets forth, for the periods indicated, the range of low and high sales prices for Rimage’s common stock as reported on The Nasdaq Stock Market.

|

|

|

|

|

|

|

|

|

|

|

|

Low |

|

High |

|

||

|

|

|

|

|

|

|

||

|

Year 2008: |

|

|

|

|

|

|

|

|

1st Quarter |

|

$ |

21.25 |

|

$ |

26.61 |

|

|

2nd Quarter |

|

$ |

12.09 |

|

$ |

23.85 |

|

|

3rd Quarter |

|

$ |

12.01 |

|

$ |

17.88 |

|

|

4th Quarter |

|

$ |

10.07 |

|

$ |

15.89 |

|

|

Year 2009: |

|

|

|

|

|

|

|

|

1st Quarter |

|

$ |

11.14 |

|

$ |

15.11 |

|

|

2nd Quarter |

|

$ |

12.58 |

|

$ |

18.00 |

|

|

3rd Quarter |

|

$ |

14.97 |

|

$ |

17.86 |

|

|

4th Quarter |

|

$ |

15.47 |

|

$ |

19.38 |

|

As of February 17, 2010, there were 46 shareholders of record of Rimage’s common stock.

To date, Rimage has not paid or declared any cash dividends on its common stock. The payment by Rimage of dividends, if any, on its common stock in the future is subject to the discretion of the Board of Directors and will depend on Rimage’s continued earnings, financial condition, capital requirements and other relevant factors.

12

Other Information Regarding Equity Compensation Plans

The following table sets forth information regarding Rimage’s equity compensation plans in effect as of December 31, 2009. Each of the Company’s equity compensation plans is an “employee benefit plan” as defined by Rule 405 of Regulation C of the Securities Act of 1933.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities Authorized for Issuance Under Equity Compensation Plans |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Plan category |

|

Number of shares of |

|

Weighted-average |

|

Number of shares of |

|

|||||||||

|

Equity compensation plans approved by shareholders: |

|

|

|

1,069,626 |

|

|

|

$ |

17.85 |

|

|

|

|

675,420 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plans not approved by shareholders: |

|

|

|

200,000 |

|

|

|

$ |

14.10 |

|

|

|

|

— |

|

|

|

Total |

|

|

|

1,269,626 |

|

|

|

$ |

17.26 |

|

|

|

|

675,420 |

|

|

|

|

|

|

|

|

(1) |

Excludes shares of common stock listed in the first column |

“Equity compensation plans not approved by shareholders” consists of a non-qualified stock option grant to Sherman L. Black on April 1, 2009, the first day of his employment with Rimage. The stock option was granted outside of the Company’s current equity incentive plan, the 2007 Stock Incentive Plan, as an “inducement award” pursuant to Nasdaq Marketplace Rule 4350(i)(1)(A)(iv). The option has an exercise price equal to the closing price of the Company’s common stock as reported by the Nasdaq Stock Market on April 1, 2009, vests in four equal installments on each of the first four anniversaries of the date of grant, and has a term of seven years. In other respects, the option was structured to mirror the terms of options granted under the Company’s 2007 Stock Incentive Plan and is subject to a stock option plan and agreement entered into by and between the Company and Mr. Black dated April 1, 2009.

13

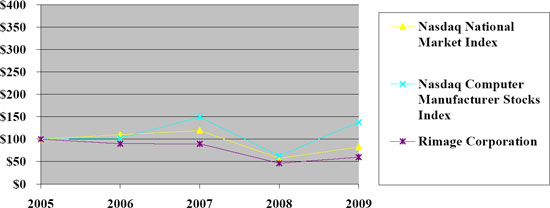

The Company’s common stock is quoted on The Nasdaq Global Market. The graph and table below set forth a comparison of the cumulative total return of the Company’s common stock over the last five fiscal years with a broad market index and either a nationally-recognized industry standard or an index of peer companies selected by the Company. Rimage has chosen to use the Nasdaq National Market Index (U.S.) as its broad market index and the Nasdaq Computer Manufacturer Stocks Index as its index of peer companies.

The following graph shows changes during the period from December 31, 2005 to December 31, 2009 in the value of $100 invested in: (1) the Nasdaq National Market Index (U.S.); (2) the Nasdaq Computer Manufacturer Stocks Index; and (3) Rimage’s common stock. The values of each investment as of the dates indicated are based on share prices plus any dividends paid in cash, with the dividends reinvested on the date they were paid. The calculations exclude trading commissions and taxes. The table and graph are not necessarily indicative of future investment performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12/30/05 |

|

12/29/06 |

|

12/31/07 |

|

12/31/08 |

|

12/31/09 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nasdaq National Market Index |

|

$ |

100.00 |

|

$ |

109.84 |

|

$ |

119.14 |

|

$ |

57.41 |

|

$ |

82.52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nasdaq Computer Manufacturer Stocks Index |

|

$ |

100.00 |

|

$ |

102.13 |

|

$ |

149.41 |

|

$ |

62.76 |

|

$ |

137.84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rimage Corporation |

|

$ |

100.00 |

|

$ |

89.72 |

|

$ |

89.54 |

|

$ |

46.27 |

|

$ |

59.83 |

|

14

|

|

|

|

SELECTED FINANCIAL DATA |

The selected consolidated financial data below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 below and the Consolidated Financial Statements and the Notes thereto included in Item 8 below. (In thousands, except per share data).

Consolidated Statements of Income Information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31, |

|

|||||||||||||

|

|

|

2009 |

|

2008 |

|

2007 |

|

2006 |

|

2005 |

|

|||||

|

Revenues |

|

$ |

83,227 |

|

$ |

91,394 |

|

$ |

108,874 |

|

$ |

103,252 |

|

$ |

95,410 |

|

|

Cost of revenues |

|

$ |

42,894 |

|

$ |

51,731 |

|

$ |

57,719 |

|

$ |

56,014 |

|

$ |

51,957 |

|

|

Gross profit |

|

$ |

40,333 |

|

$ |

39,663 |

|

$ |

51,155 |

|

$ |

47,238 |

|

$ |

43,453 |

|

|

Operating expenses |

|

$ |

29,087 |

|

$ |

27,915 |

|

$ |

30,274 |

|

$ |

29,464 |

|

$ |

26,829 |

|

|

Operating income |

|

$ |

11,246 |

|

$ |

11,748 |

|

$ |

20,881 |

|

$ |

17,774 |

|

$ |

16,624 |

|

|

Other income, net |

|

$ |

1,866 |

|

$ |

2,711 |

|

$ |

3,513 |

|

$ |

2,684 |

|

$ |

1,419 |

|

|

Income tax expense |

|

$ |

4,617 |

|

$ |

5,028 |

|

$ |

8,633 |

|

$ |

7,374 |

|

$ |

6,675 |

|

|

Net income |

|

$ |

8,495 |

|

$ |

9,431 |

|

$ |

15,761 |

|

$ |

13,084 |

|

$ |

11,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

0.91 |

|

$ |

0.99 |

|

$ |

1.59 |

|

$ |

1.33 |

|

$ |

1.19 |

|

|

Diluted net income per share |

|

$ |

0.89 |

|

$ |

0.97 |

|

$ |

1.52 |

|

$ |

1.26 |

|

$ |

1.10 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

9,374 |

|

|

9,559 |

|

|

9,915 |

|

|

9,812 |

|

|

9,530 |

|

|

Diluted |

|

|

9,507 |

|

|

9,729 |

|

|

10,371 |

|

|

10,356 |

|

|

10,312 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheet Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances as of December 31, |

|

|||||||||||||

|

|

|

2009 |

|

2008 |

|

2007 |

|

2006 |

|

2005 |

|

|||||

|

Cash and cash equivalents |

|

$ |

72,507 |

|

$ |

14,885 |

|

$ |

7,416 |

|

$ |

8,500 |

|

$ |

12,693 |

|

|

Marketable securities |

|

$ |

28,581 |

|

$ |

39,870 |

|

$ |

51,605 |

|

$ |

30,266 |

|

$ |

51,582 |

|

|

Receivables, net |

|

$ |

13,732 |

|

$ |

11,099 |

|

$ |

14,447 |

|

$ |

21,697 |

|

$ |

12,885 |

|

|

Inventories |

|

$ |

4,123 |

|

$ |

5,625 |

|

$ |

8,075 |

|

$ |

6,072 |

|

$ |

6,621 |

|

|

Current assets |

|

$ |

120,760 |

|

$ |

74,151 |

|

$ |

84,771 |

|

$ |

70,116 |

|

$ |

86,444 |

|

|

Property and equipment, net |

|

$ |

7,855 |

|

$ |

6,183 |

|

$ |

3,206 |

|

$ |

3,626 |

|

$ |

2,525 |

|

|

Marketable securities - non-current |

|

$ |

9,037 |

|

$ |

40,647 |

|

$ |

35,201 |

|

$ |

38,594 |

|

$ |

— |

|

|

Total assets |

|

$ |

140,282 |

|

$ |

123,456 |

|

$ |

125,096 |

|

$ |

112,359 |

|

$ |

89,009 |

|

|

Current liabilities |

|

$ |

17,589 |

|

$ |

12,010 |

|

$ |

17,882 |

|

$ |

16,163 |

|

$ |

12,191 |

|

|

Long-term liabilities |

|

$ |

2,744 |

|

$ |

2,398 |

|

$ |

2,153 |

|

$ |

720 |

|

$ |

289 |

|

|

Stockholders’ equity |

|

$ |

119,949 |

|

$ |

109,048 |

|

$ |

105,061 |

|

$ |

95,476 |

|

$ |

76,529 |

|

15

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The percentage relationships to revenues of certain income and expense items for the three years ended December 31, 2009 and the percentage changes in these income and expense items between years are contained in the following table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage (%) of Revenues |

|

Percent (%) Increase (Decrease) |

|

|||||||||||

|

|

|

2009 |

|

2008 |

|

2007 |

|

2009 vs. 2008 |

|

2008 vs. 2007 |

|

|||||

|

Revenues |

|

|

100.0 |

|

|

100.0 |

|

|

100.0 |

|

|

(8.9 |

) |

|

(16.1 |

) |

|

Cost of revenues |

|

|

(51.5 |

) |

|

(56.6 |

) |

|

(53.0 |

) |

|

(17.1 |

) |

|

(10.4 |

) |

|

Gross profit |

|

|

48.5 |

|

|

43.4 |

|

|

47.0 |

|

|

1.7 |

|

|

(22.5 |

) |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

(8.6 |

) |

|

(5.7 |

) |

|

(5.4 |

) |

|

36.0 |

|

|

(11.0 |

) |

|

Selling, general and administrative |

|

|

(26.4 |

) |

|

(24.8 |

) |

|

(22.4 |

) |

|

(3.2 |

) |

|

(7.0 |

) |

|

Operating income |

|

|

13.5 |

|

|

12.9 |

|

|

19.2 |

|

|

(4.3 |

) |

|

(43.7 |

) |

|

Other income, net |

|

|

2.2 |

|

|

2.9 |

|

|

3.2 |

|

|

(31.2 |

) |

|

(22.8 |

) |

|

Income before income taxes |

|

|

15.7 |

|

|

15.8 |

|

|

22.4 |

|

|

(9.3 |

) |

|

(40.7 |

) |

|

Income tax expense |

|

|

(5.5 |

) |

|

(5.5 |

) |

|

(7.9 |

) |

|

(8.2 |

) |

|

(41.8 |

) |

|

Net income |

|

|

10.2 |

|

|

10.3 |

|

|

14.5 |

|

|

(9.9 |

) |

|

(40.2 |

) |

Rimage develops, manufactures and markets digital publishing systems that are used by businesses to produce recordable CD, DVD and Blu-ray discs with customized digital content on an on-demand basis. Rimage distributes its publishing systems from its operations in the United States, Germany and Japan. The Company also distributes related consumables for use with its systems, consisting of media kits, ribbons, ink cartridges and Rimage-branded blank CD-R, DVD-R and Blu-ray media. These systems allow customers to benefit from cost savings by eliminating their manual labor efforts in markets and applications such as digital photography, medical imaging, business services, law enforcement and video workflows. As Rimage’s sales within North America and Europe have averaged 92% of total sales over the past three years, the strength of the economies in these regions plays an important role in determining the success of Rimage.

Rimage earns revenues through the sale of equipment, consumables and parts (included in product revenues on the accompanying consolidated statements of income), as well as maintenance contracts, repair and installation services (included as service revenues on the consolidated statements of income). Rimage’s recurring revenues (consumables, parts, maintenance contracts and service) comprised approximately 60%, 61% and 48% of its consolidated revenues in 2009, 2008 and 2007, respectively. Exclusive of a small amount of capital lease obligations, Rimage has no long-term debt and does not require significant capital investment as all fabrication of its products is outsourced to vendors.

Revenues. Total revenues were $83.2 million for 2009, reflecting a 9% decline from total revenues of $91.4 million in 2008, which reflected a decline of 16% from total revenues of $108.9 million in 2007.