Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ANGIODYNAMICS INC | an20130521-8k.htm |

Joseph DeVivo, President and CEO Mark Frost, EVP and CFO May 2013 AngioDynamics, the AngioDynamics logo and other trademarks displayed in this presentation are trademarks owned and used by AngioDynamics, Inc. © Copyright 2012 AngioDynamics, Inc. All rights reserved.

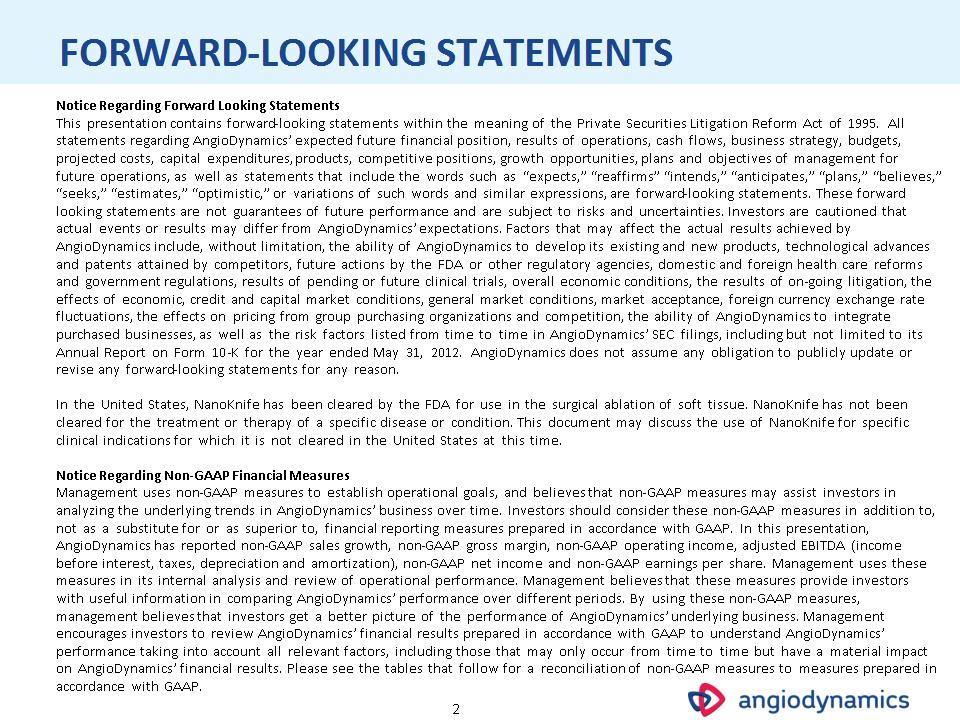

* FORWARD-LOOKING STATEMENTS Notice Regarding Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements regarding AngioDynamics’ expected future financial position, results of operations, cash flows, business strategy, budgets, projected costs, capital expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations, as well as statements that include the words such as “expects,” “reaffirms” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “optimistic,” or variations of such words and similar expressions, are forward-looking statements. These forward looking statements are not guarantees of future performance and are subject to risks and uncertainties. Investors are cautioned that actual events or results may differ from AngioDynamics’ expectations. Factors that may affect the actual results achieved by AngioDynamics include, without limitation, the ability of AngioDynamics to develop its existing and new products, technological advances and patents attained by competitors, future actions by the FDA or other regulatory agencies, domestic and foreign health care reforms and government regulations, results of pending or future clinical trials, overall economic conditions, the results of on-going litigation, the effects of economic, credit and capital market conditions, general market conditions, market acceptance, foreign currency exchange rate fluctuations, the effects on pricing from group purchasing organizations and competition, the ability of AngioDynamics to integrate purchased businesses, as well as the risk factors listed from time to time in AngioDynamics’ SEC filings, including but not limited to its Annual Report on Form 10-K for the year ended May 31, 2012. AngioDynamics does not assume any obligation to publicly update or revise any forward-looking statements for any reason. In the United States, NanoKnife has been cleared by the FDA for use in the surgical ablation of soft tissue. NanoKnife has not been cleared for the treatment or therapy of a specific disease or condition. This document may discuss the use of NanoKnife for specific clinical indications for which it is not cleared in the United States at this time. Notice Regarding Non-GAAP Financial Measures Management uses non-GAAP measures to establish operational goals, and believes that non-GAAP measures may assist investors in analyzing the underlying trends in AngioDynamics’ business over time. Investors should consider these non-GAAP measures in addition to, not as a substitute for or as superior to, financial reporting measures prepared in accordance with GAAP. In this presentation, AngioDynamics has reported non-GAAP sales growth, non-GAAP gross margin, non-GAAP operating income, adjusted EBITDA (income before interest, taxes, depreciation and amortization), non-GAAP net income and non-GAAP earnings per share. Management uses these measures in its internal analysis and review of operational performance. Management believes that these measures provide investors with useful information in comparing AngioDynamics’ performance over different periods. By using these non-GAAP measures, management believes that investors get a better picture of the performance of AngioDynamics’ underlying business. Management encourages investors to review AngioDynamics’ financial results prepared in accordance with GAAP to understand AngioDynamics’ performance taking into account all relevant factors, including those that may only occur from time to time but have a material impact on AngioDynamics’ financial results. Please see the tables that follow for a reconciliation of non-GAAP measures to measures prepared in accordance with GAAP.

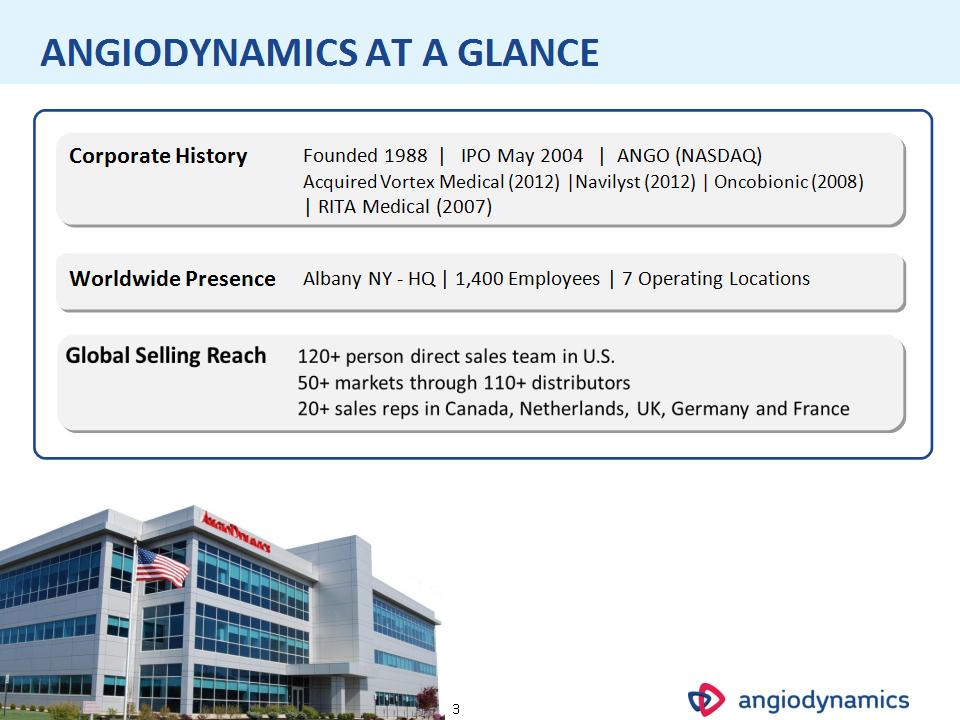

* ANGIODYNAMICS AT A GLANCE Corporate History Founded 1988 | IPO May 2004 | ANGO (NASDAQ) Acquired Vortex Medical (2012) |Navilyst (2012) | Oncobionic (2008) | RITA Medical (2007) Worldwide Presence Albany NY – HQ | 1,400 Employees | 7 Operating Locations

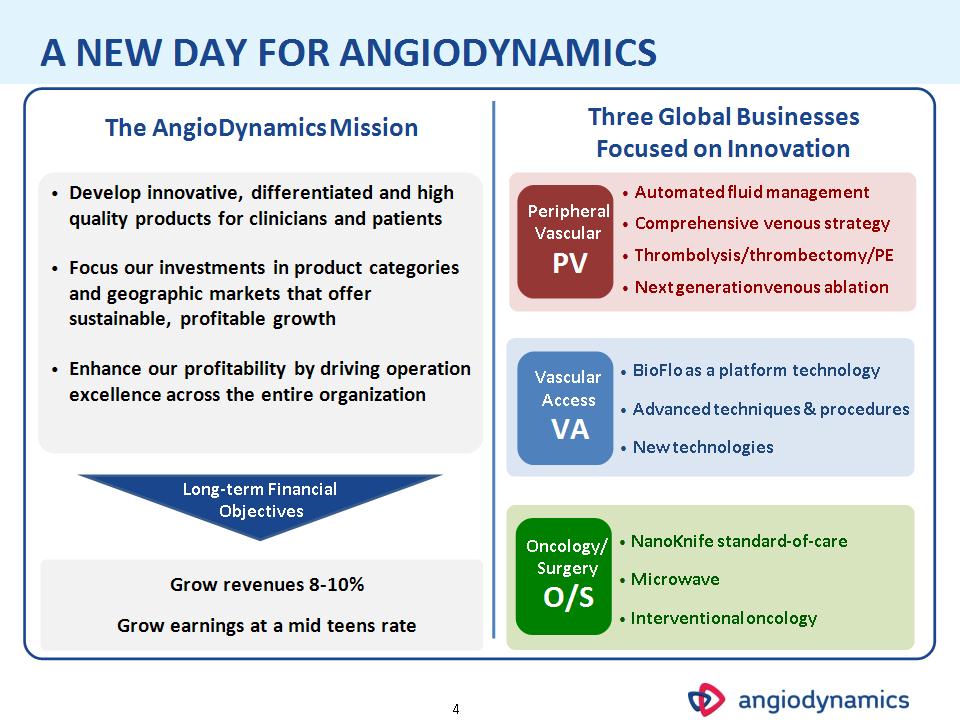

* The AngioDynamics Mission A NEW DAY FOR ANGIODYNAMICS Vascular Access VA Peripheral Vascular PV Oncology/ Surgery O/S BioFlo as a platform technology Advanced techniques & procedures New technologies Automated fluid management Comprehensive venous strategy Thrombolysis/thrombectomy/PE Next generation venous ablation NanoKnife standard-of-care Microwave Interventional oncology Three Global Businesses Focused on Innovation Develop innovative, differentiated and high quality products for clinicians and patients Focus our investments in product categories and geographic markets that offer sustainable, profitable growth Enhance our profitability by driving operation excellence across the entire organization Grow revenues 8-10% Grow earnings at a mid teens rate Long-term Financial Objectives

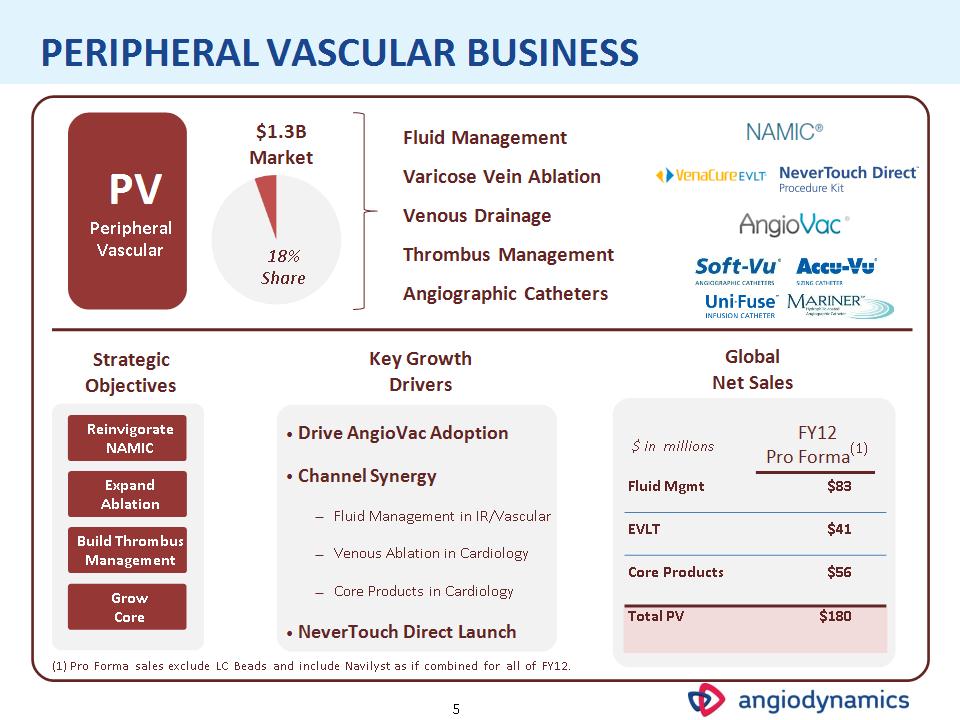

* PERIPHERAL VASCULAR BUSINESS Reinvigorate NAMIC Expand Ablation Grow Core PV Peripheral Vascular Drive AngioVac Adoption Channel Synergy Fluid Management in IR/Vascular Venous Ablation in Cardiology Core Products in Cardiology NeverTouch Direct Launch Strategic Objectives Key Growth Drivers (1) Pro Forma sales exclude LC Beads and include Navilyst as if combined for all of FY12. $1.3B Market 18% Share Fluid Management Varicose Vein Ablation Venous Drainage Thrombus Management Angiographic Catheters Global Net Sales $ in millions FY12 Pro Forma(1) Fluid Mgmt $83 EVLT $41 Core Products $56 Total PV $180 Build Thrombus Management

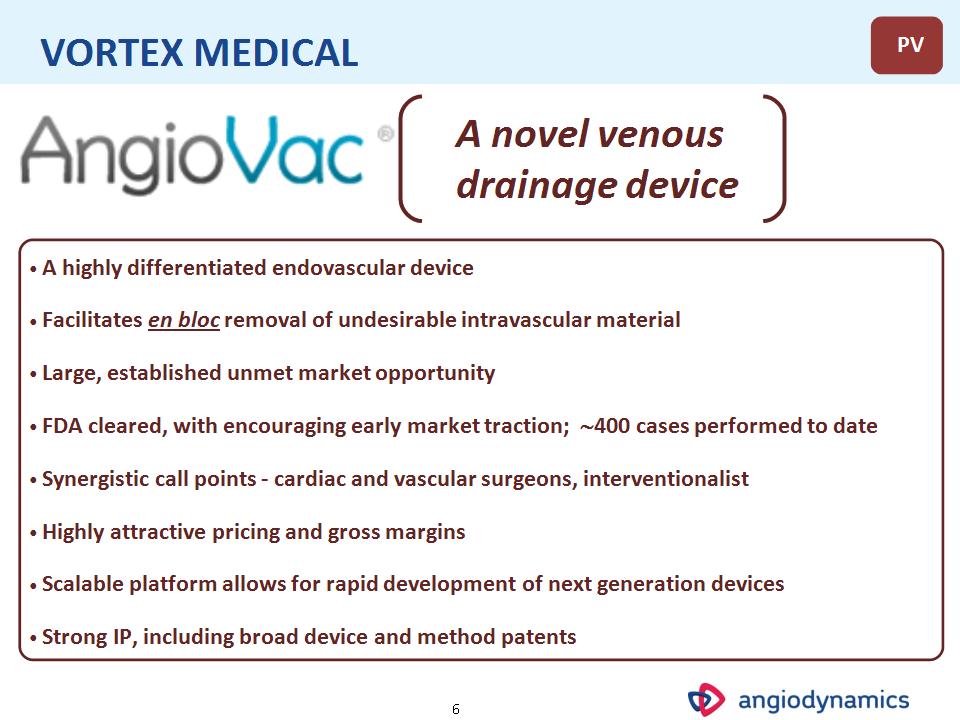

* VORTEX MEDICAL A highly differentiated endovascular device Facilitates en bloc removal of undesirable intravascular material Large, established unmet market opportunity FDA cleared, with encouraging early market traction; 400 cases performed to date Synergistic call points – cardiac and vascular surgeons, interventionalist Highly attractive pricing and gross margins Scalable platform allows for rapid development of next generation devices Strong IP, including broad device and method patents A novel venous drainage device PV

* AngioVac Procedure

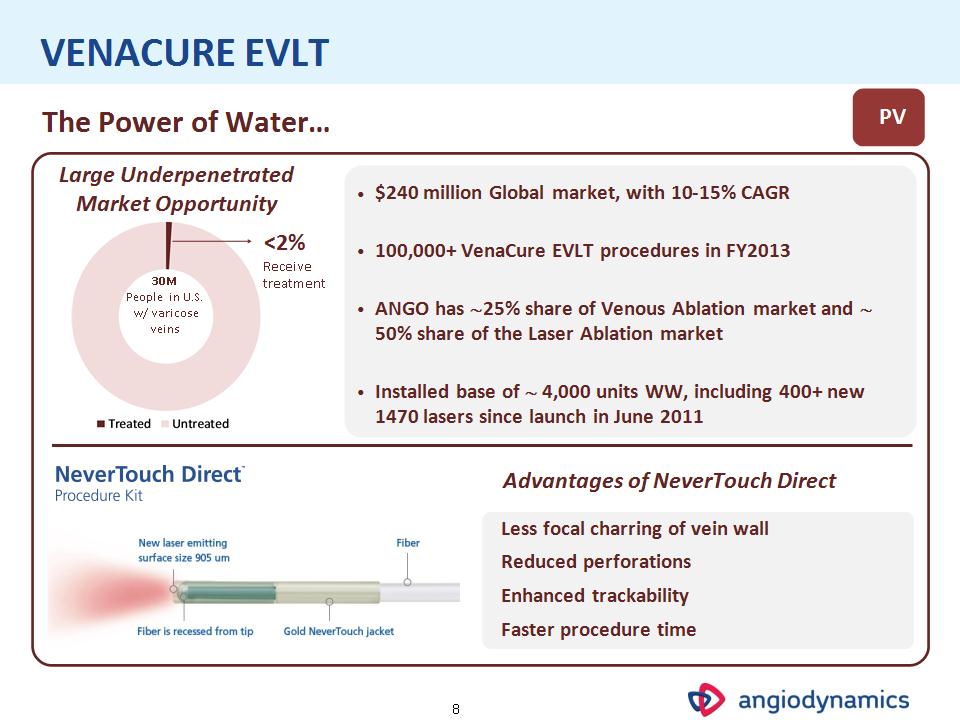

* VENACURE EVLT PV The Power of Water… 30M People in U.S. w/ varicose veins Large Underpenetrated Market Opportunity <2% Receive treatment $240 million Global market, with 10-15% CAGR 100,000+ VenaCure EVLT procedures in FY2013 ANGO has 25% share of Venous Ablation market and 50% share of the Laser Ablation market Installed base of 4,000 units WW, including 400+ new 1470 lasers since launch in June 2011 Less focal charring of vein wall Reduced perforations Enhanced trackability Faster procedure time Advantages of NeverTouch Direct

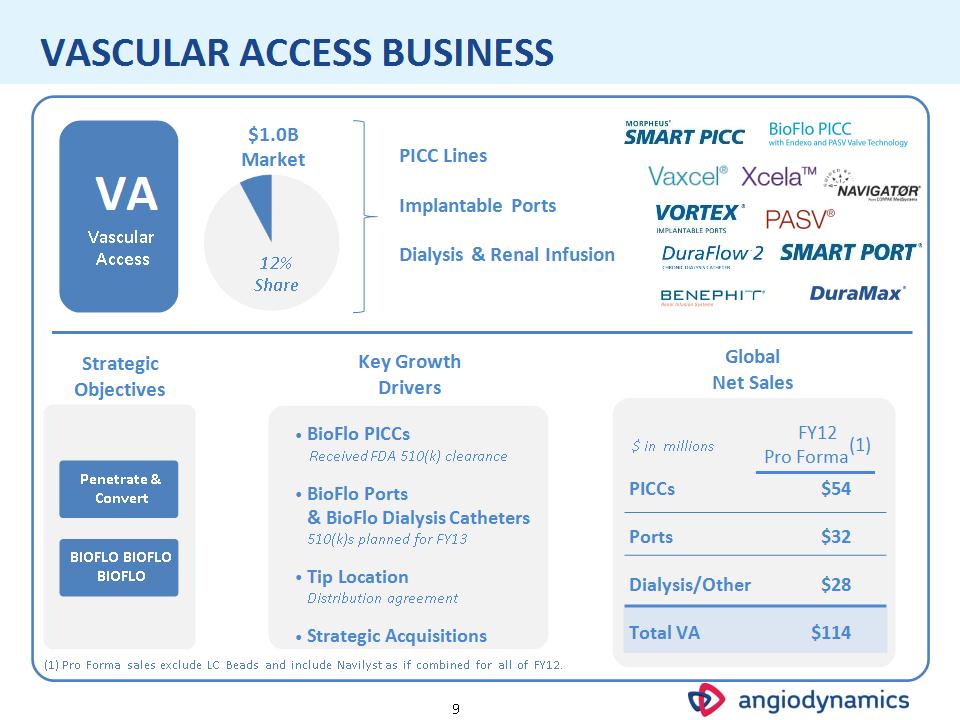

* VASCULAR ACCESS BUSINESS Penetrate & Convert BIOFLO BIOFLO BIOFLO VA Vascular Access BioFlo PICCs Received FDA 510(k) clearance BioFlo Ports & BioFlo Dialysis Catheters 510(k)s planned for FY13 Tip Location Distribution agreement Strategic Acquisitions Strategic Objectives Key Growth Drivers (1) Pro Forma sales exclude LC Beads and include Navilyst as if combined for all of FY12. $1.0B Market 12% Share PICC Lines Implantable Ports Dialysis & Renal Infusion Global Net Sales $ in millions FY12 Pro Forma(1) PICCs $54 Ports $32 Dialysis/Other $28 Total VA $114

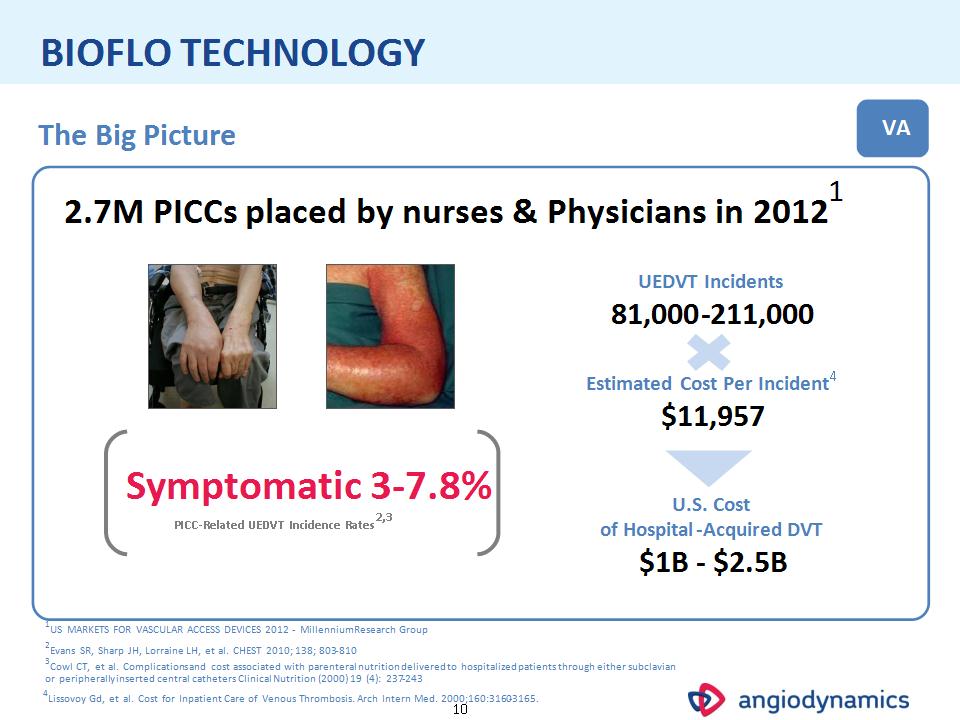

* BIOFLO TECHNOLOGY Estimated Cost Per Incident4 $11,957 PICC-Related UEDVT Incidence Rates2,3 VA 2.7M PICCs placed by nurses & Physicians in 20121 The Big Picture 2Evans SR, Sharp JH, Lorraine LH, et al. CHEST 2010; 138; 803-810 1US MARKETS FOR VASCULAR ACCESS DEVICES 2012 - Millennium Research Group U.S. Cost of Hospital-Acquired DVT $1B – $2.5B 4Lissovoy Gd, et al. Cost for Inpatient Care of Venous Thrombosis. Arch Intern Med. 2000; 160:3160-3165. Symptomatic 3-7.8% 3Cowl CT, et al. Complications and cost associated with parenteral nutrition delivered to hospitalized patients through either subclavian or peripherally inserted central catheters Clinical Nutrition (2000) 19 (4): 237-243 UEDVT Incidents 81,000-211,000

* Coatings (on the surface) Impregnated (in the pores) Current Next Generation PICC Technologies NO HEPARIN NO ANTIBIOTICS NOT A COATING NOT ELUTING Minimizes complications associated w/ heparin Reduces risks associated w/ bacterial resistance Present throughout entire catheter Present for life of device Unlike other technologies that are superficial and/or transient, BioFlo is designed to be both integral to the catheter and permanent The BioFlo™ Advantage… VA NOTE: BioFlo has been cleared in the U.S., approved in Canada, and CE Marked in Europe A Revolutionary PICC Technology… BIOFLO TECHNOLOGY (cont’d)

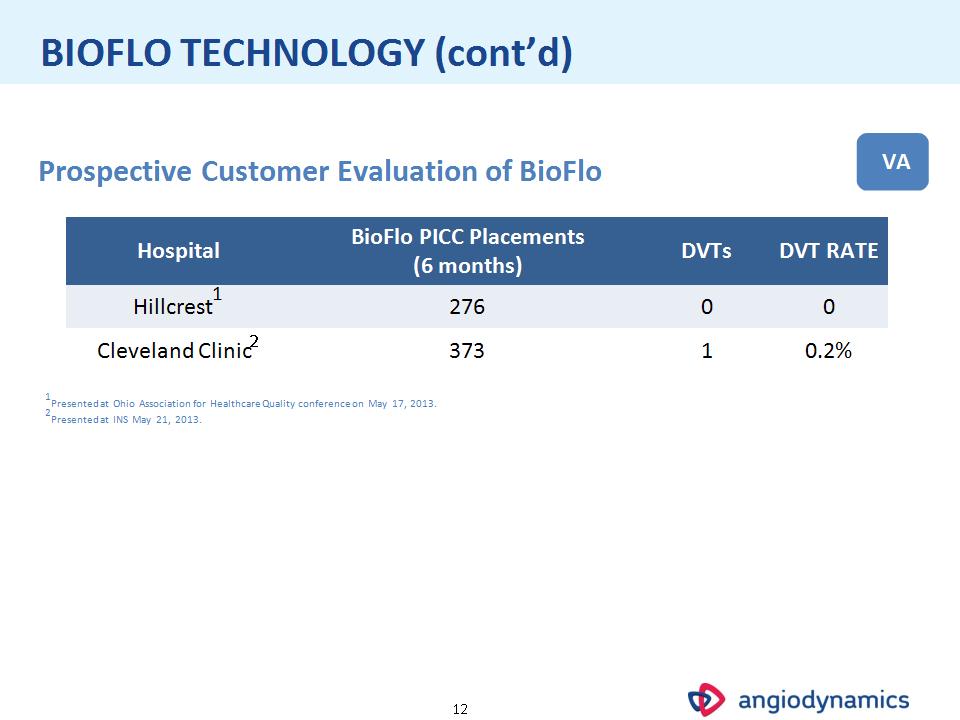

* BIOFLO TECHNOLOGY (cont’d) VA 2Presented at INS May 21, 2013. 1Presented at Ohio Association for Healthcare Quality conference on May 17, 2013. Prospective Customer Evaluation of BioFlo Hospital BioFlo PICC Placements (6 months) DVTs DVT RATE Hillcrest1 276 0 0 Cleveland Clinic2 373 1 0.2%

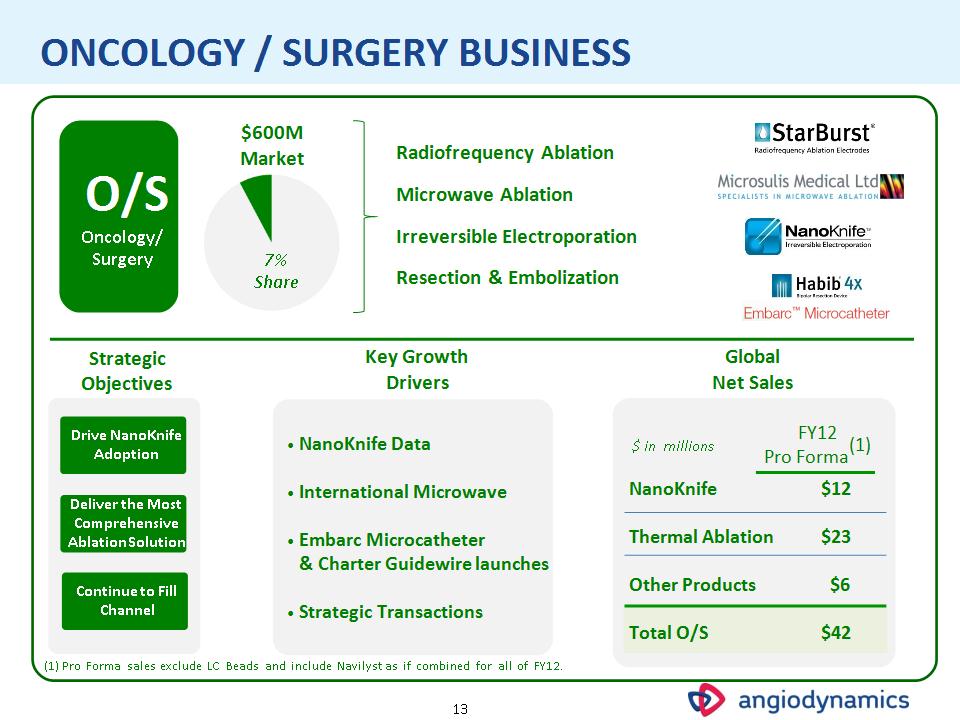

* ONCOLOGY / SURGERY BUSINESS Drive NanoKnife Adoption Deliver the Most Comprehensive Ablation Solution NanoKnife Data International Microwave Embarc Microcatheter & Charter Guidewire launches Strategic Transactions Strategic Objectives Key Growth Drivers Global Net Sales Continue to Fill Channel (1) Pro Forma sales exclude LC Beads and include Navilyst as if combined for all of FY12. O/S Oncology/ Surgery $600M Market Radiofrequency Ablation Microwave Ablation Irreversible Electroporation Resection & Embolization 7% Share $ in millions FY12 Pro Forma(1) NanoKnife $12 Thermal Ablation $23 Other Products $6 Total O/S $42

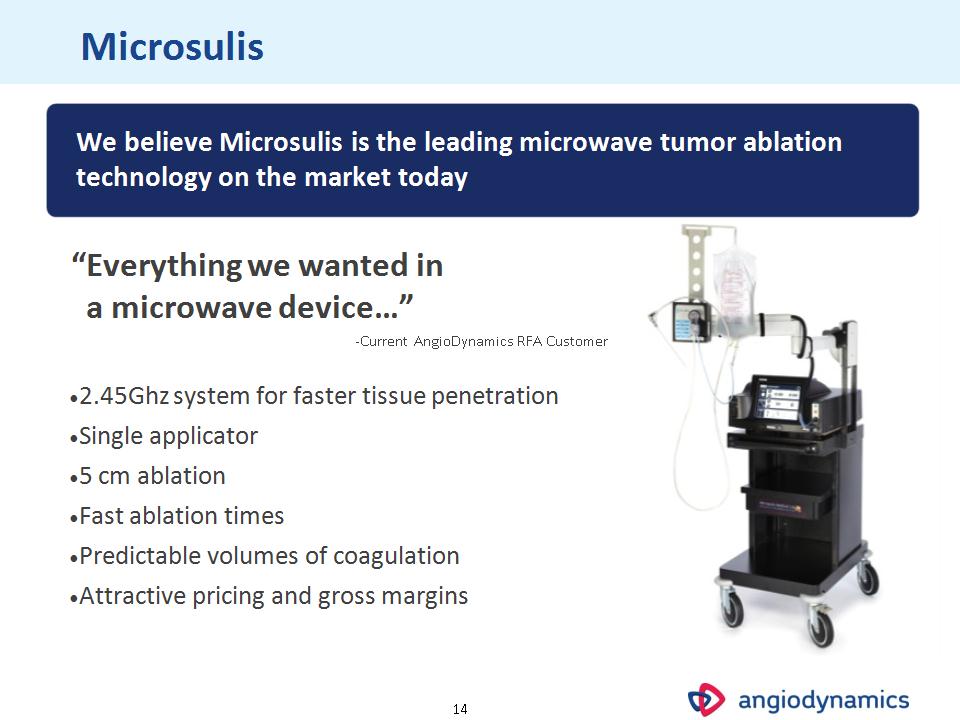

* Microsulis We believe Microsulis is the leading microwave tumor ablation technology on the market today “Everything we wanted in a microwave device…” -Current AngioDynamics RFA Customer 2.45Ghz system for faster tissue penetration Single applicator 5 cm ablation Fast ablation times Predictable volumes of coagulation Attractive pricing and gross margins

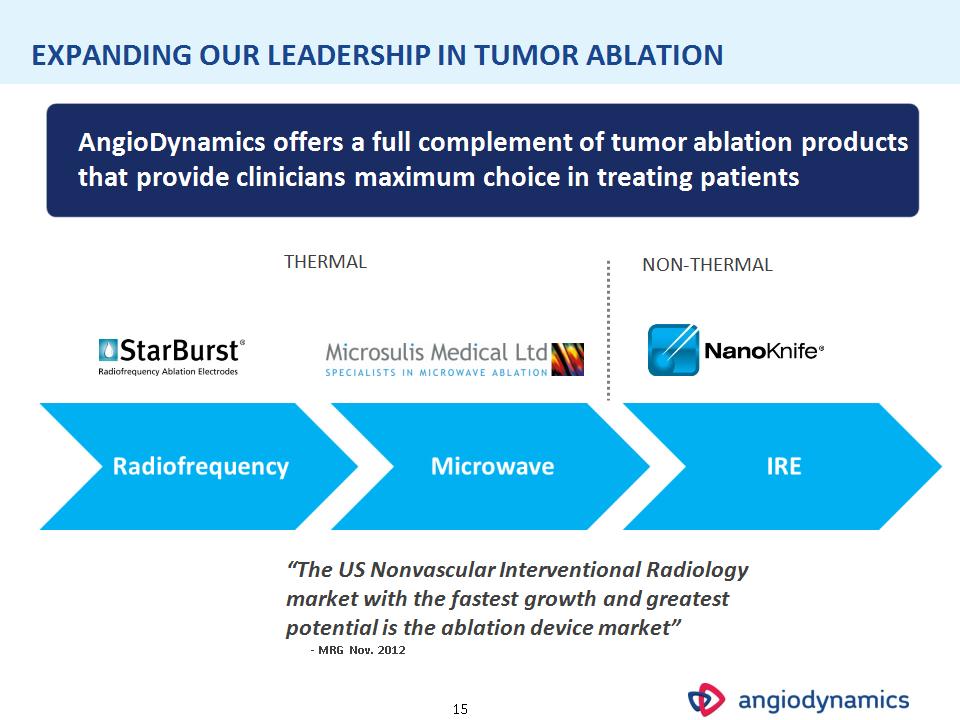

* AngioDynamics offers a full complement of tumor ablation products that provide clinicians maximum choice in treating patients THERMAL NON-THERMAL “The US Nonvascular Interventional Radiology market with the fastest growth and greatest potential is the ablation device market” – MRG Nov. 2012 EXPANDING OUR LEADERSHIP IN TUMOR ABLATION

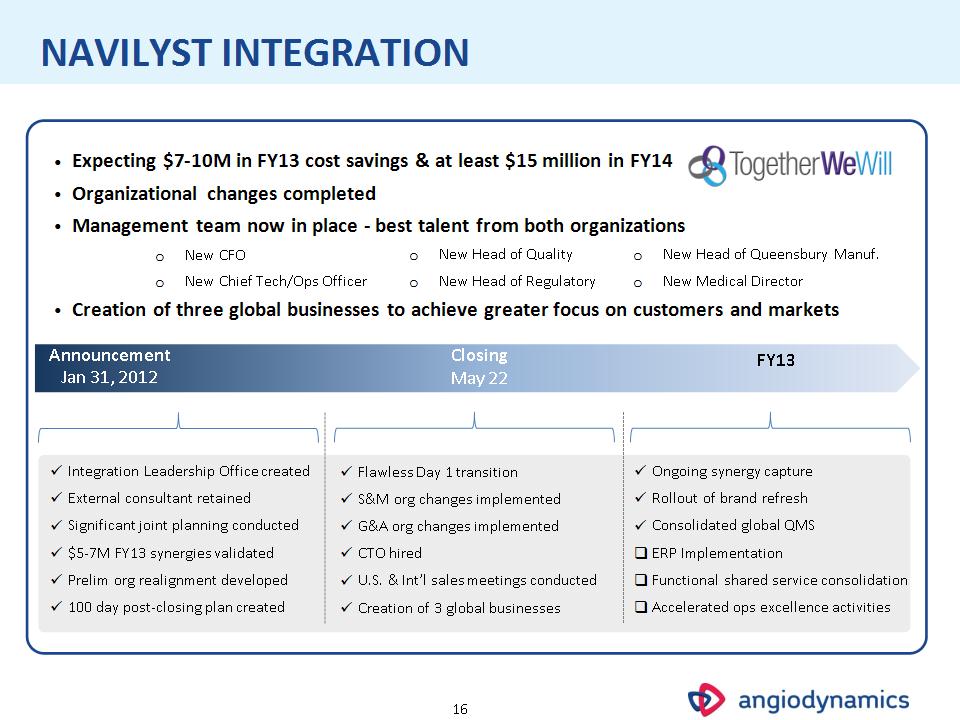

* Expecting $7-10M in FY13 cost savings & at least $15 million in FY14 Organizational changes completed Management team now in place – best talent from both organizations New CFO New Chief Tech/Ops Officer Creation of three global businesses to achieve greater focus on customers and markets NAVILYST INTEGRATION New Head of Quality New Head of Regulatory Announcement Jan 31, 2012 FY13 Integration Leadership Office created External consultant retained Significant joint planning conducted $5-7M FY13 synergies validated Prelim org realignment developed 100 day post-closing plan created Ongoing synergy capture Rollout of brand refresh Consolidated global QMS ERP Implementation Functional shared service consolidation Accelerated ops excellence activities Closing May 22 Flawless Day 1 transition S&M org changes implemented G&A org changes implemented CTO hired U.S. & Int’l sales meetings conducted Creation of 3 global businesses New Head of Queensbury Manuf. New Medical Director

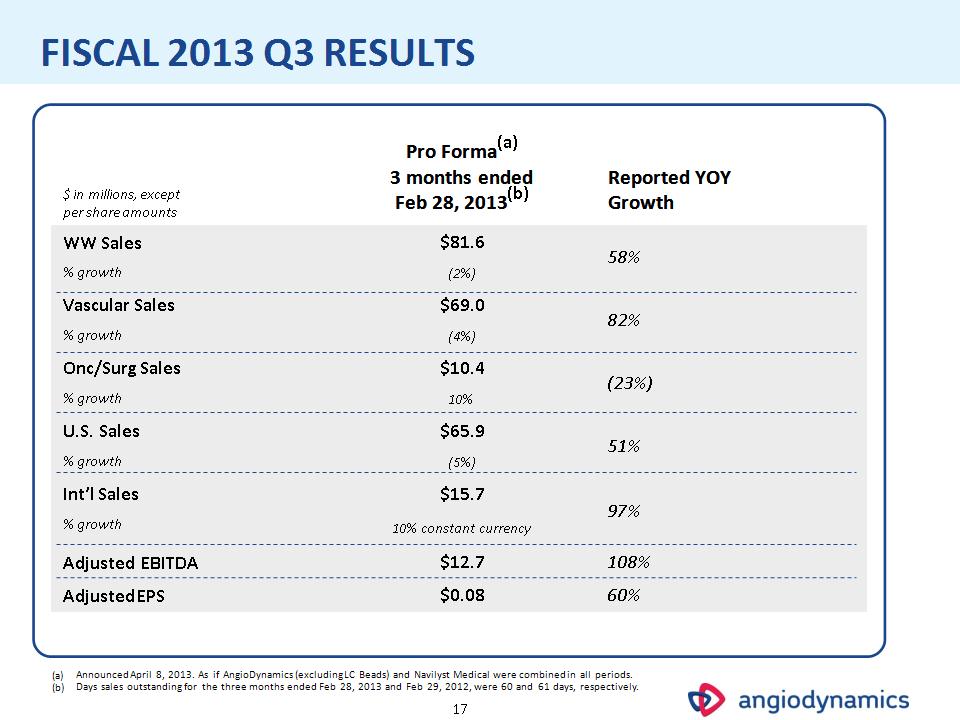

* FISCAL 2013 Q3 RESULTS $ in millions, except per share amounts Pro Forma(a) 3 months ended Feb 28, 2013(b) Reported YOY Growth WW Sales $81.6 58% % growth (2%) 58% Vascular Sales $69.0 82% % growth (4%) 82% Onc/Surg Sales $10.4 (23%) % growth 10% (23%) U.S. Sales $65.9 51% % growth (5%) 51% Int’l Sales $15.7 97% % growth 10% constant currency 97% Adjusted EBITDA $12.7 108% Adjusted EPS $0.08 60% Announced April 8, 2013. As if AngioDynamics (excluding LC Beads) and Navilyst Medical were combined in all periods. Days sales outstanding for the three months ended Feb 28, 2013 and Feb 29, 2012, were 60 and 61 days, respectively.

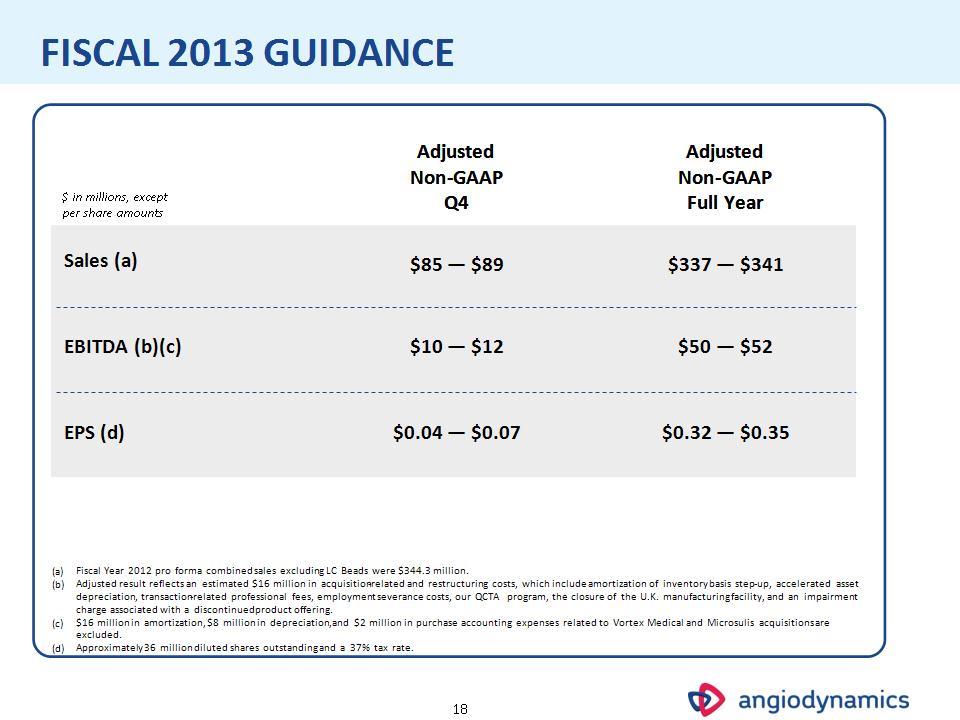

* FISCAL 2013 GUIDANCE $ in millions, except per share amounts Adjusted Non-GAAP Q4 Adjusted Non-GAAP Full Year Sales (a) $85 — $89 $337 — $341 EBITDA (b)(c) $10 — $12 $50 — $52 EPS (d) $0.04 — $0.07 $0.32 — $0.35 Fiscal Year 2012 pro forma combined sales excluding LC Beads were $344.3 million. Adjusted result reflects an estimated $16 million in acquisition-related and restructuring costs, which include amortization of inventory basis step-up, accelerated asset depreciation, transaction-related professional fees, employment severance costs, our QCTA program, the closure of the U.K. manufacturing facility, and an impairment charge associated with a discontinued product offering. $16 million in amortization, $8 million in depreciation, and $2 million in purchase accounting expenses related to Vortex Medical and Microsulis acquisitions are excluded. Approximately 36 million diluted shares outstanding and a 37% tax rate.

* INVESTMENT SUMMARY Three global business focused on innovation with multiple growth drivers Optimized R&D organization to enhance new product pipeline Adding products with high growth potential such as BioFlo and AngioVac Significantly improving quality management system Rapid growth from international business with significant upside Major emphasis on cost reduction initiatives and operational excellence Optimized capital structure with continued strong cash flow generation Stronger executive management team and talent pool Accelerating long-term sales growth and profitability

AngioDynamics, the AngioDynamics logo and other trademSarks displayed in this presentation are trademarks owned and used by AngioDynamics, Inc. © Copyright 2012 AngioDynamics, Inc. All rights reserved.