Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DSP GROUP INC /DE/ | d541390d8k.htm |

| EX-99.1 - EX-99.1 - DSP GROUP INC /DE/ | d541390dex991.htm |

1

Copyright DSP Group, 2013. All rights reserved.

May 2013

Exhibit 99.2 |

2

Copyright DSP Group, 2013. All rights reserved.

Forward

Looking Statements

This presentation contains forward-looking statements that involve risks and uncertainties, as well

as assumptions that, if proven incorrect, could cause DSP Group's results and projections to

differ materially from those expressed or implied by such forward-looking statements. All

statements other than statements of historical fact may be deemed forward-looking

statements, including statements regarding the continued growth of the traditional cordless

telephony market, expanding market for products for new applications, and our ability to

capture a higher share of these markets. We do not endorse the financial forecasts of any

analysts or comment on them if they differ from our own projections. Nothing in this

presentation should be construed as a profit forecast. Past performance should not be taken as

an indication or guarantee of future performance, and no representation or warranty, express or

implied, is made regarding performance. Information, opinions, and estimates contained in this

presentation reflect a judgment at its original date of publication by DSP Group and are

subject to change without notice. We assume no obligation to update any forward-looking

statements or financial guidance. Risks and uncertainties that could cause actual results to differ

materially include: the sustainability of the market recovery and recovery of markets for our

customers' products; delays in the introduction of new products; slower than expected change in

the nature of the residential communications domain; our ability to develop and produce new

products at competitive costs and in a timely manner; the possibility that such products may

fail to achieve broad market acceptance; and assumptions pertaining to the level of demand for

products that incorporate our technologies. For more information regarding the risks and

uncertainties that could cause actual results and projections to differ, as well as risks

relating to our business in general, see the discussion in the "Risk Factors"

section of our Annual Report on Form 10-K for fiscal year 2012 and other reports that DSP

Group has filed with the U.S. Securities and Exchange Commission. This investor presentation is

dated May 13, 2013. |

3

Copyright DSP Group, 2013. All rights reserved.

Important Information

Certain Information Regarding Participants

The Company, its directors and certain of its officers may be deemed to be

participants in the solicitation of the Company's shareholders in connection

with its 2013 annual meeting. Information regarding the names, affiliations

and direct and indirect interest (by security holdings or otherwise) of

these persons can be found in the Proxy Materials for its 2013 annual meeting filed

with the SEC. Shareholders will be able to obtain a free copy of the

Proxy Materials and other documents filed by the Company with the SEC from

the sources listed above. The Company has filed with the U.S. Securities and Exchange Commission

("SEC") and provided to its shareholders a definitive proxy statement, proxy supplement

and related materials (the "Proxy Materials") in connection with its 2013 annual meeting

of shareholders. SHAREHOLDERS ARE URGED TO READ THIS PROXY STATEMENT AND OTHER RELEVANT

DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain free

copies of these documents through the website maintained by the SEC at http://www.sec.gov and

through the website maintained by the Company at http://ir.dspg.com. |

4

Copyright DSP Group, 2013. All rights reserved.

Preamble

-

This

Proxy

Contest

Is

Not

Typical

This is the 2

nd

round, as two Starboard candidates were added to our

board last year

We believe this 2

nd

round is all about forcing a fire-sale of the

company

Now is not the time to sell the company; a fire-sale would significantly

undervalue our business and growth prospects

We have confidence that our business plan will create significant

value for stockholders |

5

Copyright DSP Group, 2013. All rights reserved.

“The company is too small to remain public

and, needs to be sold; it should have been sold

already.”

(Starboard

representatives,

Feb

6 ,

2013)

th

Starboard’s position is clear: |

6

Copyright DSP Group, 2013. All rights reserved.

Our Board has and continues to consider all

alternatives to maximize shareholder value without

ruling out any alternative. |

7

Copyright DSP Group, 2013. All rights reserved.

Giving Starboard Additional Nominees Will Hurt the

Company

Starboard’s nominees do not have relevant CEO-level experience in

managing a fabless semiconductor company

Starboard’s nominees do not have relevant experience in managing a

company in Israel, where most of DSP Group’s operations and R&D are

based

Additional Starboard nominees on the Board will have a negative impact

on employee morale resulting in the departure of key employees, and a

negative impact on key customers and suppliers with whom the

company has long-lasting partnerships

Additional Starboard nominees on the Board will considerably weaken

the

current

Board

–

the

DSP

Group

Board

members

targeted

by

Starboard are among our most experienced directors

We believe Starboard’s slate neither replaces that experience nor adds

any

unique

skill

set

or

expertise

Negative impact on shareholder value –

a dysfunctional Board can

destroy shareholder value |

8

Copyright DSP Group, 2013. All rights reserved.

AGENDA

DSP Group’s Recent Operational Success

Strategic Growth to Maximize Stockholder Value

The Proxy Contest

Executive Summary |

9

Copyright DSP Group, 2013. All rights reserved.

DSP Group is Undergoing a Robust Turnaround

Company’s stock has outperformed relevant indexes and industry peers since

cost reduction program initiated immediately after Q2 2011 when

softening of cordless market became evident Company’s stock has

outperformed relevant indexes and industry peers over past 12 months and

year-to-date with growing evidence of operational turnaround and new

product launches There has been a significant improvement in operating

performance following our cost structure re- alignment

Solidified Company’s #1 position in the cordless domain, attained #1 position

in HGW w/ DECT and #3 market share position in Enterprise VoIP

Company’s

Board

and

Management

is

Executing

a

Prudent

Plan

for

Growth

Year-to-date have successfully expanded TAM over 10x to greater than 1

billion units with three new chipset product launches

Leveraging R&D investments in cordless telephony to drive revenues in new

market opportunities in cellular and enterprise telephony has enabled the

Company to maintain below average industry R&D spend, without

sacrificing revenue growth New products targeted at growing mobile,

enterprise and home automation markets are gaining traction; significant

design wins so far this year DSP Group Board Nominees are Best Positioned to

Lead the Company They have significant operational, strategic, financial and

public company board experience in the Company’s areas of focus

Their re-election would remove uncertainty about the Company’s future

with employees, customers and suppliers

Robust Turnaround Underway with Plan for Growth; Current

Board Nominees Best Positioned to Lead the Company |

10

Copyright DSP Group, 2013. All rights reserved.

Turning more influence or control of the Company to Starboard’s nominees is

disproportionate and inappropriate

We

believe

that

Starboard’s

only

agenda

is

to

force

a

fire-sale

of

the

company

as

promptly

as

possible

A fire-sale of the company now, at current prices, would severely undervalue

the company’s growth

initiatives,

and

deprive

shareholders

of

the

returns

they

deserve

Starboard previously appointed two directors to our Board in connection with a

settlement agreement with Starboard in an effort to avoid a proxy contest

in 2012. Election of Starboard’s nominees would result in 5 out of 9

directors having been selected by Starboard; voting for Starboard’s

candidates is not in the best interests of the company Adding

more

Starboard

nominees

to

the

Board

could

provide

enough

influence

to

force

a

fire-sale

of the company

Ceding Control of DSP Group to Starboard’s Nominees Is

Not in Shareholders’

Best Interests

Our

Board

and

management

did

their

utmost

to

a

avoid

proxy

contest

this

year,

offering

much

more

than

Starboard

had

received

and

settled

for

in

other proxy contests to date

We

believe

that

shareholder

value

can

best

be

enhanced

by

taking

advantage

of

the current growth opportunities and capitalizing on the research and

development investments already made over the past few years

|

11

Copyright DSP Group, 2013. All rights reserved.

AGENDA

The Proxy Contest

DSP Group’s Recent Operational Success

Executive Summary

Strategic Growth to Maximize Stockholder Value |

12

Copyright DSP Group, 2013. All rights reserved.

A Long History of Innovation and Value Creation

A leading fabless semiconductor company specializing in voice and

converged communications

Publicly traded since 1994 (NASDAQ: DSPG)

Pioneer in digital signal processing software and ICs

Brought digitalization to answering machines by inventing a telephony

answering device (TAD) on a chip

Successfully

transformed

from

a

small

TAD

supplier

to

the

market

leader

in

SoC for the communications market

DSP Group’s core IP has led to the formation of two companies

demonstrating track record of creating value for shareholders:

AudioCodes (NASDAQ listed)

CEVA (NASDAQ listed) |

13

Copyright DSP Group, 2013. All rights reserved.

DSP Group Today –

the Voice SoC Market Leader

Well Positioned with Current & Next-Generation Products

DSP Group is a leading global provider of wireless chipset solutions for converged

communications

Approximately 400 million homes use DSP Group products today

#1 position in cordless telephony with 70% share

#1 position in HGW w/ DECT

Reached #3 position in VoIP for Office and Enterprise and rapidly expanding

Leading Ultra Low Energy effort in home automation and Internet of Things

market Successfully launched a revolutionary noise cancellation product,

with unparalleled performance targeted at cellular handset market

Financial Highlights

2012 revenues of $162 million

R&D spend as a % of revenues in 2012 was 26% as compared to 38% of our peer

group, and 24-28% during past 5 years

Strong

focus

on

cash

flow

generation

-

generated

$10

million

from

operations

in

2012

improvements for six consecutive quarters

$87 million returned to shareholders in the last 5 years

Cash & marketable securities of $120 million ($5.50/share), no debt

Market capitalization of $175 million

Successfully executing an operational turnaround as demonstrated by operational |

14

Copyright DSP Group, 2013. All rights reserved.

Despite difficult period in cordless domain, Board’s implementation of new

cost reduction program in mid-2011 has led to six consecutive quarters

of improving operational metrics including:

Gross margins

Operating Income

Net Income

EBITDA

Board’s decisive actions led to reduced GAAP annual operating

expenditures run rate by $36 million in two years and non-GAAP by $25

million

Returned to U.S. GAAP operating profitability in Q1’13

Close focus on positive cash flow; generated $10 million in 2012

Returned over $16.8 million to shareholders via buybacks in 2011

& 2012

Maintained strong balance sheet with cash and marketable securities of

$120 million and no debt

Under Board’s Leadership, DSP Group’s Cost Structure and Operating

Performance Vastly Improved in a Difficult Environment |

15

Copyright DSP Group, 2013. All rights reserved.

DSP Group Has Outperformed Relevant Indexes and

Peers Following Restructuring Program Initiated When

Cordless Market Softening Became Evident

DSP Group

Philadelphia Semiconductor Index

Nasdaq Composite Index

YTD - Outperforming Peer Group

YTD - Outperforming Relevant Indexes

|

16

Copyright DSP Group, 2013. All rights reserved.

Outperformed Relevant Indexes and Peers Over Past 12

Months -

Evidence of Successful Turnaround and New

Product Launches

DSP Group

Broadcom

PMC Sierra

Vitesse Semiconductor

Minspeed

Sigma Designs

DSP Group

Philadelphia Semiconductor Index

Nasdaq Composite Index

TTM - Outperforming Relevant Indexes

TTM - Outperforming Peer Group

|

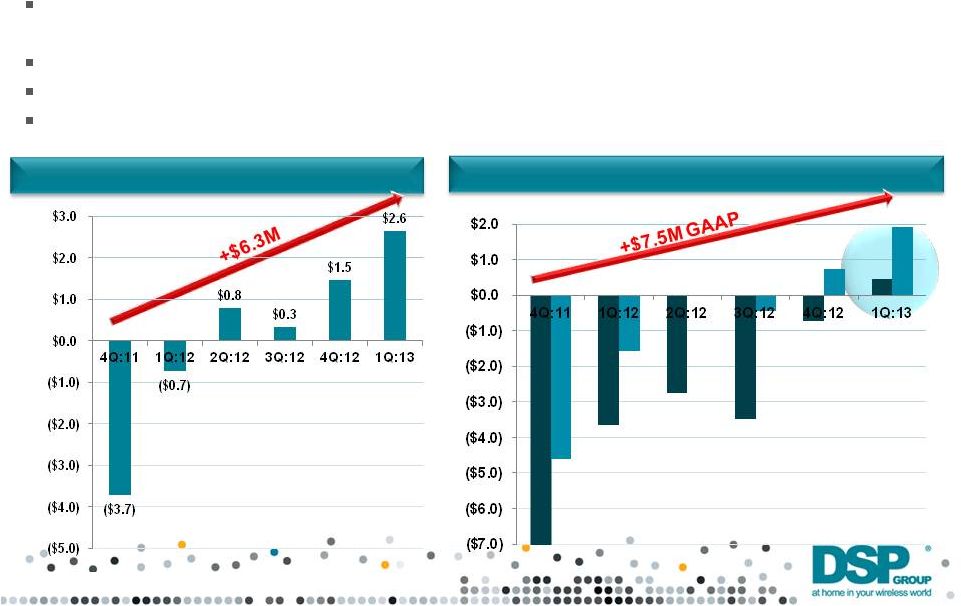

Copyright DSP Group, 2013. All rights reserved.

Delivering on Plans to Return to Operating Profitability and

Grow EBITDA

GAAP

non-GAAP

Despite topline weakness in core business, 6 consecutive quarters of lower

operating costs and improvements in gross margins

Resulted in sharp increase in quarterly EBITDA and operating income

Resumed operating profitability non-GAAP in Q4’12 and GAAP in

Q1’13 EBITDA reached 7% of revenues in Q1’13

EBITDA by Quarter

Operating Income by Quarter

17 |

Copyright DSP Group, 2013. All rights reserved.

Return to Operating Profitability Led to Positive EPS & Net

Income

GAAP

non-GAAP

GAAP

non-GAAP

Operational turnaround led to a return to net income and EPS

Consistent progress in net income and earnings per share in the last six

quarters Returning to non-GAAP net income and EPS in Q2’12 and to

GAAP net income and EPS in Q1’13

Net income by Quarter (USD in millions)

Quarterly EPS

18 |

Copyright DSP Group, 2013. All rights reserved.

Prudent Research and Development Spend Well Below Peers

DSP Group spent 26% of its net revenues on R&D versus 38% for our peer

group last year

Plan to maintain below average industry R&D spend by leveraging our past

R&D investments in voice processing as we enter new markets

R&D Expense as a % of Revenues, Comparison to SoC Peer Group

19 |

Copyright DSP Group, 2013. All rights reserved.

AGENDA

Executive Summary

DSP Group’s Recent Operational Success

The Proxy Contest

Strategic Growth to Maximize Stockholder Value

20 |

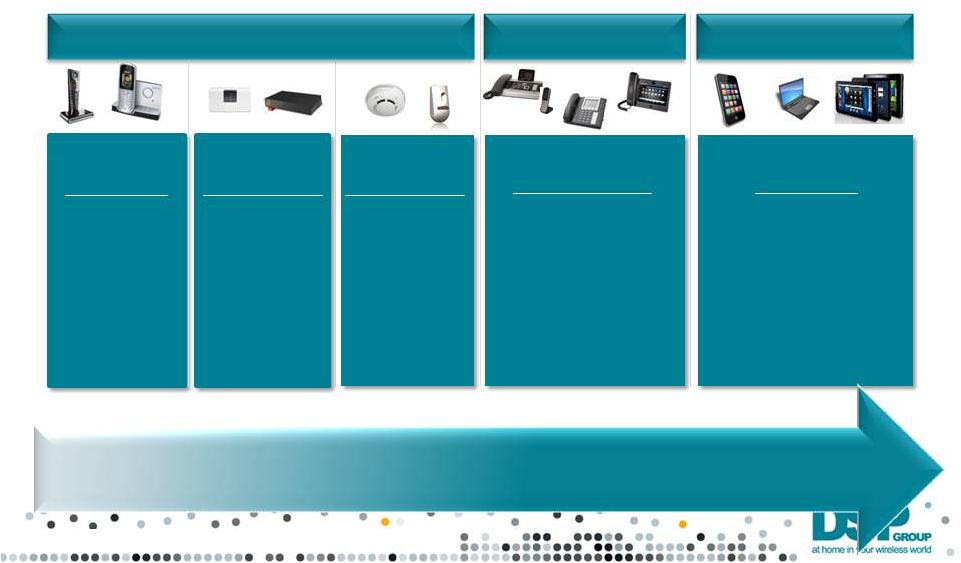

Copyright DSP Group, 2013. All rights reserved.

Cordless

Majority Of

2012 Revs

2014E TAM

110M Units

Voice Over IP

Generated 2012

Revs / DVF99

Chipset

Launched Jan 2013

2014E TAM

60M Units

HDClear

DMBD2 Chipset

Launched

Feb 2013

2014E TAM

1B Units

Home

Automation

DHX91

Chipset

Launched

Jan 2013

2014E TAM

52M Units

Home

Gateways

Generated

2012 Revs

2014E TAM

52M Units

DSP Group’s Products Now Address Three Large Market

Opportunities Expanding TAM Significantly YTD

Three new chipset launches year-to-date: DMBD2, DVF99 and DHX91 –

expand total addressable market significantly to over 1 billion units

2014E Total Addressable Market > 1.35 Billion Units

Up 10x From 2012

Home

Enterprise

Mobile

21 |

Copyright DSP Group, 2013. All rights reserved.

Our Roadmap Protects and Grows Our Established

Leadership in the Home Domain

Cordless

Cordless

Cordless

Ultra Low Energy

Ultra Low Energy

Ultra Low Energy

HGW + CAT-iq

HGW + CAT-iq

HGW + CAT-iq

•

More than 70% market

share in cordless

•

Versatile portfolio of

proven DECT solutions

•

•

More than 70% market

More than 70% market

share in cordless

share in cordless

•

•

Versatile portfolio of

Versatile portfolio of

proven DECT solutions

proven DECT solutions

•

More carriers are

integrating DECT

into HGW for

wireless HD

voice

•

New revenue

source with

potential to seed

DECT-ULE

growth

•

More carriers are

integrating DECT

into HGW for

wireless HD

voice

•

New revenue

source with

potential to seed

DECT-ULE

growth

•

Superior range

•

Interference

free band

•

Supporting two

way audio and

video

•

Lower system

& deployment

costs

•

•

Superior range

Superior range

•

•

Interference

Interference

free band

free band

•

•

Supporting two

Supporting two

way audio and

way audio and

video

video

•

Lower system

& deployment

costs

22 |

Copyright DSP Group, 2013. All rights reserved.

Successfully Executing on Growth Plan to Leverage Our

History of Innovation in Voice Processing and Diversify

into Adjacent Markets

25Y of

Voice

Processing

Noise Cancellation

HD Voice

Acoustic Echo Cancellation

Flexible Listening Enhancement

Voice Equalizer

Automatic Gain Control

FlexiSpeech

True Speech

Speech To Text

VoIP

FoIP

Text To Speech

Speech Recognition

23

Copyright DSP Group, 2013. All rights reserved. |

Copyright DSP Group, 2013. All rights reserved.

Over the Past Decade We Have Achieved a Strong

Position in

Cordless and Maintained That Leadership

As digital cordless telephony evolved from 2.4GHz to 5.8GHz to DECT over the

past decade, DSP Group built a dominant market share position

We have expanded our leadership with continuous improvements to our best-

in-class products

Today our technology powers all largest ODM/OEM products and serving

leading operators globally

The Market Leader

Key Customers

Leading Operators

DSP Group

70% Market

Share

Company A

21%

Company B

9%

24 |

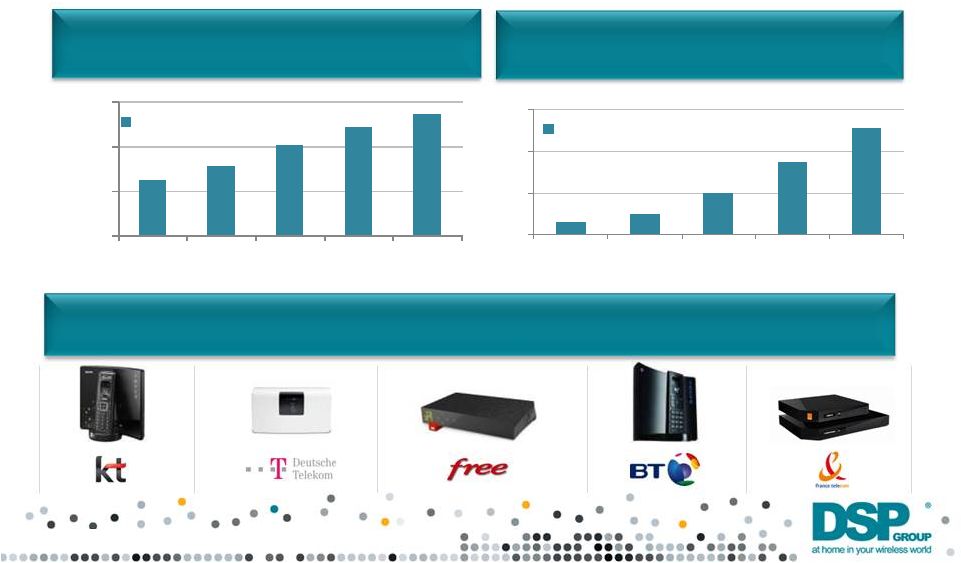

Copyright DSP Group, 2013. All rights reserved.

First Extension -

Integration of DECT into Home

Gateways; Attained #1 Position; Driving Sales & Seeding

ULE Growth

Home Gateways w/ Voice

units shipped per year (in millions)

DECT Home Gateways

units shipped per year (in millions)

62

78

101

122

137

-

50

100

150

2012E

2013E

2014E

2015E

HGW w/ Voice

2011

3

5

10

17.3

25.6

0

10

20

30

2011

2012E

2013E

2014E

2015E

DECT Home Gateways

Source

IMS,

February

2012

Source

IMS,

February

2012

DSP Group chipsets deployed in HGWs of leading European telecos. New revenue source fo

DSP Group with potential to seed DECT-ULE growth

25 |

Copyright DSP Group, 2013. All rights reserved.

Second Extension -

Enterprise VoIP; Company Rapidly

Attained #3 Position; New VoIP Product Greatly Expands

TAM

DSP Group provides System-on-Chip (SoC) solutions for Enterprise VoIP

endpoints

Now targeting Tier-1 IP-Phone providers, largest segment within Enterprise

VoIP, with our multi-core DVF99 (new product) processor introduced in

January 2013, which has achieved three design wins to date

TAM estimated at $150-$200 million in chipset value and growing at double

digit rates

DSP Group

Market Share

Source: In-Stat, DSP Group

VoIP Market

Size & Growth

(IP Phones & ATAs)

0

10

20

30

40

50

60

70

2010

2012E

2013E

2014E

2015E

2011

3%

5%

9%

17%

25%

30%

0%

20%

40%

60%

80%

26 |

Copyright DSP Group, 2013. All rights reserved.

Our Extensive Footprint in VoIP Terminals

27 |

Copyright DSP Group, 2013. All rights reserved.

DECT ULE and our newest DHX91 chipset introduced in January 2013

provide

major advantages for operators over competing technologies in the home

automation market

Important distinctions of ULE vs. other standards include licensed spectrum, superior range, lower cost, and increasing share of

DECT within home gateways Third Extension -

DECT Ultra Low Energy -

ULE is an

Emerging Standard for the Home Automation Market

Low Cost of

Deployment

Data Speed

Range &

Propagation

Power

Consumption

Video/Audio

Enabled

ULE

ZigBee

Z-Wave

28 |

Copyright DSP Group, 2013. All rights reserved.

•

‘Internet of Things’

forecasted to reach 50 Billion by 2020

(Source: Ericsson White Paper, Feb ‘11)

•

Connected devices to outnumber humans 6 to 1 by 2020

(Source: CIO, Sep ‘12)

•

80% of utility meters in EU will be connected by 2020

(Source: Ericsson White Paper, Feb ‘11)

•

Technology

leaders,

Apple,

Google

and

Microsoft,

already

spotted

‘Connected

Home’

as the Next Big Thing

(Source : Wall Street Journal & Techcrunch, Dec ’12)

•

Leading operators, telco’s and services providers, Comcast, AT&T and ADT,

already

becoming major ‘Connected Home’

players

(Source: multiple sources)

•

Telecom Italia outlined ‘Connected Home’

where combination of entertainment,

automation, security and eHealth services co-exist

(Source: ADB Global Taking control of the Connected Home)

What is Our Market Opportunity with ULE/Connected Home?

We Project a Total Addressable Market of Several Billion

Devices

29 |

Copyright DSP Group, 2013. All rights reserved.

Maximize

accuracy rate

of Automatic

Speech

Recognition

enabled

applications

Improve voice

call

intelligibility

everywhere

Redefining Use of

Speakerphone

Mode In Noisy

Environments

Fourth Extension -

Mobile; Our Voice Expertise

Leading to an Unparalleled User Experience

30

Copyright DSP Group, 2013. All rights reserved. |

Copyright DSP Group, 2013. All rights reserved.

Voice Processors from “Optional”

to “Essential”;

A 1.7bn TAM Opportunity for DSP Group

Source: Gartner

Source: IDC

Source: IDC

31

Copyright DSP Group, 2013. All rights reserved.

Smartphone Forecast, WW, 2012-2016

Mobile Communications Trends

Massive volume opportunity: 1.7B units in 2015

Voice & audio processors

66%

Smart-Phones and

Feature-Phones

9%

Tablets

25%

Mobile PC

2010

2016

2015

2014

2013

2012

2011

1600

400

600

800

1000

1200

1400

0

200

0.0

2011E

2015E

2014E

2013E

2012E

63%

47%

35%

23%

10%

1.7B

1.1B

0.8B

0.5B

0.2B

0.5

1.0

1.5

2.0

0%

25%

50%

75%

100%

Units

Penetration of mobile units |

Copyright DSP Group, 2013. All rights reserved.

DSP Group’s Technology Provides Far Superior Voice

Quality Versus Existing Solutions

•

Global Mean Opinion Score (G-MOS) measures overall quality including speech

and background

noise.

Score

difference

of

0.2

is

significant.

Values

between

4.0

to

4.5

show

high satisfaction

•

Analysis shows HDClear equipped phone versus two leading smartphones (iPhone 5

& Galaxy SIII); HDClear clearly outperforms in noisy environments

* Independent 3QUEST tests were performed at HEAD Acoustics Lab in June & Oct

2012 Quiet Environment

Noisy Environment

1.5

2

2.5

3

3.5

4

4.5

café

car

train

road

5

32 |

Copyright DSP Group, 2013. All rights reserved.

AGENDA

Executive Summary

DSP Group’s Recent Operational Success

Strategic Growth to Maximize Stockholder Value

The Proxy Contest

33 |

Copyright DSP Group, 2013. All rights reserved.

Starboard is a 10% Owner Looking to Nominate a Majority

of Our Directors; We’re Convinced They Are Seeking to

Sell the Company

In 2012, Starboard designated two directors for appointment to our Board in

connection with a settlement, which averted a proxy fight last year

In 2013, Starboard has nominated three additional directors. If elected, Starboard

would have designated five out of nine directors, which would constitute a

majority of our directors, holding only 10% of the stock and without paying

a control premium

Starboard nominees would achieve majority without Starboard paying any

premium and despite the fact that Starboard only owns about one-tenth of the

company’s shares

The

proxy

contest

is

about

adding

more

Starboard

nominees

to

our

Board

and

gaining enough influence to force a fire-sale of the company

34 |

Copyright DSP Group, 2013. All rights reserved.

Not Your Typical Situation for a Proxy Contest;

More Support for Our Belief Starboard is Looking to Sell

the Company

Starboard did not present or suggest plans to grow the company

Management and representatives of the Board have met with Starboard on

numerous occasions and, based on these conversations, we are convinced

that Starboard’s goal is to affect a sale of the company as soon as

possible A sale at current prices would undervalue the company and deprive

shareholders from a return on R&D investments that were already made and

are expected to bear fruit in coming years

Starboard

does

not

understand

our

business

–

Starboard

suggested

that

the

company should have developed a DSP core instead of entering a licensing

deal with CEVA. Developing such a core would cost the company tens of

millions compared with the low 6-figure licensing deal we signed and the fast

time to market it enabled

Starboard

does

not

understand

our

business

–

claiming

our

R&D

investments are “staggering”

or exceed what we should be spending, our

detailed comparison shows that we rank well below peers

We believe that the best shareholder value can be obtained by taking

advantage of the current market opportunities to capitalize on the research

and development investments already made over the past few years, which

are now beginning to bear fruit

35 |

Copyright DSP Group, 2013. All rights reserved.

DSP Group Directors and Management Are Committed to

Strong Corporate Governance

Poison pill was not renewed, even in the face of Starboard’s campaign to gain

control

Seven of nine directors are independent

3 out of the 9 current directors (Traub, Lacey and Seligsohn) have been

designated

or

suggested

by

shareholders

of

DSP

Group,

all

in

the

last

12

months

All directors are invited to attend all committee meetings and free to voice their

opinions on topics being discussed

4 out of the 7 independent directors joined the board in the last two years.

Separation of Chairman and CEO roles

Independent directors meet in executive session without management present

As soon as there was vacancy in our committees, we nominated Mr.

Lacey to

our Audit Committee

36 |

Copyright DSP Group, 2013. All rights reserved.

We believe that Our Nominees Will Better Serve

Shareholders and the Company

Eli Ayalon

Starboard Nominees

•

Vast CEO experience in multi national

companies

•

Proven record in leading successful

turnarounds and technology transitions

•

Public company board experience in various

technology companies in the defense,

telecom, medical equipment and

semiconductor industries including residing

five years in Europe

•

Semiconductor board experience

•

M-Systems (NASDAQ: FLSH) acquired

by SanDisk

•

Wintegra, acquired by PMC Sierra

•

Top executive background in Europe and

Israel

•

Deep understanding of the company

•

Strong connections with leading universities,

through memberships in Boards of

governance and executive committees

Michael Bornak

•

•

•

Norman Rice, III

•

•

Norman Taffe

•

•

No CEO experience

No semiconductor industry experience

CFO of SeaChange International, a company in which

Starboard holds almost 10%

No CEO experience

No semiconductor industry experience

No CEO experience

a member of the Board of Directors of Integrated Device

Technology, Inc. , a company in which Starboard is

involved

37 |

Copyright DSP Group, 2013. All rights reserved.

We believe that Our Nominees Will Better Serve

Shareholders and the Company

Zvi Limon

Starboard Nominees

•

Public company board experience

•

Technology, semiconductor and telecom

industry experience

•

Israeli and European experience

•

Deep understanding of the company

•

Vast experience in strategy and management

consulting

•

Brings unique and valuable perspective of

successful

venture

capital

Michael Bornak

•

•

•

Norman Rice, III

•

•

Norman Taffe

•

•

No CEO experience

No semiconductor industry experience

CFO of SeaChange International, a company in

which Startboard holds almost 10%

No CEO experience

No semiconductor industry experience

No CEO experience

a member of the Board of Directors of Integrated

Device Technology, Inc. , a company in which

Starboard is involved

•

Led his funds to successful investments in technology

companies such as GVT, leading Brazilian broadband

operator, sold to Vivendi in 2009 for $4.2B

•

Wintegra, a leading fabless semiconductor company, sold to

PMC-Sierra in 2010 for $240M

•

Galileo,

semiconductor

company,

sold

to

Marvell

in

2000

for

$250M

•

Provigent,

a

fabless

semiconductor

company,

sold

to

Broadcom

in 2011 for $360M

•

Phonetics,

speech

recognition

company,

acquired

by

Nuance

communication

•

DesignArt, semiconductor company, sold to QUALCOMM in

2012 for $150M

•

Trivnet, mobile financial services company, sold in 2009 to

Gemalto

38 |

Copyright DSP Group, 2013. All rights reserved.

We believe that Our Nominees Will Better Serve

Shareholders and the Company

Dr. Reuven Regev

Starboard Nominees

•

Corporate

executive

in

Rafael

-

Advanced

Defense Systems, the R&D arm of Israel’s

defense ministry

•

Led

national defense projects and was awarded the

highest defense award

•

Initiated the commercialization of unique defense

technologies, resulting in successful companies, like:

Given

Imaging

(Nasdaq:

GIVN),

Galil

Medical

and

•

Holds MSc

and PhD degrees from Stanford

University (1990). During his stay in Stanford,

was a member of a management of consulting

teams to GE, Ford, GM, Apple, Boeing, John-

Deere and Motorola

•

Multiple

CEO

experiences

including

international

industrial and venture capital companies.

•

Public companies board experience

•

First class expert in semiconductor and

communication systems and technologies

Michael Bornak

•

No CEO experience

•

No semiconductor industry experience

•

CFO of SeaChange International, a company in which

Startboard holds almost 10%

Norman Rice, III

•

No CEO experience

•

No semiconductor industry experience

Norman Taffe

•

No CEO experience

•

a member of the Board of Directors of Integrated Device

Technology, Inc. , a company in which Starboard is

involved

more

39 |

Copyright DSP Group, 2013. All rights reserved.

We believe that Our Nominees Will Better Serve

Shareholders and the Company

Gabi Seligshon

Starboard Nominees

•

Recently joined the Board

•

Suggested by one of our largest shareholders

•

CEO experience in managing multi national

companies

•

Technology and semiconductor industry

experience

•

Israeli and European executive experience

Michael Bornak

•

No CEO experience

•

No semiconductor industry experience

•

CFO of SeaChange

International, a company in which

Startboard

holds almost 10%

Norman Rice, III

•

No CEO experience

•

No semiconductor industry experience

Norman Taffe

•

No CEO experience

•

a member of the Board of Directors of Integrated Device

Technology, Inc. , a company in which Starboard is

involved

40 |

Copyright DSP Group, 2013. All rights reserved.

Summary and Conclusion

Giving Starboard Nominees More Influence or Control

Would Hurt the Company and Could Destroy

Stockholder Value

DSP Group’s stock has been one of the top performing stocks in our industry

during the last 12 months and the year-to-date

DSP Group has made significant operational and financial progress over the last

12 months

DSP Group has a clear, concise growth strategy and is on track to meet its

strategic goals

DSP Group Board nominees are diverse and have significant strategic,

operational, financial and public board experience in our areas of focus and in

the places where our operations are located

41 |