Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DSP GROUP INC /DE/ | d541390d8k.htm |

| EX-99.2 - EX-99.2 - DSP GROUP INC /DE/ | d541390dex992.htm |

Exhibit 99.1

DSP Group Proxy Contest:

Setting the Record Straight

We believe that Starboard’s presentation filed on May 13, 2013 contained a large number of factually inaccurate statements and misleading data points in its attempt to gain support for its slate of hand-picked nominees to DSP Group’s Board.

This White Paper seeks to set the record straight and allow shareholders to reach an independent and informed decision based on the facts.

STARBOARD’S ARGUMENTS FOR CHANGE ARE FALSE AND MISLEADING

Starboard Ignores the Company’s Recent Operating Success

Starboard’s claims that the Company’s operating performance has been “abysmal” are entirely false and ignore our recent operating success.

DSP Group has completed six consecutive quarters of operational improvements, measured across all key metrics. Our latest quarter provided more evidence of our successful turnaround as we exceeded our guidance across almost every financial metric. We also have delivered solid guidance above expectations for the second quarter. The Company achieved a milestone in 2013 by returning to positive GAAP net income. Our focus remains strong execution to enhance shareholder value. Below are some highlights of our performance during the first three months of the year.

| • | GAAP EPS of $0.05 and non-GAAP diluted EPS of $0.11, both above consensus expectations |

| • | Gross margins of 39.6% exceeded guidance and improved for the sixth consecutive quarter |

| • | Despite a difficult environment, EBITDA increased for the sixth consecutive quarter to $2.6 million, reaching 7% of revenues |

Our Promising Growth Potential

Our growth strategy is working although Starboard will not admit to this fact. A snapshot of our Board’s and management’s prudent plan for growth is below:

| • | Three new product launches have successfully expanded the Company’s total addressable market over ten-fold, to greater than 1 billion units. |

| • | We are leveraging R&D investments in cordless telephony, our core competence, to drive revenues in new opportunities in cellular and enterprise telephony. This has enabled the company to maintain below average industry R&D spend, without sacrificing revenue growth. |

| • | New products, targeted at the growing mobile, enterprise and home automation markets, are gaining traction with significant design wins secured so far this year. |

Here is some additional color within each market segment we currently address:

1. The Home Segment:

| • | In 2012, DSP Group became the market leader in DECT connectivity in the Home Gateway (HGW) market, and so far in 2013 the Company has further expanded its leadership position by shipping twice the volume that was shipped in 2012. |

| • | In 2013, DSP Group is shipping HGW products to 13 different service providers worldwide compared to just 7 service providers in 2012, demonstrating solid growth and the positive dynamics in the market favoring DECT integration into HGWs. |

| • | DECT is evolving from a voice-only wireless standard into a control network ecosystem for home and building automation via new ULE (Ultra Low Energy) protocols. We took a big step forward with formation of ULE Alliance during the first quarter and the publication of ULE standard specifications by the European Telecommunications Standards Institute. |

2. The Office/Enterprise Segment:

| • | During the first quarter of 2013, DSP Group reported that its VoIP revenues targeting the Office/Enterprise market increased 39% year-over-year. This year, DSP Group is shipping its products to twice as many VoIP end products vs. a year ago. |

| • | The Company expects to achieve 16% of the total market design wins by the end of this year and to grow aggressively in 2014 with new Tier 1 volume replacing an incumbent supplier that bowed out of the market. |

| • | Our newest VoIP processor, DVF99, was launched in January and has already secured three design wins. We expect to ramp up mass production during the fourth quarter. |

Starboard Uses Misleading Data to Portray DSP Group as Overspending on R&D and Acquisitions

Starboard claims that DSP Group’s spending on R&D and acquisitions have “destroyed shareholder value.” This claim also is false and, as we show below, they use inconsistent and incorrect data to try to make their point.

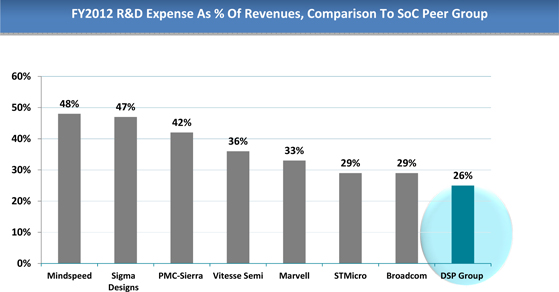

| • | Contrary to what Starboard asserts, DSP Group invests significantly less than its peers in R&D as a percentage of revenues, and the Company’s focused R&D efforts have been productive, with the launch of three new, best-in-class products in key growth markets since the beginning of 2013. These new product launches have increased the Company’s total addressable market ten-fold. |

| • | An analysis of 2012 R&D spending as a percentage of sales shows that our peer group has R&D spend approaching 38% of sales versus 26% for the Company. Additionally, over the past 5 years, DSP Group has generated $1.1 billion in revenues, 25.5% of which was spent on R&D. This ratio is well below our peer group. Our R&D spending is efficient: the new chipsets resulting from the Company’s prudent R&D efforts are all cutting-edge and generating warranted attention among significant players in our markets. It also should be noted the R&D spend directed towards defending and growing DSP Group’s position as the global leader in DECT has been successful. |

| • | It is misleading for Starboard to state in their presentation that “over the last 5 years alone, DSP has spent approximately $557 million in R&D and acquisitions.” Starboard has overstated the Company’s spending by $265 million over that timeframe. The Company has invested $293 million or 25.5% of sales on R&D and acquisitions in the past 5 years ($282 million towards R&D & $11 million to acquire BoneTone Communications) and the technologies developed from these investments have positioned the Company for top line growth and profitability in the coming years. |

| • | Starboard’s presentation of DSP Group’s investments in R&D and acquisitions on a per share basis is flawed because they use current shares outstanding instead of the number of shares outstanding at the time of the related expenditures. Starboard’s approach ignores the Company’s substantial buybacks of common stock from 2007 through 2013. These buybacks led to a 27% reduction in shares outstanding (21.9 million shares today, reduced from 31.8 million shares as of December 2007) and returned $87 million to stockholders. |

| • | Starboard also fails to acknowledge the importance of the Company’s 2007 acquisition of NXP Semiconductors’ DECT operating division. This acquisition included the full operations of NXP’s DECT division: sales, employees, offices and other overhead and infrastructure. Starboard includes the cost of this acquisition in their claim that the Company has overspent on R&D and acquisitions. The NXP acquisition has been crucial to the Company’s success within the DECT segment and the profitability of its DECT cordless business. Prior to the NXP acquisition in 2007, DSP Group generated over two-thirds of its revenues from its 2.4 GHz and 5.8 GHz cordless telephones for the US market. |

| • | The Board and management realized that this business was at risk as the world of cordless telephony transitioned to DECT standards. The NXP acquisition solidified the Company’s position in DECT and demonstrated the Board’s tremendous foresight given the precipitous |

| decline in the market for 2.4 GHz and 5.8 GHz cordless telephony. In the three years up to and including the NXP deal, 2.4 GHz and 5.8 GHz cordless telephony generated $376 million in revenues for the Company. In the past three years, 2.4 GHz and 5.8 GHz cordless telephony has generated only $60 million for the Company out of $580 million in revenues for the same period, and just $11.3 million in 2012 out of approximately $163 million in revenues, which are a direct outcome of the NXP acquisition. |

Setting the Record Straight on CEVA

Starboard misrepresents the nature of the Company’s relationship with CEVA (Nasdaq: CEVA),a licensor of silicon intellectual property, DSP cores and platform solutions for the mobile, portable and consumer electronics market, and the role the Board and the Company’s outside counsel have played in transactions between the Company and CEVA.

| • | To fully understand DSP Group’s relationship with CEVA, its history with the Company must be understood. CEVA spun off from the Company in 2002, at which point we received a license from CEVA for use of the DSP core technology that has formed the backbone of our product line, including all of the Company’s voice codecs and algorithms. By licensing IP cores for a license fee typically measured in the low hundreds of thousands of dollars, we save tens of millions of dollars in development costs that would otherwise be spent porting, rewriting and optimizing complex software. Our knowledge of CEVA and its technology makes them a logical fit. Licensing decisions are made by management acting in the ordinary course of business, without direct involvement by the Board of Directors or any involvement by outside counsel. |

| • | When the Company determined to develop a voice enhancement chip for mobile devices, we needed to ensure the speed and efficiency of the technology, a short development timeframe and cost-efficiency. All negotiations between DSP Group and CEVA were done by the companies’ respective management teams and all decisions were made based purely on business considerations. Before selecting CEVA in March 2013, we engaged in a thorough review of alternatives, such as ARM, Tensilica and others, to determine which product was best positioned from a commercial and technical point of view, as we always do when selecting among suppliers. We concluded that CEVA’s Teaklite III product was the best in performance and the most cost effective solution for our HDClear product. |

| • | Moreover, Starboard’s suggestion that we re-enter the licensing business and compete with CEVA on DSP core licensing demonstrates their failure to understand our business. Furthermore, it contradicts their own claim that the Company spends too much on R&D, as a typical R&D expense level for an IP licensing company is 35% to 45% of revenues, as compared to 26% in our business model. Moreover, the Company would have to spend millions of dollars and many man years to port our entire software suite to a new core. |

| • | The Company’s licensing arrangement with CEVA was entered into in the ordinary course, was not material to either company and, as a result, the license agreement was not submitted to the Board of either company for approval. There was no opportunity for any Board member or our outside counsel to unduly or incorrectly influence the selection process and assertions to the contrary by Starboard have been trumped up in an attempt to gain an advantage in the proxy fight. Statements that certain of the Company’s directors and its outside counsel were involved in the Company’s decisions with respect to this licensing matters, or that they were in a position to influence the Company’s decision-making with respect to this matter, are simply false. |

| • | Starboard also asserts that Bruce Mann, Esq., a partner in the law firm that represents the Company, is “Lead Independent Director of CEVA,” presumably in an attempt to make the connections between the two companies seem more significant than they are. Mr. Mann is not the Lead Independent Director of CEVA—in fact, he has not held this role since May 2005. |

Starboard has distorted the facts with respect to the Company’s business dealings with CEVA in a blatant attempt to divert shareholder focus away from the Board’s loyalty, hard work and dedication. The Board is focused on continuing DSP Group’s successful turnaround, with increased profitability and a solid strategic plan to maximize long-term shareholder value.

It should also be noted that, according to CEVA’s recent proxy statement, neither Eli Ayalon nor Zvi Limon has any stock ownership in CEVA. Both have only outstanding options granted to all directors of CEVA and both held less than 1% of CEVA’s outstanding equity. In comparison, according to DSP Group’s recent proxy statement, Messrs. Ayalon and Limon held approximately 2.3% and 1.1% of DSPG’s outstanding equity, respectively.

Starboard’s Description of Our HDClear Development Efforts Is Misleading

HDClear is DSP Group’s proprietary noise cancellation and voice enhancement technology based on algorithms originally developed by BoneTone Communications, which we acquired in the fourth quarter of 2011 to address noise cancellation in headsets.

| • | DSP Group made a strategic decision in 2012 to bypass the relatively small unit opportunity in headsets to focus on creating a solution for the significantly larger mobile market, including smartphones, through additional innovation and development. |

| • | In February, we launched our HDClear product for mobile devices at Mobile World Congress in Barcelona featuring proprietary noise cancellation algorithms and powerful acoustic echo cancellation abilities. |

| • | Starboard highlights various comments around HDClear with respect to our projections being “pushed out” continuously. What Starboard fails to mention is that in between 2011 and 2012 a major strategic change occurred and that our new path forward to the mobile market holds a significantly higher potential return for the Company and its shareholders. |

| • | We are on track to deliver engineering samples of the new DBMD2 IC this month, and have already begun evaluations with leading OEMs and mobile network operators. The Company is confident in its strategy to commercialize its HDClear by offering a voice enhancement processor with a dedicated IC, low power consumption, a small footprint and equipped with a full suite of algorithms. Our offering matches well with products and roadmaps of key players in the market like Audience, which focuses on this market with a standalone IC. With that said, licensing our IP to OEMs or merchant silicon vendors remains a future option which we open to. |

Starboard Uses Misleading Data Around Comparison to Sitel Semiconductors

Starboard draws a misleading comparison between DSP Group and SiTel Semiconductors, arguing that the businesses between 2005 and 2011 were comparable and that DSP Group should have similar results to those of SiTel.

| • | Throughout this period, SiTel was a private company that was being managed within a private equity firm, with the goal of an eventual sale. The comparison to DSP Group, therefore, is irrelevant and misleading. In addition, Starboard compares SiTel’s results for these periods to the consolidated results of DSP Group, which includes investments in new growth areas and not to the relevant segments in DSP Group’s financials. |

| • | Sitel was acquired in early 2011 by Dialog Semiconductors, a public company, thereby making comparisons more relevant for more recent periods. The table below compares the Connectivity segment in Dialog Semiconductors’ financials to the Home and Offices segments in DSP Group’s financial statements, as both include the cordless and VoIP businesses. As the below table shows, for both 2012 and the first quarter of 2013, the Connectivity segment of Dialog Semiconductors (the ex-SiTel business) underperforms DSP Group’s Home and VoIP segments. The Home & Offices segments of DSP Group generated 6% and 14% of operating income as a percentage of revenues for the year 2012 and the first quarter of 2013, significantly outperforming Dialog, which had an operating loss and income of 4% as a percentage of revenues over the same timeframe. |

A Comparison of DSP Group Segment Reporting Information to Dialog Semiconductors

| DSP Group Home & Office segments (*) |

Dialog Semiconductors Connectivity segment (**) |

|||||||||||||||

| Year 2012 | Q1 2013 | Year 2012 | Q1 2013 | |||||||||||||

| Revenues |

$ | 162.8 | M | $ | 39.6 | M | $ | 96.1 | M | $ | 20.6 | M | ||||

| Operating income as reported |

$ | 9.9 | M | $ | 5.0 | M | ($ | 6.3 | )M | $ | 0.9 | M | ||||

| Operating income as % of revenues |

6 | % | 14 | % | LOSS | 4 | % | |||||||||

| (*) | Operating income for DSP Group is based on the filed 10-K and 10-Q for the year ended December 31, 2012 and the quarter ended March 31, 2013, respectively. |

| (**) | For Dialog Semiconductors the information is based on public data, operating income is the “underlying” data that excludes amortizations and one-time items. |

Starboard Has Selected a Misleading Set of Comparable Companies and Completely Ignores the Company’s Market-Beating Stock Price Performance over the Past Year

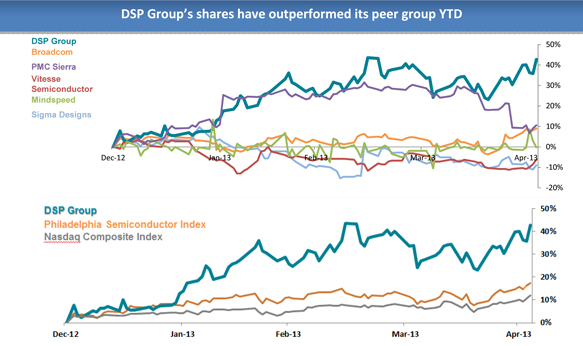

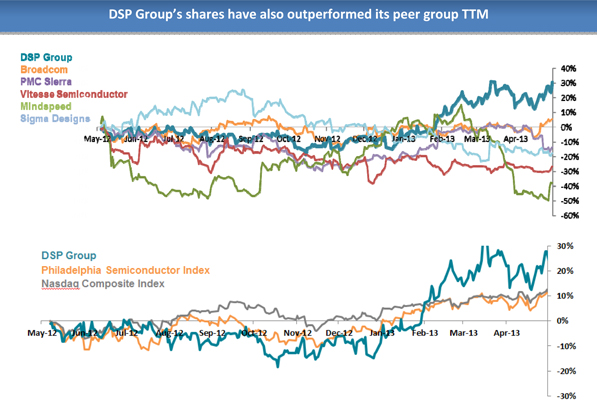

Starboard’s claims about the performance of our stock are misleading and ignore the stock’s superior performance when compared to relevant benchmark indexes and the Company’s peer group.

| • | Starboard has included comparative stock price charts on page 6 and 7 of its presentation, labeled as the “Five-Year Stock Price Chart,” the “Three-Year Stock Price Chart” and the “One-Year Stock Price Chart.” The Five-Year Stock Price Chart actually covers the period from June 2006 through the present (nearly seven years); the Three-Year Stock Price Chart actually covers the period from June 2008 through March 2013 (nearly five years); and the One-Year Stock Price Chart actually covers the period from June 2010 through the present (nearly three years). These charts are therefore inaccurate and materially misleading for investors. |

| • | Moreover, Starboard’s presentation compares the stock price performance of the Company to that of the Russell 2000 Index and the S&P Information Technology Index. While we understand we are included in the Russell 2000 Index, its sector and composition of underlying stocks makes this an inappropriate comparison. Specifically, the top sectors by weight in the Russell 2000 are financial services, consumer discretionary and producer durables. Moreover, companies within the Russell 2000 on average are significantly larger than DSP Group, with a weighted-average market capitalization of $1.1 billion and a median market capitalization of $460 million. Among the top ten holdings in the Russell 2000, there are two pharmaceuticals companies, an airline, a financial services holding company that specializes in mortgage servicing and origination and a chemical manufacturer. These companies are not our peers. |

| • | The comparisons below use a more relevant set of comparable companies. Starboard completely ignores the Company’s impressive stock performance year-to-date and for the trailing twelve months. DSP Group has significantly outperformed its peer group for the same periods. |

Starboard Inaccurately Describes the Conduct of the DSP Group Board

Starboard makes the claim that their two nominees on the DSP Group Board, Thomas Lacey and Kenneth Traub, have been “frozen out” of DSP Group’s Board deliberations and decisions. These assertions are false.

The truth is that Messrs. Lacey and Traub have not been “frozen-out” or “excluded” from deliberations of the Board. Consistent with Company policy, Messrs. Lacey and Traub were invited to every single meeting of the full Board during their tenure as directors and they attended all of them, either telephonically or in person. The minutes of the Board since the appointment of Messrs. Lacey and Traub to the Board reflect both their attendance and their active participation in meetings. Starboard has no basis whatsoever to claim that Messrs. Lacey and Traub have been “excluded” from the Board.

The Company has a policy that all Board members may attend and participate in the discussions of any meeting of its standing committees, including the Audit Committee, the Compensation Committee and the Nomination and Corporate Governance Committee. Messrs. Lacey and Traub knew of the Board’s committee meetings and, in fact, attended and participated in four of them. Either Mr. Lacey or Mr. Traub has been in attendance at every meeting of the Audit Committee and the Compensation Committee this year.

Moreover, a report from the Nomination and Corporate Governance Committee, including minutes reflecting the Board’s policy that any member of the Board may attend ordinary course committee meetings, was unanimously approved by the entire Board, including Messrs. Lacey and Traub.

Starboard’s presentation also blatantly misstates that neither Mr. Traub nor Mr. Lacey have any committee representation. In an extremely misleading slide, Starboard writes in large red text that Messrs. Traub and Lacey have “No Committee Representation;” this is simply not true. In a nearly illegible footnote at the bottom of the page, Starboard acknowledges that, as of May 6, 2013, Mr. Lacey has replaced Yair Shamir on the Audit Committee of the Board, following Mr. Shamir’s resignation in connection with his appointment to a post in the Israeli government. Starboard’s presentation of this information appears to be a calculated effort to mislead investors.

In addition, it’s important to note that the Board generally adds new directors to its committees as vacancies occur. Such was the case when Dr. Reuven Regev joined our Board in January 2011. Mr. Regev did not initially have a committee assignment, and was only named to the Nomination & Corporate Governance Committee in May 2012, filling the vacancy created when Louis Silver stepped down in connection with the settlement with Starboard. Although neither Mr. Lacey nor Mr. Traub ever requested to be formally appointed to the Board’s standing committees, the Board acted in the ordinary course to appoint Mr. Lacy to the Audit Committee following Mr. Shamir’s resignation.

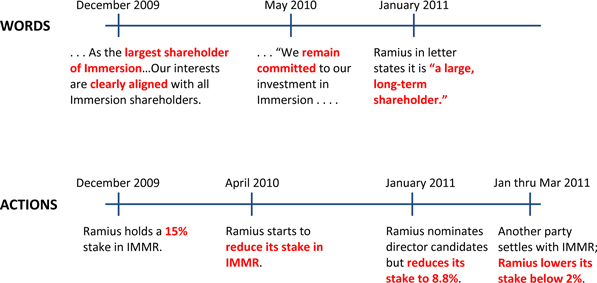

Starboard Has Used Misdirection before in Its Communications with Shareholders

There is good reason to question Starboard’s statements, intentions and motives. In the past, Starboard has said one thing while doing another.

One such example is the activist hedge fund’s involvement with Immersion (NASD: IMMR). Ramius LLC, the predecessor fund from which Starboard spun off in 2011, initially became involved with Immersion in 2009. Over the course of the following two years, Starboard touted its long-term investment intent, all the while reducing its stake. Here is the timeline of Starboard’s words and actions:

| • | December 2009 – WORDS - Ramius delivered a letter to the CEO and Board which stated “RCG Starboard Advisors, LLC… currently owns approximately 15% of the outstanding shares of Immersion Corporation…The past year has been challenging for Immersion and its shareholders…the Company has cumulatively invested almost $60 million in sales and marketing and research and development initiatives, yet revenue has remained stagnant. These substantial investments without associated revenue growth have resulted in a cumulative operating loss of approximately $42 million or $1.50 per share…the Board is lacking shareholder representatives with a strong vested interest in the financial performance of Immersion… As the largest shareholder of Immersion, we have offered to join the Board to fill this role to ensure the Company is run with the best interest of all shareholders in mind… Our interests are clearly aligned with all Immersion shareholders”. |

| • | April 2010 – ACTIONS – Less than four months later Ramius LLC and Ramius Enterprise Master Fund started to sell shares of Immersion. |

| • | May 2010 – WORDS - Ramius delivered a letter to the CEO and Board which stated, “RCG Starboard Advisors, LLC, is the largest shareholder of Immersion owning approximately 14.6% of the shares outstanding. Our interests are directly aligned with the interests of all shareholders in seeking to improve the quality and effectiveness of the Board… We remain committed to our investment in Immersion”. |

| • | June 2010 – WORDS – Ramius delivered letter to new Board member in which they stated “There is still substantial work to be done to realize Immersion’s full potential in order to maximize shareholder value”. |

| • | July 2010 Through December 2010 – ACTIONS – In the 6 months following the May and June letters, Starboard sells shares, lowering their stake to 8.8%. |

| • | January 2011 – WORDS—Ramius delivered a letter to the CEO and Board which stated, “Ramius is the largest shareholder of Immersion with current ownership of 8.8% of the shares outstanding. We are a large, long-term shareholder.” |

| • | January Through March 15th, 2011 – ACTIONS - Within two months of classifying themselves as a “large, long-term shareholder”, Ramius lowered their stake to 359,200 shares or 1.3% of Immersion down from 8.8%….and by Q3 2011 Ramius/Starboard exited their position completely. Immersion shares have recently outperformed the market by a wide margin. |

THE BOTTOM LINE

If Starboard was truly committed to ensuring that “alternative viewpoints are allowed to be introduced and properly considered in the DSP Group’s boardroom,” they would have accepted the Company’s generous offer of two additional Board seats, giving them a total of four of the ten seats, along with significant committee representation, including two of four seats (including chairmanship) on the Compensation Committee and two of five seats (including chairmanship) of a proposed Strategic Committee.

Starboard dedicates very little of its presentation to actually expressing a plan, and what they do propose lacks substance. Starboard is seeking majority representation on the Board without a viable plan and the activist hedge fund’s candidates should be rejected.

| • | They plan to “put in place clear milestones for new projects and hold management accountable for reaching those goals, rather than continue to irresponsibly invest substantial sums in R&D without appropriate returns.” As we have conveyed, their comments around our “reckless” R&D spend are baseless. Despite our R&D spend falling significantly below our peer group, DSP Group’s new product line-up is the most exciting in the Company’s 30-year history. For each of these products there are identifiable, growing market opportunities and a clear path toward generating revenues. |

| • | They plan to “closely monitor the expenses included in management’s budgets and look to drive DSP toward best-in-class operating performance while continuing to invest in new products to drive future revenue growth.” It would appear this plan is to emulate what your current Board and management team have been doing already, as evidenced by: (1) our improving operating performance over the past six quarters despite top line decline; and (2) our three new best-in-class product launches in the first quarter of 2013, which expand our total addressable market ten-fold. |

| • | On a final note, investors have recognized the Company’s successful turnaround and the merit of our growth plan. As a result, DSP Group’s stock is one of the top performing stocks in our industry for the last 12 months and year-to-date. We have made significant operational and financial progress over the last 12 months, as can be seen in the comparison to our peer group. We will continue to execute our strategic plan, focused on generating durable stockholder value and near term profitability. We are on track to meet our strategic goals and we need your support in the upcoming stockholder meeting to make this a reality. |

Important Additional Information

The Company has filed with the U.S. Securities and Exchange Commission (“SEC”) and provided to its stockholders a definitive proxy statement and a proxy supplement in connection with its 2013 annual meeting of stockholders. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT, THE PROXY SUPPLEMENT AND OTHER RELEVANT DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN THEIR ENTIRETY BECAUSE THEY CONTAIN, OR WILL CONTAIN, IMPORTANT INFORMATION. Stockholders may obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov and through the website maintained by the Company at http://ir.dspg.com.

Certain Information Regarding Participants in the Solicitation

The Company, its directors and certain of its officers may be deemed to be participants in the solicitation of the Company’s stockholders in connection with its 2013 annual meeting. Information regarding the names, affiliations and direct and indirect interests (by security holdings or otherwise) of these persons can be found in the Company’s definitive proxy statement and proxy supplement for its 2013 annual meeting, which were filed with the SEC on April 22, 2013 and May 6, 2013, respectively. Stockholders may obtain a free copy of the proxy statement, the proxy supplement and other documents filed by the Company with the SEC from the sources listed above.

Non-GAAP Financial Information

This white paper contains references to non-GAAP financial measures. See DSP Group’s current reports on Form 8-K, filed with the SEC on January 30, 2013 and April 29, 2013, for a reconciliation of the Company’s GAAP and non-GAAP net income (loss) and diluted net income (loss) per share for the three- and twelve-month periods ended December 31, 2011 and 2012 and for the three-month period ended March 31, 2013 and 2012.

Forward-Looking Information

Certain statements in this white paper qualify as “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Such statements are based on current expectations and DSP Group assumes no obligation to update this information. In addition, the events described in these forward-looking statements may not actually arise as a result of various factors, including DSP Group’s inability to develop and produce new products at competitive costs and in a timely manner, unexpected delays in the commercial launch of such products or failure of such products to achieve broad market acceptance; slower than expected changes in the nature of residential communications domain; DSPG Group’s ability to control operating costs; and other factors discussed under “RISK FACTORS” in DSP Group’s current report on Form 10-K for the fiscal year ended December 31, 2012, which is available on DSP Group’s Web site (www.dspg.com) under Investor Relations.

Contacts:

| Investor Relations

Christopher Basta Director of Investor Relations, DSP Group Work: 1-408-240-6844 Cell: 1-631-796-5644 chris.basta@dspg.com |

Daniel H. Burch, CEO MacKenzie Partners, Inc. Work: 1-212-929-5748 Cell: 1-516-429-2722 dburch@mackenziepartners.com

Paul R. Schulman, EVP MacKenzie Partners, Inc. Work: 1- 212.929.5364 Cell: 1- 203.856.6080 pschulman@mackenziepartners.com |

Media Relations

Mike Sitrick and Jeff Lloyd Sitrick And Company Work: 1-310- 788-2850 Jeff_Lloyd@sitrick.com Mike_Sitrick@sitrick.com |