Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SOUTH AMERICAN GOLD CORP. | Financial_Report.xls |

| EX-31.1 - EXHIBIT311 - SOUTH AMERICAN GOLD CORP. | exhibit311.htm |

| EX-32.2 - EXHIBIT321 - SOUTH AMERICAN GOLD CORP. | exhibit322.htm |

| EX-32.1 - EXHIBIT321 - SOUTH AMERICAN GOLD CORP. | exhibit321.htm |

| EX-31.2 - EXHIBIT312 - SOUTH AMERICAN GOLD CORP. | exhibit312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 31, 2013

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ________ to ________

Commission File Number: 000-52156

South American Gold Corp.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0486676

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

3645 E. Main Street, Suite 119, Richmond, IN 47374

|

|

(Address of principal executive offices)

|

|

(765) 356-9726

|

|

(Registrant’s telephone number, including area code)

|

|

______________________________________________________________________

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “a smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller reporting company x

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

|

Class

|

Outstanding Shares as of March 31, 2013

|

|

|

Common Stock, $0.001 par value

|

139,239,227

|

|

FORM 10-Q

SOUTH AMERICAN GOLD CORP.

March 31, 2013

|

Page

|

|

|

PART I – FINANCIAL INFORMATION

|

||

|

Item 1.

|

3

|

|

|

Item 2.

|

4

|

|

|

Item 3.

|

21

|

|

|

Item 4.

|

21

|

|

|

PART II – OTHER INFORMATION

|

||

|

Item 1.

|

23

|

|

|

Item 1A.

|

23

|

|

|

Item 2.

|

23

|

|

|

Item 3.

|

24

|

|

|

Item 4.

|

25

|

|

|

Item 5.

|

24

|

|

|

Item 6.

|

24

|

|

PART I - FINANCIAL INFORMATION

|

Our unaudited financial statements included in this Form 10-Q are as follows:

|

|

|

F-1

|

Unaudited Balance Sheet as of March 31, 2013 and Audited as of June 30, 2012

|

|

F-2

|

Unaudited Statements of Operations for the three and nine months ended March 31, 2013 and 2012 and from inception on May 25, 2005 to March 31, 2013.

|

|

F-3

|

Unaudited Statements of Cash Flows for the nine months ended March 31, 2013 and 2012 and from inception on May 25, 2005 to March 31, 2013.

|

|

F-4

|

Notes to Unaudited Financial Statements.

|

These unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and the SEC instructions to Form 10-Q. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature. Operating results for the interim period ended March 31, 2013 are not necessarily indicative of the results that can be expected for the full year.

|

SOUTH AMERICAN GOLD CORP. AND SUBSIDIARIES

|

||||||||

|

(An Exploration Stage Company)

|

||||||||

|

Condensed Consolidated Balance Sheets

|

||||||||

|

March 31,

|

June 30,

|

|||||||

|

2013

|

2012

|

|||||||

|

(Unaudited)

|

||||||||

|

Assets

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 32,609 | $ | 87 | ||||

|

Prepaid expenses

|

3,500 | $ | 2,000 | |||||

|

Total current assets

|

36,109 | 2,087 | ||||||

|

Equipment net of depreciation

|

1,125 | - | ||||||

|

Total Assets

|

37,234 | 2,087 | ||||||

|

Liabilities and Stockholders' Deficit

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

||||||||

|

(including related party amounts of $55,013 and $9,025)

|

237,893 | 263,982 | ||||||

|

Convertible notes payable, net of discount of $67,979

|

56,921 | - | ||||||

|

Derivative liability

|

183,535 | - | ||||||

|

Total Current Liabilities

|

478,349 | 263,982 | ||||||

|

Notes Payable

|

18,500 | - | ||||||

|

Total Liabilities

|

496,849 | 263,982 | ||||||

|

Stockholders' Deficit

|

||||||||

|

Common stock, $0.001 par value, 450,000,000 shares

|

||||||||

|

authorized, 133,239,227 and 79,211,890 issued and outstanding

|

||||||||

|

as of March 31, 2013 and June 30, 2012 respectively

|

133,239 | 79,212 | ||||||

|

Additional paid-in capital

|

4,054,615 | 3,972,464 | ||||||

|

Accumulated other comprehensive income

|

92 | - | ||||||

|

Deficit accumulated during the exploration stage

|

(4,647,561 | ) | (4,313,571 | ) | ||||

|

Total Stockholders' Deficit

|

(459,615 | ) | (261,896 | ) | ||||

|

Total liabilities and stockholders' deficit

|

$ | 37,234 | $ | 2,087 | ||||

|

The accompanying notes are an integral part of these condensed consolidated financial statements

|

||||||||

|

SOUTH AMERICAN GOLD CORP. AND SUBSIDIARIES

|

||||||||||||||||||||

|

(Exploration Stage Company)

|

||||||||||||||||||||

|

Condensed Consolidated Statements of Operations and Comprehensive Income

|

||||||||||||||||||||

|

(Unaudited)

|

||||||||||||||||||||

|

For the three months ended March 31,

|

For the nine months ended March 31,

|

For the Period

May 25, 2005 (Inception) to

|

||||||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

March 31, 2013

|

||||||||||||||||

|

Revenues

|

$ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Operating Expenses

|

||||||||||||||||||||

|

Exploration expense

|

9,475 | 42,318 | 41,003 | 173,447 | 730,534 | |||||||||||||||

|

Stock based compensation

|

- | - | - | - | 1,566,348 | |||||||||||||||

|

Impairment loss on goodwill

|

- | - | - | 4,797 | 1,285,710 | |||||||||||||||

|

Impairment loss on mining lease

|

- | - | 29,000 | - | 29,000 | |||||||||||||||

|

Depreciation expense

|

63 | - | 125 | - | 1,782 | |||||||||||||||

|

General and administrative expense

|

37,137 | 101,508 | 131,569 | 260,470 | 1,156,850 | |||||||||||||||

|

Total Operating Expense

|

46,675 | 143,826 | 201,697 | 438,714 | 4,770,224 | |||||||||||||||

|

Income (loss) from operations

|

(46,675 | ) | (143,826 | ) | (201,697 | ) | (438,714 | ) | (4,770,224 | ) | ||||||||||

|

Other Income (Expense)

|

||||||||||||||||||||

|

Gain (Loss) on derivative liability

|

19,061 | - | 18,213 | - | 18,213 | |||||||||||||||

|

Interest expense

|

(65,426 | ) | - | (150,506 | ) | (3,280 | ) | (153,796 | ) | |||||||||||

|

Interest income

|

- | - | - | 6,113 | 12,713 | |||||||||||||||

|

Total Other Income

|

(46,365 | ) | - | (132,293 | ) | 2,833 | (122,870 | ) | ||||||||||||

|

Net Loss

|

(93,040 | ) | (143,826 | ) | (333,990 | ) | (435,881 | ) | (4,893,094 | ) | ||||||||||

|

Other comprehensive income (loss)

|

||||||||||||||||||||

|

Foreign currency translation adjustment

|

202 | 49,450 | 92 | (16,195 | ) | 8,431 | ||||||||||||||

|

Foreign currency translation adjustment

attributable to non-controlling interest

attributable to non-controlling interest

|

- | - | - | - | (8,339 | ) | ||||||||||||||

|

Total other comprehensive income (loss)

|

202 | 49,450 | 92 | (16,195 | ) | 92 | ||||||||||||||

|

Comprehensive income (loss)

|

(92,838 | ) | (94,376 | ) | (333,898 | ) | (452,076 | ) | (4,893,002 | ) | ||||||||||

|

Net Loss

|

(93,040 | ) | (143,826 | ) | (333,990 | ) | (435,881 | ) | (4,893,094 | ) | ||||||||||

|

Net loss attributable to non-controlling interest

|

- | - | - | - | (245,532 | ) | ||||||||||||||

|

Net loss attributable to South American Gold Corp.

|

$ | (93,040 | ) | $ | (143,826 | ) | $ | (333,990 | ) | $ | (435,881 | ) | $ | (4,647,561 | ) | |||||

|

Net loss per common share outstanding,

|

||||||||||||||||||||

|

basic and diluted

|

$ | - | $ | - | $ | - | $ | - | ||||||||||||

|

Weighted average shares outstanding of common

|

||||||||||||||||||||

|

stock, basic and diluted

|

113,458,854 | 79,211,890 | 94,803,959 | 79,211,890 | ||||||||||||||||

|

The accompanying notes are an integral part of these condensed consolidated financial statements

|

||||||||||||||||||||

|

SOUTH AMERICAN GOLD CORP. AND SUBSIDIARIES

|

||||||||||||

|

(Exploration Stage Company)

|

||||||||||||

|

Condensed Consolidated Statement of Cash Flows

|

||||||||||||

|

|

For the period

|

|||||||||||

|

May 25, 2005

|

||||||||||||

|

For the nine months ended March 31,

|

(inception) to

|

|||||||||||

|

2013

|

2012

|

March 31, 2013

|

||||||||||

|

Cash Flows From Operating Activities:

|

||||||||||||

|

Net Income (Loss)

|

$ | (333,990 | ) | $ | (435,881 | ) | $ | (4,893,094 | ) | |||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||||||

|

Expenses paid by shareholders

|

- | - | 39,000 | |||||||||

|

Stock based compensation

|

- | - | 1,566,348 | |||||||||

|

Impairment loss on goodwill

|

- | 4,797 | 1,285,710 | |||||||||

|

Impairment loss on mining lease

|

29,000 | - | 29,000 | |||||||||

|

(Gain) Loss on derivative liability

|

(18,213 | ) | - | (18,213 | ) | |||||||

|

Amortization of debt discount and interest expense

|

146,347 | - | 146,347 | |||||||||

|

Depreciation expense

|

125 | 1,657 | 1,782 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Prepaid expenses

|

(1,500 | ) | (3,000 | ) | (3,500 | ) | ||||||

|

Accounts payable and accrued expenses

|

71,911 | 11,039 | 461,489 | |||||||||

|

Net Cash Provided by (Used In) Operating Activities

|

(106,320 | ) | (421,388 | ) | (1,385,131 | ) | ||||||

|

Cash Flows From Investing Activities:

|

||||||||||||

|

Acquisition of equipment

|

(1,250 | ) | - | (2,907 | ) | |||||||

|

Proceeds from business acquisition

|

- | 349,647 | (200,343 | ) | ||||||||

|

Net Cash Provided by (Used In) Investing Activities

|

(1,250 | ) | 349,647 | (203,250 | ) | |||||||

|

Cash Flows From Financing Activities:

|

||||||||||||

|

Proceeds from convertible notes payable

|

140,000 | - | 140,000 | |||||||||

|

Proceeds from issuance of common stock

|

- | - | 1,506,450 | |||||||||

|

Net Cash Provided by (Used In) Financing Activities

|

140,000 | - | 1,646,450 | |||||||||

|

Effect of Foreign Currency on Cash

|

92 | (16,196 | ) | (25,460 | ) | |||||||

|

Net Increase (Decrease) in Cash

|

32,522 | (87,937 | ) | 32,609 | ||||||||

|

Cash at Beginning of Period

|

87 | 120,537 | - | |||||||||

|

Cash at End of Period

|

$ | 32,609 | $ | 32,599 | $ | 32,609 | ||||||

|

Supplemental disclosure of noncash investing and financing activities:

|

||||||||||||

|

Expenses paid by shareholders

|

- | - | 39,000 | |||||||||

|

Shares issued for debt

|

15,100 | - | 140,695 | |||||||||

|

Shares issued for Property Acquisition

|

29,000 | - | 58,000 | |||||||||

|

Shares issued in for accounts payable

|

79,500 | - | 79,500 | |||||||||

|

The accompanying notes are an integral part of these condensed consolidated financial statements

|

||||||||||||

SOUTH AMERICAN GOLD CORP. AND SUBSIDIARIES

(Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2013

(Unaudited)

1. ORGANIZATION

The Company, South American Gold Corp., was incorporated under the laws of the State of Nevada on May 25, 2005 with the authorized capital stock of 75,000,000 shares at $0.001 par value. In January 2008, a majority of the shareholders agreed to an increase in the authorized capital stock to 450,000,000 shares at $0.001 par value.

The Company was organized for the purpose of acquiring and developing mineral properties. The Company has not established the existence of a commercially minable ore deposit and therefore is considered to be in the exploration stage.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The interim financial statements for the three months and nine months ended March 31, 2013 and 2012 are unaudited. These financial statements were prepared in accordance with requirements for unaudited interim periods, and consequently do not include all disclosures required to be in conformity with accounting principles generally accepted in the United States of America.

In the opinion of management, all adjustments (consisting solely of normal recurring adjustments) necessary to present fairly the financial position, results of operations, and cash flows for all periods presented have been made. The information for the consolidated balance sheet as of June 30, 2012 was derived from audited financial statements. The results of operations for the three and nine months ended March 31, 2013 are not necessarily indicative of the results to be expected for the year ending June 30, 2013.

Principles of Consolidation

The accompanying consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles. All significant intercompany accounts and transactions have been eliminated upon consolidation.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

For purposes of the cash flow statements, the Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents.

Revenue Recognition

The Company recognizes revenue based on FASB Account Standards Codification (“ASC”) 605 “Revenue Recognition”. In all cases, revenue is recognized only when the price is fixed or determinable, persuasive evidence of an arrangement exists, the service is performed and collectability of the resulting receivable is reasonably assured. Revenues from service contracts are recognized on a monthly, quarterly or semiannual basis as specified in the terms of a given contract. Revenues from additional services are recognized currently as the work is performed.

Basic and Diluted Net Income (Loss) Per Share

The Company computes net income (loss) per share in accordance with ASC 260 “Earnings per Share”. ASC 260 requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excluded all dilutive potential shares if their effect is anti-dilutive. As of March 31, 2013, there were no dilutive common stock equivalents outstanding.

Evaluation of Long-Lived Assets

The Company reviews and evaluates long-lived assets for impairment when events or changes in circumstances indicate that the related carrying amounts may not be recoverable. The assets are subject to impairment consideration under ASC 360-10-35-17 if events or circumstances indicate that their carrying amounts might not be recoverable. When the Company determines that an impairment analysis should be done, the analysis will be performed using rules of ASC 930-360-35, Asset Impairment, and 360-10-15-3 through 15-5, Impairment or Disposal of Long-Lived Assets. During the nine months ended March 31, 2013, the Company recorded a $29,000 impairment loss related to its Baltimore Silver Mine Project.

Foreign Currency Translation

The Company’s functional and reporting currency is the U.S. dollar. The consolidated financial statements of the Company are translated to U.S. dollars in accordance with ASC 830, “Foreign Currency Matters.” Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the balance sheet date. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income.

The Company has not, to the date of these financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

Income Taxes

The Company utilizes the liability method of accounting for income taxes. Under the liability method deferred tax

assets and liabilities are determined based on differences between financial reporting and the tax bases of the assets and liabilities and are measured using the enacted tax rates and laws that will be in effect, when the differences are expected to be reversed. An allowance against deferred tax assets is recorded, when it is more likely than not, that such tax benefits will not be realized.

Advertising and Market Development

The company expenses advertising and market development costs as incurred.

Goodwill

Goodwill consists of the excess of cost of acquired enterprises over the sum of the amounts assigned to identifiable assets acquired less liabilities assumed. Goodwill is reviewed for impairment annually at the beginning of the Company’s fourth fiscal quarter, or more frequently if there are indicators that the fair value of the related reporting unit is less than the carrying value of the Goodwill. We compare our fair value, which is determined utilizing both a market value method and discounted projected future cash flows, to our carrying value for the purpose of identifying impairment. Our annual impairment review requires extensive use of accounting judgment and financial estimates.

Mineral Property Acquisition and Exploration Costs

Mineral property acquisition costs are initially capitalized as tangible assets when purchased. At the end of each fiscal quarter and as otherwise deemed necessary, the Company assesses the carrying costs for impairment. If proven and probable reserves are established for a property and it has been determined that a mineral property can be economically developed, costs will be amortized using the units-of-production method over the estimated life of the probable reserve. Mineral property exploration costs are expensed as incurred.

Estimated future removal and site restoration costs, when determinable are provided over the life of proven reserves on a units-of-production basis. Costs, which include production equipment removal and environmental remediation, are estimated each period by management based on current regulations, actual expenses incurred, and technology and industry standards. Any charge is included in exploration expense or the provision for depletion and depreciation during the period and the actual restoration expenditures are charged to the accumulated provision amounts as incurred. As of the date of these financial statements, the Company has not established any proven or probable reserves on its mineral properties and incurred only acquisition and exploration costs.

Although the Company has taken steps to verify title to mineral properties in which it has an interest, according to the usual industry standards for the stage of exploration of such properties, these procedures do not guarantee the Company’s title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

Environmental Requirements

At the report date environmental requirements related to the mineral claim acquired are unknown and therefore any estimate of any future cost cannot be made.

Reclassifications

Certain prior period amounts have been reclassified to conform to current period presentation.

Stock-based compensation

Effective November 9, 2010, the Company adopted the provisions of ASC 718, “Compensation – Stock Compensation”, which establishes accounting for equity instruments exchanged for employee services. Under the provisions of ASC 718, stock-based compensation cost is measured at the grant date, based on the calculated fair value of the award, and is recognized as an expense over the employees’ requisite service period (generally the vesting period of the equity grant). The Company adopted ASC 718 using the modified prospective method, which requires the Company to record compensation expense over the vesting period for all awards granted after the date of adoption, and for the unvested portion of previously granted awards that remain outstanding at the date of adoption. Accordingly, financial statements for the periods prior to November 9, 2010 have not been restated to reflect the fair value method of expensing share-based compensation. Adoption of ASC 718 does not change the way the Company accounts for share-based payments to non-employees, with guidance provided by ASC 505-50, “Equity-Based Payments to Non-Employees”.

Recent Accounting Pronouncements

The Company does not expect that the adoption of other recent accounting pronouncements will have a material impact on its financial statements.

3. MINERAL PROPERTIES

Kon Tum

In February 2008, the Company purchased the Kon Tum Gold Claim located in Vietnam for $5,000. The Company had not established the existence of a commercially minable ore deposit on the Kon Tum Gold Claim.. The acquisition costs have been impaired and expensed because there had been no exploration activity nor have there been any reserves established and we cannot currently project any future cash flows or salvage value for the coming years and the acquisition costs might not be recoverable. The company has elected to not pursue further activities on these claims nor maintain ownership.

GB Project

On December 14, 2011 the company signed an agreement to purchase one unpatented mining claim and lease nine unpatented mining claims in Yavapai County, Arizona covering approximately two hundred acres. The purchased unpatented claims were for $1,000 and the vendor retained a two percent net smelter return from any future production. The leased claims are for a period of fifteen (15) years; any production subject to a two percent net smelter return to the vendor, and annual lease payments of $750.The company subsequently acquired an additional two unpatented mining claims as part of the GB project by location.

Lucky Boy Silver Project

In December 2011 the company staked five unpatented mining claims in Hawthorne, Nevada covering approximately one hundred acres. The Company forfeited these claims in the first quarter of 2013.

Baltimore Silver Mine Project

On August 6, 2012, the Company signed an agreement to lease, with an option to purchase, the Baltimore Mine located in Western Montana. The lease payment will be $10,000 per year, plus $500 per quarter; or, $2,000 per year in restricted stock at SAGD’s option, provided such restricted stock has a market bid price in excess of $20,000 for the twenty days prior to payment. Payment will be on July 31 of each year beginning July 31, 2013. SAGD may terminate the lease with ninety days’ notice; however, such determination has no bearing on cash payments or issuance of stock to Western prior to the termination of the lease option. The term of the lease is ten years and may be extended for an additional 15 years with a payment of one hundred thousand dollars ($100,000) at any time.

SAGD will have an option to purchase the property free and clear of any lien or encumbrance, for the term of this agreement, in the amount of five hundred thousand dollars ($500,000), at which time the lease would terminate and no royalty would be due afterwards from the property.

Should SAGD cause to be issued a property report meeting the industry guidelines indicating probable or proven reserves in excess of two million ounces of silver on the property, Western shall receive an additional thirty thousand dollars in cash or restricted shares value determined as (3) above, within thirty days of publication of such report.

The acquisition price of this option was 10,000,000 shares of SAGD restricted stock, based on the contractually stated value of $29,000, using the closing market price of the Company’s common stock on August 17, 2012, plus an additional $25,000 payable in the form of cash or restricted common stock, at SAGD’s option, valued at the ten day average bid price for the company’s common stock. This additional $25,000 is payable during the period January 1, 2013 to July 1, 2013. As of September 30, 2012, the Company identified there were indicators of impairment. As such, it conducted a cash flow assessment on this mining lease, and based on that assessment, the Company recorded an impairment loss of $29,000 in its statement of operations.

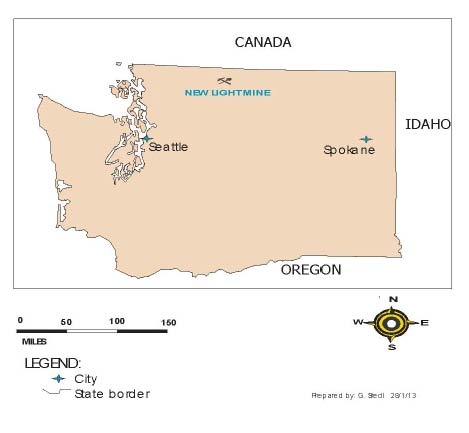

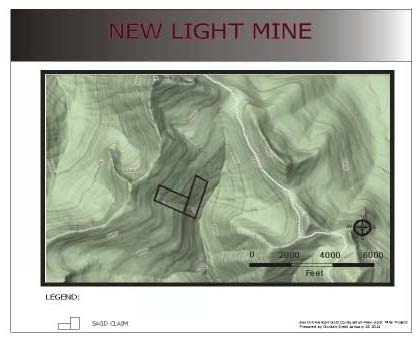

New Light Mine Project

On January 22, 2013 the Company signed a mining lease agreement for two unpatented mining claims in Whatcom County, Washington. The lease is for fifteen years and is subject to a net smelter return of two percent and annual advance royalty payments of $500 in the first year and $750 thereafter.

4. BUSINESS ACQUISITION

On April 25, 2011, the “Company entered into an Amendment No.1 to the Stock Purchase Agreement dated February 25, 2011 with Minera Kata S.A., a corporation organized under the laws of the Republic of Panama, in order to acquire a twenty-five percent (25%) of the outstanding capital stock of Kata Enterprises, Inc., a corporation organized under the laws of the Republic of Panama (“Kata”), and to revise the terms of the options under which the Company has the ability to acquire the remaining seventy-five percent (75%) of the outstanding capital stock of Kata Enterprises, Inc. In November 2010, Kata entered into an agreement to acquire, through its subsidiary, an eighty-five percent (85%) interest in certain mining concessions located in the Nariño province of Colombia, but Kata has not successfully closed that transaction as of this time. Kata was an entity that has nominal operations and was recently incorporated. The closing of the transaction was conditioned upon the transferor of the Mining Concessions receiving acceptance of an application for a concession contract, executing a concession contract with Ingeominas (the entity authorized by the Colombian Ministry of Mines and Energy to grant mining concession contracts), registration of that contract at the National Mining Registry and securing the requisite approvals and governmental consents for the transfer of the Mining Concessions to Kata’s subsidiary.

In the event that Kata failed to close the transaction by February 25, 2012 and to have the Mining Concessions registered in the National Mining Registry of Colombia in favor of Kata, the Agreement provided that Seller would be obligated to deliver to the Company one-hundred percent (100%) of the outstanding capital stock of Kata without any additional consideration being paid. In such event, the Company will not have acquired any direct or indirect interest in the Mining Concessions and not be entitled to recover any of its exploration expenditures of other expenses incurred in connection with acquiring the 25% Stake, other than its entitlement, indirectly through its subsidiary, to the return of the $500,000 paid to Seller on closing of the Agreement. Pursuant to the terms of the Amendment, the Company paid the Seller an additional $50,000 on the Effective Date, in addition to the $500,000 paid in cash at the closing of the Agreement, for the acquisition of the 25% Stake.

The Company follows ASC 810-10 and fully consolidates the assets, liabilities, revenues and expenses of Kata Enterprises, Inc. As a condition of stock purchase agreement, members of the board of directors of each of the acquired companies was required to tender their resignation with the Company subsequently appointing the new members of the board of directors. This effectively provided the Company management control of Kata Enterprises, Inc. as of February 25, 2011, resulting in a consolidation of the financial statements of Kata Enterprises, Inc.

The purchase price of $550,000 for 25% of the shares of Kata Enterprises, Inc. was allocated to the fair values of the assets and liabilities of Kata Enterprises, Inc., and non-controlling interest, as follows:

|

Assets purchased:

|

||||

|

Cash and cash equivalents

|

$

|

6,901

|

||

|

Mineral property interests

|

499,846

|

|||

|

Total assets acquired

|

506,747

|

|||

|

Liabilities assumed:

|

||||

|

Accounts payable and accrued liabilities

|

160

|

|||

|

Total liabilities assumed

|

160

|

|||

|

Non-controlling interest:

|

1,237,500

|

|||

|

Goodwill

|

$

|

1,280,913

|

||

On November 19, 2011, Kata Enterprises S.A.S. acquired the remaining 15% ownership of Minera Narino S.A.S., for $785. Kata Enterprises S.A.S. assumed liabilities of $4,012 in the acquisition, resulting in Goodwill of $4,797. Due to lack of foreseeable revenues, the Company recorded a related impairment loss on this Goodwill of $4,797 in its statement of operations, as of December 31, 2011.

Also on November 19, 2011, the Company acquired the remaining 75% ownership of Kata Enterprises Inc. through payment of $10,000. The purchase price of $10,000 was allocated as follows:

Noncontrolling interest - $603,082; Net assets of Kata Enterprises Inc. (75%) - $221,201; Credit to Capital Surplus - $814,283.

The previous fair values assigned to the noncontrolling interest and net assets of Kata Enterprises Inc. were provisional amounts, and the purchase of the remaining noncontrolling interest in November 2011 finalized the purchase accounting.

In 2012 the Company began the process of application for a liquidation and closing of Kata Enterprises Inc.

5. GOODWILL

Goodwill is reviewed for impairment annually at the beginning of the fourth fiscal quarter, or more frequently if impairment indicators arise. During fiscal year 2011, we acquired goodwill totaling approximately $1.28 million in connection with the acquisition of Kata Enterprises, Inc. We compared our fair value, utilizing both a market value method and discounted projected future cash flows, to our carrying value for the purpose of identifying impairment. During fiscal year 2011 the Company recorded an impairment loss on goodwill of approximately $1.28 million that relate primarily to indeterminate future cash flow related to the acquisition.

In its acquisition of the remaining 15% of Minera Narino S.A.S., the Company recorded Goodwill in the amount of $4,797. This amount was impaired as of December 31, 2011, due to lack of foreseeable revenues.

6. CONVERTIBLE NOTE PAYABLE AND DERIVATIVE LIABILITY

Convertible Note Payable

Convertible Note #1

On August 8, 2012, the Company entered into a securities purchase agreement and convertible note agreement, for $47,500 in cash. The note has a maturity date of May 10, 2013, and carries an interest rate of 8%, per annum. Principal and interest is due on May 10, 2013 and any amount of principal or interest not paid by this date, will accrue interest at 22% per annum. This note, plus accrued interest, is convertible 180 days from the date of the Note, at a variable conversion price of 55% of the lowest three trading prices for the common stock of the Company during the ten trading day period ending on the latest complete trading day prior to the conversion date. Accrued interest on this note, as of March 31, 2013, was $2,388.

Pursuant to the conversion option, in March 2013, the third party converted $15,100 of related debt to 17,527,337 shares of common stock.

Convertible Note #2

On October 16, 2012, the Company entered into a securities purchase agreement and convertible note agreement, for $27,500 in cash. The note has a maturity date of July 18, 2013, and carries an interest rate of 8%, per annum. Principal and interest is due on July 18, 2013 and any amount of principal or interest not paid by this date, will accrue interest at 22% per annum. This note, plus accrued interest, is convertible 180 days from the date of the Note, at a variable conversion price of 55% of the lowest three trading prices for the common stock of the Company during the ten trading day period ending on the latest complete trading day prior to the conversion date. Accrued interest on this note, as of March 31, 2013, was $1,000.

Convertible Note #3

On December 18, 2012, the Company entered into a securities purchase agreement and convertible note agreement, for $32,500 in cash, which was effective December 31,2012 upon being funded.. The note has a maturity date of September 20, 2013, and carries an interest rate of 8%, per annum. Principal and interest is due on September 30, 2013, and any amount of principal or interest not paid by this date, will accrue interest at 22% per annum. This note, plus accrued interest, is convertible 180 days from the date of the Note, at a variable conversion price of 55% of the lowest three trading prices for the common stock of the Company during the ten trading day period ending on the latest complete trading day prior to the conversion date. Accrued interest on this note, as of March 31, 2013, was $734.

Convertible Note #4

On March 27, 2013, the Company entered into a securities purchase agreement and convertible note agreement, for $32,500 in cash. The note has a maturity date of September 20, 2013, and carries an interest rate of 8%, per annum. Principal and interest is due on December 27, 2013, and any amount of principal or interest not paid by this date, will accrue interest at 22% per annum. This note, plus accrued interest, is convertible 180 days from the date of the Note, at a variable conversion price of 55% of the lowest three trading prices for the common stock of the Company during the ten trading day period ending on the latest complete trading day prior to the conversion date. Accrued interest on this note, as of March 31, 2013, was $21.

Derivative Liabilities

Convertible Note #1

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from 0.06% to 0.17%; Dividend rate of 0%; and, historical volatility rates ranging from 169.42% to 355.27%. Based on this calculation, the Company recorded an initial derivative liability of $59,875 and interest expense of $12,375. This derivative will be remeasured at each reporting period, with the change in fair value being recorded to the statement of operations. The calculated fair values of the derivative liability at September 30, 2012 and December 31, 2012 were $80,197 and $59,491, respectively, and $40,797 as of March 31, 2013. From its initial valuation on August 8, 2012 to March 31, 2013, the Company has recorded a net gain on derivative liability of $19,078, in the statement of operations.

Based on the above calculations, the Company also recorded a discount on debt of $47,500. This discount will be amortized to interest expense over the 9 month term of the convertible note. Total amortization for the nine month period ended March 31, 2013, was $42,900, which includes discount amortization of $3,338 related to the conversion of $15,100 to equity.

Convertible Note #2

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from 0.07% to 0.17%; Dividend rate of 0%; and, historical volatility rates ranging from 200.50% to 321.22%. Based on this calculation, the Company recorded a derivative liability of $43,646 and interest expense of $16,146. This derivative will be remeasured at each reporting period, with the change in fair value being recorded to the statement of operations. The calculated fair value of the derivative liability at December 31, 2012 was $42,019,and $37,415 as of March 31, 2013. From its initial valuation on October 16, 2012 to March 31, 2013, the Company has recorded a net gain on derivative liability of $6,231, in the statement of operations.

Based on the above calculations, the Company also recorded a discount on debt of $27,500. This discount will be amortized to interest expense over the 9 month term of the convertible note. Total amortization for the nine month period ended March 31, 2013, was $16,600.

Convertible Note #3

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rates ranging from 0.11% to 0.16%; Dividend rate of 0%; and, historical volatility rates ranging from 200.50% to 346.31%. Based on this calculation, the Company recorded a derivative liability of $52,817 and interest expense of $20,317. This derivative will be remeasured at each reporting period, with the change in fair value being recorded to the statement of operations. The calculated fair value of the derivative liability at March 31, 2013 was $47,848. From its initial valuation on December 18, 2012 to March 31, 2013, the Company has recorded a net gain on derivative liability of $4,969, in the statement of operations.

Based on the above calculations, the Company also recorded a discount on debt of 32,500. This discount will be amortized to interest expense over the 9 month term of the convertible note. Total amortization for the nine month period ended March 31, 2013 was $12,173.

Convertible Note #4

The Company has determined that the conversion feature in this note is not indexed to the Company’s stock, and is considered to be a derivative that requires bifurcation. The Company calculated the fair value of this conversion feature using the Black-Scholes model and the following assumptions: Risk-free interest rate of 0.13%; Dividend rate of 0%; and, historical volatility rates ranging from 254.10% to 258.87%. Based on this calculation, the Company recorded a derivative liability of $57,988 and interest expense of $25,488. This derivative will be remeasured at each reporting period, with the change in fair value being recorded to the statement of operations. The calculated fair value of the derivative liability at March 31, 2013 was $57,474. The related gain on the derivative liability of $514 was recorded in the statement of operations for the nine months ending March 31, 2013.

Based on the above calculations, the Company also recorded a discount on debt of $32,500. This discount will be amortized to interest expense over the 9 month term of the convertible note. Total amortization for the nine month period ended March 31, 2013 was $348.

7. LONG TERM NOTES PAYABLE

The Company has issued long term notes payable in settlement of account payable. Each note has a duration of twenty four months and bears simple interest of five per cent per annum, payable quarterly beginning June 30, 2013.

|

Issue Date

|

Maturity

|

$ | |||

|

March 28, 2013

|

3/28/15

|

11,500 | |||

|

March 31, 2013

|

3/31/15

|

7,000 | |||

|

Sub Total

|

18,500 | ||||

|

Less : Current Maturities

|

( -0- | ) | |||

|

Long Term Notes Payable

|

18,500 |

The Company accrued no interest on these notes during the nine months ended March 31, 2013.

8. RELATED PARTY TRANSACTIONS

As of March 31, 2013, the current officers are owed a total of $55,013 for management fees and expenses which are recorded in accounts payable on the balance sheet. Officers-directors also have made contributions to capital of $39,000, since inception, in the form of expenses paid for the Company.

9. STOCKHOLDERS’ EQUITY and STOCKHOLDERS’ DEFICIT

Issuance of Stock

On August 17, 2012, the Company issued 10,000,000 shares of SAGD common stock, valued at $29,000, based on the market value of the stock on the date of issuance, for the acquisition of a lease option on mineral properties.

In January 2013 the Company issued 26,500,000 shares of common stock in settlement of $79,500 in accounts payable, based on the market value at the date of issuance.

During Mach 2013, the Company issued 17,527,337 shares of common stock valued at $15,100 upon conversion of convertible notes payable.

Stock Options

During the year ended 30 June 2011, the Company granted 2,900,000 stock options to employees and directors of the Company, entitling the holders to purchase common shares of the Company for proceeds of $0.59 per common share expiring March 21, 2021, of which 1,200,000 were granted to employees and 1,700,000 were granted to non-employees of the Company. The fair value of the portion of the options which vested in the year ended June 30,2011, estimated using Black-Scholes model, was $1,566,378. This amount has been expensed as stock-based compensation.

The following incentive stock options were outstanding at March 31, 2013:

|

Exercise

Price

|

Number of

options

|

Remaining

contractual

life (years)

|

||||||||||

|

Options

|

$

|

0.59

|

2,500,000

|

7.9

|

||||||||

|

2,500,000

|

||||||||||||

The following is a summary of stock option activities during the nine months ended March 31, 2013:

|

Number of

options

|

Weighted

average

exercise

price

|

|||||||

|

Outstanding and exercisable at June 30, 2012

|

2,700,000

|

0.59

|

||||||

|

Granted

|

-

|

-

|

||||||

|

Exercised

|

-

|

-

|

||||||

|

Cancelled

|

(200,000)

|

0.59

|

||||||

|

Outstanding and exercisable at March 31, 2013

|

2,500,000

|

0.59

|

||||||

The aggregate intrinsic value of all warrants and stock options outstanding and exercisable at March 31, 2013 was $-0-.

10. GOING CONCERN

Our financial statements have been prepared on the basis of accounting principles applicable to a going concern. As a result, they do not include adjustments that would be necessary if we were unable to continue as a going concern and would therefore be obligated to realize assets and discharge our liabilities other than in the normal course of operations. The Company does not have sufficient working capital to service its debt or for its planned activity, which raises substantial doubt about its ability to continue as a going concern. The Company’s plans are to seek additional debt and equity investment to sustain operations.

11. SUBSEQUENT EVENTS

Pursuant to the conversion option, in April 2013, the third party converted $32,400 of related debt to 47,614,120 shares of common stock. This fully extinguished Convertible Note #1.

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may,” “should,” “could,” “will,” “plan,” “future,” “continue,” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document, and readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A wide variety of factors could cause or contribute to such differences and could adversely impact revenues, profitability, cash flows and capital needs. There can be no assurance that the forward-looking statements contained in this document will, in fact, transpire or prove to be accurate.

Important factors that may cause the actual results to differ from the forward-looking statements, projections or other expectations include, but are not limited to, the following:

|

●

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our contemplated acquisition and exploration and development projects;

|

|

●

|

risk that Federal and State permissions required for exploration on our properties are not available, or conflicting property interests preclude exploration and production on unpatented mining claims

|

|

●

|

risk that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations ;

|

|

●

|

risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits;

|

|

●

|

results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with our expectations;

|

|

●

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production;

|

|

●

|

the potential for delays in exploration or development activities or the completion of feasibility studies;

|

|

●

|

risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses;

|

|

●

|

risks related to commodity price fluctuations;

|

|

●

|

the uncertainty of profitability based upon our history of losses;

|

|

●

|

risks related to environmental regulation and liability;

|

|

●

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

●

|

risks related to tax assessments:

|

|

●

|

risks related to operating in foreign countries including, but not limited to uncertain regulatory climate, foreign currency fluctuations, expropriation risk

|

|

●

|

political and regulatory risks associated with mining development and exploration; and other risks and uncertainties related to our prospects, properties and business strategy.

|

|

●

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our contemplated acquisition and exploration and development projects;

|

|

●

|

risk that Federal and State permissions required for exploration on our properties are not available, or conflicting property interests preclude exploration and production on unpatented mining claims;

|

|

●

|

risk that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations ;

|

|

●

|

risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits;

|

|

●

|

results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with our expectations;

|

|

●

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production;

|

|

●

|

the potential for delays in exploration or development activities or the completion of feasibility studies;

|

|

●

|

risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses;

|

|

●

|

risks related to commodity price fluctuations;

|

|

●

|

the uncertainty of profitability based upon our history of losses;

|

|

●

|

risks related to environmental regulation and liability;

|

|

●

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

●

|

risks related to tax assessments;

|

|

●

|

political and regulatory risks associated with mining development and exploration; and other risks and uncertainties related to our prospects, properties and business strategy.

|

The forgoing list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

As used in this Quarterly Report, the terms “we,” “us,” “our,” and “Company” mean South American Gold Corp., unless otherwise indicated.

Overview

The Company’s current focus is on the acquisition, exploration, and potential development of mining properties in in the United States though we are also seeking mineral property interests in Southeastern Europe, Colombia and Mexico. Our primary focus is on the mining sector, but we also will consider projects in the energy field or business acquisition that may support our business plan in other sectors. Our common stock is currently quoted over-the-counter (the “OTC QB”) under the trading symbol “SAGD”.

We are considered an exploration or exploratory stage company because our business plan is to engage in the examination, investigation and exploration of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral deposit will exist on any of the properties underlying any mineral property interests we have or that we may acquire in the future. In order to make any final evaluation as to the economic and legal feasibility of placing any exploration project into production, a great deal of exploration is required. We possess no known reserves of any type of mineral, have not discovered an economically viable mineral deposit and there is no assurance that we will ever discover one. If we cannot acquire or locate mineral deposits, or if it is not economical to recover any mineral deposits that we do find, our business and operations will be materially and adversely affected and we may have to cease operations.

Substantially all of our assets will be put into commercializing mining rights and mineral claims located within a limited geographical area. Accordingly, any adverse circumstances that affect these areas would affect us financially. If any adverse circumstances were to arise, we would need to consider alternatives, both in terms of our prospective operations and for the financing of our activities. Management cannot provide assurance that we will ultimately achieve profitable operations or become cash-flow positive, or raise additional debt and/or equity capital. If we are unable to raise additional capital, we will continue to experience liquidity problems and management expects that we will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures including ceasing operations. We may also consider entering into a joint venture arrangement to provide the required funding to acquire and explore any mineral property interests. We have not undertaken any efforts to locate a joint venture participant. Even if we determine to pursue a joint venture participant, there is no assurance that any third party would enter into a joint venture agreement with us in order to fund the acquisition and exploration of mineral property interests. If we enter into a joint venture arrangement, we would likely have to assign a percentage of any mineral property interest we may hold to the joint venture participant.

In connection with our efforts to seek properties in Colombia, we have been monitoring certain changes that the Colombian government is contemplating to its administration of the mining sector, which may include the establishment of new government agencies and regulations which we are unable to determine when this may be finalized, and potentially may adversely impact us by resulting in further delays in implementing plans and increased compliance costs. For reasons which included the foregoing, we have elected to expand our focus to North America and we have acquired mineral property interests in North America and are actively considering projects in North America and Southern Europe in addition to Colombia. We have abandoned our plan to acquire an interest in certain mining and mineral rights underlying a prospective concession contact located in the Nariño province of Colombia.We have also begun the process of closing of our subsidiary in Colombia.

During the quarter ended December 31, 2011, these efforts resulted in us entering into a Mining Lease and Agreement to lease nine unpatented mining claims situated in Yavapai County, Arizona and purchasing one unpatented mining claim situated in Yavapai County and staking five unpatented mining claims in western Nevada. We are reviewing data received and results of site visits and preparing for additional exploration activity.

We entered into an agreement September 5, 2012 for a lease with option to purchase the Baltimore Silver mine project in Montana. We leased the New Light project in the state of Washington effective January 16, 2013. The Company was also considering the Lucky Boy Silver project and but after initial reviews decided not to continue its pursuit of the project.

Entry into Agreement with Minera Kata S.A. for Acquisition of Equity Interest in Kata Enterprises Inc.

On February 25, 2011 (the “Effective Date”), we entered into a Stock Purchase Agreement with Minera Kata S.A., a corporation organized under the laws of the Republic of Panama (“Seller”), as amended and supplemented by Amendment No. 1 (the “Amendment”) dated April 25, 2011 (collectively, the “Agreement”), and acquired from Seller twenty-five percent (25%) of the outstanding capital stock (the “25% Stake”) of Kata Enterprises Inc., a corporation organized under the laws of the Republic of Panama (“Kata”), with an option to acquire from Seller the remaining seventy-five percent (75%) of the outstanding capital stock of Kata in exchange for total consideration of $550,000. We paid Seller partial consideration of $500,000 in cash (the “Closing Payment”) on the Effective Date and the remaining $50,000 in cash upon execution of the Amendment.

In November 2011, we amended the prior agreements to acquire one hundred percent (100%) ownership of Kata S.A. and its related subsidiaries, and all prior agreements were terminated including those related to the mineral concession applications. In exchange for the 100% ownership, we paid $10,000. We remain in ownership of all data compiled during our exploration activities; maintain a representative office in Colombia, and are monitoring changes in mining regulations and future acquisitions in the country. We expect no direct exploration efforts in Colombia in the first six months of 2013 involving field work, though we maintain a representative office in Colombia.

Exploration Activities- Colombia and Latin America

We have conducted reconnaissance exploration on various locations in the Nariño Mining district primarily to develop better understanding of the geology of the district and to consider a potential acquisition in the area, which would be contingent on securing sufficient financing and regulatory approvals, neither of which can be assured. We have considered and evaluated projects in Colombia outside of the Nariño district and in Bolivia and plan to continue to do the same subject to same financing and regulatory conditions. We anticipate that general exploration activities required to identify and evaluate new prospects would require additional consulting, travel and sampling expense of $40,000 in the current fiscal year. Administrative costs related to our Colombian subsidiaries we estimate at $20,000 for the current fiscal year. Currently, we maintain a small office in Colombia, and regularly monitor developments in the country.

North American Exploration and Acquisition Activities

We have commenced regular activities to locate and evaluate potential projects in North America. Initial projects under review have been in Mexico (Zactaecas region) and the United States (principally projects in Nevada, Arizona, Washington and Montana). These activities have included site visits to the lease mining claims in Arizona, the Baltimore Silver Mine project in Montana, and the New Light Mine project, which are discussed below. These efforts include reviewing historical literature, contacting property owners, compiling and reviewing information on properties, and where merited site visits and negotiations with property owners, and in addition exploration preparation for our Arizona and Montana claims. Initial sampling and mapping efforts have been started on our projects.

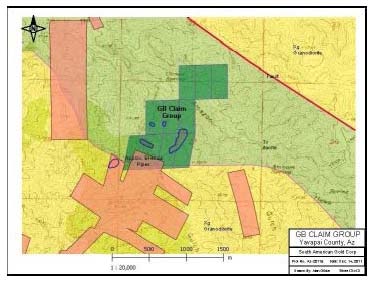

GB Claims – Arizona

During the calendar year ended December 31, 2011, and consistent with our plan to extend the focus of our exploration activities to North America, we entered into an agreement to lease certain unpatented mining claims in the historical Black Rock Mining District of Yavapai County, Arizona.

Mining and Lease Agreement

On December 14, 2011, we entered into a Mining Lease and Agreement (the “Bashore Lease”) with Marilyn Bashore (“Bashore”) to lease nine unpatented mining claims situated in Yavapai County, Arizona (the “Yavapai Property”).

The Lease granted us the exclusive right to prospect, explore, develop and mine the Property for gold, silver and other minerals. Under the terms of the Bashore Lease, we paid Bashore an initial payment of $500 and are required to pay Bashore an annual lease payment of $750 plus a 2% net smelter return on any production. We are required under the terms of the Lease to perform a minimum of $900 in annual assessment work on the Property. The Lease is for a fifteen (15) year term, but shall continue into perpetuity to the extent that minerals are produced and continue to be produced on the Property.

In addition, on December 14, 2011, we purchased from Bashore one unpatented mining claim situated in Yavapai County (the “Yavapai Claim”). As consideration for the Yavapai Claim, we paid Bashore $1,000. There was no purchase agreement documenting our acquisition of the Yavapai Claim and the Yavapai Claim was sold, transferred and conveyed by Bashore to the Company by executing and delivering a quitclaim deed.

Description of Property

In connection with our consideration of entering into the Lease, we conducted a diligence review of the Yavapai Property. The description of Yavapai Property contained herein is the product of our due diligence. Further description is available in our annual report on Form 10-K for the year ended June 30, 2012.

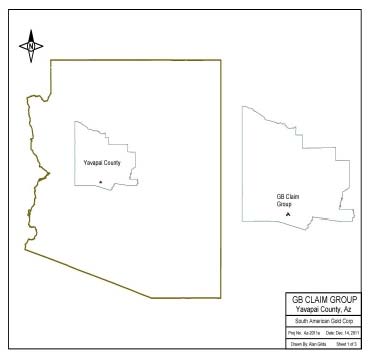

Property Description and Location

Leased Claims

The nine unpatented mining claims underlying the Bashore Lease cover approximately one hundred and eighty (180) acres and are located in the Black Rock Mining District of Yavapai County, Arizona. Set forth below are the claim reference numbers.

|

BLM Recording Number

|

||

|

GB 1

|

AMC

|

393641

|

|

GB 3

|

393643

|

|

|

GB 4

|

393644

|

|

|

GB 5

|

393645

|

|

|

GB 6

|

393646

|

|

|

GB 7

|

393647

|

|

|

GB 8

|

393648

|

|

|

GB 23

|

393931

|

|

|

GB 25

|

393930

|

|

Owned Claims

The Claim we acquired has a BLM recording number of AMC 393932 and county recording number of 84608P-982.

Location

The Black Rock Mining District is located in the southeast part of Yavapai County between the east foothills of the Bradshaw Mountains and the Agua Fria River. The following map shows the general location of the leased and owned unpatented mining claims we acquired in Yavapai County, Arizona:

Access

The Property is readily accessed from Wickenberg, Arizona (approximately sixty five miles northwest of Phoenix, Arizona), which lies on Federal Highway 93. Wickenberg is the nearest large town that has services necessary for mineral exploration and mining. From Wickenberg, paved Constellation Highway is followed about two miles, thence sixteen miles of dirt road lead to the Property. Unimproved tracks provide access to the claim group. Road access to the east side of the Property is limited.

History

The Yavapai County area of Arizona is an area of historic gold prospecting and production activities. However, the Company is not aware of any recorded history of production from the Property underlying the Lease or the Claim.

Climate, Local resources, Infrastructure, Physiography

Climate

The climate is semi-arid with roughly 12.2 inches/year precipitation, mostly in late winter. The Property can be accessed year-round because of the mild climate, good road access, and low elevation of about 1200 meters above mean sea level.

Water Rights, Power, and Mining Personnel

The status of water rights at the Property is uncertain. The amount of water in the vicinity of the Property is adequate for exploratory drilling in the winter, but may not be adequate for mineral processing. The nearest power lines are about 16 miles distant. Mining personnel are not available locally.

The most important natural feature on the Property is tertiary sandstones on the north end of the property.

Tailings Storage Areas, Waste Disposal Areas, and Plant Sites

The Company has not identified private land adjacent to the Property or within close proximity that could be used for potential storage areas, waste disposal or processing sites. There is public land in the vicinity, but it is unknown whether permits would be granted for such uses. There is evidence of old tailings on the project which have not been sampled.

Permitting

Preliminary geological mapping, sampling, and geophysical surveys can be conducted without any permits. A Plan of Operations (“POO”) will have to be filed and approved by the Bureau of Land Management before mechanized work such as access work or drilling can be undertaken on the Property. There is no cost to file a POO with the Bureau of Land Management. Water for drilling would need to be hauled into the property according to initial site visits. Permits are often granted in a short period of time as long as they do not significantly impact existing water rights or unduly degrade riparian areas.

Further mining exploration and exploitation activities are subject to federal, state and local laws, regulations and policies, including laws regulating surface disturbance, water discharge, and the removal of natural resources from the ground and the discharge of materials into the environment. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Exploration and exploitation activities are also subject to federal, state and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of exploration methods and equipment. The Company is unable to quantify at this time the potential cost of such regulations and permitting.(see also “Risk Factors ).

Infrastructure

There is no ascertainable infrastructure on the Property at present.

No adits or trenches have been identified on the property.

Regional Geology

The Property lies on the southern margin of Arizona’s Transition Zone physiographic province. The majority of the area is underlain by Precambrian gneiss, and at the north end of district Tertiary sandstone predominates. Historical information refers to complex igneous and metamorphic host rocks in the general area.

Geology and Mineralization

The Property is characterized by the Precambrian gneiss, with the westerly part exposed hornblende diorite porphyry-type mineralization identified form initial examination of the breccias pipes #4, #5 and #6. The host rock is mostly composed of Proterozoic formations intruded by younger igneous rocks.

Metallurgical

No metallurgical testing has been conducted.

Reserves

There are no established probable or proven reserves on the Property. Our due diligence activities have been limited, and to a great extent, have relied upon information provided to us by third parties. We have not established and cannot provide any assurance that any of the properties underlying the Lease or the Claim contain adequate, if any, amounts of gold or other mineral reserves to make mining economically feasible to recover that gold or other mineral reserves, or to make a profit in doing so.

Exploration Plans

The project area is an early stage prospect with potential identified to date from reconnaissance exploration. The initial objective is to identify the presence of and extent of breccia pipes on the Yavapai Property. This will require an initial work plan of geologic mapping, surface sampling and soil analysis, after which a more comprehensive plan would be developed with an objective of identifying drill targets and developing a Plan of Operation to be filed with the BLM for permission to conduct such an exploration program.

The Company has additional geological mapping to be done, and we are in the process of preparing additional site visits to investigate adjacent territory and on the existing unpatented mining claims identify areas for soil sampling and preliminary identification of drill targets. Once done, we will prepare a Plan of Operations for the required approvals. The budget for these and subsequent steps is $50,000 and included in the company-wide exploration budget provided below. A key objective is sampling the breccias pipes to guide potential drilling activity. The breccia pipes designated 4, 5 and 6 have been located and identified and will remain the initial target for sampling. We have not completed the initial mapping and sampling program.

In April 2013, an outside geologist was retained to conduct additional surface review and sampling. At the time of this filing, the Company has not received the results of such sampling.

Lucky Boy Silver Project - Nevada

Lucky Boy Silver Project

In December 2011, the Company staked five unpatented mining claims in the Walker Lane Mineral Belt in western Nevada which we are referring to as the “Lucky Boy Silver Project”.

In connection with our consideration of whether to stake these unpatented mining claims, we conducted a diligence review of the Lucky Boy Silver Project.

We staked the following five unpatented mining claims in December 2011 covering approximately 100 acres of the Lucky Boy Silver Project:

|

Claim

|

BLM Recording No.

|

|

LB#1

|

NMC 1062491

|

|

LB#2

|

NMC 1062492

|

|

LB#3

|

NMC 1062493

|

|

LB#4

|

NMC1062494

|

|

LB#5

|

NMC 1062495

|

The Company in reviewing the project, and competing project activity and financing requirements, has elected to not continue with the project, and consequently the claims were forfeited; as no surface disturbance occurred during our site visits, there is no subsequent liability related to our period of ownership of these unpatented mining claims.

Baltimore Silver Mine

Lease with Option to Purchase Baltimore Silver Mine

On August 6, 2012, the Company entered into a binding Memorandum of Understanding (the “Baltimore Silver MOU”) with Western Continental, Inc. (“Western”) to lease with option to purchase three patented mining claims ( the “Baltimore Silver Mine”) subject to a definitive agreement to be signed within ninety days, with an effective lease date of August 6, 2012.

Western, and the Company have agreed to a Definitive Agreement (“the Baltimore Silver Mine Agreement”) to Lease with Option to Purchase the Baltimore Silver Mine. The Company effected the agreement September 5, 2012. The Baltimore Silver Mine Lease will be for a term of ten years beginning August 2, 2012, and may be extended for an additional 15 years with a payment of $100,000 at any time. During the term of the Baltimore Silver Mine Lease,the Company will be responsible for the payment of any property taxes, indemnify Western for any and all activities the Company conducts on the property, and secure all required permits and operating licenses for the Company activities on the property. The lease payment will be $10,000 per year in cash, which may be paid in restricted stock as the Company’s option provided such restricted stock has a market bid price in excess of $20,000 for the 20 days average bid price for the stock prior to payment, and a quarterly cash payment of $500 per quarter. Payment will be on July 31st of each year beginning in 2013.

The Company will pay a production royalty on all minerals mined from the property in the form of a Net Smelter Return to Western of three percent (3%). The Company will have for the term of the Baltimore Silver Mine Agreement an option to purchase the property free and clear of any lien or encumbrance in the amount of $500,000 at which time the lease would terminate and no royalty would be due afterwards from the property. Should the Company cause to be issued a property report meeting standard industry guidelines indicating probable or proven reserves in excess of two million ounces of silver on the property, Western shall receive an additional $30,000 in cash or restricted shares valued as described above, within 30 days of publication of such report. The Company has issued 10,000,000 shares of its restricted common stock to Western. The Company will also pay $25,000 in cash or restricted stock, valued at the ten day average bid price for the stock, between January 1, 2013 and July 1, 2013.

Description of Baltimore Silver Mine Property

Land Status

The Baltimore Silver Mine property consists of three patented mining claims covering approximately 60 acres.

Name of Claim Mineral Survey #

Last Hope 9689

Baltimore 1540

Mona 9689

The Company has also staked two unpatented claims as part of the project, thus the project as a whole contains approximately 100 acres.

Location

The Baltimore Mine property is located in Jefferson County, Montana, approximately twenty-two miles northeast of Butte, MT and four miles northwest of Boulder, MT. Coordinates are Section 7, Township 6 N, Range 4W, Jefferson County, Montana. The Company is collating information and preparing general maps on the project.

Access

Access is generally from Boulder, Montana by four miles of unimproved county road along the Boomerang Creek Road.

Climate and Physiography

The climate is relatively temperate allowing work generally all year around. The mine is on the eastern slope area of Sugarloaf Mountain, with ridges one thousand feet above the main valley. Elevations on the property range from 6,250 feet on ridge top to 5,800 feet above sea level near the Baltimore Mine. Vegetation consists of mostly sage but stands of conifers are common on the north slopes.

Local Resources