Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESENTATION MATERIALS FOR INDIVIDUAL INVESTOR MEETINGS. - PROASSURANCE CORP | exhibitone.htm |

| 8-K - FILING TO DISCLOSE PRESENTATION MATERIALS. - PROASSURANCE CORP | bodyoffiling.htm |

May 14, 2013

2013 Securities Research Conference

2013 Securities Research Conference

Edward L. Rand, Jr. Chief Financial Officer

Frank B. O’Neil Investor Relations Officer

Investor Meetings

Investor Meetings

This presentation contains Forward Looking Statements and other information designed to convey

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

We especially identify statements concerning our transactions involving Medmarc Insurance

Company and Independent Nevada Doctors Insurance Company as Forward Looking Statements

and direct your attention to our news releases issued on June 27, 2012, our Current Report on Form

8K, issued on June 28, 2012 and our 10K, filed on February 19, 2013 for a discussion of

risk factors pertaining to these transactions and subsequent integration into ProAssurance.

Company and Independent Nevada Doctors Insurance Company as Forward Looking Statements

and direct your attention to our news releases issued on June 27, 2012, our Current Report on Form

8K, issued on June 28, 2012 and our 10K, filed on February 19, 2013 for a discussion of

risk factors pertaining to these transactions and subsequent integration into ProAssurance.

This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in

our remarks and discussions. A reconciliation of these measures to GAAP measures is available in

our latest quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Report on Form 8K disclosing that release.

our remarks and discussions. A reconciliation of these measures to GAAP measures is available in

our latest quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Report on Form 8K disclosing that release.

FORWARD LOOKING STATEMENTS

NON-GAAP MEASURES

Q1 2013 Highlights

Increased Net and Operating Income Y-O-Y

ROE of 13.4%

Book Value per share now $38.19

4% increase since year-end 2012

Book Value per Share has grown each year since

1991

1991

Shareholder’s Equity and Total Assets at record

levels

levels

Recent transactions contributing to our results

with integration proceeding as planned

with integration proceeding as planned

3

ProAssurance Corporate Profile

Specialty liability insurance writer

Healthcare Professional Liability (HCPL)

Only “pure play” public company writing predominately HCPL

Life sciences and medical devices

Attorney’s professional liability

Market Cap: ~$3.0 billion

Shareholders’ Equity: $2.4 billion

Total Assets: $5.3 billion

Claims-Paying Ratings: “A” by Fitch and A. M. Best

Ratings affirmed by Fitch on May 1st

Debt ratings recently upgraded by Moody’s

4

ProAssurance Business Profile

HCPL Distribution is Independent Agent (64%) / Direct (36%)

Direct in Alabama, Florida and in all states for Podiatric business

Dual distribution in DC, Texas and parts of Missouri

LPL and Life Sciences is 100% broker / agent

Legal Professional is direct in Georgia / MGAs used in other states

Q1 2013 Policyholders: ~64,600

Q1 2013 Premium: $163.2 mln

March 31, 2013

Includes Acquisitions

Includes Acquisitions

Tail Premium Allocated by Line

5

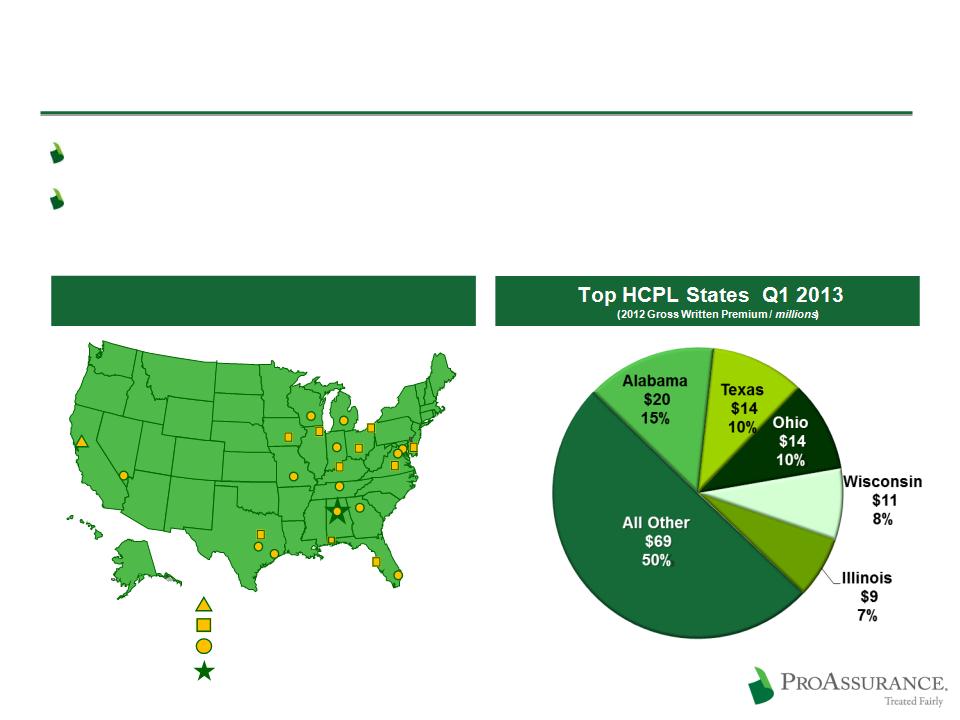

ProAssurance Geographic Profile

Broad geographic diversification

Locally-based decision-making differentiates ProAssurance by

addressing each state’s unique medical/legal challenges

addressing each state’s unique medical/legal challenges

ProAssurance Footprint / All Lines

(Birmingham)

Corporate Headquarters

Corporate Headquarters

Claims Offices

Claims Offices

Claims / Underwriting Offices

Claims / Underwriting Offices

Underwriting Offices

Underwriting Offices

6

Seeking Increased Yield But Balancing Risk

We continue to focus on

maintaining a high quality, well

diversified fixed income

portfolio

maintaining a high quality, well

diversified fixed income

portfolio

We are making incremental

changes to obtain higher yields

in blue chip investments

changes to obtain higher yields

in blue chip investments

$4.3 Billion

Portfolio

Portfolio

$4.3 Billion

Portfolio

Portfolio

Fixed Income:

84%

84%

Fixed Income:

84%

84%

Short Term: 2%

Short Term: 2%

Equity and Equity Substitutes: 12%

Equity and Equity Substitutes: 12%

BOLI: 1%

BOLI: 1%

3/31/13

7

Management is Experienced & Invested

Effective senior management remains in place—14 years average tenure

Average ProAssurance tenure through the VP level is 16 years, with an average of 26 years

industry experience

industry experience

Management and employees are invested, owning ~5.6 % of ProAssurance stock

|

W. Stancil Starnes, JD

Chairman & Chief Executive Officer

Company Tenure: 6 Years

Prior MPL Experience: 29 Years

Total Industry & Related Experience: 35 Years

Formerly in the private practice of law in MPL defense and

complex corporate litigation |

Victor T. Adamo, JD, CPCU

Vice-Chairman

Company Tenure: 28 Years

Prior MPL Experience: 5 Years

Total Industry & Related Experience: 33 Years

Formerly in the private practice of corporate law. President of

Professionals Group prior to formation of ProAssurance |

Ross E. Taubman, DPM

President of PICA

Company Tenure: 2 Year

Prior MPL Experience: -

Total Industry & Related Experience: 28 Years

Formerly in the private practice of podiatry. Leader in

organized podiatric medicine; former president and Trustee of the American Podiatric Medical Association |

|

Jeffrey L. Bowlby, ARM

Sr. Vice-President & Chief Marketing Officer

Company Tenure: 15 Years

Prior MPL Experience: -

Total Industry & Related Experience: 29 Years

Career-long experience in insurance sales and marketing,

most recently as SVP for Marketing with Meadowbrook |

Howard H. Friedman, ACAS

Sr. Vice-President & Chief Underwriting Officer

Company Tenure: 17 Years

Prior MPL Experience: 16 Years

Total Industry & Related Experience: 33 Years

Career-long experience in MPL company operations

and management. Former ProAssurance CFO. |

Jeffrey P. Lisenby, JD

Sr. Vice-President, General Counsel & Secretary

Company Tenure: 12 Years

Prior MPL Experience: -

Total Industry & Related Experience: 12 Years

Formerly in the private practice of law

|

|

Duncan Y. Manley

Vice-President, Operations and Information Systems

Company Tenure: 13 Years

Prior MPL Experience: 7 Years

Total Industry & Related Experience: 20 Years

Career-long experience in MPL company operations as an

executive and consultant. |

Frank B. O’Neil

Sr. Vice-President & Chief Communications Officer

Company Tenure: 26 Years

Prior MPL Experience: -

Total Industry & Related Experience: 26 Years

Formerly a television news executive and anchor

|

Edward L. Rand, Jr., CPA

Sr. Vice-President & Chief Financial Officer

Company Tenure: 8 Years

Prior MPL Experience: -

Total Industry & Related Experience: 20 Years

Career-long experience in insurance finance and accounting.

Most recently Chief Accounting Officer for Partner Re |

|

Darryl K. Thomas, JD

Sr. Vice-President & Chief Claims Officer

Company Tenure: 18 Years

Prior MPL Experience: 10 Years

Total Industry & Related Experience: 28 Years

Career-long experience in MPL claims management

|

Hayes V. Whiteside, MD, FACS

Sr. Vice-President & Chief Medical Officer

Company Tenure: 9 Years

Prior MPL Experience: -

Total Industry & Related Experience: 29 Years

Formerly in the private practice of Urology

|

Mary Todd Peterson

President & CEO of Medmarc

Company Tenure: 12 Years

Prior Industry Experience: 14 Years

Total Industry & Related Experience: 26 Years

Former Partner with Johnson Lambert and VP Finance &

Controller with Acacia |

8

Our Commitment to Treated Fairly

Unwavering dedication to the defense of

non-meritorious lawsuits

non-meritorious lawsuits

Allows our insureds the right to an unfettered defense of

their claims where permitted by law

their claims where permitted by law

Steadfast dedication to in-depth underwriting and

adequate pricing

adequate pricing

An unsurpassed level of customer service

Unquestioned financial strength consistently

delivering value for insureds and shareholders

delivering value for insureds and shareholders

9

Strategies for Future Success

Our successful experience and deep expertise

uniquely qualify ProAssurance to insure the

widest range of healthcare risks

uniquely qualify ProAssurance to insure the

widest range of healthcare risks

Building a Bridge to the Future

Our core business is at a pivot point

We are uniquely positioned to succeed by serving the

emerging market and remaining legacy business

emerging market and remaining legacy business

Smaller competitors with less experience and capacity

have decisions to make

have decisions to make

11

Legacy business is largely

single-state, solo

and small groups.

A substantial amount of this

business will remain, but

will demand more from

insurers.

single-state, solo

and small groups.

A substantial amount of this

business will remain, but

will demand more from

insurers.

The future will be

dominated by large

groups and institutions,

often multi-disciplinary

and multi-state. They

will demand financial

strength and deep

expertise.

dominated by large

groups and institutions,

often multi-disciplinary

and multi-state. They

will demand financial

strength and deep

expertise.

Building a Bridge to the Future

Larger risks will demand sophisticated

coverages that span the continuum of healthcare

coverages that span the continuum of healthcare

Broad healthcare liability experience is our

foundation

foundation

We added capacity & capability through M&A

Example: Medmarc, PICA and Mid-Continent

Home

Healthcare

Healthcare

Non-Traditional

Delivery Settings

Delivery Settings

Multi-Specialty

Clinics

Clinics

Hospital & Facility

Centered Care

Centered Care

New delivery

devices,

techniques and

research

devices,

techniques and

research

ProAssurance spans the continuum of care

Traditional

Practices

Practices

12

ProAssurance’s Successful M&A

Strategy

Strategy

Consolidation will continue and will remain episodic

Fewer significant targets

Remaining companies of size are in important strategic areas

We prefer “health care centric” but will consider closely related

liability lines

liability lines

Legal/regulatory environment must be favorable

Not all M&A opportunities should be pursued

We do not “bet the company” on any transaction

Soft Market

Hard Market

M & A

de novo

Expansion

Expansion

Internal

Growth

Growth

All avenues

open

because of

pricing

power

open

because of

pricing

power

M & A is

preferable

because of

pricing

pressure

preferable

because of

pricing

pressure

M & A and the Insurance Cycle

13

ProAssurance’s Successful M&A History

Original

Companies

Companies

Purchased Company

Demutualization

OHIC

HOSPITALS ONLY

HOSPITALS ONLY

2

1

1

1

1

1

1

1

1

3

4

4

1

4

Renewal Rights

Assumed Business

2

2

†

2

3

1

3

3

1

SERTA

14

ProAssurance Will Grow Prudently

ProAssurance is a demonstrated leader in M&A

We will broaden our lines of coverage as needed

Healthcare-related

Through prudent leverage of our expertise and the

addition of specialized expertise

addition of specialized expertise

The market will firm and we are prepared to

grow organically

grow organically

Past history teaches us the turn will be sudden and

capital will allow us to respond rapidly

capital will allow us to respond rapidly

15

Strategy for an Evolving Market

Shaped by a healthcare landscape that will

change—with or without federal healthcare

reform

change—with or without federal healthcare

reform

Expanding our capabilities and commitment

across the continuum of healthcare

across the continuum of healthcare

Building on two decades of hospital experience

Recent expansion into products liability for life

sciences and medical devices through M&A

sciences and medical devices through M&A

Enhancing our historical commitment to

individual providers and small groups

individual providers and small groups

16

Strategy for an Evolving Market

Leverage our reach, expertise and financial

strength with larger accounts

strength with larger accounts

Largest non-profit healthcare

system in the US

system in the US

Now in Michigan, Florida,

Illinois, Indiana and Texas

Illinois, Indiana and Texas

Insuring Ascension-affiliated

physicians through coordinated,

jointly insured programs

physicians through coordinated,

jointly insured programs

Financial involvement of both entities creates incentive to reduce risk

*www.ascensionhealth.org/index.php?option=com_locations&view=locations&Itemid=148

Ascension Health’s Ministry Locations*

17

Strategy for an Evolving Market

Joint physician/hospital insurance products to

address the unique risk tolerance and claims-

handling expectation of each insured

address the unique risk tolerance and claims-

handling expectation of each insured

Partnerships with existing physician-focused

companies to leverage hospital expertise

companies to leverage hospital expertise

Recently announced California venture with

CAP-MPT: CAPAssurance

CAP-MPT: CAPAssurance

Alternative risk and self-insurance mechanisms

Captive insurance, risk sharing programs and

Risk Retention Groups for

specific specialties or regions

Risk Retention Groups for

specific specialties or regions

18

Healthcare Reform

No meaningful change after the election

Known: More customers for us

May accelerate the growth of hospital-owned practices and

consolidation into larger groups

consolidation into larger groups

Provides an opportunity for us due to our geographic reach,

long-term experience in hospitals and our financial strength

long-term experience in hospitals and our financial strength

We have enhanced our ability to write new classes of

business through acquisitions

business through acquisitions

May hasten the need for consolidation of smaller insurers

Unknown: Effect on the medical/legal environment

Increased patient frustration with the system

Possibility of more unexpected outcomes

19

Today’s Healthcare Professional Liability Market

ProAssurance delivers an unparalleled level of

service and financial stability that truly

differentiates our coverage and our Company in an

evolving, competitive market

service and financial stability that truly

differentiates our coverage and our Company in an

evolving, competitive market

HCPL Stands Apart in Insurance

HCPL claims may not be filed for years after an

incident and may take years to resolve: Long-tail

incident and may take years to resolve: Long-tail

Personal lines are short tail

Introduces long periods of uncertainty

Loss trends may change expected severity from time of

initial pricing

initial pricing

Can be mitigated by the use of the claims-made policy form

Can provide a false sense of security for start-ups and

companies seeking to aggregate market share based on price

companies seeking to aggregate market share based on price

Float can be meaningful

HCPL claims are almost always lawsuits

High cost to defend, even if you win

21

The HCPL Market Today

Prolonged period of “benign profitability”

Premiums levels remain well above levels of 2000

Significant policyholder retention by all companies

despite fierce competition

despite fierce competition

No large commercial carriers have entered the market

in a meaningful manner

in a meaningful manner

Significant barriers to entry in underwriting and claims

handling

handling

Psychological barriers exist—failures in the past

No catastrophe exposure

22

The HCPL Market Today

23

The HCPL Market Today

Changes in healthcare delivery are changing the

underlying dynamics

underlying dynamics

Physicians are combining into larger groups

Physician practices are being brought into hospitals through

purchase or affiliation

purchase or affiliation

Hospitals are combining into large networks requiring

greater insurance expertise and greater financial security

greater insurance expertise and greater financial security

Larger companies with geographical reach and

financial strength will have an advantage in attracting

new business and continuing to consolidate

financial strength will have an advantage in attracting

new business and continuing to consolidate

24

The HCPL Market Today

Market remains fragmented even after two

decades of consolidation

decades of consolidation

More than 100 writers

Largest market share is ~8%

87% of top 100 companies have <2%

76% of top 100 companies have <1%

25

ProAssurance’s Standing in HCPL

ProAssurance is the largest independent

publicly-traded writer of HCPL insurance

publicly-traded writer of HCPL insurance

Fourth largest overall writer

DPW: SNL Data 2012

26

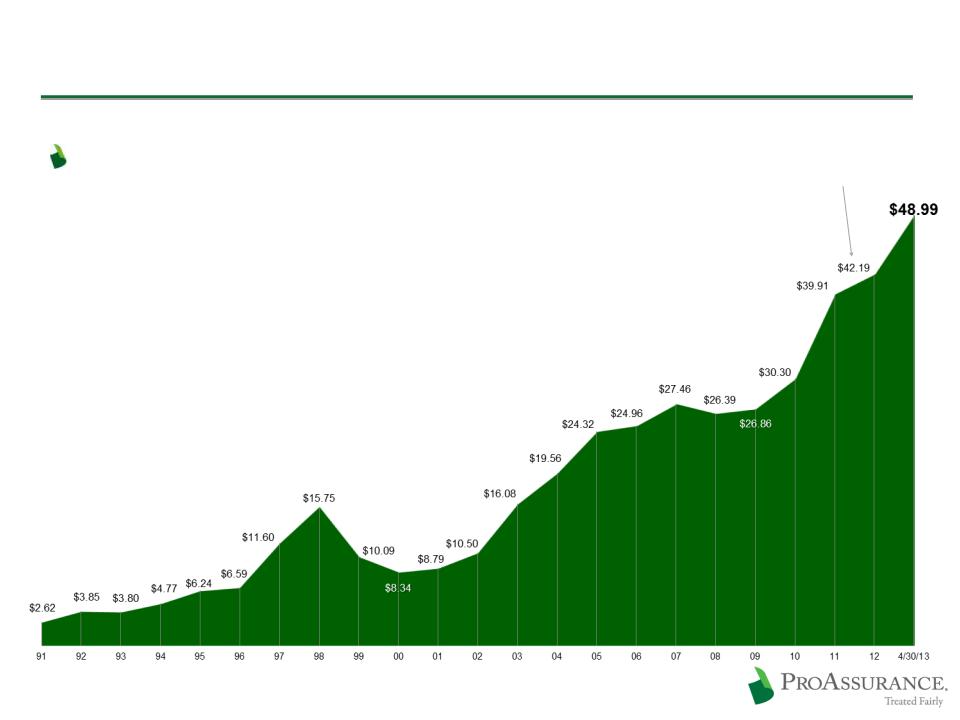

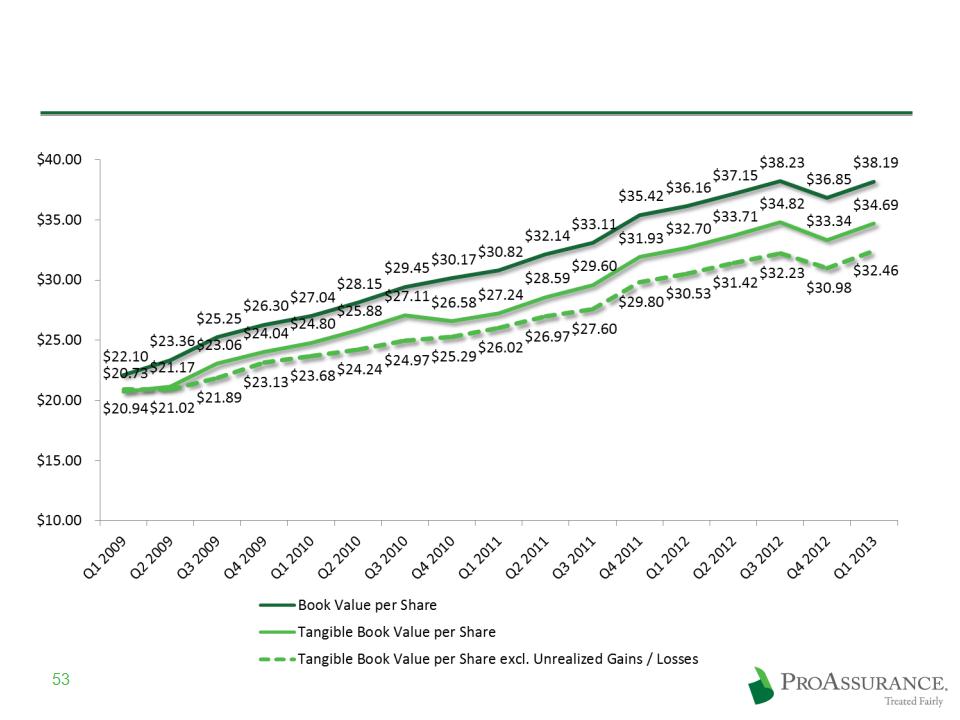

Sound Strategy = Consistent Profitability

Captures our focus on long-term excellence

Increased every year we have been public

The Payoff: Consistent Book Value Growth

28

Inception to 3/31/13

CAGR: 16%

CAGR: 16%

Cumulative: 2,179%

10 Year Summary (2003 -2012)

CAGR: 16%

CAGR: 16%

Cumulative: 360%

Historical Book Value Per Share

Split Adjusted

Dividends Shown in the Year Declared

Split Adjusted

Dividends Shown in the Year Declared

Reflects all stock splits and includes all dividends in the year declared

Share price reflects investor confidence in

our business decisions and long-term strategy

our business decisions and long-term strategy

The Payoff: Steady Share Price Increase

29

Historical Share Price

Reflects all stock splits

2012 excludes

$2.50/share

special dividend

$2.50/share

special dividend

Inception to 3/31/13

CAGR: 15%

CAGR: 15%

Cumulative: 1,706%

10 Year Summary (2003-2012)

CAGR: 15%

CAGR: 15%

Cumulative: 302%

Historical Financial Performance

Our disciplined, long-term approach drives

consistent profitability

consistent profitability

$ in millions

Net Income1

Operating Income2

30

1 Includes a gain of $35.5 million in the first quarter of 2013 in connection with our acquisition of Medmarc as a result of the value

of the net assets acquired vs. our purchase price.

of the net assets acquired vs. our purchase price.

2 Excludes the after-tax effects of net realized gains or losses and one-time items that do not reflect normal operating results

Q1 2013 Income Statement Highlights

in millions, except per share data

31

|

|

March 31,

|

Y-OVER-Y

Change |

|

|

|

2013

|

2012

|

|

|

Gross Premiums Written

|

$ 163

|

$ 170

|

-4%

|

|

Net Investment Result

|

32

|

31

|

+2%

|

|

Total Expenses (Includes Loss Costs)

|

95

|

105

|

-10%

|

|

Net Income (Includes Realized Investment Gains & Losses

and gain on acquisition) |

$ 113

|

$ 56

|

+103%

|

|

Operating Income

|

$ 60

|

$ 48

|

+24%

|

|

Net Income per Diluted Share

|

$1.82

|

$0.90

|

+102%

|

|

Operating Income per Diluted Share

|

$0.97

|

$0.78

|

+24%

|

2012 Income Statement Highlights

in millions, except per share data

32

|

|

December 31,

|

Y-OVER-Y

Change |

|

|

|

2012

|

2011

|

|

|

Gross Premiums Written

|

$ 536

|

$ 566

|

-5%

|

|

Net Investment Result

|

129

|

132

|

-2%

|

|

Total Expenses (Includes Loss Costs)

|

320

|

302

|

+6%

|

|

Net Income (Includes Realized Investment Gains & Losses)

|

$ 275

|

$ 287

|

-4%

|

|

Operating Income

|

$ 257

|

$ 279

|

-8%

|

|

Net Income per Diluted Share

|

$4.46

|

$4.65

|

-4%

|

|

Operating Income per Diluted Share

|

$4.16

|

$4.52

|

-8%

|

Consistent Approach to Reserves

Consistent reserving practices provide protection

against a loss trend reversal and capital erosion

against a loss trend reversal and capital erosion

33

$ in thousands

Disciplined Underwriting

Five Year Premium History

34

Consistently writing profitable business to ensure

long-term success

long-term success

Premium decline driven by competition, physician

consolidation and rate actions driven by an

unprecedented favorable loss environment

consolidation and rate actions driven by an

unprecedented favorable loss environment

Gross Premiums Written

Net Premiums Earned

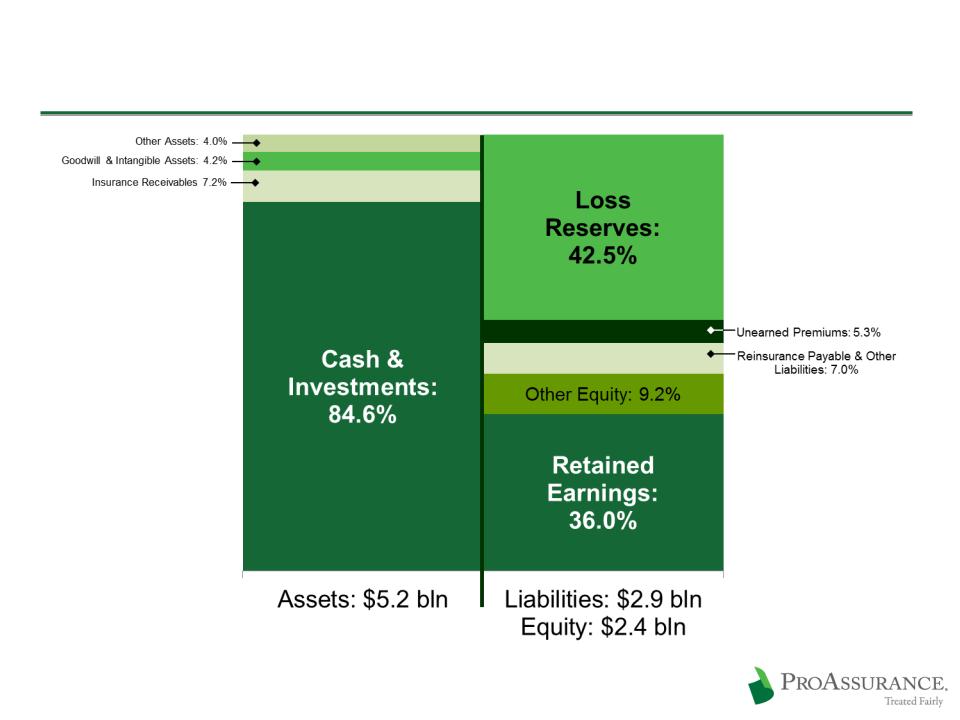

Q1 2013 Balance Sheet Highlights

Split adjusted, in billions, except Book Value per share

Shareholders’ Equity $ 2.4 $ 2.3 +4%

Total Investments 4.3 3.9 +10%

Total Assets 5.2 4.9 +6%

Policy Liabilities 2.5 2.3 +9%

3/31/13 12/31/12 CHANGE

Shareholders’ Equity

66% increase since 2008

Book Value per Share $ 38.19 $36.85 +4%

35

Long-Term Financial Strength

Our balance sheet is our

top financial priority

top financial priority

Financial strength

differentiates us in

the market

differentiates us in

the market

The claims defense

philosophy that

differentiates us in the

market leverages our

financial strength

philosophy that

differentiates us in the

market leverages our

financial strength

Total Assets

36

Capital Management Priorities

Preferred use is to support growth through M&A or new business

We balance future needs with current market reality

Regular dividend is $1.00/share

~2% yield based on 5/8/13 closing price

Prudent share repurchase program

$321 million spent to

repurchase 6.1 million shares

since 2005

repurchase 6.1 million shares

since 2005

Repurchasing shares at prices

that enhance shareholder value

and build Book Value

that enhance shareholder value

and build Book Value

Additional funds utilized

to eliminate long-term debt

to eliminate long-term debt

Share Repurchase History

37

Calendar Year Combined Ratio: ProAssurance Consistently Outperforms in MPL

ProAssurance Outperforms the Industry

Five Years: ProAssurance Average: 58.7% / Industry Average: 84.4%

Ten Years: ProAssurance Average: 77.8% / Industry Average: 94.7%

All Years: ProAssurance Average: 89.8% / Industry Average: 107.9%

Source: A.M. Best Aggregates and Averages, Medical Malpractice Lines of Business, preliminary 2012 data used

38

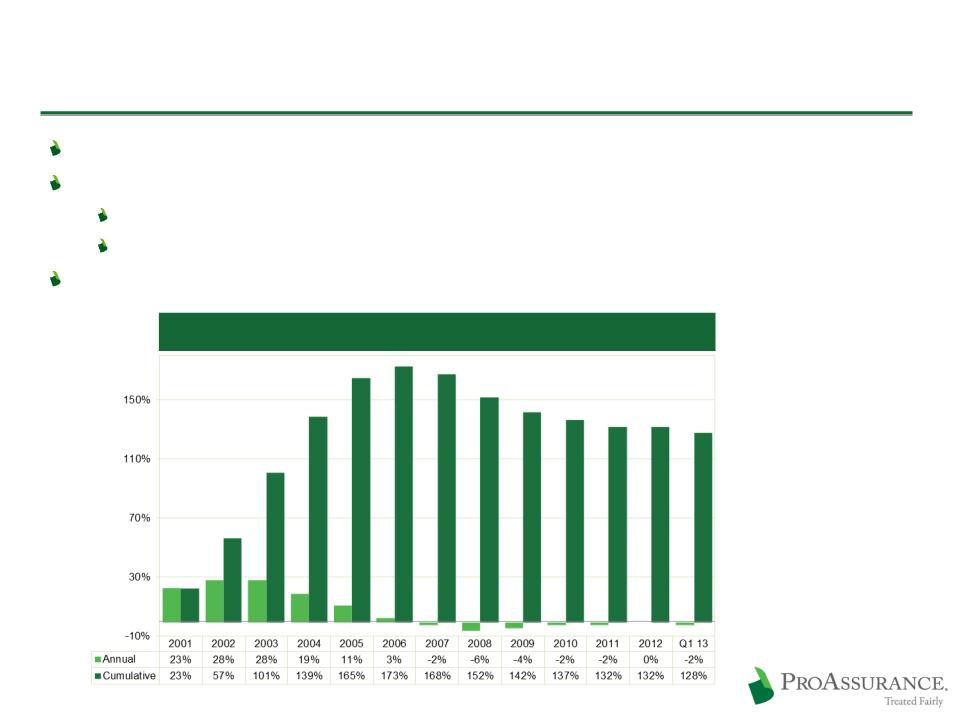

ProAssurance Pricing History

Peak pricing was in 2006

Improved frequency trends are reflected in recent rate declines

Improvement in frequency has outweighed the steady, manageable rise in severity

Loss trends have improved in states with and without tort reforms

Rate changes (up or down) through 2013 likely will be low-to-mid single digits

MD/DO Rate Change History

PICA excluded to facilitate accurate comparisons over time

39

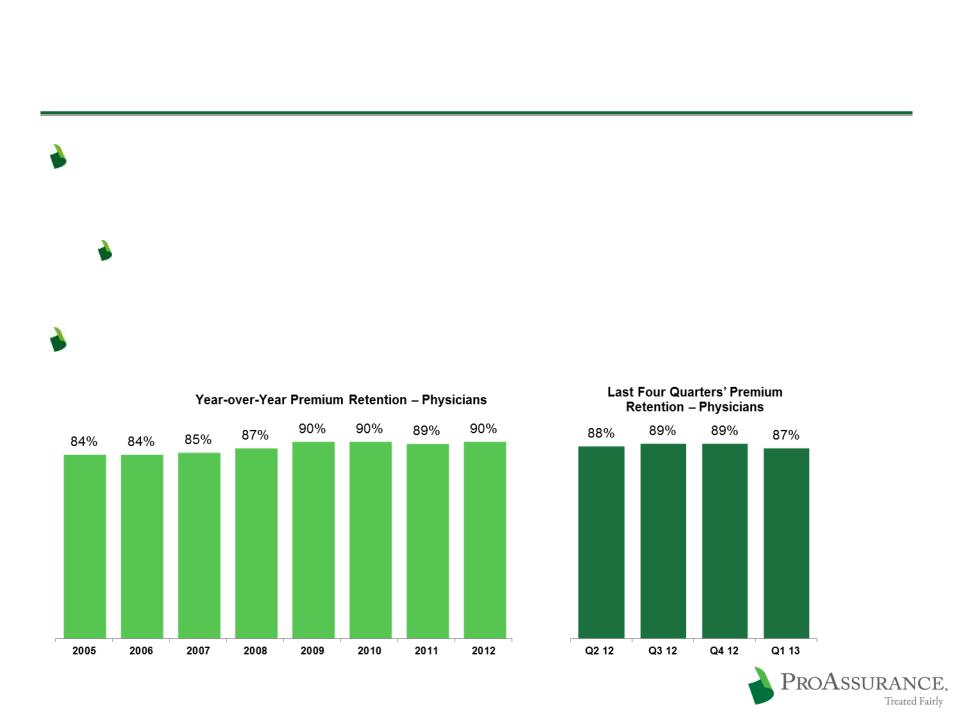

ProAssurance Retention Remains High

Continued underwriting vigilance is being used today

to ensure future success

to ensure future success

Market share is important, but NOT as important as

profitability

profitability

Retention remains in line with recent quarters

40

ProAssurance Operational Review

ProAssurance delivers an unparalleled level of

service and financial stability that truly

differentiates our coverage and our Company in an

evolving, competitive market

service and financial stability that truly

differentiates our coverage and our Company in an

evolving, competitive market

Underwriting for Profitability Not Market Share

Underwriting process driven by individual risk

selection and assessment of loss history, areas

of practice, and location

selection and assessment of loss history, areas

of practice, and location

Rates contemplate specific ROE expectations

Frequent rate/loss reviews ensure adequate prices

Rate filings consider the results of the past five to

seven years to ensure a single year does not unduly

influence results

seven years to ensure a single year does not unduly

influence results

Stringent underwriting standards maintain rate

structure and enhance profitability

structure and enhance profitability

42

Key State Rate Comparison

Annual Premium for a $1M / $3M Policy

Filed or Approved at 1/01/13

43

Understanding Recent Loss Trends

Frequency stable after

historic declines

historic declines

Lawyers are the gatekeepers

Must weigh the cost of a trial vs.

chances of success

chances of success

Likelihood of success is affected

by many factors

by many factors

Societal perceptions of lawsuits

against physicians

against physicians

Effects of the overall Tort

Reform debate and headlines

across the country

Reform debate and headlines

across the country

Reforms enacted in some states

Better quality of care reduces the

number of medical misadventures

number of medical misadventures

Severity uptrend remains

steady at 2%-3%

steady at 2%-3%

Closely tied to inflation

Primarily medical cost inflation

Jury sentiment in reaction to

headlines has moderated, but

not eliminated, runaway

verdicts in recent years

headlines has moderated, but

not eliminated, runaway

verdicts in recent years

Tort Reforms have limited

non-economic damages in a

number of states

non-economic damages in a

number of states

44

New Claims Opened Each Year

Claims Trends Remain Favorable

Fewer cases to try following significant decline in frequency

Severity trends steady and manageable

No observed effect from the economic downturn

Trends are much the same in states with or without Tort Reform

ProAssurance Claims Tried to a Verdict

45

Differentiate Through Claims Defense

We leverage our financial strength to give our insureds the opportunity for

an uncompromising defense of each claim

an uncompromising defense of each claim

Differentiates our product

Provides long-term financial and marketing advantages

Retains business and deters future lawsuits

Increasingly important as claims data becomes public

Malpractice outcomes now public in 26 states

ProAssurance: 78% No Paid Losses

Industry: 72% No Paid Losses

Source: Preliminary PIAA 2011

Claim Trend Analysis,

ProAssurance Excluded

Claim Trend Analysis,

ProAssurance Excluded

Five Year Average

2007-2011

2007-2011

Source: ProAssurance,

as reported to

PIAA

as reported to

PIAA

46

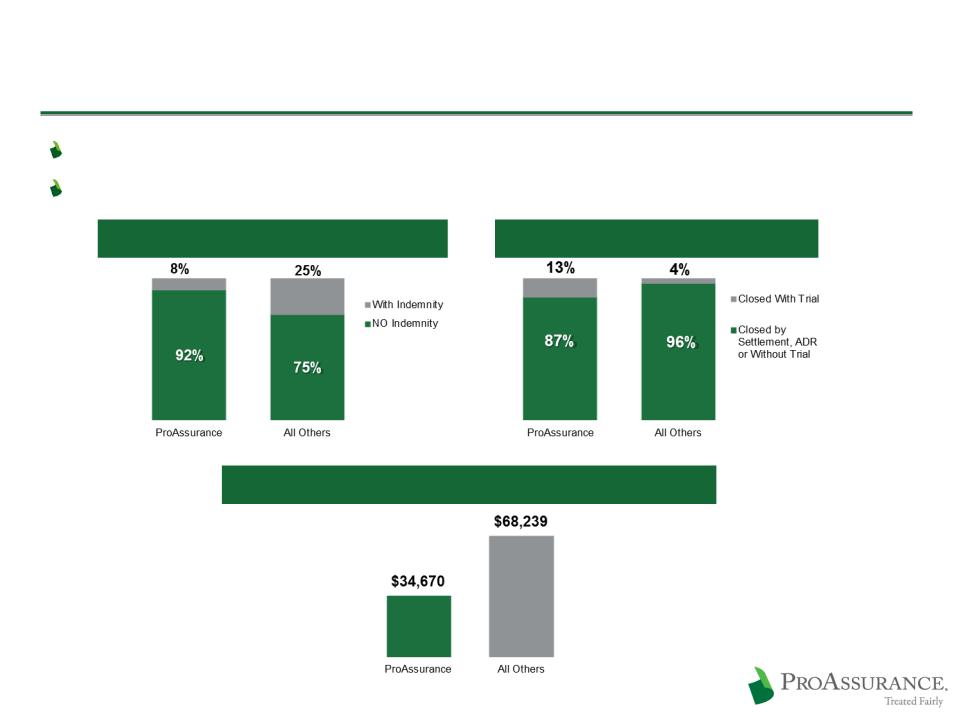

The Ohio Example: 2005 - 2011 Data

Comprehensive, reliable data provided by the Ohio Department of Insurance

Broad range of competitors and business approaches

www.insurance.ohio.gov/Legal/Reports/Documents/2011ClosedClaimReport.pdf

More Claims Closed With No Indemnity

More Claims Defended in Court

2x Lower Average Indemnity Payment per Closed Claim

47

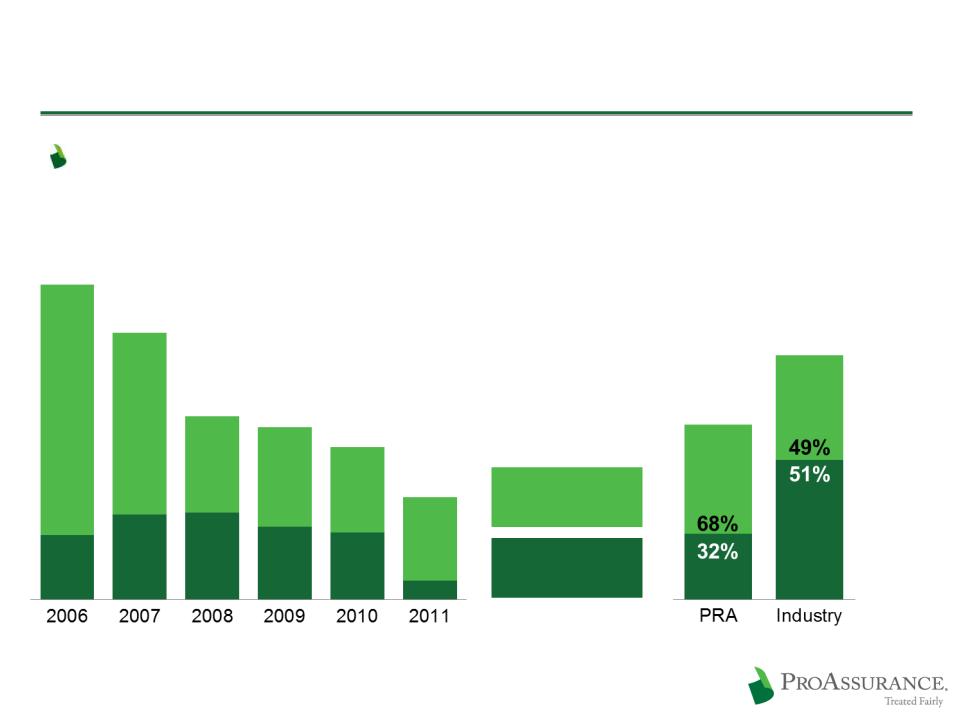

The Bottom Line Benefits of Strong Defense

Our ability and willingness to defend claims allows us

to achieve better results

to achieve better results

Source: Statutory Basis, A.M. Best Aggregates & Averages

Some totals may not agree due to rounding

Some totals may not agree due to rounding

ProAssurance vs. Industry

Average Loss Ratio (2007-2011)

Legal Payments as

a Percentage of

Total Loss Ratio

a Percentage of

Total Loss Ratio

Loss Payments as a

Percentage of Total

Loss Ratio

Percentage of Total

Loss Ratio

64.3%

44.2%

58.9%

42.0%

41.6%

76.0%

36.8%

ProAssurance Stand Alone

Loss Ratio (2006-2011)

Calendar Year

Calendar Year

24.7%

79%

68%

52%

58%

56%

81%

19%

21%

32%

48%

42%

44%

48

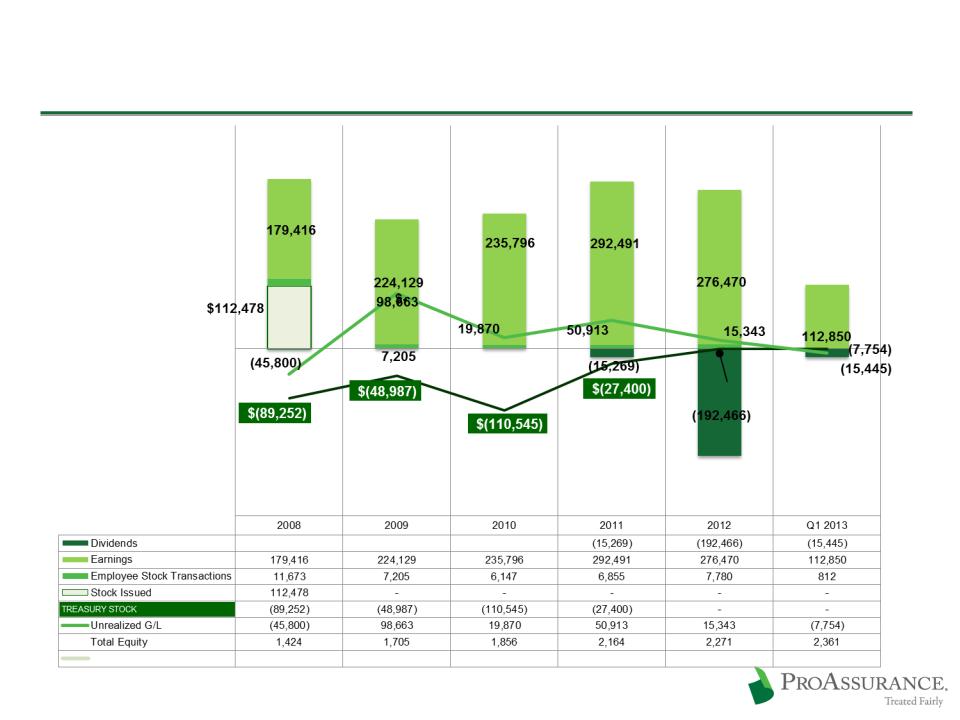

Behind the Numbers

Capital Growth: 2008-Q1 2013

in $000’s except

total equity (000,000’s)

total equity (000,000’s)

* Includes economic cost of holding treasury shares

50

Inside ProAssurance’s Balance Sheet

3/31/13

51

Inside ProAssurance’s Income Statement

3/31/13

52

$35.5 Non-Taxable Gain on Acquisition

Recent Book Value per Share History

Steady Return in an Unfavorable Environment

Long-term ROE target: 12% -14%

Driven to Excel / Focused on Shareholder Value

Maintaining profitability

Continuing growth in book value per share

Producing sustainable shareholder value

Focusing on long-term—ready for the market turn

Current Prices Continue to Offer a Compelling Buying Opportunity

Current Price to Q1 2013 Book: 1.2x Average Since Inception: 1.4x

Unadjusted for dividends

Prices Adjusted for 2:1 Stock Split

55

ProAssurance Transaction Discussion

Medmarc is broadening our product offerings and capabilities in

protecting the delivery of healthcare

protecting the delivery of healthcare

With the acquisition of

Independent Nevada Doctors Insurance Exchange (IND),

ProAssurance becomes the leading

medical professional liability writer in Nevada

Independent Nevada Doctors Insurance Exchange (IND),

ProAssurance becomes the leading

medical professional liability writer in Nevada

Medmarc Transaction Update

A leading products liability writer in medical

technology and life sciences

technology and life sciences

Meaningful legal professional liability book

Acquisition completed effective January 1, 2013

Functioning as an operationally independent

subsidiary

subsidiary

Broad acceptance in Medmarc’s target markets

Coordinated marketing opportunities growing

57

IND Transaction Update

Leading MPL writer in Nevada

Acquisition completed in late November 2012

Integration well underway and proceeding

smoothly

smoothly

New business opportunities evolving as agents

understand the scope and capability of the

combined organizations

understand the scope and capability of the

combined organizations

58

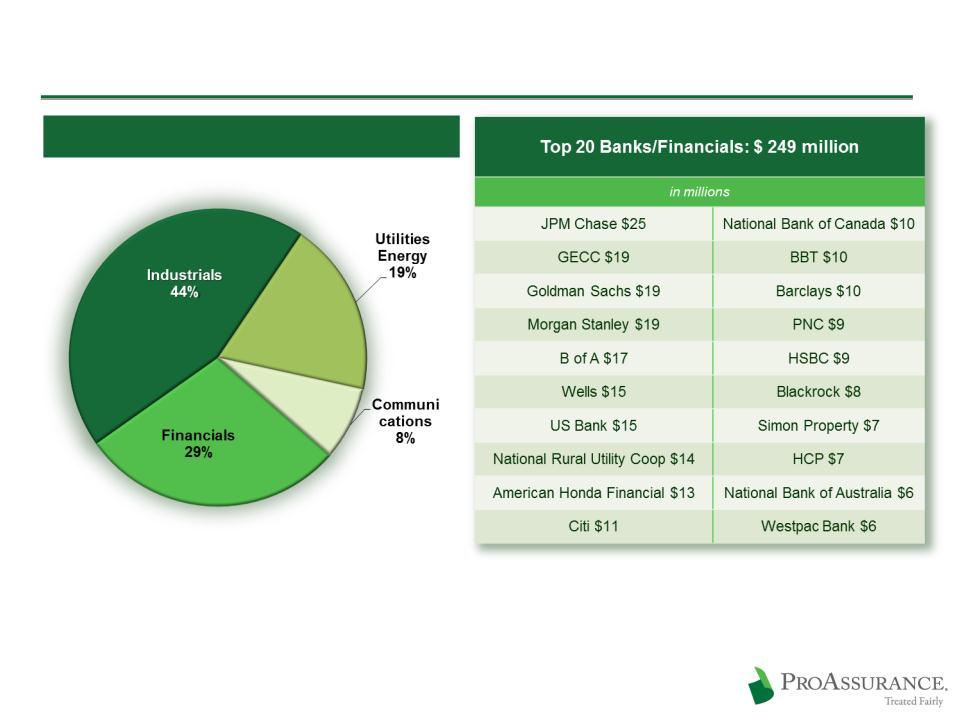

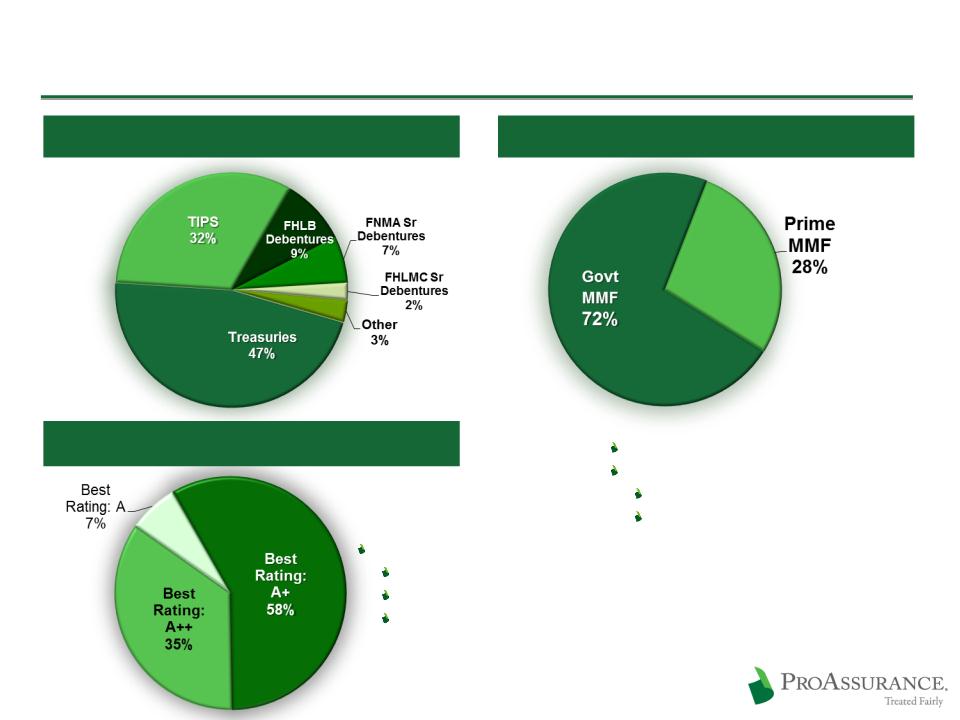

Investment Portfolio Detail

ProAssurance remains conservatively

invested, to ensure our ability to keep our

long-term promise of insurance protection

invested, to ensure our ability to keep our

long-term promise of insurance protection

ProAssurance: Investment Profile

$4.3 Billion Overall Portfolio

$3.6 Billion Fixed Income Portfolio

Average duration: 3.9 years

Average tax-equivalent

income yield: Q1 13: 4.2% / Q1 12: 4.4%

income yield: Q1 13: 4.2% / Q1 12: 4.4%

Investment grade: 93%

Weighted average: A+

03/31/13

Tax credit portfolio not reflected in investment

income—provides approximately $17.8 million

in tax credits and $10.9 million in deductions in

2013

income—provides approximately $17.8 million

in tax credits and $10.9 million in deductions in

2013

CUSIP-level portfolio disclosure on our website:

www.proassurance.com/investorrelations/supplemental.aspx

www.proassurance.com/investorrelations/supplemental.aspx

60

ProAssurance Portfolio Detail: Asset Backed

03/31/13

Subject to Rounding

Asset Backed: $490 Million

Weighted Average Rating: “AA+”

61

ProAssurance Portfolio Detail: Corporate

Corporates: $1.6 Billion

Weighted Average Rating: A-

3/31/13

62

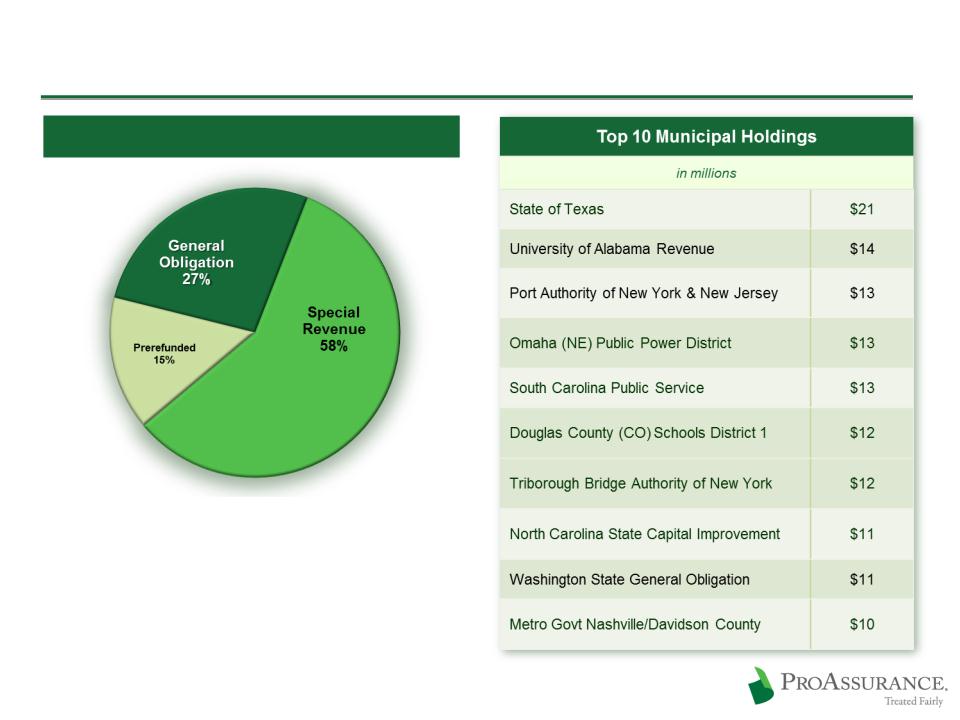

ProAssurance Portfolio Detail: Municipals

Municipals: $1.3 Billion / Average Rating is AA

Investment policy has always required

investment grade rating prior to applying the

effect of insurance

investment grade rating prior to applying the

effect of insurance

Weighted Average Rating: AA

12/31/12

63

ProAssurance Portfolio Detail: Equities & Other

12/31/12

64

Equities & Other: $489 Million

4.9% TE Book Yield

13% TE IRR

ProAssurance Portfolio Detail: Various

Rated A1/P1 or better

Money Markets:

Moody’s: Aaa

S&P: AAA

Weighted average rating

Moody’s: AA3

S&P: AA-

A. M. Best: A+

Treasury / GSE: $291 Million

Short Term: $149 Million

BOLI: $53 Million

03/3/13

65

Additional Financial Data

Prepared for an improving market

Conservative Use of Debt / Low Leverage

Credit facility accessed for

$125 million in short-term

borrowing (December 2012)

$125 million in short-term

borrowing (December 2012)

Debt to Equity

No Debt Prior to 2001

Strong Capital Position

67

The choice: chase yield or extend duration

We are maintaining duration, looking for

opportunities

opportunities

Pricing discipline becomes even more

critical in a low interest rate environment

critical in a low interest rate environment

Lack of investment yield may be a hard

market catalyst

market catalyst

Return on Equity and Investment Returns

Assumes a 1:1 premium to surplus ratio for physicians

professional liability claims-made coverages

professional liability claims-made coverages

Combined Ratio Required to

Generate a 13% Return on Equity

Generate a 13% Return on Equity

Long-Term ROE Target is 12%-14%

The Yield Trap

Revised to reflect yields at 03/31/13

68