Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESENTATION MATERIALS FOR GROUP PRESENTATION. - PROASSURANCE CORP | exhibittwo.htm |

| 8-K - FILING TO DISCLOSE PRESENTATION MATERIALS. - PROASSURANCE CORP | bodyoffiling.htm |

May 14, 2013

2013 Securities Research Conference

2013 Securities Research Conference

Edward L. Rand, Jr. Chief Financial Officer

Frank B. O’Neil Investor Relations Officer

Investor Presentation

Investor Presentation

This presentation contains Forward Looking Statements and other information designed to convey

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

We especially identify statements concerning our transactions involving Medmarc Insurance Group

and Independent Nevada Doctors Insurance Exchange as Forward Looking Statements and direct

your attention to our news releases issued on June 27, 2012, our Current Report on Form 8K,

issued on June 28, 2012 and our 10K, filed on February 19, 2013 for a discussion of risk factors

pertaining to these transactions and subsequent integration into ProAssurance.

and Independent Nevada Doctors Insurance Exchange as Forward Looking Statements and direct

your attention to our news releases issued on June 27, 2012, our Current Report on Form 8K,

issued on June 28, 2012 and our 10K, filed on February 19, 2013 for a discussion of risk factors

pertaining to these transactions and subsequent integration into ProAssurance.

This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in

our remarks and discussions. A reconciliation of these measures to GAAP measures is available in

our latest quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Report on Form 8K disclosing that release.

our remarks and discussions. A reconciliation of these measures to GAAP measures is available in

our latest quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Report on Form 8K disclosing that release.

FORWARD LOOKING STATEMENTS

2

NON-GAAP MEASURES

ProAssurance Financial & Strategy Overview

Edward L. Rand, Jr.

Chief Financial Officer

Chief Financial Officer

ProAssurance Corporate Profile

Specialty liability insurance writer

Healthcare Professional Liability (HCPL)

Life sciences and medical devices

Attorney’s professional liability

Market Cap: ~$3.0 billion

Shareholders’ Equity: $2.4 billion

Total Assets: $5.3 billion

Claims-Paying Ratings: “A” by A. M. Best and Fitch

Debt ratings recently upgraded by Moody’s

4

Q1 2013 Highlights

Increased Net and Operating Income Y-O-Y

ROE of 13.4%

Book Value per share now $38.19

4% increase since year-end 2012

Book Value per Share has grown each year since

1991

1991

Recent transactions contributing to our results

with integration proceeding as planned

with integration proceeding as planned

5

Q1 2013 Income Statement Highlights

in millions, except per share data

6

|

|

March 31,

|

Y-OVER-Y

Change |

|

|

|

2013

|

2012

|

|

|

Gross Premiums Written

|

$ 163

|

$ 170

|

-4%

|

|

Net Investment Result

|

32

|

31

|

+2%

|

|

Total Expenses (Includes Loss Costs)

|

95

|

105

|

-10%

|

|

Net Income (Includes Realized Investment Gains & Losses

and gain on acquisition) |

$ 113

|

$ 56

|

+103%

|

|

Operating Income

|

$ 60

|

$ 48

|

+24%

|

|

Net Income per Diluted Share

|

$1.82

|

$0.90

|

+102%

|

|

Operating Income per Diluted Share

|

$0.97

|

$0.78

|

+24%

|

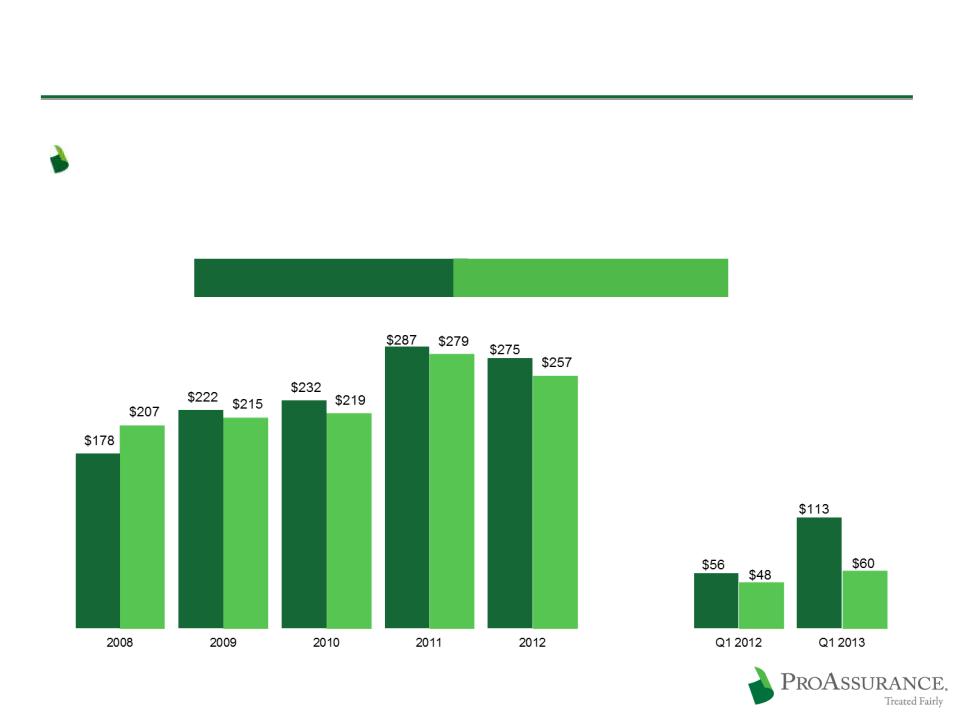

Disciplined Underwriting

Five year Premium History

7

Focused on writing profitable business to ensure

long-term success

long-term success

Premium decline driven by competition, physician

consolidation and rate actions driven by an

improving loss environment

consolidation and rate actions driven by an

improving loss environment

Gross Premiums Written

Net Premiums Earned

Q1 2013 Income Statement Highlights

in millions, except per share data

8

|

|

March 31,

|

Y-OVER-Y

Change |

|

|

|

2013

|

2012

|

|

|

Gross Premiums Written

|

$ 163

|

$ 170

|

-4%

|

|

Net Investment Result

|

32

|

31

|

+2%

|

|

Total Expenses (Includes Loss Costs)

|

95

|

105

|

-10%

|

|

Net Income (Includes Realized Investment Gains & Losses

and gain on acquisition) |

$ 113

|

$ 56

|

+103%

|

|

Operating Income

|

$ 60

|

$ 48

|

+24%

|

|

Net Income per Diluted Share

|

$1.82

|

$0.90

|

+102%

|

|

Operating Income per Diluted Share

|

$0.97

|

$0.78

|

+24%

|

Seeking Increased Yield But Balancing Risk

We continue to focus on

maintaining a high quality,

well diversified fixed income

portfolio

maintaining a high quality,

well diversified fixed income

portfolio

We are making incremental

changes to obtain higher yields

in blue chip investments

changes to obtain higher yields

in blue chip investments

$4.3 Billion

Portfolio

Portfolio

$4.3 Billion

Portfolio

Portfolio

Fixed Income:

84%

84%

Fixed Income:

84%

84%

Short Term: 2%

Short Term: 2%

Equity and Equity Substitutes: 12%

Equity and Equity Substitutes: 12%

BOLI: 1%

BOLI: 1%

3/31/13

9

Q1 2013 Balance Sheet Highlights

Split adjusted, in billions, except Book Value per share

Shareholders’ Equity $ 2.4 $ 2.3 +4%

Total Investments 4.3 3.9 +10%

Total Assets 5.2 4.9 +6%

Policy Liabilities 2.5 2.3 +9%

3/31/13 12/31/12 CHANGE

Shareholders’ Equity

66% increase since 2008

Book Value per Share $ 38.19 $36.85 +4%

10

Historical Financial Performance

Our disciplined, long-term approach drives

consistent profitability

consistent profitability

$ in millions

Net Income1

Operating Income2

11

1 Includes a gain of $35.5 million in the first quarter of 2013 in connection with our acquisition of Medmarc as a result of the value

of the net assets acquired vs. our purchase price.

of the net assets acquired vs. our purchase price.

2 Excludes the after-tax effects of net realized gains or losses and one-time items that do not reflect normal operating results

Consistent Approach to Reserves

Consistent reserving practices provide protection

against a loss trend reversal and capital erosion

against a loss trend reversal and capital erosion

$ in thousands

Capital Management Priorities

Preferred use is to support growth through M&A or new business

We balance future needs with current market reality

Regular dividend is $1.00/share

~2% yield based on 5/8/13 closing price

Prudent share repurchase program

$321 million spent to

repurchase 6.1 million shares

since 2005

repurchase 6.1 million shares

since 2005

Repurchasing shares at prices

that enhance shareholder value

and build Book Value

that enhance shareholder value

and build Book Value

Additional funds utilized

to eliminate long-term debt

to eliminate long-term debt

Share Repurchase History

13

Captures our focus on long-term excellence

Increased every year we have been public

The Payoff: Consistent Book Value Growth

14

Inception to 3/31/13

CAGR: 16%

CAGR: 16%

Cumulative: 2,179%

10 Year Summary (2003 -2012)

CAGR: 16%

CAGR: 16%

Cumulative: 360%

Historical Book Value Per Share

Split Adjusted

Dividends Shown in the Year Declared

Split Adjusted

Dividends Shown in the Year Declared

Reflects all stock splits and includes all dividends in the year declared

Share price reflects investor confidence in

our business decisions and long-term strategy

our business decisions and long-term strategy

The Payoff: Steady Share Price Increase

15

Historical Share Price

Reflects all stock splits

2012 excludes

$2.50/share

special dividend

$2.50/share

special dividend

Inception to 3/31/13

CAGR: 15%

CAGR: 15%

Cumulative: 1,706%

10 Year Summary (2002 -2012)

CAGR: 15%

CAGR: 15%

Cumulative: 302%

Strategies for Future Success

Frank B. O’Neil

Senior Vice-President

Building a Bridge to the Future

Our core business is at a pivot point

We are uniquely positioned to succeed by serving the

emerging market and remaining legacy business

emerging market and remaining legacy business

Smaller competitors with less experience and capacity

have decisions to make

have decisions to make

17

Legacy business is largely

single-state, solo

and small groups.

A substantial amount of this

business will remain, but

will demand more from

insurers.

single-state, solo

and small groups.

A substantial amount of this

business will remain, but

will demand more from

insurers.

The future will be

dominated by large

groups and institutions,

often multi-disciplinary

and multi-state. They

will demand financial

strength and deep

expertise.

dominated by large

groups and institutions,

often multi-disciplinary

and multi-state. They

will demand financial

strength and deep

expertise.

Building a Bridge to the Future

Larger risks will demand sophisticated

coverages that span the continuum of healthcare

coverages that span the continuum of healthcare

Broad healthcare liability experience is our

foundation

foundation

We added capacity & capability through M&A

Example: Medmarc, PICA and Mid-Continent

Home

Healthcare

Healthcare

Non-Traditional

Delivery Settings

Delivery Settings

Multi-Specialty

Clinics

Clinics

Hospital & Facility

Centered Care

Centered Care

New delivery

devices,

techniques and

research

devices,

techniques and

research

ProAssurance spans the continuum of care

Traditional

Practices

Practices

18

ProAssurance Will Grow Prudently

ProAssurance is a demonstrated leader in M&A

We will broaden our lines of coverage as needed

Healthcare-related

Through prudent leverage of our expertise and the

addition of specialized expertise

addition of specialized expertise

The market will firm and we are prepared to

grow organically

grow organically

Past history teaches us the turn will be sudden and

capital will allow us to respond rapidly

capital will allow us to respond rapidly

19

Strategy for an Evolving Market

Shaped by a healthcare landscape that will

change—with or without federal healthcare

reform

change—with or without federal healthcare

reform

Expanding our capabilities and commitment

across the continuum of healthcare

across the continuum of healthcare

Building on two decades of hospital experience

Recent expansion into products liability for life

sciences and medical devices through M&A

sciences and medical devices through M&A

Enhancing our historical commitment to

individual providers and small groups

individual providers and small groups

20

Strategy for an Evolving Market

Leverage our reach, expertise and financial

strength with larger accounts

strength with larger accounts

Largest non-profit healthcare

system in the US

system in the US

Now in Michigan, Florida,

Illinois, Indiana and Texas

Illinois, Indiana and Texas

Insuring Ascension-affiliated

physicians through coordinated,

jointly insured programs

physicians through coordinated,

jointly insured programs

Financial involvement of both entities creates incentive to reduce risk

*www.ascensionhealth.org/index.php?option=com_locations&view=locations&Itemid=148

Ascension Health’s Ministry Locations*

21

Strategy for an Evolving Market

Joint physician/hospital insurance products to

address the unique risk tolerance and claims-

handling expectation of each insured

address the unique risk tolerance and claims-

handling expectation of each insured

Partnerships with existing physician-focused

companies to leverage hospital expertise

companies to leverage hospital expertise

Recently announced California venture with

CAP-MPT: CAPAssurance

CAP-MPT: CAPAssurance

Alternative risk and self-insurance mechanisms

Captive insurance, risk sharing programs and

Risk Retention Groups for

specific specialties or regions

Risk Retention Groups for

specific specialties or regions

22

Healthcare Reform

No meaningful change after the election

Known: More customers for us

May accelerate the growth of hospital-owned practices and

consolidation into larger groups

consolidation into larger groups

Provides an opportunity for us due to our geographic reach,

long-term experience in hospitals and our financial strength

long-term experience in hospitals and our financial strength

We have enhanced our ability to write new classes of business

through acquisitions

through acquisitions

May hasten the need for consolidation of smaller insurers

Unknown: Effect on the medical/legal environment

Increased patient frustration with the system

Possibility of more unexpected outcomes

23