Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Air Transport Services Group, Inc. | a20138kcover-may10annualst.htm |

0 Air Transport Services Group, Inc. Annual Meeting of Shareholders May XX, 2013 Investor Meetings May 2013

Safe Harbor Statement Except for historical information contained herein, the matters discussed in this presentation contain forward-looking statements that involve risks and uncertainties. There are a number of important factors that could cause Air Transport Services Group's ("ATSG's") actual results to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, changes in market demand for our assets and services, the cost and timing associated with the modification of Boeing 767 and 757 aircraft, the availability and costs to acquire used passenger aircraft for freighter conversion, ABX Air’s ability to maintain on-time service and control costs under its operating agreement with DHL, and other factors that are contained from time to time in ATSG's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this presentation and should not place undue reliance on ATSG's forward-looking statements. These forward-looking statements were based on information, plans and estimates as of the date of this presentation. ATSG undertakes no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. 1

2 Business Units Leasing ACMI Services Other

3 2012 Accomplishments ▌ Consolidated CCIA and ATI operations ▌ Awarded two-year combi agreement with military ▌ Bought two 767-300s, one 757-200 combi ▌ Completed mod of four 767s ▌ Agreed to expand AMES hangar facilities in Wilmington ▌ Established new dedicated sales presence in Asia, Europe ▌ Retired all DC-8 and 727 freighters to create all-767/757 freighter fleet ▌ Extended credit agreement, expanded revolver ▌ Provided outstanding service for DHL and other customers 98.8% 98.2% 98.9% 99.0% 1Q 2Q 3Q 4Q DHL CMI 2012 Reliability Performance Goal: 97.75%

4 First Quarter 2013 Accomplishments ▌ Completed CCIA-ATI merger ▌ Agreed to add three 767s, one 757 to DHL’s U.S. network ▌ Extended agreements for DHL Mideast service ▌ Completed purchase of two 757 combis from National Air Cargo ▌ Launched FAA certification for 757 combis ▌ Started construction of new AMES hangar facilities

5 ATSG Strategy – It Starts With The Lease 767 and 757 freighter dry leases, plus airline operations and other complementary services generating incremental returns Foundation of ATSG’s economic model ▌ Cargo Aircraft Management (CAM) purchases passenger aircraft, manages extensive modification and upgrade process ▌ Completed aircraft offered for dry lease at market rates to yield 10%+ unlevered ROIC ▌ Dry leases typically have 5-7 year term; customers assume operating risk ▌ ATSG subsidiary airlines compete with third-party lessees for access to assets ▌ Incremental returns from maintenance and other custom services

6 ATSG Strategy – ACMI or CMI Operations We crew, maintain and insure our aircraft types for incremental (CMI) or package (A+CMI) price ▌ABX Air and ATI provide ACMI services for cargo transport companies worldwide ▌Customer accepts fuel-price risk ▌ACMI generates incremental operating return above market lease rates ▌CMI services available for customer aircraft – incremental return without capital investment

7 ATSG Strategy – Customized Support The world’s only source of complete turnkey solutions for customers seeking midsized freighter air network services Airborne Maintenance & Engineering Services ▌ Heavy & line maintenance, component overhaul, engineering, manufacturing ▌ Customers include major airlines, private operators ▌ Expanding facilities to serve more 3rd party fleets LGSTX Services, Inc. ▌ Equipment leasing, and equipment/facility maintenance ▌ Customers: major airlines, regional airports ▌ Logistics support services ▌ Sort management services for USPS Logistics Maintenance

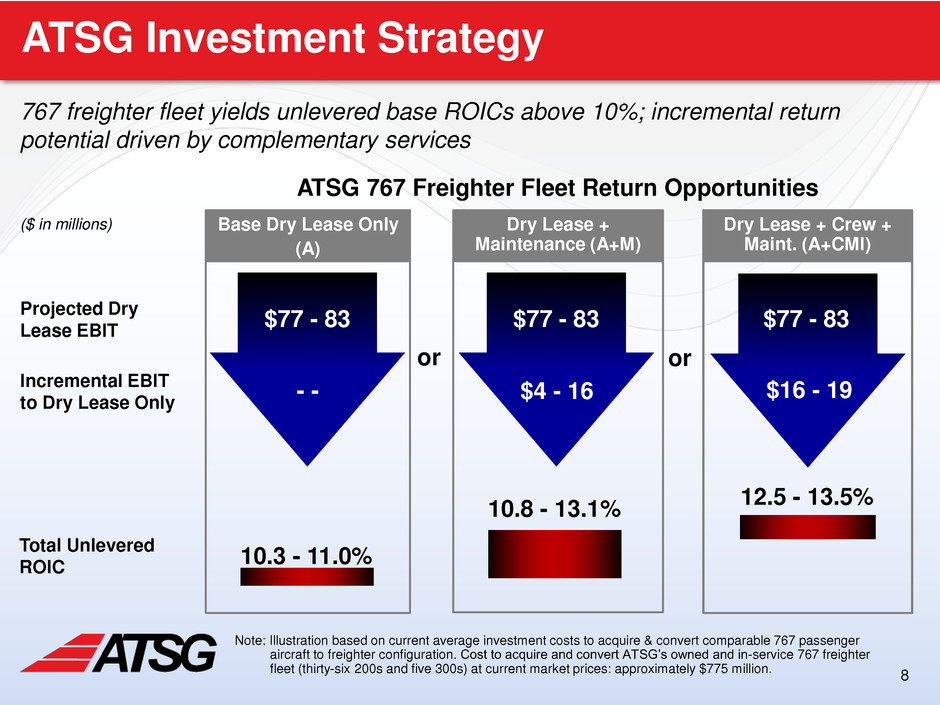

8 ATSG Investment Strategy 767 freighter fleet yields unlevered base ROICs above 10%; incremental return potential driven by complementary services Base Dry Lease Only (A) Dry Lease + Crew + Maint. (A+CMI) Dry Lease + Maintenance (A+M) Projected Dry Lease EBIT Incremental EBIT to Dry Lease Only Total Unlevered ROIC $77 - 83 - - $77 - 83 $77 - 83 $4 - 16 $16 - 19 Note: Illustration based on current average investment costs to acquire & convert comparable 767 passenger aircraft to freighter configuration. Cost to acquire and convert ATSG’s owned and in-service 767 freighter fleet (thirty-six 200s and five 300s) at current market prices: approximately $775 million. ($ in millions) ATSG 767 Freighter Fleet Return Opportunities or or 12.5 - 13.5% 10.8 - 13.1% 10.3 - 11.0%

9 2012 Results 2012 2011 Revenues ▌ Revenues increased 10% excluding Schenker, reimbursables ▌ CAM pre-tax earnings up 29% ▌ ACMI Services loss of $15 million in 2012 due to delayed deploy- ments, Schenker-related costs ▌ Salaries, wages & benefits down $4 million, pension expense up $6 million in 2012 ▌ 2011 pre-tax, EPS included $27 million of impairment, $7 million refinancing charges ▌ Low balance sheet leverage offers capacity for growth 2012 2011 Adj. EBITDA* 2012 2011 Pre-tax Income $607 $730 $66 $41 $0.65 $0.37 $163 $181 ($M, except ratios) 12/31/2012 12/31/2011 Cash & Cash Equivalents $ 15.4 $ 30.5 Total Debt 364.5 346.9 EBITDA* 165.0 145.9 Adjusted EBITDA* 163.2 180.8 Adjusted Net Leverage Ratio* 2.14 1.75 ATSG’s 2012 results, strong financial position demonstrate the core strength of its business model: low risk with strong cash-generating power * Non-GAAP metric. See table at end of this presentation for reconciliation to nearest GAAP results Schenker $M $M $M

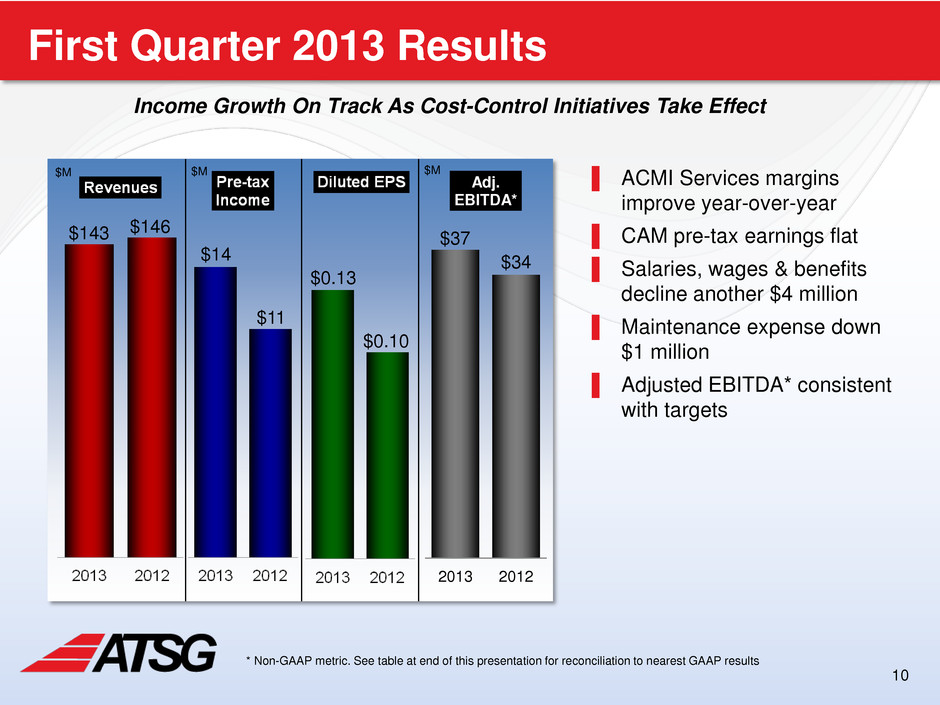

10 First Quarter 2013 Results ▌ ACMI Services margins improve year-over-year ▌ CAM pre-tax earnings flat ▌ Salaries, wages & benefits decline another $4 million ▌ Maintenance expense down $1 million ▌ Adjusted EBITDA* consistent with targets 2013 2012 Adj. EBITDA* $143 $146 $14 $11 $0.13 $0.10 $37 $34 Income Growth On Track As Cost-Control Initiatives Take Effect $M $M $M * Non-GAAP metric. See table at end of this presentation for reconciliation to nearest GAAP results

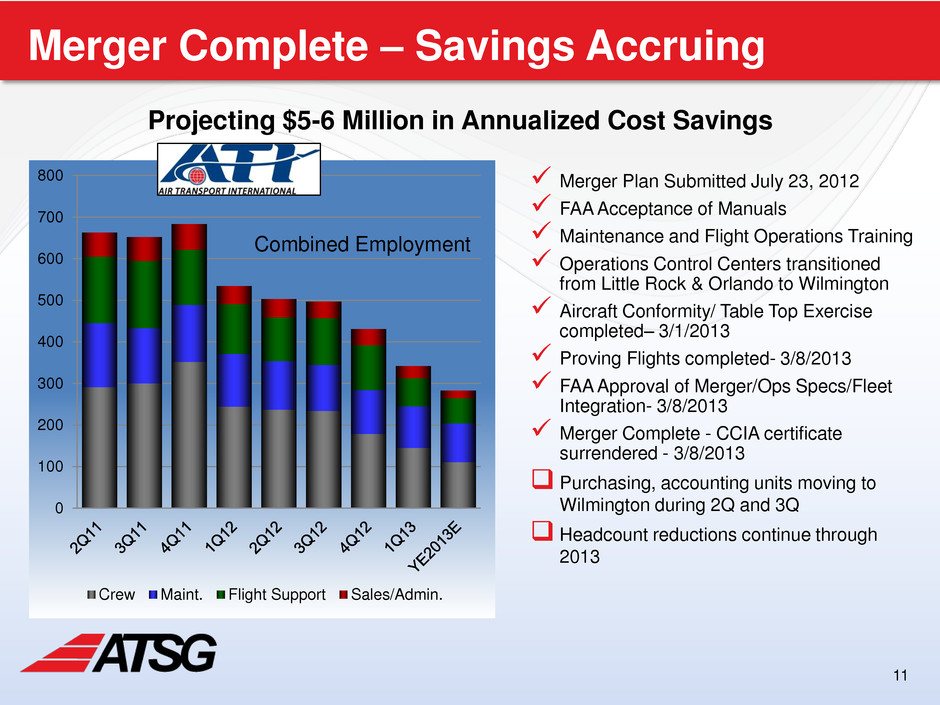

11 Merger Complete – Savings Accruing Merger Plan Submitted July 23, 2012 FAA Acceptance of Manuals Maintenance and Flight Operations Training Operations Control Centers transitioned from Little Rock & Orlando to Wilmington Aircraft Conformity/ Table Top Exercise completed– 3/1/2013 Proving Flights completed- 3/8/2013 FAA Approval of Merger/Ops Specs/Fleet Integration- 3/8/2013 Merger Complete - CCIA certificate surrendered - 3/8/2013 Purchasing, accounting units moving to Wilmington during 2Q and 3Q Headcount reductions continue through 2013 0 100 200 300 400 500 600 700 800 Crew Maint. Flight Support Sales/Admin. Combined Employment Projecting $5-6 Million in Annualized Cost Savings

12 3.2x 2.7x 1.8x 1.9x 2.2x 2008 2009 2010 2011 2012 Capital Base to Support Growth Strong Adjusted EBITDA generation, moderate financial leverage and minimal off-balance sheet liabilities provide capacity for further growth $113.4 $135.8 $158.9 $151.9 2009 2010 2011 2012 Debt Obligations / Adjusted EBITDA* Adjusted EBITDA* Less Maintenance Capex * Adjusted EBITDA is a non-GAAP metric. Debt Obligations are as of end of year. See table at end of this presentation for reconciliation to nearest GAAP results $M

13 Global Industry Facing Challenges ▌ Demand stagnant since 2010 ▌ Overcapacity ▌ New large widebody freighters ▌ Passenger belly space ▌ Modal shift ▌ Lower yields ▌ Fuel prices remain high ▌ Price competition from faster growing Middle East, Asian freight carriers International Domestic + Intl. Source: IATA

14 (Fastest Growing Regions, 2011-2031) ATSG’s Global Opportunities Projected Long-Term Annual Demand Growth Source: Boeing World Air Cargo Forecast 2012-13 Large Freighter Markets ATSG Target Markets Americas ▐ Strong growth ▐ ATSG has Miami hub ▐ Ideal 767 range/payload fit for north-south routes Intra Asia ▐ Rapid economic growth ▐ Manufacturing moving inland China and to Emerging Markets, i.e. Vietnam, Thailand ▐ China becoming consumer nation, to/from China ▐ Ideal 767 range/payload fit as feeder aircraft Middle East ▐ Strong growth ▐ Aging, unreliable Airbus fleets due for replacement Dry Lease Only ▐ Large domestic growth ▐ Intra-China ▐ Intra-Brazil ATSG’s Current Opportunities 2.3% 2.4% 3.5% 4.8% 5.3% 5.6% 5.7% 5.7% 5.8% 5.8% 6.9% 8.0% Intra-N. Amer. Intra-Europ Europe-N. Amer. Europe-Africa Europe-L. Amer. L. Amer.-N. Amer. Europe-Mideast Europe-Asia S. Asia-Europe Asia-N. America Intra Asia Intra China

15 Current 767 Freighter Deployments 20 External Leases 21 Internal Leases (ACMI) 13 DHL - U.S. Seven-year leases running thru 2017-18 Piloted by ABX Air crews under CMI agreement 7 ATI Geographic Distribution 14 ABX Air 7 Other External Leases 3 Amerijet thru 2017-18 2 CargoJet thru 2015 1 RIO thru 2016 1 FirstAir thru 2015 41 CAM-Owned 767Fs in Service 4 leased from DHL; ABX operates them in U.S. under CMI agreement 2 leased 767-300s in ACMI service In-service Targets: 1 in 2Q 2013 1 in 3Q 2013 Note: Reflects in-service aircraft as of May 2013 6 in Latin America 2 in Europe 3 in Middle East 10 in North America 767-200 767-300 6 Leased From Others 2 CAM-Owned 767-300s in Mod

16 32 2 1 11 6 10 5 3 4 3 5 3 2 3 0 5 10 15 20 25 30 35 40 ATSG Air Contractors Cargojet Maximus Midex MNG myCargo Rio Linhas Star Air ULS Global Sources of Medium Wide-body Freighters - ACMI Basis (number of aircraft by type, as of 4Q 2012) Source: Air Cargo Management Group Unrivaled Leader in ACMI Medium Wide-body 1. Includes, as of 4Q 2012, 767 freighter aircraft operated by ATSG airlines ABX Air and Air Transport International, including 13 dry-leased to DHL through 2017 but operated by ATSG airline under CMI, and 767s dry-leased from other entities. 2. 767-200F aircraft operated by these carriers are owned by ATSG’s Cargo Aircraft Management subsidiary and provided under long-term dry leases. Boeing 767-300F Boeing 767-200F Airbus A300-600F Airbus A300-B4F Airbus A310-300F 1 2 2

17 How we win in challenging markets Our aircraft assets, and our business model, emphasize flexibility Midsize Boeing 767-300 freighter particularly valuable as yields soften ▌ 767-300 range covers five of the eight largest-volume transcontinental routes normally served by large freighters without refueling ▌ Operating cost for 767-300 significantly less than large freighters, ▌ New manufacturing centers in Africa, Asia and S. America driving major freight integrators to expand regional hub and spoke networks Midsize freighter market less vulnerable to aggregate demand swings ▌ Competitive network need protects air network spokes through down markets ▌ ACMI, lease contracts not directly volume sensitive Business model supports unique, flexible solutions for customers as market turns ▌Rapid response with aircraft, crew, and maintenance support to replace parked assets ▌Connect freight companies that can jointly, but not separately, fill 767 under block-space agreements ▌WET2DRY - low-risk transition from other aircraft into 767

18 2013 Outlook ▌ 2013 Adjusted EBITDA* from continuing operations projected to be $175-180 million from baseline business, with upside potential ▌ Two 767-300 freighters in conversion; no more airframe purchases in 2013 without customer commitment ▌ Four 757-200 combis will replace remaining DC-8 combis in mid-2013, yielding all-767/757 fleet ▌ Factors impacting guidance: ▌ Progress in 767 freighter deployment ▌ Reductions in overhead, operating expense from merger of ATI and CCIA ▌ Benefits in maintenance, crew, and other operating expenses from all-767/757 fleet * Non-GAAP metric. See table at end of this presentation for reconciliation to nearest GAAP results

19 Non-GAAP Reconciliation Statement * Adjusted Pre-Tax Earnings from Continuing Operations, Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio and Adjusted Net Leverage Ratio are non-GAAP financial measures and should not be considered alternatives to net income or any other performance measure derived in accordance with GAAP. Adjusted Pre-Tax Earnings from Continuing Operations excludes pre-tax earnings from the severance and retention agreement with DHL that ended in 2010, unrealized gains or losses from derivative instruments, impairment charges for aircraft, goodwill & intangibles, and costs from termination of credit agreements. Adjusted EBITDA from Continuing Operations is defined as EBITDA (Pretax Earnings (loss) from Continuing Operations Before Income Taxes minus Interest Income, plus Interest Expense and plus Depreciation and Amortization) excluding results from Severance & Retention Activities, unrealized gains or losses in derivative instruments, impairment charges for aircraft, goodwill & intangibles, and costs from termination of credit agreements. Debt Obligations/Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations at end of period) divided by Adjusted EBITDA from Continuing Operations. Adjusted Net Leverage Ratio is defined as Debt Obligations minus Cash and Cash Equivalents, divided by Adjusted EBITDA from Continuing Operations. Management uses these adjusted financial measures in conjunction with GAAP finance measures to monitor and evaluate its performance, including as a measure of financial strength. Adjusted Pre-tax Earnings, Adjusted EBITDA and Debt Obligations/Adjusted EBITDA Ratio should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP, or as alternative measures of liquidity. 2008 2009 2010 2011 2012 (56,619)$ 45,358$ 63,317$ 40,860$ 66,320$ Impairment Charges 91,241 - - 27,144 - Severance & Retention Activities (816) (16,727) (3,549) - - Net Deriv. Loss and Credit Agrmt Termination 7,767 (1,879) 33,806$ 28,631$ 59,768$ 75,771$ 64,441$ Interest Income (2,335) (449) (316) (179) (136) Interest Expense 37,002 26,881 18,675 14,181 14,383 Depreciation and amortization 93,752 83,964 87,594 91,063 84,477 162,225$ 139,027$ 165,721$ 180,836$ 163,165$ 512,486$ 377,427$ 302,528$ 346,904$ 364,481$ 3.16 2.71 1.83 1.92 2.23 Cash & Cash Equivalents, end of period $30,503 $15,442 Adjusted Net Leverage Ratio 1.75 2.14 Reconciliation Stmt. ($ in 000s except Ratios) Debt Obligations/Adjusted EBITDA Ratio* GAAP Pre-tax Earnings (Loss) from Continuing Operations Adjusted EBITDA from Continuing Operations* Debt Obligations - end of period Adjusted Pre-tax Earnings from Continuing Operations* 1Q12 2Q12 3Q 2 4Q12 1Q 3 10,743$ 18,171$ 18,959$ 18,447$ 13,592$ Derivative Gain (460) (202) (294) (923) (290) $ 10,283 $ 17,969 $ 18,665 $ 17,524 $ 13,302 Interest Income (28) (38) (38) (32) (21) Interest Expense 3,547 3,671 3,668 3,497 3,132 Depreciation and amortization 20,300 21,514 21,057 21,606 20,920 $ 34,102 $ 43,116 $ 43,352 $ 42,595 $ 37,333 GAAP Pre-t x arnings R concili ti Stmt. ($ in 000s) Adjusted EBITDA from Continuing Operations from Continuing Oper ti ns Adj. Pre-tax Earnings - Cont. Oper.