Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TRC COMPANIES INC /DE/ | trcform8-khoulihanlokeycon.htm |

Investor Presentation Houlihan Lokey – Global Industrials Conference Third Quarter Fiscal 2013 TRR

Safe Harbor Statement 2 Certain statements in this presentation may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify these statements by forward-looking words such as "may," "expects," "plans," "anticipates," "believes," "estimates," or other words of similar import. You should consider statements that contain these words carefully because they discuss TRC’s future expectations, contain projections of the Company’s future results of operations or of its financial condition, or state other "forward-looking" information. TRC believes that it is important to communicate its future expectations to its investors. However, there may be events in the future that the Company is not able to accurately predict or control and that may cause its actual results to differ materially from the expectations described in its forward-looking statements. Investors are cautioned that all forward-looking statements involve risks and uncertainties, and actual results may differ materially from those discussed as a result of various factors, including, but not limited to, the uncertainty of TRC’s operational and growth strategies; circumstances which could create large cash outflows, such as contract losses, litigation, uncollectible receivables and income tax assessments; regulatory uncertainty; the availability of funding for government projects; the level of demand for TRC’s services; product acceptance; industry-wide competitive factors; the ability to continue to attract and retain highly skilled and qualified personnel; the availability and adequacy of insurance; and general political or economic conditions. Furthermore, market trends are subject to changes, which could adversely affect future results. See the risk factors and additional discussion in TRC’s Annual Report on Form 10-K for the fiscal year ended June 30, 2012, Quarterly Reports on Form 10-Q, and other factors detailed from time to time in the Company’s other filings with the Securities and Exchange Commission.

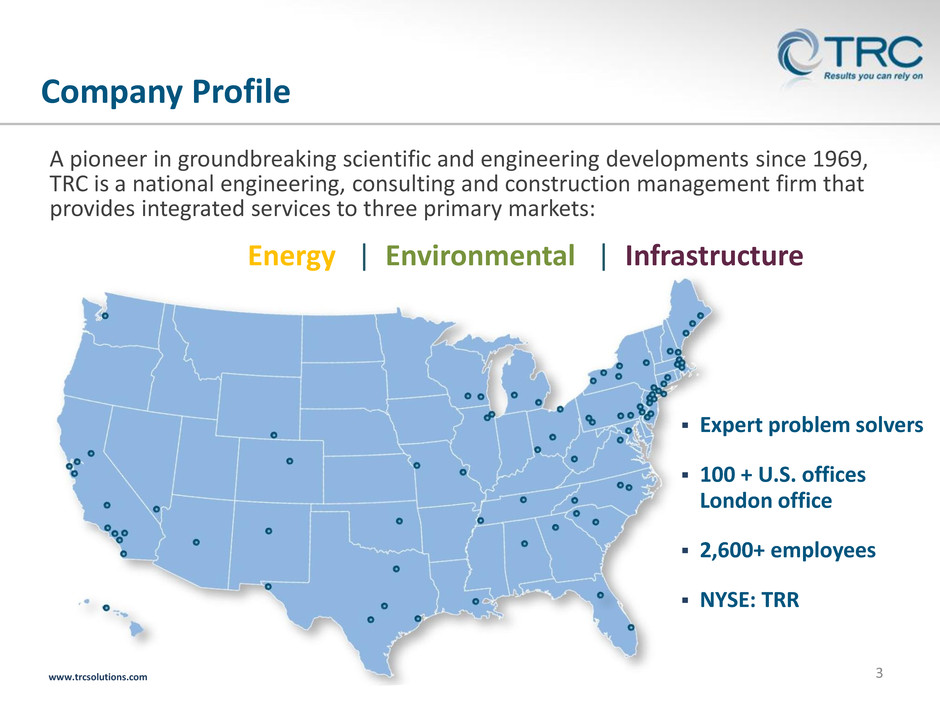

A pioneer in groundbreaking scientific and engineering developments since 1969, TRC is a national engineering, consulting and construction management firm that provides integrated services to three primary markets: Energy | Environmental | Infrastructure Expert problem solvers 100 + U.S. offices London office 2,600+ employees NYSE: TRR 3 Company Profile www.trcsolutions.com

ENR Top 500 Design Firms 4 "The energy market growth is inevitable and one of the largest sectors for capital investment. Any design firm working and supporting that market will have a bright future.“ Chris Vincze, CEO, TRC Companies Inc. E 32 36 TRC Cos. Inc., Lowell, Mass. Rank 2013 2012 Firm Firm Type

Investment Highlights 5 Shifted to growth focus after successful turnaround execution Strong balance sheet & leaner cost structure Large addressable market opportunity All three segments provide significant long-term growth potential Diversified revenue stream with attractive customer base Well-positioned competitively

Organizational Transformation 6 Strengthened balance sheet Executed multi-year organizational restructuring Centralized management team and key functions Implemented company-wide cost reductions Invested in internal technology systems Narrowed business and working capital focus Restructured or exited unprofitable business lines Rebranded TRC and raised awareness nationwide Shifted focus toward organic and acquisition growth Fiscal 2012 NSR Growth = Organic: 45% / Acquisitions: 55% Two successful acquisitions in fiscal 2012 Acquired three businesses in fiscal 2013

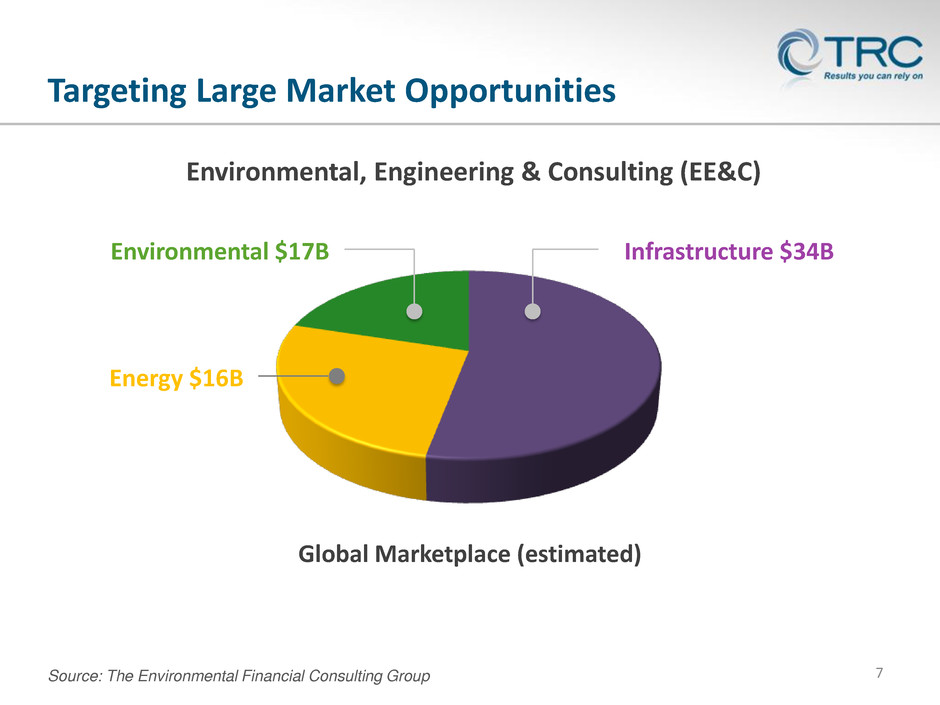

Targeting Large Market Opportunities 7 Source: The Environmental Financial Consulting Group Environmental, Engineering & Consulting (EE&C) Infrastructure $34B Energy $16B Environmental $17B Global Marketplace (estimated)

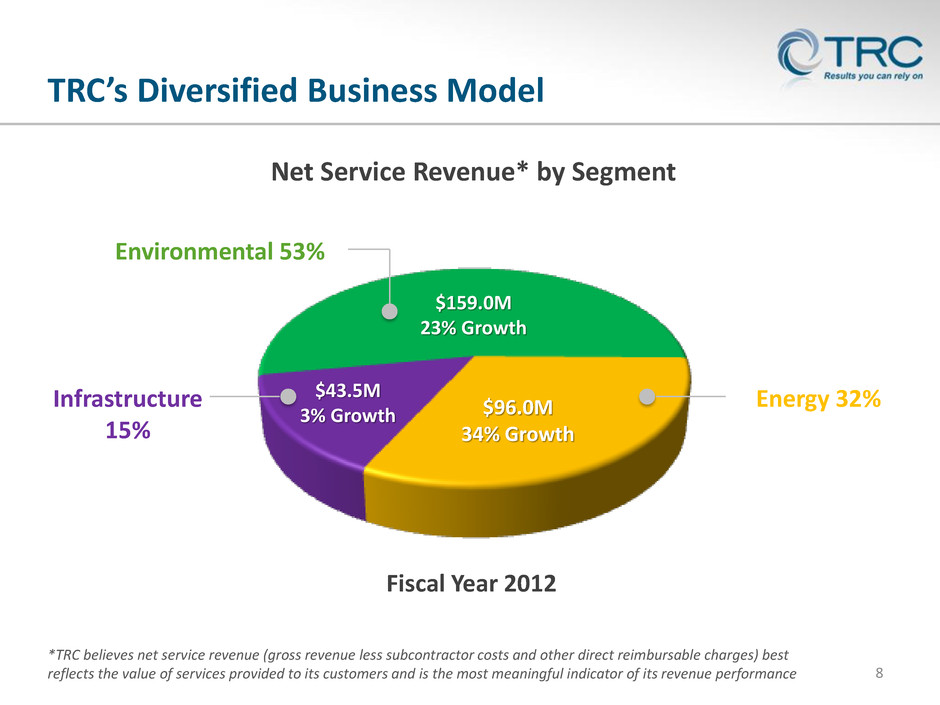

TRC’s Diversified Business Model 8 $96.0M 34% Growth $159.0M 23% Growth $43.5M 3% Growth *TRC believes net service revenue (gross revenue less subcontractor costs and other direct reimbursable charges) best reflects the value of services provided to its customers and is the most meaningful indicator of its revenue performance Net Service Revenue* by Segment Fiscal Year 2012 Infrastructure 15% Environmental 53% Energy 32%

En vi ronmen tal S egmen t 9 Permitting and Resource Management Remediation and Hazardous Waste Management Air Quality and Air Measurements Building Sciences, Industrial Hygiene, and Compliance Solid Waste 53% of Total NSR Growth Drivers Economic Development | Risk Management | Regulatory Compliance Sustainability / Climate Change

Ene rgy S egmen t Growth Drivers Reliability | Power Supply | Aging Generation Assets | Regulatory 10 32% of Total NSR Electrical Transmission, Distribution & Substation Engineering Energy Efficiency Communications Engineering Transformation

Inf rastruct ur e S egmen t Transportation Design Services Civil Engineering Services Security Consulting & Engineering Services Geotechnical Engineering & Materials Inspection Construction Engineering, Inspection & Management 11 15% of Total NSR Growth Drivers Population & Demographic Changes Aging & Failing Infrastructure Engineering Capacity Shortfalls Shifting Regulatory Spending

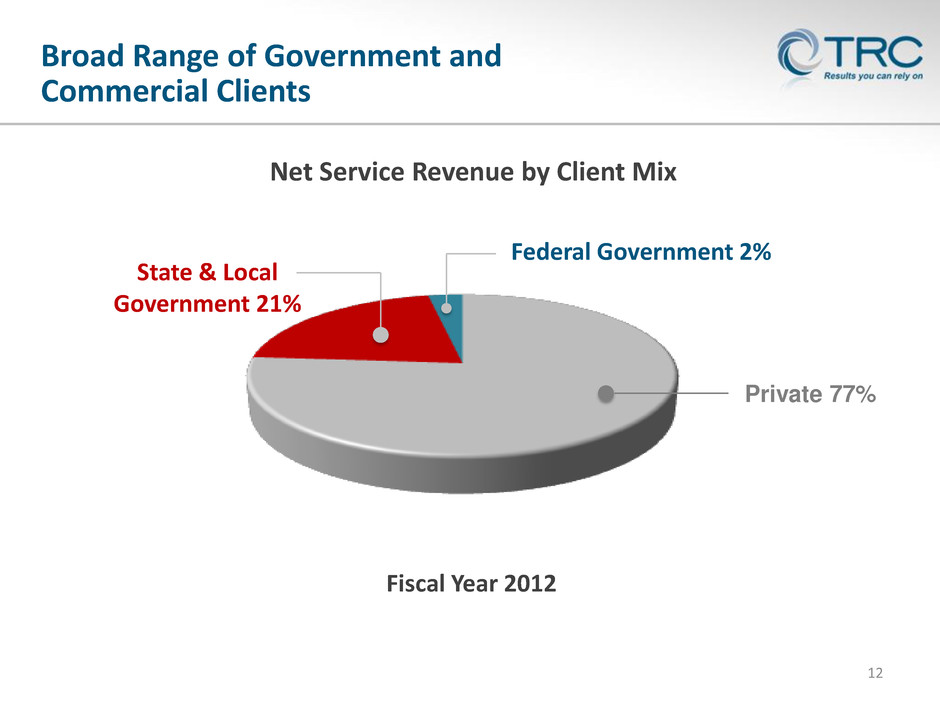

Broad Range of Government and Commercial Clients 12 Private 77% Net Service Revenue by Client Mix Fiscal Year 2012 State & Local Government 21% Federal Government 2%

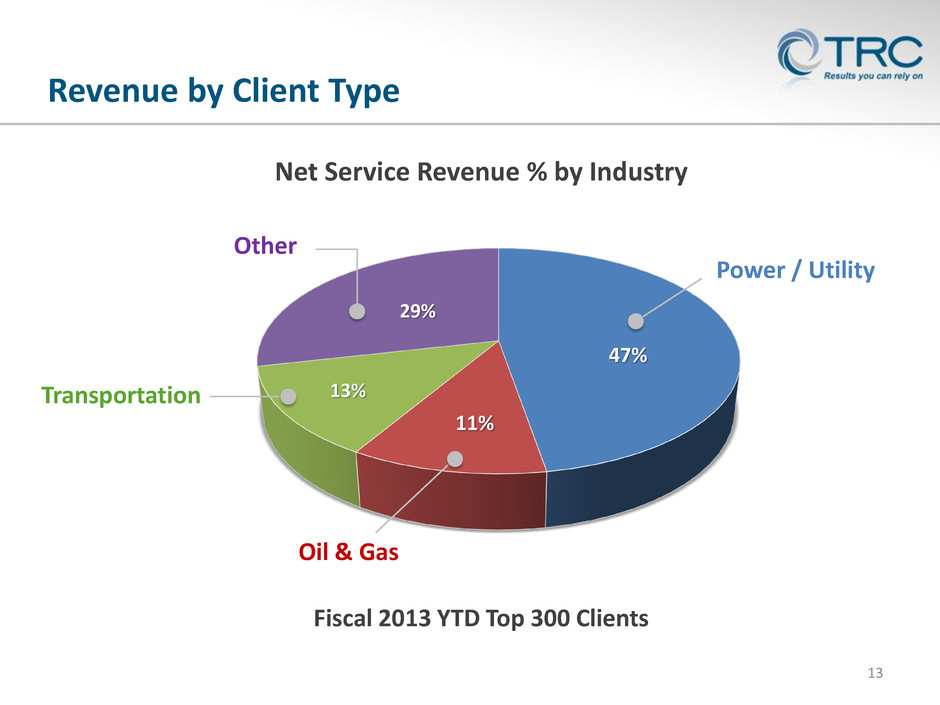

Revenue by Client Type 13 47% 29% 13% Net Service Revenue % by Industry Other Transportation Power / Utility Oil & Gas 11% Fiscal 2013 YTD Top 300 Clients

High-Profile Private Sector Clients 14

Working With All Levels of Government 15 State and Local Federal

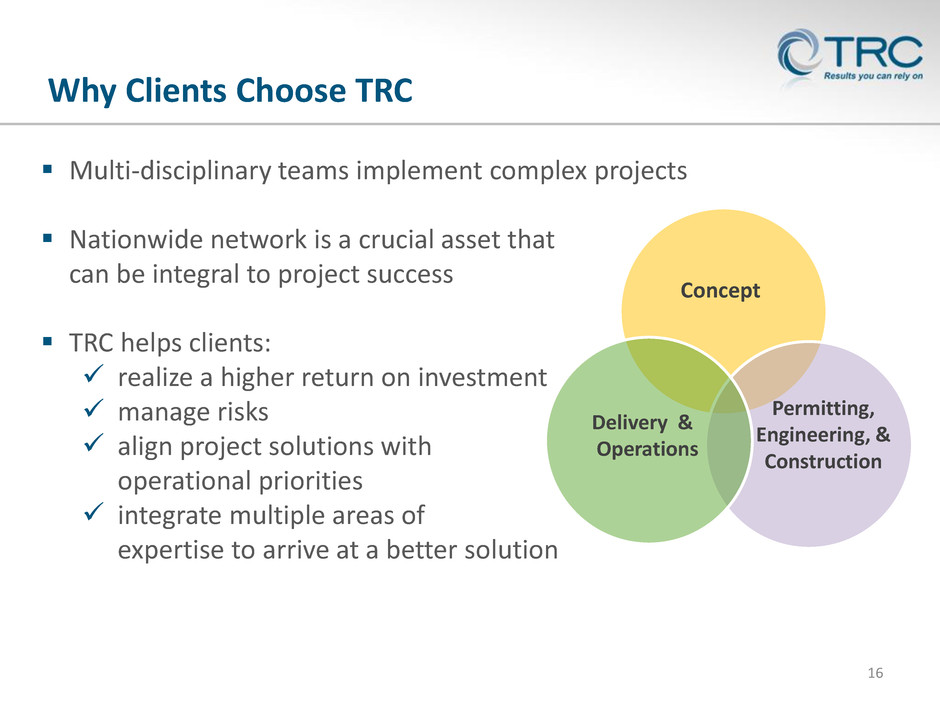

Multi-disciplinary teams implement complex projects Nationwide network is a crucial asset that can be integral to project success TRC helps clients: realize a higher return on investment manage risks align project solutions with operational priorities integrate multiple areas of expertise to arrive at a better solution Why Clients Choose TRC 16 Concept Delivery & Operations Permitting, Engineering, & Construction

Two-Pronged Growth Strategy 17 Invest in high-margin organic growth opportunities focused on two Primary Markets: Utility / Power and Oil & Gas Integrated National and Regional Initiatives National and Regional Key Accounts Programs Development of Cross-Selling Strategies Pursue strategic acquisitions to enhance service lines and geographic footprint Ocampo-Esta Corp. (Covina, CA Operations) – May 2013 GE’s Air Emissions Testing business – January 2013 Heschong Mahone Group, Inc. – December 2012 East Region Operations of EORM – March 2012 The Payne Firm, Inc. – September 2011 RMT Environmental – June 2011

18 Go-to-Market Strategy RE PowerTM Shale Generation & Utilities Pipelines and Terminals Oil & Gas Utility / Power Position TRC as the premiere service provider to the Utility/Power and Oil & Gas Markets

19 Financial Review

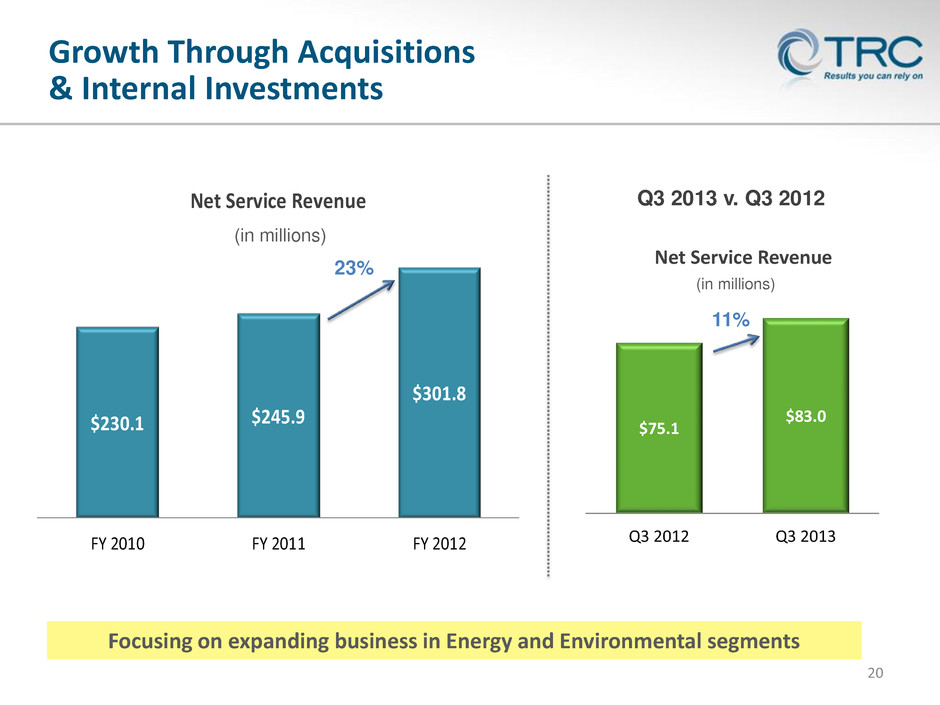

20 $230.1 $245.9 $301.8 FY 2010 FY 2011 FY 2012 Net Service Revenue (in millions) 23% $75.1 $83.0 Q3 2012 Q3 2013 Net Service Revenue (in millions) 11% Q3 2013 v. Q3 2012 Growth Through Acquisitions & Internal Investments Focusing on expanding business in Energy and Environmental segments

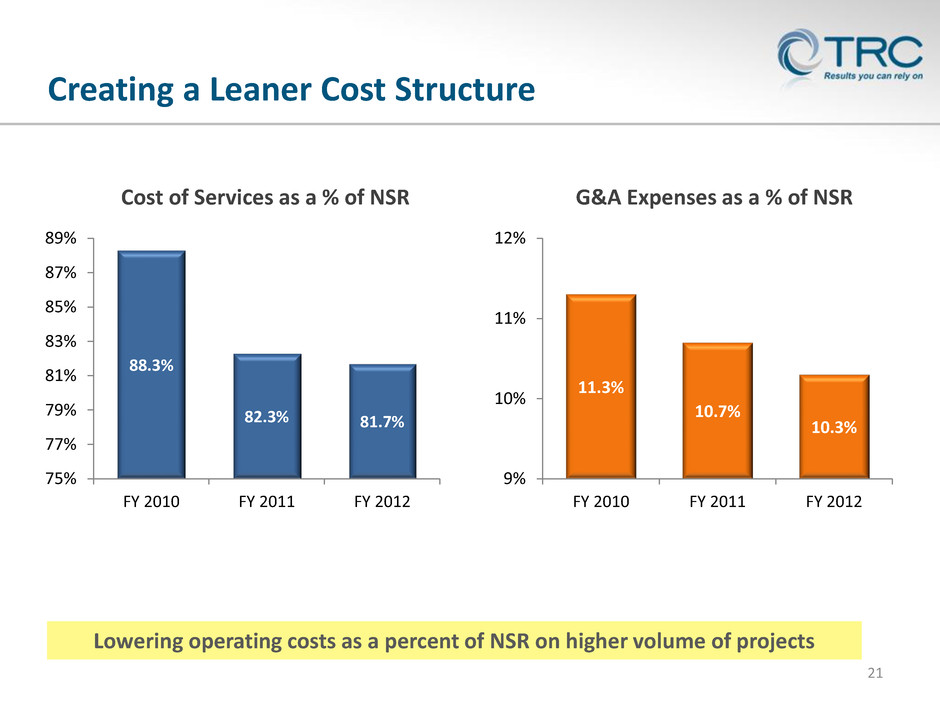

Creating a Leaner Cost Structure 21 88.3% 82.3% 81.7% 75% 77% 79% 81% 83% 85% 87% 89% FY 2010 FY 2011 FY 2012 Cost of Services as a % of NSR 11.3% 10.7% 10.3% 9% 10% 11% 12% FY 2010 FY 2011 FY 2012 G&A Expenses as a % of NSR Lowering operating costs as a percent of NSR on higher volume of projects

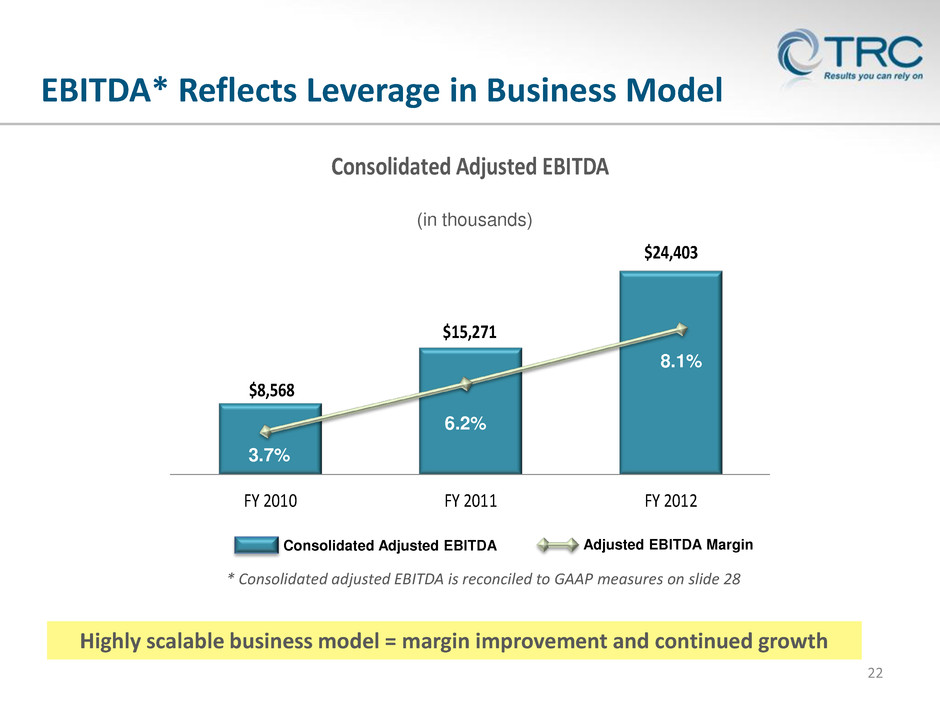

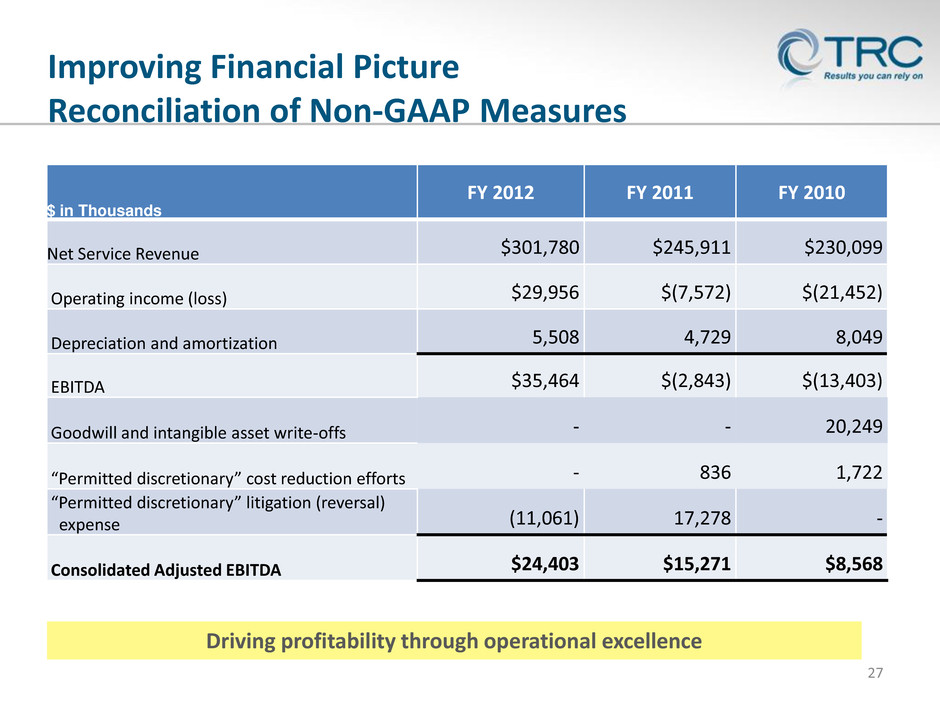

$8,568 $15,271 $24,403 FY 2010 FY 2011 FY 2012 Consolidated Adjusted EBITDA EBITDA* Reflects Leverage in Business Model 22 * Consolidated adjusted EBITDA is reconciled to GAAP measures on slide 28 (in thousands) 3.7% 6.2% 8.1% Consolidated Adjusted EBITDA Adjusted EBITDA Margin Highly scalable business model = margin improvement and continued growth

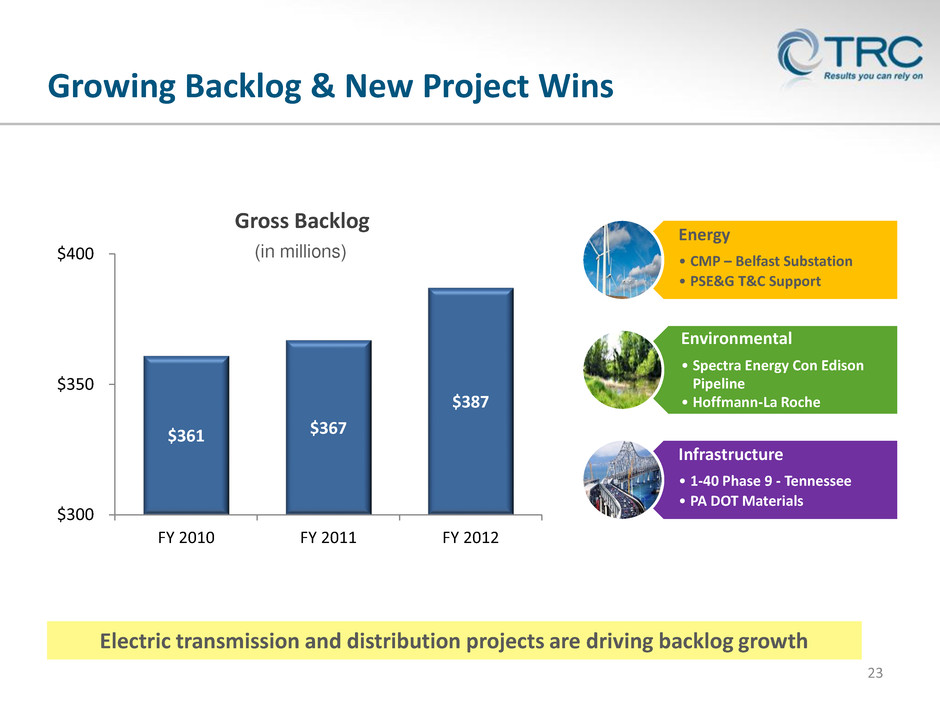

$361 $367 $387 $300 $350 $400 FY 2010 FY 2011 FY 2012 Gross Backlog Growing Backlog & New Project Wins 23 (in millions) Energy • CMP – Belfast Substation • PSE&G T&C Support Environmental • Spectra Energy Con Edison Pipeline • Hoffmann-La Roche Infrastructure • 1-40 Phase 9 - Tennessee • PA DOT Materials Electric transmission and distribution projects are driving backlog growth

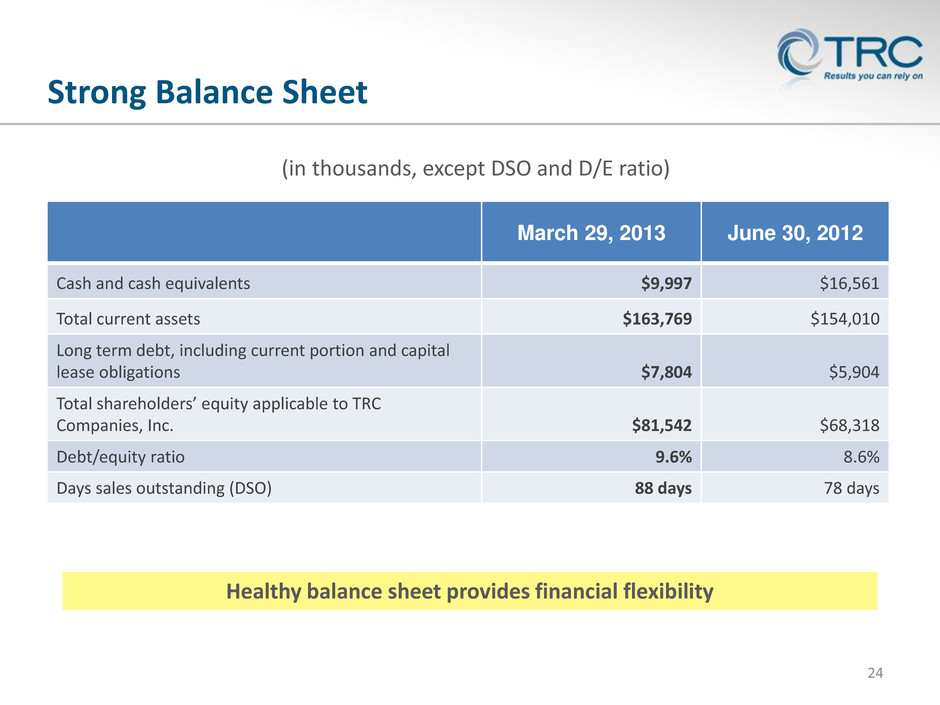

24 March 29, 2013 June 30, 2012 Cash and cash equivalents $9,997 $16,561 Total current assets $163,769 $154,010 Long term debt, including current portion and capital lease obligations $7,804 $5,904 Total shareholders’ equity applicable to TRC Companies, Inc. $81,542 $68,318 Debt/equity ratio 9.6% 8.6% Days sales outstanding (DSO) 88 days 78 days (in thousands, except DSO and D/E ratio) Strong Balance Sheet Healthy balance sheet provides financial flexibility

Investment Highlights 25 Shifted to growth focus after successful turnaround execution Strengthened balance sheet & leaner cost structure Large addressable market opportunity All three segments provide significant long-term growth potential Diversified revenue stream with attractive customer base Well-positioned competitively

James B. Stephenson SVP Corporate Planning & Development P: 617.385.6030 | E: JStephenson@trcsolutions.com www.trcsolutions.com Questions?

Improving Financial Picture Reconciliation of Non-GAAP Measures 27 $ in Thousands FY 2012 FY 2011 FY 2010 Net Service Revenue $301,780 $245,911 $230,099 Operating income (loss) $29,956 $(7,572) $(21,452) Depreciation and amortization 5,508 4,729 8,049 EBITDA $35,464 $(2,843) $(13,403) Goodwill and intangible asset write-offs - - 20,249 “Permitted discretionary” cost reduction efforts - 836 1,722 “Permitted discretionary” litigation (reversal) expense (11,061) 17,278 - Consolidated Adjusted EBITDA $24,403 $15,271 $8,568 Driving profitability through operational excellence