Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - TRC COMPANIES INC /DE/ | exhibit312certificationpur.htm |

| EX-32.1 - EX-32.1 - TRC COMPANIES INC /DE/ | exhibit321certificationpur.htm |

| EX-21 - EX-21 - TRC COMPANIES INC /DE/ | exhibit21subsidiariesofthe.htm |

| EX-32.2 - EX-32.2 - TRC COMPANIES INC /DE/ | exhibit322certificationpur.htm |

| EX-23.1 - EX-23.1 - TRC COMPANIES INC /DE/ | exhibit231consentofregiste.htm |

| EX-31.1 - EX-31.1 - TRC COMPANIES INC /DE/ | exhibit311certificationpur.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

for the fiscal year ended June 30, 2011

or

o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

for the transition period from to

Commission file number 1-9947

TRC COMPANIES, INC.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 06-0853807 (I.R.S. Employer Identification No.) |

21 Griffin Road North Windsor, Connecticut (Address of principal executive offices) | 06095 (Zip Code) |

Registrant's telephone number, including area code: (860) 298-9692

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.10 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No ý.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES o NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý.

The aggregate market value of the registrant's common stock held by non-affiliates on December 24, 2010 was approximately $46,386,000.

On August 31, 2011, there were 27,538,446 shares of common stock of the registrant outstanding.

TRC Companies, Inc.

Index to Annual Report on Form 10-K

Fiscal Year Ended June 30, 2011

Page | ||

2

Forward-Looking Statements

Certain information included in this report, or in other materials we have filed or will file with the Securities and Exchange Commission (the "SEC") (as well as information included in oral statements or other written statements made or to be made by us), contains or may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the "1995 Act"). Such statements are being made pursuant to the 1995 Act and with the intention of obtaining the benefit of the "Safe Harbor" provisions of the 1995 Act. Forward-looking statements are based on information available to us and our perception of such information as of the date of this report and our current expectations, estimates, forecasts and projections about the markets in which we operate and the beliefs and assumptions of our management. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They contain words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "may," "can," "could," "might," or variations of such wording, and other words or phrases of similar meaning in connection with a discussion of our future operating or financial performance, and other aspects of our business, including growth, trends in our business and other characterizations of future events or circumstances. From time to time, forward-looking statements are also included in our other periodic reports on Forms 10-Q and 8-K, in press releases, in our presentations, on our website and in other material released to the public. Any or all of the forward-looking statements included in this report and in any other reports or public statements made by us are only predictions and are subject to risks, uncertainties and assumptions, including those identified below in the "Risk Factors" section, the "Management's Discussion and Analysis of Financial Condition and Results of Operations" section, and other sections of this report and in other reports filed by us from time to time with the SEC as well as in press releases. Such risks, uncertainties and assumptions are difficult to predict and beyond our control and may cause actual results to differ materially from those that might be anticipated from our forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures made on related subjects in our subsequent reports on Forms 10-K, 10-Q, and 8-K should be consulted.

Part I

Item 1. Business

General Description

TRC Companies, Inc. (hereinafter collectively referred to as "we" "our" or "us"), was incorporated in 1971. We are a national engineering, consulting and construction management firm that provides integrated services to the environmental, energy, and infrastructure markets, primarily in the United States. A broad range of commercial and governmental clients depend on us to design solutions to their toughest business challenges. Our multidisciplinary project teams help our clients (i) implement complex projects from initial concept to delivery and commissioning, (ii) maintain and operate their facilities in compliance with regulatory standards and (iii) manage their assets through decommissioning, demolition, restoration and disposition.

We are headquartered in Windsor, Connecticut, and our corporate website is www.trcsolutions.com (information on our website has not been incorporated by reference into this Form 10-K). Through a link on the investor center section of our website, we make available the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(d) or 15(d) of the Securities and Exchange Act of 1934 (the "Exchange Act") as well as reports filed pursuant to Section 16 of the Exchange Act. All such filings are available free of charge. Under applicable SEC rules, because the aggregate market value of our stock held by non-affiliates was below $50.0 million as of December 24, 2010, the end of our second fiscal quarter, we could have foregone the auditor reporting requirements of Section 404 of the Sarbanes Oxley Act of 2002 for the fiscal year ended June 30, 2011. Nonetheless, we decided to proceed with that process, and the auditors' report on the effectiveness of our internal controls is included in Item 9A. Controls and Procedures.

Financial Highlights

We incurred net losses applicable to our common shareholders of $16.6 million, $22.9 million and $24.1 million for fiscal years 2011, 2010 and 2009, respectively. The net loss applicable to our common shareholders for fiscal year 2011 included a $17.3 million charge related to the Arena Towers litigation reserve and $7.3 million of accretion charges related to preferred stock. The net loss applicable to our common shareholders for fiscal year 2010 included $20.2 million for a goodwill impairment charge and $6.4 million of accretion charges related to preferred stock which were partially offset by a net tax benefit of $4.2 million and a $1.7 million gain on extinguishment of debt. The preferred stock converted to common stock on December 1, 2010, and, as of that date, no further preferred stock accretion charges will be recorded. The net loss applicable to

3

our common shareholders for fiscal year 2009 included a $21.4 million charge for goodwill and intangible asset write-offs and a charge of $3.9 million related to the provision for income taxes.

Business Strategy

We understand our clients' goals and embrace them as our own, applying creativity, experience, integrity and dedication to deliver superior solutions to the world's energy, environmental, and infrastructure challenges. We have continued to unify the Company on a national basis within our operating segments and national sales and marketing organization, giving us the ability to respond to customer challenges and current, dynamic market conditions. We are committed to safety, quality, client satisfaction, excellence in project management, and financial performance to help us win work in areas where our success rate is highest and maintain a growing presence in the future direction of our markets.

In support of our clients and shareholders, we maintain our focus on technical excellence and excellence in all areas of the project cycle including bidding, sales, performance, quality and collections.

Our objectives for fiscal year 2012 are:

• | Continue profitable growth in our operating segments. During fiscal year 2011 we successfully transitioned to a nationally focused sector model for each operating segment. Our Energy and Infrastructure service offerings have been managed and marketed on a national basis since fiscal year 2010, and we are continuing the national integration for our Environmental service offerings in fiscal year 2012. Our national operating platform is linked to our corporate sales and marketing organization, providing information exchange on project execution, regulatory trends and market feedback to better deliver and communicate to our markets. |

• | Continue focus on improvement of operating margins and increase positive operating cash flow. Evolving economic conditions require us to continue our disciplined focus on efficiency and effectiveness by controlling and reducing operating costs. In the past several years, we have taken steps to consolidate and reduce our general and administrative expenses as well as improve our project margins through increased productivity and more efficient execution. These enhancements have created a foundation for maintaining or exceeding our current levels of operating margins in the midst of adverse economic conditions. |

• | Attract and retain top talent. We continue to add top performers to expand our expertise and depth. Our objective is to maintain a workplace where top performers in our industry will be challenged by meaningful projects, rewarded for successful performance, and motivated to develop their entrepreneurial and project management skills for the benefit of the entire company. Our acquisition of the Environmental Business Unit ("RMT-EBU") of RMT, Inc., a subsidiary of Alliant Energy in fiscal year 2011 has added over 200 professional and support staff, expanding our resource base, technical expertise and market services. |

Services

Our services are focused on three operating segments: Energy, Environmental, and Infrastructure.

In the course of providing our services we routinely subcontract services. Generally these subcontractor costs are passed through to our clients and, in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and consistent with industry practice, are included in gross revenue. Because subcontractor services can change significantly from project to project, changes in gross revenue may not be indicative of business trends. Accordingly, we also report net service revenue ("NSR"), which is gross revenue less subcontractor costs and other direct reimbursable charges, and our discussion and analysis of financial condition and results of operations uses NSR as a primary point of reference.

Energy

The Energy operating segment is strategically positioned to serve key areas within the energy market which is currently investing in modernization, expansion, enhancement and replacement of outdated facilities. Currently within the United States, 70% of transmission lines and larger transformers are 25 years or older, and 60% of circuit breakers are more than 30 years old. The country has recently seen shifts in public policy intended to stimulate renewable energy development, development of a smarter and more robust power grid, and end-user demand management. TRC is one of the leading firms supporting the significant investment associated with the development of new sources of energy and the infrastructure required to deliver new and existing energy sources to consumers. This market, like all other markets dependent upon large capital investment, is influenced by cost and access to capital. Access to private sources of credit and capital were somewhat constrained through calendar 2010, but we have observed a more favorable capital investment environment during 2011 for many of the customers we serve. The American Recovery and Reinvestment Act of 2009 ("ARRA" or "stimulus bill"), targeted, among other

4

investments, those specific areas in which we concentrate our Energy service offerings: energy efficiency, renewable generation, and transmission and distribution. While we believe ARRA may have helped bridge the gap observed in 2010, the credit markets for new energy-related capital projects must be carefully monitored in coming years to maintain confidence in the health of these markets.

Services we provide to energy companies have evolved over the past decade to include support in the licensing and engineering design of new sources of power generation, electrical transmission system upgrades, and natural gas and liquid products pipelines and terminals. Approximately 30% of our total employee base is dedicated to providing energy services to our customers. As major investor owned utilities continue to consolidate and downsize their engineering and environmental staffs, we expect to continue to see long-term growth in these service areas. In addition, we expect to see continued expansion of our expertise in energy efficiency and demand management programs.

Key markets for our Energy operating segment are:

• | Energy Efficiency. An integral part of the nation's energy plan will consist of more effectively managing our use of finite resources through efficiency, conservation, load management and shifting to renewable energy sources. |

We develop and manage statewide energy efficiency programs in New York and New Jersey that reduce energy use and cost-effectively manage demand. We provide comprehensive services including program design, program management, quality control, engineering, financial tracking and reporting. In addition to our statewide programs, we also design and manage portfolio energy efficiency programs including a broad range of services from program management to engineering, quality control and construction inspection for a broad spectrum of end users including commercial office buildings, hospitality chains, educational facilities, residential complexes and military installations.

We are also actively focused on the relationship of energy conservation measures to the reduction in carbon footprints, and we are assisting a number of utilities in "greening" their operations against quantifiable objectives.

• | Electric Transmission. Investment in electric transmission and distribution infrastructure represents one of the largest financial commitments facing utilities over the upcoming decade. The age of the transmission and distribution network combined with continuing electric load growth, and the deployment of renewable generating sources has resulted in heightened concern over the reliability and efficiency of the nation's transmission grid. Capital programs by utilities for necessary upgrades to the grid system are in the early stages of development and are expected to total several billion dollars. |

We have emerged as one of the leading engineering and environmental licensing service providers supporting the extensive upgrade underway to the nation's electric transmission grid. We provide full scope engineering design, material procurement and construction management services. We also provide essential operations and management support to utilities as the trend towards outsourcing engineering functions continues. Our ability to provide integrated energy and environmental services has proven to be a key factor to our success in obtaining these projects.

Environmental

The Environmental operating segment represents our largest operating segment in terms of both profitability and NSR.

The demand for environmental services originally arose in response to the significant environmental legislation in the 1970's. Since that time, regulatory compliance has been a significant market driver, however mergers and acquisitions and the real estate market created economic drivers as well and enabled us to serve those markets on many fronts including support of property owners on a wide range of issues. We provide substantial support to buyers and sellers in the pre-acquisition due diligence and asset valuation process. Our Exit Strategy program grew to national prominence in response to the need for responsible parties, as well as buyers and sellers, to resolve environmental remediation uncertainties.

We are also a national market leader in the areas of air quality modeling, air emissions testing and monitoring, cultural and natural resource management and remediation of contaminated sites.

The markets for our environmental services are dynamic and include:

• | Investigation, remediation, and compliance of contaminated sites. The Environmental Protection Agency estimates over 29,000 contaminated sites of all sizes still need to be evaluated and remediated. This fact combined with the emergence of economically distressed assets into the market provides a strong impetus for assessing and resolving environmental impacts to real estate assets. |

5

• | Natural Gas Related Energy Strategies. Natural gas is a preferred fuel source for domestic energy initiatives. While investment in development of new supplies, transmission pipelines and storage facilities is a function of price and economic conditions, we believe it will become increasingly important in the domestic energy mix. We continue to be an industry leader in serving this market based upon our staff experience which includes Federal Energy Regulatory Commission ("FERC") licensing; federal and state media specific environmental permitting; electrical interconnection engineering; and construction management and oversight. With one of the most experienced national teams of environmental scientists, we have been responsible for the licensing and construction oversight of several of the largest multi-state gas transmission pipeline projects in development. We are currently providing services for the permitting of both land-based and offshore Liquefied Natural Gas ("LNG") terminals in the Gulf and Northwest. |

• | Power and Generation Source Licensing and Permitting. The demand for licensing services and electrical interconnection for new electrical generation sources continues to increase due to several strong market factors. In load congested areas such as the Mid-Atlantic, Northeast, and California, utilities are pursuing development of new sources of electrical supply. Recognizing the importance of fuel diversity, fossil fuel plant development is focusing on both natural gas and coal. Coal plant development projects we are supporting include traditional pulverized coal, waste coal and Integrated Gas Coal Conversion technology. |

With over half of the States implementing renewable portfolio standards, we are providing licensing and engineering support to a number of wind power projects. Reflecting the breadth of our staff capabilities and experience, we are participating in both land-based and offshore wind power developments. Services provided have broadened to include feasibility studies, environmental permitting, site civil engineering, electric transmission interconnect/substation design, construction management and transactional support involving the sale or purchase of existing generation assets. We have provided due diligence and best management practices consulting support with respect to energy assets to a number of leading financial institutions, equity firms and diversified energy companies. This year we have seen a significant increase in the solar development market in particular.

• | Greenhouse gases. There is continuing pressure on the United States to reduce greenhouse gas emissions across all segments of the economy. This will provide us opportunities to support clients in the areas of air emissions consulting, project development, renewable energy permitting, and the development of sustainable business practices. The need to reduce greenhouse gas emissions represents a new starting point for businesses to "green" their processes and make them more efficient and environmentally friendly. |

• | Solid waste management. We offer a full spectrum of solid waste and landfill management services including, siting and permitting, site investigations, planning, alternatives analysis, design, construction, operation, closure and post-closure. The United States generates about 250 million tons of solid waste annually, and all the current facilities have finite capacity. We will be leveraging existing professional expertise with our acquisition of RMT-EBU to expand into this market in fiscal year 2012. |

• | Transaction support. Our ability to evaluate environmental and regulatory risk in real property and business transfers continues to be one of our core strengths. We forecast a steady need for due diligence activities by public and private equity investors, financial institutions, regulatory agencies, and property owners as properties and businesses change ownership. |

• | Environmental compliance and auditing. Industrial and commercial projects must comply with regulations covering, among other things, air quality, water quality, solid and hazardous waste requirements, land use, wildlife, wetlands, cultural resources, and natural resource conservation. Many of these requirements are independent of economic circumstances. In fiscal year 2012 we will be expanding our service line offering in environmental compliance auditing, strategic due diligence services, and environmental health and safety auditing and compliance services. |

• | Infrastructure modernization. Modernizing our national transportation and energy delivery systems continues to be a focus of both the public and the private sectors. Investment in these areas will include the related environmental impacts associated with such modernization. |

• | Sustainability and Climate Change. The market for climate change related services is being driven domestically from many fronts, most of which are not regulatory in nature. We have seen demand for services emerge in the areas of carbon emission assessment and verification, alternate energy development, and public and private sector programs which are designed around energy conservation and other green initiatives. We believe our expertise in air modeling and measurement, renewable energy project licensing, project environmental impact assessment and project engineering, as well as program design and management, provides us an advantage in this emerging |

6

market.

In addition, other market factors are also creating opportunities in the following areas:

• | Mercury monitoring of air emissions as a function of emerging legislation. |

• | Control technology requirements in the Clean Air Act, e.g., the Best Available Retrofit Technology requirements for certain air emission sources. |

• | Continued litigation over a variety of air issues such as facility compliance and operations, historic discharge enforcement and toxic tort claims. |

• | Indoor environmental exposures such as "sick building syndrome" and microbial (mold) issues. |

The primary demand for environmental assessment and remediation services is driven by the regulatory obligations of our clients at existing operating facilities and by the real estate transfer and redevelopment process. We expect our assessment and remediation services market to continue to grow as more of our clients adopt newer, more aggressive environmental management strategies as part of evolving corporate philosophies embracing sustainability and environmental accountability. These strategies require voluntary, accelerated assessment and remediation to lower costs and improve environmental conditions which meet increased societal and shareholder demands for better stewardship. While the market for this type of service has been somewhat reinvigorated due to some positive economic trends, the need for cleanup at affected sites in support of economic redevelopment opportunities continues to lag due to the continued slow conditions in the real estate market. Opportunities to support private sector development-related cleanup projects should expand as economic conditions in real estate and the associated transactional markets improve. We expect our assessment and remediation services market to continue to grow in support of the power generation industry as older facilities are retired or re-powered. Special services we offer are:

• | Exit Strategy®. Our Exit Strategy program is one of the most innovative services we offer our clients. We pioneered this program and created a new national market of environmental risk transfers for contaminated properties. We remain a national market leader with over 100 sites under contract. Traditionally our Exit Strategy offering has been especially attractive to clients in the following situations: |

• | Discontinued Operations. We assume responsibility for the cleanup of contamination at closed or redundant facilities, allowing our clients to focus on their core business operations. |

• | Bankruptcy. Debtors and the creditors are seeking the highest possible value for saleable assets and relief from lingering environmental liabilities. By assuming those liabilities, we can help them achieve a responsible financial solution. |

• | Acquisitions and Divestitures. We assume responsibility for existing environmental cleanup liabilities which neither the buyer wants to assume nor the seller wants to retain. |

• | Multi-Party Superfund Sites. By transferring responsibility for the cleanup of Superfund sites from groups of potentially responsible parties to us, the cleanup schedule can be accelerated and the legal and administrative cost burden substantially reduced. |

• | Brownfield Real Estate Development. By assuming responsibility for site cleanup and defining the related cost with certainty, our Exit Strategy program aids in the settlement of commercial issues among interested parties, such as property owners, lenders, developers, and municipalities, that often stall the redevelopment process. |

• | RE Power®. RE Power is a program where we, in conjunction with a decommissioning and demolition company, provide comprehensive dismantling, cleanup, liability transfer and asset optimization solutions to power and utility companies that elect to decommission and reposition their aging power plant assets. The goal of RE Power is to provide energy companies with a one-stop resource to gain maximum value for power plant assets within any constraints imposed by the power grid and the larger community. This can include safely removing plants from service through demolition and environmental cleanup, and potentially into a redevelopment phase, or preparing the existing power plant for re-powering with more economical fuel sources or more efficient generating equipment. |

Infrastructure

We offer a wide variety of services to our infrastructure clients primarily related to: (1) rehabilitation of overburdened and deteriorating infrastructure systems; (2) design, construction engineering inspection and construction management associated with new infrastructure projects; and (3) management of risks related to security of public and private facilities. We have a

7

strong geographic presence in the Northeast corridor of the United States as well as Texas, Louisiana and California. The following is a listing of the general types of infrastructure services we offer:

• | Construction Management. We provide support to our clients in the areas of program management, project management, construction engineering and inspection, fabrication plant inspections, construction management, estimating and scheduling. |

• | Transportation. We provide planning, design and construction management services in support of work on roads, highways, bridges and aviation facilities. In addition to performing basic design engineering, we also incorporate activities associated with completing environmental studies, marine engineering, seismic analysis, and traffic engineering. |

• | General Civil Engineering Services. We provide civil engineering services associated with development support for commercial and residential real estate development projects by providing master planning, traffic studies, storm water design and management, utility design, and site engineering. We also can provide the basic engineering needs of small municipalities, and our civil engineering expertise is utilized on projects such as the planning, design and construction management of potable water and wastewater treatment systems; master drainage planning; street, roadway and site drainage; dam analysis and design; and master drainage planning. |

• | Geotechnical and Materials Engineering. We provide subsurface exploration, laboratory testing, geotechnical assessments, seismic engineering and quality assurance testing. |

• | Hydraulics and Hydrological Studies. We provide aquifer tests, ground water modeling and yield analysis, scour and erosion studies, design and analysis of storage and distribution systems, Federal Emergency Management Agency studies and watershed modeling. |

• | Security. We provide vulnerability assessments, design engineering and structural improvements for public and private infrastructure facilities, design and implementation of security and surveillance systems, blast resistance design, disaster recovery planning, and force protection analysis. Through the assistance of our national sales program, our market emphasis has shifted from providing these services in commercial buildings to a focus upon public and quasi-public infrastructure and energy-related facilities such as transit systems, utility companies and ports. |

• | Geographic Information Systems & Mapping. We provide, among other services, data modeling, terrain analysis, shoreline management analysis, total station mapping and resource mapping. |

We believe that the long-term market for our infrastructure services will be stable and driven by population growth in certain geographic regions, continued aging and obsolescence of existing infrastructure, capacity shortfalls, and future federal stimulus funding for state and municipal projects. However, spending by both private and government clients has continued to decline in recent years, reflecting economic conditions, and these conditions did not materially improve in the current calendar year. In addition, legislation regarding long term funding for federal transportation projects still remains unresolved at this time. We expect this trend to continue in the near term.

Of note is the continued lack of design-related projects in the "pipeline" for both public and private clients. Given the need to rebuild and modernize our aging national infrastructure, however, we do expect increased spending on public infrastructure programs over the intermediate and long term. The timing and extent of recovery in the private sector is, however, more uncertain in the short and mid-term. The pace of spending on private infrastructure projects has diminished, and, as a result, during the past fiscal year we have experienced client initiated delays and/or cancellation of some assignments. We are focusing our activities where the pace of infrastructure development has remained somewhat robust, and therefore continue to be optimistic regarding the prospects for this market.

In addition, we made the decision to aggressively seek out new markets and service offerings to foster our organic growth plans amidst a challenged economy. Toward that end, we have entered the Steel Fabrication Inspection market. Steel inspection in fabrication shops complements our existing inspection program of pre-cast concrete structures for the same clients. In addition, we have expanded our Construction Management Program in the Northeast to take advantage of local opportunities in our existing market.

8

Clients

No single client accounted for 10% or more of our NSR during fiscal years ended 2011, 2010 and 2009.

Representative clients during the past five years include:

AES Enterprises | Goodyear Tire and Rubber Company | Sempra Energy | ||

AIMCO, Inc. | Hoffman La Roche, Inc. | Spectra Energy | ||

Alcoa | Iberdrola USA | SPX Corporation | ||

Alyeska Pipeline Service Co. | J-Power | Transwestern Pipeline Company, LLC | ||

ASARCO | Kinder Morgan | Waste Management | ||

BNSF | LS Power | State Transportation/Power Authorities: | ||

British Petroleum | Lower Manhattan | • California | ||

Canadian Northern Railway | Development Corporation | • Massachusetts | ||

Central Maine Power Company | Magellan Midstream Partners | • New Hampshire | ||

Competitive Power Ventures | Mirant | • New Jersey | ||

Connecticut Resources Recovery | National Grid | • New York | ||

Authority | New York State Energy Research and | • Pennsylvania | ||

ConocoPhillips | Development Authority | • Texas | ||

Consolidated Edison | Nexterra | • West Virginia | ||

Constellation Energy | Northeast Utilities | • Louisiana | ||

Covanta | NRG | U.S. Government: | ||

Duke Energy | Orange County Transportation Authority | • Environmental Protection Agency | ||

El Paso Energy | PG&E Corporation | • Department of Defense | ||

Entergy | Public Service of New Hampshire | • Federal Aviation Administration | ||

ExxonMobil | PSE&G | • General Services Administration | ||

Competition

The markets for many of our services are highly competitive. There are numerous engineering and consulting firms and other organizations that offer many of the same services offered by us. These firms range in size from small local firms to large national firms that have substantially greater resources than we do. Competitive factors include reputation, performance, price, geographic location and availability of skilled technical personnel. As a mid-size firm, we compete with both the large international firms and the small niche or geographically focused firms.

The majority of our work comes from repeat orders from long-term clients, especially where we are one of the leading service providers in the markets we address. For example, we believe that we are one of the top providers of licensing services for large energy projects. We also believe we are the market leader in the complete outsourcing of site remediation services through our Exit Strategy program. By continuing to stay in front of emerging trends in our markets we believe our competitive position will remain strong.

Backlog

As of June 30, 2011, our contract backlog based on gross revenue was approximately $367 million, compared to approximately $361 million as of June 30, 2010. Our contract backlog based on NSR was approximately $230 million as of June 30, 2011, compared to approximately $222 million as of June 30, 2010. The increase in backlog can be most directly attributed to backlog assumed in the acquisition of RMT-EBU during fiscal year 2011. Approximately 60% of backlog is typically completed in one year. In addition to this contract backlog, we hold open-order contracts from various clients and government agencies. As work under these contracts is authorized and funded, we include this portion in our contract backlog. While most contracts contain cancellation provisions, we are unaware of any material work included in backlog that will be canceled or delayed.

Employees

As of June 30, 2011, we had approximately 2,300 full- and part-time employees. Approximately 90% of these employees are engaged in performing professional services for clients. Many of these employees have advanced degrees. Our professional staff includes program managers, project managers, professional engineers and scientists, construction specialists, computer programmers, systems analysts, attorneys and others with degrees and experience that enable us to provide a diverse range of services. Other employees are engaged in executive, administrative and support activities. We consider the relationships with

9

our employees to be favorable.

Contracts with the United States Government and Agencies of State and Local Governments

We have contracts with agencies of the United States government and various state agencies that are subject to examination and renegotiation. We believe that adjustments resulting from such examination or renegotiation proceedings, if any, will not have a material impact on our operating results, financial position or cash flows.

Regulatory Matters

Our businesses are subject to various rules and regulations at the federal, state and local government levels. We believe that we are in substantial compliance with these rules and regulations. We have the appropriate licenses to bid and perform work in the locations in which we operate. We have not experienced any significant limitations on our business as a result of regulatory requirements. We do not believe any currently proposed changes in law or anticipated changes in regulatory practices would limit bidding on future projects.

Trademarks, Patents and Licenses

We have a number of trademarks, patents, copyrights and licenses. None of these are considered material to our business as a whole.

Environmental and Other Considerations

We do not believe that our own compliance with federal, state and local laws and regulations relating to the protection of the environment will have any material effect on our capital expenditures, earnings or competitive position.

Item 1A. Risk Factors

The risk factors listed below, in addition to those described elsewhere in this report, could materially and adversely affect our business, financial condition, results of operations or cash flows.

Risks Related to Our Company

We incurred significant losses in fiscal years 2011, 2010, and 2009, and may incur such losses in the future. If we continue to incur significant losses or are unable to generate sufficient working capital from our operations or our revolving credit facility, we may have to seek additional external financing.

As reflected in our consolidated financial statements, we incurred net losses applicable to our common shareholders of $16.6 million, $22.9 million and $24.1 million in fiscal years 2011, 2010 and 2009, respectively. Major factors in our losses have been the Arena Towers litigation reserve in fiscal year 2011 and non-cash goodwill and intangible asset impairment charges in fiscal years 2010 and 2009. In addition we recorded significant non-cash preferred stock accretion charges in fiscal years 2011 and 2010. Operating performance has, however, improved and we are continuing to take actions to increase profitability. Nevertheless, if we are unable to maintain operating performance we may incur additional losses. We depend on our core businesses to generate profits and cash flow to fund our working capital growth.

We finance our operations through cash generated by operating activities and borrowings under our revolving credit facility with Wells Fargo Capital Finance. During fiscal year 2010 we completed a preferred stock offering with gross proceeds of $15.5 million. While we have rarely used the credit facility since the preferred stock offering, we are dependent on this facility for any short term liquidity needs when available cash and cash equivalents and cash provided by operations are not adequate to support working capital requirements. The credit facility contains covenants which, among other things, require us to maintain minimum levels of earnings before interest, taxes, depreciation, and amortization as defined in the credit agreement ("EBITDA"), maintain a minimum fixed charge coverage ratio, maintain a minimum level of backlog, and limit capital expenditures.

We believe that existing cash resources, cash forecasted to be generated from operations and availability under our credit facility are adequate to meet our requirements for the foreseeable future. The current uncertain state of the economy and the possibility that economic conditions could continue to be uncertain or deteriorate may affect businesses such as ours in a number of ways. While management cannot directly measure it, variability in the economy and any corollary impact on the availability of credit could affect the ability of our customers and vendors to obtain financing for significant purchases and operations and could result in a decrease in their business with us which could adversely affect our ability to generate profits and cash flows. We are unable to predict the likely duration of the current economic uncertainty and its potential impact on our

10

clients.

If we must write off a significant amount of intangible assets or long-lived assets, our earnings will be negatively impacted.

Goodwill was approximately $20.9 million as of June 30, 2011. We also had other identifiable intangible assets of $4.8 million, net of accumulated amortization, as of June 30, 2011. Goodwill and identifiable intangible assets are assessed for impairment at least annually or whenever events or changes in circumstances indicate that the carrying value of the assets may not be recoverable. We have recorded goodwill and intangible asset impairment charges of $20.2 million and $21.4 million in the fiscal years 2010 and 2009, respectively. A decline in the estimated future cash flows of our reporting units, declines in market multiples of comparable companies and other factors may result in additional impairments of goodwill or other assets which would negatively impact our earnings.

We are and will continue to be involved in litigation. Legal defense and settlement expenses can have a material adverse impact on our operating results.

We have been, and likely will be, named as a defendant in legal actions claiming damages and other relief in connection with engineering and construction projects and other matters. These are typically actions that arise in the normal course of business, including employment-related claims, contractual disputes, professional liability, or claims for personal injury or property damage. We have substantial deductibles on several of our insurance policies, and not all claims are insured. In addition, we have also incurred legal defense and settlement expenses related to prior acquisitions. Accordingly, defense costs, settlements and potential damage awards may have a material adverse effect on our business, operating results, financial position and cash flows in future periods.

A trial was recently held in the The Arena Group v. TRC Environmental Corporation and TRC Companies, Inc. case which resulted in jury verdict being rendered against us and our subsidiary on June 20, 2011. As a result, the accompanying statement of operations for the fiscal year ended June 30, 2011 includes a charge of $17.3 million representing the full value of the verdict as well as pre-judgment interest and certain potential costs associated with appeal.

Subcontractor performance and pricing could expose us to loss of reputation and additional financial or performance obligations that could result in reduced profits or losses.

We often hire subcontractors for our projects. The success of these projects depends, in varying degrees, on the satisfactory performance of our subcontractors and our ability to successfully manage subcontractor costs and pass them through to our customers. If our subcontractors do not meet their obligations or we are unable to manage or pass through costs, we may be unable to profitably perform and deliver our contracted services. Under these circumstances we may be required to make additional investments and expend additional resources to ensure the adequate performance and delivery of the contracted services. These additional obligations have resulted in reduced profits or, in some cases, significant losses for us with respect to certain projects. In addition, the inability of our subcontractors to adequately perform or our inability to manage subcontractor costs on certain projects could hurt our competitive reputation and ability to obtain future projects.

Our operations could require us to utilize large sums of working capital, sometimes on short notice and sometimes without the ability to recover the expenditures.

Circumstances or events which could create large cash outflows include losses resulting from fixed-price contracts, remediation of environmental liabilities, legal expenses and settlements, project completion delays, failure of clients to pay, income tax assessments and professional liability claims, among others. We cannot provide assurance that we will have sufficient liquidity or the credit capacity to meet all of our cash needs if we encounter significant working capital requirements as a result of these or other factors.

Our services expose us to significant risks of liability and it may be difficult or more costly to obtain or maintain adequate insurance coverage.

Our services involve significant risks that may substantially exceed the fees we derive from our services. Our business activities expose us to potential liability for professional negligence, personal injury and property damage among other things. We cannot always predict the magnitude of such potential liabilities. In addition, our ability to perform certain services is dependent on the availability of adequate insurance.

We obtain insurance from insurance companies to cover a portion of our potential risks and liabilities subject to specified policy limits, deductibles or coinsurance. It is possible that we may not be able to obtain adequate insurance to meet our needs, may have to pay an excessive amount for the insurance coverage we want, or may not be able to acquire any insurance for certain types of business risks. As a result of events in the financial markets, we face additional risks due to the continuing uncertainty and disruption in those markets. Much of our commercial insurance is underwritten by the regulated insurance subsidiaries of Chartis (formerly the American International Group). Chartis has also underwritten almost all of the cost cap

11

and related insurance purchased by Exit Strategy clients which share some specific characteristics that present additional risk. The Exit Strategy related policies all tend to be long term; many are ten years or more. Some policies also serve to satisfy state and federal financial assurance requirements for certain projects, and without these policies, alternative financial assurance arrangements for these projects would need to be arranged. Additionally, most of our Exit Strategy projects require us to perform the work in the event insurance limits are exhausted, directly exposing us to financial risks.

We are self-insured or carry deductibles for a significant portion of our claims exposure, which could materially and adversely affect our operating income and profitability.

We are self-insured or carry deductibles for most of our insurance coverages, including certain insurance programs related to discontinued businesses. Because of these deductibles and self-insured retention amounts, we have significant exposure to fluctuations in the number and severity of claims. As a result, our insurance and claims expense could increase in the future. Under certain conditions, we may elect or be required to increase our self-insured or deductible amounts, which would increase our already significant exposure to expense from claims. If any claim exceeds our coverage, we would bear the excess expense, in addition to our other self-insured amounts. If the frequency or severity of claims or our expenses increase, our operating income and profitability could be materially adversely affected.

Our failure to properly manage projects may result in additional costs or claims.

Our engagements involve a variety of projects, some of which are large-scale and complex. Our performance on projects depends in large part upon our ability to manage the relationship with our clients and to effectively manage the project and deploy appropriate resources, including third-party contractors and our own personnel, in a timely manner. If we miscalculate, or fail to properly manage, the resources or time we need to complete a project with capped or fixed fees, or the resources or time we need to meet contractual obligations, our operating results could be adversely affected. Furthermore, any defects, errors or failures to meet our clients' expectations could result in claims against us.

If we miss a required performance standard, fail to timely complete, or otherwise fail to adequately perform on a project, we may incur a loss on that project, which may reduce or eliminate our overall profitability.

We may commit to a client that we will complete a project by a scheduled date. We may also commit that a project, when completed, will achieve specified performance standards. If the project is not completed by the scheduled date or fails to meet required performance standards, we may incur significant additional costs or be held responsible for the costs incurred by the client to rectify damages due to late completion or failure to achieve the required performance standards. The uncertainty of the timing of a project can present difficulties in planning the amount of personnel needed for the project. If the project is delayed or canceled, we may bear the cost of an underutilized workforce that was dedicated to fulfilling the project. In addition, performance of projects can be affected by a number of factors beyond our control, including unavoidable delays from weather conditions, changes in the project scope of services requested by clients or labor or other disruptions. In some cases, should we fail to meet the required schedule or performance standards, we may also be subject to agreed-upon financial damages, which are determined by the contract. To the extent that these events occur, the total costs of the project could exceed our estimates or, in some cases, cause a loss on a project, which may reduce or eliminate our overall profitability.

Our business and operating results could be adversely affected by our inability to accurately estimate the overall risks, revenue or costs on a contract.

We generally enter into three principal types of contracts with our clients: fixed-price, time-and-materials, and cost-plus. Under our fixed-price contracts, we receive a fixed price irrespective of the actual costs we incur and, consequently, we are exposed to a number of risks. These risks include: underestimation of costs, problems with new technologies, unforeseen costs or difficulties, delays, price increases for materials, poor project management or quality problems, and economic and other changes that may occur during the contract period. Under our time-and-materials contracts, we are paid for labor at negotiated hourly billing rates and for other expenses. Profitability on these contracts is driven by billable headcount and cost control. Many of our time-and-materials contracts are subject to maximum contract values, and, accordingly, revenue relating to these contracts is recognized as if these contracts were fixed-price contracts. Under our cost-plus contracts, some of which are subject to contract ceiling amounts, we are reimbursed for allowable costs and fees which may be fixed or performance-based. If our costs exceed the contract ceiling or are not allowable under the provisions of the contract or any applicable regulations, we may not be able to obtain reimbursement for all such costs. Accounting for a fixed-price contract requires judgments relative to assessing the contract's estimated risks, revenue and estimated costs as well as technical issues. The uncertainties inherent in the estimating process make it possible for actual costs to vary from estimates, or estimates to change, resulting in reductions or reversals of previously recorded revenue and profit. Such differences could be material.

Our Exit Strategy projects present risks that could arise from the eventual expiration of the fixed insurance policy term or the potential for the incurred costs to exceed of the financial limits of the insurance policy. Funding for each Exit Strategy project is provided through a notional commutation account held by the insurer and an insurance layer which provides for

12

additional funding of incremental costs incurred above the funds contained in the notional commutation account. If we are unable to complete the work within the financial and term limits of the commutation account and the insurance layer, we may incur costs which are not reimbursable, and we may incur a significant loss on the contract. Exit Strategy projects typically involve complex multi-year environmental remediation measures which must be approved by regulators both as to the remedial approach as well as the achievement of the final result.

Our profitability could suffer if we are not able to maintain adequate utilization of our workforce.

As a service organization, the percentage of our employees' time that is chargeable to clients (utilization) is a key factor. The rate at which we utilize our workforce is affected by a number of factors, including:

• | Our ability to transition employees from completed projects to new assignments and to hire and assimilate new employees; |

• | Our ability to forecast demand for our services and thereby maintain an appropriate headcount in each of our geographies and workforces; |

• | Our ability to manage attrition; |

• | Our need to devote time and resources to training, business development, professional development and other non-chargeable activities; and |

• | Our ability to match the skill sets of our employees to the needs of the marketplace. |

Our backlog is subject to cancellation and unexpected adjustments and is an uncertain indicator of future operating results.

Our contract backlog based on NSR as of June 30, 2011 was approximately $230 million. We cannot guarantee that the NSR projected in our backlog will be realized or, if realized, will result in profits. In addition, project cancellations or scope adjustments may occur from time to time with respect to contracts reflected in our backlog. These types of backlog reductions could adversely affect our revenue and margins. Accordingly, our backlog as of any particular date is an uncertain indicator of our future earnings.

Acquisitions, joint ventures and strategic alliances may have an adverse effect on our business.

We expect to continue making acquisitions or entering into joint ventures and strategic alliances as part of our long-term business strategy. These transactions involve significant challenges and risks including that the transaction does not advance our business strategy, that we don't realize a satisfactory return on our investment, that we experience difficulty integrating new employees, business systems, technology, and cultures or that management's attention is diverted from our other businesses. It may take longer than expected to realize the full benefits of acquisitions, such as increased revenue, enhanced efficiencies, or market share, or those benefits may ultimately be smaller than anticipated, or may not be realized. These events could harm our operating results or financial condition.

If we are not able to successfully manage our growth strategy, our business and results of operations may be adversely affected.

Our expected future growth presents numerous managerial, administrative, operational and other challenges. Our ability to manage the growth of our operations will require us to increase the capacity of our management information systems and maintain strong internal systems and controls. In addition, our growth will increase our need to attract, develop, motivate and retain management and professional employees. The inability of our management to effectively manage our growth or the inability of our employees to achieve anticipated performance could have a material adverse effect on our business.

Our operating results may be adversely impacted by worldwide political and economic uncertainties and specific conditions in the markets we address.

General worldwide economic conditions have experienced a downturn due to the lack of available credit, slower economic activity, concerns about inflation and deflation, increased energy costs, decreased consumer confidence, reduced corporate profits and capital spending, and adverse business conditions. These conditions make it extremely difficult for our clients and our vendors to accurately forecast and plan future business activities and could cause businesses to slow spending on services, and they have also made it difficult for us to predict the short-term and long-term impacts on our business. We cannot predict the timing, strength or duration of any economic slowdown or subsequent economic recovery worldwide or in our industry. If the economy or markets in which we operate deteriorate from the level experienced in fiscal year 2011, our business, financial condition and results of operations may be materially and adversely affected.

13

Our inability to maintain adequate bonding capacity could have a material adverse effect on our future revenue and business prospects.

Certain clients require bid bonds and performance and payment bonds. These bonds indemnify the client should we fail to perform our obligations under a contract. If a bond is required for a particular project and we are unable to obtain an appropriate bond, we cannot pursue that project. We currently have bonding capacity but, as is typically the case, the issuance of bonds under that facility is at the surety's sole discretion. Moreover, due to events that can negatively affect the insurance and bonding markets, bonding may be more difficult to obtain or may only be available at significant additional cost. There can be no assurance that bonds will continue to be available to us on reasonable terms. Our inability to obtain adequate bonding and, as a result, to bid on new work, could have a material adverse effect on our future revenue and business prospects.

Risks Related to Our Industry

Changes in existing environmental laws, regulations and programs or reductions in the level of regulatory enforcement could reduce demand for our environmental services which could cause our revenue to decline.

While we pursue markets for our services that are strongly tied to the overall health of the domestic economy, our business is also materially dependent on the continued enforcement by federal, state and local governments of various environmental regulations. A significant amount of our business is generated either directly or indirectly as a result of existing federal and state laws, regulations and programs related to pollution and environmental protection. Accordingly, a relaxation or repeal of these laws and regulations, or changes in governmental policies regarding the funding, implementation or enforcement of these programs, could result in a decline in demand for environmental services that may have a material adverse effect on our revenue and business prospects.

We operate in highly competitive industries.

The markets for many of our services are highly competitive. There are numerous professional architectural, engineering and consulting firms and other organizations which offer many of the services offered by us. We compete with many companies, some of which have greater resources. Competitive factors include reputation, performance, price, geographic location and availability of technically skilled personnel. In addition, many clients also use in-house staff to perform the same types of services we do.

We are materially dependent on contracts with federal, state and local governments. Our inability to continue to win or renew government contracts could result in material reductions in our revenues and profits.

We have increased our contract activity with the federal, state and local governments in recent years and are materially dependent on such contracts. We estimate that contracts with agencies of the United States government and various state and local governments represented approximately 25% of our NSR in fiscal year 2011. Companies engaged in government contracting are subject to certain unique business risks. Among these risks are dependence on appropriations and administrative allotment of funds as well as changing policies and regulations. These contracts may also be subject to renegotiation of profits or termination at the option of the government. The stability and continuity of that portion of our business depends on the periodic exercise by the government of contract renewal options, our continued ability to negotiate favorable terms and the continued awarding of task orders to us. We cannot control whether those clients will fund or continue funding our outstanding projects.

We are subject to procurement laws and regulations associated with our government contracts. If we do not comply with these laws and regulations, we may be prohibited from completing our existing government contracts or suspended from government contracting and subcontracting for some period of time or debarred.

Our compliance with the laws and regulations relating to the procurement, administration, and performance of our government contracts is dependent upon our ability to ensure that we properly design and execute compliant procedures. Our termination from any of our larger government contracts or suspension from future government contracts for any reason would result in material declines in expected revenue. Because government agencies have the ability to terminate a contract for convenience, the agencies could terminate or decide not to renew our contracts with little or no prior notice.

Our government contracts are subject to audit. These audits may result in the determination that certain costs claimed as reimbursable are not allowable or have not been properly allocated to government contracts according to government regulations. We are subject to audits for several years after payment for services has been received. Based on these audits, government entities may adjust or seek reimbursement for previously paid amounts. None of the audits performed to date on our government contracts have resulted in any significant adjustments to our financial statements. It is possible, however, that an audit in the future could have an adverse effect on our revenue, profits and cash flow.

14

Reductions in state and local government budgets could negatively impact their capital spending and adversely affect our business, financial condition and results of operations.

Several of our state and local government clients are currently facing budget deficits, resulting in smaller budgets and reduced capital spending, which has negatively impacted our revenue and profitability. Our state and local government clients may continue to face budget deficits that prohibit them from funding new or existing projects. In addition, existing and potential clients may either postpone entering into new contracts or request price concessions. If we are not able to reduce our costs quickly enough to respond to the revenue decline from these clients that may occur, our operating results would be adversely affected. Accordingly, these factors affect our ability to accurately forecast our future revenue and earnings from business areas that may be adversely impacted by market conditions.

Other Risks

The value of our equity securities could continue to be volatile.

Our stock is thinly traded and over time has experienced substantial price volatility. In addition, the stock market has experienced price and volume fluctuations that have affected the market price of many companies that have often been unrelated to the operating performance of these companies. The overall market and the price characteristics of our common stock may continue to fluctuate greatly. Additionally, volatility or a lack of positive performance in our stock price may adversely affect our ability to retain or attract key employees. Many of these key employees are granted stock options and restricted stock as an element of compensation, the value of which is dependent on our stock price.

Our actual business and financial results could differ from the estimates and assumptions that we use to prepare our financial statements, which may significantly reduce or eliminate our profits.

To prepare financial statements in conformity with generally accepted accounting principles ("GAAP") in the United States, management is required to make estimates and assumptions as of the date of the financial statements. These estimates and assumptions affect the reported values of assets, liabilities, revenue and expenses, as well as disclosures of contingent assets and liabilities. For example, we recognize revenue over the life of a contract based on the proportion of costs incurred to date compared to the total costs estimated to be incurred for the entire project. Areas requiring significant estimates by our management include:

• | The application of the percentage-of-completion method of accounting and revenue recognition on contracts, change orders and contract claims; |

• | Provisions for uncollectible receivables and client claims and recoveries of costs from subcontractors, vendors and others; |

• | Provisions for income taxes and uncertain tax positions; |

• | Value of goodwill and recoverability of other intangible assets; |

• | Valuations of assets acquired and liabilities assumed in connection with business combinations; |

• | Estimated earn-out payments due in connection with business combinations; |

• | Valuation of self insured reserves; |

• | Valuation of stock-based compensation expense; and |

• | Accruals for estimated liabilities, including litigation and insurance reserves. |

Our actual business and financial results could differ from those estimates, which may significantly reduce or eliminate our profits.

We may experience adverse impacts on our results of operations as a result of adopting new accounting standards or interpretations.

Our adoption of, and compliance with, changes in accounting rules, including new accounting rules and interpretations, could adversely affect our operating results or cause unanticipated fluctuations in our operating results.

We are highly dependent on key personnel.

The success of our business depends on our ability to attract and retain qualified employees. We need talented and experienced personnel in a number of areas to support our core business activities. An inability to attract and retain sufficient qualified personnel could harm our business. Turnover among certain critical staff could have a material adverse effect on our ability to implement our strategies and on our results of operations.

15

Safety related issues could result in significant losses.

Safety is a primary focus of our business. We often work on large-scale and complex projects, sometimes in geographically remote locations which can place our employees and others near large equipment, dangerous processes or highly regulated materials, and in challenging environments. Many of our clients require that we meet certain safety criteria to be eligible to bid on contracts, and some of our contract fees or profits are subject to satisfying safety criteria. Unsafe work conditions also have the potential of increasing employee turnover, increasing project costs and raising our operating costs. We are responsible for the safety of our employees at work, and, on occasion on certain projects, we take on expanded site safety responsibilities. If our employees or others become injured, or if we fail to implement appropriate health and safety procedures, we could be subject to claims and liability. In addition, if our overall safety metrics fall below certain levels we may be foreclosed from bidding on work with certain clients.

We rely on third-party internal and outsourced software to run our critical accounting, project management and financial information systems. As a result, any sudden loss, disruption or unexpected costs to maintain these systems could significantly increase our operational expense and disrupt the management of our business operations.

We rely on third-party software to run our critical accounting, project management and financial information systems. We also depend on our software vendors to provide long-term software maintenance support for our information systems. Software vendors may decide to discontinue further development, integration or long-term software maintenance support for our information systems, in which case we may need to abandon one or more of our current information systems and migrate some or all of our accounting, project management and financial information to other systems, thus increasing our operational expense as well as disrupting the management of our business operations.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, investors could lose confidence in our financial reporting, which could harm our business and the trading price of our stock.

Effective internal controls are necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed. We devote significant attention to establishing and maintaining effective internal controls. Implementing changes to our internal controls has entailed substantial costs in order to modify our existing accounting systems. Although these measures are designed to do so, we cannot be certain that such measures and future measures will guarantee that we will successfully maintain adequate controls over our financial reporting processes and related reporting requirements. For example, in the past we have had material weaknesses, including a material weakness relating to the policies and procedures relating to the development, documentation and review of contract values and estimates of cost at completion, which we have remediated. Internal controls that are found to not be operating effectively could affect our operating results or cause us to fail to meet our reporting obligations and could result in a breach of a covenant in our revolving credit facility in future periods. Ineffective internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the market price of our stock.

Extraordinary events, including natural disasters and terrorist actions could negatively impact the economies in which we operate or disrupt our operations, which may affect our financial condition, results of operations or cash flows.

Extraordinary events beyond our control, such as natural and man-made disasters, computer hacking, as well as terrorist actions, could negatively impact us by causing the closure of offices, interrupting projects and forcing the relocation of employees. Further, despite our implementation of network security measures, our computer systems are vulnerable to computer viruses, break-ins and similar disruptions from unauthorized tampering with our computer systems. If we are not able to react quickly to these sort of events, our operations may be affected significantly, which would have a negative impact on our financial condition, results of operations or cash flows.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We provide our services through a network of approximately 100 offices located nationwide. We lease approximately 700,000 square feet of office and commercial space to support these operations. In addition, a subsidiary of ours owns a 26,000 square foot office/warehouse building in Austin, Texas. This property is subject to a deed of trust in favor of the lenders under our principal credit facility. All properties are adequately maintained and are suitable and adequate for the business activities conducted therein. In connection with the performance of certain Exit Strategy or real estate projects, some of our subsidiaries have taken title to sites on which environmental remediation activities are being performed.

16

Item 3. Legal Proceedings

See Note 18—Commitments and Contingencies of the Notes to Financial Statements (Part II, Item 8 of this Form 10-K) for information regarding legal proceedings in which we are involved.

17

Part II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

On June 1, 2009, we sold 7,209.302 shares of a new Series A Convertible Preferred Stock, $0.10 par value, for $2,150 per share pursuant to a stock purchase agreement by and among us and three of our existing shareholders and related entities. The preferred stock offering resulted in proceeds of $15.3 million, net of issuance costs of $0.2 million. On December 1, 2010, the preferred stock converted to 7,209,302 shares of common stock. The preferred stock offering was made pursuant to the exemption from registration provided in Regulation D, Rule 506, under Section 4 (2) of the Securities Act of 1933 as amended (the “Act”). Each of the investors is an “accredited investor” within the meaning of Rule 501 (a) under the Act.

During fiscal year 2011, we issued 79,787 shares of unregistered common stock with a market value of $0.3 million as consideration for the purchase of Alexander Utility Engineering, Inc.

Our common stock is traded on the New York Stock Exchange ("NYSE") under the symbol "TRR." The following table sets forth the high and low per share prices for the common stock for fiscal years 2011 and 2010 as reported on the NYSE:

Fiscal 2011 | Fiscal 2010 | ||||||||||||||

High | Low | High | Low | ||||||||||||

First Quarter | $ | 3.25 | $ | 2.65 | $ | 4.97 | $ | 3.50 | |||||||

Second Quarter | 3.98 | 2.20 | 3.86 | 2.55 | |||||||||||

Third Quarter | 5.14 | 3.45 | 3.11 | 2.57 | |||||||||||

Fourth Quarter | 9.01 | 4.30 | 3.56 | 2.66 | |||||||||||

As of July 13, 2011, there were 259 shareholders of record, and, as of that date, we estimate there were approximately 1,845 beneficial owners holding our common stock in nominee or "street" name.

To date we have not paid any cash dividends on our common stock, and the payment of dividends in the future will be subject to financial condition, capital requirements and earnings. Future earnings are expected to be used for expansion of our operations, and cash dividends are not currently anticipated. The terms of our credit agreement also prohibit the payment of cash dividends.

18

Stock Performance Graph

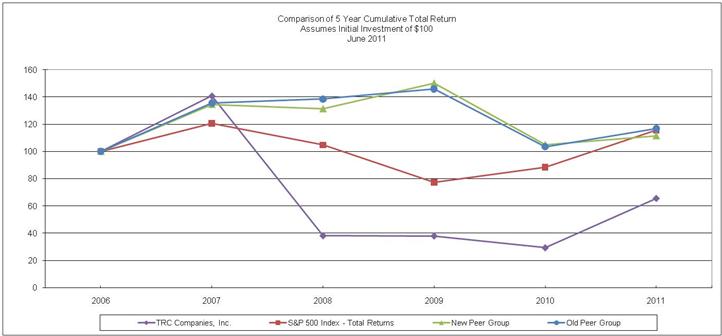

Comparison of Five-Year Cumulative Total Return Among TRC, S&P 500 Total Return Index and Peer Companies

The annual changes for the five-year period shown in the graph below are based upon the assumption (as required by SEC rules) that $100 had been invested in our Common Stock on June 30, 2006. The figures presented assume that all dividends, if any, paid over the performance periods were reinvested.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

June 2011

Data and graph provided by Zacks Investment Research, Inc. Copyright© 2011, Standard & Poor's, a division of The McGraw-Hill Companies, Inc. All rights reserved.

Year Ended June 30, | |||||||||||||||||||||||

2006 | 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||||

TRC | $ | 100 | $ | 141 | $ | 38 | $ | 38 | $ | 29 | $ | 66 | |||||||||||

S&P 500 Index | 100 | 121 | 105 | 77 | 88 | 116 | |||||||||||||||||

New Peer Group | 100 | 134 | 131 | 150 | 105 | 111 | |||||||||||||||||

Old Peer Group | 100 | 136 | 139 | 146 | 104 | 117 | |||||||||||||||||