Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HANCOCK WHITNEY CORP | d536412d8k.htm |

Gulf South Bank

Conference

May 13, 2013

Gulf South Bank

Conference

May 13, 2013

Exhibit 99.1 |

Carl Chaney

President & CEO

2 |

Forward-Looking

Statements

Forward-Looking

Statements

Certain of the statements or information included in this presentation

may constitute forward-looking statements.

Forward-looking statements include projections of revenue, costs, results of operations or

financial condition or statements regarding future market conditions or

our potential plans and strategies for the future.

Forward-looking statements that we may make include, but may not be limited to, comments

with respect to future levels of economic activity in our

markets, loan growth, deposit trends, credit quality

trends, future sales of nonperforming assets, net interest margin

trends, future expense levels and the ability to achieve

reductions in non-interest expense or other cost savings, projected tax rates, future

profitability, improvements in expense to revenue (efficiency) ratio,

purchase accounting impacts such as accretion levels, the impact

of the branch rationalization process, uses of capital and the financial impact

of regulatory requirements. Hancock’s ability to accurately

project results or predict the effects of future plans or

strategies is inherently limited. We believe that the

expectations reflected or implied by any forward-looking statements are based on

reasonable

assumptions,

but

actual

results

and

performance

could

differ

materially

from

those

set

forth

in

the forward-looking statements. Factors that could cause

actual results or outcomes to differ from those expressed in the

Company's forward-looking statements include, but are not limited to, those outlined in

Hancock's

SEC

filings,

including

the

“Risk

Factors”

section

of

the

Company’s

10-K

for

the

year

ended

December 31, 2012 and most recent form 10-Q.

Hancock undertakes no obligation to update or revise any

forward-looking statements, and you are cautioned not to

place undue reliance on such forward-looking statements. 3

|

•

Diversified footprint across the Gulf South

•

2 well-known Gulf Coast brands

•

Loyal customer base and attractive deposit funding

•

Diversified revenue stream with strong earnings momentum

•

Leading market share in key MSAs

•

Louisiana and Houston economies are best performing markets within

our footprint

A Premier Gulf South

Financial Services Franchise

Whitney Bank

Hancock Bank

4 |

#1

Most Improved Metro in the USA [Wall Street Journal]

#1 Growing Metro Area for Employment

[Brookings Inst.]

#1 Metro for IT Job Growth in the USA

[Forbes]

#1 Most Improved State in the U.S.

[Chief Executive magazine]

#1 State for Economic Growth Potential

[Business Facilities]

Recent Accolades For

Recent Accolades For

New Orleans and LA

New Orleans and LA

5

Source: GNO, Inc. |

•

Net income $48.6 million or $.56

per diluted common share

•

ROA 1.03%

•

ROTCE 12.04%

•

Continued to build strong capital

levels

•

Improved asset quality metrics

•

Expenses in line with guidance

•

Recent balance sheet decline related

mainly to seasonal trends in deposits

and loan demand

•

Challenges from operating

environment & headwinds continue

Fundamentals Remain Solid

Fundamentals Remain Solid

Compared to Peers

Compared to Peers

6

* A reconciliation of net income to operating income and pre-tax,

pre-provision income is included in the appendix.

** Noninterest expense as a percent of total revenue (TE) before

amortization of purchased intangibles, securities transactions and merger expenses.

|

Sam Kendricks

Chief

Credit

Officer

7 |

Growth Continues In C&I

Growth Continues In C&I

Portfolio, Energy Lending

Portfolio, Energy Lending

•

Total loans $11.5B; down $95 million, or less than 1%

linked-quarter

•

Seasonal reductions in demand from some C&I customers

in the first quarter

•

New loan activity in many markets across the footprint,

especially Houston, Florida and Louisiana

•

Loans outstanding to oil & gas industry customers totaled

$960 million, or approximately 8% of total loans, at

March 31, 2013

•

Based on current levels of activity, management expects

some success in achieving net loan growth in future

quarters.

Period-end balances. As of March 31, 2013

8

Total Loan Mix 3/31/13

Energy Portfolio Mix |

Whitney Portfolio Continues

Whitney Portfolio Continues

Solid Performance

Solid Performance

•

FAS 91 mark accreted into earnings over the life of the portfolio

•

Credit impaired mark available for charge-offs; if not needed for

charge-offs then accreted into income

•

Quarterly reviews of accretion levels and portfolio performance will

impact reported margin 9

$s in millions

Credit

Impaired

(SOP 03-3)

Performing

(FAS 91)

Total

Whitney loan mark at acquisition

(as adjusted in 4Q11)

$284

$187

$471

Acquired portfolio loan balances at acquisition

$818

$6,101

$6,919

Discount at acquisition

34.7%

3.1%

6.8%

Remaining Whitney loan mark at 3/31/13

$188

$68

$255

Remaining acquired portfolio loan balances at

3/31/13

$317

$3,565

$3,882

Acquired loan charge-offs from acquisition thru

3/31/13

$27

$6

$33

Discount at 3/31/13

59.2%

1.9%

6.6%

As of March 31, 2013 |

Peoples First Loan Mark Used

Peoples First Loan Mark Used

For Charge-Offs

For Charge-Offs

•

FDIC covered loan portfolio

•

Entire loan mark available for charge-offs; if not needed for

charge-offs then accreted into income

•

Quarterly reviews of accretion levels and portfolio performance will

impact reported margin •

FDIC loss share receivable totaled $153 million at March 31, 2013

Balance reflects the total amount expected to be collected from the

FDIC 10

$s in millions

Credit Impaired

(SOP 03-3)

Peoples First loan mark at acquisition (12/2009)

$509

Charge-offs from acquisition thru 3/31/13

$387

Accretion since acquisition date

$71

Remaining loan mark at 3/31/13

$91

Impairment reserve at 3/31/13

$62

Remaining acquired portfolio loan balances at 3/31/13

$568

Discount & allowance at 3/31/13

26.9%

As of March 31, 2013 |

•

Provision for loan losses was $9.6 million, down $18.5 million from

4Q12 •

4Q12 includes $13.7 million related to the bulk loan sale

•

1Q13 includes $6.6 million impact from FDIC-covered loan

portfolio •

1Q13 includes $3.0 million for the non-covered loan

portfolio •

Linked-quarter decrease related to a lower level of non-covered

charge-offs and the impact of a slowdown in newly identified

impaired loans •

Do not expect to maintain lower level of non-covered provision in

the near term •

Non-covered net charge-offs totaled $6.6 million, or

0.23% •

4Q12 included $16.2 million related to the bulk loan sale

•

Linked-quarter decrease reflects a lower level of gross

charge-offs and a higher than normal level of recoveries •

Do

not

expect

to

maintain

higher

level

of

recoveries

in

the

near

term

•

Allowance for loan losses/loans 1.20%

•

Excluding the impact of the Whitney acquired loans and FDIC covered

loans, allowance for loan losses was 1.02%

Improved Asset Quality Metrics

Improved Asset Quality Metrics

11

As of March 31, 2013 |

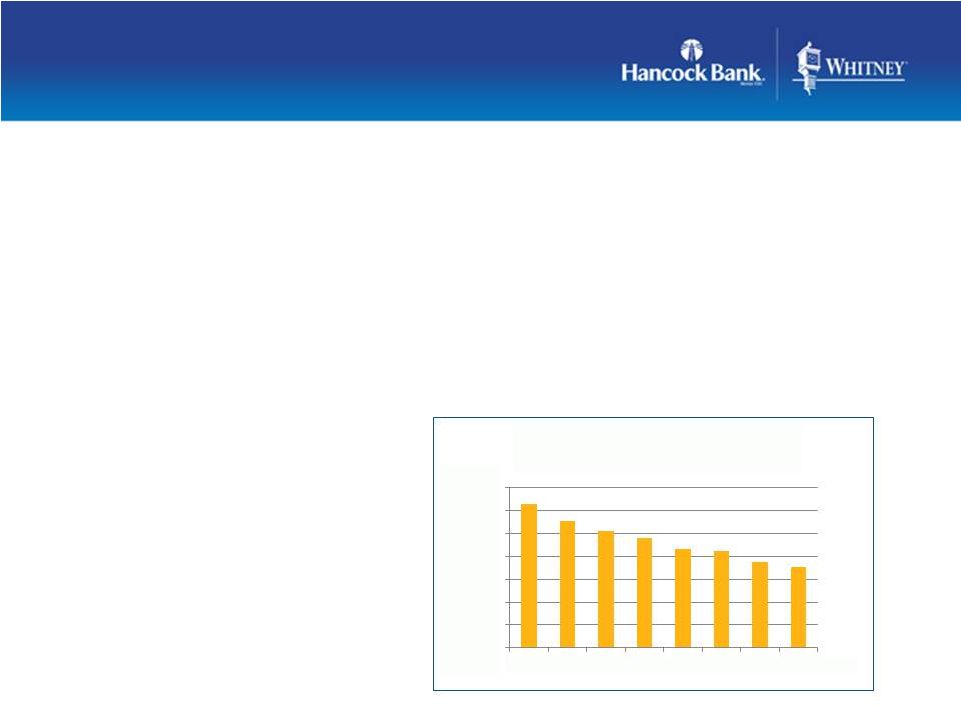

•

Nonperforming assets totaled $229 million, a decrease of $27 million

linked-quarter

•

Nonaccrual loans down $6.5 million

•

Restructured loans increased $2.1 million

•

ORE and foreclosed assets down $22.4 million

•

Management will continue to

evaluate the costs and benefits of

NPL and ORE sale

opportunities as part of its

normal credit risk management

process

Improved Asset Quality Metrics

Improved Asset Quality Metrics

12

$s in millions

Excludes covered portfolio and gross of the Whitney loan mark

As of March 31, 2013

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

Criticized Loans

(Special Mention, Substandard, Doubtful) |

13

|

Strong Core Deposit

Strong Core Deposit

Funding

Funding

•

Total deposits $15.3 billion, down

approximately $500 million linked-quarter

•

Decrease related mainly to seasonal trends

and maturity of $100 million of brokered

CDs

•

Funding mix remained strong

–

Noninterest-bearing demand deposits (DDA) comprised

36% of total period-end deposits

–

Shift continued from CDs to no or low cost deposits

–

Cost of funds 28bps

•

Approximately $1.6B in CDs maturing over

the next 4 quarters at average rate of .38%

Period-end balances. As of March 31, 2013

14 |

Net Interest Margin Impacted By

Net Interest Margin Impacted By

Earning Asset Repricing

Earning Asset Repricing

•

Reported net interest margin (NIM) 4.32%, down 16bps

linked-quarter •

Core NIM compressed 20bps

–

Continued repricing of earning assets causing NIM compression

–

Average rate on new loans booked in 1Q13

in the range of 3.0%-3.5% ;

–

New securities purchased in 1Q13 at an

average rate of 1.68%

•

Compression of 5-10 bps in the core margin

is expected in the near term

•

All else equal, and adjusting for the volatility

related to loan accretion, compression of the

reported margin of 10-20 bps is

anticipated in the near term

As of March 31, 2013

15

•

Increase in net purchase accounting adjustments,

mainly from the Whitney transaction,

positively impacted net interest income (NII), NIM, EPS

•

Higher than expected accretion in 1Q13 added

approximately $7.5 million to NII, or $.06 to EPS

•

Absent additional accretion, and all else equal,

quarterly EPS $.06 lower than reported 1Q13

|

Core NIM Compression Related

Core NIM Compression Related

to Lower Earning Asset Yields

to Lower Earning Asset Yields

16

*Core loan yields exclude purchase accounting accretion

•

NIM compression mitigation

strategies in place

•

Main focus on additional loan

volumes, enhanced loan mix,

better pricing

•

C&I

•

Owner-occupied CRE

•

Consumer

•

Continual deployment of excess

liquidity

•

Lower cost of funds where

possible |

Expected Annual Impact of Purchase

Expected Annual Impact of Purchase

Accounting Adjustments

Accounting Adjustments

•

Net purchase accounting adjustments

will be ‘sizeable’

part of earnings for

the next few years

•

Post 2015, diminishing levels of

purchase accounting adjustments

also expected

•

Revenue includes loan accretion,

securities amortization, CD accretion

•

Amortization of intangibles mainly

related to the Whitney acquisition

$s in millions

Impact of Purchase Accounting Adjustments and Efficiency Initiative

2012-2015 (2013-2015 projections will be updated

quarterly; subject to volatility) 17

$124

$113

$86

$72

$31

$29

$27

$24

$93

$85

$59

$48

$0

$25

$50

$75

$100

$125

2012

2013

2014

2015

Revenue impact

Amortization of intangibles

Pre

-

tax impact PAA |

Efficiency & Process

Efficiency & Process

Improvement Initiative

Improvement Initiative

•

Announced an efficiency and process improvement initiative

•

Part of the Company’s updated long-term Strategic Plan

•

Most effective way of operating the consolidated organization

Short-term efficiency improvements

Long-term process improvement

•

Committed to reducing non-interest expense in future years by

$50 million compared to annualized 2013 expense

•

Designed to reduce overall annual expense levels over the

next 7 quarters

50% attainment by 1Q14

100% attainment by 4Q14

•

Will include reviews of front and back office areas as well as branch

network and current business models

•

Longer-term sustainable efficiency ratio target of 57%-59%

set for 2016

•

Expect to incur one-time costs in implementing the initiative

18

$s in millions

1Q13 non-interest

expense

$160

Annualized 1Q13

non-interest expense

$640

1Q14 non-interest

expense projection

$153

4Q14 non-interest

expense projection

$147

** Noninterest expense as a percent of total revenue (TE) before

amortization of purchased intangibles, sub debt redemption

costs, securities transactions and merger expenses |

Efficiency Improvements Will Offset Loss

Efficiency Improvements Will Offset Loss

of Purchase Accounting Adjustments

of Purchase Accounting Adjustments

$s in millions

Impact of Purchase Accounting Adjustments and Efficiency Initiative

2012-2015 (2013-2015 projections will be updated

quarterly; subject to volatility) 19 |

Carl Chaney

President & CEO

20 |

•

Have reviewed each market for commercial and/or retail line

of business focus

•

Will close between 40-45 branches across the 5-state footprint

during 3Q13 and 4Q13

•

Expect

to

incur

one-time

costs

of

between

$18

-

$22

million

related to branch closures

•

Very little impact in core markets of Greater New Orleans

and MS Gulf Coast

Strategic Review of Markets and

Line of Business Focus

Whitney Bank

Hancock Bank

21 |

•

TCE ratio 9.14% at March 31, 2013

•

Have reviewed opportunities to

deploy excess capital and liquidity in

the best interest of the Company and

its shareholders

•

Announced stock buyback of up

to 5% of outstanding common stock

•

Completed accelerated share repurchase

of approximately 2.8 million shares as of

May 9, 2013

•

Total transaction amount of $115 million

•

Remaining shares to be repurchased

within 12 months

•

Proforma TCE ratio as of

3/31/13…..8.56%

Solid Capital Levels

Solid Capital Levels

22 |

Strong

Strong

Opportunities

Opportunities

Two premier Gulf South franchises

Successful merger, integration, retention of

customers, associates

Today, one strong, consolidated company

History of effective capital management

Superior liquidity

Conservative credit culture

Enhanced earnings potential

Well positioned for future growth

Focused on shareholder value creation

23 |

Appendix

24 |

Non-GAAP

Reconciliation

Non-GAAP

Non-GAAP

Reconciliation

Reconciliation

25

(a) Net income less tax-effected merger costs, debt early redemption costs, and securities

gains/losses. Management believes that this is a useful financial measure because it

enables investors to assess ongoing operations. (b) Pre-tax pre-provision

profit (PTPP) is total revenue less noninterest expense, merger items, and securities transactions. Management believes that PTPP profit is a useful

financial measure because it enables investors and others to assess the Company’s ability

to generate capital to cover credit losses through a credit cycle. (amounts

in thousands) (unaudited)

3/31/2013

12/31/2012

3/31/2012

Income Statement

Interest income

$185,272

$191,140

$191,716

Interest income (TE)

187,998

194,075

194,665

Interest expense

11,257

11,275

15,428

Net interest income (TE)

176,741

182,800

179,237

Provision for loan losses

9,578

28,051

10,015

Noninterest income excluding

securities transactions

60,187

64,308

61,494

Securities transactions gains/(losses)

-

623

12

Noninterest expense

159,602

157,920

205,463

Income before income taxes

65,022

58,825

22,316

Income tax expense

16,446

11,866

3,821

Net income

$48,576

$46,959

$18,495

Merger-related expenses

-

-

33,913

Securities transactions gains/(losses)

-

623

12

Taxes on adjustments

-

(218)

11,865

Operating income (a)

$48,576

$46,554

$40,531

Difference between interest income and interest income (TE)

$2,726

$2,935

$2,949

Provision for loan losses

9,578

28,051

10,015

Merger-related expenses

-

-

33,913

Less securities transactions gains/(losses)

-

623

12

Income tax expense

16,446

11,866

3,821

Pre-tax, pre-provision profit (PTPP) (b)

$77,326

$89,188

$69,181

Three Months Ended |

Gulf South Bank

Conference

May 13, 2013

Gulf South Bank

Conference

May 13, 2013 |