Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DOT HILL SYSTEMS CORP | dhform8-k_investorpresenta.htm |

DRIVING GROWTH NASDAQ: HILL May 9, 2013 First Quarter 2013 Earnings Conference Call Dot Hill Systems Corp.

Safe Harbor and Non-GAAP Financial Measures Statements contained in this presentation regarding matters that are not historical facts are “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include statements regarding future opportunities for additional business and the stage of such opportunities relative to a final binding agreement, prospects for Dot Hill’s continued growth, and Dot Hill’s projected financial results for the second quarter and full year of 2013. The risks that contribute to the uncertain nature of the forward- looking statements include, among other things: the risk that actual financial results for the second quarter and full year of 2013 may be different from the financial guidance provided in this press release; the risks associated with macroeconomic factors that are outside of Dot Hill’s control; the risk that projected future opportunities may never fully develop into ongoing business relationships and/or binding contractual agreements; the fact that no Dot Hill customer agreements provide for mandatory minimum purchase requirements; the risk that one or more of Dot Hill’s OEM or other customers may cancel or reduce orders, not order as forecasted or terminate their agreements with Dot Hill; the risk that Dot Hill’s new products may not prove to be popular; the risk that one or more of Dot Hill’s suppliers or subcontractors may fail to perform or may terminate their agreements with Dot Hill; the risk that Vertical Markets’ sales may not ramp as expected; unforeseen product quality, technological, intellectual property, personnel or engineering issues and any costs that may result from such issues; and the additional risks set forth in Dot Hill’s most recent Form 10-Q and Form10-K filings with the Securities and Exchange Commission. All forward-looking statements contained in this press release speak only as of the date on which they were made. Dot Hill undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made. May 9, 2013 NASDAQ: HILL 2

About Non-GAAP Financial Measures In 2012 and/or 2013, the Company’s non-GAAP financial measures exclude the impact of stock-based compensation expense, legal settlements and associated expenses, intangible asset amortization, restructuring and severance charges, charges or credits for contingent consideration adjustments, charges for impairment of goodwill and other long-lived assets, specific and significant warranty claims arising from a supplier’s defective products, the impact of our discontinued AssuredUVS software business and the effects of foreign currency gains or losses. The non-GAAP financial measures include the recognition of revenues and directly related costs associated with long term AssuredVRA software contracts, which were deferred and amortized in the Company’s GAAP financial statements. The Company used these non-GAAP measures when evaluating its financial results as well as for internal resource management, planning and forecasting purposes. These non-GAAP measures should not be viewed in isolation from or as a substitute for the Company’s financial results in accordance with GAAP. A reconciliation of GAAP to non-GAAP measures is attached to this press release and is included in this investor presentation. 3 May 9, 2013 NASDAQ: HILL

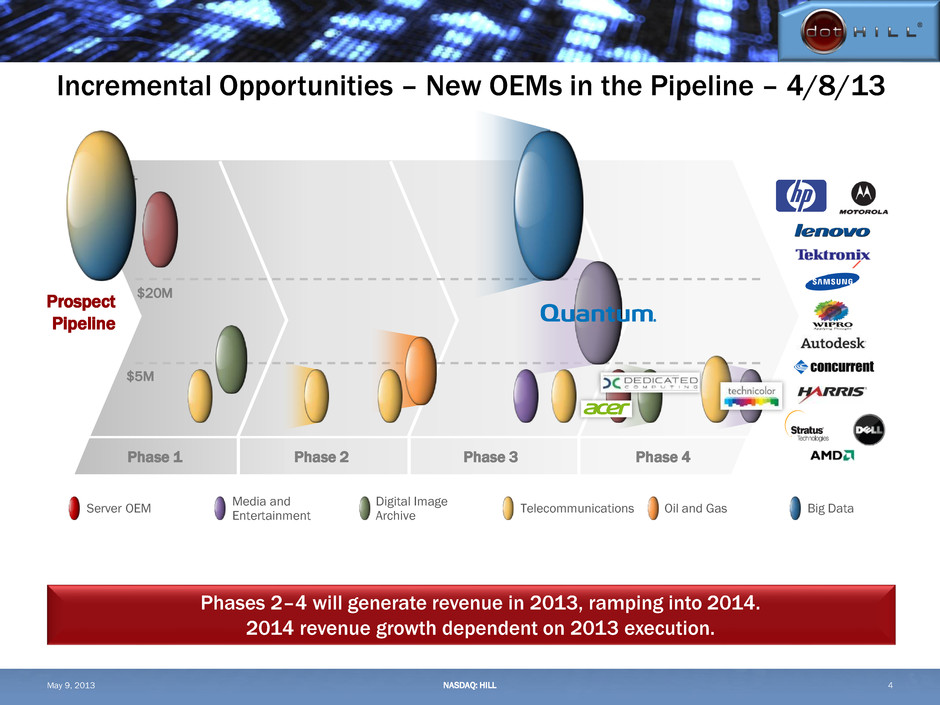

Incremental Opportunities – New OEMs in the Pipeline – 4/8/13 Prospect Pipeline $50M+ $5M $20M Server OEM Digital Image Archive Media and Entertainment Telecommunications Oil and Gas Big Data Phase 1 Phase 4 Phase 2 Phase 3 Phases 2–4 will generate revenue in 2013, ramping into 2014. 2014 revenue growth dependent on 2013 execution. May 9, 2013 NASDAQ: HILL 4

Incremental Opportunities – New OEMs in the Pipeline – 5/9/13 Prospect Pipeline $50M+ $5M $20M Server OEM Digital Image Archive Media and Entertainment Telecommunications Oil and Gas Big Data Phase 1 Phase 4 Phase 2 Phase 3 Phases 2–4 will generate revenue in 2013, ramping into 2014. 2014 revenue growth dependent on 2013 execution. May 9, 2013 NASDAQ: HILL 5

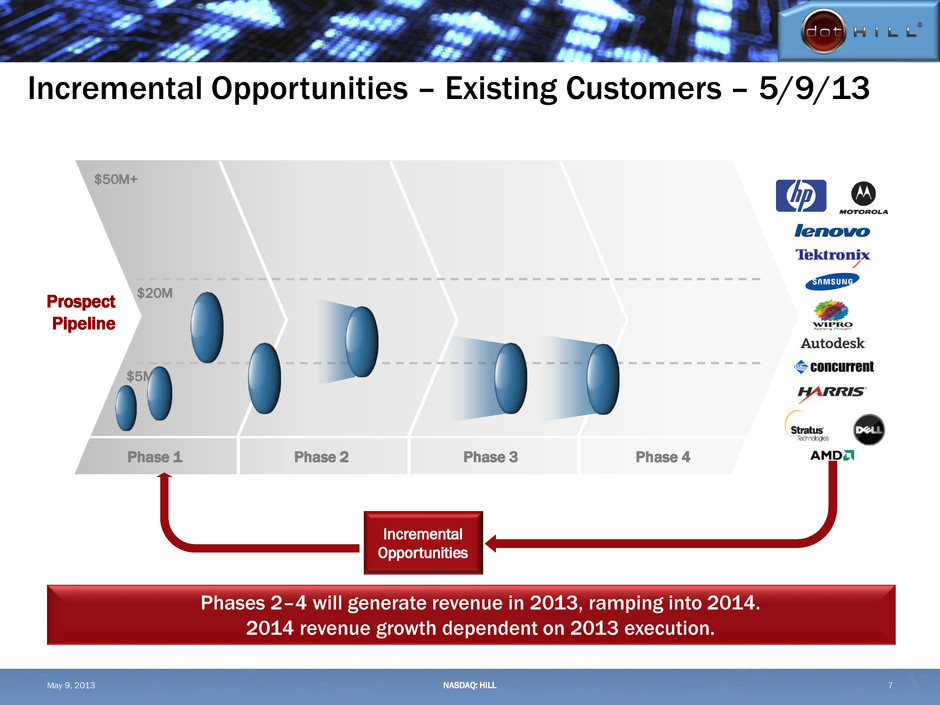

Incremental Opportunities – Existing Customers – 4/8/13 May 9, 2013 NASDAQ: HILL Prospect Pipeline $50M+ $5M $20M Phase 1 Phase 4 Phase 2 Phase 3 Phases 2–4 will generate revenue in 2013, ramping into 2014. 2014 revenue growth dependent on 2013 execution. 6 Incremental Opportunities

Incremental Opportunities – Existing Customers – 5/9/13 May 9, 2013 NASDAQ: HILL Prospect Pipeline $50M+ $5M $20M Phase 1 Phase 4 Phase 2 Phase 3 Phases 2–4 will generate revenue in 2013, ramping into 2014. 2014 revenue growth dependent on 2013 execution. 7 Incremental Opportunities

Q1’13 Non-GAAP Financial Metrics May 9, 2013 NASDAQ: HILL 8 Revenue ($M) 44.9 54.6 46.2 -17.8% -2.8% 21% QoQ Vertical Markets growth but 11% server OEM decline Gross Margin (%) 32.4% 29.3% 28.3% +4.1 pts +3.1 pts More favorable customer mix Operating Expenses ($M) 14.3 14.2 14.7 0.7% -2.7% EPS/(LPS) ($) 0.00 0.03 -0.03 -0.03 0.03 Normal Seasonality Cash Net of ST Borrowings ($M) 37.5 41.4 37.5 -$3.9M Flat Operating Profit and reduced Re-structuring expenses Q1’13 Q1’12 Q4’12 YoY QoQ

Q2’13 and Full Year 2013 Non-GAAP Guidance 9 Revenue (M) $47-53 +12% Expect continued traction in Vertical Markets EPS $ (0.01)-0.02 +0.015 Revenue growth and product mix 2nd Quarter 2013 Sequential Growth at mid points Revenue (M) $205-227 +10% 4-5% expected industry growth Gross Margin 30-31% +2.6% PTS More favorable customer and product mix Operating Expenses (M) $60-64 +$4.2 Tied to expected revenue ramp EPS $ 0.02-0.10 +0.12 Operating leverage impact Full Year 2013 Annual Growth at mid-points May 9, 2013 NASDAQ: HILL

DRIVING GROWTH NASDAQ: HILL May 9, 2013 Appendix: Reconciliation of GAAP to Non-GAAP Financial Measures A STRONG FOUNDATION FOR

Q1’13 GAAP to Non-GAAP Revenue Reconciliation ($K) 11 Q1’13 Q1’12 Q4’12 GAAP net revenue from continuing operations 44,480$ 54,598$ 44,019$ Revenue from discontinued operations 20 146 128 Net revenue, from continuing and discontinued operations 44,500$ 54,744$ 44,147$ ITC revenue (20) (146) (128) Long-term software contract royalties 401 - 2,141 Non-GAAP net revenue 44,881$ 54,598$ 46,160$ May 9, 2013 NASDAQ: HILL

Q1’13 GAAP to Non-GAAP Gross Profit Reconciliation ($K) 12 Q1’13 Q1’12 Q4’12 GAAP gross profit from continuing operations 14,440$ 15,565$ 7,877$ Gross margin % from continuing operations 32.5% 28.5% 17.9% Gross profit from discontinued operations (111) (391) - Gross profit from continuing and discontinued operations 14,329 15,174 7,877 Gross margin % from continuing and discontinued operations 32.2% 27.7% 17.8% Stock-based compensation 96 172 135 Severance costs 23 6 4 Power supply component failures (808) - - ITC revenue (20) (147) (128) ITC expenses 129 356 128 Long-term software contract royalties 401 - 2,141 Long-term software contract cost 256 - 2,885 Intangible asset amortization - 441 - Non-GAAP gross profit 14,406$ 16,002$ 13,042$ Non-GAAP gross margin % 32.1% 29.3% 28.3% May 9, 2013 NASDAQ: HILL

Q1’13 GAAP to Non-GAAP Operating Expenses Reconciliation ($K) 13 Q1’13 Q1’12 Q4’12 GAAP operating expenses from continuing operations 14,958$ 15,508$ 12,468$ Operating expenses from discontinued operations 310 1,636 137 Operating expenses from continuing and discontinued operations 15,268 17,144 12,605 Currency loss (343) (376) (341) Stock-based compensation (572) (970) (615) ITC expenses (353) (956) (147) Long-term software contract deferred cost 400 - 3,562 Restructuring (charge) recoveries 10 (601) (95) Legal fees related to power supply component failure (1) - (9) Severance costs (82) (9) (237) Non-GAAP operating expenses 14,327$ 14,232$ 14,723$ May 9, 2013 NASDAQ: HILL

Q1’13 GAAP to Non-GAAP Net Income (Loss) Reconciliation ($K) 14 Q1’13 Q1’12 Q4’12 GAAP net income (loss) from continuing operations (560)$ 160$ (4,883)$ Net loss from discontinued operations (421) (2,028) (137) Net loss from continuing and discontinued operations (981) (1,868) (5,020) Currency loss 343 376 341 Stock-based compensation 668 1,142 750 Restructuring charge (recoveries) (10) 601 95 Intangible asset amortization - 441 - Power supply component failures (807) - 9 ITC expenses 482 1,312 275 ITC revenue (20) (147) (128) Long-term software contract royalties 401 15 2,141 Long-term software contract cost 256 - 2,885 Long-term software contract deferred cost (400) - (3,562) Severance costs 105 - 241 Non-GAAP net income (loss) 37$ 1,872$ (1,973)$ May 9, 2013 NASDAQ: HILL

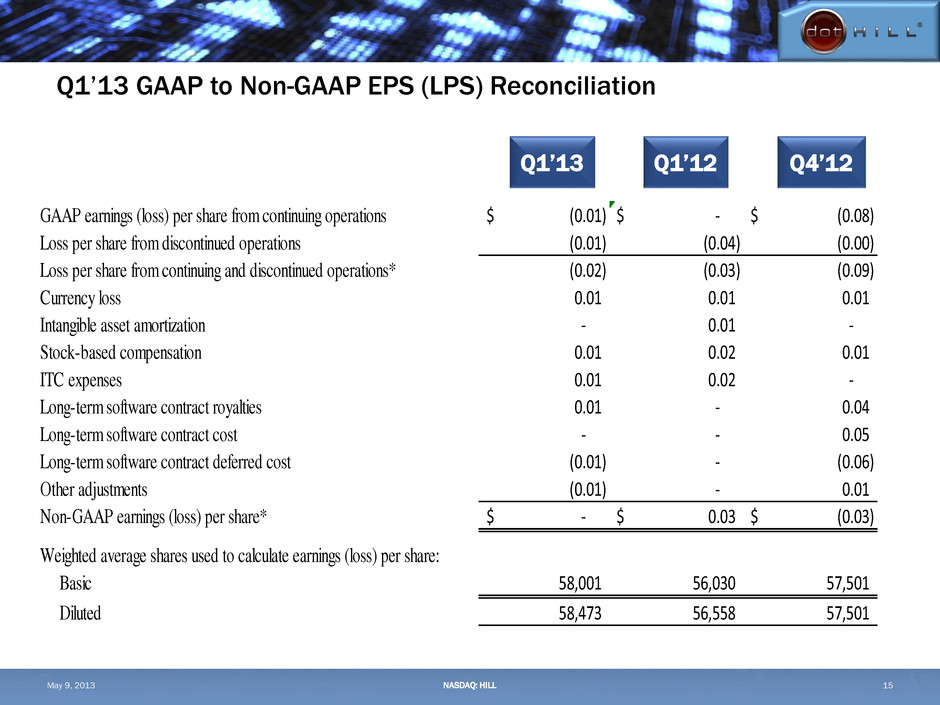

Q1’13 GAAP to Non-GAAP EPS (LPS) Reconciliation 15 Q1’13 Q1’12 Q4’12 GAAP earnings (loss) per share from continuing operations (0.01)$ -$ (0.08)$ Loss per share from discontinued operations (0.01) (0.04) (0.00) Loss per share from continuing and discontinued operations* (0.02) (0.03) (0.09) Currency loss 0.01 0.01 0.01 Intangible asset amortization - 0.01 - Stock-based compensation 0.01 0.02 0.01 ITC expenses 0.01 0.02 - Long-term software contract royalties 0.01 - 0.04 Long-term software contract cost - - 0.05 Long-term software contract deferred cost (0.01) - (0.06) Other adjustments (0.01) - 0.01 Non-GAAP earnings (loss) per share* -$ 0.03$ (0.03)$ Weighted average shares used to calculate earnings (loss) per share: Basic 58,001 56,030 57,501 Diluted 58,473 56,558 57,501 May 9, 2013 NASDAQ: HILL

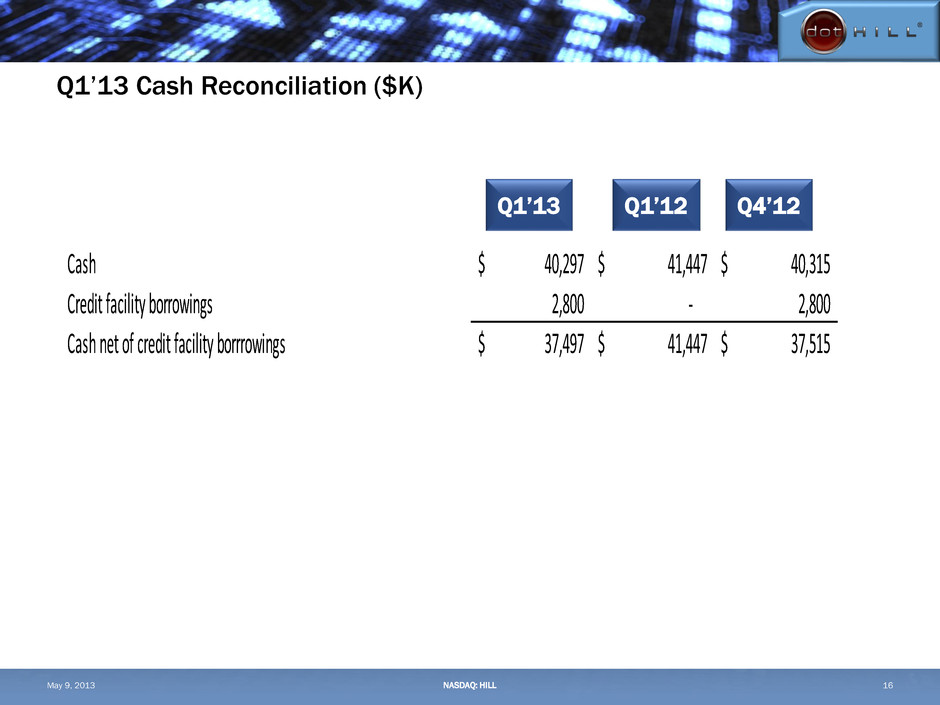

Q1’13 Cash Reconciliation ($K) 16 Q1’13 Q1’12 Q4’12 Cash 40,297$ 41,447$ 40,315$ Credit facility borrowings 2,800 - 2,800 Cash net of credit facility borrrowings 37,497$ 41,447$ 37,515$ May 9, 2013 NASDAQ: HILL