Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Gramercy Property Trust | d533061d8k.htm |

| EX-99.2 - EX-99.2 - Gramercy Property Trust | d533061dex992.htm |

Exhibit 99.1

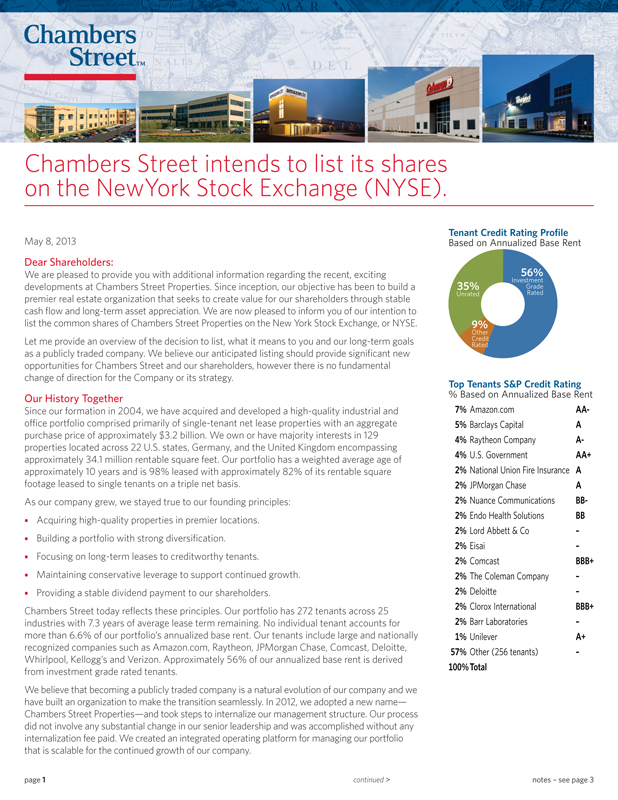

Chambers Street intends to list its shares on the NewYork Stock Exchange (NYSE). May 8, 2013 Dear Shareholders: We are pleased to provide you with additional information regarding the recent, exciting developments at Chambers Street Properties. Since inception, our objective has been to build a premier real estate organization that seeks to create value for our shareholders through stable cash flow and long-term asset appreciation. We are now pleased to inform you of our intention to list the common shares of Chambers Street Properties on the New York Stock Exchange, or NYSE. Let me provide an overview of the decision to list, what it means to you and our long-term goals as a publicly traded company. We believe our anticipated listing should provide significant new opportunities for Chambers Street and our shareholders, however there is no fundamental change of direction for the Company or its strategy. Our History Together Since our formation in 2004, we have acquired and developed a high-quality industrial and office portfolio comprised primarily of single-tenant net lease properties with an aggregate purchase price of approximately $3.2 billion. We own or have majority interests in 129 properties located across 22 U.S. states, Germany, and the United Kingdom encompassing approximately 34.1 million rentable square feet. Our portfolio has a weighted average age of approximately 10 years and is 98% leased with approximately 82% of its rentable square footage leased to single tenants on a triple net basis. As our company grew, we stayed true to our founding principles: Acquiring high-quality properties in premier locations. Building a portfolio with strong diversification. Focusing on long-term leases to creditworthy tenants. Maintaining conservative leverage to support continued growth. Providing a stable dividend payment to our shareholders. Chambers Street today reflects these principles. Our portfolio has 272 tenants across 25 industries with 7.3 years of average lease term remaining. No individual tenant accounts for more than 6.6% of our portfolio’s annualized base rent. Our tenants include large and nationally recognized companies such as Amazon.com, Raytheon, JPMorgan Chase, Comcast, Deloitte, Whirlpool, Kellogg’s and Verizon. Approximately 56% of our annualized base rent is derived from investment grade rated tenants. We believe that becoming a publicly traded company is a natural evolution of our company and we have built an organization to make the transition seamlessly. In 2012, we adopted a new name—Chambers Street Properties—and took steps to internalize our management structure. Our process did not involve any substantial change in our senior leadership and was accomplished without any internalization fee paid. We created an integrated operating platform for managing our portfolio that is scalable for the continued growth of our company. Based_on_Annualized_Base_Rent Tenant_Credit_Rating_Profile %_Based_on_Annualized_Base_Rent Top_Tenants_S&P_Credit_Rating _ %_Amazon_com_AA- _ %_Barclays_Capital_ A _ _%_Raytheon_Company__ A- _ _%_U_S__Government_ AA_ _ _%_National_Union_Fire_Insurance_ A _ _%_JPMorgan_Chase_ A _ _%_Nuance_Communications_ BB- _ _%_Endo_Health_Solutions_ BB _ _%_Lord_Abbett_&_Co_ – _ _%_Eisai_ – _ _%_Comcast_ BBB_ _ _%_The_Coleman_Company_ – _ _%_Deloitte_ – _ _%_Clorox_International_ BBB_ _ _%_Barr_Laboratories_ – _ _%_Unilever_ A_ _ %_Other_(‡^‰_tenants)_ –___%_Total_ page 1 continued > notes – see page 3

Chambers Street intends to list its shares on the NewYork Stock Exchange (NYSE) continued What Does a Public Listing Mean to You? We expect to list our common shares on the NYSE under the symbol “CSG” on or about May 21, 2013. Upon the listing your shares will be eligible to trade, providing you with the opportunity to buy or sell shares. Of course, we hope you will remain a shareholder with us as we work to grow our portfolio and business. The decision by our board of trustees to list the shares on the NYSE is the result of careful consideration. Based on the current capital market environment, we believe a listing on the NYSE provides a strong platform from which to maximize the value of your shares. Publicly traded real estate companies have enjoyed strong returns in recent years, and companies such as ours that own net lease properties are trading at attractive valuations. Please note, however, that while the listing of your shares on the NYSE is not a taxable event, the sale of your shares could subject you to potential taxes. Please consult your tax and financial advisors for assistance in understanding the tax considerations in the event of a sale of your shares. In conjunction with the listing, we intend to commence a modified “Dutch Auction” tender offer to purchase up to $125 million of our common shares. Under the terms of the proposed tender offer, Chambers Street intends to select the lowest price, within a range of $10.10 per share and $10.60 per share, net to the tendering shareholder in cash, less any applicable withholding taxes and without interest, which would allow the Company to purchase up to the full $125 million of its common shares. We expect to allow shareholders to tender all or a portion of their shares, but if the tender offer is oversubscribed, shares will be accepted on a prorated basis. Chambers Street expects to commence the proposed tender offer on or about May 21, 2013 in conjunction with the listing of its common shares on the NYSE. As a publicly traded company, our board of trustees has determined that the Company will pay a quarterly distribution to its shareholders, reflecting an annual payment of $0.50 per common share, beginning with the third quarter ending September 30, 2013. The Company anticipates that the third quarter distribution of $0.125 per common share will be paid on October 11, 2013 to all shareholders of record on September 26, 2013. Chambers Street believes this dividend level is competitive with dividend payments declared by other publicly traded real estate companies, and provides an appropriate level of retained capital to support the Company’s growth strategies. For further information about our anticipated listing on the NYSE, we refer you to our public filings with the SEC available at www.sec.gov. In addition, we encourage you to contact your financial advisor or our investor services group at (855) 450-0288 for any assistance you may require. A New Platform for Growth Let me assure you that as a publicly traded company, Chambers Street will continue with the same management team and the same disciplined approach to acquiring and managing high-quality, income-producing commercial real estate. We still believe the keys to success are acquiring the right properties at reasonable prices, leasing our buildings to a diversified mix of creditworthy companies and giving those businesses every incentive to stay with us by being highly responsive to their needs. We intend to maintain a strong balance sheet, with ample liquidity and access to multiple sources of capital that we expect a listing will provide. We remain committed to growing Chambers Street as a premier real estate company, and hope you will remain our partner as a shareholder for many years to come. Thank you for your continued confidence and support. Based_on_Annualized_Base_Rent Top____Industries _ __%_Financial_Services _ __%_Pharma_and_Healthcare _ __%_Consumer_Products __%_ Internet_Retail _ %_Defense_and_Aerospace _ _%_Logistics_and_Distribution __%_ Insurance __%_Telecom __%_Government __%_Food_Service_and_Retail _ __%_ Other_(___industries) ____%_Total Based_on_Rentable_Square_Feet Property_Types Based_on_Rentable_Square_Feet Lease_Types Based_on_Acquisition_Cost Jack A. Cuneo President and Chief Executive Officer Chambers Street Properties __% NNN Single-Tenant page 2 continued > notes – see page 3

Chambers Street intends to list its shares on the NewYork Stock Exchange (NYSE) continued Notes Unless otherwise indicated, the information contained herein is as of December 31, 2012. Square footage amounts include 100% of unconsolidated joint ventures and dollar amounts include our pro rata share of unconsolidated joint ventures. Such amounts do not include our unconsolidated investment in Asia. Our aggregate portfolio purchase price of approximately $3.2 billion is pro forma for the March 1, 2013 purchase of Duke Realty’s 20% interest in 17 properties owned by our joint venture. When we refer to a “credit rated tenant,” we mean a tenant, or the tenant’s guarantor or parent, that has a credit rating, as determined by either Standard and Poor’s (“S&P”) or Moody’s. When we refer to an “investment grade rated tenant,” we mean a tenant, or the tenant’s guarantor or parent, that has an investment grade credit rating, as determined by either Standard and Poor’s (“S&P”) or Moody’s. Numbers of properties include indirect interests in properties owned by our unconsolidated entities, however excludes investment in Asia. Average occupancy is weighted based on net rentable square feet. Includes 100% of unconsolidated property square feet. The National Union Fire Insurance Company’s lease expired on December 31, 2012, and it vacated the property. The 90 Hudson Street property is currently 65% leased. Triple net single-tenant properties include certain properties that have minimal secondary tenant(s). When we refer to “annualized base rent,” we mean as of December 31, 2012, either (i) current cash base rent due on an annualized basis, or (ii) for any lease still in an initial free or reduced rent period as of December 31, 2012, base rent due during the 12 months following December 31, 2012. Important Notice This document is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any securities of the Company. The tender offer will be made only pursuant to an offer to purchase, letter of transmittal and related materials that the Company intends to distribute to its shareholders and file with the Securities and Exchange Commission (the “SEC”). The full details of the tender offer, including complete instructions on how to tender shares, will be included in the offer to purchase, the letter of transmittal and other related materials, which the Company will distribute to shareholders and file with the SEC upon commencement of the tender offer. Shareholders are urged to carefully read the offer to purchase, the letter of transmittal and other related materials when they become available because they will contain important information, including the terms and conditions of the tender offer. Shareholders may obtain free copies of the offer to purchase, the letter of transmittal and other related materials that the Company files with the SEC at the SEC’s website at http://www.sec.gov or by calling the information agent for the contemplated tender offer, who will be identified in the materials filed with the SEC at the commencement of the tender offer. In addition, shareholders may obtain free copies of the Company’s filings with the SEC from the Company’s website at http:// www.chambersstreet.com or by directing a request to Mr. Martin A. Reid, Chambers Street Properties, 47 Hulfish Street, Suite 210, Princeton, NJ 08542 or (609) 683-4900. Forward Looking Statements This document may contain various “forward-looking statements.” You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “approximately,” “intends,” “plans,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases. You can also identify forward-looking statements by discussions of strategy, plans or intentions, including statements about the timing and likelihood of providing a liquidity event to our shareholders. Statements regarding the following subjects may be impacted by a number of risks and uncertainties such as our business strategy; our ability to obtain future financing arrangements; estimates relating to our future distributions; our understanding of our competition; market trends; projected capital expenditures; the impact of technology on our products, operations and business; and the use of the proceeds of any offerings of securities. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our common shares, along with the following factors that could cause actual results to vary from our forward-looking statements such as our ability to complete the listing of our common shares on the NYSE; our ability to complete the tender offer; the price at which our common shares may trade on the NYSE which may be higher or lower than the purchase price of the tender offer; the price and time at which we may make additional repurchases of common shares following completion of the tender offer; the number of common shares acquired in such repurchases and the terms, timing, costs and interest rate on any indebtedness incurred to fund such repurchases; national, regional and local economic climates; changes in supply and demand for office and industrial properties; adverse changes in the real estate markets, including increasing vacancy, decreasing rental revenue and increasing insurance costs; availability and credit worthiness of prospective tenants; our ability to maintain rental rates and maximize occupancy; our ability to identify and secure acquisitions; our failure to successfully manage growth or operate acquired properties; our pace of acquisitions and/or dispositions of properties; risks related to development projects (including construction delay, cost overruns or our inability to obtain necessary permits); payment of distributions from sources other than cash flows and operating activities; receiving corporate debt ratings and changes in the general interest rate environment; availability of capital (debt and equity); our ability to refinance existing indebtedness or incur additional indebtedness; failure to comply with our debt covenants; unanticipated increases in financing and other costs, including a rise in interest rates; the actual outcome of the resolution of any conflict; material adverse actions or omissions by any of our joint venture partners; our ability to operate as a self-managed company; availability of and ability to retain our executive officers and other qualified personnel; future terrorist attacks in the United States or abroad; the ability of our operating partnership to continue to qualify as a partnership for U.S. federal income tax purposes; our ability to continue to qualify as a REIT for U.S. federal income tax purposes; foreign currency fluctuations; changes to accounting principles, policies and guidelines applicable to REITs; legislative or regulatory changes adversely affecting REITs and the real estate business; environmental, regulatory and/or safety requirements; and other factors discussed under Item 1A Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2012 and those factors that may be contained in any filing we make with the Securities and Exchange Commission. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of future events, new information or otherwise. Chambers Street Properties 47 Hulfish Street, Suite 210 Princeton, NJ 08542-3706 www.ChambersStreet.com page 3