Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GAIN Capital Holdings, Inc. | d532588d8k.htm |

| EX-99.1 - EX-99.1 - GAIN Capital Holdings, Inc. | d532588dex991.htm |

1 Quarter 2013

Financial and Operating Results

May 7, 2013

st

Exhibit 99.2 |

Special Note Regarding Forward-Looking Information

2

In addition to historical information, this presentation contains

"forward-looking" statements that reflect

management's expectations for the future. The forward-looking

statements contained in this earnings presentation include,

without limitation, statements relating to GAIN Capital’s expectations regarding the opportunities and

strengths of the combined company created by the proposed business

combination of GAIN and GFT, anticipated cost and revenue

synergies as well as expected growth in financial and operating metrics, the strategic rationale for

the proposed business combination, including expectations regarding

product offerings, growth opportunities, value creation, and

financial strength, and the timing of the closing. A variety of important factors could cause results to

differ materially from such statements. These factors are noted

throughout GAIN Capital's annual report on Form 10-K, as

filed with the Securities and Exchange Commission on March 18, 2013, and include, but are not limited to,

the actions of both current and potential new competitors, fluctuations

in market trading volumes, financial market volatility, evolving

industry regulations, including changes in regulation of the futures companies, errors or

malfunctions in our systems or technology, rapid changes in technology,

effects of inflation, customer trading patterns, the success of

our products and service offerings, our ability to continue to innovate and meet the demands

of our customers for new or enhanced products, our ability to

successfully integrate assets and companies we have acquired,

including the successful integration of Open E Cry and Global Forex & Futures, LTD, our ability to

effectively compete in the futures industry, changes in tax policy or

accounting rules, fluctuations in foreign exchange rates and

commodity prices, adverse changes or volatility in interest rates, as well as general economic,

business, credit and financial market conditions, internationally or

nationally, and our ability to continue paying a quarterly

dividend in light of future financial performance and financing needs. The forward-looking statements

included herein represent GAIN Capital's views as of the date of this

presentation. GAIN Capital undertakes no obligation to revise or

update publicly any forward-looking statement for any reason unless required by law. |

Overview

Glenn Stevens, CEO |

Highlights

•

Strong organic growth with revenue and EBITDA up 50% and 481%, respectively,

compared to prior year quarter

•

Revenue diversification accelerating with run-rate of 22% of total revenue

coming from commission or fee-based activities

•

Institutional volume and revenue up 90% and 65%, respectively, compared to

prior year quarter

•

April metrics show continued positive momentum

•

Transformational acquisition of GFT to accelerate growth in financial

and

operating

metrics

(1)

–

Combined 2013 run-rate revenue: $329mm

–

Combined 2013 run-rate pro forma EBITDA: $77mm (20+% margin)

–

Potential operating expense synergies: $35mm-$45mm

–

Pro forma client assets: ~$650mm

–

Pro forma funded accounts: ~140,000

4

(1)

Financial metrics based on simple addition of first quarter 2013 results for both

companies projected over four quarters and includes the implementation of $40mm in year 1

operating synergies.

|

(1)

EBITDA is a non-GAAP financial measure that represents our earnings before

interest, taxes, depreciation, amortization and non- recurring expenses.

A reconciliation of net income to EBITDA is available in the appendix to this presentation.

(2)

Definitions for all our operating metrics are available in the appendix to this

presentation. 1 Quarter 2013 Results Overview

•

Q1 2013 Financial Summary

•

Net revenue of $49.8 million compared with $33.2 million

•

EBITDA

(1)

of $7.5 million compared with $1.3 million

•

Net Income of $4.3 million compared with a net loss of $1.3 million

•

EPS (Diluted): $0.11

•

Operating Metrics

(2)

•

Total trading volume up 55% to $1.3 trillion

•

Retail volume increased 12% to $431.8 billion

•

Institutional volume increased 90% to $889.9 billion

•

Funded accounts up 36% to 100,020

•

Client assets up 40% to $456.9 million as of March 31, 2013

(Comparisons are referenced to Q1 2012)

5

st

•

Q1 2013 positive momentum continuing in April |

Q1

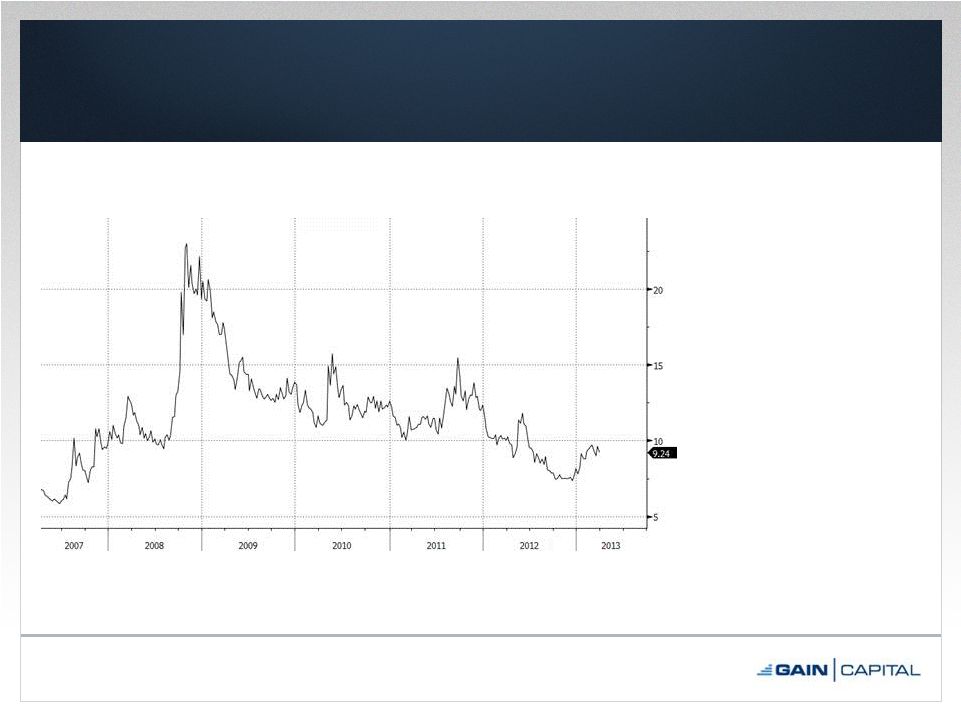

2013 Market Conditions 6

Source: JPMorgan’s G7 Volatility Index

•

Volatility higher in Q1

2013, but still well

below 2008-2011

averages

•

Index looks to be

forming a base,

indicating support for

sustained levels of

volatility |

Retail

OTC •

Significant growth in all key operating metrics

reflects Company’s strong position to take

advantage of improved market conditions

–

Funded retail accounts up 36% to 100,020

–

Approximately 15,000 net new accounts in Q1

–

Highest quarterly trading volume since Q2 2011

–

Strong asset gathering continues

•

Leading market consolidation in the U.S.

–

FX Solutions U.S. customer acquisition (February 2013)

–

GFT U.S. customer acquisition (December 2012)

7 |

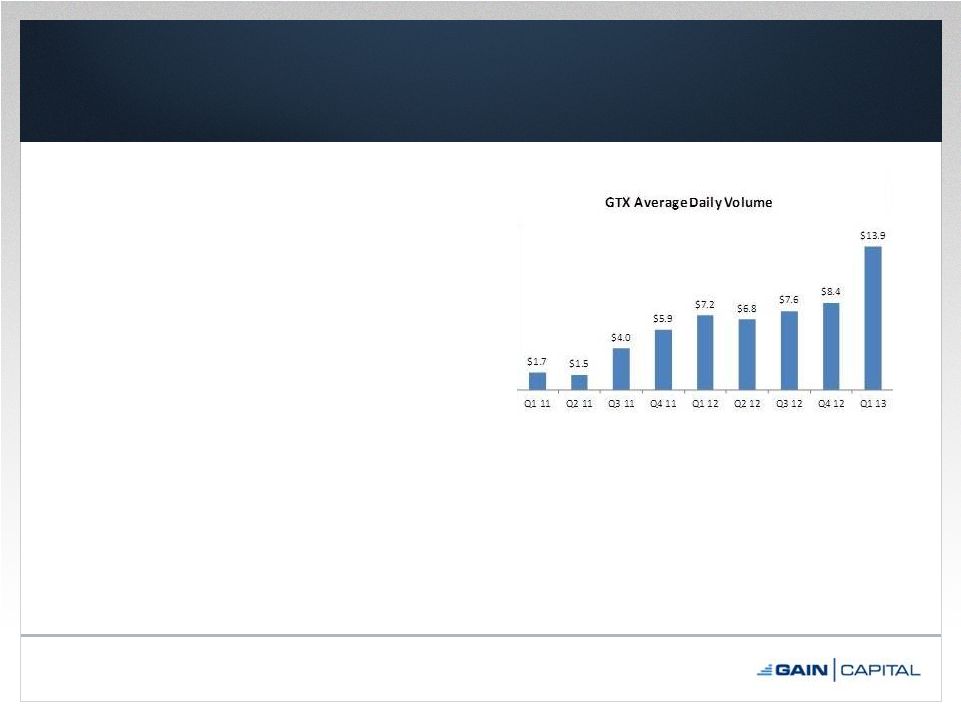

Commission-Based Business

8

•

GTX –

Institutional

–

Significant volume growth since Q1 2011 –

average of 30% per quarter

–

On-boarded new money center bank in Q1

–

Strong pipeline of additional customers

–

Opportunity to leverage GTX in connection

with GFT’s Sales Trader business to drive

additional growth

•

OEC –

Futures

–

OEC customer assets up 21% since

acquisition announced in July 2012

–

Expanded institutional sales team to

accelerate futures growth

•

On track to contribute more than 20% of

total 2013 revenue, based on Q1 run rate

–

Provides significant source of steady non-

trading revenue with substantial growth

prospects |

Growth

Through M&A – GFT Acquisition

•

GAIN previously announced its acquisition of GFT on April 25, 2013

•

GFT has ~40,000 customer accounts with over $190mm of customer assets

–

Pro forma GAIN Capital operating metrics:

•

~140,000 funded accounts

•

~$650mm client assets

•

Transaction Overview

–

Structure:

•

~4.9mm GAIN Capital shares

•

$40mm cash

•

$40mm senior secured note

–

8.0% annual interest rate, payable quarterly

–

$1.5mm quarterly amortization

–

Anticipated operating expense synergies: $35mm-$45mm

–

Targeted close: Q3 2013 (on track)

–

Existing revolving credit facility with JPM/SVB will terminate at closing

•

Will seek replacement facility as financing needs develop

•

Transaction expected to be accretive in the first full quarter after closing

•

Acquisition demonstrates GAIN’s position as a trusted partner for both asset

transfers and acquisitions

–

Another example of GAIN’s successful market consolidation strategy

9 |

GFT

Acquisition – Strategic Rationale

•

Immediate scale increase

–

Combination enhances scale and positioning in the global OTC market

•

Combined

2013

run-rate

revenue:

$329mm

(1)

•

Pro forma client assets: ~$650mm

•

Pro forma FY 2012 volume: $4.6 trillion

–

Increases GAIN’s key financial, trading and client metrics

–

Greater ability to withstand potential regulatory changes and market

volatility •

Broader product offering

–

Total of 12,500 financial markets

–

OTC FX, CFDs, binary options, spread betting, FX options, exchange-traded

futures and options •

Significant operating synergies anticipated

–

Potential to realize approximately $35mm-$45mm of cost savings via

first-year synergies –

Potential to capitalize on additional operating and capital synergies

•

Diversifies revenue streams

–

Significant expansion of CFDs and spread betting products

–

Enhances GAIN’s indirect distribution network by leveraging GFT’s skill

and experience in servicing large brokerage partners

–

Institutionally-focused Sales Trader team complements and augments existing

institutional services and GTX business

10

(1)

Based

on

simple

addition

of

first

quarter

2013

results

for

both

companies

projected

over

four

quarters. |

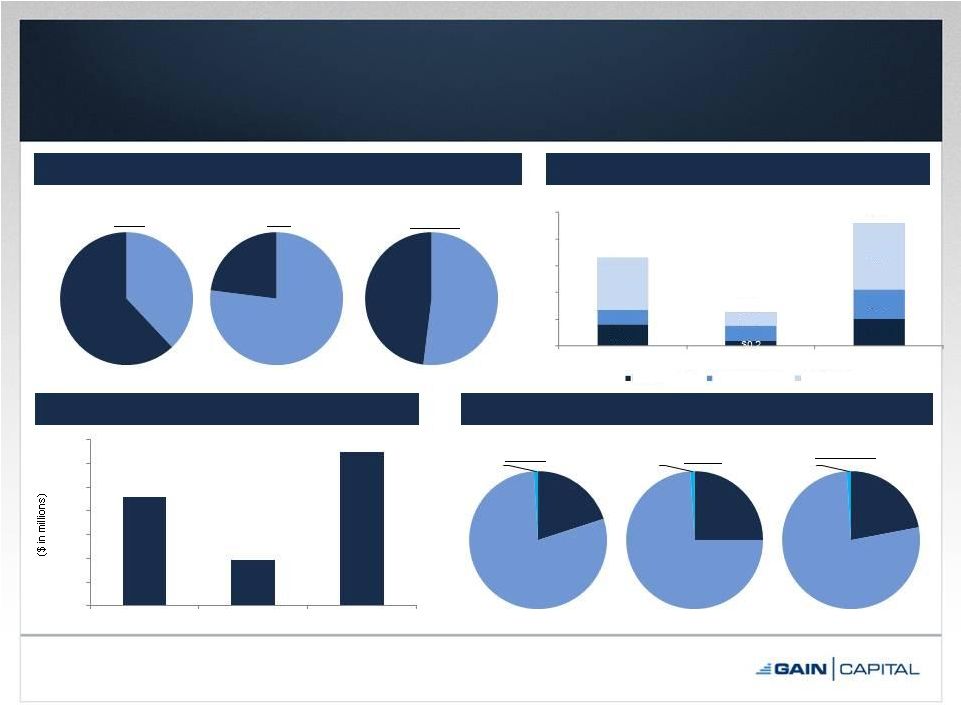

Pro

Forma Financial & Operating Metrics 11

FY 2012 Retail Volume Contribution %

FY 2012 Revenue Contribution %

(1)

Institutional volume reflects GTX for GAIN and Sales Trader for GFT.

(2)

Commission revenue represents PF 2012 to include full-year impact of OEC

acquisition. (3)

Commission revenue represents revenue from Sales Trader clients.

(4)

Commission

revenue

represents

revenue

from

Sales

Trader

clients,

GTX

and

full-year

impact

of

OEC

acquisition.

FY 2012 Trading Volume ($ in trillions)

3/31/2013 Client Assets

(1)

Indirect

38%

Direct

62%

GAIN

Indirect

77%

Direct

23%

GFT

Indirect

52%

Direct

48%

PF GAIN

$456.9

$192.2

$649.1

$0

$100

$200

$300

$400

$500

$600

$700

GAIN

GFT

PF GAIN

$0.8

$1.0

$0.5

$0.6

$1.1

$2.0

$0.5

$2.5

$3.3

$1.3

$4.6

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

GAIN

GFT

PF GAIN

Retail -

Direct

Retail -

Indirect

Institutional

Commission

Revenue

20%

Trading

Revenue

79%

Other

1%

GAIN

(2)

Commission

Revenue

25%

Trading

Revenue

74%

Other

1%

GFT

(3)

Commission

Revenue

22%

Trading

Revenue

77%

Other

1%

PF GAIN

(4) |

Financial Review

Daryl Carlough, Interim CFO |

1 Quarter 2013 Financial Results

13

Note: Dollars in millions.

(1)

Reconciliation of net income to EBITDA is available in the appendix to this

presentation. $35.1

$44.6

$0

$10

$20

$30

$40

$50

Q1 2012

Q1 2013

Total Expenses

Comp & Benefits

Marketing

Trading

All Other

$33.2

$49.8

$1.3

$7.5

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

Q1 2012

Q1 2013

Net Revenue & EBITDA

(1)

Net Revenue

EBITDA

$99.0

$76.4

$80.3

$129.0

$107.1

$98.3

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

1Q 11

2Q 11

3Q 11

4Q 11

1Q 12

2Q 12

3Q 12

4Q 12

1Q 13

Retail Trading Revenue per Million

Retail Trading Revenue per Million (Quarterly)

Retail Trading Revenue per Million (Last Twelve Months)

st

($1.3)

$4.3

($2.0)

($1.0)

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

Q1 2012

Q1 2013

Net Income/(Loss) |

Quarterly Dividend & Share Buyback

•

$0.05 per share quarterly dividend approved

•

Board approved to increase share repurchase program by

$15.0 million to opportunistically buy back undervalued

GAIN shares

14

–

Record Date: June 12, 2013

–

Payment Date: June 21, 2013 |

Monthly

Operating

Metrics

(1)

15

(1)

Definitions for all our operating metrics are available in the appendix to this

presentation. •

GAIN will begin providing monthly operating metrics

beginning with April 2013 (next week)

–

Metrics for subsequent months will be provided in the

middle of the following month

(Volume in billions; assets in millions)

Oct-12

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Retail

OTC Trading Volume

$99.5

$105.7

$93.6

$147.5

$143.6

$140.7

Average Daily Volume

$4.3

$4.8

$4.9

$6.4

$7.2

$6.7

Active OTC Accounts

(1)

58,869

58,775

60,219

60,776

60,967

62,606

Futures DARTs

12,909

12,971

12,598

11,776

14,742

13,406

Funded Accounts

82,222

81,511

85,099

85,557

85,873

100,020

Customer Assets

$438.0

$440.6

$446.3

$442.7

$444.6

$456.9

Institutional

Trading Volume

$174.9

$169.1

$194.4

$314.5

$306.0

$269.4

Average Daily Volume

$7.6

$7.7

$10.2

$13.7

$15.3

$12.8 |

Closing Remarks

16

•

Strong Q1 operating and financial metrics;

diversification strategy showing results

•

Focus on controlling fixed expenses to drive

margins

•

Record client assets position GAIN to continue

taking advantage of improved market conditions

•

Continued strength in financial and operating

metrics through April 2013

•

Steady progress towards closing transformational

GFT acquisition

•

Pursuing further organic growth opportunities |

Appendix |

Condensed Consolidated Statements of Operations

18

Note: Unaudited. Dollars in millions, except per share data.

Three Months Ended

March 31,

Revenue

2013

2012

Trading revenue

35.3

$

29.5

$

Commission revenue

10.9

3.7

Other revenue

3.6

0.1

Total non-interest revenue

49.8

33.3

Interest revenue

0.1

0.1

Interest expense

(0.1)

(0.2)

Total net interest revenue/(expense)

-

(0.1)

Net revenue

49.8

33.2

Expenses

Employee compensation and benefits

13.3

10.3

Selling and marketing

5.4

7.1

Trading expenses and commissions

15.7

8.7

General & Administrative

5.6

4.2

Depreciation and amortization

1.6

1.1

Purchased intangible amortization

0.6

1.9

Communication and data processing

2.2

1.8

Bad debt provision

0.2

-

Total

44.6

35.1

Income/(loss) before tax expense

5.2

(1.9)

Income tax expense/(benefit)

0.9

(0.6)

Net income/(loss)

4.3

$

(1.3)

$

Basic

0.12

$

(0.04)

$

Diluted

0.11

$

(0.04)

$

Weighted averages common shares outstanding used

in computing earnings per common share:

Basic

35,052,375

34,480,705

Diluted

37,331,592

34,480,705

Earnings/(loss) per common share: |

Consolidated Balance Sheet

19

Note: Unaudited. Dollars in millions.

March 31,

December 31,

2013

2012

ASSETS:

Cash and cash equivalents

12.1

$

36.8

$

Cash and securities held for customers

456.9

446.3

Short term investments

1.4

1.4

Receivables from banks and brokers

124.7

89.9

Property and equipment - net of accumulated

depreciation 10.7

11.0

Prepaid assets

7.7

7.7

Goodwill

9.0

9.0

Intangible assets, net

9.2

9.9

Other assets

18.8

17.9

Total assets

650.5

$

629.9

$

LIABILITIES AND SHAREHOLDERS' EQUITY:

Payables to customer, brokers, dealers, FCM'S and other regulated entities

456.9

$

446.3

$

Accrued compensation & benefits payable

5.5

6.1

Accrued expenses and other liabilities

11.5

12.5

Income tax payable

3.0

1.3

Note payable

10.0

-

Total

liabilities 486.9

$

466.2

$

Shareholders' Equity

163.6

$

163.7

$

Total

liabilities and shareholders' equity 650.5

$

629.9

$

|

Current Liquidity

20

Note: Dollars in millions.

(1)

(2)

Reflects cash that would be received from brokers following the close-out of all

open positions. Excludes current liabilities of $20.0mm and $19.9mm as of

March 31, 2013 and December 31, 2012, respectively, and capital charges associated with open

positions.

As of

3/31/2013

12/31/2012

Cash and cash equivalents

$12.1

$36.8

Cash and securities held for customers

456.9

446.3

Short term investments

1.4

1.4

Receivables

from

banks

and

brokers

(1)

124.7

89.9

Total Operating Cash

$595.1

$574.4

Less: Cash and securities held for customers

(456.9)

(446.3)

Free Operating Cash

$138.2

$128.1

Less: Minimum regulatory capital requirements

(49.3)

(45.6)

Less: Note payable

(10.0)

-

Free Cash Available

(2)

$78.9

$82.5 |

1 Quarter 2013 Financial Summary

21

Note: Dollars in millions, except per share data.

(1)

See page 22 for a reconciliation of GAAP net income to EBITDA.

(2)

EBITDA margin is calculated as EBITDA divided by net revenue (ex. interest

expense). st

3 Months Ended March 31,

'13 v '12

2013

2012

% Change

Net Revenue

$49.8

$33.2

50%

Interest Expense

0.1

0.2

(33%)

Net Revenue (ex. Interest Expense)

$49.9

$33.4

50%

Operating Expenses

42.4

32.1

32%

EBITDA

(1)

$7.5

$1.3

481%

Net Income/(Loss)

$4.3

($1.3)

NM

EPS (Diluted)

$0.11

($0.04)

NM

EBITDA Margin %

(1)(2)

15.0%

3.9%

11 pts

Net Income Margin %

8.6%

(3.9%)

13 pts |

EBITDA & Margin Reconciliation

22

Note: Dollars in millions.

(1)

EBITDA margin is calculated as EBITDA divided by net revenue (ex. interest

expense). Three Months Ended December 31,

2013

2012

Net Revenue

49.8

$

33.2

$

Interest Expense

0.1

0.2

Net Revenue (ex. Interest Expense)

49.9

$

33.4

$

Net income/(loss)

4.3

$

(1.3)

$

Depreciation & amortization

1.6

1.1

Purchase intangible amortization

0.6

1.9

Interest expense on note

0.1

0.2

Income tax expense/(benefit)

0.9

(0.6)

EBITDA

7.5

$

1.3

$

EBITDA Margin %

(1)

15.0%

3.9% |

Operating Metrics

(1)

23

Note: Volume in billions. Assets in millions.

(1)

Definitions for all our operating metrics are available on page 24.

3 Months Ended,

31-Mar-12

30-Jun-12

30-Sep-12

31-Dec-12

31-Mar-13

Retail

OTC Trading Volume

$385.1

$340.8

$278.7

$298.8

$431.8

Average Daily Volume

$5.9

$5.2

$4.2

$4.7

$6.7

Active OTC Accounts

62,723

61,746

59,166

60,219

62,606

Futures DARTs

-

-

15,270

(2)

13,000

13,238

Funded Accounts

73,483

74,620

82,394

85,099

100,020

Customer Assets

$325.9

$320.2

$426.6

$446.3

$456.9

Institutional

Trading Volume

$468.0

$442.5

$503.7

$538.4

$889.9

Average Daily Volume

$7.2

$6.8

$7.6

$8.4

$13.9 |

Definition of Metrics

•

Funded Accounts

–

Retail accounts who maintain a cash balance

•

Active OTC Accounts

–

Retail accounts who executed a transaction during a given period

•

Trading Volume

–

Represents the U.S. dollar equivalent of notional amounts traded

•

Futures DARTs

–

Represents the average daily trades transacted by OEC customers

•

Customer Assets

–

Represents amounts due to clients, including customer deposits and

unrealized gains or losses arising from open positions

24 |

1 Quarter 2013

Financial and Operating Results

May 7, 2013

st |