Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Douglas Emmett Inc | a2013q18-kcoverpage.htm |

Douglas Emmett, Inc. | EXECUTIVE SUMMARY | |

We are one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Southern California and Hawaii. Our properties are concentrated in ten submarkets - Beverly Hills, Brentwood, Burbank, Century City, Honolulu, Olympic Corridor, Santa Monica, Sherman Oaks/Encino, Warner Center/Woodland Hills and Westwood. We focus on owning and acquiring a substantial share of top-tier office properties and premier multifamily communities in neighborhoods with significant supply constraints, high-end executive housing and key lifestyle amenities. We operate as a REIT and are listed on the New York Stock Exchange under the symbol DEI.

FIRST QUARTER 2013 EXECUTIVE SUMMARY

• | Fundamentals. During the quarter, we increased the leased rate in our total office portfolio by 30 basis points while our occupied percentage decreased by 30 basis points as a result of tenant move-outs deferred from the fourth quarter. Excluding the effects of those tenant move outs, during the first quarter our leased rate increased by 70 basis points and our occupied rate increased by 10 basis points. We have begun to raise office rents in Honolulu, and continue to show higher net effective office rents in all of our other submarkets except Warner Center. In our multifamily portfolio, which remains fully leased, our average asking rents are 5.8% higher than in the first quarter of 2012. |

• | Funds From Operations: Funds From Operations (FFO) (adjusted for terminated swaps) for the quarter ended March 31, 2013 increased by 7.0% to $64.1 million from $59.9 million for the quarter ended March 31, 2012, while Adjusted Funds from Operations increased by 21.8%. GAAP net income attributable to common stockholders for the first quarter of 2013 increased by 124.3% to $12.1 million from $5.4 million for the first quarter of 2012. |

• | Same Property Cash NOI: Our same property cash NOI in the first quarter of 2013 was 2.7% higher than in the first quarter of 2012, fueled by increases in both our office and multifamily revenues as well as good expense control. |

• | Recent Developments: |

◦ | In May 2013, we are scheduled to use a portion of our cash on hand to purchase a 225,000 square foot Class A office building located at 8484 Wilshire Blvd in Beverly Hills for a contract price of $89 million, or approximately $395 per square foot. |

◦ | In February 2013, we purchased additional interests in our unconsolidated Funds for a total purchase price of $8 million. On a weighted average basis, we own almost 60% of these Funds, which own 8 buildings totaling 1.8 million square feet in our core markets. |

◦ | In March 2013, we used $90.0 million of our cash on hand to reduce the outstanding balance of our loan that matures in April 2015 to $150 million. |

◦ | On April 30, 2013, we closed a $325 million loan to refinance the outstanding debt for one of our unconsolidated Funds, reducing its outstanding debt by $40 million. The new loan matures on May 1, 2018, and we have effectively fixed the interest rate at 2.35% per annum until May 1, 2017. |

◦ | At March 31, 2013, we had $292.6 million in cash and cash equivalents on our balance sheet, and our net consolidated debt to enterprise value was 41%. |

• | Dividends: On April 15, 2013, we paid a quarterly cash dividend of $0.18 per share, or $0.72 on an annualized basis per share, to our shareholders of record on March 29, 2013. |

• | Guidance: As set forth on page 22, we have adjusted our 2013 FFO guidance to $1.43-$1.49 per diluted share. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

Douglas Emmett, Inc. | TABLE OF CONTENTS | |

PAGE | |

COMPANY OVERVIEW | |

CONSOLIDATED FINANCIAL RESULTS | |

PORTFOLIO DATA | |

______________________________________________

This First Quarter 2013 Earnings Results and Operating Information supplements the information provided in our reports filed with the Securities and Exchange Commission. It contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and we claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements presented in this Earnings Package, and those that we may make orally or in writing from time to time, are based on our beliefs and assumptions. Actual results will be affected by known and unknown risks, trends, uncertainties and factors, some of which are beyond our control or ability to predict, including, but not limited to: adverse economic and real estate developments in Southern California and Honolulu; a general downturn in the economy, such as the recent global financial crisis; decreased rental rates or increased tenant incentives and vacancy rates; defaults on, early terminations of, or non-renewal of leases by tenants; increased interest rates and operating costs; failure to generate sufficient cash flows to service our outstanding indebtedness; difficulties in identifying properties to acquire and completing acquisitions; failure to successfully operate acquired properties and operations; failure to maintain our status as a REIT; possible adverse changes in rent control laws and regulations; environmental uncertainties; risks related to natural disasters; lack or insufficient amount of insurance; inability to successfully expand into new markets or submarkets; risks associated with property development; conflicts of interest with our officers; changes in real estate and zoning laws and increases in real property tax rates; the consequences of any possible future terrorist attacks; and other risks and uncertainties detailed in our Annual Report on Form 10-K and other documents filed with the Securities and Exchange Commission. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution in relying on previously reported forward-looking statements, which were based on results and trends at the time they were made, to anticipate future results or trends. This Earnings Package and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by thecautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date of this Earnings Package.

Douglas Emmett, Inc. | CORPORATE DATA | |

as of March 31, 2013 | ||

Office Portfolio | Consolidated | Total Portfolio | |||

Number of office properties | 50 | 58 | |||

Square feet (in thousands) | 12,853 | 14,676 | |||

Leased rate | 91.9 | % | 91.4 | % | |

Occupied rate | 90.0 | % | 89.3 | % | |

Multifamily Portfolio | |||||

Number of multifamily properties | 9 | ||||

Number of multifamily units | 2,868 | ||||

Multifamily leased rate | 99.6 | % | |||

Market Capitalization (in thousands, except price per share) | |||||

Closing price per share of common stock (NYSE:DEI) | $ | 24.93 | |||

Shares of common stock outstanding | 142,569 | ||||

Fully diluted shares outstanding | 174,920 | ||||

Equity capitalization (1) | $ | 4,360,752 | |||

Net debt (2) | $ | 3,058,505 | |||

Total enterprise value | $ | 7,419,257 | |||

Net debt/total enterprise value | 41 | % | |||

__________________________________________

(1) | Common equity capitalization represents our fully diluted shares multiplied by the closing price of our stock. |

(2) | Net debt represents our consolidated debt, net of our cash and cash equivalents. It excludes the debt of our unconsolidated real estate funds. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

3

Douglas Emmett, Inc. | PROPERTY MAP | |

as of March 31, 2013 | ||

4

Douglas Emmett, Inc. | BOARD OF DIRECTORS AND EXECUTIVE OFFICERS | |

as of March 31, 2013 | ||

CORPORATE OFFICES

808 Wilshire Boulevard, Suite 200, Santa Monica, California 90401

Phone: (310) 255-7700

OUR BOARD OF DIRECTORS

______________________________________________________________________________________________________

Dan A. Emmett | Chairman of the Board – Douglas Emmett, Inc. | |

Jordan L. Kaplan | Chief Executive Officer and President – Douglas Emmett, Inc. | |

Kenneth M. Panzer | Chief Operating Officer – Douglas Emmett, Inc. | |

Christopher Anderson | Retired Real Estate Executive and Investor | |

Leslie E. Bider | Chief Executive Officer – PinnacleCare | |

Dr. David T. Feinberg | Chief Executive Officer – University of California, Los Angeles (UCLA) Hospital System, Associate Vice Chancellor – UCLA Health Sciences | |

Thomas E. O’Hern | Senior Executive Vice President, Chief Financial Officer & Treasurer – Macerich Company | |

Dr. Andrea L. Rich | Former President and Chief Executive Officer – Los Angeles County Museum of Art (LACMA), Former Executive Vice Chancellor and Chief Operating Officer – UCLA | |

William E. Simon, Jr. | Co-chairman, William E. Simon & Sons, LLC | |

OUR EXECUTIVE OFFICERS

______________________________________________________________________________________________________

Dan A. Emmett | Chairman of the Board | |

Jordan L. Kaplan | Chief Executive Officer and President | |

Kenneth M. Panzer | Chief Operating Officer | |

William Kamer | Chief Investment Officer | |

Theodore E. Guth | Chief Financial Officer | |

For more information, please visit our website at www.douglasemmett.com or contact:

Stuart McElhinney, Vice President, Investor Relations

(310) 255-7751

smcelhinney@douglasemmett.com

5

Douglas Emmett, Inc. | BALANCE SHEETS | |

(in thousands) | ||

March 31, 2013 | December 31, 2012 | ||||||

(unaudited) | |||||||

Assets | |||||||

Investment in real estate: | |||||||

Land | $ | 851,679 | $ | 851,679 | |||

Buildings and improvements | 5,245,857 | 5,244,738 | |||||

Tenant improvements and lease intangibles | 707,198 | 690,120 | |||||

Investment in real estate, gross | 6,804,734 | 6,786,537 | |||||

Less: accumulated depreciation | (1,350,492 | ) | (1,304,468 | ) | |||

Investment in real estate, net | 5,454,242 | 5,482,069 | |||||

Cash and cash equivalents | 292,635 | 373,203 | |||||

Tenant receivables, net | 1,338 | 1,331 | |||||

Deferred rent receivables, net | 65,152 | 63,192 | |||||

Acquired lease intangible assets, net | 4,376 | 4,707 | |||||

Investment in unconsolidated real estate funds | 157,140 | 149,478 | |||||

Other assets | 32,801 | 29,827 | |||||

Total assets | $ | 6,007,684 | $ | 6,103,807 | |||

Liabilities | |||||||

Secured notes payable | $ | 3,351,140 | $ | 3,441,140 | |||

Interest payable, accounts payable and accrued expenses | 57,768 | 45,171 | |||||

Security deposits | 34,570 | 34,284 | |||||

Acquired lease intangible liabilities, net | 62,650 | 67,035 | |||||

Interest rate contracts | 93,280 | 100,294 | |||||

Dividends payable | 25,662 | 25,424 | |||||

Total liabilities | 3,625,070 | 3,713,348 | |||||

Equity | |||||||

Douglas Emmett, Inc. stockholders' equity: | |||||||

Common stock | 1,426 | 1,412 | |||||

Additional paid-in capital | 2,653,586 | 2,635,408 | |||||

Accumulated other comprehensive income (loss) | (77,898 | ) | (82,991 | ) | |||

Accumulated deficit | (587,753 | ) | (574,173 | ) | |||

Total Douglas Emmett, Inc. stockholders' equity | 1,989,361 | 1,979,656 | |||||

Noncontrolling interests | 393,253 | 410,803 | |||||

Total equity | 2,382,614 | 2,390,459 | |||||

Total liabilities and equity | $ | 6,007,684 | $ | 6,103,807 | |||

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

6

Douglas Emmett, Inc. | OPERATING RESULTS | |

(unaudited and in thousands, except per share data) | ||

Three Months Ended March 31, | |||||||

2013 | 2012 | ||||||

Revenues: | |||||||

Office rental: | |||||||

Rental revenues | $ | 97,330 | $ | 98,038 | |||

Tenant recoveries | 10,585 | 9,975 | |||||

Parking and other income | 18,508 | 17,257 | |||||

Total office revenues | 126,423 | 125,270 | |||||

Multifamily rental: | |||||||

Rental revenues | 17,551 | 16,748 | |||||

Parking and other income | 1,484 | 1,370 | |||||

Total multifamily revenues | 19,035 | 18,118 | |||||

Total revenues | 145,458 | 143,388 | |||||

Operating Expenses: | |||||||

Office expenses | 41,309 | 40,947 | |||||

Multifamily expenses | 5,009 | 4,930 | |||||

General and administrative | 7,096 | 6,700 | |||||

Depreciation and amortization | 46,024 | 45,797 | |||||

Total operating expenses | 99,438 | 98,374 | |||||

Operating income | 46,020 | 45,014 | |||||

Other income | 410 | 233 | |||||

Income (loss), including depreciation, from unconsolidated real estate funds | 1,189 | (984 | ) | ||||

Interest expense | (32,832 | ) | (37,561 | ) | |||

Acquisition-related expenses | (175 | ) | — | ||||

Net income | 14,612 | 6,702 | |||||

Less: Net income attributable to noncontrolling interests | (2,530 | ) | (1,316 | ) | |||

Net income attributable to common stockholders | $ | 12,082 | $ | 5,386 | |||

Net income per common share – basic | $ | 0.08 | $ | 0.04 | |||

Net income per common share – diluted | $ | 0.08 | $ | 0.04 | |||

Weighted average shares of common stock outstanding - basic | 142,440 | 138,399 | |||||

Weighted average shares of common stock outstanding - diluted | 174,582 | 171,816 | |||||

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

7

Douglas Emmett, Inc. | FUNDS FROM OPERATIONS AND | |

ADJUSTED FUNDS FROM OPERATIONS | ||

(unaudited and in thousands, except per share data) | ||

Three Months Ended March 31, | |||||||

2013 | 2012 | ||||||

Funds From Operations (FFO) | |||||||

Net income attributable to common stockholders | $ | 12,082 | $ | 5,386 | |||

Depreciation and amortization of real estate assets | 46,024 | 45,797 | |||||

Net income attributable to noncontrolling interests | 2,530 | 1,316 | |||||

Less: adjustments attributable to consolidated joint venture and unconsolidated investment in real estate funds | 3,508 | 3,074 | |||||

FFO (before adjustments for terminated swaps) | 64,144 | 55,573 | |||||

Amortization of accumulated other comprehensive income as a result of terminated swaps (1) | — | 4,347 | |||||

FFO (after adjustments for terminated swaps) | $ | 64,144 | $ | 59,920 | |||

Adjusted Funds From Operations (AFFO) | |||||||

FFO (after adjustments for terminated swaps) | $ | 64,144 | $ | 59,920 | |||

Straight-line rent adjustment | (1,960 | ) | (2,058 | ) | |||

Amortization of acquired above and below market leases | (4,054 | ) | (4,877 | ) | |||

Amortization of interest rate contracts and loan premium | — | (996 | ) | ||||

Amortization of prepaid financing | 1,170 | 1,155 | |||||

Recurring capital expenditures, tenant improvements and leasing commissions | (11,245 | ) | (13,827 | ) | |||

Non-cash compensation expense | 2,541 | 2,181 | |||||

Less: adjustments attributable to consolidated joint venture and unconsolidated investment in real estate funds | (474 | ) | (349 | ) | |||

AFFO | $ | 50,122 | $ | 41,149 | |||

Weighted average share equivalents outstanding - diluted | 174,582 | 171,816 | |||||

FFO per share- diluted | $0.37 | $0.35 | |||||

AFFO per share- diluted | $0.29 | $0.24 | |||||

AFFO payout ratio | 61.38 | % | 62.04 | % | |||

Dividends per share declared | $0.18 | $0.15 | |||||

__________________________________________________

(1) | We terminated certain interest rate swaps in December 2011 in connection with the refinancing of related loans. In calculating FFO, we make an adjustment to treat debt interest rate swaps as terminated for all purposes in the quarter of termination. In contrast, under GAAP, terminated swaps can continue to impact net income over their original lives as if they were still outstanding. In calculating FFO, we recognize the full expense in the period the swaps are terminated and offset the subsequent amortization expense contained in GAAP net income by an equivalent amount in this table. In the three months ended March 31, 2012, GAAP net income was reduced by amortization expense as a result of certain swaps terminated in December 2011, and we offset that expense by an equivalent amount in calculating our FFO. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

8

Douglas Emmett, Inc. | SAME PROPERTY STATISTICAL AND FINANCIAL DATA | |

(unaudited and in thousands, except statistics) | ||

As of March 31, | ||||||

2013 | 2012 | |||||

Same Property Office Statistics(1) | ||||||

Number of properties | 49 | 49 | ||||

Rentable square feet | 12,773,632 | 12,772,215 | ||||

Ending % leased | 91.9 | % | 90.5 | % | ||

Ending % occupied | 89.9 | % | 88.7 | % | ||

Quarterly average % occupied | 89.9 | % | 88.5 | % | ||

Same Property Multifamily Statistics | ||||||

Number of properties | 9 | 9 | ||||

Number of units | 2,868 | 2,868 | ||||

Ending % leased | 99.6 | % | 99.8 | % | ||

Three Months Ended March 31, | % Favorable | ||||||||||

2013 | 2012 | (Unfavorable) | |||||||||

Same Property Net Operating Income - GAAP Basis | |||||||||||

Total office revenues | $ | 125,323 | $ | 124,313 | 0.8 | % | |||||

Total multifamily revenues | 19,035 | 18,118 | 5.1 | % | |||||||

Total revenues | 144,358 | 142,431 | 1.4 | % | |||||||

Total office expense | (40,878 | ) | (40,527 | ) | (0.9 | )% | |||||

Total multifamily expense | (5,009 | ) | (4,930 | ) | (1.6 | )% | |||||

Total property expense | (45,887 | ) | (45,457 | ) | (0.9 | )% | |||||

Same Property NOI - GAAP basis | $ | 98,471 | $ | 96,974 | 1.5 | % | |||||

Same Property Net Operating Income - Cash Basis | |||||||||||

Total office revenues | $ | 120,203 | $ | 118,290 | 1.6 | % | |||||

Total multifamily revenues | 18,193 | 17,273 | 5.3 | % | |||||||

Total revenues | 138,396 | 135,563 | 2.1 | % | |||||||

Total office expense | (40,924 | ) | (40,572 | ) | (0.9 | )% | |||||

Total multifamily expense | (5,009 | ) | (4,930 | ) | (1.6 | )% | |||||

Total property expense | (45,933 | ) | (45,502 | ) | (0.9 | )% | |||||

Same Property NOI - cash basis | $ | 92,463 | $ | 90,061 | 2.7 | % | |||||

_____________________________________________

(1) | We are excluding a 79,000 square foot office property in Honolulu (in which we own a two thirds interest) from our same property statistics while it is undergoing a repositioning. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

9

Douglas Emmett, Inc. | RECONCILIATION OF SAME PROPERTY NOI | |

TO GAAP NET INCOME | ||

(unaudited and in thousands) | ||

Three Months Ended March 31, | |||||||

2013 | 2012 | ||||||

Same property office revenues - cash basis | $ | 120,203 | $ | 118,290 | |||

GAAP adjustments per definition of NOI - cash basis | 5,120 | 6,023 | |||||

Same property office revenues - GAAP basis | 125,323 | 124,313 | |||||

Same property multifamily revenues - cash basis | 18,193 | 17,273 | |||||

GAAP adjustments per definition of NOI - cash basis | 842 | 845 | |||||

Same property multifamily revenues - GAAP basis | 19,035 | 18,118 | |||||

Same property revenues - GAAP basis | 144,358 | 142,431 | |||||

Same property office expenses - cash basis | (40,924 | ) | (40,572 | ) | |||

GAAP adjustments per definition of NOI - cash basis | 46 | 45 | |||||

Same property office expenses - GAAP basis | (40,878 | ) | (40,527 | ) | |||

Same property multifamily expenses - cash basis | (5,009 | ) | (4,930 | ) | |||

GAAP adjustments per definition of NOI - cash basis | — | — | |||||

Same property multifamily expenses - GAAP basis | (5,009 | ) | (4,930 | ) | |||

Same property expenses - GAAP basis | (45,887 | ) | (45,457 | ) | |||

Same property Net Operating Income (NOI) - GAAP basis | 98,471 | 96,974 | |||||

Non-comparable office revenues | 1,100 | 957 | |||||

Non-comparable office expenses | (431 | ) | (420 | ) | |||

Total property NOI - GAAP basis | 99,140 | 97,511 | |||||

General and administrative expenses | (7,096 | ) | (6,700 | ) | |||

Depreciation and amortization | (46,024 | ) | (45,797 | ) | |||

Operating income | 46,020 | 45,014 | |||||

Other income | 410 | 233 | |||||

Income (loss), including depreciation, from unconsolidated real estate funds | 1,189 | (984 | ) | ||||

Interest expense | (32,832 | ) | (37,561 | ) | |||

Acquisition-related expenses | (175 | ) | — | ||||

Net income | 14,612 | 6,702 | |||||

Less: Net income attributable to noncontrolling interests | (2,530 | ) | (1,316 | ) | |||

Net income attributable to common stockholders | $ | 12,082 | $ | 5,386 | |||

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

10

Douglas Emmett, Inc. | OPERATING RESULTS OF | |

UNCONSOLIDATED REAL ESTATE FUNDS(1) | ||

(unaudited and in thousands) | ||

Three Months Ended March 31, | ||||||||

Summary Income Statement of Unconsolidated Real Estate Funds | 2013 | 2012 | ||||||

Office revenues | $ | 15,382 | $ | 15,116 | ||||

Office expenses | (5,972 | ) | (5,799 | ) | ||||

NOI | 9,410 | 9,317 | ||||||

General and administrative | (67 | ) | (64 | ) | ||||

Depreciation and amortization | (6,493 | ) | (6,812 | ) | ||||

Operating income | 2,850 | 2,441 | ||||||

Other income | — | 3 | ||||||

Interest expense | (2,508 | ) | (5,926 | ) | ||||

Net income (loss) | $ | 342 | $ | (3,482 | ) | |||

FFO of Unconsolidated Real Estate Funds | ||||||||

Net income (loss) | $ | 342 | $ | (3,482 | ) | |||

Add back: depreciation and amortization | 6,493 | 6,812 | ||||||

FFO | $ | 6,835 | $ | 3,330 | ||||

Douglas Emmett's Share of the Unconsolidated Real Estate Funds | ||||||||

Our share of the unconsolidated real estate funds' net income (loss) | $ | 399 | $ | (1,856 | ) | |||

Add back: our share of the funds' depreciation and amortization | 3,692 | 3,246 | ||||||

Equity allocation and basis difference | 790 | 872 | ||||||

Our share of the unconsolidated real estate funds' FFO | $ | 4,881 | $ | 2,262 | ||||

__________________________________________________

(1) | We manage, and have a significant investment in, two unconsolidated institutional real estate Funds which own 8 properties. The Investment Period for these Funds ended on October 7, 2012, and no further properties will be purchased by them. Our ownership interest entitles us to a pro rata share of any distributions based on our ownership (a weighted average of 59% at March 31, 2013 based on square footage), additional distributions based on the total invested capital and a carried interest if the investors’ distributions exceed a hurdle rate. We also receive fees and reimbursement of expenses for managing our unconsolidated Funds’ properties. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

11

Douglas Emmett, Inc. | DEBT BALANCES | |

(unaudited and in thousands) | ||

Consolidated Debt

Maturity Date | at March 31, 2013 (1) | ||||||

Principal Balance | Effective Annual Rate (2)(3) | ||||||

3/3/2014 | $ | 16,140 | (4) | LIBOR + 1.85% | |||

2/1/2015 | 111,920 | (5) | DMBS + 0.707% | (Fannie Mae) | |||

4/1/2015 | 150,000 | LIBOR +1.50% | |||||

3/1/2016 | 82,000 | LIBOR + 0.62% | (Fannie Mae) | ||||

6/1/2017 | 18,000 | LIBOR + 0.62% | (Fannie Mae) | ||||

10/2/2017 | 400,000 | 4.45% | |||||

4/2/2018 | 510,000 | 4.12% | |||||

8/1/2018 | 530,000 | 3.74% | |||||

8/5/2018 | 355,000 | (6) | 4.14% | ||||

2/1/2019 | 155,000 | (7) | 4.00% | ||||

6/5/2019 | 285,000 | (8) | 3.85% | ||||

3/1/2020 | (9) | 350,000 | (10) | 4.46% | |||

11/2/2020 | 388,080 | 3.65% | |||||

$ | 3,351,140 | ||||||

____________________________________________________

(1) | As of March 31, 2013, (i) the weighted average remaining life of our outstanding debt was 5.4 years; (ii) of the $2.97 billion of debt on which the interest rate was fixed under the terms of the loan or a swap, the weighted average remaining life was 5.8 years, the weighted average remaining period during which interest was fixed was 4.4 years and the weighted average annual interest rate was 4.05%; and (iii) including the non-cash amortization of interest rate contracts and prepaid financing, the effective weighted average interest rate was 4.17%. Except as otherwise noted, each loan is secured by a separate collateral pool consisting of one or more properties, requiring monthly payments of interest only with outstanding principal due upon maturity. |

(2) | Includes the effect of interest rate contracts and excludes amortization of prepaid financing, all shown on an actual/360-day basis. |

(3) | The termination date of swaps fixing the rate on these loans is generally one to two years prior to the maturity of the loan. As of March 31, 2013, the swap termination dates were as follows: $400.0 million loan, July 2015; $510.0 million loan, April 2016; $530.0 million loan, August 2016; and $388.1 million loan, November 2017. |

(4) | The borrower is a consolidated entity in which our Operating Partnership owns a two-thirds interest. |

(5) | The loan has a $75.0 million tranche bearing interest at DMBS + 0.76% and a $36.9 million tranche bearing interest at DMBS + 0.60% |

(6) | Interest-only until February 2016, with principal amortization thereafter based upon a 30-year amortization table. |

(7) | Interest-only until February 2015, with principal amortization thereafter based upon a 30-year amortization table. |

(8) | Interest only until February 2017, with principal amortization thereafter based upon a 30-year amortization table. |

(9) | We have 2 one-year extension options, which would extend the maturity to March 1, 2020 from March 1, 2018, subject to meeting certain conditions. |

(10) | Interest at a fixed interest rate until March 1, 2018 and a floating rate thereafter, with interest-only payments until March 2014 and payments thereafter based upon a 30-year amortization table. |

Unconsolidated Debt

at March 31, 2013 | ||||||||||

Maturity Date | Outstanding Principal | Our Share of Principal | Effective Annual Rate | |||||||

8/19/2013 | $ | 365,000 | $ | 249,471 | (1) | LIBOR+1.65% | ||||

4/1/2016 | 53,983 | 13,080 | (2) | 5.67% | ||||||

$ | 418,983 | $ | 262,551 | |||||||

_____________________________________________________

(1) | The $249.5 million represents our share of a $365.0 million loan to one of our unconsolidated Funds. Secured by six properties in a collateralized pool. Requires monthly payments of interest only, with outstanding principal due upon maturity. The Fund refinanced this loan in April 2013, with the proceeds from a $325 million loan (maturing on May 1, 2018 with an effective annual rate of 2.35%) and cash. |

(2) | The $13.1 million represents our share of a $54.0 million amortizing loan to one of our unconsolidated Funds. Secured by one property. Requires monthly payments of principal and interest. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

12

Douglas Emmett, Inc. | OFFICE PORTFOLIO SUMMARY | |

as of March 31, 2013 | ||

Submarket | Number of Properties | Rentable Square Feet | Percent of Square Feet of Our Total Portfolio | Submarket Rentable Square Feet | Our Market Share in Submarket | ||||||||||

Beverly Hills | 7 | 1,417,911 | 9.7 | % | 7,709,880 | 18.4 | % | (1) | |||||||

Brentwood | 14 | 1,700,886 | 11.6 | 3,356,126 | 50.7 | ||||||||||

Burbank | 1 | 420,949 | 2.9 | 6,662,410 | 6.3 | ||||||||||

Century City | 3 | 916,059 | 6.2 | 10,064,599 | 9.1 | ||||||||||

Honolulu | 4 | 1,716,704 | 11.7 | 5,088,599 | 33.7 | ||||||||||

Olympic Corridor | 5 | 1,098,070 | 7.5 | 3,022,969 | 36.3 | ||||||||||

Santa Monica | 8 | 970,962 | 6.6 | 8,700,348 | 11.2 | ||||||||||

Sherman Oaks/Encino | 11 | 3,181,254 | 21.7 | 6,171,530 | 51.5 | ||||||||||

Warner Center/Woodland Hills | 3 | 2,855,909 | 19.4 | 7,203,647 | 39.6 | ||||||||||

Westwood | 2 | 396,808 | 2.7 | 4,443,398 | 8.9 | ||||||||||

Total | 58 | 14,675,512 | 100.0 | % | 62,423,506 | 23.5 | |||||||||

_____________________________________________________

(1) | Including the pending acquisition of 8484 Wilshire, our market share in the Beverly Hills submarket will be 21.3%. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

13

Douglas Emmett, Inc. | OFFICE PORTFOLIO PERCENT LEASED AND IN-PLACE RENTS | |

as of March 31, 2013 | ||

Submarket | Percent Leased(1) | Annualized Rent | Annualized Rent Per Leased Square Foot (2) | Monthly Rent Per Leased Square Foot | |||||||||||

Beverly Hills | 94.3 | % | $ | 54,620,660 | $ | 42.35 | $ | 3.53 | |||||||

Brentwood | 88.4 | 54,548,527 | 37.68 | 3.14 | |||||||||||

Burbank | 100.0 | 15,145,670 | 35.98 | 3.00 | |||||||||||

Century City | 97.1 | 33,450,612 | 37.87 | 3.16 | |||||||||||

Honolulu | 91.2 | 47,284,946 | 32.07 | 2.67 | |||||||||||

Olympic Corridor | 93.5 | 31,436,817 | 31.38 | 2.61 | |||||||||||

Santa Monica (3) | 99.1 | 51,403,407 | 54.77 | 4.56 | |||||||||||

Sherman Oaks/Encino | 92.6 | 91,370,375 | 32.09 | 2.67 | |||||||||||

Warner Center/Woodland Hills | 83.6 | 66,249,300 | 29.10 | 2.42 | |||||||||||

Westwood | 93.4 | 12,629,015 | 35.02 | 2.92 | |||||||||||

Total / Weighted Average | 91.4 | $ | 458,139,329 | 35.40 | 2.95 | ||||||||||

Recurring Office Capital Expenditures per Rentable Square Foot | |||||||||||||||

For the three months ended March 31, 2013 | $ | 0.03 | |||||||||||||

_______________________________________________________________

(1) | Includes 303,029 square feet with respect to signed leases not yet commenced. |

(2) | Represents annualized rent divided by leased square feet (excluding signed leases not commenced). |

(3) | Includes $1,332,386 of annualized rent attributable to our corporate headquarters. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

14

Douglas Emmett, Inc. | MULTIFAMILY PORTFOLIO SUMMARY | |

as of March 31, 2013 | ||

Submarket | Number of Properties | Number of Units | Units as a Percent of Total | ||||||||

Brentwood | 5 | 950 | 33 | % | |||||||

Honolulu | 2 | 1,098 | 38 | ||||||||

Santa Monica | 2 | 820 | 29 | ||||||||

Total | 9 | 2,868 | 100 | % | |||||||

Submarket | Percent Leased | Annualized Rent | Monthly Rent Per Leased Unit | ||||||||

Brentwood | 99.5 | % | $ | 24,551,899 | $ | 2,165 | |||||

Honolulu | 99.9 | 19,964,400 | 1,517 | ||||||||

Santa Monica(1) | 99.4 | 23,334,792 | 2,386 | ||||||||

Total / Weighted Average | 99.6 | % | $ | 67,851,091 | 1,979 | ||||||

Recurring Multifamily Capital Expenditures per Unit | |||

For the three months ended March 31, 2013 | $ | 66 | |

________________________________________________________________

(1) | Excludes 8,013 square feet of ancillary retail space generating annualized rent of $162,681. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

15

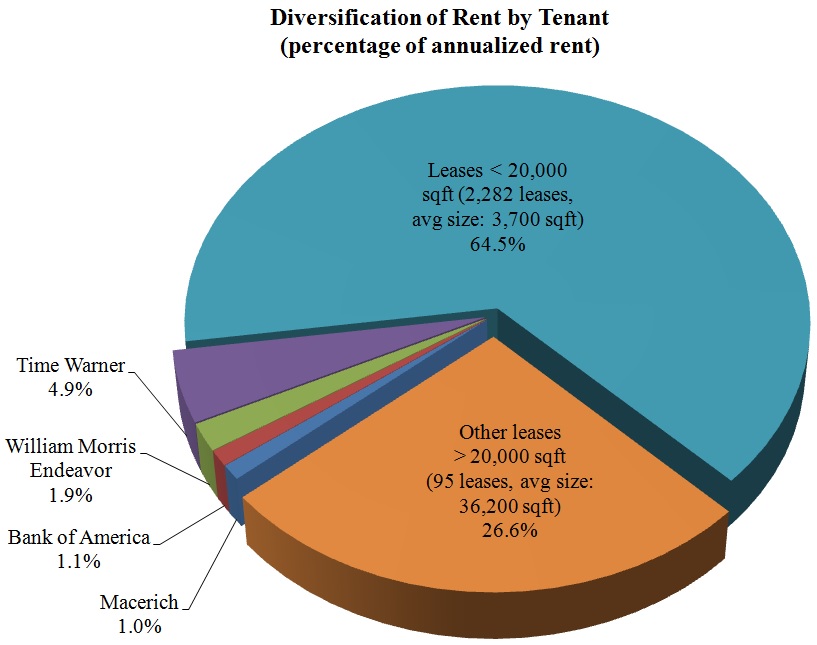

Douglas Emmett, Inc. | OFFICE TENANT DIVERSIFICATION | |

(1% or Greater of Annualized Rent) | ||

as of March 31, 2013 | ||

Individual tenants paying more than 1% of aggregate Annualized Rent:

Tenant | Number of Leases | Number of Properties | Lease Expiration(1) | Total Leased Square Feet | Percent of Rentable Square Feet | Annualized Rent | Percent of Annualized Rent | |||||||||||

Time Warner (2) | 4 | 4 | 2015-2020 | 625,750 | 4.3 | % | $ | 22,402,484 | 4.9 | % | ||||||||

William Morris Endeavor (3) | 1 | 1 | 2027 | 173,912 | 1.2 | 8,696,993 | 1.9 | |||||||||||

Bank of America (4) | 10 | 8 | 2013-2018 | 111,815 | 0.7 | 4,970,715 | 1.1 | |||||||||||

The Macerich Partnership, L.P. | 1 | 1 | 2018 | 90,832 | 0.6 | 4,717,172 | 1.0 | |||||||||||

Total | 16 | 14 | 1,002,309 | 6.8 | % | $ | 40,787,364 | 8.9 | % | |||||||||

_______________________________________________________________

(1) | Expiration dates are per leases and do not assume exercise of renewal, extension or termination options. For tenants with multiple leases, the range shown reflects all leases other than storage, ATM and similar leases. |

(2) | Includes a 10,000 square foot lease expiring in April 2015, a 150,000 square foot lease expiring in April 2016, a 421,000 square foot lease expiring in September 2019 and a 45,000 square foot lease expiring in December 2020. |

(3) | Includes 172,000 square foot office and 2,000 square foot storage expiring June 2027. Does not include an additional 5,000 square feet under lease that commences in 2013 and expire in 2027. |

(4) | Includes a 21,000 square foot lease expiring in September 2013, a 7,000 square foot lease expiring in March 2014, a 9,000 square foot lease expiring in September 2014, an 11,000 square foot lease expiring in October 2014, an 11,000 square foot lease expiring in November 2014, a 4,000 square foot lease expiring in February 2015, a 6,000 square foot lease expiring in May 2015, a 23,000 square foot lease expiring in December 2015, a 12,000 square foot lease expiring in March 2018 and an 8,000 square foot lease expiring in March 2018. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

16

Douglas Emmett, Inc. | INDUSTRY DIVERSIFICATION | |

as of March 31, 2013 | ||

Industry | Number of Leases | Annualized Rent as a Percent of Total | |||

Legal | 473 | 18.6 | % | ||

Financial Services | 314 | 13.9 | |||

Entertainment | 154 | 12.9 | |||

Real Estate | 181 | 9.2 | |||

Accounting & Consulting | 293 | 9.0 | |||

Health Services | 311 | 8.0 | |||

Insurance | 110 | 7.7 | |||

Retail | 192 | 7.1 | |||

Technology | 103 | 4.4 | |||

Advertising | 64 | 2.7 | |||

Public Administration | 68 | 2.4 | |||

Educational Services | 23 | 1.7 | |||

Other | 107 | 2.4 | |||

Total | 2,393 | 100.0 | % | ||

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

17

Douglas Emmett, Inc. | OFFICE LEASE DISTRIBUTION | |

as of March 31, 2013 | ||

Square Feet Under Lease | Number of Leases | Leases as a Percent of Total | Rentable Square Feet | Square Feet as a Percent of Total | Annualized Rent | Annualized Rent as a Percent of Total | ||||||||||

2,500 or less | 1,234 | 51.6% | 1,673,416 | 11.4% | $ | 58,448,812 | 12.8% | |||||||||

2,501-10,000 | 855 | 35.7 | 4,085,670 | 27.8 | 141,572,207 | 30.9 | ||||||||||

10,001-20,000 | 202 | 8.4 | 2,814,927 | 19.2 | 99,535,621 | 21.7 | ||||||||||

20,001-40,000 | 76 | 3.2 | 2,071,411 | 14.1 | 72,660,820 | 15.9 | ||||||||||

40,001-100,000 | 21 | 0.9 | 1,290,641 | 8.8 | 49,136,331 | 10.7 | ||||||||||

Greater than 100,000 | 5 | 0.2 | 1,005,335 | 6.9 | 36,785,538 | 8.0 | ||||||||||

Subtotal | 2,393 | 100.0% | 12,941,400 | (1) | 88.2% | 458,139,329 | 100.0% | |||||||||

Signed leases not commenced | 303,029 | 2.1 | ||||||||||||||

Available | 1,265,334 | 8.6 | ||||||||||||||

Building Management Use | 100,670 | 0.7 | ||||||||||||||

BOMA Adjustment(2) | 65,079 | 0.4 | ||||||||||||||

Total | 2,393 | 100.0% | 14,675,512 | 100.0% | $ | 458,139,329 | 100.0% | |||||||||

_________________________________________________________________

(1) | Average tenant size is approximately 5,400 square feet. Median tenant size is approximately 2,400 square feet. |

(2) | Represents square footage adjustments for leases that do not reflect BOMA 1996 remeasurement. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

18

Douglas Emmett, Inc. | OFFICE LEASE EXPIRATIONS | |

as of March 31, 2013 | ||

Year of Lease Expiration | Number of Leases | Rentable Square Feet | Expiring Square Feet as a Percent of Total | Annualized Rent at March 31, 2013 | Annualized Rent as a Percent of Total | Annualized Rent Per Leased Square Foot(1) | Annualized Rent Per Leased Square Foot at Expiration(2) | |||||||||||||||||

Short Term Leases | 61 | 186,561 | 1.3 | % | $ | 5,628,280 | 1.2 | % | $ | 30.17 | $ | 30.18 | ||||||||||||

2013 | 308 | 973,345 | 6.6 | 35,406,394 | 7.7 | 36.38 | 36.68 | |||||||||||||||||

2014 | 464 | 1,953,678 | 13.3 | 70,616,909 | 15.4 | 36.15 | 37.28 | |||||||||||||||||

2015 | 429 | 1,968,673 | 13.4 | 66,887,757 | 14.6 | 33.98 | 35.86 | |||||||||||||||||

2016 | 367 | 1,928,663 | 13.2 | 65,621,054 | 14.3 | 34.02 | 36.42 | |||||||||||||||||

2017 | 317 | 1,748,431 | 11.9 | 57,468,901 | 12.6 | 32.87 | 36.82 | |||||||||||||||||

2018 | 209 | 1,209,394 | 8.2 | 47,467,830 | 10.4 | 39.25 | 43.06 | |||||||||||||||||

2019 | 68 | 1,009,518 | 6.9 | 35,688,206 | 7.8 | 35.35 | 40.89 | |||||||||||||||||

2020 | 66 | 643,434 | 4.4 | 23,078,277 | 5.0 | 35.87 | 42.05 | |||||||||||||||||

2021 | 39 | 423,659 | 2.9 | 15,264,380 | 3.3 | 36.03 | 42.09 | |||||||||||||||||

2022 | 24 | 231,635 | 1.6 | 7,350,642 | 1.6 | 31.73 | 41.21 | |||||||||||||||||

Thereafter | 41 | 664,409 | 4.5 | 27,660,699 | 6.1 | 41.63 | 52.22 | |||||||||||||||||

Subtotal/Weighted Average | 2,393 | 12,941,400 | 88.2 | 458,139,329 | 100.0 | 35.40 | 38.78 | |||||||||||||||||

Signed leases not commenced | 303,029 | 2.1 | ||||||||||||||||||||||

Available | 1,265,334 | 8.6 | ||||||||||||||||||||||

Building Management Use | 100,670 | 0.7 | ||||||||||||||||||||||

BOMA Adjustment(3) | 65,079 | 0.4 | ||||||||||||||||||||||

Total/Weighted Average | 2,393 | 14,675,512 | 100.0 | % | $ | 458,139,329 | 100.0 | % | 35.40 | 38.78 | ||||||||||||||

_________________________________________________________________

(1) | Represents annualized rent at March 31, 2013 divided by leased square feet. |

(2) | Represents annualized rent at expiration divided by leased square feet. |

(3) | Represents the square footage adjustments for leases that do not reflect BOMA 1996 remeasurement. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

19

Douglas Emmett, Inc. | QUARTERLY OFFICE LEASE EXPIRATIONS - NEXT FOUR QUARTERS | |

as of March 31, 2013 | ||

Q2 2013 | Q3 2013 | Q4 2013 | Q1 2014 | |||||||||||||

Expiring SF(1) | 177,011 | 460,251 | 336,083 | 473,798 | ||||||||||||

Percentage of Portfolio | 1.2 | % | 3.1 | % | 2.3 | % | 3.2 | % | ||||||||

Expiring Rent per SF(2) | $ | 36.90 | $ | 38.32 | $ | 34.32 | $ | 40.44 | ||||||||

Detailed Submarket Data(3) | Q2 2013 | Q3 2013 | Q4 2013 | Q1 2014 | |||||||||||||

Beverly Hills | Expiring SF(1) | 17,616 | 25,800 | 30,356 | 42,668 | ||||||||||||

Expiring Rent per SF | $ | 41.65 | $ | 36.20 | $ | 38.10 | $ | 45.47 | |||||||||

Brentwood | Expiring SF(1) | 23,310 | 38,875 | 40,272 | 104,435 | ||||||||||||

Expiring Rent per SF | $ | 45.14 | $ | 44.95 | $ | 40.87 | $ | 43.45 | |||||||||

Century City | Expiring SF(1) | 1,001 | 30,959 | 4,877 | 7,951 | ||||||||||||

Expiring Rent per SF | $ | 39.99 | $ | 35.32 | $ | 43.59 | $ | 40.43 | |||||||||

Honolulu | Expiring SF(1) | 16,512 | 66,334 | 55,821 | 29,815 | ||||||||||||

Expiring Rent per SF | $ | 32.30 | $ | 33.81 | $ | 28.76 | $ | 36.27 | |||||||||

Olympic Corridor | Expiring SF(1) | 14,752 | 26,286 | 53,233 | 43,225 | ||||||||||||

Expiring Rent per SF | $ | 40.15 | $ | 32.54 | $ | 32.10 | $ | 34.26 | |||||||||

Santa Monica | Expiring SF(1) | 2,023 | 44,949 | 5,606 | 47,940 | ||||||||||||

Expiring Rent per SF | $ | 43.48 | $ | 62.56 | $ | 53.93 | $ | 68.04 | |||||||||

Sherman Oaks/Encino | Expiring SF(1) | 36,522 | 88,397 | 98,373 | 86,879 | ||||||||||||

Expiring Rent per SF | $ | 35.31 | $ | 35.92 | $ | 34.44 | $ | 33.03 | |||||||||

Warner Center/Woodland Hills | Expiring SF(1) | 63,228 | 128,006 | 37,996 | 102,472 | ||||||||||||

Expiring Rent per SF | $ | 33.78 | $ | 34.28 | $ | 29.72 | $ | 31.67 | |||||||||

Westwood | Expiring SF(1) | 2,047 | 10,645 | 9,549 | 8,413 | ||||||||||||

Expiring Rent per SF | $ | 33.10 | $ | 36.59 | $ | 40.46 | 49.93 | ||||||||||

_________________________________________________________________

(1) | Includes leases with an expiration date in the applicable quarter where the space had not been re-leased as of March 31, 2013, excluding 186,561 square feet of short term leases. Commencing this quarter, we are excluding short term leases, such as month to month leases and other short term leases, from this table because they are not included in our changes in rental rate data, have rental rates that may not be reflective of market conditions and can distort the data trends, particularly in the first upcoming quarter. The variations in this number using the revised methodology from quarter to quarter primarily reflects the mix of buildings/submarkets involved, although it is also impacted by the varying terms and square footage of the individual leases involved. |

(2) | Includes the impact of rent escalations over the entire term of the expiring lease, and thus is not directly comparable to asking rents. |

(3) | Due to the small square footage of leases in each quarter in each submarket, and the varying terms and square footage of the individual leases and individual buildings involved, these numbers should be extrapolated with caution. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

20

Douglas Emmett, Inc. | OFFICE PORTFOLIO LEASING ACTIVITY | |

for the three months ended March 31, 2013 | ||

Rentable Square feet | Percentage(2) | |||||

Net Absorption During Quarter(1) | 43,876 | 0.30% | ||||

Leases Signed During Quarter | Number of leases | Rentable square feet | Weighted Average Lease Term (months)(3) | |||

New leases | 86 | 236,611 | 55 | |||

Renewal leases | 93 | 517,448 | 70 | |||

All leases | 179 | 754,059 | 65 | |||

Change in Rental Rate for Leases Executed during the Quarter(4) | |||||

Starting Cash Rent | Straight-line Rent | Expiring Cash Rent(5) | |||

Leases executed during the quarter | $32.22 | $33.43 | N/A | ||

Prior leases for same space | $33.23 | $35.45 | $38.52 | ||

Percentage change | (3.0)% | (5.7)% | (16.4)% | ||

Percentage change (excluding AIG) | (1.4)% | (3.8)% | (13.7)% | ||

Average Lease Transaction Costs (Per Square Foot)(6) | |||

Lease Transaction Costs | Lease Transaction Costs per Annum | ||

New leases signed during quarter | $20.91 | $4.59 | |

Renewal leases signed during quarter | $17.98 | $3.09 | |

All leases signed during quarter | $18.90 | $3.49 | |

________________________________________________________________

(1) | Excludes any properties acquired during the quarter. |

(2) | As previously announced, we had approximately 60 basis points of expected tenant departures in the fourth quarter of 2012 that were delayed until 2013. Adjusted to record these departures in the fourth quarter as expected, the net absorption in the first quarter of 2013 would have been 0.70%. |

(3) | Excluding the AIG lease, the weighted average term was 53 months and the average lease transaction costs per square foot per annum was $3.74. |

(4) | Represents the average initial stabilized cash rents and straight-line on new and renewal leases executed during the quarter compared to the prior lease on the same space, excluding short term leases and new leases on space which had not been leased for at least a year. |

(5) | The percentage change represents the difference in the starting cash rent on leases executed during the quarter compared to the expiring cash rent on the prior leases for the same space, which reflects the impact of rent escalations over the entire term of the expiring lease. The impact on cash revenues in the quarter was offset by the increase in cash revenues due to the annual rent escalations on the continuing in place leases. |

(6) | Represents weighted average tenant improvements and leasing commissions. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

21

Douglas Emmett, Inc. | 2013 GUIDANCE | |

2013 OUTLOOK:

Metric | Guidance | Compared to Prior Guidance |

Funds from operations (FFO) | $1.43 to $1.49 per share | Revised |

Office occupancy rate as of 12/31/2013 | 1.0% to 1.5% greater than at 12/31/12(1) | Revised |

Residential leased rate as of 12/31/2013 | Essentially fully leased | Unchanged |

Same store cash NOI growth rate | Up 1.0% to 2.0% from 2012(2) | Revised |

G&A | $28 million to $29.5 million | Unchanged |

Interest expense | $130 million to $131 million(3) | Revised |

FAS 141 revenue (amortization of above/below market leases) | $15 million to $16 million | Revised |

Straight-line revenue | $4 million to $6 million | Unchanged |

Recurring capex (Office) | $0.25 per square foot | Unchanged |

Recurring capex (Multifamily) | $400 to $450 per unit | Unchanged |

Weighted average diluted shares | 174.5 million to 175.5 million (4) | Revised |

These projections are forward looking statements and reflect our views of current and future market conditions, including assumptions with respect to rental rates, occupancy levels and the impact of various events, some of which are referenced in this earnings package or during our quarterly conference calls. Except as disclosed, this guidance does not include the impact on operating results from possible future property acquisitions or dispositions, other possible capital markets activity or possible future impairment charges. There can be no assurance that our actual results will not differ materially from the estimates set forth above.

________________________________________

(1) | Adjusted for tenant departures deferred from the fourth quarter of 2012 into 2013, projected 2013 office occupancy growth would be about 1.6% to 2.1%. |

(2) | Includes the impact of free rent associated with the strong occupancy growth in the fourth quarter of 2012 and the renewal of a large lease with AIG. |

(3) | Includes the impact of the pay down of outstanding debt by $90 million on March 29, 2013. |

(4) | The variation depends on the market price for our common stock and not on any stock issuances. |

NOTE: Please see the page titled "Definitions" at the end of this Earnings Package for certain definitions.

22

Douglas Emmett, Inc. | DEFINITIONS | |

Adjusted Funds From Operations (AFFO): We compute Adjusted Funds From Operations (AFFO) by adding to FFO (as adjusted-see definition below) any non-cash compensation expense, amortization of prepaid financing costs and straight-line rents, and then subtracting any recurring capital expenditures, tenant improvements and leasing commissions. AFFO is a non-GAAP financial measure; we believe that net income is the most directly comparable GAAP financial measure. AFFO is not intended to represent cash flow for the period, but may provide an additional perspective on our operating results and ability to fund cash needs and make distributions to stockholders. As a widely reported measure of the performance of REITs, AFFO is also used by investors to compare our performance with other REITs. However, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to that of other REITs. Accordingly, AFFO should be considered only as a supplement to net income as a measure of our performance.

Annualized Rent: Represents annualized monthly cash base rent (i.e., excludes tenant reimbursements, parking and other revenue) before abatements under leases commenced as of the measurement date (does not include 303,029 square feet with respect to signed leases not yet commenced at March 31, 2013). For our triple net Burbank and Honolulu office properties, annualized rent is calculated by adding expense reimbursements to base rent.

Diluted Shares: Represents ownership in our company through shares of common stock, units in our Operating Partnership and other convertible equity instruments. Basic and diluted shares are calculated in accordance with GAAP and include common stock plus dilutive equity instruments, as appropriate.

Funds From Operations (FFO): We calculate funds from operations before noncontrolling interest (FFO) in accordance with the standards established by the National Association of Real Estate Investment Trusts (NAREIT), adjusted to treat debt interest rate swaps as terminated for all purposes in the quarter of termination (see footnote 1 to the Funds From Operations table for detail). FFO is a non-GAAP financial measure which represents net income (loss), computed in accordance with accounting principles generally accepted in the United States (GAAP), excluding gains (or losses) from sales of depreciable operating property, real estate depreciation and amortization (other than amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. We provide FFO as a supplemental performance measure because, by excluding real estate depreciation, amortization and gains and losses from property dispositions, it can illustrate trends in occupancy rates, rental rates and operating costs from year to year. We also believe that, as a widely recognized measure of the performance of REITs, FFO can be used by investors as a basis to compare our operating performance with that of other REITs. However, FFO has limitations as a measure of our performance because it excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our results from operations. Other equity REITs may not calculate FFO in accordance with the NAREIT definition and, accordingly, our FFO may not be comparable to those other REITs’ FFO. Accordingly, FFO should be considered only as a supplement to net income as a measure of our performance. FFO should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends. FFO should not be used as a supplement to or substitute measure for cash flow from operating activities computed in accordance with GAAP.

23

Douglas Emmett, Inc. | DEFINITIONS | |

Net Operating Income (NOI): Net operating income (NOI) is a non-GAAP measure consisting of the revenue and expense attributable to the real estate properties that we own and operate. We present two forms of NOI:

• | “NOI - GAAP basis” is calculated by excluding the following from our net income (or loss): general and administrative expense, depreciation and amortization expense, interest income, interest expense, income (or loss) from unconsolidated partnerships, income (or loss) attributable to noncontrolling interests, gains (or losses) from sales of depreciable operating properties, net income (or loss) from discontinued operations and extraordinary items. |

• | “NOI - Cash basis” is calculated by excluding from GAAP basis NOI our straight-line rent adjustments and the amortization of above/below market lease intangible assets and liabilities. |

We provide NOI as a supplemental performance measure because, by excluding real estate depreciation and amortization expense and gains (or losses) from property dispositions, some investors use it to illustrate trends in occupancy rates, rental rates and operating costs from year to year. We also believe that NOI can be useful to investors as a basis to compare our operating performance with that of other REITs. However, NOI has limitations as a measure of our performance because it excludes depreciation and amortization expense and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties (all of which have real economic effect and could materially impact our results from operations). Other equity REITs may not calculate NOI in a similar manner and, accordingly, our NOI may not be comparable to those other REITs’ NOI. Accordingly, NOI should be considered only as a supplement to net income as a measure of our performance. NOI should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends. NOI should not be used as a substitute measure for cash flow from operating activities computed in accordance with GAAP.

Occupied: Represents percent leased less signed leases not yet commenced.

Properties Owned: All properties included are 100% owned except 8 properties totaling 1.8 million square feet owned by our unconsolidated real estate Funds and a 79,000 square foot property owned by a joint venture in which we own a 66.7% interest.

Quarterly Average Percent Occupied: Represents the average of the percentage occupied on the last day of the period and the percent occupied on the last day of the prior period.

Rentable Square Feet: Based on BOMA 1996 remeasurement. At March 31, 2013, total consists of 13,244,429 leased square feet (including 303,029 square feet with respect to signed leases not commenced), 1,265,334 available square feet, 100,670 building management use square feet and 65,079 square feet of BOMA 1996 adjustment on leased space.

Same Property NOI: To facilitate a comparison of NOI between periods, we calculate comparable amounts for a subset of our owned properties referred to as our “same properties.” Same property amounts are calculated as the amounts attributable to properties which have been owned and operated by us, and reported in our consolidated results, during the entire span of both periods compared. Therefore, any properties either acquired after the first day of the earlier comparison period or sold, contributed or otherwise removed from our consolidated financial statements before the last day of the later comparison period are excluded from same properties. We may also exclude from the same property set any property that is undergoing a major repositioning project that would impact the comparability of its results between two periods.

Shares of Common Stock Outstanding: Represents undiluted shares, and so does not include OP units or other convertible equity instruments.

Short Term Leases: Represents leases that expired on or before the measurement date or had a term of less than one year, including, for example, hold over tenancies, month to month leases and other short term occupancies.

24