Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GAIN Capital Holdings, Inc. | d524532d8k.htm |

| EX-99.3 - EX-99.3 - GAIN Capital Holdings, Inc. | d524532dex993.htm |

| EX-99.1 - EX-99.1 - GAIN Capital Holdings, Inc. | d524532dex991.htm |

GFT

Acquisition Announcement & Q1 2013 Preliminary Results

April 2013

Exhibit 99.2 |

Safe

Harbor Statement 2

Forward-Looking Statements

The forward-looking statements contained herein include, without

limitation, statements relating to GAIN Capital’s and/or Global Futures &

Forex, Ltd.’s (“GFT”) expectations regarding the

opportunities and strengths of the combined company created by the proposed business

combination, anticipated cost and revenue synergies, the strategic

rationale for the proposed business combination, including expectations

regarding product offerings, growth opportunities, value creation, and

financial strength, and the timing of the closing. All forward looking

statements are based upon current expectations and beliefs and various

assumptions. There can be no assurance that GAIN Capital or GFT

will realize these expectations or that these beliefs will prove

correct. In addition, a variety of important factors could cause results to differ

materially from such statements. These factors are noted throughout

GAIN Capital’s annual report on Form 10-K, as filed with the

Securities and Exchange Commission on March 18, 2013, and include, but

are not limited to, the actions of both current and potential new

competitors, fluctuations in market trading volumes, financial market

volatility, evolving industry regulations, including changes in

regulation of the futures companies, errors or malfunctions in GAIN

Capital’s systems or technology, rapid changes in technology, effects of

inflation, customer trading patterns, the success of our products and

service offerings, our ability to continue to innovate and meet the

demands of our customers for new or enhanced products, our ability to

successfully integrate assets and companies we have acquired, our

ability to effectively compete in the futures industry, changes in tax

policy or accounting rules, fluctuations in foreign exchange rates and

commodity prices, adverse changes or volatility in interest rates, as

well as general economic, business, credit and financial market

conditions, internationally or nationally, and our ability to continue

paying a quarterly dividend in light of future financial performance and

financing needs. The forward-looking statements included

herein represent GAIN Capital’s views as of the date of this release. GAIN

Capital undertakes no obligation to revise or update publicly any

forward-looking statement for any reason unless required by law.

Non-GAAP Financial Measures

EBITDA is a non-GAAP financial measure that represents our

historical and pro forma earnings before interest, taxes, depreciation,

amortization and non-recurring expenses. This non-GAAP

financial measure has certain limitations, including that it does not have a

standardized meaning and, therefore, our definition may be different

from similar non-GAAP financial measures used by other companies

and/or analysts. Thus, it may be more difficult to compare our

financial performance to that of other companies. We believe our reporting of

EBITDA assists investors in evaluating our historical and expected

operating performance. However, because EBITDA is not a measure of

financial performance calculated in accordance with GAAP, such measure

should be considered in addition to, but not as a substitute for,

other measures of our financial performance reported in accordance with

GAAP, such as net income. |

ACQUISITION OF

GLOBAL FUTURES & FOREX, LTD

3

Glenn Stevens, CEO |

Transaction Highlights

•

GAIN has signed a definitive agreement for the acquisition of Global Futures &

Forex, LTD (“GFT”)

•

The acquisition significantly enhances GAIN’s scale and position as an

industry leader with diverse revenue streams and product offerings

–

Large scale

•

Combined

2013

run-rate

revenue

(1)

:

$329mm

•

Pro forma client assets: ~$650mm

•

Pro forma FY 2012 volume: $4.6 trillion

–

Broader product offering

•

Total of 12,500 financial markets

•

OTC FX, CFDs, binary options, spread betting, FX options, exchange-traded

futures and options –

Diversified revenue streams

•

Expanded partner-based business

•

New institutional revenue stream from GFT’s Sales Trader business

•

Total commission-based business rises to 22% of revenue

•

Complementary technology and product functionality

•

Operating expense synergies of $35mm-$45mm

•

Regulatory capital synergies

4

(1)

Based on preliminary Q1 2013 results. |

GFT

Overview •

Company Overview

–

Founded in 1997 and offers retail customers FX, CFDs, spread betting, binaries and

FX options

–

Headquarters in Grand Rapids, Michigan with offices located in London, Singapore,

Tokyo and Sydney

–

Customers

principally

trade

via

GFT’s

proprietary

Dealbook

360

platform

•

Customers & Operations

–

Over $190mm in customer assets

–

FY 2012 volume: $1.3 trillion

–

>75% of retail customer volume sourced through partners

–

Sales Trader (institutional-like) business generates 40% of total volume

•

Transaction discussions began immediately following GFT’s transfer of its

U.S. customer assets to GAIN in December 2012

5 |

Financial

Summary of Transaction •

Net purchase price: $27.8mm

–

Represents

0.3x

FY 2012

revenue

and

1.7x

adjusted

pro

forma

FY 2012

EBITDA

(1)

–

Net cash on hand: $80.0mm

(2)

–

Total purchase price: $107.8mm

•

Transaction structure

–

GAIN equity: ~4.9mm shares

–

Cash: $40.0mm

–

Sr. Secured Note: $40.0mm

•

8.0% annual interest, payable quarterly

•

$1.5mm minimum quarterly amortization

•

Synergies

–

$35mm -

$45mm of estimated expense synergies

–

Additional regulatory capital synergies expected through the combination of

existing entities •

GAIN

expects

the

transaction

to

be

accretive

to

2H

2013

earnings

and

significantly accretive to FY

2014 earnings

•

Expected to close transaction in early Q3 2013

6

(1)

Assumes mid-point of $35mm-$45mm of expected year 1 synergies achieved.

A reconciliation of FY 2012 EBITDA to pro forma FY 2012

EBITDA is available in the appendix to this presentation.

(2)

As of March 31, 2013. |

Strategic

Rationale •

Provides GAIN with significant scale with customer assets of ~$650mm, run-rate

revenue

of

$329mm,

run-rate

pro

forma

EBITDA

(1)

of

$77mm

and

approximately

140,000 customer accounts

•

Broadens

offering

to

include

over

12,500

products,

including

FX,

CFDs,

spread

betting, binaries, FX options and exchange-traded futures & options

•

Significantly expands partner-based business with GFT’s existing

relationships •

New institutional-like revenue stream with low fixed cost base from GFT’s

rapidly expanding Sales Trader business

•

Complementary technology and product functionality to existing GAIN

platforms •

Expands global footprint in key markets, including Continental Europe and S.E.

Asia •

Opportunity to take advantage of major synergies from overlapping operations

–

Estimated first-year operating synergies of $35mm-$45mm

–

Potential capital synergies

7

(1)

Pro Forma EBITDA assumes $40mm of estimated synergies achieved based on

mid-point of assumed year 1 synergies of $35mm-$45mm. |

Synergies

•

As a result of the combination, GAIN expects to generate $35mm-$45mm of

incremental run-rate EBITDA

•

Operating synergies will be realized through:

–

Consolidation of redundant functions and office locations

–

Combined selling and marketing efforts

–

Reduced product and software development costs as a result of combinations of

platforms and back offices

–

Reduced data and communications, professional fees and other expenses as a result

of combination

•

Modest expense savings expected to be achieved in FY 2013

–

Full integration expected to be completed in 2014

•

Potential capital synergies as a result of overlapping regulatory requirements and

the freeing-up of a portion of collateral posted with trading

partners 8 |

Benefits

for GAIN •

Immediate scale increase

–

Combination enhances scale and positioning in the global OTC market

–

Substantially increases GAIN’s key financial, trading and client

metrics –

Greater ability to withstand potential regulatory changes and market

volatility •

Significant operating synergies

–

Expected to be accretive to 2H 2013 earnings

–

Potential to realize approximately $35mm-$45mm of cost savings via

first-year synergies –

Potential to capitalize on additional operating and capital synergies

•

Diversifies revenue streams

–

Significant

expansion

of

CFDs

and

spread

betting

products

–

Institutionally-focused Sales Trader team complements and augments existing

institutional services and GTX platform

–

Enhances GAIN’s indirect distribution network by leveraging GFT’s skill

and experience in servicing large brokerage partners

•

Transaction enhances GAIN’s status as a successful industry

consolidator 9 |

Transaction Benefits for Clients

•

Maintain quality of trading experience

•

Best of breed trading platforms, research and tools

•

Superior pricing and execution through combination of GAIN and GFT’s risk

management expertise

•

Robust multi-product offering which includes FX, CFDs, spread betting,

binaries, FX options and exchange traded futures and options

•

Enhanced access for clients in Europe, Asia and the Middle East

•

Financial strength and stability of combined company

10 |

Pro

Forma GAIN Financials •

Both companies have seen a

significant rebound in financial and

operating performance in Q1 2013

11

(1)

EBITDA

is

a

non-GAAP

financial

measure

that

represents

earnings

before

interest,

taxes,

depreciation,

amortization

and

non-recurring

expenses.

A reconciliation of net income to EBITDA is available in the appendix to this

presentation. (2)

Pro forma EBITDA assumes $40mm of estimated synergies achieved based on

mid-point of assumed year 1 synergies of $35mm-$45mm. (3)

Pro forma EBITDA assumes $10mm of estimated Q1 synergies achieved based on

mid-point of assumed year 1 synergies of $35mm-$45mm. (4)

Assumes transaction closes in early Q3 2013.

(5)

FY 2013 EBITDA range assumes $20mm of estimated synergies achieved.

•

Based on FY Q1 2013 results and

the synergies available via the

transaction, GAIN believes that the

combined company will demonstrate

strong profitability in FY 2013

•

Both GAIN and GFT experienced a

decline in financial results during FY

2012, primarily due to the decline in

volatility and trading volume in the FX

market

($ in millions)

Q1 2013 Run-Rate

FY 2013 Range

(4)(5)

Revenue

$329

$230 -

$260

EBITDA

77

35 -

55

EBITDA Margin %

23%

15% -

21%

($ in millions)

Fiscal Year Ended December 31, 2012

GAIN

GFT

PF GAIN

Revenue

$151.4

$97.8

$249.2

EBITDA

(1)(2)

11.1

(23.4)

27.7

EBITDA Margin %

7%

NM

11%

($ in millions)

Quarter Ended March 31, 2013

GAIN

GFT

PF GAIN

Revenue

$49.8

$32.5

$82.3

EBITDA

(1)(3)

7.5

1.8

19.3

EBITDA Margin %

15%

6%

23%

Key Balance Sheet Data & Operating Metrics

Client Assets

$456.9

$192.2

$649.1

Funded Accounts

100,020

39,690

139,710

Y-o-Y Q1 Revenue Growth

50%

34% |

Pro

Forma Financial & Operating Metrics 12

(1)

Commission revenue represents PF 2012 to include full-year impact of OEC

acquisition. (2)

Commission revenue represents revenue from Sales Trader clients.

(3)

Commission

revenue

represents

revenue

from

Sales

Trader

clients,

GTX

and

full-year

impact

of

OEC

acquisition.

$0.8

$0.2

$1.0

$0.5

$0.6

$1.1

$2.0

$0.5

$2.5

$3.3

$1.3

$4.6

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

GAIN

GFT

PF GAIN

Retail -

Direct

Retail -

Indirect

Institutional

$649.1

$456.9

FY 2012 Trading Volume ($ in billions) |

Q1 2013

PRELIMINARY HIGHLIGHTS Glenn Stevens, CEO

13 |

14

•

Financials

–

Revenue: $49.8mm (50% year-over-year growth)

–

EBITDA

(1)

: $7.5mm (15% margin)

–

Net Income: $4.3mm

–

EPS: $0.11

•

Operating Metrics

–

Total trading volume: $1.3 trillion (+55%)

•

Retail volume: $433.9bn (+13%)

•

Institutional volume: $887.8bn (+90%)

–

Futures DARTs: 13,238

–

Client assets: $456.9mm (+40%)

–

Funded accounts: 100,020 (+36%)

Q1 2013 Preliminary Highlights

(Comparisons are referenced to Q1 2012)

(1) EBITDA is a non-GAAP financial measure that represents our earnings

before interest, taxes, depreciation, amortization and non-recurring expenses. |

RESPONSE TO FXCM’S

UNSOLICITED TAKEOVER ATTEMPT

Glenn Stevens, CEO

15 |

16

•

GAIN Capital received an unsolicited proposal dated April 8, 2013 from FXCM to

acquire GAIN for 0.3996 shares of FXCM Class A common stock for each share

of GAIN common stock •

GAIN’s

Board

of

Directors

conducted

a

thorough

review

of

the

proposal

with

the

assistance

of

its

financial and legal advisors

•

The Board determined that the sale of GAIN to FXCM on the terms proposed would not

be in the best interests of GAIN’s shareholders

•

The Board therefore unanimously rejected the proposal and reaffirmed its

commitment to GAIN’s strategic plan

•

The Board’s rejection of FXCM’s takeover proposal is based on the

following conclusions: –

The proposal does not properly value GAIN or the synergies in a combination of the

companies

–

The Board believes that GAIN’s stock has been undervalued in the public

markets –

The proposal is an opportunistic attempt by FXCM to capitalize on the nearly 40%

increase in FXCM’s stock price over the last five months and acquire

GAIN at a below-market premium while GAIN is trading near its

all-time lows –

GAIN’s

first

quarter

results

and

the

highly

strategic

and

synergistic

acquisition

of

GFT

demonstrate the value that the Board believes can be created through the execution

of the Company’s strategic plan

GAIN Capital Rejects FXCM’s Opportunistic

Takeover Proposal |

17

•

Over the course of the last several months, GAIN’s common stock price has

declined from nearly $5.00

per

share

to

approximately

$4.27

per

share,

due

in

part

to

GAIN’s

disappointing

full

year

and fourth quarter 2012 amid challenging market conditions

•

Over this same period, FXCM’s common stock price increased by approximately

40%, from less than $9.00 per share to more than $14.00 per share as FXCM

has realized the benefit of consolidating its investment in FX market

making firm, Lucid Markets, into its results •

Both

GAIN

and

FXCM

benefitted

from

improved

market

conditions

in

1Q13;

FXCM

has

publicly

announced monthly volumes while GAIN disclosed preliminary results today

•

At no point in 2013 prior to the public declaration of FXCM’s proposal to

acquire GAIN did FXCM or its advisors contact GAIN to indicate their

interest in a merger or acquisition transaction between FXCM and GAIN

•

On April 8, 2013, FXCM publicly announced an unsolicited proposal to acquire GAIN

for 0.3996 shares of FXCM Class A common stock for each share of GAIN

common stock •

The following day, GAIN issued a press release acknowledging receipt of the

proposal and stating the Board would consider the proposal, as well as a

range of options to build shareholder value Recent Events

|

18

•

FXCM stated that it believes that GAIN’s EBITDA contribution, including

synergies, will be between $35 million and $55 million in 2014 and $50

million and $70 million in 2015

–

GAIN believes that these projections underestimate GAIN’s EBITDA before

synergies and / or the synergies available in a combination of the

companies –

FXCM’s offer represents only approximately 3x to 4x FXCM’s estimate of

GAIN’s EBITDA contribution, including GAIN’s cash balance

•

GAIN is successfully executing an organic growth strategy focused on

diversifying its retail product offering and institutional services, as well as

pursuing targeted, synergistic acquisitions

The Proposal Does Not Properly Value GAIN or

Synergies |

19

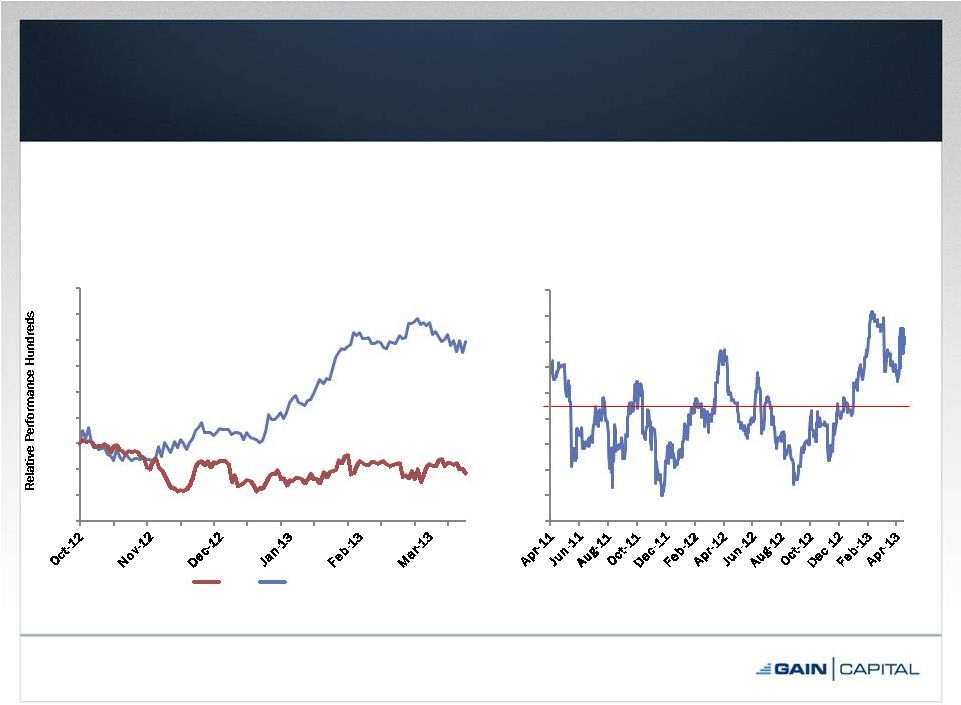

•

Volatility and FX trading volume metrics

are the primary drivers of GAIN’s

business and fell to multi-year lows in

2012

–

This has had a substantial negative

impact on GAIN’s financial results,

stock price and valuation

•

During 2012, GAIN took measures to

reduce expenses, bolster the product

offering and the scale of its retail

business, grow its institutional platform

and expand into exchange-based

products

•

Together with higher levels of volatility

and trading volume in early 2013, these

initiatives have positioned GAIN for

substantially improved growth and

profitability, as evidenced by its strong

first quarter results

GAIN’s Stock Has Been Undervalued in the

Public Markets

Source: S&P CapitalIQ as of 4/19/13.

Average: 22.4

5

10

15

20

25

30

35

40

45

50

55

CVIX Volatility Index |

•

FXCM is attempting to capitalize on the recent substantial increase in its stock

price and use its highly-valued stock as a currency to acquire GAIN at

a time when GAIN is trading near its all-time low

20

FXCM’s Takeover Attempt is Opportunistic

Source: S&P CapitalIQ as of 4/8/13.

Source: S&P CapitalIQ.

70%

80%

90%

100%

110%

120%

130%

140%

150%

160%

FXCM and GAIN Recent Relative Stock Price Performance

GAIN

FXCM

8.0x

9.0x

10.0x

11.0x

12.0x

13.0x

14.0x

15.0x

16.0x

17.0x

FXCM NTM Price-to-Earnings Ratio Over Last Two Years

39.0%

(11.6%)

15.1x

Average: 12.2x

Current Multiple 24%

Premium to Average |

21

•

FXCM’s proposed exchange ratio is well-below the exchange ratio prior to

the recent increase in FXCM’s stock price and decrease in GAIN’s

stock price FXCM’s Takeover Attempt is Opportunistic

FXCM Proposed Exchange Ratio: 0.40x

Source: Share price metrics from CapitalIQ as of 4/8/13.

Average Exchange Ratio: 0.52x

Average Exchange Ratio with 40% Control Premium: 0.73x

0.20x

0.30x

0.40x

0.50x

0.60x

0.70x

0.80x

Historical Exchange Ratio since GAIN’s IPO |

22

•

We believe that GAIN is strongly positioned to create value for our common

stockholders through our core strengths and growth strategies:

–

Innovative technology

–

Strong brand recognition in the OTC market

–

Global OTC market opportunity

–

State-of-the-art institutional platform

–

Diversifying product offerings, target markets and revenue streams

–

Strategic and synergistic acquisitions

–

Management of costs in response to the market environment

–

Return of capital through dividends and buybacks

•

Our strong first quarter results demonstrate our ability to create revenue and

earnings growth through the execution of our organic strategy

•

The acquisition of GFT demonstrates our ability to drive industry consolidation to

create additional shareholder value

•

We will act in the best interests of our shareholders and will carefully review

every opportunity to maximize long-term shareholder value

GAIN and its Board of Directors Are Committed

to Our Shareholders Interests |

CLOSING

REMARKS Glenn Stevens, CEO

23 |

Transaction Highlights

•

GAIN has signed a definitive agreement for the acquisition of Global Futures &

Forex, LTD (“GFT”)

•

The acquisition significantly enhances GAIN’s scale and position as an

industry leader with diverse revenue streams and product offerings

–

Large scale

•

Combined

2013

run-rate

revenue

(1)

:

$329mm

•

Pro forma client assets: ~$650mm

•

Pro forma FY 2012 volume: $4.6 trillion

–

Broader product offering

•

Total of 12,500 financial markets

•

OTC FX, CFDs, binary options, spread betting, FX options, exchange-traded

futures and options –

Diversified revenue streams

•

Expanded partner-based business

•

New

institutional

revenue

stream

from

GFT’s

Sales

Trader

business

•

Total commission-based business rises to 22% of revenue

•

Complementary technology and product functionality

•

Operating expense synergies of $35mm-$45mm

•

Regulatory capital synergies

24

(1)

Based on preliminary Q1 2013 results. |

Closing

Remarks •

Transformative acquisition of GFT will create market-leading

company with scale and diversity of revenues and products to drive

further growth

•

Improved

1Q13

results

show

GAIN

is

well

positioned

to

capitalize

on

higher volatility

•

GAIN’s Board believes that these factors will create greater

shareholder value than FXCM proposal

25 |

APPENDIX

26 |

EBITDA

& Margin Reconciliation 27

(1)

Non-recurring expenses relating to cost savings effected in 2Q 2012.

(2)

EBITDA margin is calculated as EBITDA divided by net revenue (ex. interest

expense). (3)

Assumes $10mm of estimated Q1 synergies achieved based on mid-point of assumed

year 1 synergies of $35mm-$45mm. ($ in millions)

FYE December 31, 2012

3 Months Ended March 31, 2013

Gain

GFT

Gain

GFT

Net revenue

151.4

$

97.8

$

49.8

$

32.5

$

Interest expense

0.4

-

0.1

-

Net revenue (ex. interest expense)

151.8

$

97.8

$

49.9

$

32.5

$

Net income / (loss)

2.6

$

(32.7)

$

4.3

$

(2.4)

$

Depreciation and amortization

4.9

9.5

1.6

2.2

Purchased intangible amortization

4.1

-

0.6

-

Interest expense

0.4

-

0.1

-

Restructuring

(1)

0.6

-

-

-

Income tax expense / (benefit)

(1.5)

(0.2)

0.9

2.0

EBITDA

11.1

$

(23.4)

$

7.5

$

1.8

$

EBITDA Margin %

(2)

7%

NM

15%

6%

($ in millions)

3 Months Ended March 31, 2013

Gain

GFT

Synergies

(3)

PF GAIN

Net revenue (ex. interest expense)

49.9

$

32.5

$

-

$

82.4

$

EBITDA

7.5

1.8

10.0

19.3

EBITDA Margin %

15%

6%

NM

23%

Net revenue

$

49.8 32.5

$

-

$

82.3

$

Interest expense

0.1

-

-

0.1

(2) |

GFT Pro

Forma EBITDA Reconciliation 28

(1)

Assumes mid-point of $35mm-$45mm of expected year 1 synergies

achieved. ($ in millions)

GFT

FY 2012 EBITDA

(23.4)

$

Plus: Synergies

(1)

40.0

FY 2012 Pro Forma EBITDA

16.6

$

Net Purchase Price

27.8

$

FY 2012 Adjusted EBITDA

16.6

FY 2012 Pro Forma EBITDA Multiple

1.7x |

GFT

Acquisition Announcement & Q1 2013 Preliminary Results

April 2013 |